Canadian mining, oil & gas have a lot to lose from minority government

2019.10.25

In mid-August, a ground-breaking ceremony of sorts took place in Edmonton for the Trans Mountain Pipeline project.

Natural Resources Minister Amarjeet Sohi picked the yard of pipeline contractor SA Energy to announce that Trans Mountain Corp. is moving forward to construct the federally-owned pipeline extension, known for short as TMX.

Trans Mountain Corp is the Crown corporation created to build the embattled pipeline, which has been opposed by the City of Burnaby, the City of Vancouver and the BC government, mostly, they postured, due to the increased tanker traffic.

After years of protests on Burnaby Mountain, court injunctions, environmental reviews and raucous public meetings, former owner Kinder Morgan finally gave up on the project in 2018 – agreeing to sell it to the BC government for the enormous taxpayer-funded sum of $4.5 billion.

The proposal would twin the existing pipeline, tripling the amount of crude oil from 300,000 barrels to 890,000 barrels a day, moving from Alberta to Burnaby, while also triggering a seven-fold increase in the number of oil tankers coming and going from Vancouver Harbour.

In June Ottawa re-approved the stalled pipeline development, and in August Trans Mountain Corp issued 30-day notices to contractors along the route, asking them to mobilize equipment, purchase supplies and start hiring workers. The construction workforce is expected to grow from 650 to about 4,200 by the fourth quarter. Pending more regulatory approvals and permits, the TMX project has an in-service date of mid-2022.

“With the first wave of regulatory approvals complete, we are confident that we have a path forward by which the expansion project construction can commence,” TMC CEO Ian Anderson said in an Aug. 21 news release.

Construction is slated to begin along the right-of-way between Edmonton and Edson, Alberta, at the existing line’s Burnaby storage terminal in BC, and on land at the Westridge Marine Terminal, where the crude oil is loaded onto tankers.

We start this article by updating readers on the Trans Mountain Pipeline because most of us in the resource industry figured the government purchase of the project meant the end of it.

It’s good to hear the pipeline is finally moving forward, but its completion three years from now is anything but certain following the election of a minority government on Monday night.

Indeed the pipeline promises to be a major headache for the Liberals, who have hung onto power with the most seats – 157 – but 13 short of the 170 required to command the majority of the 338-seat parliament.

With their previous comfortable majority the Grits could easily finish construction by whipping the votes on key decisions, but now they will need approval from the NDP or the Bloc Quebecois, both of which oppose the project; either could form the balance of power (not a formal coalition but a case by case solution) by voting with the Liberals against the opposition Conservatives on budgets and confidence motions.

One could imagine a secret deal being negotiated between the Liberals and the NDP or BQ (more likely the NDP since the Liberals, at least you’d think, would avoid joining with a party whose goal is to cleave Quebec from Canada), where the support of a budget is contingent upon scrapping the pipeline.

As the only other party supporting the pipeline, would the Conservatives back the government on a confidence motion hinging on the pipeline moving ahead? Or vote against the interests of their constituents in Western Canada if it ensured the government’s defeat? It’s a question that might play out in the coming weeks/ months.

Pipeline in peril

One thing is for sure. The prospect of a left-leaning minority government in Ottawa whose support for a critical piece of industrial infrastructure is luke-warm at best, is not grounds for optimism among Alberta’s business community.

Trudeau has said, “We can’t shut down the oilsands tomorrow. We need to phase them out.” Jagmeet Singh didn’t visit Alberta once during the election campaign and has said he is “fully opposed to Trans Mountain”.

Remember, the provincial NDP, with the support of 3 Green seats, holds power in British Columbia. Its anti oil pipeline premier, John Horgan, will surely find common cause with the NDP leader who has made it clear he is no friend of the oil industry.

“There’s a palpable fear about what an alliance between Justin Trudeau and Jagmeet Singh could mean for the oil and gas business,” the Globe and Mail quoted oil executive Rick Orman.

Burnaby Mayor Mike Hurley has already gone on record in saying Singh should demand that the Liberals cancel TMX in exchange for the NDP’s votes.

The fact that the Liberals will need the support of other parties to put a pipeline into service worries Grant Fagerheim, CEO of Whitecap Resources. Interviewed by CTV News, he asked, “If the Liberal government could not get it done as a majority government, what do you think they can get done with a minority coalition government?

