Boreal Metals hunting high-grade VMS in mining-friendly Sweden

2019.03.08

Among the most important criteria in deciding which junior mining companies to invest in, is the place where the exploration is being conducted.

Many a development project that by all indications looks to be outstanding, has been halted by a government either intent on expropriating the minerals for itself, or yields to public pressure to halt mining in an environmentally sensitive area – or other reasons that might fuel opposition.

Venezuela, Ecuador, Bolivia and Mongolia are among countries that have nationalized foreign-owned mines and are at risk of “resource nationalism”. Tax increases, royalty grabs and tighter regulations are other ways for governments to limit operations or skim the profits of mining companies.

Wise investors steer clear of such jurisdictions.

On the flip side are countries that have a reputation for being mining-friendly while at the same time upholding environmental and social legal frameworks. One of these countries is Sweden.

Nordic powerhouse

Often overlooked by North American investors, the Swedes have mining and mineral exploration running through their Nordic veins. A little-known fact: mining in Sweden goes back 6,000 years.

Its first mine, the Falun copper mine, produced about two-thirds of Europe’s copper for hundreds of years. Archeological and geological records show that Falun first started being mined around 1,000AD; it remained in operation until 1992.

Revenue from the mine, a giant volcanogenic massive sulfide (VMS) deposit, funded Sweden’s wars in the 17th and 18th centuries.

Sweden is also a large producer of iron ore; Kiruna in Lapland is the world’s largest underground iron ore mine.

Every day, Sweden-owned LKAB pulls 750,000 tonnes of iron ore from hundreds of meters below surface – the equivalent volume of a 12-storey building. Kiruna made headlines several years ago for a 20-year plan to move the town of Kiruna to a new location, after it was discovered that cracks from mining were appearing in populated areas. Instead of closing the mine, the 20,000 residents and the town’s main buildings are being relocated, allowing the 4,000 townspeople who work there to keep their jobs.

Sweden is Europe’s second biggest gold producer after Finland. Gold was found at Boliden in 1924, from which the mining company Boliden AB took its name. At one time Europe’s largest and richest gold mine, Boliden closed in 1967. The Boliden Group currently produces nearly 18,000 kilograms of gold a year and has three gold mines plus two gold smelters.

Sweden’s mining success clearly stems from its rich geological endowment; it lies overtop of the Baltic Shield, which spreads throughout Sweden, the Fennoscandian Peninsula and parts of Russia.

In total, the country has 15 metal mines in operation. Between Sweden and Finland, there are 30 mines and six smelters. Aitkik in northern Sweden is Europe’s largest copper mine. Aitkik was established in 1968 with approximately 39 million tonnes of ore processed into copper, gold and silver concentrates in 2017.

In southern Sweden, Boliden’s Garpenberg mine is the oldest mining area in Sweden still in operation, with a 120-million-tonne VMS deposit. The Zinkgruvan underground mine is Lundin Mining’s flagship operation in Scandinavia, producing zinc, lead and copper concentrates.

For mining companies and explorers, Sweden is an extremely desirable country to work in. It has nearly 100 companies with active exploration permits, and around 6,000 people directly employed in the industry. A 2011 national strategy for mineral exploration has resulted in more funding for mapping and gathering data on minerals.

Political stability, a solid legal system based on penal and civil law, and highly developed infrastructure are important pluses for mining. Sweden has 12,000 kilometers of rail track (85% electrified) and 69 ports including Goteborg, Falkenbergs Terminal, Ahus and Stockholm.

Another little-known fact about Sweden is the low cost of power. Commercial electricity contracts are in the order of 4 to 5 cents a kilowatt-hour, which is 20% cheaper than the normal cost of power in Europe. That’s important for mining because it allows miners to lower their cut-off grades in order to process more ore economically.

The corporate tax rate is a competitive 22.5% versus the mid-20-percent range in neighboring Norway. In comparison the corporate tax rate in Canada is 26%.

There are no state royalties or other assessments, making the effective tax rate for mining around 23% in Sweden.

Mining is governed through the Swedish Minerals Act; mining laws have been in place since the 1300s according to the Geological Survey of Finland. Exploration rights are valid for three years and can be extended for up to 15. Once a concession is granted it’s good for 25 years, with a 10-year extension possible if work is performed on a regular basis.

A key advantage of exploring in Sweden is the short permitting process. Where permitting can take years/decades in other jurisdictions, in Sweden it can be a matter of months, if all the i’s are dotted and t’s crossed. The environmental laws are well-defined.

