Cassiar Gold: An undervalued gold play in northern BC with substantial upside potential – Richard Mills

2025.12.12

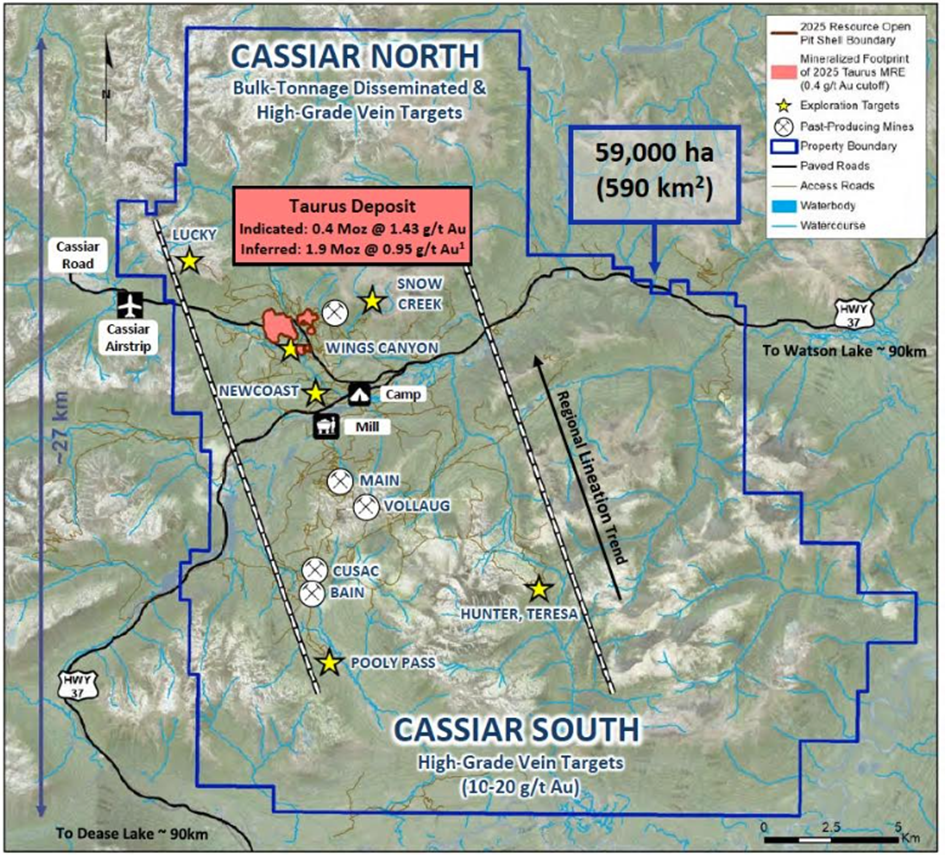

Cassiar Gold’s (TSXV:GLDC; OTCQX:CGLCF) flagship project of the same name is a large orogenic gold property located in the Cassiar Mining District of northern British Columbia. The project has substantial upside potential for both bulk-tonnage resources in the Cassiar North area, and high-grade gold targets in the Cassiar South area.

