Assays confirm high-grade mineralization at Max’s CESAR

2020.07.14

Max Resource Corp (TSX-V:MXR) continues to expand the surface mineralization at its CESAR copper + silver project in Colombia, on Tuesday releasing assay results from its AM South Zone.

Since last November, Max’s geological teams have been identifying copper and silver targets in the 100 km x 20 km target area at CESAR, using rock chip channel, panel and bulk sampling to identify structures, continuity of thickness, and strike length, to determine potential size prior to drilling.

Crews have been looking for surface outcrops, that Max thinks could be the tip of the iceberg of a giant sediment-hosted copper system below surface.

Two greenfield discoveries earlier this year, AM North and AM South, appear to support this conclusion.

AM South features four stratabound copper + silver horizons, with mineralized structures currently totaling over 5.8 km of strike length.

In a Feb. 27 news release, Max notes AM North and AM South discovery zones are both hosted in well-bedded sandstone-siltstone. They appear to be of significant size, gently dipping, and partly outcrop at surface.

The stratabound (confined to a single stratigraphic unit) copper-silver mineralization found at CESAR is similar to the mineralization found in Ecuador and Peru in Jurassic-age rocks. The project lies along a historic 120-km copper-silver belt within the Cesar-Ranchería Basin, a major oil and gas and coal-mining sedimentary basin.

AM South – discovery

In January, 2020 Max identified a new copper-silver horizon at CESAR that appeared to trend over 1.4 km.

On April 2, Max announced another discovery, AM-2, that extended for 1 km. Surface sampling showed the zone to be open on strike and dip. The same news release said the company extended the AM-1 copper + silver horizon by 1,000m, to 2,400 meters of strike.

Initial results from petrographic analysis of two samples from AM South were released on May 26.

They confirmed the presence of native copper, chalcolite, and malachite hosted in siltstone and sandstone. Covellite, a rare copper sulfide mineral, was also detected, having not been found previously. That is significant, because copper sulfides are more profitable to mine as a result of their higher copper content. The copper is also more easily separated from other minerals, compared to copper oxides.

Kupferschiefer analog

Moreover, Max anticipates that the near-surface copper oxides transition to richer copper minerals chalcocite and covellite at depth. According to CEO Brett Matich, this is important because it provides further evidence to support Max’s geological model, that CESAR is analogous to the massive “Kupferschiefer” copper-silver mineral deposits in Poland.

“The petrographic study elucidated the relationships of the various copper minerals further reinforcing the similarity to Kupferschiefer mineralogy and to the stratigraphic control on mineralization,” said Matich.

State-owned KGHM Polska Miedz is the world’s eighth largest copper producer and the second biggest silver producer. Its Kupferschiefer (“copper shale” in German) copper-silver deposits are regionally extensive.

KGHM’s three copper-silver mines in Poland – Lubin, Rudna and Polkowice-Sieroszowice- combined are Europe’s largest copper mine, with production in 2018 of 30 million tonnes grading 1.49% copper and 48.6 g/t silver from a mineralized zone of 0.5 to 5.5-meter thickness. The Kupferschiefer is also the world’s leading silver producer, yielding 40 million ounces in 2019, almost twice the production of the world’s second largest silver mine, states the 2020 World Silver Survey.

According to the USGS, the massive volume of metal in Poland’s Kupferschiefer is due to continuous mineralization that extends down dip and laterally for kilometers.

In an earlier interview with AOTH, Max’s head geologist, Piotr Lutynski, said Colombia’s stratigraphy is similar to his homeland, Poland, and its cluster of Kupferschiefer sediment-hosted copper-silver deposits.

AM South – outcrops

Back to AM South, on July 8 Max comfirmed that new copper-silver outcrops supported the continuity of the AM-1 zone. Rock chip sample results demonstrated that AM-1 extended for over 2.4 km, including 2.1% copper and 30 g/t silver over an 8- by 1-meter panel.

The company said field work is testing the continuity of several horizons at the AM Zone, which now extends over 12 square kilometers. The fact that AM-1 and AM-2 are parallel, strongly suggests stacked horizons.

Moreover, the AM South zone and the AM North zone occur on opposite ends of the same 40-kilometre-long mineralized trend, as Figure 1 below shows.

AM South – assays

Finally, a complete picture is emerging of AM South, with all four mineralized zones reporting assay results. On July 14 Max announced several composite grab sample and panel sample results from AM-2, shown in Figure 2 below in red. Highlights include 5.6% copper and 70 g/t silver from a 13- by 1-meter panel, and 1.7% copper + 13 g/t silver over 5 meters.

Notice the 40-km target zone shown on the map as a lighter gradient. All four zones – AM-1 (2.4 km), AM-2 (1.1 km), AM-3 (1.6 km) and AM-4 (0.7 km) – are open to the northwest and southeast, shown by the white arrowheads, with a cumulative strike length exceeding 5.8 km.

