Building the most critical metals mine in America

2018.10.19

In the movie Avatar, humans have depleted their natural resources to the point where there’s a severe energy crisis. The year is 2154. To maintain civilization, they must travel to a distant solar system to mine unobtanium (not the most original name for a rare metal) on Pandora, a densely forested moon inhabited by the Na’vi, a species of 10-foot tall “humanoids” who live in harmony with nature. Pandora’s atmosphere is poisonous to humans, so they employ Na’vi-human hybrids called avatars. The lead character, Jake Sully, is a paraplegic former Marine who replaces his dead identical twin brother as an avatar, and is sent to Pandora to act as a bodyguard. The story unfolds from there.

James Cameron’s 2009 science fiction blockbuster plays on themes of colonialism and environmentalism, but it is also a good analog for the present situation the United States find itself in regarding access to critical minerals – obviously not yet for the survival of the human race, but for applications considered vital for the defense of the nation, and to supply materials needed for the inevitable shift from an economy powered by fossil fuels, to one more dependent on non-carbon-based sources of energy such as renewables, nuclear and hydroelectricity.

Most people don’t know it, but the US is dependent on foreign countries for a number of these critical metals, including battery metals used in electronic devices like cell phones and electric vehicles. Why is that important? Security of supply. Without a reliable supply chain, a country must depend on outsiders. This gives foreign suppliers incredible leverage over the United States. There is always the possibility of slowed flows or bans on strategic materials, due to politics or trade disputes – a perfect example is Saudi Arabia’s threat to slow or stop oil production if sanctioned over the Khoshoggi affair, another current example is in the ongoing trade war with China. If that country were to suddenly refuse sale of any of all of the 20 of 23 metals the US deems as most critical that China supplies 100% to the US the economy would shut down almost immediately. Unobtainium indeed!

Security of supply

Access to raw materials at competitive prices has become essential to the functioning of all industrialized economies. As we move forward developing and developed countries will, with their:

- Massive population booms

- Infrastructure build out and urbanization plans

- Modernization programs for existing, tired and worn out infrastructure

Continue to place extraordinary demands on our ability to access and distribute the planets natural resources.

Threats to access and distribution of these commodities could include:

- Political instability of supplier countries

- The manipulation of supplies

- The competition over supplies

- Attacks on supply infrastructure

- Accidents and natural disasters

- Climate change

Accessing a sustainable, and secure, supply of raw materials is going to become the number one priority for all countries. Increasingly we are going to see countries ensuring their own industries have first rights of access to internally produced commodities and they will look for such privileged access from other countries.

Numerous countries are taking steps to safeguard their own supply by:

- Stopping or slowing the export of natural resources

- Shutting down traditional supply markets

- Buying companies for their deposits

- Project finance tied to off take agreements

Donald Trump’s Administration recognized this when the President issued an executive order in December 2017, instructing his underlings to devise “a strategy to reduce the Nation’s reliance on critical minerals” that are largely imported.

“The United States must not remain reliant on foreign competitors like Russia and China for the critical minerals needed to keep our economy and our country safe,” Reuters quoted President Trump saying. The directive was a response to the USGS’ first assessment of US critical minerals since 1973. Its report concluded that the US relies on China for sourcing 20 out of the 23 minerals deemed critical for US national security and the economy.

Included on that list are the building blocks of the new electrified economy, including lithium and rare earths.

The United States was once the largest producer of permanent magnets, used in electric vehicle motors and for energy applications (eg. wind turbines). Permanent magnets are built from rare earths like neodymium. Until the mid-1990s, when it ceded control to China, which now has a monopoly, producing over 80% of the materials used in everything from smart phones to weaponry – without a domestic supply, Americana must rely on Chinese sources of rare earths to build “made in America” military and space equipment.(For the fascinating story on how this happened, read our (Magnequench Has Left the Building).

