Cassiar Gold hits jewelry box gold grades at Taurus – Richard Mills

2026.01.09

Cassiar Gold (TSXV:GLDC, OTCQX:CGLCF) recently announced results from nine initial diamond drill holes of the 2025 exploration program at the Taurus deposit. According to Cassiar, the results expand mineralization near surface and beyond the extent of the current resource block model.

The 2025 drill program comprised 7,308 meters over 20 drill holes and concluded in early October.

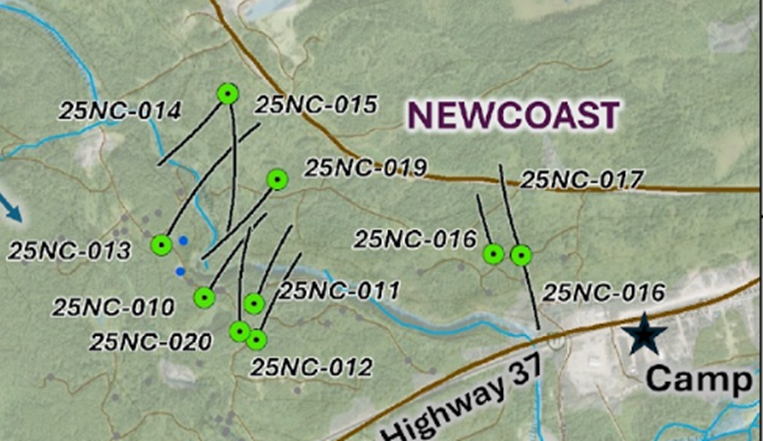

Results are pending for 5,243m of drilling over 11 drill holes from the Newcoast prospect which lies 2 kilometers to the south.

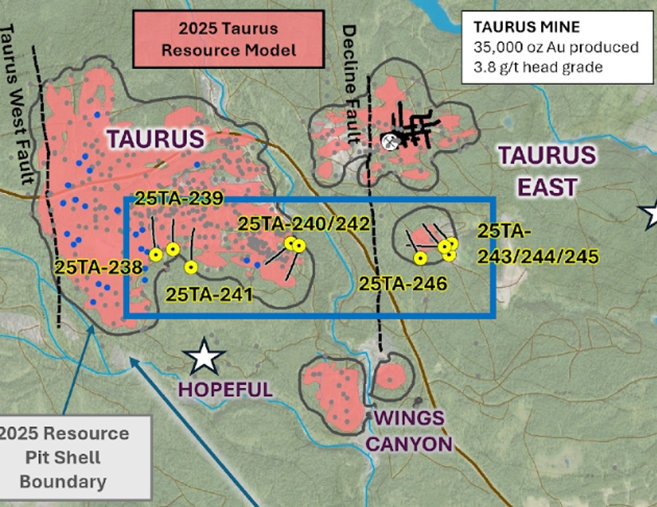

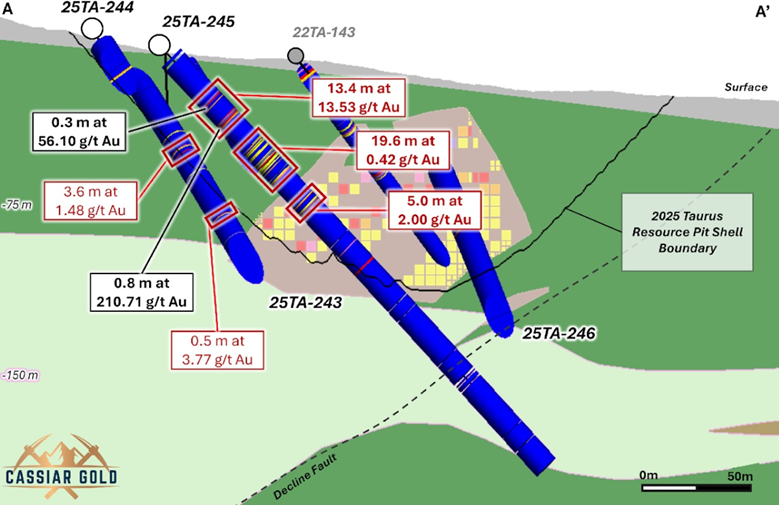

The drill results reported in the Dec. 3 news release are from nine drill holes totaling 2,066m, which tested the outer margins of the known extents of the Taurus deposit. Drilling was distributed across a 1.3-kilometer corridor of the deposit footprint to evaluate the expansion potential of mineralization beyond the block model with step-outs ranging from 30m up to 110m.

