Backpack drilling confirms grade consistency and continuity of mineralization at Core Assets’ Blue property

2022.03.22

Emerging BC-focused explorer Core Assets Corp. (CSE: CC) (FSE: 5RJ) (OTCQB: CCOOF), currently advancing the province’s most northern district-scale porphyry asset, has delivered another update on last year’s exploration efforts at the company’s flagship Blue property.

This time, results have come in from six backpack drill holes completed during Phase 2 exploration at the Sulphide City (Whaleback) and Jackie targets, following up on its recent release of rock sampling assays.

About Blue Property

Core Assets’ Blue property commands 1,083 km² of district-scale land position in British Columbia’s prolific Atlin mining district. It is located 48 km southwest of the community of Atlin, which alongside Tagish Lake provides cost-effective exploration mobilization and potential low-cost ore transportation.

The project is located geologically in the Stikine Terrane, which is host to some of the province’s most significant projects such as Teck Resources’ Schaft Creek and Galore Creek and Newmont’s Tatogga (see map below).

A significant feature of this region is the abundance of carbonate replacement deposits (CRD). These deposits are polymetallic, which simply implies that they have various metals in them such as copper, gold, silver, lead, manganese and zinc. The mineralogy changes depend on the distance from the intrusive rock.

CRDs are epigenetic, meaning they are produced on or near the Earth’s surface, usually through a very similar process (called “replacement process”, hence the name). In turn, it creates remarkably similar deposits in terms of their mineralogy and the form of the specimens and crystals, regardless of where they are in the world.

For instance, a sample of CRD deposit found in China would have a very similar mixture of minerals as it would in Mexico.

The similarities in mineralization are so closely related that it helps create a geologic link between the deposits and highlights a clear proximity to large porphyry systems.

Many CRDs today are characterized by high grades (up to 1,500 g/t Ag, 25% Pb and Zn, and 5% Cu), bulk tonnage (up to 150Mt), low mining costs and minimal environmental footprint.

Evidently, the CRD geological model has been responsible for many of the world’s major discoveries, such as Newmont’s Peñasquito mine in Mexico and the Resolution Copper joint venture in Arizona held by Rio Tinto and BHP.

Comparison to Bingham Canyon

Preliminary results from the Blue property indicate that it follows on the “hub & spoke” model similar to one of the largest CRD-Porphyry deposits in the world: Bingham Canyon.

Bingham Canyon, also commonly known as the Kennecott copper mine, is one of the world’s biggest man-made excavation, open-pit copper operations. Opened in 1906, it has produced more copper than any other in history (17Mt). The mine is located near Salt Lake City, Utah, and is 100% owned by Rio Tinto.

Bingham Canyon represents a classic copper porphyry orebody that is not only huge but also enjoys a fairly uniform distribution of sulphide mineralization, mainly chalcopyrite.

As of December 2019, the mine had 612Mt of copper, 612Mt of Au, 612Mt of Ag, 612Mt of Mo in proven and probable reserves, from a total of 524Mt grading 0.43% Cu, 0.16g/t Au, 2.04g/t Ag, and 0.03% Mo.

As shown in the schematic above, Bingham’s “hub” is the porphyry copper zone in red, with the “spokes” extending out 1.5 km, to a series of Pb-Zn-Ag mantos, and a copper skarn zone.

