As copper supply approaches “extreme scarcity”, GSP looks to reboot former producing mine with bulk-tonnage potential

2022.02.16

“I’ve been doing this 30 years and I’ve never seen markets like this.”

Those were the exact words from Goldman Sachs’ Jeff Currie when asked about the state of the global commodities market in a recent Bloomberg interview.

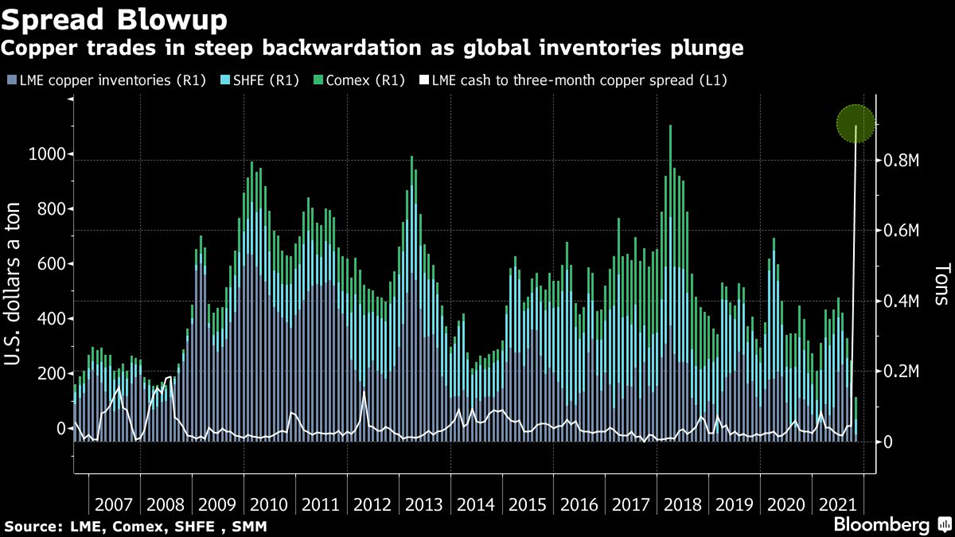

Several commodity futures are trading in what is called “super-backwardation” — meaning traders are now paying bumper premiums for immediate supply, a sign of scarcity.

In fact, there are more futures contracts trading in backwardation than at any point since at least 1997. That’s a total of 19 out of 28 raw materials encompassing everything from energy to grains, according to data compiled by Bloomberg.

Severe undersupply has driven near-time commodity prices on an upward spiral. The Bloomberg Commodity Spot Index, which tracks 23 energy, metals and crop futures, has already touched a record high this year.

“This is a molecule crisis. We’re out of everything,” the bank’s head of commodities research exclaimed.

Included in this “everything” is copper, the industrial metal that is used in almost every domestic, industrial and high-tech applications today. Not only is copper a key cog in the world economy, it also plays an essential role in the global transition towards sustainable energy.

Analysts at Goldman Sachs are even calling copper “the new oil”, as the metal is a key part of sustainable technologies including electric vehicles.

“Copper will be crucial in achieving decarbonization and replacing oil with renewable energy sources, and right now, the market is facing a supply crunch that could boost the price by more than 60% in four years,” Goldman Sachs wrote back in May 2021.

If what Goldman says about copper is anything to go by, then sustained periods of high copper prices should be out of question.

This is because the modern electric vehicle and associated infrastructure cannot be built without copper.

According to the Copper Alliance, an average EV contains about 85 kg of the red-colored metal; that’s 4 times as much as the regular ICE (internal combustion engine) vehicle. Charging stations require another 0.7 kg (for a 3.3 kW slow charger), going up to 8 kg (for a 200 kW fast charger).

Given an increased EV adoption worldwide, the general consensus is that copper will be a clear winner of the “clean energy” investment theme for at least the next 3-5 years.

