BRICS launch gold-backed currency – Richard Mills

2025.12.26

The BRICS countries are moving away from the US dollar as the currency that settles international transactions, and gold is an integral part of the new settlement mechanism.

The Unit

On Oct. 31, 2025, researchers launched a pilot to test a gold-anchored settlement “Unit” inside the 10-member BRICS+ bloc of countries, which includes Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Indonesia, Iran, and the United Arab Emirates.

This was followed by a Unit prototype launched on Dec. 8.

The four original BRICS members were Brazil, Russia, India, China and South Africa. The six additional countries were invited to become BRICS members following the 2023 BRICS Summit.

The Unit is a “digital trade currency” pilot created for settlement between BRICS economies. The initiative came from IRIAS, the International Research Institute for Advanced Systems.

Importantly, the Unit does not replace national currencies. Rather, it aims to act as a neutral settlement tool that reduces reliance on the US dollar in trade between BRICS economies.

- The BRICS Unit is a gold-anchored digital trade currency designed for cross-border settlement.

- Its launch coincides with record public anxiety about dollar debasement, as shown in Google Trends data shared by Bloomberg.

- The prototype uses a 40% gold and 60% BRICS-currency basket that adjusts daily.

- The pilot signals a structural move toward de-dollarization and strengthens long-term global demand for gold.

Why are the BRICS doing this?

Regarding bullet point two, CCN says public interest in dollar debasement has reached a new peak. It cites Google Trends data shared by Bloomberg Opinion that shows an unprecedented spike in searches for the term during the last quarter of 2025.

There are several reasons why the BRICS created the Unit to trade without the dollar. Members face sanctions, high dollar borrowing costs, and volatility tied to US monetary policy.

The Unit would allow them to settle trade without using US banks; store value using gold instead of foreign currency reserves; reduce exposure to dollar liquidity shocks and build a monetary framework independent of Western systems.

Macro trends driving the initiative include US deficit spending, with heavy borrowing raising doubts about the dollar’s long-term strength; geopolitical fragmentation, with rival blocs seeking options beyond dollar-based systems; elevated inflation which is pushing capital into more stable assets; declining purchasing power, with many currencies losing value faster than wages or savings can keep up; and rising gold demand, with central banks continuing to increase their reserves.

Investing News Network adds that the BRICS want to set up a new currency due to aggressive US foreign policies, including the US placing sanctions on Russia and Iran. The two countries are reportedly working together to bring about a BRICS currency that would negate the economic impacts of such restrictions.

The BRICS want to better serve their own economic interests while reducing global dependence on the dollar and the euro, INN states.

In this sense, the horse has already left the barn.

In parallel, Russia and China now settle almost all of their bilateral trade using the yuan and the rouble, while local currencies dominate transactions across the Eurasian Economic Union. This de-dollarisation process accelerated following Western sanctions on Russia after its invasion of Ukraine in February 2022.

(As much as $250 billion worth of Russian assets have been frozen in the European Union since the U.S. and its allies prohibited transactions with Russia’s central bank and finance ministry — Reuters)

Operability

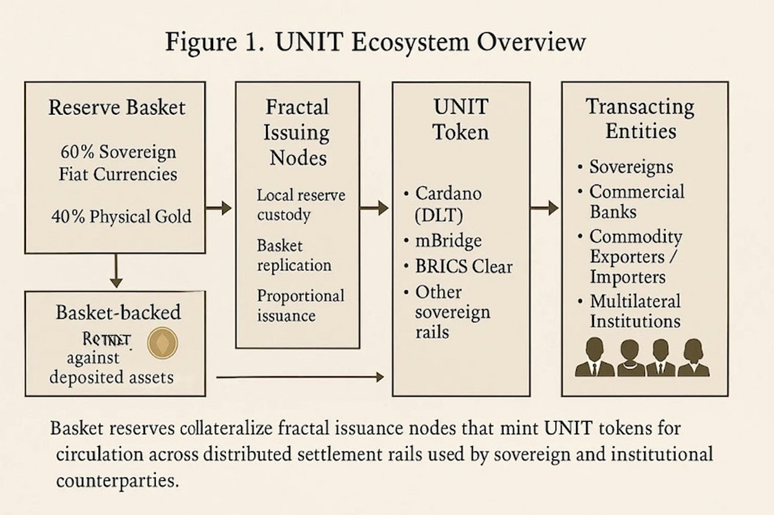

The Unit “combines hard assets with national currencies to create a settlement instrument that avoids dependence on a single economy.”