That’s important not only for limiting an exploration company’s cash burn rate, but also preserving a project’s economics. Consider – in most countries it takes years from discovery to drill, do a resource estimate, consultations, a PEA, a PFS, more consultations, a feasibility study and get environmental approvals, mining permit etc. The years from initial discovery to actual mining start can, in many countries, be counted in decades. The delay throws off the economics, making your projects stated net present value (NPV) and internal rate of return (IRR) pretty much irrelevant. In Sweden, a drill program can be permitted in six weeks and production has started in as little as 4 years from discovery!

An example of how quickly a mine can move from exploration to production is the Storliden mine, a massive sulfide mine co-owned by Boliden and Lundin. First discovered in 1998, the mine was up and running by 2002. That kind of quick timeline is unheard of in just about every other mining jurisdiction. In Canada it can take 20 years from a discovery to mine opening.

Boreal Metals Corp.

Boreal Metals Corp. (TSX-V:BMX) is poised to benefit from Sweden’s attractive exploration and mining climate. Boreal’s history is closely linked with EMX Royalty Corp. (NYSE:EMX), a global prospect generator.

During the mining downturn a few years ago, EMX needed to cull its Scandinavian asset portfolio of around 24 projects. After whittling it down to its best four, EMX management began looking around for a partner to either acquire the Scandinavia portfolio or become a strategic partner in the new royalty company.

They knew Patricio Varas, the former CEO of Western Potash, through an earlier collaboration in Arizona, and asked if he would be interested. He was, and a series of fruitful discussions resulted in the birth of Boreal.

Based in North Vancouver with an office in Sweden, Boreal now presides over a portfolio of eight projects, which were the product of approximately $6 million spent by EMX over several years in assembling this Scandinavian portfolio.

EMX holds a royalty on Boreal’s flagship Gumsberg project, along with a 9.4% equity interest.

Gumsberg VMS Project

EMX first came upon the Gumsberg VMS Project in southern Sweden through an exploration alliance it had with Chilean copper company Antofagasta PLC.

The 18,300-hectare land package, with five exploration licenses, was mined from the 13th century through to the 1900s, with an astounding 30 historic mines on the property including Östra Silvberg – the largest silver mine in Sweden from 1250 to 1590. Twenty-one holes were drilled between 1939 and 1958.

The project is in good company, located within the Bergslagen mining district between the past-producing Falun and Saxberget mines, and the active Garpenberg and Zinkgruvan mines mentioned above.

New geophysical surveys plus reconnaissance drilling and analysis of historical drill data identified fresh targets near the historical workings.

In 2016 four holes drilled along one of the VMS mineralized trends, the plus two kilometer long Vallberget-Loberget trend, pulled up significant intervals including: 2.8m of 17.9% zinc (Zu), 6.9% lead (Pb), 0.5% copper (Cu) and 68.9 grams per tonne (g/t) silver (Ag). Another 3.0m interval hit 9.2% Zn, 3.0% Pb, and 12.8 g/t Ag.

Just to highlight the high-grade nature of these intersections I used today’s metals price of:

Zinc US$1.22lb

LeadUS$0.94lb

Copper US$2.80lb

Silver US$15.79 oz

Gold US$1,360.60 oz

17.9% zinc (Zu), 6.9% lead (Pb), 0.5% copper (Cu) and 68.9 grams per tonne (g/t) silver (Ag) = US$690.28t

High-grade assays

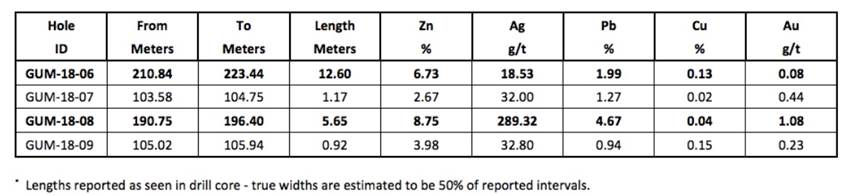

The final assays of a two-month, 1,620-meter drill program were released on Tuesday, March 4. The results, from the last four of nine holes, build on assays from the first four holes which hit high-grade intercepts in a new South Zone.

Drilling east and west of a previously reported high-grade intercept south of the Östra Silvberg Mine workings, holes four and five both returned “11.0 meter high grade intercepts containing veinlet, disseminated, semi-massive and massive sulphide mineralization.”

The final four holes identified in Tuesday’s news release extend the South Zone, with the results interpreted as containing primary VMS mineralization.