“Therein lies the challenge,” he added. “So Canada goes into the abyss for a period of time from my perspective.”

True enough, as far as resource development. The oil and gas sector accounts for about 11% of economic output and supplies 550,000 direct and indirect jobs. Oil products account for 25% of our exports, so an oil-patch slowdown invariably affects GDP. Shutting down the oilsands would kill the dollar and probably send Canada swiftly into a recession.

With no turnaround in sight from the oil and gas slump that began five years ago, companies in Alberta are restricting spending and some are cutting staff.

The future of oil in Canada

The oil sands accounted for 64% of Canada’s oil production in 2018 or 2.9 million barrels per day. The oil sands have an estimated $313 billion of capital investment to date, including $10.4 billion in 2018.

On Tuesday Husky Energy confirmed it is laying off an unconfirmed number of employees due to a lack of access to markets and low investor interest.

“My sense is that there’s going to more of those layoffs coming later this week or imminently in the next couple of weeks,” CTV News quoted Gary Mar, CEO of the Petroleum Services Association of Canada, ahead of a 2020 drilling forecast. The number of wells drilled this year is expected to fall 18%.

Not only are energy companies having to contend with low oil prices (benchmark crude has fallen 23% this year) they are being pressured to address environmental, social and governance issues, and reduce greenhouse gas emissions. To remain competitive, and within regulations, margins are being squeezed.

The S&P/TSX Capped Energy Index is down 8% this year and most energy companies are way undervalued.

Tens of billions of investment dollars have been yanked from the oil patch due to low oil prices and rising costs in the capital-intensive oilsands. An oil services company goes bankrupt every week in Alberta.

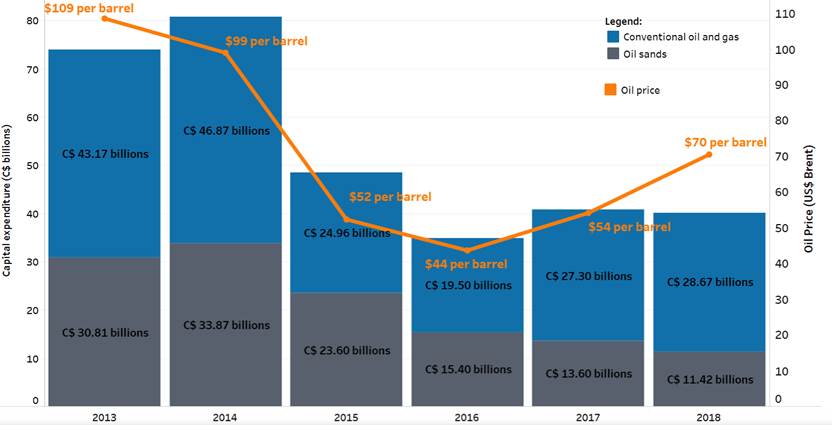

According to the Canadian Association of Petroleum Producers, capital spending in the oil and natural gas industry will fall to $37 billion in 2019 compared with $81 billion in 2014.

Amid this negative industry outlook, the minority government elected this week is not going to help, say oil and gas sector participants.

“We are already in a terrible spot as far as global investment goes,” says Tim McMillan, head of the Canadian Association of Petroleum Producers (CAPP). “A minority government doesn’t send a clear signal to the market, to global investors, that we’re getting a shift in direction that would change their view of us.”

Calgary Herald columnist Chris Varcoe quotes Rafi Tahmazian, a senior portfolio manager at Canoe Financial, saying a minority government means Canadian energy stocks will remain stuck with “dirt cheap valuations today, and we will bounce along the bottom for an extended period of time.”

The oil patch had a lot riding on this election but the failure of the pro-oil Conservative Party to beat the Liberals, despite sweeping Western Canada, has left many disappointed. And worried that the influence of the NDP or the BQ could undermine efforts to build a pipeline to tidewater that would relieve the glut of oilsands crude and raise punishingly low prices.

Varcoe, the columnist, quotes Bob Geddes, president of Ensign Energy Services, saying the election outcome will continue the diminishment of the Canadian oil and gas sector and likely lead to less spending and drilling activity going forward if pipelines aren’t built and the sector can’t grow.

And provincial Energy Minister Sonya Savage, who told the Herald “For us in Alberta, our main objective is to get market access. “We are tired of being a punching bag. All we want is to get our resources to market. We have a constitutional right to develop them. “I think we have a pipeline in peril if we have a minority government.”