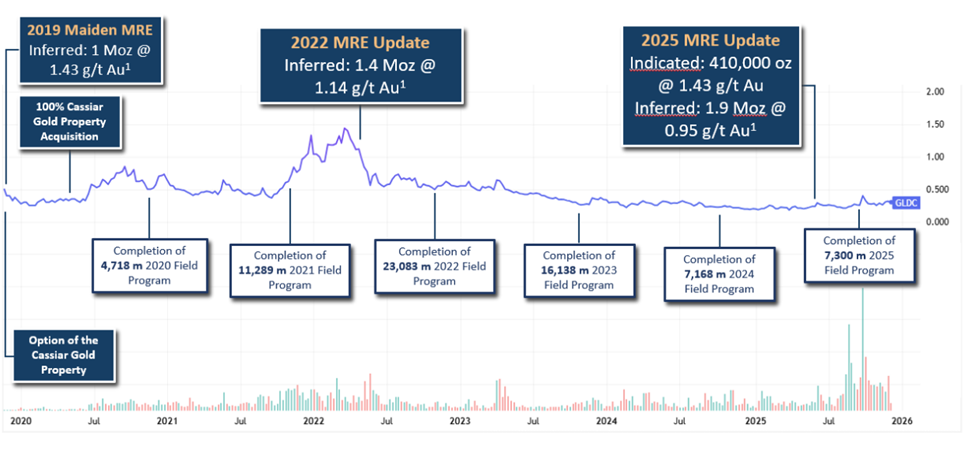

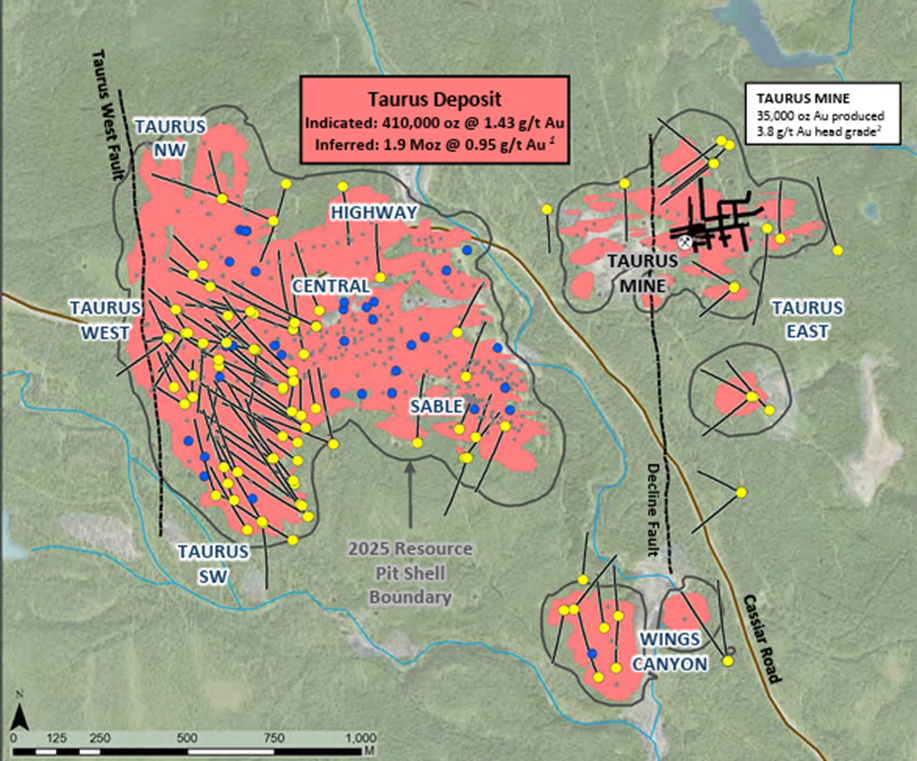

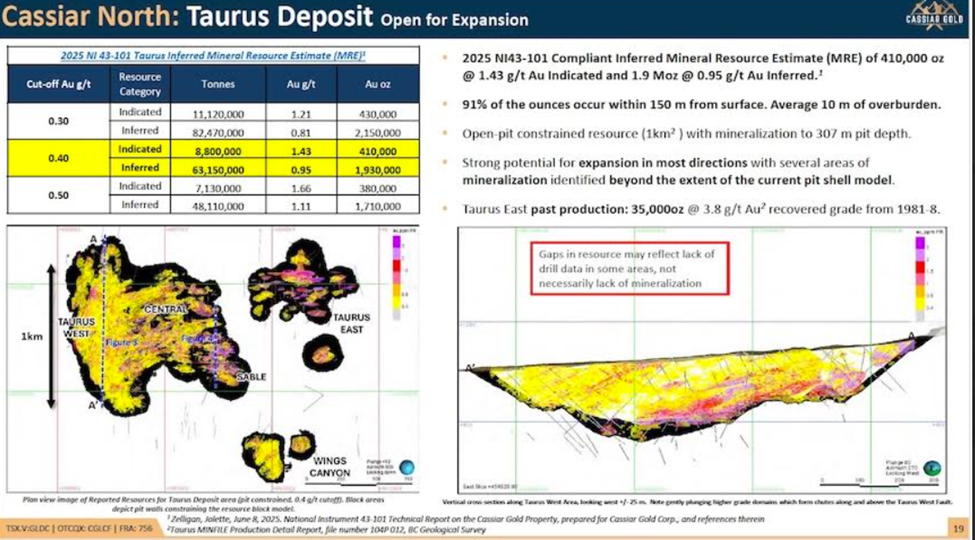

At Cassiar North, there is an updated (June 2025) pit-constrained Mineral Resource Estimate (MRE) defined for the Taurus Gold Deposit, reported above a 0.4 g/t Au cutoff and USD$2,400/oz gold price comprising:

- Indicated Mineral Resource: 8.8 Mt at 1.43 g/t Au for 410,000 ounces; with an additional

- Inferred Mineral Resource: 63.2 Mt at 0.95 g/t Au for 1.93 million ounces

The 2025 MRE is a substantial increase over the 2022 MRE, which contained an Inferred resource of 1.4 Moz at 1.14 g/t Au, and is currently based on 462 drill holes (~56,500 m) drilled by previous operators but mostly by Cassiar Gold.

