Brigadier Gold chasing high-grade silver-gold veins in Mexico

2020.08.14

Mexico’s mining history goes back almost 500 years.

According to the US Geological Survey, Mexico is by far the largest silver producer, outputting 6,300 tonnes in 2019, followed by Peru and China, at a respective 3,600t and 3,800t. Global silver production in 2019 totaled 27,000 tonnes, or 868 million ounces.

Mexico was the ninth-largest producer of gold and the seventh-largest copper miner in 2018. It is also an important producer of coal with annual production of 82,537 tons.

The country’s terrain is one of the most tectonically active on Earth. According to Fresnillo, a large precious metal producer whose origins in Mexico trace back over a century,

Orogenesis has pushed up mountain chains all across Mexico, including the Sierra Madre Oriental, Sierra Madre Occidental and Sierra Madre del Sur. These three regions have formed some of the key metallogenic areas. Gold and silver mineralization is commonly linked to the two belts of hydrothermal veins and gaps that stretch out underneath both sides of the Sierra Madre Occidental.

That potential has attracted more than 250 private exploration companies to Mexico, with operations concentrated in the northern states of Sonora, Zacatecas and Chihuahua.

Mexico is an established mining jurisdiction with no evidence of resource nationalism, unlike other Latin American nations like Peru, Ecuador and Venezuela.

Mining being an important contributor to the economy, the industry benefits from a well-structured and supportive regulatory framework.

According to export.gov, Mexico is the world’s fourth largest recipient of foreign direct investment for mining, and the second largest destination of mining FDI in Latin America. The most active foreign investors in Mexico are Canada, the US, Spain, Germany and Japan.

Export.gov states,

The majority of this FDI is directed to mining gold, copper, zinc, and uranium. Companies such as Newmont, Fresnillo PLC, Agnico Eagle, and Alamos Gold produce over 100,000 tons of gold each year. In 2018, 6,100 tons of silver was produced in Mexico, mined by Fresnillo, Newmont, Coeur D’Alene and others. Mexico’s copper production amounts to 3 percent of global production, mined primarily by Grupo Mexico, Cobre del Mayo, and Capstone.

The far western state of Sinaloa – across from the Baja California and hosting the resort city of Mazatlán – has an interesting silver-mining history.

By the 1560s, it became common knowledge that gold and silver were plentiful in Sinaloa, and Spaniards began arriving in force to mine it. One of the first was Francisco de Ibarra, a Spanish explorer of Basque descent. After conquering Durango, Sinaloa’s neighbor to the east, Ibarra headed west across the rugged Sierra Madre Occidental mountains, driven by rumors of rich mineral deposits in what is now the state of Sinaloa.

As the story goes, while Ibarra was following the path of the modern-day Mexican Federal Highway 40, between Durango and Mazatlan, he struck pay-dirt. The lucky Spaniard discovered rich silver veins near the rural Sinaloan towns of Panuco and Copala, that were heavily mined for hundreds of years and continue to yield ore to this day.

After the 1500s, more silver deposits were discovered by Spanish adventurers, including major finds in areas east of Culiacan in northern Sinaloa. Throughout the 1800s, Sinaloan mining communities like Concordia, El Rosario and Panuco continued to yield massive amounts of silver and gold.

The mining industry even played a role in the siege and occupation of Mexico by France’s Napoleon III and his Second French Empire. In 1861, a heavily indebted Mexico owed France some 135 million gold francs, and was behind on its interest payments. Britain and Spain were also owed tens of millions in gold coins. The debt issue was one reason for France invading Mexico, another was mineral riches – Napoleon was no doubt aware of the amount of gold and silver being produced from Sinaloa and elsewhere in Mexico.

In the early 1860s, historians estimate up to US$5 million in silver – an enormous sum at the time – was flowing through the Port of Mazatlán annually. And that was only a fraction of Sinaloa’s total output, with most of the precious metal leaving the state via overland routes.

Brigadier Gold Ltd.

Despite recent pullbacks, the bull markets for silver and gold are fully intact, and Mexico is a highly sought-after destination for mining capital. As the chart below shows, Mexico led the number of gold financings in June, garnering $606.6 million compared to second-place China and third-ranked Quebec.

Without question, Mexico continues to be a primary focus for gold and silver explorers, their investors and financiers.

Above-mentioned Sinaloa state is front and center, particularly the Sierra Madre region where a number of exploration plays are taking shape.

Two companies operating there, Vizlsa Resources (TSX-V:VZLA) and GR Silver Mining (TSX-V:GRSL), have seen their shares double and triple on bonanza-grade gold and silver discoveries, sending their market caps well above $100 million.

