Battle for nickel to power EV revolution takes center stage in Ontario’s emerging mining district

2021.08.26

Nickel, traditionally used to make stainless steel, is now taking center stage in the global push towards electrification.

The metal is often used as cathode material in the lithium-ion batteries that power our electric vehicles and other clean energy applications. While there are other battery cathode chemistries available to carmakers today (see below), none have been as popular as the ones that deploy nickel (NCM and NCA).

In China, the biggest EV market, concerns about the driving range of EVs prompted the government to incentivize the production of lithium-ion batteries with higher energy densities, which precipitated an industry-wide shift towards the nickel chemistries.

At the same time, the high cost of cobalt and concerns surrounding the metal’s supply chain integrity have made battery makers constantly looking for more ways to use more nickel instead.

The NCM cathode, which is used by almost every major automaker except Tesla, is commonly 60% nickel, 20% manganese and 20% cobalt (6-2-2). However, as battery technology advances, the percentage of nickel is going up; the preferred ratio nowadays is 80% nickel, 10% cobalt and 10% manganese (8-1-1).

Looking ahead, Benchmark Mineral Intelligence (BMI) forecasts NCM cathodes to represent over 75% of the cathode market share by 2030, with well over half of these being the 811 high-nickel variety.

Nickel, therefore, stands to benefit the most of all the battery metals from higher adoption of EVs and energy storage systems.

Nickel Supply Crunch

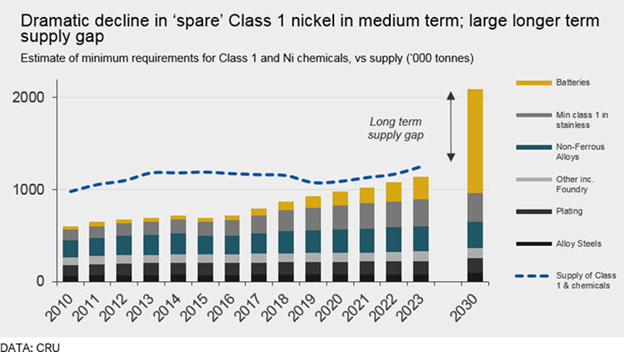

According to commodity market analysts at CRU, nickel usage in EV batteries is expected to grow from 70,000 tonnes in 2017 to 240,000 tonnes in 2023, representing a compound annual growth rate (CAGR) of 20%.

In fact, the rate of nickel consumption for EV battery manufacturing is set to outpace both lithium and cobalt over the next decade, with an average annual growth rate of 29%, according to Fitch Solutions.

The Bank of America projects that 13.6 million EVs sold in 2025 would need 690,00 tonnes of nickel. That represents nearly the entire mined supply of Indonesia, the world’s top nickel producer, which in 2020 produced 760,000 tonnes out of the 2.5-million-tonne total globally.

As mentioned, a majority of the world’s nickel is used in steel production, around 70% to be exact. However, this is expected to change dramatically over the next decade as the need for battery minerals ramps up.

By 2040, batteries will represent 33% of nickel demand, taking a large market share away from stainless steel, according to CRU.

The research firm also estimates that global primary nickel demand, which stood at approximately 2.2 million tonnes per annum for 2018, is expected to reach 2.8 million tonnes as early as 2023.

Therefore, based on a mined production of 2.5 million tonnes last year, the nickel market will naturally slide into deficit in absence of an annual supply increase of at least 300,000 tonnes over the next two years.

(Remember, the market not only has to supply enough nickel to meet stainless steel demand, but a significant increase in demand from EV batteries.)

Further down the EV supply chain, the mining industry has also taken notice of the impending nickel supply crunch.

Glencore CEO Ivan Glasenberg recently said that nickel supplies need to grow by an additional 250,000 tonnes a year, while projecting annual nickel demand to increase from 2.5 million tonnes currently to 9.2 million tonnes over the next decades.

BMI notes that nickel is different from other battery metals in its inability to respond quickly to a supply crunch, due to the fact that bringing on a new large-scale nickel mine can often run into the billions of dollars.

The Right Nickel

Further exacerbating the issue is the fact that not all mined nickel can be used in EV batteries. Like lithium, the quality of nickel is important to battery makers.