The reserve basket is composed of 40% physical gold (40 grams gold in the initial test) and 60% BRICS currencies, split into five equal weights of 12% each: real, yuan, rupee, ruble and rand.

As for how the Unit would actually operate, CCN explains that gold would stabilize valuations during periods of currency volatility, and that all deposits and daily pricing updates would run on a blockchain maintained by IRIAS.

Could the Unit move beyond a prototype?

It’s important to clarify that at this stage the Unit is only a prototype; it has not yet been adopted by BRICS central banks.

According to CCN,

The next phase of the Unit depends on whether BRICS members treat it as a research exercise or a blueprint for a shared settlement system. Expansion would require coordinated reserves, unified rules, and deeper interoperability between national payment networks.

If the pilot succeeds, the Unit could form the first large-scale gold-linked settlement rail in the digital era, a development with long-term implications for global liquidity, foreign reserves, and the structure of international trade…

For the Unit to function as a shared settlement layer, members would need to agree on how to manage volatility, contribute reserves, and respond to stress events. These structural differences form the core challenge that will determine whether the Unit becomes a functional multilateral tool or remains a controlled research prototype.

BRICS and gold

IDN Financials quoted Russian economist Yevgeny Biryukov, who said, “For BRICS countries, gold is a tool to protect against sanction risks, a response to the unreliability of traditional partners, and a tangible asset recognised for thousands of years.”

According to the World Gold Council, central banks bought more than 1,000 tonnes of gold per year from 2022-24, making it the longest sustained gold-buying period in modern history.

The four original BRICS nations are increasingly moving away from the US dollar by increasing their accumulation of gold. IDN Financials says the alliance now controls about 50% of global gold production through a combination of output from member states and strategic partners.

Russia and China are the main drivers of this strategy, with China in 2024 producing 380 tonnes and Russia 340 tonnes.

“This large-scale production ensures that BRICS holds significant control over the world’s physical gold supply.”

The BRICS are not only producing more gold; they are also expanding their gold reserves. According to IDN Financials,

The combined gold reserves of member states now exceed 6,000 tonnes, with Russia leading at 2,336 tonnes, followed by China with 2,298 tonnes and India with 880 tonnes. Brazil added 16 tonnes in September 2025—its first purchase since 2021—bringing its total reserves to 145.1 tonnes.

This dual strategy of high production alongside the accumulation of strategic reserves positions BRICS as both a key supplier and a major influence in the physical gold market. Between 2020 and 2024, central banks of BRICS member states purchased more than 50% of global gold, systematically reducing their reliance on dollar-denominated assets.

The Unit, says CCN, is the answer to countries facing inflation, weak currencies and rising debt. They are moving toward assets that hold real value and are using gold to support trade between BRICS nations.

Another important point:

The Unit makes gold part of daily settlement, not just storage, thereby shifting the role of metal from a passive reserve to an active trade asset.

Additionally, the design can strengthen gold’s position in global finance based on the following elements:

- Gold becomes a tool for government-level transactions

- BRICS members need reserves to issue more Units

- Expansion means more consistent gold buying

- Gold moves through trade and not only vaults

As a result, the Unit marks a shift in how value moves across borders. While still a pilot, it brings gold back into the spotlight as more than a hedge. It becomes part of the global trade system.

The Unit and dollar debasement

The Unit is connected to concerns about dollar debasement.

While the Unit does not compete with domestic BRICS currencies, it still challenges the dominance of the dollar. That’s because any system that allows major economies to settle trade without using the dollar reduces demand for it. Lower demand erodes its purchasing power.

For decades, the US dollar has enjoyed unparalleled dominance as the world’s reserve currency. According to the US Federal Reserve, via INN, between 1999 and 2019 the buck was used in 96% of international trade invoicing in the Americas, 74% in the Asia-Pacific region and 79% in the rest of the world.

However, as of November 2025, the USD was only used in about 89% of currency exchanges and represents 56% of all foreign currency reserves held by central banks. (Read more about de-dollarization below)

The dollar has lost ground mostly to the euro and the yen. However, INN notes the dollar is still the most widely used reserve currency, followed by the euro, the yean, the pound and the yuan.

