Breadline blues

- Home

- Articles

- Environment

- Breadline blues

2020.05.01

Is it safe to re-open? That is the question facing US governors and Canadian premiers, forced to walk a tightrope between protecting their citizens from the potentially deadly coronavirus, and allowing enough economic activity to head off what is shaping up to be the worst financial crisis in a generation.

As locked-down jurisdictions discuss what “re-opening” means (Is it schools? parks? beaches? gyms? What about barbershops and hair salons? Should restaurants be allowed to offer dine-in service?) and timelines, the economic picture in Canada and the United States is darkening.

On Tuesday the Globe and Mail reported the Canadian economy is likely in its deepest recession on record – hit by a one-two punch of the covid-19 pandemic and an oil price collapse even worse than 2014.

A Reuters poll of 25 economists predicted Canada’s economy contracted at an annualized 9.8% last quarter, and is forecast to shrink 37.5% in Q2.

If their predictions come true, it would mean Canada is already in the ugliest recession since records started being kept in 1961. The poll also silences the rallying cry of optimists. Despite expectations of a 19% and 11% bounce in the third and fourth quarters, respectively, over half of the polled economists said it would be a U-shaped recovery, a third said it would be tick-shaped and only one chose V-shaped. Bank of Canada Governor Stephen Poloz has said it would take “a couple of years” to make up lost ground after the pandemic is over, with GDP growth remaining under a sickly 0.3%, reached in November 2019, until 2022.

In short, we Canadians are in this for the long haul. It’s the same situation south of the border, only worse. The latest statistics show over 1 million coronavirus cases and 61,668 deaths in the United States, versus 51,597 infections and 2,996 killed by covid-19 in Canada.

Despite the grim totals, many US states are planning a re-opening, or partial re-opening of their economies, sometime in May. About half of Canadian provinces and territories are also in the midst of a re-start of some description; among those still locked down are British Columbia, Alberta, Nova Scotia, and Newfoundland/ Labrador.

The question weighing on the minds of both health officials and economists, is whether letting up on social distancing restrictions will cause the number of covid cases to spike, thereby setting back virus containment efforts and the timeline of economic recovery.

That is the subject of the second part of this article. For the first part, we address the question, how much of an economic reckoning could we face from the coronavirus pandemic?

Recession or depression?

A recession was previously defined as two consecutive quarters of economic decline. However the National Bureau of Economic Indicators, which officially declares recessions, now sees it as a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales, according to Investopedia.

A depression is commonly defined as an extreme recession that lasts three or more years, leading to a decline of at least 10% in a year’s GDP.

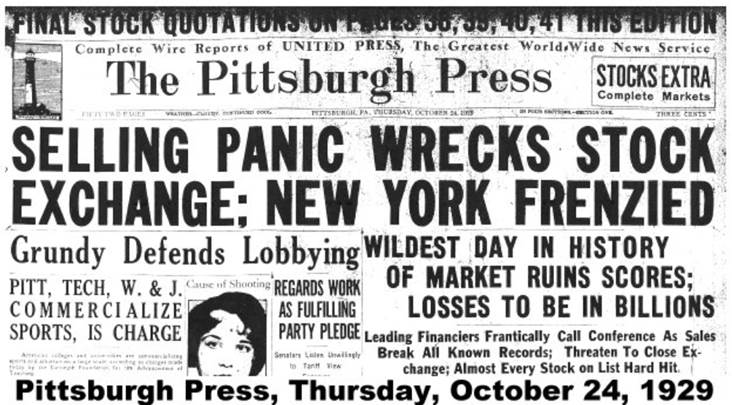

The Great Depression lasted roughly a decade and is considered the worst economic downturn in the history of the industrialized world. It began shortly after the “Black Thursday” stock market crash of Oct. 24, 1929. Investopedia states, During the Great Depression, unemployment rose to 24.9 percent, wages slid 42 percent, real estate prices declined 25 percent, total U.S. economic output nearly halved to $55 billion and many investors’ portfolios became completely worthless.

There was also a major drop in consumer spending, widespread poverty/ hunger and political unrest. Unemployment peaked in 1933 at 25% and remained in the double digits until 1941 when it finally receded to 9.6%.

