Canada’s EV ambitions

2021.06.01

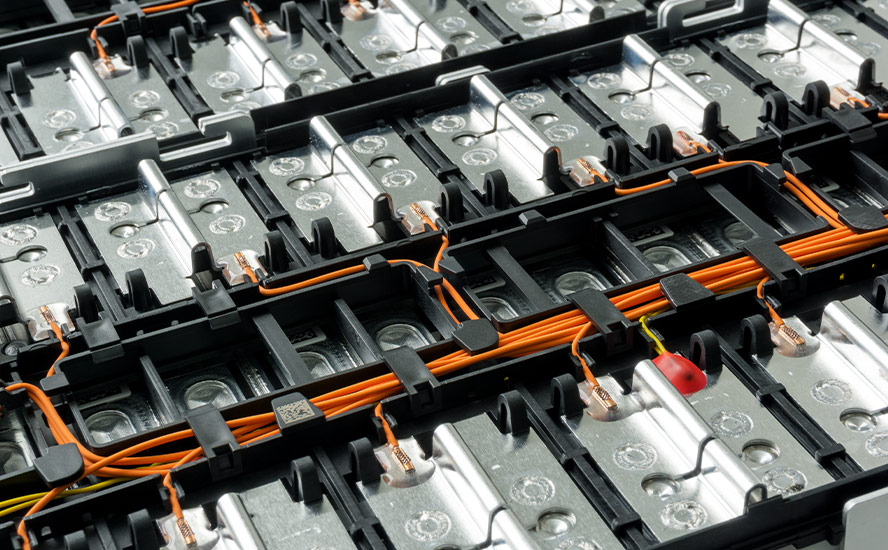

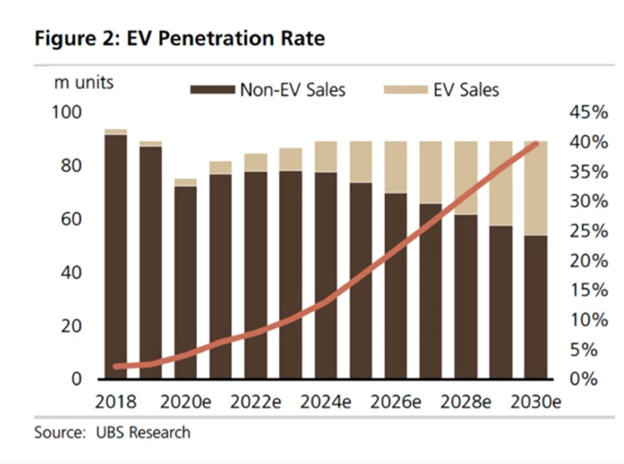

Meeting new emissions targets being set by countries like Canada, the US, Britain, and Japan, will mean large-scale deployment of electric vehicles, renewable power, and electrical transmission, all of which will require copious metal content.

With an abundance of battery metals and cheap hydroelectric power, particularly in British Columbia and Quebec, Canada is uniquely positioned to become an EV leader, from the mining and processing of metal ores, all the way up to the manufacture and assembly of electric and hybrid vehicles.

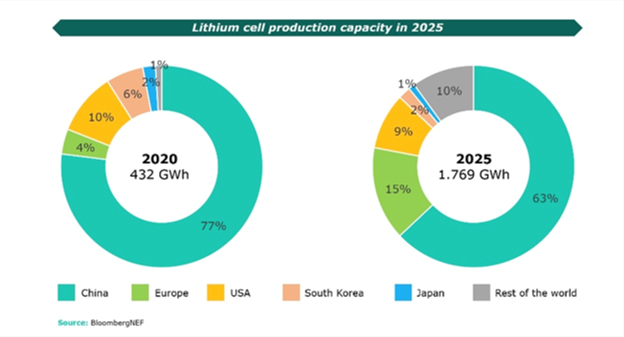

Up to now, Europe and China have dominated EV sales and battery-manufacturing plants, but that is starting to change.

A North American EV supply chain, from mine-site to showroom, is still in its infancy, but progress is being made. In April CNBC reported that General Motors and South Korean battery-maker LG Chem will invest over $2.3 billion in a second EV battery plant, in Tennessee.