The program also followed up recently identified quartz veins hosting higher-grade gold mineralization along key controlling structural trends.

Several higher-grade sample intervals were intersected internal to broader mineralized intercepts.

These extend the distribution of near-surface mineralization south, east, and west of previous drilling along an extensive east-northeast striking corridor of sheeted extensional vein sets within an associated prospective, gold-bearing carbonate-pyrite alteration halo.

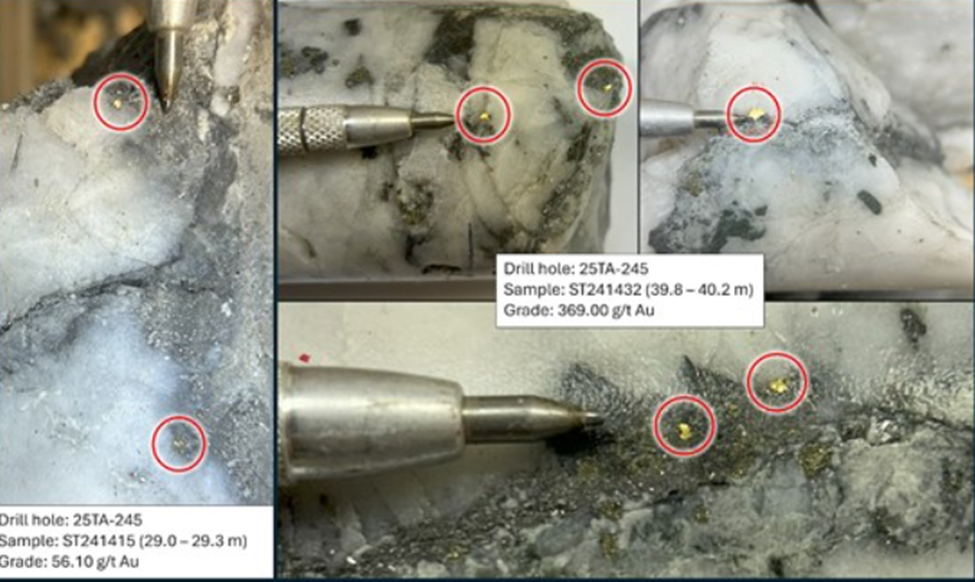

The highlight intercept was from drill hole 25TA-245 at Taurus, which encountered multiple quartz veins with visible gold, returning 13.4m of 13.4 g/t Au from 28.2m downhole, including 56.10 g/t Au over 0.3m and 210.71 g/t Au over 0.8m, with 0.4m of 369.00 g/t Au.

Stretching the mining width

High grades over narrow widths must be treated with caution. It’s been my experience that a comfortable mining width for an underground operation is 4 meters, which allows machinery to access the stope.

Let’s take the intercept of 210 grams per tonne over 0.8 meters. That works out to 1.69 ounces per tonne gold per meter over 4 meters. At today’s gold prices that is USD$7,500 per tonne, or converted to Canadian dollars, since the project is in Canada, CAD$10,400 a meter.

Those are jewelry box grades.

The drilling was outside the pit-constrained resource, so it therefore has potential to add ounces in the next resource update. There is a Preliminary Economic Estimate (PEA) due the second quarter of the year.

More importantly, the intercept is from 28 meters down hole — very close to surface and open-pittable. And remember, the 210 grams per tonne over 0.8 meters is the higher-grade portion of the more continuous 13.4 g/t over 13.4m. That is also a very good grade for an open pit.