“The continued success intersecting multiple high grade precious and base metal massive sulphide mineralization in the new South Zone is very exciting for the Boreal team, as our initial thesis was always to prove that around these old relatively untested mine workings new economic discoveries could be found,” said Executive Chairman Patricio Varas.

Six of the nine holes drilled at the Östra Silvberg target cut significant mineralization, with the possibility of more, since the new area is open to the east and at depth.

Drilling in the South Zone is expected to continue this spring.

The results are more meaningful if dollar figures are attached. From the table below, we ascertain that the best hole, Hole GUM-18-08, cut 5.65m of 289.32 grams per tonne silver, 8.75% zinc, 4.67% lead, 0.04% copper and 1.08% gold.

Based on today’s metals prices, that rock is valued at US$529.96 a tonne. Anything above $200 a tonne is considered profitable for an underground mine. These are high VMS grades.

“We’re really excited about what we’re seeing. We had some great press releases in 2018 announcing not only the mineralization here at the Östra Silvberg mine, but also about 5 or 6 kilometers to the southwest in what we call the Vallberget zone,” said Eric Jensen, a Boreal Director and General Manager of Exploration for EMX, in an Ahead of the Herd interview.

A 2,545-meter drill program in 2017-18 produced high-grade lead and silver mineralization at two targets – Östra Silvberg and Vallberget-Loberget. The best intercepts were over 1kg (1,000 grams) per tonne silver with over 45% combined zinc and lead.

“Our hit rates are really high in both of these zones on the Gumsberg Project and so we’re off to a really, really good start,” he added.

VMS – a primer

So what is VMS and why is high-grade important? Volcanogenic massive sulfides were formed on the ocean floor during ancient underwater volcanic activity. Where the earth’s crust was thin, magma boiled up, forming volcanoes which erupted minerals that deposited on the ocean floor. Minerals also escaped through cracks or “black smokers”, a mineral-rich plume that also blanketed the seabed. Eventually with the movement of tectonic plates, these mineral deposits ended up on land that was once underwater.

An estimated 900 VMS deposits are found worldwide, averaging about 17 million tonnes each.

VMS deposits in Canada include Flin Flon, Bathurst and Noranda. The Kidd mine in Quebec, the deepest base-metal mine in the world, has been in production since 1966. The Iberian Pyrite Belt running through Spain and Portugal has about 90 VMS deposits, with some larger than 100 million tonnes.

VMS deposits are sought after for mining because they usually contain a melange of base metals and sometimes precious metals including zinc, lead, copper, silver and gold. The minerals are often clustered together, making them relatively easy to extract.

For more on VMS deposits read our All you need to know about VMS

“These rocks have been squeezed, faulted, and folded,” Jensen described the sulfide bodies (sulfur-combined minerals like pyrite, chalcopyrite, galena) at Gumsberg. They are shaped like “a series of vertically oriented cigars.”

“These cylindrical vertical ore bodies are great geometries for mining. So, on this property, we’re likely to see a whole series of what we call these high-grade shoots, what we are apparently drilling into now south of the Östra Silvberg mine.” Stated Jensen

Grade is king

Indeed even if a VMS project has nicely grouped mineralization, it stands a much better chance of going into production if it’s high grade. That’s because high grade improves the economics.

“When we looked at Scandinavian projects, particularly Gumsberg and you look at some of the historical intercepts and you’re looking at hundreds of grams per tonne of silver, it just makes your modeling a little bit easier because you don’t need huge deposits to have a positive IRR [internal rate of return],” said Patricio Varas, Boreal’s Executive Chairman. “The reason it makes money is because of the grade, so I think grade is king.”

Jensen agreed, noting “that it’s fine to keep stepping out and expanding mineralization, but if the grade’s not there, you can’t improve it by drilling more. That’s why EMX liked the Gumsberg VMS Project and wanted it in their portfolio, he said.” But now he’s thinking, how big could it get?

“This has been really exciting because you can see those grade characteristics. The enrichment in silver, other precious metal and a gram of gold with this mineralization as well that we’re seeing in these recent results. So, yeah, this is pretty exciting for us because now it’s a question of size. How big can we get this thing to grow by drilling? The grade’s already there and that’s the thing that’s really hard to come by.”

The company’s strategy at this point, then, is not so much to build tonnage, but to keep searching for high-grade material. In that respect, it’s good to be working in the Bergslagen mining district. Says Jensen:

“There’s thousands of small historical mines in the Bergslagen mining region, where Gumsberg is located. If you draw a circle, 10 kilometers around it, there are many hundreds of working pits and old shafts and little mines that exist. So, we think that that’s exactly the kind of environment where you’re going to have lots of prospectivity to find new VMS deposits.”