Other large automakers and battery companies are jumping on the EV train, including Ford Motor Co. and SK Innovation, another South Korean battery manufacturer. The latter and LG Chem recently struck a $1.8 billion deal to end a trade dispute between them, allowing SK to finish building a lithium-ion battery plant in Georgia, that will supply batteries to Ford and Volkswagen.

The question yet to be answered, is whether the investments will be made in the United States, where automakers led by Tesla are gradually enticing car buyers to make their first EV purchase, or will Canada, the far better jurisdiction in terms of battery metals availability, attract the dollars and the expertise to develop its own, home-grown mine to EV supply chain?

Recent media reports point to the need for Canada to go it alone. Our southern neighbor has always seen us as the diminutive “hewer of wood, drawer of water”. The US essentially views Canada as a cheap commodities supplier (eg. timber, oil), then manufactures those materials into finished products from US sawmills, refineries, auto assembly plants, etc. that create jobs and employ US labor.

Last week we got a sense of how the Biden administration sees North American EV production playing out.

Its approach would have the United States rely on Canada, Australia, and Brazil – among others – to produce most of the critical raw materials needed, while it competes for higher-value jobs turning those minerals into computer chips and batteries, according to anonymous sources.

So, instead of building a true “mine to EV” supply chain, Biden and his crew want to skip the mining and go straight to the cleaner, manufacturing-intensive electric vehicle-building, that will supposedly bring plenty of jobs.

What Biden is really saying, is the US wants to replace China as the world’s supplier of batteries and EVs, create its own green “one belt one road” by sourcing its raw materials — graphite, lithium, nickel, cobalt, etc. — from countries friendly to its interests. Canada would become just another branch plant of the United States, that feeds cheap minerals to “America, Inc.”

Unfortunately, Canada’s leaders are blind to what is really happening here. Soon after Biden’s inauguration in January, Prime Minister Justin Trudeau said this:

“We now have a president who is much more aligned with not only my own values as prime minister but also the values of Canadians.”

Say what?

On his first day in office, Biden immediately canceled the Keystone XL pipeline, snubbing the Canadian and Alberta governments, US and Canadian corporate interests, and unions, all of whom had spent years making the case for the pipeline extension, and had even begun building it.

Other protectionist decisions taken since then show that Biden is no friend to Canada.

While Trump-era duties on Canadian imports of steel and aluminum were lifted in 2019, Biden did nothing to stop US lumber interests from doubling the tariff on Canadian softwood lumber imports, a back and forth issue that has consistently turned in Canada’s favor according to international trade tribunals.

The higher prices are passed onto American home builders and ultimately, home buyers and renovators.

Another long-running dispute between Canada and the US concerning dairy products is the latest trade irritant to emerge.

According to the Wall Street Journal, the Biden administration has initiated a dispute process against the Canadian dairy industry. US dairy producers allege that Canada’s system of tariff-rate quotas that sets aside a share of the market for Canadian dairy processors, violates what Canada previously agreed to. If the US wins, Canada would have to bring its practices into compliance and would face tariffs if it didn’t.

With friends like these, who need enemies?

Why should we, as Canadians, agree to supply the US with cheap minerals (just like we export raw logs and how there are plans in place to divert huge amounts of fresh water state-side) so they can create new jobs and sell finished products back to us, when we could mine, process and build them here, by setting up our own mine to EV supply chain?

The good news is, there are signs this is beginning to take shape.

‘Immense opportunity’

In the past six months, three of the world’s largest car companies have announced they are investing in Ontario, Canada’s most populated province and auto sector hub.

In January General Motors said it will spend close to $1 billion to produce electric commercial vans in Ingersoll, while Ford will invest C$1.2 billion to start building five battery-powered car models in Oakville from 2025. Last October, the governments of Ontario and Canada announced they would each spend $295 million to help Ford upgrade its Oakville assembly plant in its transition to EV production. The company thinks electrics will out-sell its traditional models within the next decade.

Not to be outdone, Fiat Chrysler expects to shell out as much as $1.5 billion in creating its electric vehicle platform in Ontario.