Highlight panel values include: 5.8% copper + 80 g/t silver over 7 meters by 1 metre; 5.6% copper + 70 g/t silver over 13 meters by 1 metre; 4.3% copper + 57 g/t silver over 3 meters by 3 meters; 3.6% copper + 48 g/t silver over 7 meters by 1 meter; 3.5% copper + 26 g/t silver over 10 meters by 2 meters.

AM South’s copper-silver mineralization is interpreted to be of stratabound/Kupferschiefer-type, hosted in fine-grained sediments. The principal minerals are chalcocite – a copper sulfide – and copper oxides malachite and azurite.

“Our field teams continue to locate stratabound copper-silver mineralization within the key horizon units as they trace these horizons along strike and down dip. We feel more and more confident the Company is on the verge of a significant mineral discovery at CESAR,” said CEO Matich, adding:

“Along with the continuing exploration providing on-going assay results from AM South zone, we eagerly await assay results from the 11-kilometre AM North zone, located 40-kilometres north of the AM South zone, along the targeted stratabound copper-silver mineralized trend. We also look forward to initial results from Fathom Geophysics, our strategic research partners in collaboration with both AGH Krakow, Poland, one of the world’s leading copper producers, and the National University of Colombia.”

Copper market

Hundreds of mine workers in Chile are falling ill from covid-19, prompting Codelco, the world’s largest copper mining company, to shutter its Chuquicamata smelter and refinery to prevent the spread of the virus.

Labor unions in the world’s number 1 copper producer are demanding that companies do more to safeguard the health of their workers, particularly at state-owned Codelco, where three miners have died from coronavirus.

The country is experiencing one of the highest infections rates in the world. Combined with covid-related mine shutdowns in neighboring Peru, the world’s second biggest red metal producer, and solid demand from China, copper prices are near a two-year high.

Copper traded within a few cents of $3 a pound on Tuesday, on the back of a surge in Chinese imports and worries about supply from South America. September copper futures in New York changed hands at $2.94 a pound, as Chinese unwrought copper imports hit a record 656,483 tonnes – 50% above May’s levels and 15% higher than the previous record.

JP Morgan pegs Chile’s copper production losses at around 440,000 tonnes, citing research house CRU. Metal traders already see mine supply disruptions reflected in low copper warehouse inventories.

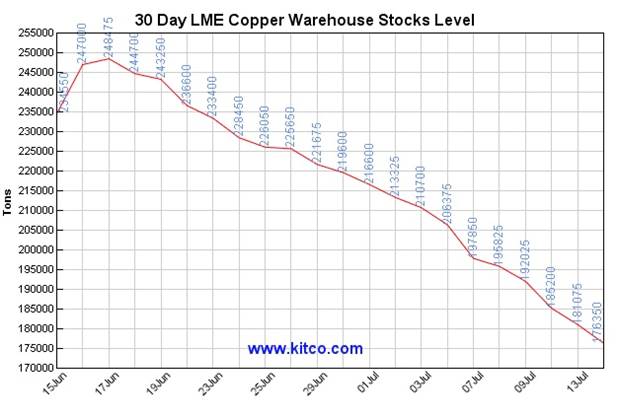

Copper stocks at LME warehouses have fallen below 250,000 tonnes for the first time in seven years. Global inventories between March and June dropped by 412,000 tonnes. 30-day LME copper warehouse stocks on Monday, July 13 were down to 176,350t.

Our extensive copper coverage predicted a supply shortage by the early 2020s; in fact that supply shock is here already, and will likely get worse, in part due to virus-related mine output cuts in the top two producers, Chile and Peru.

We see tight supply reflected in multi-year lows in copper warehouse stocks, and depleted supplies of scrap copper metal.

Combine the tight supply narrative with surging demand from China, whose recovering economy is clambering for metals, and you have a very bullish set-up for copper going forward.

We see copper prices reacting to news of infrastructure buildouts that can help put economies hit hard by the coronavirus back on track. On June 4th the red metal hit a 12-week high, on news of China’s $700 billion “new infrastructure” and “new urbanization” rollouts.

BMO cites the latest survey of copper wire and cable fabricators, showing operating rates in May hitting 101.7%, the highest level in the history of the survey – thanks mainly to purchases from China’s state electricity grid.

Closer to home, on Tuesday Joe Biden, the Democrats’ presumptive nominee to take on Donald Trump in the November election, laid out his plan for jump-starting the embattled US economy, through what he called “historic investments” in clean energy.

If elected president, a Biden White House would put an end to power plant carbon emissions by 2035, and spend $2 trillion over four years on clean energy projects. His proposed 100% clean electricity standard by 2035 is reportedly modeled after a proposal offered by Washington Gov. Jay Inslee and later embraced by Massachusetts Sen. Elizabeth Warren.

The former Vice President would also hand out cash vouchers allowing citizens to trade in their gas-powered cars for electric vehicles, and steer tens of billions of dollars toward building charging infrastructure in rural communities.

