Cashed-up Graphite One advancing Alaska project to prefeasibility with 2021 drill program and new hire

2021.06.03

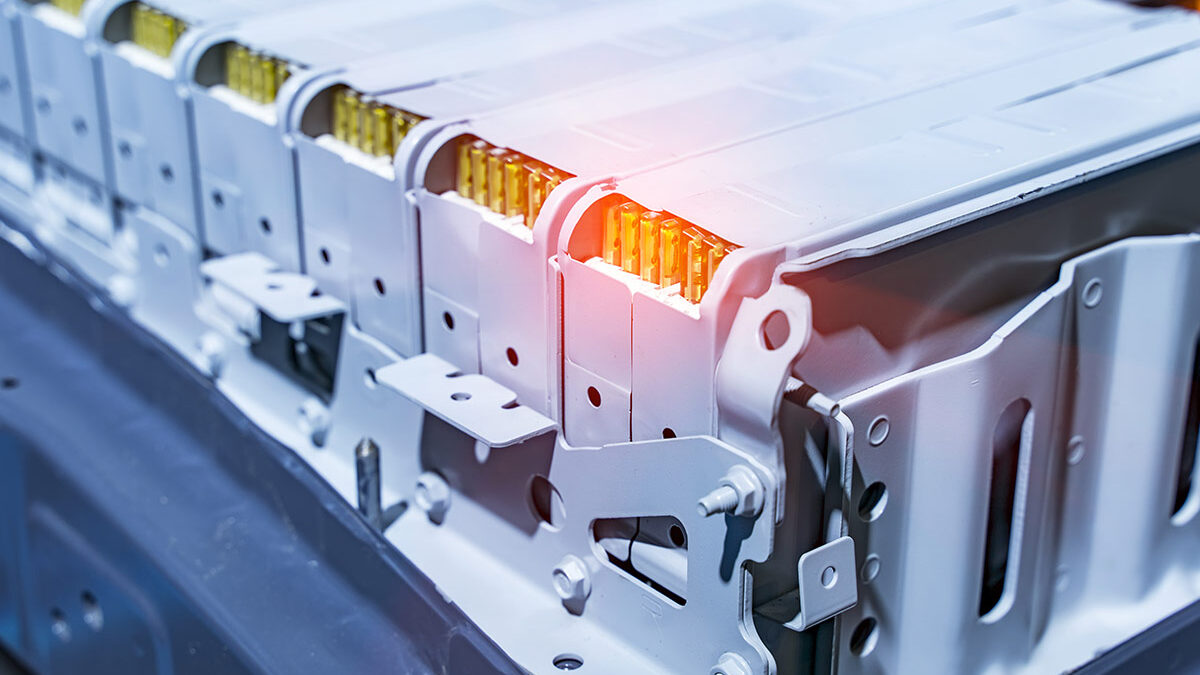

At AOTH we’re invested in metals necessary for the inevitable shift from a global transportation system powered by fossil fuels, to one that is fully electric. As sales of electric vehicles continue to climb, among the metals we are most bullish on, are graphite, lithium, nickel, cobalt, manganese and copper.

All six are crucial to electrification. The first five (also aluminum) are needed for lithium-ion batteries, and copper is utilized in other parts of an EV, like the electric motor and wiring. An electric vehicle contains four times as much copper as a fossil-fueled model.

There are no substitutes for lithium and graphite; these critical metals are expected to remain the foundation of all lithium-ion EV battery chemistries for the foreseeable future.

Lithium is in the battery cathode and graphite, or more precisely, spherical graphite, is in the anode.

Graphite composition and uses

There are two types of graphite: natural and synthetic. Synthetic graphite is made by treating amorphous carbon materials at high temperatures. In the US the primary feedstock is calcined petroleum coke and coal tar pitch. Manufacturing synthetic graphite costs up to 10X more than natural graphite, therefore it is less appealing for most applications.