The NDP and Greens are anti-pipeline and the new Liberal government is likely to be just as unsure as the last. Consider the election in Montreal of star Liberal candidate Steven Guilbeault. The former Greenpeace activist told the National Post he thinks that Bill C-69, the new federal law that tightens the assessment process on big industrial projects, will bar the construction of any new pipelines due to their suspected contribution to higher greenhouse gas emissions:

“I think that now that we have a real evaluation and impact assessment for projects, we will come to the conclusion that many of these projects are incompatible with the goals we have for 2030.”

Speculation is that Guilbeault will be chosen for environment minister. How bad is that for Canadian energy and mining?

#Wexit

Beyond pipelines, the imposition of a federal carbon tax on the provinces was another bad idea by Trudeau and a key factor in electing five Conservative governments – in Alberta, Ontario, Manitoba and Saskatchewan and New Brunswick.

The Liberal government in Ottawa said it would levy a carbon tax on provinces and territories that don’t already have one, effective April 1. That went over like a lead balloon with provinces that have significant carbon-intensive mining and oil and gas operations. Alberta and four other provinces representing half of Canada’s population, have opposed the carbon tax.

As they have in the past, and especially through his father’s National Energy Program, universally despised in Alberta, regional pressures have bubbled up and Alberta is even talking about separating from Canada.

Western alienation is reflected in the fact that not one Liberal MP was elected in Alberta or Saskatchewan; even the natural resources minister lost his seat.

A political scientist at the University of Alberta was quoted by the Calgary Herald saying “It’s almost like a ‘Nixon goes to China’ thing, where the only people that can stand up for Canada and stop this alienation from becoming a broader separatist movement are people who champion Conservative values that those same people possess.”

Martha Hall Findlay, president and CEO of the Canada West Foundation, described Alberta and Saskatchewan as “once again flyover provinces” during the election campaign, and noted that both Conservative and non-Conservative voters in the two Western Canadian provinces are being ignored:

“The Conservative vote in Alberta and Saskatchewan is taken for granted, so why bother showing up, why engage in those discussions? The non-Conservative votes are deemed to be irrelevant . . . so the non-Conservative votes, the fact that they’re deemed to be irrelevant, is also insulting and frustrating. And so once again we’re going to wake up, an election will have happened, and there will be a continued sense of frustration, regardless of how one voted.”

On Monday night as the results rolled in, the hashtag #Wexit, referring to a potential Western Canadian exit from confederation, was trending on Twitter.

Surely the most obvious example of the federal government not needing the West is when the CBC calls the election result 15 minutes before the polls close in BC.

In fact this election may have birthed a government reflecting a deeply divided Canada, fractured along resource lines and in the case of Quebec, an invigorated nationalism.

The winners were the Conservatives, who got more of the popular vote than the Liberals (ie. more people voted for the Tories than the Grits, but the Liberals won more seats) and the Bloc Quebecois who, not long ago considered dead, managed a phoenix-like rise from the ashes, to gain a stunning 22 seats in Quebec.

The Liberals lost 20 seats, many of them in Western Canada. Six Liberals were turfed in BC. Trudeau’s cynical calculation that the oil industry, and Canadians, would feel better about paying a carbon tax in exchange for his government supporting the pipeline expansion, backfired. Many BC voters felt betrayed, that Trudeau had broken a 2015 campaign promise not to allow more tankers.

For an entertaining skewer of Trudeau and his “preachy, gauzy, meaningless aphorisms” that no longer cut it, read CBC television reporter Neil McDonald’s hit piece on CBC News.

The NDP failed to renew Jack Layton’s “orange wave” that swept the New Democrats to official Opposition status in 2011. Under Jagmeet Singh, the NDP lost 15 seats, several to the Bloc.

Makes me wonder, what was the NDP thinking in electing a leader whose Sikh religion demands that he wear a turban, running candidates in a fervently nationalistic province where Bill 21 bans the wearing of religious symbols by public servants? As a sign of how popular this measure is, consider there has been not one court challenge. Not by the Federal Government, not any political party, nor religious group or outraged citizens coaliation. To dispel any notions of racism, Andrew Scheer’s faith-based, anti-abortion positions didn’t carry much truck in Quebec either.