Current production of nickel-rich battery cathodes requires high-purity nickel, in the form of nickel sulfate, derived from ‘Class 1’ high-grade nickel sulfide deposits.

However, most of today’s nickel production is nickel pig iron (NPI) used in steelmaking (also known as ferro-nickel), which is ill-suited for making battery-grade nickel. That essentially rules out over half of the world’s nickel for what is potentially its biggest growth market in EV batteries.

A bigger problem lies in the scarcity of nickel sulfide deposits.

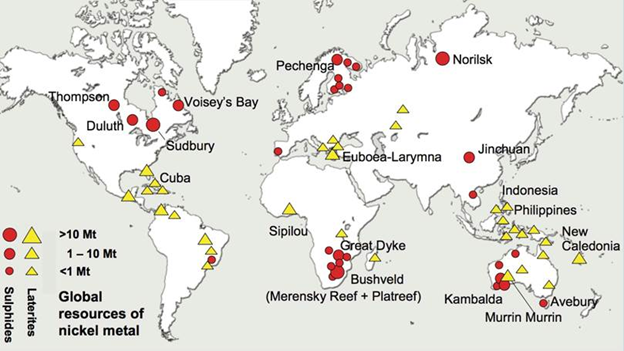

Nickel deposits can come in two forms: sulfide or laterite. About 60% of the Earth’s known nickel resources are laterites, which tend to be in the southern hemisphere. The remaining 40% are sulfide deposits.

Nickel sulfide deposits, also called magmatic sulfide deposits, are formed from the precipitation of nickel minerals by hydrothermal fluids. The main benefit of sulfide ores is that they can be concentrated using a simple physical separation technique called flotation.

Nickel laterite deposits, on the other hand, are formed from the weathering of ultramafic rocks and are usually operated as open-pit mines. Unlike sulfides, there is no simple separation technique for nickel laterites. The rock must be completely molten or dissolved to enable nickel extraction.

As a result, laterite projects require large economies of scale at higher capital costs to be viable. They are also generally much higher cash-cost producers than sulfide operations.

Ontario – Battleground for Nickel

Ideally, the mining industry would prefer to see more sulfide deposits given a growing need for battery-grade nickel. But in reality, large-scale sulfide deposits are extremely rare.

Historically, most of the high-purity nickel was produced from sulfide ores, including the giant (>10 million tonnes) Sudbury deposits in Ontario, Canada, Norilsk in Russia, and the Bushveld Complex in South Africa.

But as these existing mines become depleted, nickel miners nowadays have no option but to choose the lower-quality, more polluting, and more expensive to process nickel laterites such as those found in the Philippines, Indonesia and New Caledonia.

According to BloombergNEF, demand for Class 1 nickel is expected to outstrip supply within five years, fueled by rising consumption by lithium-ion EV battery manufacturers.

BMI asserts that any new nickel supply to fuel the EV revolution will come from a handful of sulfide deposits (such as Turnagain or Dumont), or from the abundance of laterites in Southeast Asia and Australia — but immediately rejects the laterite production as uneconomic.

Decades of underinvestment have been met with only a few large-scale greenfield nickel sulfide discoveries. Indeed, only one nickel sulfide discovery occurred in the past 15 years: the Nova-Bollinger in Western Australia.

The result of such limited nickel exploration is a very low pipeline of new projects, especially lower-cost sulfides in geopolitically safe mining jurisdictions. Nevertheless, mining firms would still jump at the opportunity to develop the world’s next nickel mine, should the conditions align.

Fortunately, the well hasn’t run dry in some parts of the world.

The Canadian province of Ontario, with its historically high output, remains an attractive destination for mining high-grade nickel. Recently, it has turned into a battleground for two of the industry’s biggest names as miners around the globe joust for positions in the battery metals race.

Late July, BHP announced its intention to rival Australian mining billionaire Andrew Forrest’s Wyloo Metals in its bid to acquire Noront Resources, which owns all the major discoveries in the emerging Ring of Fire region of Northern Ontario.