Investopedia notes soon after Franklin D. Roosevelt was elected president in 1942, the Federal Deposit Insurance Corporation (FDIC) was created to protect depositors’ accounts, and the Securities and Exchange Commission (SEC) formed to regulate US stock markets.

Since 1854 there have been 33 recessions and just one depression.

GDP being the official scorecard of economic growth, the latest figures from the United States are ominous. Having grown at a steady 2% the past 11 years, during the longest economic expansion in US history, between January and March 2020, GDP shrank by 4.8%. Economists said it was the biggest first-quarter drop in gross domestic product since 2008.

“Shelter in place” orders to slow the spread of the coronavirus have throttled the engine of the economy. Consumer spending, which makes up 70% of US GDP, fell 7.6%, the biggest retreat since 1980. Spending on durable goods tumbled 16.1% and expenditures on services slumped 10.6%.

Last week another 3.6 million Americans filed for unemployment, bringing the total thrown out of work over the past six weeks to about 30 million.

As bad as it was, Q1 was only a prelude for what is to come. According to Marketwatch, the economy is likely to decline by 25% or more in the second quarter, with some economists projecting a record drop of 40%.

“The upshot is this was already an economic catastrophe within two weeks of the lockdowns going into effect. The second quarter will be far worse,” said U.S. economist Paul Ashworth of Capital Economics.

Economists polled by Refinitiv expect unemployment in April will hit 14%.

At the close of a two-day meeting in Washington, officials at the US Federal Reserve said the central bank would deploy its “full range of tools” to support the economy. An agreement to maintain interest rates in the range of zero to 0.25% was accompanied by a plan to continue purchasing US Treasuries and mortgage-backed securities, as well as to keep offering large-scale repurchase agreements, CNN Business said.

Fed Chair Jerome Powell put the challenge facing the central bank in war-like terms, defending the Federal Open Market Committee against criticisms its decisions are adding to the country’s massive $24 trillion national debt.

“The time will come again, and reasonably soon I think, where we can think about a long term way to get our fiscal house in order and we absolutely need to do that,” Powell said during a news conference, Wednesday. “But this is not the time in my personal view to let that… get in the way of us winning this battle.”

Despite the tough talk, markets were clearly expecting more aggressive measures. Following the Fed announcement, the US dollar fell against a basket of other currencies to 99.5, continuing a downward trend for the buck after scaling a three-year peak of 102.9 in late March. Stocks and bonds also reacted poorly to the Fed’s plan to stop an economy in free-fall. CNBC stated,

The dollar reaction to the data was not “huge,” but “I think it’s going to pour cold water over hopes of a V-shape recovery. And I think it also validates fears that second-quarter growth could be in line with some of the more dire forecasts of a 40% contraction,” said Joe Manimbo, senior market analyst at Western Union Business Solutions in Washington.

Globally, the International Monetary Fund warned the world economy will contract by 3% this year, the fastest pace in decades.

In its latest World Economic Outlook, the IMF said both advanced and developing economies are expected to fall into recession, with the UK economy shrinking by 6.5% in 2020, the biggest downturn in a century, and the US economy contracting by 5.9%, the worst annual decline since 1946. Australia will enter its first recession since 1991, and China’s anticipated 1.2% growth would be the slowest since 1976. In some countries the jobless rate will surpass that of the financial crisis.

If the pandemic fades in the second half of this year, the Fund predicts global growth will rebound by 5.8% next year, but warns that growth in advanced economies won’t get back to pre-virus levels until at least 2022. A second wave of covid-19 in 2021 would knock an additional 8 percentage points off global GDP, and trigger a downward spiral in heavily-indebted economies, said the IMF, via the BBC.

Given all this gloom and doom, are we actually going to go into depression?

David Chapman, chief strategist at Enriched Investing, helps answer this question with a couple of key charts.