Trudeau may claim he’s got a second mandate, but in reality the Liberals have been knocked back. Canada is divided as never before. The country didn’t reject division, as Trudeau said in his victory speech, we embraced it. BC is painted orange and blue with a splash of red in the Lower Mainland (11 seats versus 17 in 2015), the Conservatives own the prairie provinces, and the Bloc, whose grand ambition is to divorce Canada, is firmly entrenched in Quebec with 32 seats.

Nothing stopping BC LNG

With the NDP likely to have a real say in keeping this parliament alive, it’s fair to assume that the policies of the provincial BC NDP government will find a sympathetic ear in the federal NDP. That includes the NDP’s dismissal of pipelines and strange embrace of liquefied natural gas, (LNG) along with fracking to get it.

Despite rejecting the TMX expansion, the BC NDP had no problem with LNG, welcoming a final investment decision by Shell and its Asian partners to go ahead with LNG Canada in Kitimat – after a CAD$5.3 billion tax break. The Trudeau Liberals kicked in $275 million.

But it’s funny. While in Opposition, the BC NDP railed against BC Liberal government policies it deemed unfriendly to the environment, including the proposed Site C dam and over a dozen envisioned LNG projects the NDP said would belch too much pollution.

Yet when the NDP won power, its majority propped up by three Green Party MLAs, it was business as usual.

While the NDP passed an ambitious new climate plan, it settled back into the groove of supporting fossil fuels, in particular the rapid and massive acceleration of natural gas fracking and LNG. And it approved Site C.

An LNG industry of at least three more facilities will not only derail the NDP’s climate plan envisioning a 40% reduction in greenhouse gases by 2030 (contrary to popular belief the LNG industry and its supply of hydraulically-fractured gas is both polluting and geologically destabilizing), it’s also building LNG capacity at exactly the wrong time.

According to an article in The Financial Post, a slowing Chinese economy is limiting the appetite for LNG in northeast Asia, where most of the world’s LNG importers are, and where BC plans to ship its liquefied gas product. Despite LNG imports growing 14% this year, China is unlikely to sop up the glut of the fuel in Asia, which dragged prices down 40% in the six months prior to April.

United against mining

In June the Canadian Senate passed Bill C-69, legislation to overhaul the Canadian Environmental Assessment Act which had been in place since 2012. Bill C-69 broadens the scope of the assessment process and adds more consultation with the public and particularly indigenous groups.

There is nothing wrong with consultation, in fact it is a necessary part of making changes to the land base given our fractious relationship with First Nations, but this legislation introduces a whole new level of uncertainty to the environmental review process that is critical to the passage of a mining project.

As an industry, mining is so capital-intensive, investors need a great deal of certainty that their money will be safe and offer good returns for years, often decades, from exploration to production to mine closure. Uncertainty keeps capital away, delays add costs to already hugely expensive construction plans.

Tough but fair resource regulation is necessary and expected. Unfortunately, Bill C-69 does nothing to assuage the industry’s concerns that the environmental assessment process is hampering investment in the sector.

“Put simply, investment confidence in Canada’s natural resource sectors is in trouble. The politicization of pipelines and a decade of legislative uncertainty regarding the review of natural resource projects lie at the heart of it. This politicization needs to end,” states Pierre Gratton, president and CEO of the Canadian Mining Association, writing in the Globe and Mail.

Not sure why, but Gratton actually supports the legislation. He shouldn’t. Bill C-69 will move us to a situation where the cards are thoroughly stacked against a resource proponent. It shouldn’t take 20 years to build a mine in Canada.

Read Road to a mining ‘yes’ littered with obstacles in Canada for all the reasons to reject C-69.

Conservative leader Andrew Scheer has said he would repeal the bill if elected prime minister. But as Opposition leader, Scheer lacks leverage over changing the contents of the bill; 90% of his party’s amendments to it were rejected in June.

That means waiting another four years, or however long the minority government lasts (usually about two) to get a shot at over-turning what is an extremely large roadblock for ‘going mining’ in Canada. And its timing couldn’t be worse.

That’s a shame, because Canada has a prolific mining history. In fact it could be argued that mining is to our economy what hockey is to our culture. Canadians are known for their ability to find, fund and build mines. Some of the biggest mining names are Canadian: Ross Beaty, Pierre Lassonde, Ian Telfer, Robert Friedland.