The next-door province of Quebec has also attracted EV investment. In March, Quebec-based Lion Electric announced it will build a battery pack manufacturing plant in its home province. The $185 million factory, funded by the Quebec and federal governments who each committed $50 million, will build lithium-ion battery packs capable of electrifying 14,000 medium and heavy-duty vehicles annually.

“The opportunity is immense,” Bloomberg quotes Scott Bell, CEO of GM Canada, regarding the potential market for electric vehicles in Canada, especially considering that under 3% of new vehicles sold here are currently electric, leaving huge upside: “We certainly see the opportunity to transform that entire fleet to electrification over time.”

Shareholder buy-in

Shareholders seem to agree. Ford CEO Jim Farley’s recent pledge to boost his bet on EVs by over a third, or $30 billion, coupled with his promise to electrify virtually the entire lineup, pleased investors, who bid the stock up to a five-year high.

He expects 40% of all vehicles sold by Ford by 2030 will be battery-powered, compared to just one model presently, the Mustang Mach-E. The company just unveiled its electric Ford Lightning pickup, and there are plans for electric versions of the Explorer and its popular SUV, the Lincoln Aviator, among un-named others.

Ford has also partnered with South Korea’s SK Innovation to build batteries at two US plants and says it will need 10 battery factories by 2030. The iconic US automaker is creating a lineup of batteries called IonBoost, developing next-generation solid state batteries said to extend the range on a single charge, and creating a charging network of public, depot and home plug-in stations, according to Bloomberg.

Government’s role

The shift from gas-powered cars to electrics and hybrids will not only be market-driven, as consumers get more comfortable with a new propulsion system and charging infrastructure; it must also be supported by government, whose role is arguably crucial in pushing out such a disruptive technology.

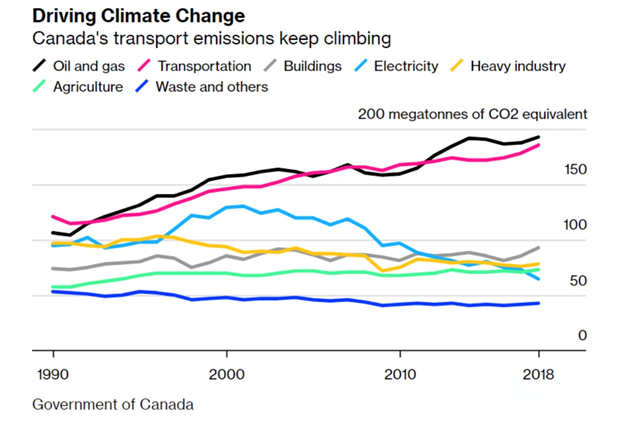

In Canada, transportation ranks as the highest source of greenhouse gas emissions, alongside oil and gas production — the latter fueled heavily by the Alberta oilsands. Hardly a surprise, given that much of the population lives in rural areas, where electrification and range limits don’t yet work, not to mention extreme temperatures requiring robust automotive heating and cooling systems that currently rely on fossil fuels.

According to the Canadian government, per capita greenhouse gas emissions in 2018 were nearly 20 tons, more than those living in all but four of the world’s top 20 GHG emitters.

The latter, and regular complaints about the oil sands, has been taken up by the Trudeau Liberals, who last December announced an aggressive hike to the country’s carbon tax. The tax will rise from the current 30 per tonne to $170/t in 2030, the federal government’s target year for meeting its goal of a 30% cut in emissions.

Of course, Canada is far from alone in setting climate goals. According to Bloomberg New Energy Finance, more than two dozen countries have directed nearly $1 trillion toward a “green recovery” from the pandemic.