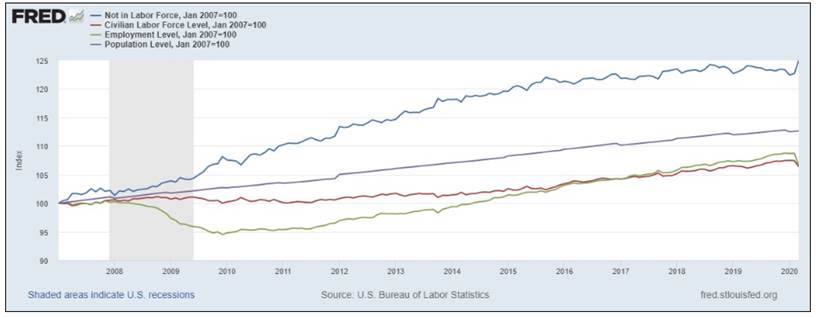

The first chart concerns unemployment. The 30 million in the United States who lost their jobs due to covid-19 lockdowns, combined with those who were already unemployed, represents at least 20% of the labor force. In Canada the 6.7 million applications for the Canada Emergency Response Benefit is about 30% of the workforce. As shown in the FRED chart below, the number of people not in the US labor force has increased 25% since the start of the Great Recession. Out of the 103.5 million Americans currently out of the labor force, 54.8 million are retired and 9.9 million are disabled, leaving potentially 38.8 million looking for work. Some economists are predicting over 30% unemployment. Recall that in 1933, the worst year of the Depression, the jobless rate peaked at 25%.

If unemployment tops 25% this year – it could be as soon as the second quarter – we fully expect economists to start framing the downturn as a depression, even if the other criteria named by Investopedia have yet to present themselves. Unemployment is our first depression box to be ticked.

Chapman believes what started as a wallop to the service economies of both countries, which comprise about 70% of total jobs including restaurant staff and retail employees, has extended to white-collar workers. This is causing consumer confidence (and spending) in Canada and the United States to “fall off the map”.

This can be seen in plummeting house listings and sales, and a marked decrease in car sales. Chapman says “cratering” income will hurt the most vulnerable, including renters, possibly even leading to social unrest and food shortages.

He writes, Thousands could be pushed onto the street homeless and destitute, despite efforts to put money into people’s pockets. Many, however, will fall through the cracks. Most people have very little in the bank and have lived paycheck to paycheck. People are hoarding food and use of food banks is already starting to rise. Worse, soup kitchens and even food banks have been forced to close as well, some because they can’t get deliveries. Most food banks are operated by volunteers, many of them seniors who are now reluctant to show up. As to food itself, meat plants are closing because of outbreaks and warehouses that sort and move food are under increasing pressure. If an outbreak occurs there, one could see shortages show up at the retail grocery level.

And while Chapman says grocery stores are doing well amid widespread economic dislocation, along with robotics, biotech and pharmaceuticals, [i]f anyone thinks we are going to go back to the way it was before this unprecedented shutdown they should probably give their head a shake. A V-shaped recovery is most likely out of the question and so is a U recovery. More likely an L, or a weak W.

We agree. The latter has steadily gained traction as health experts increasingly warn of a resurgence of virus cases in the fall, causing a second downturn, however Fed Chair Jerome Powell this week expressed doubt about the possibility of even a W-shaped recovery. Reuters reports,

In comments on Wednesday, Powell indicated he sees even more disruption than the “W” camp… Calling all current economic forecasts “highly uncertain,” Powell mapped out why he believes the economy may go through a series of peaks and troughs for at least a year or more as the world battles to keep the virus under control.

If that happens, put another tick in the boxes calling for a depression.

Chapman’s technical skills show up in the next chart and analysis, wherein he attempts to answer the question, have we entered your “garden variety” bear market or is this a secular bear market? If the latter, it would only be the third “secular bear” since the Great Recession.

A bear market is defined as a 20% stock market correction. However for a trend to be set, a previous monthly low must be broken, or even better, a previous yearly low. As Chapman sees it, the only historical drop comparable to the one we just witnessed (a downturn of at least 25% during the March 2020 crash, and 30% in most G20 nations), was the 1987 crash that saw the Dow Jones Industrial Average fall from 36.1% between August 25 and October 19, 1987. Chapman writes,

While today’s situation appears comparable to the 1987 crash, there are some significant differences. As with the 1987 crash, we broke under the 2019 low and we also broke under the 2018 low although we didn’t close under that low. We did, however, close under the 2019 low, something the 1987 crash did not do as it never closed on a monthly basis below the 1986 low. The 2020 crash almost broke the 2017 low as well. This, we believe is a far more serious crash than what we witnessed in 1987…

It is interesting to note that while the DJI did not close below its key yearly lows, the TSX Composite did as it closed below the 2017, 2018, and 2019 yearly low. That signals to us that this is not your secondary correction but the start of something potentially more long-lasting. It is not as yet conclusive that this is the start of a new secular bear market; however, given the evidence so far, the odds suggest that we could be in the early throes of one.