Copper in “Breakout” Mode

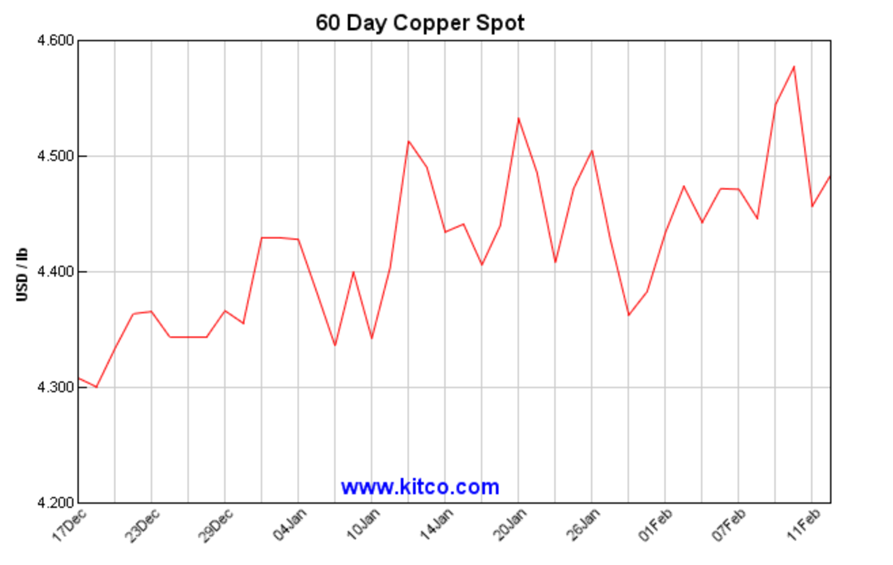

Due to several conflicting forces in play this year, copper prices have so far struggled to replicate their 2021 performance, but that doesn’t stop analysts from predicting another rally.

To paint an even more bullish picture for copper, the Goldman team last week published a report that points towards the metal “building towards a breakout” as worries about the global economy, particularly the slowdown in China’s property sector, begin to ease.

“With a diversified set of demand drivers – from EVs to electrical grids – sustaining a very tight micro into 2022, we believe that copper will re-price once these broader macro concerns abate,” the research report says.

According to Goldman, the limited seasonal build-up of copper inventories from record low levels – currently at just over 200,000 tonnes – is scarcely enough to cover three days of global consumption is “entirely insufficient to tackle” its expected deficit of 197,000 tonnes for 2022.

Copper stocks in LME warehouses are once again falling, down 10% on the start of January. So too, are those on the Shanghai exchanges and CME.

Reuters columnist Andy Home recently noted that the “clockwork cancellation of copper stocks” in Europe is starting to tighten exchange availability again, resembling the same pattern of events leading up to last October’s super squeeze (see chart below).

The depletion of copper stocks across global exchanges speaks volumes about the strength of demand, especially in top consumer China. So, while the optics may not appear as bullish, the seeds of another copper rally may have already been planted.

The longer this continues, the higher the risk of “an extreme scarcity episode” by the end of the year, Goldman asserts.

As such, the investment bank reiterated its bullish forecast for copper to average $11,875 a tonne in 2022, rising steadily to $15,000 during 2025.

Copper Production Lagging

In its report, Goldman also attributes copper’s positive long-term outlook to the inevitable exhaustion of existing mine supply, predicting that the copper market has only two years of primary production growth left.

After fresh tonnes from Ivanhoe’s Kamoa-Kakula in the Congo, Anglo American’s greenfield Quellaveco project in Peru and Teck Resources’ Quebrada Blanca Phase 2 in Chile hit the market, there will be “an open-ended decline in mine supply,” the bank says.