For a visualization, look at Figure 2 below.

news release.

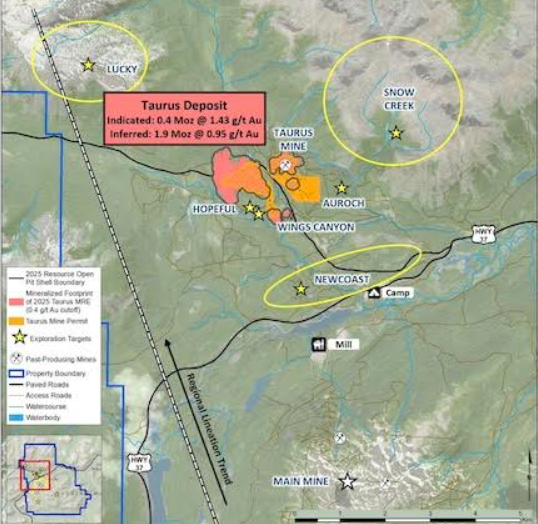

At Cassiar North, there is an updated (June 2025) pit-constrained Mineral Resource Estimate (MRE) defined for the Taurus gold deposit, reported above a 0.4 g/t Au cutoff and USD$2,400/oz gold price comprising:

- Indicated Mineral Resource: 8.8 Mt at 1.43 g/t Au for 410,000 ounces; with an additional

- Inferred Mineral Resource: 63.2 Mt at 0.95 g/t Au for 1.93 million ounces

An astounding 91% of the ounces in the resource occur within 150m of surface

The 2025 MRE is a substantial increase over the 2022 MRE, which contained an Inferred resource of 1.4 Moz at 1.14 g/t Au, and is currently based on 462 drill holes (~56,500 m) drilled by previous operators but mostly by Cassiar Gold.

The current mineral resource estimate comprises just over a one-square-kilometer footprint of the 590 km2 property. Mineralization outcrops in places and extends from surface to a maximum pit depth of 307m, with 48% of the resource occurring within 50m of surface, 81% occurring within 100m of surface, and 91% occurring within 150m of surface.

Apart from the high grades, CEO Marco Roque said what is also exciting is the fact that the new MRE has better-defined, higher-grade domains than the previous MRE. Cassiar Gold targeted those domains in the drill program, and they intercepted what they were expecting to find — higher-grade extensions of the known high-grade corridors.