So how to regain control? The first step is exploring for critical battery metals on home turf. Which brings us to the point of this article. Here we discuss the evolution of the Clayton Valley Lithium Project, being advanced by Cypress Development Corp. (TSX-V:CYP). We think this project has all the makings of a great lithium, scandium, dysprosium and neodymium mine, with other important by-credits to boot. These end products are some of the most crucial metals needed for a future clean energy economy.

If successful, the project would become the first US mine since the Chinese forced the closure of Mountain Pass in 2015 to resume processing rare earths, and could be a major supplier of both lithium carbonate and lithium hydroxide needed for electric vehicle batteries. In short, this mine is everything the Trump Administration could hope for.

Cypress: 5 first steps to a lithium mine

Step 1. Claims acquisition

Three years ago Cypress began prospecting in the Clayton Valley, hoping to find a property that could support a lithium carbonate resource to compete with or possibly complement its neighbor, Albemarle’s Silver Peak Mine, whose lithium brine grades are declining. Silver Peak is the only operating lithium mine in the US. The former head geologist noticed that some of claims on the south flank of an outcropping known as Angel Island had not been staked, and those that had been, had elapsed. Cypress wasted no time in acquiring two land packages: the 1,520-acre Glory Project totaling 76 placer/lode claims located in Esmeralda County, and the 2,700-acre (35 associated placer claims) Dean Project. The Glory claims share their western boundary with claims controlled by Pure Energy Minerals whose lithium brine resource is just west of Cypress’ property boundary.

Step 2. Resource estimate

Reviewing seismic data in Pure Energy’s technical report indicated favorable lithium brine exploration targets along the western and west central portions of Cypress’ Glory Project.

With geological data in hand and two prospective properties acquired, Cypress started taking surface samples in September 2016. The samples returned results ranging from 340 parts per million (ppm) to 2,940 ppm, with an average grade of 925 ppm lithium carbonate equivalent (LCE).

The first stage of a 2017 drill program involving nine core holes in the claystone delivered average grades of 900 ppm, or 0.48% LCE, throughout an average thickness of 250 feet starting from just below surface. In January 2018 Cypress completed the first five holes of a second-stage 12 to 14-hole program. The assays from the last two drill holes showed the mineralization continuing about 2.4 miles long and 1.2 miles wide across the Dean property. The fourth of five holes averaged 1,206 ppm over 88.4 meters while the fifth hole ended in three meters of 912 ppm.

The 23-hole drill program concluded this past spring, with assays from the last three holes reported on April 3. The highlight was an intersection of 97 meters averaging 1,144 ppm Li in the final hole.

A maiden resource estimate was published on May 1, then a more detailed estimate appeared on SEDAR on June 11. The later report showed 1.3 billion tonnes of lithium containing 6.2 million tonnes of LCE, including 3.287 million tonnes LCE in the indicated category and 2.916MT LCE inferred. At Ahead of the Herd, we did some calculations to put the size of the deposit in perspective. In comparison to some of the world’s largest lithium deposits, Cypress is right up there, around the same size as the Salar de Oroz lithium facility (the fifth largest deposit in the world) in Argentina which has a measured and indicated resource of 6.4 million tonnes LCE. The mine owned by Orocobre started production in 2015.

The deposit remains open at depth, with 21 of 23 holes ending in lithium mineralization, meaning the drills have plenty of room to run in expanding the resource.

Step 3. Metallurgy

The size of a lithium deposit is of limited value if the metallurgy doesn’t work. Importantly CYP’s deposit contain non-hectorite clay, meaning the process to separate the lithium from the clay is simpler and less costly than clay containing hectorite.

The company has shown that lithium can be extracted from the claystones using a flow sheet whereby recoveries of 80% can be achieved in short leach times (4 to 8 hours) using conventional dilute sulfuric acid and leaching. The amount of sulfuric acid and reagents needed is relatively low, and being able to leach the lithium with acid avoids more costly processing associated historically with other claystone deposits, specifically those needing high-temperature roasting.