Oil trading used to be nearly 100% conducted in US dollars, but this is also changing. In 2023, a fifth of oil trades were made in non-USD currencies.

While the potential impact of a new BRICS currency on the dollar remains uncertain, INN maintains if it was to stabilize against the dollar, it could weaken the power of US sanctions, leading to a further decline in the dollar’s value.

However, the publication also cites a study by the Atlantic Council’s GeoEconomics Center released in June 2024 that shows that the US dollar is far from being dethroned as the world’s primary reserve currency. “The group’s ‘Dollar Dominance Monitor’ said the dollar continued to dominate foreign reserve holdings, trade invoicing, and currency transactions globally and its role as the primary global reserve currency was secure in the near and medium term,” Reuters reported.

De-dollarization

Donald Trump has boldly imposed a new era of US economic policy dominated by tariffs, trade wars, and threats to the sovereignty of nations it has long considered allies, as the second-term president aims to rewrite the rules of international trade mostly by disregarding them as he pursues an America-first agenda.

Gold, copper and silver are the answer to global turmoil — Richard Mills

The cost to the United States of Trump’s trade war and “country takeover” rhetoric has already cost America its reputation.

Is the US dollar and its status as the world’s most important reserve currency also about to be tossed into the rubbish bin of world history?

A de-dollarization movement that started a few years ago appears to be gathering pace. What’s going on with the dollar and if it recedes or, God forbid, collapses, what are the alternatives?

The US dollar is the most important unit of account for international trade, the main medium of exchange for settling international transactions, and the store of value for central banks.

Because of the dollar’s position, the US can borrow money cheaply, American companies can conveniently transact business using their own currency, and when there is geopolitical tension, central banks and investors buy US Treasuries, keeping the dollar high and the United States insulated from the conflict. A government that borrows in a foreign currency can go bankrupt; not so when it borrows from abroad in its own currency i.e. through foreign purchases of US Treasury bills.

Lately though, the dollar is losing its “exorbitant privilege” and de-dollarization is being pursued by countries with agendas at odds with the US, including Russia, China and Iran.

A few years ago, China came up with a new crude oil futures contract, priced in yuan and convertible into gold. The Shanghai-based contract allows oil exporters like Russia and Iran to dodge US sanctions against them by trading oil in yuan rather than US dollars.

Russia and China have both made moves to de-dollarize and set up new platforms for banking transactions outside of SWIFT. The two nations share the same strategy of diversifying their foreign exchange reserves, encouraging more transactions in their own currencies, and reforming the global currency system through the IMF.

Most Russia-China trade is now conducted in Chinese yuan or Russian rubles, with the US dollar almost completely bypassed.

Since Trump has returned for a second term, his tariffs and trade war has accelerated the decline of the dominance of the dollar. (Geopolitical Economy)

GE says it’s not only governments that are seeking alternatives to the US dollar but also major financial institutions and investors.

The Financial Times of Britain published an analysis from the global head of FX research at Deutsche Bank, who warned, “We are witnessing a simultaneous collapse in the price of all US assets including equities, the dollar versus alternative reserve FX and the bond market. We are entering unchartered territory in the global financial system.”

Certain countries are diversifying away from the dollar, buying gold and other reserve currencies like the euro instead, or conducting trade in one another’s currencies, like yuan and rubles.

JP Morgan points to two scenarios that could erode the dollar’s status. The first includes adverse events that undermine the perceived safety and stability of the greenback. “Bad actors” like Donald Trump seem to fit this description perfectly. The second factor involves positive developments outside the US that boost the credibility of alternative currencies — economic and political reforms in China, for example.

The influential bank notes that signs of de-dollarization are evident in the commodities space, where energy transactions are increasingly priced in non-US dollar currencies. India, China and Turkey are all either using or seeking alternatives to the greenback, while emerging market central banks are increasing their gold holdings in a bid to diversify away from a USD-centric financial system.

Watcher.Guru’s De-Dollarization Tracker identifies 55 countries that are now using non-dollar currencies to conduct international transactions.

As mentioned above, new payments systems are facilitating cross-border transactions without the involvement of US banks, which could undermine the dollar’s clout.

Finally, the US dollar’s share of foreign-exchange reserves has decreased, mostly in emerging markets.

According to IMF data, at the end of 2024, the dollar accounted for 58% of global foreign exchange reserves, while 10 years earlier that share was 65%.

