Cashed-up Renforth drills first 1,000m at Parbec

2020.09.24

Renforth Resources (CSE:RFR, OTC:RFHRF, WKN:A2H9TN) is making good progress at its Parbec property in northern Quebec, having completed the first 1,000m of drilling.

On Sept. 8 Renforth announced the start of a 7,200m drill program.

The company currently has over CAD$4.8 million in its treasury, including cash and securities. More funds from the close of a $0.13/sh private placement, anticipated by month-end, are expected to raise about $3.2 million. The current exploration program, aimed at adding to the just over 200,000 ounces (indicated and inferred) delineated at Parbec in an updated (May 2020) resource estimate, is budgeted at around $1.25 million.

The company is well-funded for the New Year, with no additional private placement financing anticipated for the foreseeable future.

Renforth Resources Inc.

Among the most active gold juniors in Quebec, Renforth Resources is hoping to, a/ expand upon its existing resources, and b/ find new mineralization.

It currently has five gold projects including its flagship property, Parbec. Renforth is also exploring near the Canadian Malartic mine at its West Malartic project, at Denain-Pershing in an active mining camp on strike to the Chimo mine and contiguous to the Croinor mine, and among a collection of claims it recently consolidated into a new project it is calling Surimeau.

Additionally, the company owns the Nixon-Bartleman gold project located 45 km outside of Timmins, Ontario.

An important clarification: Renforth Resources is not looking for mineralization; it has already found it at Parbec, which contains an updated resource estimate. Renforth is focused on increasing the resources at brownfield projects, by proving mineralized structures and occurrences not fully defined, and open to expansion.

“Renforth is not engaged in searching for mineralization, we have several mineralized assets we can mature with field operations, continuing to define their extent and de-risk the deposits,” says Nicole Brewster, Renforth’s President and CEO.

Watch an AOTH video with Nicole Brewster, CEO of Renforth Resources

Cadillac Break

Much of the mining in Quebec has taken place along the Abitibi Greenstone Belt, one of the largest Archean greenstone belts on Earth. For the past century, over 100 mines operating along the belt have churned out nickel, copper, zinc, diamonds, and of course, gold.

650 kilometers long and 150 km wide, the Abitibi runs from west of Kirkland Lake, Ontario to Chibougamau, Quebec.

In the heart of the Abitibi Greenstone Belt, Quebec’s Cadillac Break is a regional fault zone thought to host a whopping 45 million gold ounces. The world-renowned structure stretches from west of Kirkland Lake in Ontario to east of Val d’Or, Quebec, which translates to “valley of gold”.

The Cadillac Break has been mined to various extents since the early 1900s, but it wasn’t until the 1990s that new mines were discovered along the gold trend, which revitalized mining and mineral exploration in the area. They include Agnico Eagle’s LaRonde mine, the old O’Brien mine now owned by Radisson Mining, and Canadian Malartic, a joint venture between Agnico Eagle and Yamana Gold that is currently Canada’s largest gold mine.

Parbec

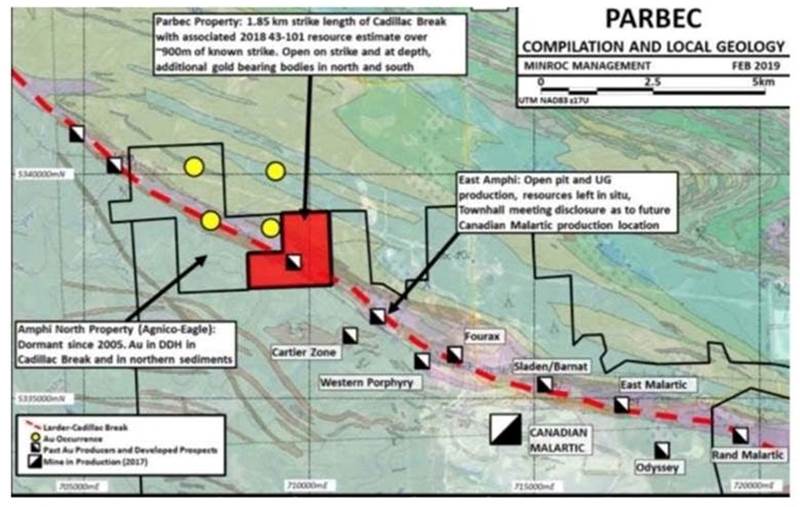

The brownfield Parbec project, on the Cadillac Break, borders the Canadian Malartic mine, and is adjacent to the past-producing East Amphi mine, where the joint venture that owns Canadian Malartic has been drilling.