The natural graphite market is 1-1.2 million tonnes per year and consists of three different forms of graphite — flake, amorphous and lump. Historical applications primarily use amorphous and lump graphite, however most new technologies and applications require large flake graphite. Of the approximately 1.2 million tonnes of graphite that are processed each year, just 40% is flake.

Graphite has long been used in the aviation, automotive, sports, steel and plastic industries, as well as in the manufacture of bearings and lubricants. Graphite is an excellent conductor of heat and electricity, is corrosion- and heat-resistant, and is strong and light.

Autos and steel

Currently, the automotive and steel industries are the largest consumers of graphite with demand across both rising at 5% per annum. The steel industry uses graphite as liners for ladles and crucibles, in the bricks which line blast furnaces, and to increase the carbon content of steel. Graphite has already replaced asbestos in automotive brake linings and pads and is used for gaskets and clutch materials. Sparks plugs are also made incorporating graphite.

Flexible graphite sheets

Graphoil flexible graphite is one of the fastest-growing graphite markets. It is desirable for compression packing and gaskets, whose ability to seal comes from filling gaps through which fluid might flow.

Nuclear power

Graphite plays a key role in many current, and future, nuclear reactor designs. In the INL-led Next Generation Nuclear Plant (NGNP) and other proposed gas-cooled reactors, temperatures are expected to reach as high as 1,000°C in their cores.

Graphite, having a higher melting point than steel, doesn’t burn until 3,000°C. Because graphite has such heat-absorbing capacity, it’s also used to keep nuclear fuel at safe temperatures during unexpected events.

Fuel cells

The two types of fuel cells under development, phosphoric acid fuel cell (PAFC) and proton electrolyte membrane fuel cell (PEMFC), rely heavily on graphitized carbon. PAFCs are for stationary power generation (primary or backup power for remote locations such as cell phone towers), whereas PEMFCs have attracted interest for use in transportation applications.

Solar thermal collectors

The biggest limitation of solar or photovoltaic (PV) panels is that they can use only a fraction of the sunlight that hits them. The rest of the sunlight turns into heat which actually hurts the performance of the panels.

An alternative that can make use of all of the sunlight, including light frequencies PVs can’t use, is the solar thermal collector. These devices collect heat that is used to boil the water to make the steam, which drives the turbine creating the electricity. Graphite nanoparticles are very efficient heat collectors.

Vanadium redox batteries

When the sun doesn’t shine and the wind doesn’t blow, neither solar nor wind plants generate electricity. These green energies need batteries to store the excess energy they are able to produce under optimal conditions. Vanadium redox batteries (VRB) could be the perfect answer as they have unlimited capacity simply by increasing the size of their storage tanks, and

can be recharged by simply replacing the electrolyte. VRBs require almost 300 tonnes of flake graphite per 1,000 megawatts of storage capacity.

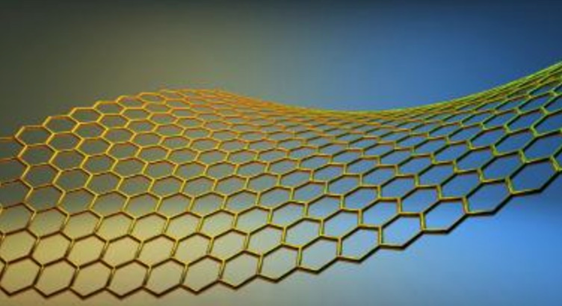

Graphene

If you take a very close look at a graphite pencil lead, you will see “graphene”, a one-atom-thick layer of carbon atoms arranged in a hexagonal lattice. The reason graphite works so well as a writing material, and industrial lubricant, is because the layers of atoms slip easily over one another.