If the pattern holds, check a third box for this being a depression.

Forbes points to three economic signposts to watch for a coming depression: unemployment, GDP and stocks. Recall that economists expect unemployment in April will hit 14%. James Bullard, president of the St. Louis Federal Reserve Bank, told Bloomberg he believes second-quarter unemployment could soar to 30%, higher than the 25% jobless reached in 1933.

Also keep a firm eye on GDP growth. Forbes notes the current contraction is happening far quicker and steeper than the Great Depression, when GDP shrank by 8.5% in 1930, 6.3% in 1931 and 12.9% in 1932. First-quarter 2020 GDP fell by 4.8%, but remember, the downturn only really impacted March numbers; the economy in January in February was still running ok. The really awful Q2 GDP figures will be published in July. Among the big banks, Goldman Sachs forecasts a 24% drop, JP Morgan says it will be 14%, and Morgan Stanley predicts a 30.1% decline in GDP this quarter, which would be the worst performance in 74 years. Recall that a depression is defined as more than a 10% drop in GDP. This box will almost certainly get ticked.

You want stock declines? We’ve got ‘em. Forbes quotes data stating that in 1931, the Dow Jones Industrial Average lost a little bit over 30% in one month. That’s nothing compared to the 51% plunge in the Dow between Feb. 17, 2020 and March 16, the 45% drop in the S&P 500 during the same period, and the 41% fall in the Nasdaq. (note however from the charts below, all three indices have recovered some of their losses)

Check another box for depression, the fifth so far. We’re on a roll.

Other commentators tackling the “recession vs depression” quandary are less technical in their analysis. Michael Snyder’s Economic Collapse blog notes the present situation is alarming for the speed at which the economy has collapsed, a mere weeks versus years the Depression took to unfold.

Although some states are attempting to re-open, Snyder thinks, correctly in our view, that In most instances, there will be several stages before all of the restrictions are finally lifted, and that means that economic suffering will be stretched out for an extended period of time. And of course if cases and deaths start spiking again we could see another wave of strict lockdowns all over the country, and needless to say that would greatly escalate this economic downturn.

Moreover, even if all of the coronavirus restrictions in the entire country were lifted tomorrow, fear of the coronavirus would cause economic activity to be greatly depressed for many months to come.

He also touts the familiar rejoinder that, while everyone thought 10% unemployment was bad during the financial crisis, unemployment was 25% during the Depression and the covid crisis could mean an even higher percentage of jobless.

A philosophical George Friedman in his ‘Recession and Depression’ essay states that Depressions are not economic events; they are the result of exogenous forces such as wars or disease. Depressions are not a necessary culling but a by-product of the savage destruction of these external forces, which not only disrupt but destroy vast parts of humanity and decency, along with the economy. Therefore, the question of whether we are now in a depression or recession is not an academic question but the single most important question that humanity faces. We will recover from a recession. We will recover from a depression as well, but it will take much longer and involve far more pain.

Positive step forward or dangerous step back?

To review: the US and Canadian economies have already plunged into a deep recession and are likely to be weak for some time. How quickly they turn around depends on how well the states, provinces and respective federal governments limit the spread of covid-19, allowing individuals and businesses to get back to work without triggering new outbreaks.

We are reasonably confident in the Canadian government and provinces/ territories to get the job done. Prime Minister Justin Trudeau and his Liberal minority appear to be taking their cues from epidemiologists and other health experts as to how plans should proceed for a staged re-opening.

Earlier this month Trudeau made clear in one of his regular morning briefings that a return to normality will not resume in this country until a vaccine has been found.