2019 drilling by Renforth proved that mineralization at Parbec is continuous for 1.8 km along the Cadillac Break, right up to the border with East Amphi – where resources were left underground following the cessation of mining in 2007.

Among the highlights are three areas of mineralization on the property: the discovery zone within the Cadillac Break, where the gold resource is largely above 200m, with the zone open to depth; the “Island Trench Zone”, sampled on surface and pierced to 738m, where 0.96 g/t gold was drilled over 0.5m; and the “Diorite Splay Zone” where gold is present on surface, within cross-cutting faults, and at contacts between sediments and diorite intrusives, in the Pontiac sediments – a unique setting similar to Canadian Malartic.

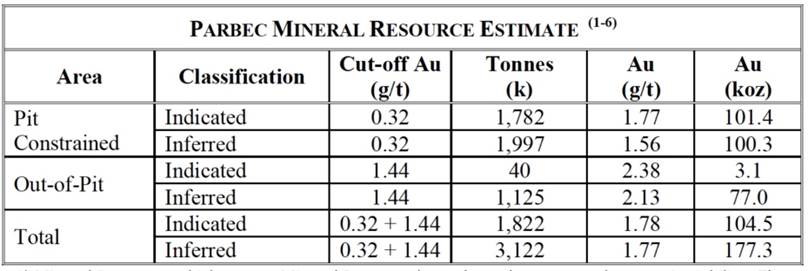

Parbec currently hosts an open-pit-constrained gold resource estimate of 104,500 indicated ounces gold at a grade of 1.78 grams per tonne, and an inferred 177,300 oz at 1.77 g/t.

Drill program

Drilling involves 26 holes totaling 7,261 meters, so far with the mobilization of one drill rig and technical staff to the property. Unlike previous drilling, which was perpendicular to the Cadillac Break, the current drill program will cross the break at an angle.

Renforth’s geological team believes there are likely cross-cutting structures, running across the Cadillac Break, that were missed in previous drill programs. “With Renforth as well funded as it is now, there is budget room available to drill holes due north and test this hypothesis,” the company states in a Sept. 22 news release.

According to Renforth, of the 37 holes previous drilled at Parbec – each of which returned gold values – there were some aggressive step-outs over 25m. The company plans to in-fill drill those areas, in an attempt to expand the resource, on strike.

In-fill drilling will also take place between holes where the resource was delineated.

At the neighboring East Amphi property, Richmont’s 2006 resource estimate hosts mineralized zones extending over 1 km, to a depth of 600m. Parbec has a comparable strike length, but it is relatively shallow; only two to three holes over the past 10 years have reached that kind of depth. Renforth therefore plans to drill deep in search of mineralization.

The three holes completed to date are:

PAR-20-100 (proposed DDH #8) – this hole was drilled due north, through the Cadillac Break, for 405m, encountering the expected Parbec lithologies, including the “magnetic diorite”, associated with the presence of gold. Samples have been selected, split, and have been delivered for assay, required to determine if gold is present.

PAR-20-101 (proposed DDH #9) – this hole was drilled due north, through the Cadillac Break, for 291m, again intersecting the expected lithologies associated with gold at Parbec, including felsites, diorite, sheared diorites and “tuff” zones. Samples have been selected, split and will shortly be delivered for assay required to determine if gold is present.

PAR-20-102 (proposed DDH #10) – this hole was drilled perpendicular to the Break, as is typical at Parbec, and drilled for 505m before terminating in the volcanics on the north side of the Cadillac Break earlier today. This hole also intersected the targeted lithologies, including the “magnetic diorite”. This hole is being logged and samples selected and split to be sent for assay.

The next hole in the program, DDH#13, is being drilled due north.

Along with continued exploration at Parbec, Renforth’s 2021’s expenditures will likely include work at Surimeau and Malartic West. Assay results for both properties have been received and are being interpreted. News is expected out in the next couple of weeks.

Renforth Resources

CSE:RFR, OTC:RFHRF, WKN:A2H9TN

Cdn$0.055 2020.09.24

Shares Outstanding 213,836,539m

Market cap Cdn$11.76m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not own shares of Renforth Resources (CSE:RFR). RFR is a paid advertiser on Richard’s site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.