Graphene can carry more electricity more efficiently, faster and with greater precision than any other material. It also beats diamonds in thermal conductivity, and is the thinnest and strongest material known to man — 200 times stronger than steel. Graphene is invisible and weightless, and stretches like rubber. Possible applications include:

- batteries

- transistors

- computer chips

- energy generation

- supercapacitors

- DNA sequencing

- water filters

- antennas

- touchscreens (for LCD or OLED displays)

- solar cells

- spintronics-related products

EV batteries

Lithium-ion batteries contain 10 to 15 times more graphite than lithium. An average hybrid vehicle carries up to 10 kg of graphite and a plug-in EV has around 70 kg. Every million EVs require in the order of 75,000 tonnes of natural graphite. This represents a 10% increase in flake graphite demand. The need for lithium batteries not only for EVs, but energy storage, handheld tools like drills, and an array of consumer electronics like cell phones and laptops, is almost certain to outstrip supply. The current lithium-ion battery manufacturing capacity currently under construction would require flake graphite production to double by 2025.

Only flake graphite, which can be upgraded to 95.95% purity, can be used as anode material in a lithium-ion battery.

Graphite market

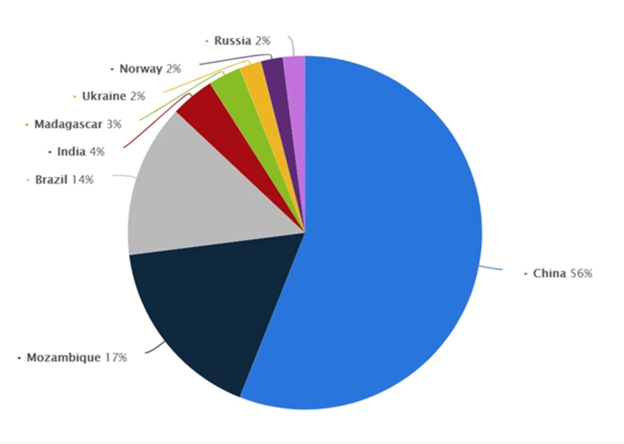

China, Brazil and Mozambique are responsible for most graphite mining and processing, with China producing the lion’s share at around 70%. China’s production is about 40% amorphous and 60% flake.

It’s interesting to note that while China does produce some large flake graphite, the majority of its production is smaller, in the +200-mesh range. North America produces just 4% of the world’s graphite supply, from mines in Canada and Mexico.

China imports a significant amount of North Korea’s large flake graphite production, raising doubts in regards to China’s abilities to ramp up its own graphite supply. Indeed, China has already taken steps to retain its graphite resources by restricting its export quota – the country imposed a 20% export duty, a 17% VAT and also closed state-owned enterprises.

“The days of cheap, abundant graphite from China are over.” — Industrial Minerals Magazine

Large graphite deposits are being developed in Madagascar, northern Mozambique, Namibia, and south-central Tanzania. The world’s largest graphite mine, Syrah Resources’ 50-year Balama operation in Mozambique, achieved commercial production in 2019.

No US natural graphite production was reported to the USGS in 2020, but two companies – Graphite One in Alaska, the other in Alabama – were noted as developing graphite deposits.

According to the USGS, in 2020 the US imported 41,000 short tons, of which 71% was high-purity flake graphite, 28% was amorphous, and 1% was lump and chip graphite. The top importers, in order, were China, Mexico, Canada, Madagascar, Mozambique and Brazil.

It’s thought that the increased use of lithium-ion batteries could gobble up well over 1.6 million tonnes of flake graphite per year (more than current mined supply of 1.1Mt) — remember, only flake graphite, upgraded to 99.9% purity, and synthetic graphite (made from petroleum coke, a very expensive process) can be used in lithium-ion batteries.

The USGS believes that large-scale fuel cell applications are being developed that could consume as much graphite as all other uses combined. We have clearly come to the point when much more graphite needs to be discovered and mined. Tesla’s Nevada gigafactory alone, consumes around 35,000 tons of spherical graphite per year.

Global graphite consumption has been increasing steadily every year since 2013, although in 2019 there was a reduction of 14%. The covid-19 pandemic has mostly affected graphite supplies outside of China, according to the USGS.

Roskill expects total graphite demand over the next 10 years to grow around 5 to 6% per annum.