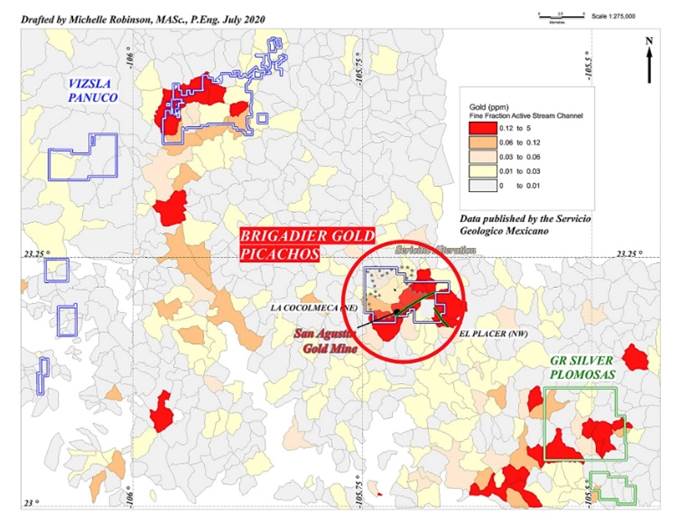

Sitting between them only 15 miles north and south, is a new player on the scene, Brigadier Gold (TSX-V:BRG, FSE:B7LM).

The BC-based company entered the limelight with its recent acquisition of Picachos, a 3,954-hectare, drill-ready property centered over the historic “Viva Zapata” National Mineral Reserve due east of Mazatlán.

In only 30 days, the newly listed company has managed to raise $4.2 million – which is extraordinary for a junior of its size, just $21 million market cap – and is moving quickly to drill Picachos by early fall.

The story is still largely undiscovered, leaving plenty of upside potential.

Team

The company has over 100 years of collective experience in resource development and capital markets. Led by President & CEO Ranjeet Sundher (25 years in capital markets), the team includes special advisor Garry Clark, Executive Director of the Ontario Prospectors Association, who is also on the Ontario Minister of Mines Mining Act Advisory Committee.

Interestingly, the project’s vendor, Michelle Robinson, will be handling exploration and drill planning.

Ms. Robinson, P.Eng, has detailed knowledge of the property, having assembled it some time ago. A geologist with an extensive resume to her name. Robinson is a member of working groups organized by the Mexican Mining Chamber (CAMIMEX), speaks fluent Spanish, and is a Qualified Person as defined by NI 43-101. Robinson has authored more than 20 technical reports and has published several papers for the Society of Economic Geologists.

Picachos

Earlier this month Brigadier Gold signed an option agreement to acquire a 100% interest in the Picachos gold-silver property in Sinaloa.

The project features over 160 historic mines and workings, high-grade veins open at depth, and it is road accessible, with drill permits and agreements with the local community already in place.

Primary targets include under-explored gold veins at the past-producing San Agustín mine, and La Gloria, a historic mine with rock samples containing 21.1 grams per tonne gold and 6 g/t silver across 0.8m.

Under the option agreement, to earn full own ownership Brigadier must make a series of cash payments, issue 4 million shares within five years, and spend $3.85 million exploring the property.

The company will also issue the vendor a million shares upon delineating a minimum mineral resource of 325,000 gold ounces in the inferred category, pay $725,000 plus another million shares after completing a feasibility study, and $2 million upon commercial production.

“Closing the Picachos acquisition marks our official entry into the Sierra Madre epithermal belt, which has seen tremendous drilling success from neighboring exploration companies,” CEO Ranjeet Sundher said in a media statement.

Comprising four mining concessions, Picachos hosts two precious metal vein systems and a large porphyry copper prospect. It overlaps part of the western foothills of the Sierra Madre Occidental, one of the world’s largest silicic igneous provinces. Regional geochemical work at the turn of the millennium highlighted the reserve as one of the largest contiguous anomalies for gold and base metals in southern Sinaloa and northern Nayarit.

It sits on one of the largest high-amplitude anomalies for gold and base metal in the western Sierra Madre, with values up to 6,841 parts per billion (ppb) gold in fine-fraction, active channel stream sediments, according to the Mexican Geological Service (SGS), which staked and explored it in the 1980s.

Picachos is about a four-hour drive from Mazatlán via state highway and paved road to the town of Cacalotán, then by country road into the property. Mine workings are accessed from about 20 kilometers of roads within the project’s boundaries.

