Big copper mines cutting output

2019.01.23

Some of the world’s largest copper mines are slashing production, thus feeding into the supply deficit thesis that is predicted to push the copper price back up over three dollars a pound.

Yesterday the copper price slipped to $2.76 a pound, a 1.6% drop compared to Friday’s close, after negative Chinese economic growth data was released on Monday. China, being the largest copper consumer, is watched closely with respect to the rise and fall of the copper price.

The data said that economic growth slowed to 6.4% during the fourth quarter, and 6.6% for the whole of 2018, which is the lowest it’s been since 1990. Q4 was the third quarter in a row of falling Chinese growth.

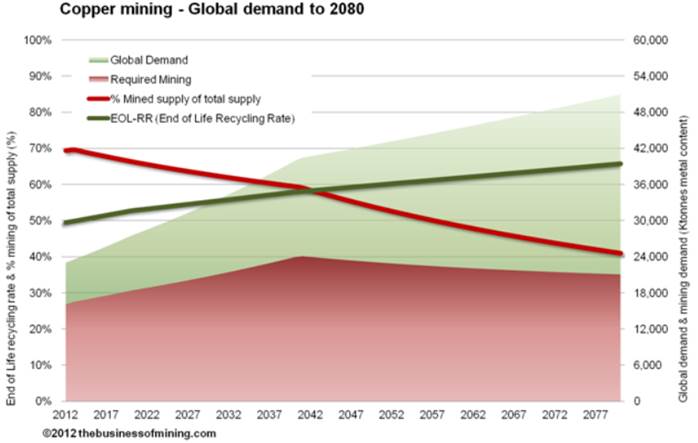

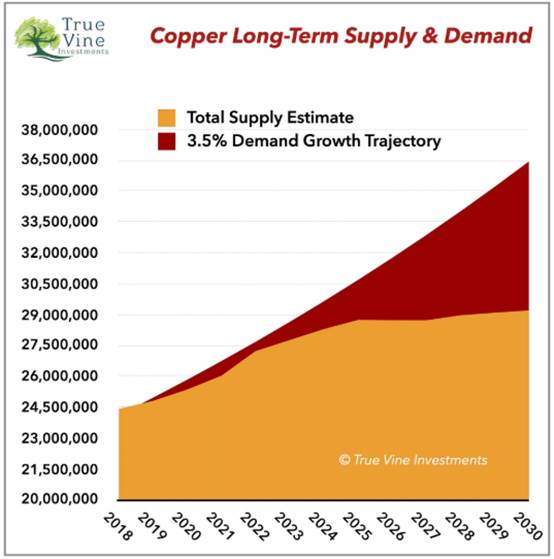

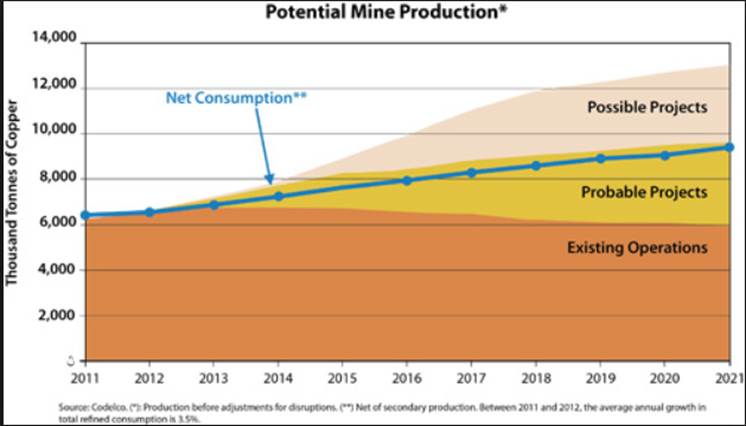

Prices will rise and fall, but it’s long-term supply and demand that copper miners and explorers look to, as far as planning expansions and development properties. Here the market is extremely bullish on copper. As we wrote in The coming copper crunch, copper mine production is expected to increase for the next year or so, then drop off significantly. By 2035, without major new mines up and running to replace the ore that is being depleted from existing copper mines, we are looking at a 15-million-tonne supply deficit by 2035. Four to six million tonnes of added capacity are needed by 2025.

However if we compile what has been in the mining headlines over the past few days, the results contradict the idea that higher global copper production will come to pass. Here’s a summary of the news:

- On January 6 a new copper supply and demand outlook by Fitch Solutions found that global refined copper demand will outpace supply over the next few years – with a deficit of 276,000 tonnes in 2018, and the market remaining in deficit until 2021.

- Three days later, it was reported that exports from Chile’s Escondida, the world’s second largest copper mine behind Grasberg in Indonesia, will be down by 85% due to operations moving from open-pit to underground. That’s a dramatic fall from 1.8 million tonnes in 2018 to just 200,000 this year. The mine is expected to take until 2022 to re-gain full production.

- A processing problem at BHP’s Olympic Dam copper, gold and uranium mine ate into the company’s second-half production numbers. A failure of boiler tubes at the acid plant was expected to disrupt output for eight weeks, it was reported in August. Volumes for H2 indeed dropped by 45,000 tonnes. BHP’s Spence copper mine, located in Chile’s Atacama Desert, also saw production tumble by 25,000 tonnes, MINING.com said.