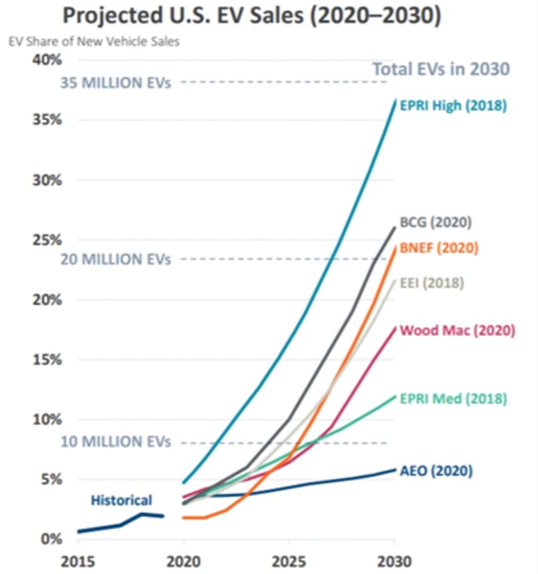

Yet what Canada has dedicated so far, just C$15 billion, is not enough to make much of a difference to emissions, states BNEF (in comparison the Biden administration is proposing a $174 billion investment to “win the EV market”. He and Trudeau have agreed to achieving “net zero” emissions by 2050).

Instead, what is needed are funding and policies to support the entire value chain for minerals to batteries to car assembly.

The out-going chief executive of Sherritt International, a global nickel miner, offers some advice on this issue. David Pathe says Canada needs a better strategy for building an EV supply chain and becoming a North American battery hub.

“Canada as a whole, with some leadership from the federal government, needs to be more strategic about how we develop that industry from a national industrial policy perspective,” Pathe said in a recent interview covered by The Financial Post:

“It takes more coordinated policy from the government to bring all the pieces together because it needs more than just raw materials.”

“Historically Canada has been a supplier of raw materials to the world — I think Canada can aspire to be more than that” …

“There’s a role to be played between the government and bringing all the participants in the industry” from project developers and miners to technology and research firms and processors to identify “bottlenecks” and help foster an EV battery industry.

Mine it here

100 percent. So far Canadian automakers have relied on Chinese companies to supply batteries and raw materials. We saw during the coronavirus what happens when your medical supply chain is dominated by a foreign power, in that case one whose interests are most definitely not aligned with our own. During the Trump-era trade war, Beijing threatened to use rare earths as pawns, by restricting exports of the minerals that are crucial to the US and Canada’s economic and national security.

It’s high time we took steps to mine and process critical minerals in our own backyard, independent of outsiders.

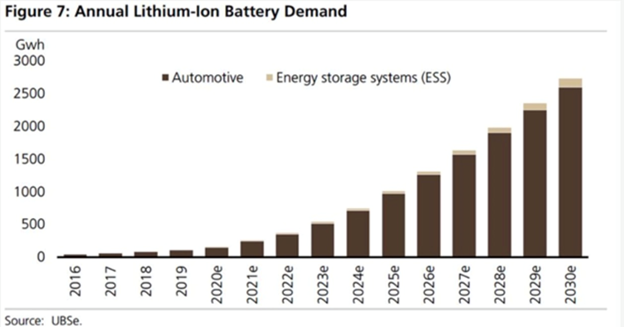

According to Roskill analysts, electric and hybrid vehicles – which represented over 70% of demand from lithium-ion battery technologies in 2020 — are expected to increase their market share in the period to 2031.

A similar sentiment was echoed by those at Benchmark Mineral Intelligence, which predicted global demand for lithium carbonate equivalent (LCE) to rise by as much as 10-fold to 5 million tonnes.

As EV and grid energy storage applications continue to drive up demand for battery minerals, more production will be needed.

As we speak, battery giants and major automakers worldwide are scaling up battery production with mega-factories and actively acquiring graphite, lithium and other battery metals through offtake and joint venture agreements.

Currently, there are over 150 battery mega-factories around the world in the pipeline to 2028 (Benchmark), all of which are based on lithium-ion batteries becoming an all-purpose energy storage unit that is highly scalable.

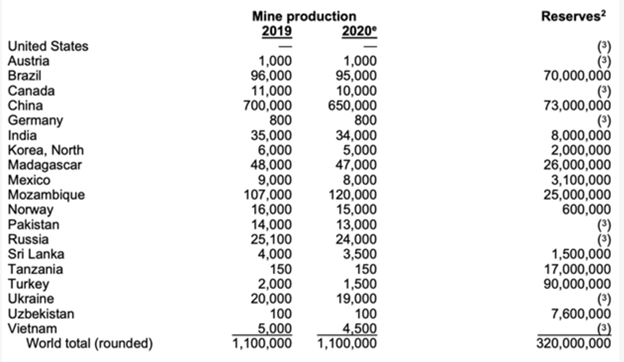

However, a glance at the US Geological Survey’s mine production data, shows how little of these materials Canada and the United States mines.