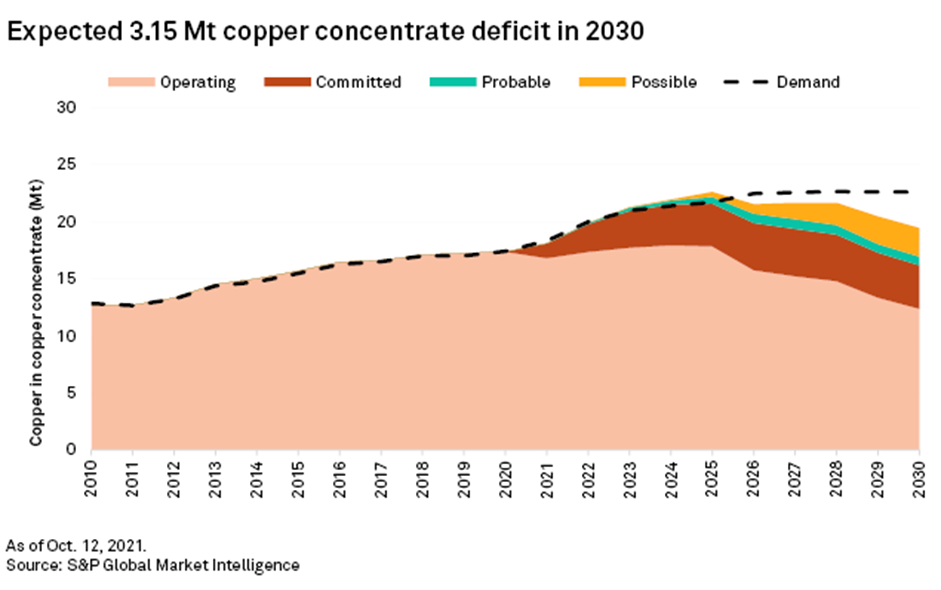

Due to a shortage of projects, copper supply is expected to lag demand as soon as 2025, according to S&P Global Market Intelligence, which projects mined output to climb to approximately 26.1Mt by then, about 3.8Mt short of demand.

From 2026 to 2030, the copper industry will be unable to meet a growing demand for concentrate, even when including uncommitted development-stage projects that could potentially move forward and start up during this period, S&P Global says.

In 20 years, BloombergNEF says copper miners need to double the amount of global copper production, just to meet the demand for a 30% penetration rate of electric vehicles — from the current 20Mt a year to 40Mt.

Lack of New Copper

All of this leads back to years of underinvestment dating back to the early 2000s.