The current mineral resource estimate comprises just over a one-square-kilometer footprint of the 590 km2 property. Mineralization outcrops in places and extends from surface to a maximum pit depth of 307 m, with 48% of the resource occurring within 50 m of surface, 81% occurring within 100 m of surface, and 91% occurring within 150 m of surface.

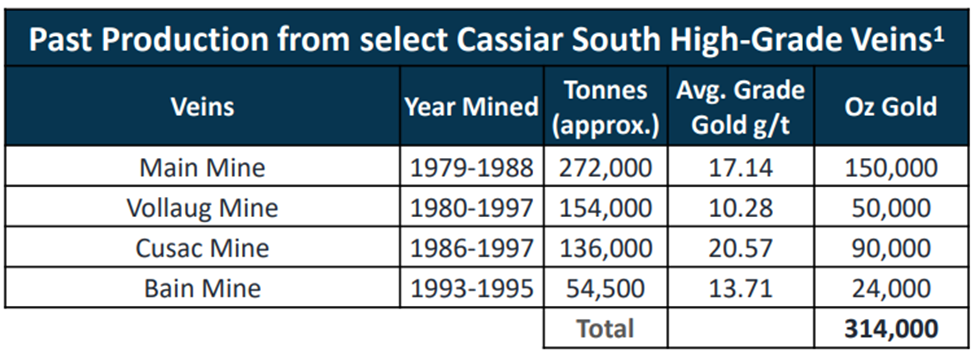

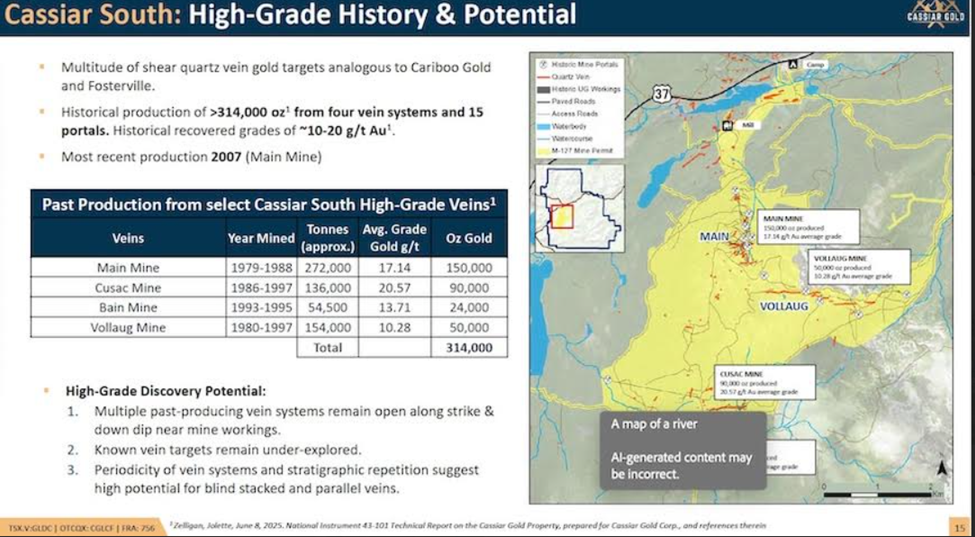

The Cassiar South project area hosts several past-producing high-grade gold mines that targeted high-grade quartz vein mineralization grading between 10-20 g/t gold. Past production totaled 314,000 oz gold, with most of it extracted from the high-grade quartz veins.

The company

Cassiar Gold is led by President & CEO Marco Roque, who has 20 years of international finance experience including banking, capital markets, venture capital and corporate advisory. He is the co-founder of Reyna Silver, Sendero Resources & Infinitum Copper.

Chairman Stephen Letwin has over 30 years in the resource sector. Previous postings include President & CEO of IAMGOLD, Executive VP Gas Transportation & International with Enbridge, and President & COO of TransCanada Energy.

VP Exploration Jill Maxwell has 15 years in precious metals, with a wide range of experience in mineral exploration from greenfields programs through to feasibility studies for orogenic gold and nickel-copper-PGEs, including at Sabina Gold & Silver’s Back River Project acquired by B2Gold for C$1.2 billion; and North American Palladium through and following its acquisition by Impala Platinum for C$1 billion.