However, the federal, provincial and territorial governments recently came out with a list of re-opening criteria. As mentioned at the top, about half of Canadian provinces and territories are in the midst of a re-start. To re-open a region must demonstrate:

- The ability to contain covid-19 transmission to a level the health system can manage

- That sufficient capacity is in place to test, trace and isolate the virus

- The health system’s ability to support both covid-19 and non covid-19 patients has been expanded, including making sure there is enough medications and supplies to go around

- That workplace protocols are in place and are being monitored to prevent the spread of COVID-19 when people do return to their jobs, such as providing personal protective equipment for workers who can’t maintain physical distancing

- The easing of restrictions on non-essential travel in a “co-ordinated manner;” to avoid the risk of importing the virus through domestic travel

- Seeing to it that communities are able to manage localized outbreaks, including within schools or on public transit

Regarding the United States accomplishing a successful return to normal economic activity, we are not confident this is happening properly, or can happen properly, given current conflicts between the White House and governors over provision of personal protective equipment, the speed at which the Trump administration wants to re-open versus the more cautious approach of many states, the lack of adherence to science (Clorox injections, anyone?) on the federal level, nor an appreciation of the risks of re-opening too soon.

While there are signs of covid cases plateauing in some places, such as in Washington State, where the first US coronavirus patient was diagnosed, it is also spreading to new areas of the country.

The President’s response has been inconsistent, to say the least. While Trump appeared to accept the seriousness of the situation around Easter, when he extended federal social distancing measures to the end of April, in recent days Trump has continued his war with Democratic governors, and encouraged protests against social distancing restrictions with tweets like “LIBERATE MICHIGAN”.

According to a Washington State pandemic modeling expert, the key to re-opening is mass testing, so that health officials know where the virus is, its spread is contained, and critically under-supplied equipment and personnel are deployed to the right locations.

Chris Murphy, who runs the Institute for Health Metrics and Evaluation at the University of Washington, recently told a PBS Frontline documentary,

“The issue will be the capacity to test. How many tests are practically feasible, come June, state by state? It may not be anywhere near enough, to be able to do full-scale mass testing.”

Murphy says taking social distancing restrictions off on May 1, as some states are planning to do, “there’s a pretty quick rebound, and by mid-July we’ll be right back to where we are now” – referring to the current rate of deaths and hospitalizations. “We’re not going to want to take off measures May 1, let’s put it that way,” he told Frontline.

Yet without a shred of medical evidence, Trump went on television to say “the second wave won’t be like the first wave.”

The confused messaging has resulted in a hodge-podge of planned re-openings across the United States, with some governors setting their own timelines for lifting restrictions and what exactly that means.

The Trump administration has released an 18-page document detailing three phases for re-opening economies. Trump recently said the federal government will not extend social distancing rules when they expire at the end of April, citing the work of governors to deploy re-starts in their states, according to Marketwatch.

We acknowledge the responsibility of states to take charge of their own pandemic response, considering the bicameral nature of the US political system, but the lack of top-down leadership in what is clearly a national, and an international health crisis, is concerning.

The fact that Trump decided to cut funding to the WHO in the middle of the pandemic speaks volumes of the current US leadership’s determination to “go it alone” in all aspects of governing.

Before Covid-19

In December 2019, North American investors were divided between those who believed the decade-long stock market bull was going to keep running into the 2020s, and investors who, wary of something terrible happening, were hoarding cash and gold. We described this polarity of views in Gold vs cash in a crisis

In that article we predicted the next crisis will be a debt crisis, based on the fact that worldwide, total debt including household, corporate and sovereign loans, in 2019 hit a record $250 trillion, led by the US and China. We are not backing down on our debt crisis call, Covid-19’s impact will be tremendous in accelerating our called for debt crisis.

The US national debt in November surpassed $23 trillion. Driven by Congressional borrowing, it rose 5.6% up to Q3 2019, compared to the same period in 2018, against nominal GDP of just 3.7%. In other words, debt was outrunning economic growth.

Excess debt is a brake on aggregate demand. Consider: over the last 13 years, global debt has increased by $128 trillion, but GDP has only risen by $27 trillion. Ie. countries borrowed five times more than their economies produced.

Wolfstreet asked a good question:

If the growth of the federal debt outruns the economy during these fabulously good times, what will the debt do when the recession hits? When government tax receipts plunge and government expenditures for unemployment and the like soar? The federal debt will jump by $2.5 trillion or more in a 12-month period. That’s what it will do.