The country is famous for its vast reserves of gold, copper, coal, iron ore and uranium. We are the fifth largest gold producer, and four of the 10 largest gold companies are headquartered in Canada. Many of the world’s junior resource companies are listed on the TSX or the TSX Venture Exchange.

While Canada is still known as a mining powerhouse (two provinces and two territories were in the top 10 jurisdictions for mining investment in the latest Fraser Institute rankings), a recent report by the Mining Association of Canada asserts that the country appears to be losing its competitive edge.

“For decades, our industry has been a leader in the production of minerals and metals. A leader in mining services and supplies. A leader in mine finance. A leader in sustainability and safety, but that position is in jeopardy and will be lost without continued, decisive action at both the federal and provincial levels,” Gratton says in the news release.

Is this government going to do anything to help Canada to regain its mining edge? I wouldn’t count on it. The day after the election the mining association put out a news release congratulating Trudeau and saying it looks forward to working with the new government to “maintain and grow responsible mining”. All the expected fluff.

The Liberal platform was cited for commitments made on the electrification of the resource sector and zero-emission vehicles, (meaning what? EV haul trucks?) indigenous reconciliation (ie. giving a louder voice to mining opponents) and infrastructure investments in the Canadian north (no details given).

Pointing out the competitiveness issue, Gratton states, “While Canada has long benefited from a prosperous minerals and metals industry, the country is not immune to global competitive forces and cannot take the benefits and opportunities that exploration and mining present to Canadians for granted.”

“With the strong building blocks Canada already has in place, and with mineral exploration and mining playing a critical role in the low-carbon future, the need to support one of the country’s most vital sectors is more important now than ever before.”

Can’t argue with that. It’s just that with only one party supporting mining, it’s hard to imagine any real progress being made. The NDP’s platform would go even further than C-69 down the rabbit-hole of endless consultation with special interests that have little interest in “getting to yes” on a mining proposal.

Found on its “Reconciliation” page , the platform says “A New Democrat government will replace mere consultation with a standard of free, prior and informed consent for Indigenous communities affected by government policies – including for all decisions affecting constitutionally protected land rights, like energy project reviews.”

Thankfully for the mining industry, the NDP will not form government, but as a party the Liberals are likely to depend on for passing budgets and other important pieces of legislation, it’s possible, even likely, if Trudeau names an environmental activist to Cabinet, that government policies related to mining will take on a distinctly lunch bucket orange hue.

Conclusion

A lot of people are mad as hell about the results of this election. As Neil McDonald says in his column, “The vast majority of Canadians voted for other parties. More people, in fact, voted for Andrew Scheer than for Justin Trudeau.” Yet there was Trudeau on election night, gloating about how voters had given him a “clear mandate”. Did anybody show him the map? You know, the one with the ocean of blue Conservative votes stretching from Ontario to the Rockies? The far fewer patches of Liberal red?

It has been like this before when the Canadian electoral map showed a great Conservative blue sea washed over the Prairies.

But the last time, it was even worse. In the 1980s, there wasn’t a speck of Liberal red anywhere west of Winnipeg. It’s really no coincidence that the last time it happened, the prime minister was Pierre Trudeau.

Mention Pierre Trudeau’s name on the Prairies and the National Energy Program will inevitably be spat back at you. Or, if you’re talking to older farmers, they will tell you about the day in Regina when he sneeringly asked them, “Why should I sell your wheat?” Daphne Bramham: Solving western alienation? It’s complicated

Now Justin Trudeau spits on Albertans; “Why should I sell your oil?”

The prairie provinces and half of BC did their part in ditching the glassy-eyed man-child for the only reasonable alternative, but what about the rest of the country? Did they really think that giving Trudeau and his politically impeccable minions a second chance at driving this train-wreck of an economy, limping along and drowning in debt, would be a good idea?

For those of us in the resource sector, it’s kicking us when we’re down. It’s failing to recognize and exploit (liberals really hate that word) the great oil riches of northern Alberta. It’s putting more obstacles in front of mining companies trying to attract investors to Canada, a country with a proud mining history, that has a trained work-force ready to go to work on the next generation of deposits needed for the new global, electrified economy. This government would rather pander to the wants and needs of the few, than man up for the greater good.

The sorry outcome of Monday’s election is a minority government that reflects a Canada so broken, it’s hard to imagine how the pieces will fit back together.

Richard (Rick) Mills

subscribe to my free newsletter

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.