Rounding out the board of directors are geologists Steve Robertson, who led the team that permitted and developed the Red Chris mine which Newcrest (now Newmont) acquired 70% of for US$1 billion, and James Maxwell (former exploration director for Sabina (acquired by B2Gold for C$1.2 billion); mining engineer Chris Stewart, the GM for Hemlo gold mine, recently sold by Barrick for C$1.1 billion; and Dave Rhys, chief technical advisor. Rhys has 30 years of mining experience and is a renowned orogenic gold expert who has consulted for major mining companies. He has conducted field-based geological studies on deposits collectively containing >600Moz Au and >2Boz Ag (silver), including deposits in the Carlin Trend and the Abitibi Greenstone Belt.

The team has a track record discovering, permitting, building, operating, and selling multi-billion-dollar gold mines. Insider ownership is 14% and institutional ownership is 29%, including Delbrook, US Global, Sprott, Ixios, Myrmikan, EMA, Commodity Discovery Fund and Terra Capital.

The market cap currently stands at CAD$46 million with 146,659,300 shares outstanding. GLDC has $8.7 million in cash and deposits as of August 2025.

Cassiar Gold Rush and project history

Gold was discovered at Dease Creek in 1872, which started the Cassiar Gold Rush. 1877 saw a record-breaking 72-oz gold nugget recovered from McDame Creek right in the heart of the property.

In 1934, the first gold-bearing quartz veins were discovered, followed by about 40 years of small-scale mining. Larger-scale mining operations began in 1979 at Main, Vollaug, Cusac, Bain (Cassiar South) and Taurus (Cassiar North) mines, producing a total of 350,000 ounces until 1998.

In 1994 the Taurus deposit was discovered by International Taurus Resources. In 2008 the Cassiar gold property was consolidated by Hawthorne Gold and drilling was advanced on the property.

Hawthorne subsequently became Wildsky Resources, which continued exploration of the Cassiar North and South areas until 2018. In 2019, Margaux Resources entered into an agreement to acquire an 100% interest in the project. The next year, Margaux exercised its option to fully acquire the project and rebranded the company to Cassiar Gold Corp.

Cassiar Gold Project

Cassiar Gold owns a 100% interest in the advanced-stage Cassiar Gold Project, which covers 59,000 hectares of mineral claims in the Cassiar Mining District, in good standing.

Previous work has been focused on two main areas — Cassiar North with predominantly a bulk-tonnage opportunity, and Cassiar South with predominantly high-grade quartz vein targets.

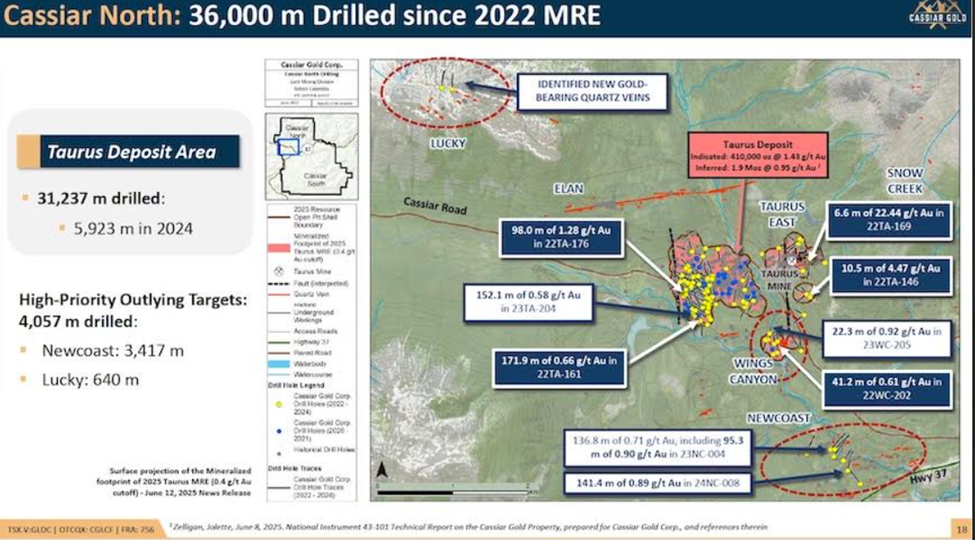

Historical drilling totals 277,000 meters. Since becoming the operator in 2020, Cassiar Gold has drilled +69,000 meters. The new pit-constrained MRE for the Taurus Deposit area and supporting technical report for the property incorporate results from 46,389 m of diamond drilling completed across the property since the previous MRE in 2022. 36,000 m of drilling was done at Cassiar North between 2022 and 2024, with 31,237m into the Taurus deposit area.