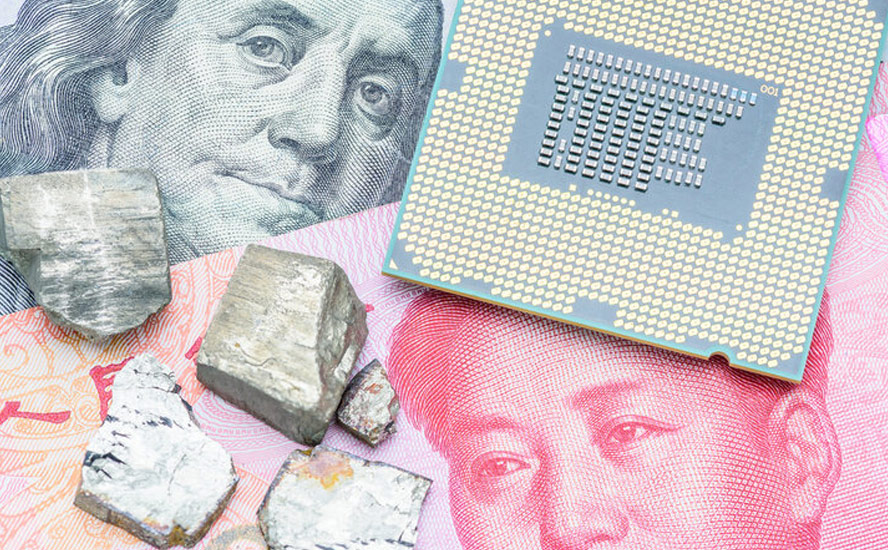

Criticality

Ten years ago the European Commission included graphite among the 14 materials it considered high in both economic importance and supply risk. The British Geological Survey listed graphite as one of the materials to most likely be in global short supply.

The US has also declared graphite a critical material.

Graphite is included on a list of 23 critical metals the US Geological Survey has deemed critical to the national economy and national security.

In late February, the Biden administration announced it would conduct a government review of US supply chains to seek to end the country’s reliance on China and other adversaries for crucial goods.

About 30% of an electric car’s cost goes towards its battery, which requires metals such as lithium, graphite, and cobalt — all on the US critical minerals list.

America’s graphite vulnerability

The global supply chain for graphite is severely vulnerable to disruptions due to the near monopolistic nature of the market.

Currently nearly all graphite processing takes place in China because of the ready availability of graphite there, weak environmental standards, and low costs. However as we have seen with rare earths, a market that China manipulated in its favor following a territorial dispute with Japan in 2010, and more recently, with restricted shipments of personal protective equipment from China during the pandemic (China simply used its monopoly on PPE production to cut exports and supply its own population), being overly reliant on foreign suppliers is dangerous.

In the US, China’s biggest economic rival and a main driver of the future EV movement, there is currently no graphite being mined on American soil. The lack of a domestic source meant that US manufacturers had to import roughly 40,000 tonnes of graphite material during 2018, rising to 58,000 tonnes in 2019.

This kind of dependence on foreign suppliers is one of the primary reasons why the United States Geological Survey (USGS) included graphite on its list of 35 minerals considered “critical” to the nation (graphite and cobalt are the top two non-rare earths on the USGS list of mineral commodities at risk for supply disruptions). Many of these are overwhelmingly produced by one nation: China.

In 2020 the US imported a third of its natural graphite from China, with the balance of shipments coming from Canada and Mexico.

For years, the reliance on China for resources had been an “elephant in the room” for Western policymakers, but the executive order issued by President Donald Trump meant that the US had taken steps to rectify that. And now, the Biden administration and like-minded leaders around the world will make their moves to address this supply chain vulnerability.

Another key factor for listing graphite as a critical mineral is US domestic demand. The USGS sees a major spike in demand once Tesla’s Gigafactory 1 in Nevada becomes fully operational (although the facility has, with partner Panasonic, been building battery packs for its vehicles and energy storage products since 2017, it is infamously only “30% complete).