Equally, the share of the US Treasury market owned by foreigners has also fallen sharply, from 50% in 2014 to around a third today.

At $38 trillion and counting, interest payments on the debt now surpass the entire US defense budget. Many countries are questioning the fiscal strength of the US economy and whether holding Treasuries is worth hitching their wagon to an economy that is so deep in the red.

Along with the Unit initiative, there have been calls to use the IMF’s Special Drawing Rights as a global reserve currency. SDR is based on five currencies: the euro, pound sterling, renminbi, USD and yen. Proponents argue it would be more stable than one national currency.

Still, many experts agree that the dollar will not be overtaken by another currency anytime soon. More likely is a future in which it slowly comes to share influence with other currencies.

Conclusion

The Unit would allow the 10-member BRICS alliance to conduct trade amongst themselves, while having a gold and BRICS currency-backed payment basket to settle transactions.

It is emerging as the most viable options for breaking the US dollar’s chokehold on global trade and investment.

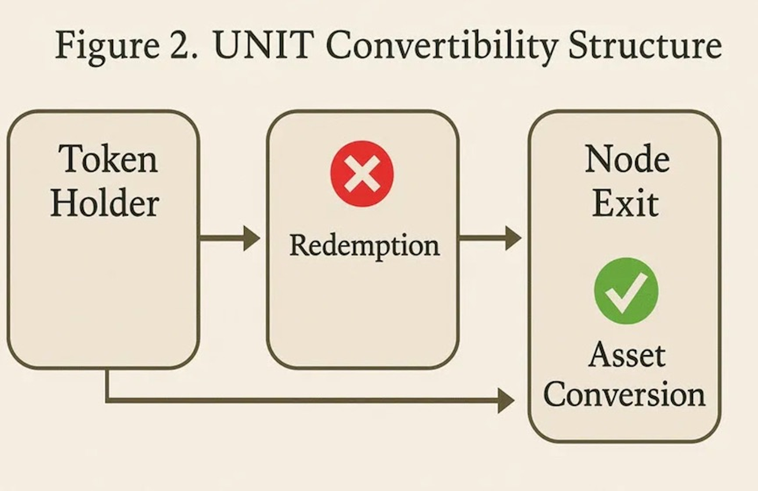

The Jerusalem Post points out that the Unit is non-redeemable; holders cannot convert Unit into gold or fiat currencies. “Gold anchors valuation confidence without introducing redemption risk.”

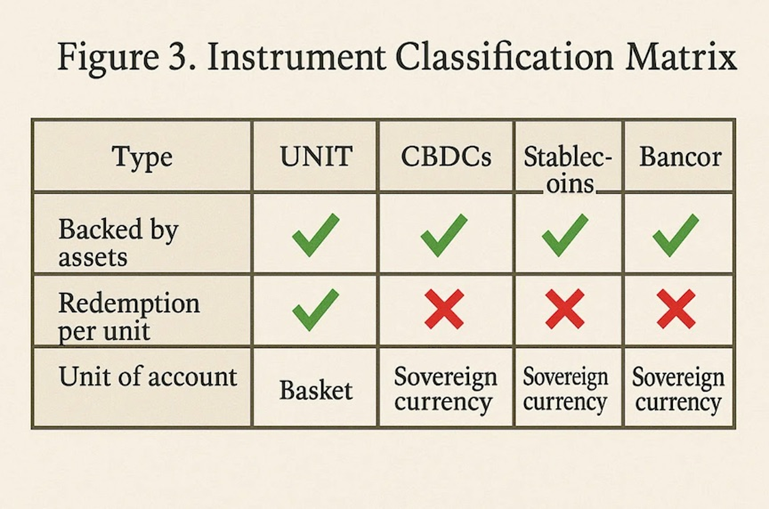

It’s also important to note that the Unit is neither a central bank digital currency (CBDC) nor a cryptocurrency stablecoin. Unlike a CBDC, the Unit is not issued by the state or used for domestic payments. And unlike a stablecoin, it is not designed for retail circulation or reserve convertibility.

Rather, the Unit most closely resembles the bancor, an invention of economist John Maynard Keynes that was a non-redeemable, basket-oriented settlement unit designed specifically for international clearing.

But they are different. As the Jurasalem Post column says, “Bancor was ledger theory; UNIT is ledger execution.”

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.