Infrastructure and access

Highway 37 bisects the project, and there are 160 km of access roads throughout the property. The project also has a fully owned and permitted 300 tonnes-per-day mill and a 48-person camp with power and water access. A 1.2-km airstrip is 5 km from the Taurus deposit. The area features ideal topography and access for open-pit-mine infrastructure, with paved roads and grid power. There are also 17 historical portals, 25 km of underground workings, four tailings facilities and a core shack.

The project is surrounded by existing significant mines, including Teck Resources’ Galore Creek, Skeena Resources’ Eskay Creek, Seabridge Gold’s KSM, Coeur Mining’s Silvertip, Tatogga, Red Chris and Brucejack. There are two mine permits on the property and one exploration permit.

Cassiar North

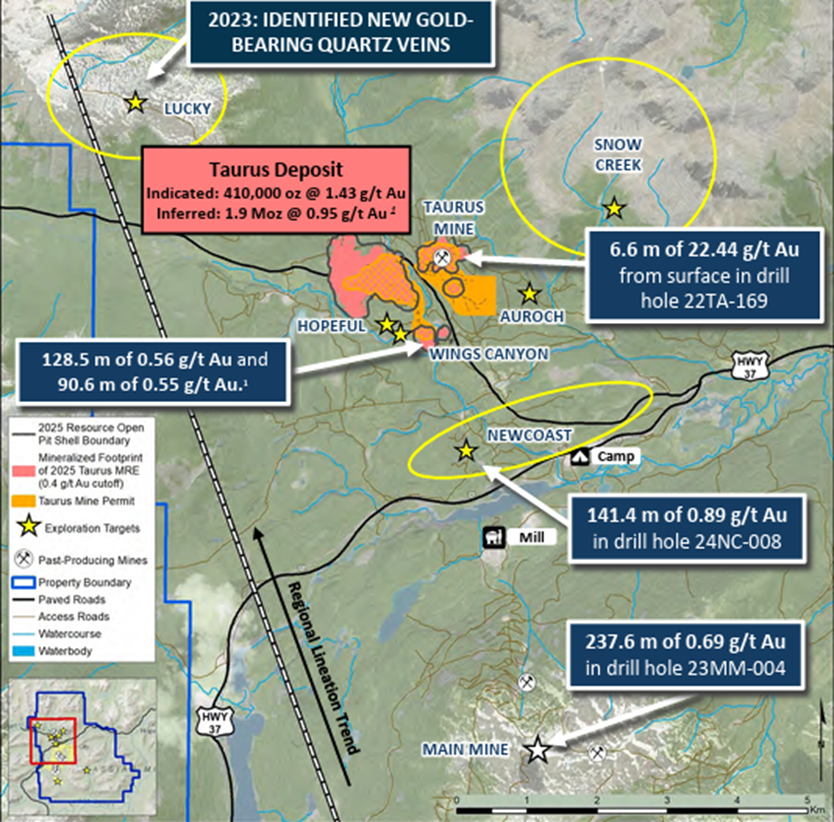

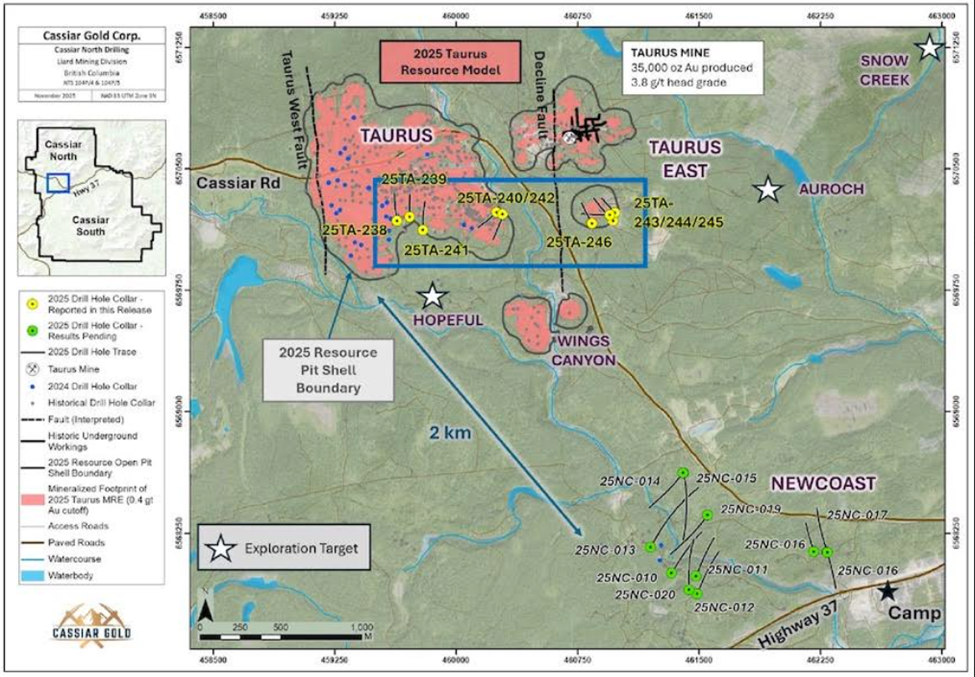

The Cassiar North project area hosts the Taurus deposit as well as multiple similar bulk-tonnage-style regional targets including the Newcoast, Auroch, Hopeful, Snow Creek, and Lucky prospects, among others.

As mentioned, Cassiar North hosts an NI 43-101 Inferred resource of 0.4 Moz gold at 1.43 g/t gold Indicated and 1.93 Moz gold at 0.95 g/t gold Inferred at the Taurus deposit. This is using a 0.40 g/t Au cut-off.

The deposit has seen past production of 35,000 oz at a recovered grade of 3.8 g/t Au at the Taurus underground mine from 1981-88.

Recent exploration began in 2019 when Margaux Resources (the predecessor to Cassiar Gold) conducted geological mapping and prospecting of both new and known gold prospects on the property. Although the property has an extensive exploration history, much of the historical work has targeted high-grade veins, and not the bulk-tonnage potential. To that end, geological mapping, chip and grab sampling, as well as resampling of one historical drill hole core, were done on numerous prospects in both the Taurus and the Table Mountain areas. Rock samples were simple grab samples, while chips were taken across veins and alteration areas.

In 2020, Cassiar Gold completed a 5,000-meter drill program which successfully extended mineralization between past drill holes to confirm continuity of mineralization. In 2021, Cassiar completed another drill program consisting of 15 holes totaling 4,098m which was aimed at defining and/or confirming higher-grade mineralized areas where historical drilling was widely spaced. Results were encouraging.