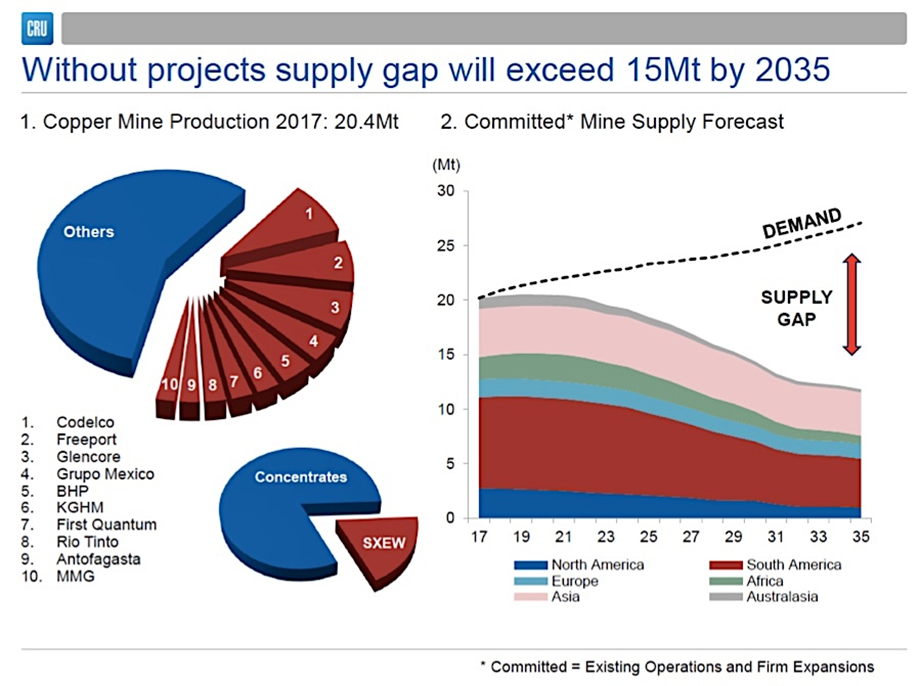

Without new capital investments, CRU predicts global copper mined production will drop from the current 20 million tonnes to below 12Mt by 2034, leading to a supply shortfall of more than 15Mt.

Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place, CRU estimates.

Dwindling reserves and lower ore grades at some of the world’s largest mines also mean that any new copper deposit would just be replacing the existing output, thus not contributing to supply growth at all.

Complicating matters is the political uncertainty in top producer Chile, which supplies over 30% of the world’s copper. Goldman analysts believe that a new mining royalty bill has the potential to put at risk as much as 1Mt of production.

A report last year by Goehring & Rozencwajg Associates found that both greenfield and brownfield reserve additions are expected to disappoint through the decade.

According to the New York-based research firm, the number of new world-class discoveries coming online this decade “will decline substantially and depletion problems at existing mines will accelerate.”

This is problematic, as copper producers must, at the minimum, double the current production of 20Mt by 2040 to have a chance of coming close to meeting demand. This equates to one new Escondida mine (1Mt annual production) every year for the next 20 years!

While such a feat is difficult to achieve, finding the right investments in projects leading to copper discoveries would help to close the supply gap. According to CRU, the copper industry needs to spend upwards of $100 billion to erase what it estimates to be a 4.7Mt deficit by 2030.

Thus, given the dire situation with global mine supply and relentless demand amid the clean energy transition, exploration companies with high-quality copper assets will likely sit atop every mining investor’s list for the foreseeable future.

BC’s Historic Copper Mine

One company that caught our attention over the past year is GSP Resource Corp. (TSXV: GSPR) (FRA: 0YD), which is looking to bring the historic Alwin copper mine in British Columbia back into production.

GSP was first formed in 2018 with the goal of finding copper-gold-silver assets in southwestern BC. Management prefers the area’s three-season climate to the Golden Triangle of northwestern BC, which gets a lot of snow and therefore has a limited exploration window, roughly May to October.

The company’s core asset is an option to acquire a 100% interest in the past producing Alwin copper mine situated in BC’s Highland Valley copper camp. It also has an option to acquire 60% of the Olivine Mountain project, about 25 km northwest of Copper Mountain mine.

Alwin Mine Background

The Alwin mine project is located 18 km from the town of Logan Lake, southwest of the New Afton (New Gold) and Ajax (KGHM) mines, and less than a kilometer from the Highland Valley copper mine owned and operated by Teck Resources (see map below).

Small-scale mining was conducted at the Alwin mine in the early 1900s, with modern exploration and mining occurring in two periods, from 1967 to 1982, and from 2005 to 2008. In all, about 36,000m of historical drilling has been completed.

The first copper occurrence discovered in the Highland Valley was the Ashcroft glory hole, an outcropping copper deposit that saw limited mining during the First World War, then lay dormant until the 1960s when it was explored on a larger scale.

Between 1967 and 1970, a total of 6,940m of surface diamond drilling in 81 holes were drilled along the main Alwin mineralized trend, and 5,860m of underground drilling in 119 holes were completed in 1,400m of mine workings.

In 1980, Dekalb Mining Corp. expanded the capacity of the mill to 700 tonnes per day and resumed mining of the Alwin trend. Total production was 155,000 tonnes grading 1.54% Cu.

Mining was suspended in 1981 due to low copper prices. At the conclusion of mining, a trackless development decline was extended to a depth of 270m, and 3,935m of drilling was completed in 76 underground holes.