Next steps will include more testing to demonstrate that a lithium carbonate product can be reliably produced. This will entail further bench scale testing, followed by a larger bulk test using a pilot mill which CEO Bill Willoughby says they are already considering.

Step 4: PEA

The detailed PEA released in June showed an attractive net present value of $1.45 billion at an 8% discount rate, yielding an internal rate of return (after tax) of 32.7%. Payback is just under three years. The IRR is based on a lithium carbonate price of $13,000 a tonne, what we here at Ahead of the Herd think is a conservative estimate. The proposed mine would produce an average 24,042 tonnes of lithium carbonate a year, and have a mine-life of 40 years. The mine would be neither a hard-rock nor a lithium brine operation, but rather, would process the lithium from clays in Nevada’s Clayton Valley by leaching with sulfuric acid.

The IRR is all the more impressive considering that Cypress only spent a million dollars in exploration. What’s more, the resource increased 39% from the original estimate released in June. The Clayton Valley Lithium Project now hosts a combined indicated and inferred resource of 8.9 million tonnes of LCE, which is 2.5 million tonnes more than previously reported. This breaks down to 3.835 million tonnes of LCE in the indicated category, and 5.126 million tonnes of LCE in the inferred category. The grades in the PEA are only slightly different, at 867 parts per million (ppm) indicated and 860 ppm inferred, versus the June resource estimate’s 889 and 888 ppm.

The initial pit shell now contains about 500 million tonnes of claystone, more than enough to last Cypress 40 years of mining at the rate of 5.5 million tonnes per year.

Cypress’ PEA has a capex of just under half a billion, a portion of which will go into a building a sulfuric acid plant. Processing costs are estimated at just under $4,000 per tonne of lithium carbonate (compared to around $5,000 a tonne for hard rock mining). The mine would churn cash of $150 million to $200 million a year for the next four decades.

A sulfuric acid plant converts molten sulfur into low-cost sulfuric acid. Cypress has the potential to sell excess sulfuric acid and generate more revenue that way – further bringing down its costs per tonne – while also generating electricity from the acid plant to recover power costs.

Excess acid could be sold locally to large consumers and if a co-generation facility were built in, it could provide enough carbon-free electricity to power the entire project with excess power being sold to the grid.

Step 5: Prefeasibility study

The PEA was all about showing what is possible at the Clayton Valley Lithium Project, with Cypress having hired an independent consultant to crunch the numbers. But the numbers are at this point are theoretical. The next step is a prefeasibility study that will prove out those figures. Institutional investors and financiers need to know that CYP’s numbers are solid and that they can deliver on what the report says they can do. Cypress recently raised $1.9 million through a private placement, a portion of which will be used to complete the prefeasibility study, expected sometime early next year.

So far the stock hasn’t reacted to what we at Ahead of the Herd think is impressive progress made on the project in just two years. But we fully expect the market to start a re-evaluation based on what it sees in the prefeas. It also needs to be stressed that Cypress is the only lithium project in North America without a strategic partner or offtake agreement. Obtaining either would be a significant catalyst for a second market re-evaluation. It would build confidence and validate the metallurgy, since any company that partners with Cypress is sure to do comprehensive due diligence.

Listen to an Ahead of the Herd interview with Cypress CEO Bill Willoughby

Lithium ion batteries

The ability of lithium to be used in rechargeable batteries has been known about since the early 1900s, but lithium-ion batteries have only been available in the last 27 years. As the lightest of all metals, it was discovered that having rechargeable batteries with lithium on the anode could provide extremely high energy densities. Attempts to commercialize lithium batteries in the 1980s, for use in mobile phones, failed because small particles called “dendrites” would accumulate on the anode. This caused an electrical short.