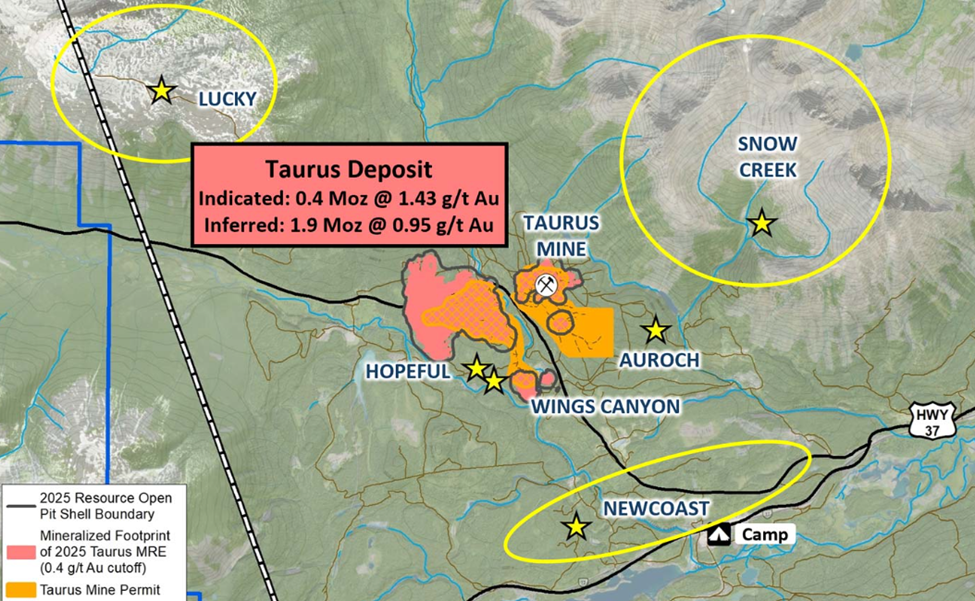

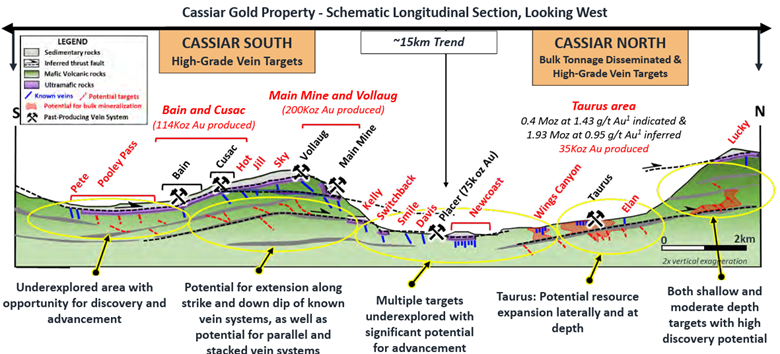

Cassiar North

The Cassiar North project area hosts the Taurus deposit as well as multiple similar bulk-tonnage-style regional targets including the Newcoast, Auroch, Hopeful, Snow Creek, and Lucky prospects, among others.

As mentioned, Cassiar North hosts an NI 43-101 Inferred resource of 0.4 Moz gold at 1.43 g/t gold Indicated and 1.93 Moz gold at 0.95 g/t gold Inferred at the Taurus deposit. This is using a 0.40 g/t Au cut-off.

At the Taurus deposit, mineralization consists primarily of basalt-hosted low-sulfide gold-bearing veins, which have well-defined alteration envelopes of quartz-sericite-iron carbonate and pyrite. Shear veins, extensional veins, thrust-filling veins, as well as vein arrays and breccia zones all occur, but shear veins are the most economically significant in terms of gold mineralization.

The Taurus deposit remains open in most directions laterally and at depth, providing the potential for significant expansion of the resource and additional discoveries through further exploration.

Conclusion

Drilling at the Taurus deposit continues to demonstrate potential for ongoing expansion of near-surface mineralization along the main east-northeast striking sheeted vein sets than defined by the 2025 mineral resource estimate.

The reported drill holes increase the population of high-grade, visible gold-bearing veins at the deposit, such as drill hole 25TA-245 which delivered 0.3m grading 56.10 g/t Au and 0.4m grading 369 g/t, and hole 25TA-238 with 59.50 g/t over 0.4m, nested in broader intercepts.

From a retail perspective, it’s important to say that Cassiar has found gold in every single hole it drilled last year. Over the past five years, the success rate is 99%. Out of almost 300 drill holes drilled, only a couple missed. Which is an incredible hit ratio for an early-stage junior and shows the extent of mineralization over the Cassiar Gold Project.

Note too, there is massive discovery potential. The resource only occupies one square kilometer out of the 590 square-kilometer land package.

More results from Taurus are expected this quarter, along with metallurgy. A preliminary economic assessment (PEA) is due out in Q2. The company is fully financed for all its commitments.

I’m impressed by Cassiar Gold’s performance at the drill bit. I’m optimistic 2026 will bring equally good results and several catalysts that could potentially attract investor attention.

Cassiar Gold Corp.

TSX.V:GLDC, OTCQX:CGLCF

2026.01.08 Share Price: Cdn$0.40

Shares Outstanding: 146.6m

Market Cap: Cdn$58.9m

GLDC website

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard does not own shares of Cassiar Gold Corp. (TSX.V:GLDC) GLDC is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of GLDC

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.