For example, in 2020 (and earlier) the only lithium production in the US was from Albemarle’s Silver Peak brine operation in Nevada.

No natural graphite, needed to make spherical graphite used in the EV battery anode, was mined in the US in 2020. The world’s inferred resources of recoverable graphite exceed 800 million tons, but domestic sources are “relatively small,” states USGS.

The concentration of production in only a few countries is cause for concern, and reason for Western governments to stockpile battery metals crucial to the green transformation such as graphite, lithium and cobalt, the International Energy Association (IEA) stated earlier this month.

“Meeting our climate change goals will turbocharge demand for mineral resources,” Fatih Birol, the head of the IEA, told Bloomberg. “Voluntary strategic stockpiling can in some cases help countries weather short-term supply disruptions.”

Investment bank Goldman Sachs and Trafigura Group, a large commodities trader, have both said higher prices of in-demand green commodities are needed to incentivize new supply.

Bullish on graphite

The outlook for graphite, used in the EV battery anode (versus the cathode, containing lithium) is bullish.

Benchmark Mineral Intelligence forecasts graphite demand is set to increase by 15 times over the next decade, rising from 200,000 to 3 million tonnes annually. The batteries segment is expected to be the fastest-growing application for natural graphite, and the largest usage category, by 2024.

Yet global graphite supply is expected to remain tight for the foreseeable future. Last year, total output came to 952,600 tonnes, a 15% decline over 2019, according to UK-based analytics firm GlobalData.

The supply-demand imbalance has meant a rising price environment for the mineral since 2017. Roskill analysts believe prices will likely remain high with resilient demand for EV raw materials, major suppliers getting hit by covid-19, and environmental crackdowns in China.

Lomiko Metals

This is great news for companies exploring for graphite. Our Canadian favorite is Lomiko Metals (TSX.V:LMR, OTC:LMRMF, FSE:DH8C), hunting for the grayish-black mineral in the Canadian province of Quebec.

The mining-friendly jurisdiction placed in the top 10 of the Fraser Institute Annual Survey of Mining Companies 2020, for investment attractiveness. Also last year, the province unveiled the Quebec Plan for the Development of Strategic Minerals 2020-25, signaling its intention to transition to a lower-carbon economy. Quebec has also established a list of 22 minerals considered critical and strategic, among them graphite, lithium, nickel, cobalt and rare earth earths.

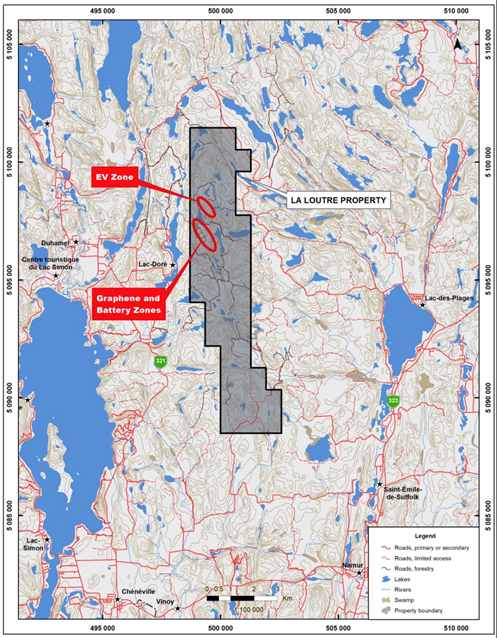

Lomiko’s flagship project is the La Loutre flake graphite property, located 117 km northwest of Montreal, and 53 km east of Imerys Carbon and Graphite’s Lac des Iles mine.

Originally explored for base and precious metals, historical reports showed graphite to be present on the property in quartzite and biotite gneiss, and in shear zones where the graphite content ranges from 1-10% on surface including visible flakes.