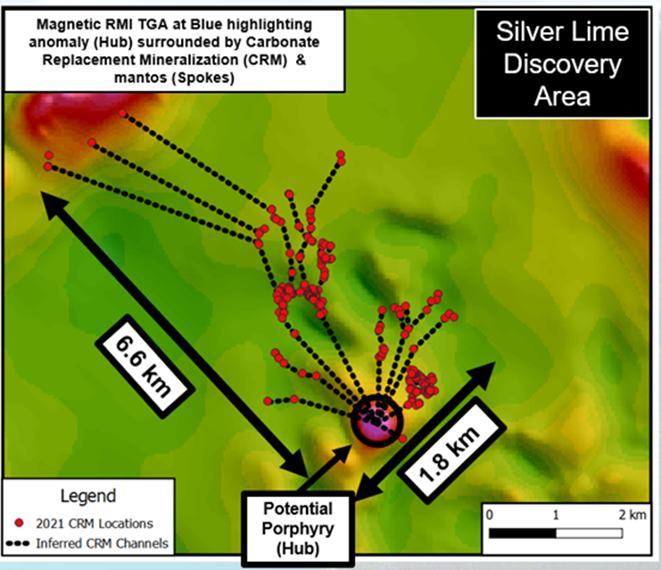

Similarly, residual magnetics at Blue show the potential porphyry “hub” in dark purple, with the “spokes,” consisting of the Silver Lime manto. Channel sampling in this area has returned “off the charts” grades including 4,870 g/t silver, >25% lead and >25% zinc.

2021 Discovery Zone

2021 exploration at the Silver Lime discovery area defined one manto, Grizzly, which has two sub-parallel Zn-Pb-Ag-Cu rich carbonate replacement manto zones sampled over a strike length of >500m with widths >5m.

Assay values from 44 samples from Grizzly returned averages of 8.2% Zn, 1.8% Pb, 0.40% Cu and 110 g/t Ag. The mineralization remains open in both directions along strike and at depth (see figure below).

What’s intriguing about the Grizzly manto is its “striking” resemblance to South32’s Taylor deposit in Arizona. They both exhibit the same age limestone base, silica cap and altered volcanics, over a similar strike length (~400m).

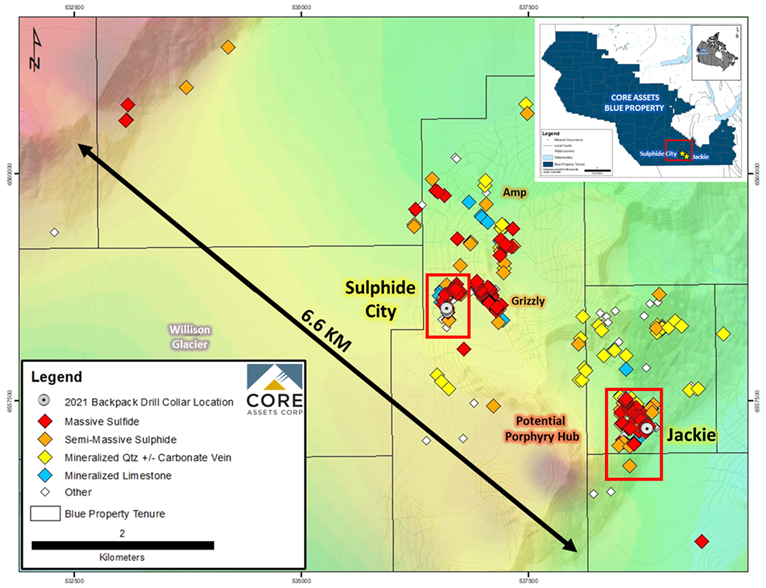

The 2021 Discovery Zone (Grizzly, Sulphide City and Amp targets) combined with the Silver Lime prospect (Jackie target) currently defines an area of tight, high-grade carbonate replacement (CRM) and skarn mineralization within a broad mineralized corridor that remains open.

This area extends out 6.6 km from the potential porphyry hub (the newly defined “spokes” are seen below as dotted black lines), stretching over a 1.8 km wide distance.

Unlike vein-hosted deposits, carbonate replacement deposits (CRDs) typically manifest as continuous sulphide bodies over multi-kilometer scales that broaden with depth and demonstrate continuity back to the source. Hence, all dots should be connected in the subsurface, and that’s what Core Assets aims to test this year.

Exploration to date has indicated the presence of a large and well-endowed carbonate replacement system on the Blue property. Samples taken last year from these “spokes” within the Silver Lime discovery area returned values up to 9.92% Cu, 2,020 g/t Ag, >30% Zn, >20% Pb and 6.75 g/t Au.