Once fully finished, the 10-million-square-foot plant will have the capacity to manufacture enough batteries for roughly half a million Tesla cars per year. This plant alone will need around 35,200 tonnes of spherical graphite per year, which is almost comparable to US annual imports.

(Tesla also has its Fremont Factory outside of San Francisco, where the Model S, Model X, Model 3 and Model Y are built, along with a majority of their components. Plus there’s the Gigafactory 3 in Shanghai, and two more under construction, one in Texas, the other in Berlin. Read more)

“The world’s future energy course is being charted today because of the ramifications of peak oil and a need to reduce our carbon footprints.

A whole new industry – a global wide automotive and industrial lithium-ion battery industry – is going to be built.” April 17th 2010, Richard Mills, aheadoftheherd.com

A North American EV supply chain, from mine-site to showroom, is still in its infancy, but progress is being made. In April CNBC reported that General Motors and South Korean battery-maker LG Chem will invest over $2.3 billion in a second EV battery plant, in Tennessee.

Other large automakers and battery companies are jumping on the EV train, including Ford Motor Co. and SK Innovation. The latter and LG Chem recently struck a $1.8 billion deal to end a trade dispute between them, allowing SK to finish building a lithium-ion battery plant in Georgia, that will supply batteries to Ford and Volkswagen.

The inevitable demand surge adds further incentive to overcome the deficiencies in the battery metals supply chain.

This is what Republican Senator Lisa Murkowski, who serves as chair of the Senate Committee on Energy and Natural Resources, had to say on the subject:

“It is a greater vulnerability, I believe, than we once had when it came to our need for oil and resources to power ourselves.”

Murkowski has been pushing legislation to boost domestic mining of minerals such as lithium, cobalt and graphite, those essential to the national movement towards batteries and energy storage.

In my opinion, it’s hard to imagine the US being able to fulfill its new clean energy agenda without either a significant increase in critical metal imports that frankly may not be possible in current market conditions, or executing a home-grown strategy to explore for and mine them.

The United States (and Canada) needs secure, cost-competitive and environmentally sustainable sources of graphite, and that means developing graphite deposits into mines.

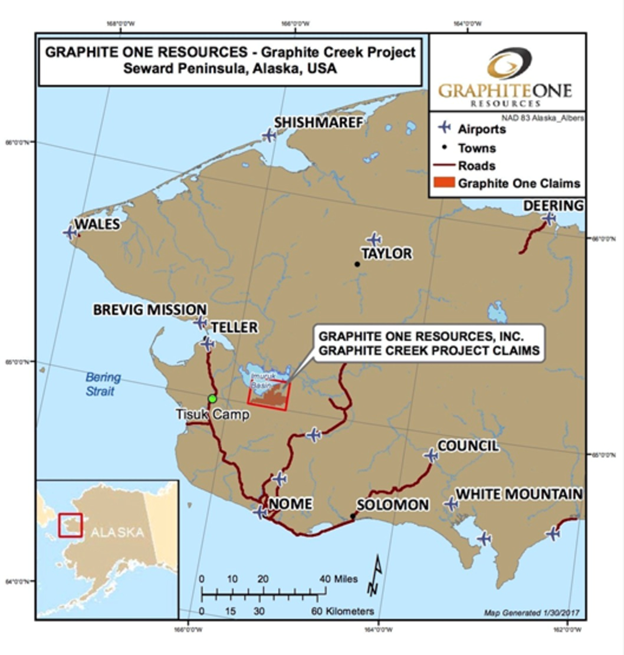

Graphite One

Located on the Seward Peninsula in western Alaska, Graphite One’s (TSXV:GPH, OTCQB:GPHOF) Graphite Creek property hosts America’s highest-grade large flake deposit. A preliminary economic assessment (PEA) released in 2017 showed 81 million tonnes of resources, mostly in the inferred category at a grade of 7% Cg, containing about 5.7 million tonnes of graphite. The same study envisioned a long-life (40 years) operation — based on drilling less than 20% of the deposit — with a mineral processing plant capable of producing 60,000 tonnes of graphite concentrate (at 95% Cg) per year once full production begins in the sixth year. Tests carried out on the property found that 75% of the flake graphite could be converted into spherical graphite, which is the form used in EV batteries.