From this, Dekalb calculated a resource of 390,000 tonnes grading an average of 2.5% Cu, after factoring for 25% dilution. No cut-off grade was reported.

This historical resource is not National Instrument 43-101-compliant, and therefore, GSP is not relying on it for accuracy; more drilling needs to be done to bring the resource up to modern reporting standards.

An important aspect of the GSP story is the fact that previous underground operators were focused on the high-grade copper mineralization — a series of deep and narrow replacement deposits.

At a 1.5% cut-off grade with copper being less than a dollar a pound, and getting as low as $0.56, the mine was never considered from a bulk tonnage, open-pit perspective.

Ironic, really, considering that is precisely what the Highland Valley has become known for, with five large pits developed over the past 60 years including Teck’s Highland Valley open-cast copper-molybdenum operation.

Another Highland Valley Opportunity?

Fast forward to today, when the economics of copper mining are completely different, with copper currently trading at about $4.60 a pound compared to a ballpark average of $0.68 during the 1960s and early 1980s.

The much higher copper price now makes the lower-grade areas of the Alwin mine project more interesting if they can be developed into an open-pit mine.

GSP management believes there is a low-grade halo of mineralization north and south of an east-west trending structure that could be bulk-tonnage and open-pittable.

A lot of historical drilling has been done at the Alwin mine, though most of that was underground with short, tightly-spaced holes targeting the high-grade material. Not much was drilled from surface around the edges of the mine.

So, the company decided to investigate what would happen if they stepped back from the east-west trending structure the mine sits on, at first pointing the drill south to north.

Drilling in 2020 from the southern property boundary towards the mine, GSP hit numerous low-grade halo structures that proved to be in excess of the Highland Valley pit’s 0.28% CuEq mining head grade.

A side note: the Alwin property is so close to Highland Valley that when you stand on it you can see, hear and feel the mining trucks rolling “next door”.

Last year’s drill programs (one in summer, another in fall) further strengthened the company’s belief that this is indeed a porphyry-style copper system similar to the mineralization found at Highland Valley.

Highlights of the 2021 summer drilling included 3.5% copper, 2.4% gold and 39.6% silver over 6.4m (4.66% CuEq), and 2.71% CuEq over 35.5m.

Bulk tonnage grade highlights were 0.61% CuEq over 164.6m, 0.14% CuEq over 176.7m, and 0.21% CuEq over 229.7m including a higher-grade 0.28% CuEq over 158.5m and 0.48% CuEq over 79.3m.

“Work at Alwin to date continues to support the reimagining of the Alwin Mine from a high-grade underground operation to a potential shallow, bulk tonnage open-pittable deposit model,” GSP chief executive Simon Dyakowski stated in the company’s latest update.

Conclusion

At AOTH we are very encouraged by what we are seeing from GSP at its Alwin mine project.

Alwin has always been thought of as a high-grade underground mine and for good reason. During its last phase of production (1916 to 1981), copper was only a fraction of the >$4.00 per pound it is worth today, making any low-grade material surrounding the mine uneconomic.

But times have changed, and the low-grade halo that appears to be north and south of the mine might, under the current market environment, be a standalone bulk-mined open pit.

The fact the project is situated right next to Teck’s well-recognized Highland Valley operation, with a similar porphyry-style copper system, opens up some very interesting possibilities for its future development (i.e. partnerships).

Whether this mineralization is a separate system or an extension of Highland Valley remains to be seen, but either way, it represents a potential porphyry discovery that would appeal to those looking for brownfields development opportunities.

Things should become clearer when more work is done this year; GSP has already secured a five-year exploration permit for the Alwin project.

Management is now planning a substantial infill drill program to support a future resource estimate, as well as seeking additional exploration targets.

GSP Resource Corp.

TSXV:GSPR, FRA:0YD

Cdn$0.16, 2022.02.15

Shares Outstanding 20.4m

Market cap Cdn$3.2m

GSPR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of GSP Resource Corp. (TSXV: GSPR). GSPR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.