Rock sampling results (February 2022) from several carbonate replacement and skarn, massive to semi-massive sulfide occurrences at the Sulphide City and Grizzly targets contained values up to 406 g/t Ag, 11.8% Cu, >20% Pb and 15.45% Zn.

The latest results for backpack drilling further strengthened the company’s belief that these occurrences exhibit grade consistency and continuity over shallow depths as well as along surface.

2021 Backpack Drilling Results

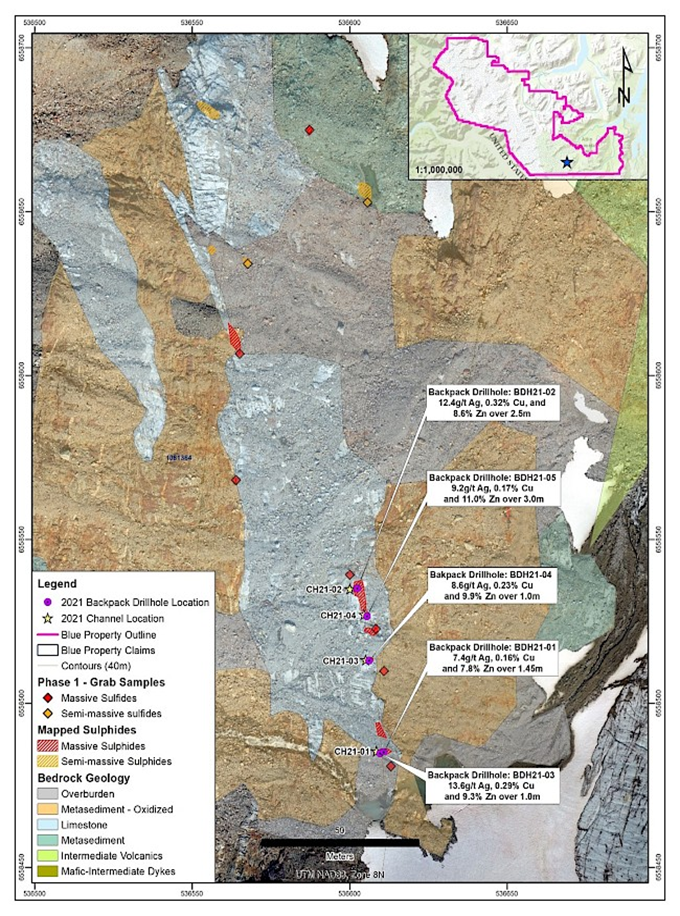

The 2021 backpack drilling campaign was designed to test the extent of target mineralization at depth within the central part of Blue property. Six drill holes (25mm core diameter) were collared within zones of skarn (Sulphide City – Whaleback target) or carbonate replacement mineralization (Jackie target) that were originally tested by channel sampling during the Phase 2 exploration program.

Location of the Sulphide City and Jackie targets, within the extensive 6.6 km mineralized corridor at the Blue property, are shown in the map below. All historic and recent surficial samples, as well as the locations of the 2021 backpack drill collars are plotted.

All five backpack drill holes completed at Sulphide City (Whaleback) intersected calc silicate skarn-hosted semi-massive sulphide over their full lengths ranging from 1-3m depth, and returned assays greater than 7 g/t Ag, 0.16% Cu and 7% Zn (see figure below).

Three of drill holes were specifically highlighted:

- BDH21-02 targeted semi-massive skarn mineralization previously tested in CH21-02 and returned 12.41 g/t Ag, 0.32% Cu and 8.56% Zn over 2.5m, including 1.05m of 18.5 g/t Ag, 0.46% Cu, and 10.15% Zn.

- BDH21-03 intercepted 1m of skarn mineralization grading 13.6 g/t Ag, 0.29% Cu and 9.35% Zn.

- BDH21-05 targeted calc-silicate hosted semi-massive skarn mineralization and assayed 9.2 g/t Ag, 0.17% Cu and 11% Zn over 3m.