- Problems in Zambia, Africa’s second-largest copper producer, are putting a big question mark beside the country’s output. First Quantum Minerals has reacted to a planned tax hike on operators by laying off 2,500 workers. Barrick is reportedly considering selling its Lumwana copper mine. The new tax increases the royalty spread of 4% to 6% by 1.5 percentage points, and levies a 10% tax when the copper price exceeds $7,500 per tonne. According to Bloomberg, the new tax regime could make over half of Zambian copper mines unprofitable.

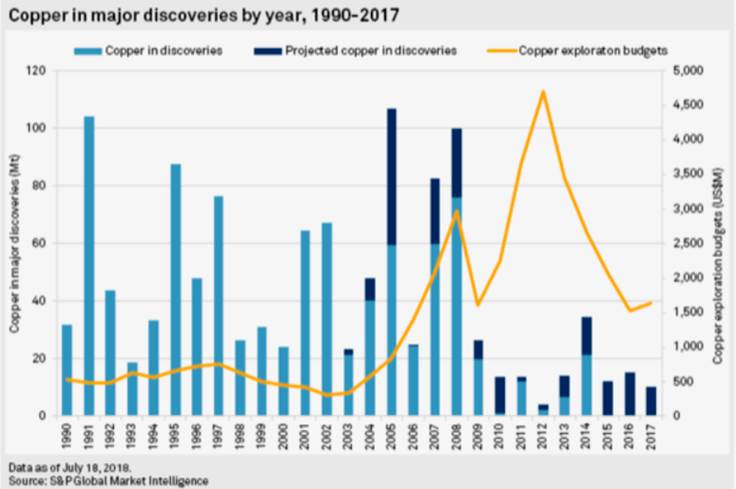

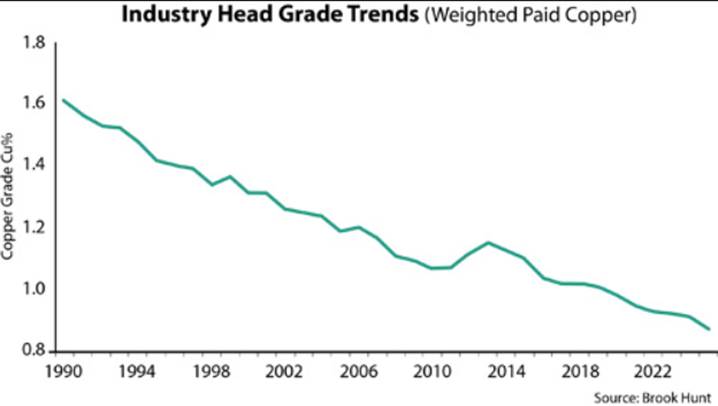

Back to copper supply, lower ore grades are also expected to be painted into the waning supply picture. Copper grades have declined about 25% in Chile in the last decade – highlighting the urgent need for grassroots exploration to arrest the trend.

Then there’s the long-running trend of population growth.

We already have one billion people out of today’s current population slated to become consumers by 2025.

Another 2.8 billion people will be added to the world between now and 2050. Most will not be Americans but they are going to want a lot of things that we in the Western developed world take for granted – electricity, plumbing, appliances, A/C, etc.

If we mined every last discovered, and undiscovered, pound of copper, the expected 8.2 billion people in the developing world would only get three quarters of the way towards copper use parity per capita with the US.

Of course the rest of us, the other 1.8 billion people expected to be on this planet by 2050, aren’t going to be easing up, we’re still going to be using copper at prestigious rates while our developing world cousins play catch up.

Copper use parity isn’t going to happen, it can’t.

In order to improve the supply-demand imbalance and delay, or maybe even avoid, the coming copper crunch, there needs to be a lot of new copper exploration done. All the low hanging copper fruit has been picked – either mined, refined or recycled – so where are new economic copper deposits to be found? According to conference organizer CRU, the supply gap requires that every copper mining project with a feasibility study is developed, and over 90% of new projects “see the light of day”, Investorintel reports.

Of course, that isn’t going to happen. Mining is a complicated business, so a high percentage of projects will fail due to any number of reasons – low grades, distance from infrastructure, lack of funding, poor management, etc.

For good companies and projects though, the future is bright. An excellent way to play the coming copper deficit is to get in early to a junior copper explorer. Our top pick is Rockridge Resources (TSX-V:ROCK), developing the Knife Lake volcanogenic massive sulfide (VMS) deposit in Saskatchewan’s Flin Flon-Snow Lake mining district.

The advanced-stage copper project (about $20 million has been spent so far) has a historical resource estimate, and is estimated to contain between 300 and 350 million pounds of copper-equivalent metal.

A $700,000 drill program starting in February or March should provide ample news flow going into the spring and summer.

The option agreement ROCK signed recently with Eagle Plains Resources (TSX-V:EPL) comes at the perfect time to be exploring for copper in Canada, one of the safest and mining-friendly environments in the world.

Richard (Rick) Mills

Ahead of the Herd is on Twitter

Ahead of the Herd is now on FaceBook

Ahead of the Herd is now on YouTube

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Rockridge Resources (TSX-V:ROCK), is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares of ROCK.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.