At the San Agustín mine, about 664 meters of underground development has been completed. Underground sampling by a previous operator returned an average 81.22 g/t Au and 73.36 Ag across 1.2m. Values from the bottom of a 45-meter-deep production shaft were 185 g/t Au. In 2014, Vane Minerals test-mined three rounds from the south face. Average assay values were 15.8 g/t Au and 63 g/t Ag across a width of 2.5 m. The veins are open at depth and have never been drill-tested.

The La Gloria mine was developed on one of many exposed northwest-trending veins. Gold mineralization occurs in a structural zone characterized by 10-20% red chalcedonic quartz hematite veinlets that contain minor bright green zinc-copper oxides and hematite stain.

2020 exploration

Brigadier Gold is readying drill targets for an exploration program focused on the San Agustín former mine site. A minimum 5,000 meters is planned for the start of September, in approximately 40 holes targeting four high-grade gold-silver veins. The drill holes are expected to be between 90m and 300m long.

Along with San Agustín, the first-ever drill program at Picachos will zero in on the Mochomos vein, where a historic rock chip channel sample yielded 18.5 g/t Au and 570 g/t Ag over half a meter; the Los Tejones vein with values of 28.6 g/t Au and 114 g/t Ag across a meter; and the Fermin vein, which sampled 268 parts per million (ppm) Ag and 0.3 g/t Au over 1m.

According to an Aug. 13 news release, The Company’s focus is proving the potential for high-grade gold-silver veins that will likely be developed using underground mining methods…

San Agustín is the best understood of these veins, mainly because it has been historically exposed underground by approximately 670 line meters of tunnels, stopes and shafts. Geologically, it appears to be disrupted by the NW trending Genardo Fault. On the northeast side of the fault, the Tejones veins might correlate to San Agustín. Collectively, this first round of drilling is designed to test approximately 1 kilometer of vein strike between the past-producing San Agustín Mine and the Tejones Prospects.

Phase 1 is anticipated to total 5,170m of PQ/HQ diamond drilling in 41 drill holes as well as approximately 3 line kilometers of trenching across several historic sample sites to systematically sample the anomalies identified by the historic work and formalize the drill targets.

Peer to peer

As mentioned Picachos is equidistant (15 miles away) between Vizsla Resources’ Panuco project to the north, and GR Silver’s Plomosas silver project to the south.

All three properties are on the same mineralized trend.

The highlights from 16 holes recently returned from the Napoleon Vein Corridor at Panuco, were 1,541 grams per tonne silver-equivalent (AgEq) (includes silver, gold, lead and zinc) over a 2m intersection, and 261 g/t AgEq over a lengthy 22.6m.

At Plomosas, near-surface gold and silver mineralization was recently reported at 716 g/t AgEq over 6.8m, 1,687 g/t AgEq over 0.4m, and 12.6m at 1.7 g/t Au, 17 g/t Ag and 0.7% Zn.

Again, from the chart below its easy to see that newly minted Brigadier Gold stands out like a sore thumb among its Canadian junior exploration company peers operating in Mexico.

Its $21 million market capitalization is a pale ghost compared to neighboring GR Silver and Vizsla Resources, at a respective $89 million and $174 million, much less the towering bars on the right, Discovery Mining and Bear Creek Mining.

At AOTH we believe this, in our opinion, undervalued stock presents an excellent opportunity for investors looking for an early-stage silver/ gold play.

Conclusion

Brigadier Gold is a fully funded junior about to explore a property that, despite having +160 historic mines and workings, has never seen a full-scale drill program. Until now.

Its neighbors to the north and south are hitting high-grade gold and silver discoveries on a regular basis, causing their share prices to take off. Brigadier might be in the starting blocks of what could be a big run too, if the drills find what management, and AOTH, is expecting them to, at the four targets centered around the historic San Agustín mine.

The company checks all the boxes we like to see in a discovery-phase junior: cashed up from a recent financing, led by experienced management, working in a safe country jurisdiction in an area known for historic mining, with high-grade veins and loads of exploration and discovery upside.

Brigadier Gold has just 58.4 million shares outstanding, with potentially $6.7 million available from the exercise of warrants.

We’re excited to be working with Brigadier Gold and will be reporting news from the Picachos project as soon as the diamond drills break ground in September.

Brigadier Gold Limited

TSX.V:BRG, FSE:B7LM

Cdn$0.385, 2020.08.12

Shares Outstanding 58,400,000m

Market cap Cdn$22.48m

BRG website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard Mills does not own shares of Brigadier Gold. BRG is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.