Looking to advance what would be an integral part of the US graphite supply chain, Graphite One in February announced the completion of two non-brokered private placement offerings, raising gross proceeds totaling C$10 million. Proceeds will be used to further develop Graphite Creek, including a prefeasibility study (PFS) scheduled for completion in the fourth quarter.

Towards that goal, Graphite One this week published news of its 2021 drill program. 3,000 meters of HQ core drilling is planned to infill and expand the measured and indicated resources of graphitic carbon for the feasibility study (FS), the next step after the prefeas.

According to the company, the drill program and other field work is expected to begin in July, including geotechnical drilling for open pit design and to advance understanding of ground conditions at proposed infrastructure sites.

“With the growing demand for graphite in electric vehicle batteries and other energy storage applications — and recent actions by the Biden administration to secure US supply chains for critical minerals — we see Graphite One’s aim to produce a U.S.-based supply chain solution becoming increasingly significant as a new potential source of advanced graphite products for decades to come,” Anthony Huston, Graphite One’s President and CEO, states in the June 1 news release.

“While the 2017 Preliminary Economic Analysis indicated excellent economics, we are very excited about the potential for the PFS to show a clear path for further development.”

Graphite One has also brought on board new talent that should serve to enhance the company’s graphite processing capabilities.

Effective April 1, 2021, Zhengli (Andrew) Tan was appointed director, graphite products, a position focused on the company’s plan to manufacture

high-grade coated spherical graphite appropriate for lithium-ion batteries, energy storage systems and other value-added products.

For the past eight years Andrew Tan has worked as an independent consultant, advising companies on graphite materials manufacturing. From 2011-13 he was general manager of an expanded graphite foil manufacturing facility in China for SGL Group. Prior to that, he held industry positions in the US and Canada. Mr. Tan has a master’s degree in chemical engineering from the University of New Brunswick and a bachelor’s degree in materials science from China’s Hunan University.

Conclusion

Graphite One’s board appointment of a graphite processing expert is an excellent sign that the company is intending to take Graphite Creek all the way to commercial production, rather than selling it along the way to the highest bidder.

As graphite plays go, it doesn’t get any better than Graphite Creek. The deposit has the largest known graphite resource with the highest grade in the United States, and is one of the biggest sources of undeveloped graphite in the world.

Earlier this year the project was given High-Priority Infrastructure Project (HPIP) status by the US government, sending a strong signal that the world’s leading economy wants to put an end to the days of 100% import-dependency on the increasingly critical mineral.

Graphite One is exploring for graphite at an auspicious time in the market. With ambitious plans for vehicle electrification happening in the United States, Europe and China, the demand for lithium-ion batteries is going bonkers.

Given sufficient investment in the sector, the number of EVs in the US could rise from just 1.5 million in 2020 to as many as 35 million by 2030, a new study released by economists at The Brattle Group says.

The latest reports estimate the global electric car market to grow at a CAGR of 37.1% from 2021 to 2028, reaching $1.9 trillion by the end of the forecast year.

While companies like Tesla can muse about alternative battery technologies that depend less on sulfide nickel and cobalt, for example, the fact of the matter is that lithium-ion batteries are here to stay for the foreseeable future.

That means steady demand for graphite will continue to outstrip supply and keep prices high, incentivizing North American companies like Graphite One to develop local sources that can help on the road to electrification and decarbonization.

Graphite One Inc.

TSXV:GPH, OTCQB:GPHOF

Cdn$01.31, 2021.06.02

Shares Outstanding 62.1m

Market cap Cdn$82.1m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc. (TSX.V:GPH, OTCQB:GPHOF). GPH is an advertiser on Richard’s site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.