How will America find all the metal to build the kind of infrastructure that 2 trillion dollars pays for?

We already know that near-term copper supply is expected to be weak, with only a handful of new mines entering production. But demand keeps building.

According to Eurasia Group, clean energy and 5G programs are expected to push average annual demand for copper up 2.5% this decade, driving consumption toward 30 million tons by 2030 (last year mine production was only 20 million metric tons).

There is an undeniable need to move away from energy sources powered by fossil fuels, and replace them with renewable hydro, wind and solar. A key part of the program should be a continued ramping up of vehicle electrification, since the transportation sector is such a large contributor to greenhouse gas emissions.

Electric vehicles contain about four times as much copper as regular vehicles.

Wood Mackenzie states that US utilities have invested nearly $2.3 billion in EV charging infrastructure. The consultancy predicts that by 2030 there will be more than 20 million (residential) charging points consuming over 250% more copper than in 2019.

With each residential charger using about 2 kg of copper, that’s 42 million tonnes, or double the current amount of copper mined in one year.

No two ways about it, the world is going to need more copper. We suggest a possible source is the giant sediment-hosted copper deposit Max Resource Corp is developing, with mineralization analogous to the largest copper mine in Europe and the world’s leading silver producer.

Silver market

Over 50% of silver demand comes from industrial uses like solar panels, electronics, and the automotive industry.

The solar power industry currently accounts for 13% of silver’s industrial demand.

More and more silver will be demanded for its use in solar photovoltaic cells, as countries move further towards adopting renewable energy sources. Around 20 grams of silver are required to build a solar panel. The Silver Institute predicts 100 gigawatts of new solar facilities will be constructed per year between 2018 and 2022, which would more than double the world’s 2017 capacity of 398GW.

All of that solar will be a major boon for silver.

CRU expects PV manufacturers to consume 888 million ounces of silver between now and 2030. That’s 51.5 million oz more than the combined output from all the world’s silver mines in 2019.

5G technology is set to become another big new driver of silver demand.

5G is the next generation of mobile broadband that will eventually either replace or augment existing 4G LTE connections. The main benefits of 5G are its drastically improved upload and download speeds. Latency, which is the time it takes devices to communicate with wireless networks, is also much quicker using 5G.

Among the 5G components requiring silver, are semiconductor chips, cabling, microelectromechanical systems (MEMS), and Internet of things (IoT)-enabled devices.

The Silver Institute expects silver demanded by 5G to more than double, from its current ~7.5 million ounces, to around 16Moz by 2025 and as much as 23Moz by 2030, which would represent a 206% increase from current levels.

The Trump administration is said to be preparing a nearly $1 trillion infrastructure proposal – with some of the dollars geared toward 5G/ broadband.

Conclusion

Whether the next President of the United States is Joe Biden or Donald Trump, both are eyeing infrastructure spending as a way to get the American economy back on track. Trump would funnel more of the money into traditional bricks and mortar projects, like road and bridge construction, water and wastewater upgrades, etc., with some directed at 5G/broadband, whereas Biden is targeting electric vehicles and renewable energy.

Whether or not the infrastructure is “green”, both plans will need millions of tonnes of metals, including copper, silver, zinc, nickel, iron ore, aluminium, and specialty metals like vanadium and manganese.

Unfortunately, the major infrastructure spending push comes at the wrong time for the copper and silver markets, which are facing supply pressures, as demand for both goes through the roof, on clean energy applications.

However, the timing is good for Max Resource Corp, which is steadily building its CESAR copper+silver project in Colombia.

Less than a year into its exploration program, Max is on the radar of “one of the world’s leading copper producers”. The collaboration agreement between Max and the yet-to-be-named company begins with a geophysical study of CESAR, which has already demonstrated enormous potential.

The University of Science and Technology (“AGH”), Krakow, Poland has commenced mineralogy and geochemical studies on CESAR. AGH will use knowledge gleaned from KGHM’s world-renowned Kupferschiefer sediment-hosted copper-silver deposits in Poland as part of the academic study of CESAR.

“Ongoing exploration continues to build confidence in CESAR as a significant discovery of regional scale,” said Max’s CEO, Brett Matich.

Admittedly CESAR is early-stage, but it is also one of the few copper projects that is demonstrating the massive scale needed to interest a major.

Moreover, and this is really important, Max doesn’t have to drill it, not at this stage. The whole idea is to identify the mineralized horizons and the dips. So far, Max has managed to do this with rock chip sampling because rivers, streams and creeks cut across and expose the multiple horizons for a considerable depth.

Having a major copper company come in so early – just 7 months into an exploration program – validates Max’s exploration model…and the results.

Max Resource Corp.

TSX-V:MXR

Cdn$0.14, 2020.07.14

Shares Outstanding 35,719,906m

Market cap Cdn$5m

MXR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Max Resources (TSX.V:MXR), MXR is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.