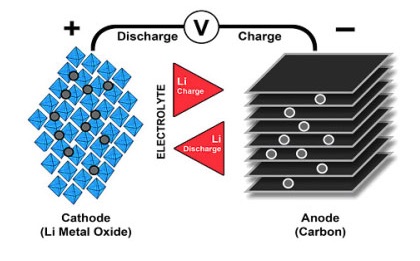

Research then shifted to a metallic solution using lithium ions. While lower in energy than lithium-metal batteries, lithium-ion batteries are safer. The first lithium-ion battery was produced by Sony in 1991. There are three parts to the battery: a cathode (positive electrode), an anode (negative electrode) and a conductive electrolyte. The cathode is composed of metal oxide and the anode is made from graphite. Ions flow from the anode to the cathode through the electrolyte and separator, as illustrated in the graphic below by Battery University. When the battery is charged, the reverse happens, with ions moving from the cathode to the anode.

Today, there are several combinations of lithium-ion batteries that use different metals. These include lithium-cobalt-oxide, lithium-manganese-oxide, lithium-nickel-manganese-cobalt-oxide (NMC), lithium-iron-phosphate, lithium-nickel-cobalt-aluminum-oxide (NCA) and lithium titanate.

Either lithium carbonate or lithium hydroxide can be used as the raw material for the lithium-ion battery cathode.

Rare earths potential

According to the PEA Cypress might have a unique and potentially extremely lucrative opportunity to mine rare earth elements (REE) at its Clayton Valley Lithium Project. REEs were detected in leach solutions from hole DCH-2 in all samples, ranging from 100 to 200 ppm. The rare earths include scandium, dysprosium and neodymium, in order of economic value (ie highest to lowest price). Cypress ran diagnostic leach tests and determined there is the potential to recover these elements, along with potassium, magnesium and other salts. From the PEA:

Using just the 1-hour leach test extractions and an annual feed rate of 5.475 million tonnes, the project, for example, could generate 10 to 15 tonnes of scandium, 25 to 40 tonnes of neodymium, and 5 to 10 tonnes of dysprosium in solution as potentially recoverable oxides. Additional test work is warranted.

Scandium

No scandium is currently mined in the United States. The US gets most of its scandium and scandium components from China. Scandium is mainly found in aluminum-scandium alloys and solid oxide fuel cells (SOFCs). Other uses include ceramics, electronics, lasers, lighting and radioactive isotopes.

Adding scandium to aluminum significantly improves the tensile strength of the metal, which is why the alloy is used in sports equipment like baseball bats and tennis rackets. Smith & Wesson has even used scandium-aluminum alloys in revolvers. Aerospace is another application of scandium. The Russian MIG 29 is the aircraft with the highest content of aluminum-scandium alloys, according to Aluminum Insider.

According to the USGS, supply and consumption of scandium is estimated at just 10 to 15 tonnes per year. It’s a small market, but scandium is expensive.

A gram of scandium oxide at 99.9% purity sells for US$8 a gram, while a gram of the same-purity scandium acetate is $44 a gram. The really big numbers come from 99.9% scandium chloride, which sells for $124 a gram, and 99.9% scandium fluoride, which goes for a whopping $277 a gram. Now we can’t, and won’t, assume that Cypress has the flowsheet to produce and sell scandium acetate, chloride or fluoride, but mining 15 tonnes of scandium oxide, over the life of the mine, fetching $8 a gram could be looked at a couple of ways: as enough revenue to pay for the acid plant, projected to cost just over $100 million; or, the potential for the recovery of saleable rare earths with the lithium could also represent a major reduction in processing costs. And that isn’t counting the revenue from the magnesium and potassium salts, which could shave off more costs per tonne.

Neodymium

The rare earths needed for electric vehicles are neodymium and praseodymium – used for making the magnets in electric motors and generators. The market for the neodymium-iron-boron magnet, installed in Tesla’s Model 3 Long Range electric car, is estimated at $11.3 billion. Demand for neodymium has been growing steadily. While neodymium is classified as a rare earth, it’s not that rare. It is widely distributed in the Earth’s crust, and is as common as cobalt, nickel or copper. Most neodymium comes from China.