At the Jackie target, BDH21-06 was collared to test the carbonate replacement mineralization (CH21-11), and although it was unrecoverable due to equipment limitations, the backpack drilling still proved that massive, galena-rich CRM extends to depths of at least 3m. Recovery will be improved using large-diameter core size during the 2022 drilling program.

Samples collected from CH21-11 recently returned 1.25m of 336 g/t Ag, 0.26% Cu, 7.9% Pb, and 9.6% Zn, including 0.35m of 851 g/t Ag, 0.29% Cu, >20% Pb, and 9.7% Zn.

The Jackie target is part of the Silver Lime prospect and consists of numerous massive-to-semi-massive sulphide occurrences that measure up to 30m long and 6m wide.

Many sulphide occurrences at Jackie are clustered and hosted within mapped NE-SW trending faults and fault splays. These fault-hosted sulphide bodies are interpreted as the “spokes” of the company’s “hut & spoke” model; these typically broaden at depth and express continuity back towards a causative intrusion.

It’s important to note that backpack drilling can be very limited in terms of where the drilling takes place and what is being drilled; this type of drilling, using handheld equipment, can only be done when convenient, and usually no rocks can be taken out of the ground.

In the case with the Jackie target, due to the soft nature of the silver-bearing galena, the material was just pulverized by the drill, which resulted in no recovery. Nevertheless, it was still continuous high-grade material.

The machines also are not suited to drill any mantos (i.e. a flat-lying, bedded ore deposit), which can be over 60m thick or as little as a few meters.

As mentioned, the Blue property is defined by multiple carbonate replacement manto zones, one of which could be one of the largest ever documented (at surface). So, drilling with a larger core size can help to confirm the company’s findings.

“Despite the backpack-style drilling depth limitations, the results from the low-hanging skarn and carbonate replacement occurrences at the 2021 Discovery zone demonstrate that grade is consistently elevated along surface and at shallow depths,” Core Assets’ president and CEO Nick Rodway commented in a news release.

The company’s next steps will focus on incorporating property-wide, reprocessed geophysical data, and interpreting this information with respect to historic drilling, recent surficial geochemistry and geological mapping.

Conclusion

A potential copper discovery of substantial size could prove pivotal for the global shift to clean energy, as the metal is a key input in electric applications, transportation systems and civil infrastructure.

BloombergNEF estimates that in 20 years, the world’s copper miners must double the amount of global production — from the current 20Mt annually to 40Mt — just to match the demand for a 30% penetration rate of electric vehicles.

However, due to a shortage of projects, copper supply will lag demand starting as early as 2025, with global mine production dropping from last year’s 21.5Mt to roughly 15.9Mt in 2030, S&P Global Market Intelligence predicts.

A report last year by Goehring & Rozencwajg Associates found that both greenfield and brownfield reserve additions are expected to disappoint through the decade.

According to the New York-based research firm, the number of new world-class discoveries coming online this decade “will decline substantially and depletion problems at existing mines will accelerate.”

To avoid a global copper crisis heading into the latter half of this decade, the mining industry has to step up its efforts in making new, significant discoveries. According to CRU, the industry needs to spend upwards of $100 billion to erase what it estimates to be a 4.7Mt deficit by 2030.

For the next 3-5 years, the general consensus is that copper will be a clear winner of the “clean energy” investment theme. In fact, analysts at Goldman Sachs are calling copper “the new oil”, because it is so vital to our future energy use.

Core Assets is going to drill test a massive project, a potential world class discovery, situated in an area hosting significant carbon replacement deposits, which are often related to large porphyry systems. With CC using a geological model that has proven successful with many of the well-recognized deposits around the world 2022 is going to be extremely interesting.

Core Assets Corp.

CSE:CC, OTC.QB: CCOOF, Frankfurt: 5RJ

Cdn.$0.50, 2022.03.17

Shares Outstanding 73.8m

Market cap Cdn$36.9m

CC website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Core Assets Corp. (CSE:CC). CC is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.