A recent grab sampling and mapping program confirmed a graphite-bearing structure of approximately 7 km by 1 km, with results up to 22% graphite in multiple parallel zones 30m to 50m wide. Another 2 km x 1 km area consisting of multiple parallel zones, 20m to 50m, includes up to 18% graphite.

The property already has a resource of 18.4 million tonnes carbon flake graphite (Cg) grading 3.19% in the indicated category, and 16.7Mt @ 3.75% inferred. Using a 3% cut-off grade, the resource amounts to 4.1Mt @ 6.5% Cg indicated, and 6.2Mt @ 6.1% inferred.

Lomiko is currently working on a preliminary economic assessment (PEA) at La Loutre, and in 2019 completed a drill campaign at the EV Zone. Highlights from the 21-hole, 2,985-meter program featured 7.74% Cg over 135.60m, including 16.81% Cg over 44.10m; 17.08% Cg over 22.30m and 14.80 Cg over 15.10m; and 14.56 Cg over 110.80m.

The new PEA will include the latest results from both the Graphene-Battery and the EV zones.

“La Loutre has proven to be a large and high-grade area worthy of further investment,” stated A. Paul Gill, CEO, in the March 4, 2021 news release. “The only operating graphite mine in North America is the Imerys Graphite & Carbon at Lac-des-Îles, 53 km northwest of La Loutre which reported proven reserves of 5.2M tonnes at a grade of 7.42% Cg in July 1988 before the start of production.”

Earlier this year Gill referenced President Biden’s above-mentioned review of US supply chains including EV batteries, with respect to its nearest neighbor (TSX:NOU, NYSE:NMG), being “recently provided a mine permit which bodes well for other groups in Quebec such as Lomiko,” he stated in the Feb. 26 news release. “Although we are only starting our development process, it is good to know there has been nearby success.”

Lomiko has also made progress recently with the project’s metallurgy. A metallurgical flowsheet development program was carried out on samples from both the Graphene Battery Zone and the EV Zone. The program culminated in a locked cycle test (“LCT”) that generated a combined concentrate grading 97.8% total carbon at 93.5% graphite recovery — meeting the program’s objective of upgrading La Loutre mineralization to at last 95% total carbon.

“These very encouraging results of initial testing suggest that La Loutre graphite may be suitable for high-end industrial use,” Gill stated in the April 7 news release.

Conclusion

Lomiko is developing it’s very promising La Loutre graphite project in Quebec during what looks to be an auspicious time for the sector.

With an abundance of battery metals and cheap hydroelectric power, particularly in British Columbia and Quebec, Canada is uniquely positioned to become an EV leader.

The country has a lot going on, as far as plans for electric vehicles. Three domestic automakers have announced their intentions to build EVs in Ontario, including Ford which is upgrading its Oakville, ON facility to battery-powered vehicles. Quebec-based Lion Electric will soon be manufacturing battery packs for 14,000 medium and heavy-duty vehicles per year.

Ford’s Oakville project and Lion Electric’s facility have both attracted funding commitments from provincial and federal governments.

Canadian efforts pale in comparison to what is being promised in the US by the Biden administration. However, despite the $174 billion being dangled in front of the auto industry, Biden officials have made it abundantly clear they do not support domestic mining. Most or all of the money is to go into “cleaner” facilities further down the supply chain, such as battery factories and EV manufacturing/ assembly plants.

In Canada we aren’t so precious. The loss to US miners could easily be Canada’s gain. We have plenty of critical minerals deposits (graphite, lithium, sulfide nickel, rare earths, etc.) worthy of private and possibly public sector investment. All it takes is the right company with the right team.

Lomiko Metals is well-positioned to take advantage of currently favorable market conditions for graphite as the Canadian mine to battery to EV supply chain takes shape.

Lomiko Metals Inc.

TSXV:LMR, OTC:LMRMF, FSE:DH8C

Cdn$0.11, 2021.05.31

Shares Outstanding 76.5m

Market cap Cdn$23.5m

LMR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Lomiko Metals Inc. (TSXV:LMR) LMR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.