At the Taurus deposit, mineralization consists primarily of basalt-hosted low-sulfide gold-bearing veins, which have well-defined alteration envelopes of quartz-sericite-iron carbonate and pyrite. Shear veins, extensional veins, thrust-filling veins, as well as vein arrays and breccia zones all occur, but shear veins are the most economically significant in terms of gold mineralization.

The Taurus deposit remains open in most directions laterally and at depth, providing the potential for significant expansion of the resource and additional discoveries through further exploration.

Cassiar South

At the Cassiar South project area, there are many known veins with only minimal drilling. Several underground mines operated from 1997-2007. They collectively produced >315,000 oz gold extracted from high-grade quartz vein mineralization (four vein systems and 15 portals) with grades of 10-20 g/t Au. The most recent production was in 2007 from the Main mine.

There is significant exploration upside with a 15-km prospective strike length.

18,000 meters of drilling conducted in 2021-23:

- Identified extensions of known mineralization near existing infrastructure

- Interpreted offset vein segment of the past-producing Bain vein system

- Identified gold-bearing quartz veins adjacent to known vein systems

- Confirmed continuity of high-grade mineralization at the East Bain vein

Orogenic gold

The significance of orogenic gold deposits is well known. Globally, they account for about 2.7 billion ounces, or 30% of known gold. Orogenic gold dominates gold production in Canada, Australia, Africa, Russia and China.

In Canada, over 80% of gold comes from this style of deposit, with the Abitibi region alone contributing over 180 million ounces. In British Columbia, 45% of historic lode gold production to 2002, and almost all the province’s historic placer gold production can be attributed to orogenic gold mineralization.

Orogenic deposits form during regional, continent-building tectonic episodes as opposed to being associated with hydrothermal fluids related to intrusive activity. This style of deposit can produce high-grade veins as well as low-grade, bulk-tonnage deposits.

The Cassiar Gold District is located on BC’s inland orogenic gold belt with other known districts such as the Cariboo-Barkerville District and the Sheep Creek District.