Dysprosium

Dysprosium’s main use is in neodymium-based magnets, due to the element’s resistance to de-magnetization at high temperatures. This makes dysprosium ideal for magnets placed in motors and generators. Because it is good for absorbing neutrons, dysprosium is also used in nuclear reactors rods. Most dysprosium is mined from clay ores found in southern China. According to the US Department of Energy, dysprosium is the most critical rare earth element for clean energy technologies. It has no known substitutes.

The Mine

So how is Cypress going to handle extracting these by-products, and the lithium, from the clays, and use them? That is still to be determined; the company has only known about the rare earths potential for about two months, so more work needs to be done. However we can tell you that Cypress’ vision is to build the mine with the ability to extract whatever oxides they choose, from the processing plant.

Picture the mine as a sulfuric acid plant with an open pit on one side, on the other side is a processing plant. You feed sulfur, water and claystone from the pit into the acid plant, and it comes out as a liquid leach. The leach goes into the processing plant, where lithium carbonate or lithium hydroxide is the end result. Magnesium, potassium and potentially, rare earth oxides – scandium, dysprosium and neodymium precipitate out of the leach solution along the way to producing lithium products.

The end result is that through by-product credits, electricity sales and acid sales, Cypress has the ability to shave millions of dollars off of their processing costs – further enriching what we already think is looking to be a very profitable mine.

At this point we should mention water. Does Cypress have enough water to run a 24,000 tonne lithium carbonate per year operation? From the PEA, water will be delivered via pipeline from about 10 kilometers away. It’s apparent from a recent press release that the water source is located on Daijin Resources’ Alkali Spring Valley Lithium Property. In early October Cypress announced an agreement to acquire a 50% interest in Daijin’s unpatented mining claims and water rights.

According to the PEA, 345 cubic meters of water per hour is required, but 60% can be recovered through a reverse osmosis (RO) system. That means the net water required is only 138 cubic meters per hour (40% of 345). Assuming the plant operates 12 hours a day, 365 days a year, Cypress needs 604,440 cubic meters a year. Based on the 50% option, Cypress has the right to 607,050 cubic meters a year. Bottom line: Cypress should, if the water application is successful, have enough water to run its operation.

Lithium market developments

Over the past few months there have been some major changes in the lithium market that bear mentioning; most of them appear to benefit Cypress.

- Chile is having water problems and the government is cracking down on miners that use a lot of water. In Chile’s Salar de Atacama, where SQM and Albemarle have operations just 3 miles apart, the companies are at loggerheads over how much lithium brine (saltwater) each is using.

- Chile refused to increase the production quota on Albemarle’s Salar de Atacama operation. Further evidence that Albemarle is less welcome in Chile and may look elsewhere to produce more lithium – maybe partnering with Cypress in the Clayton Valley.

- US-based Albemarle, the largest lithium miner in the world, is currently building a battery research center near its headquarters at Kings Mountain, North Carolina. The R&D facility is part of Albemarle’s plan to remain the top producer by investing millions of dollars to engineer specialized types of the light metal for electric car batteries. That can only be good for Cypress, considering that the lithium grades at Albemarle’s Silver Peak Mine next to Cypress are declining and the chemical company giant could use more feedstock to keep the mine going.

- Chile’s South American lithium competitor, Argentina, recently announced austerity measures to strengthen the country’s ailing economy. Among them is a proposed export duty on goods and services until the end of 2020. Companies are looking at paying a 7.5% tax which applies to revenues, not earnings, so the impact on miners’ bottom lines is likely to be significant. We’ve seen this kind of resource nationalism before in Argentina. It will only drive investment out of the country and elsewhere – likely Chile.