Among those is the early-stage Eagle’s Nest deposit, billed by Wyloo as the largest high-grade nickel discovery in Canada since the Voisey’s Bay nickel find in the eastern province of Newfoundland and Labrador, with an initial mine life of 11 years.

BHP’s offer, which would value Noront at $258.45 million, represents a whopping 129% premium to the miner’s market cap the day before Wyloo unveiled its proposal. Although the BHP deal has the support of the Noront board, a resolution may not materialize anytime soon as Wyloo, being Noront’s top shareholder, is refusing to back down and has suggested it would make a superior offer.

The ongoing battle between BHP, whose Nickel West operations in Australia is already a key supplier for battery makers, and the Forrest-backed Wyloo is just the latest example of an industry-wide push towards the booming EV minerals space.

Forrest, best known for his leadership role at iron ore giant Fortescue Metal Group, has long signaled he’s interested in battery metals and has expressed ambitions to get into the business for at least half a decade. It was revealed last week that the billionaire has taken up a substantial position in Australian nickel producer Western Areas Ltd., which, like Noront, is also surrounded by takeover talks.

For some time, the writing has been on the wall that the world’s nickel supply isn’t growing fast enough to keep pace with the metal’s demand. More nickel projects need to be developed in the next few years to avoid a severe supply crunch.

Thus, any junior resource company with a sulfide nickel project, preferably located within a favorable jurisdiction, could prove to be a shrewd investment opportunity.

At AOTH, we have our eyes set on two companies that are developing nickel sulfide deposits, both in Canada, within similar geographic settings to the Noront discovery.

Renforth Resources Inc. (CSE: RFR) (OTCQB: RFHRF) (FSE: 9RR)

Renforth Resources is advancing the Surimeau nickel-copper-zinc property in Quebec. This brownfield project covers an area of 260 square kilometres south of the Cadillac Break, a prolific gold structure, and is among current and former producing mines.

The current exploration focus is on Victoria West, one of the six polymetallic targets on the property. The target area is located within the western 5 km of a 20 km magnetic anomaly that hosts proven mineralization at either end.

Renforth recently completed a four-hole drill program at Victoria West. Like last year’s program, the 2021 drilling yielded more promising results. Specifically, the second hole reported the highest concentration of visible nickel encountered on the property to date.

Successive drilling at the Victoria West target is already alluding to higher concentrations of nickel mineralization as it gets deeper. And with that, the company is now on the verge of defining the nickel sulfide mineralization at Surimeau.

Palladium One (TSXV: PDM) (FSE: 7N11) (OTC: NKORF)

Palladium One is developing the Tyko Ni-Cu-PGE project near Marathon, Ontario, where previous work has indicated high potential for a Voisey-style mineralization.

The project covers approximately 24,500 hectares of land within the highly prospective Mid-Continent Rift nickel province, including over 7,000 hectares of the mafic-ultramafic Bulldozer intrusion, which has seen virtually no geological mapping nor exploration.

The Archean-aged mafic-ultramafic intrusion is rich in nickel, containing twice as much the battery metal as copper, and equal amounts of platinum and palladium.

According to the company, the high tenor of the sulfide minerals suggests a valuable concentrate could be produced, and that even if the sulfides are disseminated, the deposit could still be economic.

Drilling in 2020 primarily focused on the Smoke Lake target, an EM anomaly identified through geophysical surveying. Magnetic survey undertaken shortly before drilling helped to refine the anomaly, resulting in the successful discovery of massive magmatic sulfides.

The first discovery of massive sulfide mineralization at Tyko was confirmed in January, when the company announced drill intercepts from massive magmatic sulfide of up to 9.9% nickel equivalent. Subsequent drill results reported from the 2020 program were a resounding success, confirming the high-grade nature of the deposit.

A second-phase, 2,000m drill program was initiated in April to follow up on these high-grade hits. The assays to date have been excellent, including massive magmatic sulfide intercepts grading up to 10.2% nickel equivalent, demonstrating a robust mineralization spread over a distance of at least 18 km.

In addition to the high-grade Smoke Lake zone, Palladium One believes there are new zones of nickel-copper mineralization yet to be discovered. Results of the airborne EM survey will help guide further exploration at Tyko.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares or PDM or RFR. Both companies are paid sponsors of his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.