Drill results

Cassiar Gold recently announced results from nine initial diamond drill holes of the 2025 exploration program at the Taurus deposit. According to Cassiar, the results demonstrate potential for ongoing expansion of near-surface mineralization along key structural trends and increase the population of high-grade, visible gold-bearing veins.

The 2025 drill program comprised 7,308 meters over 20 drill holes and concluded in early October.

Results are pending for 5,243m of drilling over 11 drill holes from the Newcoast regional prospect which lies 2 kilometers to the south.

The drill results reported in the Dec. 3 news release are from nine drill holes totaling 2,066m, which tested the outer margins of the known extents of the Taurus deposit. Drilling was distributed across a 1.3-kilometer corridor of the deposit footprint to evaluate the expansion potential of mineralization beyond the block model with step-outs ranging from 30m up to 110m.

The program also followed up recently identified quartz veins hosting higher grade gold mineralization along key controlling structural trends (Figure 1). Several higher-grade sample intervals were intersected internal to broader mineralized intercepts. These extend the distribution of near-surface mineralization south, east, and west of previous drilling along an extensive east-northeast striking corridor of sheeted extensional vein sets within an associated prospective, gold-bearing carbonate-pyrite alteration halo.

The highlight intercept was from drill hole 25TA-245 at Taurus, which encountered multiple quartz veins with visible gold, returning 13.4m of 13.4 g/t Au from 28.2m downhole, including 56.10 g/t Au over 0.3m and 210.71 g/t Au over 0.8m, with 0.4m of 369.00 g/t Au.

“Our exploration programs demonstrate the Cassiar Gold Project holds meaningful potential as a gold resource expansion opportunity in an important region in British Columbia,” said Cassiar Gold’s President and CEO Marco Roque. “Confirming continuity and established extensions of near-surface higher-grade mineralization in the Taurus East, Southwest, and Sable areas demonstrates that this well-established foundational resource can continue to grow.”

“Our drilling continues to delineate and extend new higher-grade trends within and adjacent to the Taurus deposit,” said Jill Maxwell, VP Exploration. “We continue to intersect visible gold in structures across the deposit, with opportunity to identify new trends and advance higher-grade domains along strike and down-dip in future programs. The results from Taurus East are particularly encouraging as we continue to evaluate the emerging volume potential at recently established satellite zones in the resource area, within the footprint of the existing mine permit.”

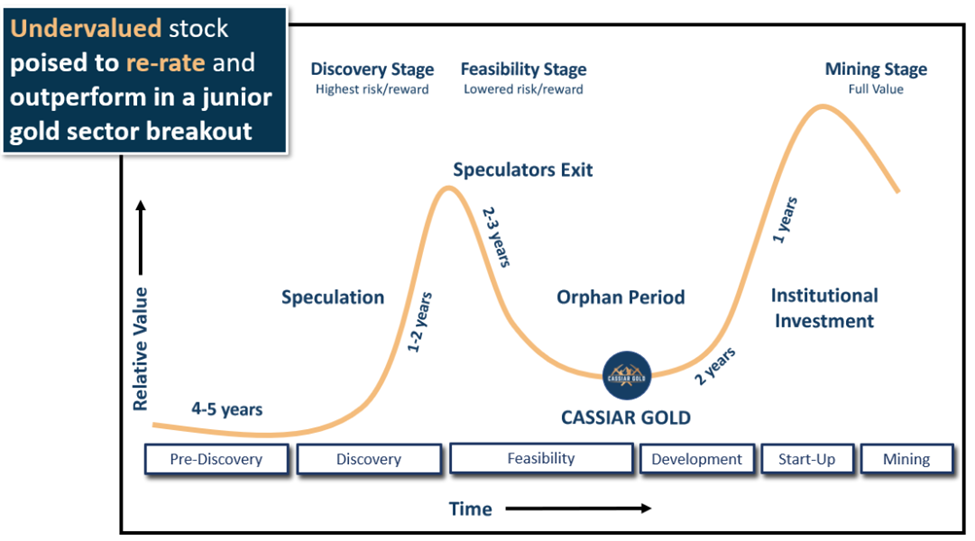

The opportunity

Trading at 31.5 cents Canadian at the close on Friday, Dec. 5, Cassiar Gold with a $46-million market capitalization is, in my opinion, undervalued. Not only for the gold ounces it already has, but it seems obvious the market isn’t valuing the company’s resource expansion potential nor it’s fully permitted mill and other infrastructure.

It was mentioned that the Cassiar Gold Project is markedly unexplored, with less than 0.3% of the land package having been worked with modern exploration methods.