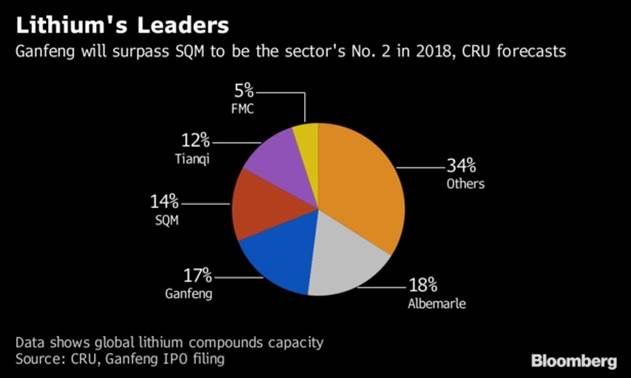

- While some are concerned about the lithium market being flooded with supply as new mines come online, that isn’t a worry for Ganfeng Lithium, which is poised to become the second largest lithium producer this year. Ganfeng, which supplies lithium to Tesla and BMW, said recently that there will be short-term volatility in the lithium market, but it is expected to tighten in 2023-24, “when EV production will be ramping up quickly and that’s when most of the battery makers will be expanding their capacity. The OEMs want to secure long-term supply,” Bloomberg reported.

No such problem exists for Cypress in the Clayton Valley. Cypress will get its water through its JV with Daijin Resources. It won’t have to compete for water with Albemarle, whose Silver Peak Mine is in the same valley. At the same time, Chile is looking to expand its copper and lithium production in order to shield itself from the US-China trade war. It’s worried that the trade war could presage an economic slowdown in China, which buys a lot of Chilean copper and lithium.

Conclusion

Cypress Development is starting down the path towards building a lithium mine in the United States, which suffers from a serious shortage of battery metals that are becoming essential to the new electrified economy. While these metals do have to be mined, they are clean and green. Their applications are for clean technologies – a term that refers to products that reduce waste and require few non-renewable resources. Clean-tech includes electric vehicles and renewable energies, which use lithium and rare earths – the same materials that will be mined from Cypress’ Clayton Valley Lithium Project.

In just two years, Cypress has moved the project all the way from claims acquisition and exploration to a PEA that, from our analysis, looks to be extremely economic. The costs per tonne can be reduced by selling excess acid and electricity from the acid plant, and by-product credits including potassium, magnesium and rare earths.

But it’s about more than building a profitable mine that will benefit shareholders. Cypress is trying to build a mine that is critical to the United States right now. Why? At one time the US was self-sufficient in critical metals essential to the functioning of a modern-day economy, but the new economy – which will see the transition from electricity produced from carbon-based fuels (oil, natural gas, coal) to non-carbon sources (renewables, nuclear, hydro) needs metals the US doesn’t have.

We could continue to import these metals from foreign countries, but this puts the US in a state of dependency that is getting more and more uncomfortable. Do we really want to put our faith in China, with whom we are fighting at trade war, to keep supplying us with lithium and rare earths that are critical to both industrial and military applications?

Foreign lithium and REE based supplies can no longer be taken for granted. Resource nationalism is once again rearing its head in Argentina and Chile, two of the top producers.

Both China and India have mandates for 100% EV adoption, and Europe has recently soured on diesel going all in on electrification. Globally every major automaker plans to dramatically increase EV production.

China’/s increasing control over the production of lithium and REEs is causing great angst in the global EV industry. At Ahead of the Herd we believe this will trigger a scramble, by miners, battery makers, defense contractors and end users, such as EV makers, to secure the limited resources left.

So this is about building a new lithium mine, but it’s also about security of supply. The size of Cypress’ lithium resource in the Clayton Valley puts it up there among the largest in the world. The United States could become a major player in the lithium market, and supply rare earths too – taking away some of the power that China currently wields over these indispensable materials. Wouldn’t that be something. Miners, battery makers, defence contractors and end users such as EV makers could all be potential dance partners with Cypress.

I’m looking forward to seeing Cypress put some hard numbers to their estimates in the PEA, in the upcoming prefeasibility study. Which is why I continue to follow Cypress Development Corp and own shares.

Richard (Rick) Mills

Ahead of the Herd is on Twitter

Ahead of the Herd is now on FaceBook

Ahead of the Herd is now on YouTube

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares of Cypress Development (TSX.V:CYP). CYP is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.