Reading that question now, knowing how badly coronavirus has damaged the global economy, sends a shiver of fear up my spine.

Why? Because I know the answer. The US budget deficit this year is expected to reach nearly $4 trillion, after Congress pumped about $2.5 trillion into the economy to stem the bleeding from coronavirus lockdowns.

The predicted $3.6 trillion spending shortfall amounts to 17.7% of GDP, nearly double the 2007-09 Great Recession, when the deficit never reached even 10% of GDP. But guess what? The government doesn’t have the money; the gap will have to be bridged through borrowing or printing money. No doubt much of it will be financed, pushing the national debt to a new record high. According to usdebtclock.org, it has already reached $24.3 trillion.

Yet in February 2020, there appeared to be nothing wrong with the US economy.

Unemployment was at its lowest in 50 years, wages in 2019 grew by 3.1%, and stock markets kept rolling along. Turns out much of this was “fake news”.

Marketwatch reported US companies cut back on investment last year, due to reduced exports and disruptions to the global economy from the US-China trade war.

High US stock market performance masked another economic indicator, that had fallen to its lowest level since 2016 – the purchasing managers index.

The IHS Markit manufacturing PMI in January fell to a three-month low – from 52.4 in December to 51.7; any reading below 50 indicates poor economic conditions.

This shows that, well before supply chain disruptions and industrial demand destruction owing to covid-19, US manufacturing was slowing.

We said there would be more interest rate cuts, beyond the three last year, to deal with the looming threat of the coronavirus which in February was mostly confined to China.

In March the central bank obliged, first cutting the federal funds rate by half a percentage point, then slashing it by another full percentage point, taking the Fed’s benchmark for short-term lending down to near 0%.

We also pointed out the spread between 2- and 10-year Treasury yields, which in February was the flattest since November. A yield curve inversion, when short-term yields push higher than long-term yields, is a predictable recession indicator. Right again. The covid crisis has spun the global economy into the steepest, and worst recession since World War II.

On March 9 the entire US yield curve fell below 1% for the first time ever.

A decline in consumer spending is the canary in the coal mine for deflation.

We saw it happening as early as September, 2019, when US retail sales fell for first time in seven months, as households slashed spending on building materials, online purchases, and especially cars.

Three months later, sales at clothing stores declined the most since January 2009.

And instead of going out and spending their hard-earned shekels, in 2019, many Americans were plowing them into savings accounts.

All of the trends we previously identified as affecting the US and global economies are still in play, but the worsening economic fall-out from coronavirus has meant their effects are magnified.

Recovery

Back to the imagery of the U-shaped, V-shaped and W-shaped recoveries, we think the most likely scenario is a W-shape, one that is flatly curved on both “U’s” at the bottom, with a small line pointing upward where the two U’s meet in the middle. This envisions a swift move down, corresponding with the lockdowns which started in March, then the relatively long period of social distancing we are currently in, followed by an uptick of too many re-openings, too soon. For a short period of time economic activity returns, shown by the upward trajectory, but the curve soon moves back down, following the shape of the second U, as a second wave of covid-19 cases hits, followed by a second long period of social distancing.

The result, we predict, is a jagged, stop-and-go recovery that drags out the economic downturn far beyond what should have occurred – causing continued slow, maybe even double-digit negative economic growth, persistent unemployment and anemic stock market performance.

According to JP Morgan, global GDP will slump 14% in the second half of 2020. In the United States, that could mean 25 million layoffs – as it currently stands, 13% of the US workforce has been idled.

Just as bad, is how the economy-killing pandemic will impact corporate bottom lines; Morgan expects global profits to plunge by 70% in Q2 2020. And they won’t be coming back for awhile. The investment bank predicts that even after rebounding from covid-19, global profits will be stuck 20% below their pre-virus levels at the end of 2021. It may take another year or two after that, just to reach pre-pandemic baseline financials.

If these awful predictions prove correct, we may be looking at prolonged unemployment, rising corporate debt, and a moribund stock market until 2022-23. We realize that’s not what anyone wants to hear right now.

Eddie Hobbs, a columnist at the Irish Examiner, has some more pain points for you to think about.