In sum, there is the potential to expand the Taurus resource in most directions laterally and at depth. And the company notes there is potential for multiple bulk-tonnage/Taurus-style satellite deposits across the land package i.e., 11 holes were drilled into the Newcoast prospect 2 km to the south of Taurus, with assays pending.

There is also potential to expand multiple high-grade vein targets grading 10-20 g/t Au along strike and down dip, with additional discovery potential for multiple blind parallel as well as stacked shear vein systems.

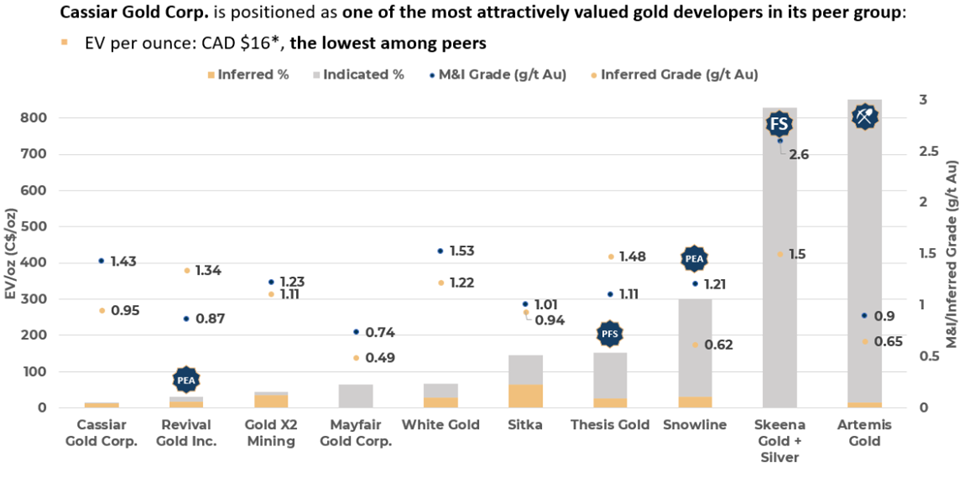

We can see Cassiar Gold’s challenge in the below peer comparison chart. The companies on the horizontal axis are ranked according to their enterprise value per ounce in CAD$, on the left vertical axis, and their Measured and Indicated/Inferred grade, on the right vertical axis.

Cassiar Gold is the lowest ranked at just $11 EV per oz compared to other companies as you move to the right.

Cassiar is already doing other things to advance the project. They’ve attracted funding for exploration, no doubt helped by the explosion in gold prices this year, which are up 61% as of Dec. 5. CAD$50 million has been raised by Cassiar since 2020. They’re working on a PEA. They’re working on expanding the ounces through step-out drilling at Taurus and Newcrest. Historically the metallurgy has been proven with recoveries in the 90% range.

Cassiar will catch up to its peers as the story becomes more broadly known and could result in a significant stock re-rating. Let’s also remember there is all the necessary infrastructure present to potentially go mining on Cassiar’s project — roads, power, water, a 300-tpd mill and a camp are all present.

A skilled local workforce is available in the region, and the project already benefits from mine permits, proving fast timeline to production.

Near-term catalysts

- Drill program: Cassiar’s 2025 program was completed with over 7,300 meters of expansion drilling through 20 holes. Its first group of results from nine holes at the Taurus deposit is detailed in the above news release. The remaining 11 holes will be released between December and February 2026.

- Metallurgical and economic studies: Metallurgical and first Preliminary Economic Assessment (PEA) studies have started, with results expected in H1 2026.

Conclusion

I like what I see in Cassiar Gold. This is not greenfields exploration; the Cassiar Gold Project has historical production of >350,000 ounces. To quote a well-worn mining cliché, “The best place to find a new mine is in the shadow of an old headframe.” With Cassiar Gold we could perhaps change that to “The best place to find a new mine is in the shadow of many old headframes.”

The management team has a track record of discovering, permitting building and operating mines. The company offers significant leverage to the gold price, it is well-capitalized, and it has strong institutional support.

Cassiar is drilling for gold and finding it, at the Taurus deposit and environs, according to the latest news release.

Cassiar Gold’s future seems bright and it’s my opinion that Cassiar Gold represents an AOTH opportunity.

Cassiar Gold Corp.

TSX.V:GLDC, OTCQX:CGLCF

2025.12.05 Share Price: Cdn$0.31.5

Shares Outstanding: 146.6m

Market Cap: Cdn$46.4m

GLDC website

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard does not own shares of Cassiar Gold Corp. (TSX.V:GLDC). GLDC is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of GLDC

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.