Experienced team

Of course, it takes a great mining team to not only discover high-grade VMS but find more of it and expand the mineralization into a deposit. Fortunately, Boreal Metals has the goods.

Patricio Varas, Executive Chairman, has been working in mining for 30+ years and he was a founder of Western Potash, raising over $240 million, he also was instrumental in the discovery of the Santo Domingo Sur deposit in Chile, now being developed by Capstone and was the project manager during discovery at Diavik, a diamond mine operated by RIO Tinto in the Canadian north.

Karl Antonius is a finance professional with a 26-year career in Europe and North America and founded Mandalay Resources Corp., which is now the owner-operator of the Bjorkdal gold mine in Sweden, and initial financier of the Viking Resources’ Svartliden gold mine.

Boreal has a strong technical team which includes Eric Jensen and Dan MacNeil.

Eric Jensen, Director of Boreal and General Exploration Manager for EMX, has over 20 years experience as mine geologist, mine-site exploration geologist, and grassroots exploration geologist.

Daniel McNeil, Vice President of Exploration, is a precious and base metal specialist with over 16 years of experience with continental-scale project generation to in-mine resource expansion, in a wide variety of geological settings throughout the Americas and Eastern Europe.

Boreal has recently brought in former Boliden Management which is very unique for an exploration company. Thomas Söderqvist, Director, and Rodney Allen, Techincal Advisory Committee, were both senior management of the largest mining company in the region.

Thomas Söderqvist started as an underground miner at Boliden at the age of 18 and had an impressive mining career leading him to becoming number four at Boliden, as Senior Vice President, and in December 2018 was the acting CEO at Boliden.

Rodney Allen is an economic geologist with nearly 40 years of experience, specializing in the geology of complex ancient volcanic regions. Throughout his 40 year career he was Head of Exploration at Boliden and is credited withh reviving the Garpenberg VMS mine (near Boreal’s Gumsberg Project). Garpenberg was near closure with ore reserves running low, but over four years, four new satellite deposits were discovered. Thanks to Allen, Garpenberg’s reserves were lifted from a few million tonnes to 36MT, plus resources of 38MT and production of 42MT, for a total of 116MT by the end of 2013. The four discoveries were the basis of an expansion project in 2014 that nearly doubled Garpenberg’s annual production.

Conclusion

We think that Boreal (TSX-V:BMX ) has all the pieces in place to advance a project that could become the next base metals producer in Sweden, a mining-friendly jurisdiction that has removed most, if not all, of the impediments to mining.

I’ve always thought of Sweden as a social-democratic country that pays for its generous social programs through high taxes. I was surprised to learn that Sweden offers a competitive corporate tax rate, plus a number of big pluses for mineral exploration and mining including low electricity rates, highly developed rail and port infrastructure, an exceptionally short permitting process, well-defined mining laws and environmental regs, and virtually no chance of resource nationalism.

Boreal stands out as a company with huge exploration potential, with four projects in Sweden already vetted by EMX, and millions in exploration completed. There are 18 targets currently being developed among eight projects in Sweden and Norway.

The company is knee-deep in mining experience. Director Jensen is a PhD geology with tons of projects under his belt, and he has country experience. He knows the Sweden portfolio back to front while with EMX, where he is the General Manager of Exploration. Patricio Varas and Karl Antonius are mining veterans who know what it takes to move projects forward both technically and financially. We also like that the board has brought on Thomas Söderqvist, who has worked for Boliden as a top executive. Söderqvist not only knows the territory (Boliden’s Garpenberg mine is close to Gumsberg) he has drilling supplier expertise. Great to have him on the team.

We love the flagship Gumsberg VMS Project, especially its high grades. The company has only just started exploring this property with 30 historic mines including Östra Silvberg, where they are currently drilling, at one time the largest silver mine in Sweden.

We expect plenty of news flow in the coming months as Boreal looks for more high-grade VMS among the historic mine workings and identifies additional prospects within this 18,000-hectare land assemblage.

For all of these reasons I have BMX on my radar screen.

Richard (Rick) Mills

Ahead of the Herd is on Twitter

Ahead of the Herd is now on FaceBook

Ahead of the Herd is now on YouTube

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Boreal Metals (TSX-V:BMX) is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares of BMX.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.