First, he says there are three phases to this recovery – medical, financial markets and the real economy. Currently we are in the first phase, characterized by the pandemic onset and the first countermeasures. As for what comes next, The deluge from the fractures will follow. Capitulation will mark the bottom before recovery…There is no going back to the old economy, this is going to be deeper and longer than before.

On the way, Hobbs expects vulnerable countries to go bust, with at least one OECD country needing a bailout. Economies with a lot of dollar-denominated debt could be hurt bad, as the US dollar – still the reserve currency despite all the US economy’s, and its political leaders’ shortcomings – maintains strength against other currencies.

With so many unemployed, tax revenues will collapse, leading to further rounds of quantitative easing to bail out local and state/ provincial governments. Here in British Columbia, the City of Vancouver, highly overleveraged, teeters on bankruptcy and is already asking for a handout.

With no vaccine in sight, and covid-19 curves refusing to flatten, national health care systems could temporarily collapse. Hobbs writes, The delay will have grim outcomes for tourism, airlines, sports and other mass gathering events, those who survive will mop up, including Governments who nationalize flag carriers…

The very severe and sharp stop in large parts of the economy is likely to see economic activity plummet by a fifth over Q1 and Q2 2020 with the potential to drag into H2. At best 2021 will see sluggish growth, at worst further deflation. Each deflationary test will be met by an air fleet of Keynesian, counter cyclical monetary and fiscal carpet bombing.

Unemployment will rise sharply to swamp a fifth of workforces and despite social welfare buffers and fiscal programmes such as tax suspensions, utility holidays and loan suspensions, consumer savings will deplete to service core lifestyle costs. This will lead to a severe weakening of consumer spending power on the other side until savings are replenished.

There will be negative price expectations due to the fall in demand for discretionary items. This will affect many prices, including property. The decline in oil prices is a consumer buffer, but hurtful to hydrocarbon producing economies and to national tax revenues.

Overleveraged corporates and institutions without the cash buffers to withstand the cliff fall in economic activity, especially in consumer discretionary, retail, transport, airlines, hospitality, etc., will become casualties. This means a slew of distressed sales, bankruptcies, administrations and takeovers as the weak are consumed by the strong and flagships get nationalized where there is market failure.

The banking system, despite liquidity operations becomes unsafe leading to problems at inter-bank level and will require fresh emergency quantitive easing operations to prevent gumming up.

Not all banks will escape, the spike in non-performing loans will hit weaker balance sheets a blow that will lead to defaults and contagion and, if not rapidly contained, led to banks shutting for a spell during restructuring.

Only banks deemed of systemic importance will be socialized, others will be subject to bondholder and deposit holder haircuts.

After the deflationary shock created by the [Great Pandemic Crisis], it is difficult to see how a prolonged phase of high inflation will not eventually emerge from money expansion and rising velocity which will test the fundamental value of fiat currencies. In this climate the value of currency becomes a casualty and gold a king.

And that’s for the G20 countries. For poorer nations lacking the medical supplies, facilities, health care workers, and whose economies do not have the monetary or fiscal resources needed to ride out a global pandemic, the outcome could be dire.

CBC notes reports that civil unrest in Iraq, following the loss of oil revenues, may be an indicator of wider economic and political fallout.

Bessma Momani, a specialist in international financial institutions at Ontario’s University of Waterloo, says the world’s poorest people, not just in South Asia, sub-Saharan Africa and South America but in U.S. inner cities, too, will suffer the most, and in ways that could lead to revolts. Places such as Venezuela, already chaotic, may collapse into something worse.

In the dream of your downy couches,

through the shades of your pampered sleep,

Give ear you can hear it coming,

the tide that is steady and deep.

Give ear for the sound is growing,

from the desert and dungeon and den.

The tramp of the marching millions;

The march of the hungry men.

March of the hungry Men, Reginald Wright Kaufman

Conclusion

The blowback from re-starting economies and sending non-essential workers back to work too early could be severe. Workers who managed to avoid covid-19 during social distancing will be infected at the workplace. Without proper testing and because the virus is so easily spread by the asymptomatic, meaning nobody knows who has the virus, the US is at risk of losing a large percentage of its workforce.

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.