AOTH – Our Battery Metal and Stock for 2024 – Richard Mills

2024.01.19

Due to its natural strength and stiffness, graphite is an excellent conductor of heat and electricity. It is also stable over a wide range of temperatures.

Graphite is thus found in a wide range of consumer devices, including smartphones, laptops, tablets and other wireless devices, earbuds and headsets. Besides being integral to electric car batteries, graphite is found in e-bikes and scooters.

Graphite’s role in electrification

A White House report on critical supply chains showed that graphite demand for clean energy applications will require 25 times more graphite by 2040 than was produced in 2020.

Graphite has the largest component in batteries by weight, constituting 45% or more of the cell. Nearly four times more graphite feedstock is consumed in each battery cell than lithium and nine times more than cobalt.

Graphite is therefore indispensable to the EV supply chain.

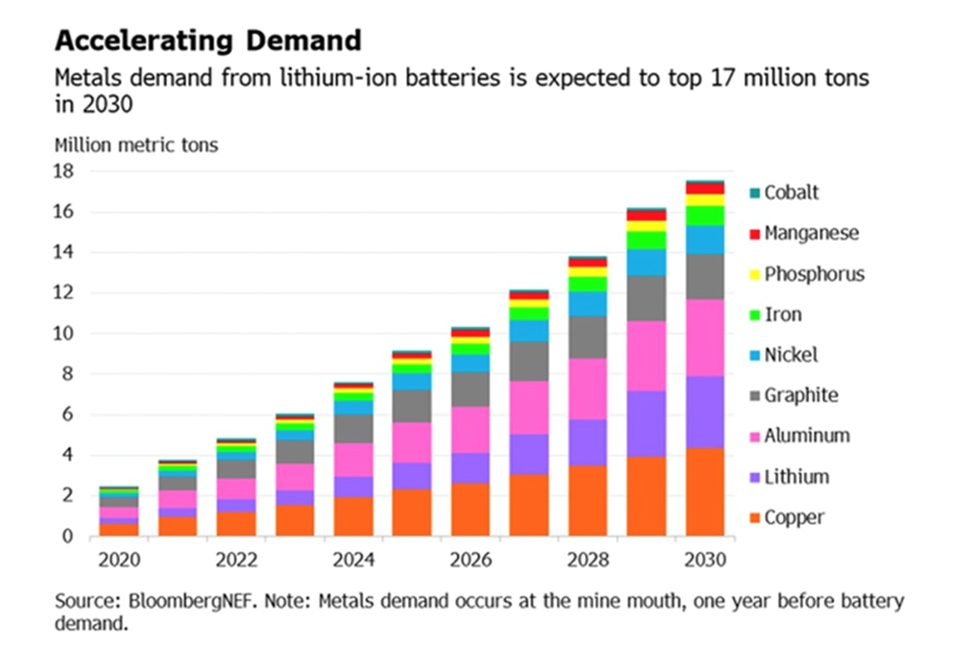

BloombergNEF expects graphite demand to quadruple by 2030 on the back of an EV battery boom transforming the transportation sector. It is not an exaggeration to say that electrification of the global transportation system doesn’t happen without graphite.

The lithium-ion batteries in electric vehicles are composed of an anode (negative) on one side and a cathode (positive) on the other. Graphite is used in the anode.

The cathode is where metals like lithium, nickel, manganese and cobalt are used, and depending on the battery chemistry, there are different options available to battery makers. Not so for graphite, a material for which there are no substitutes.

Electric vehicles

An average plug-in EV has 70 kg of graphite. Every 1 million EVs requires about 75,000 tonnes of natural graphite, equivalent to a 10% increase in flake graphite demand.

According to the latest edition of the International Energy Agency’s ‘Global Electric Vehicle Outlook’, more than 10 million electric cars were sold in 2022; their share of the overall vehicle market rose from 4% in 2020 to 14% in 2022. Moreover, over 26 million EVs were on the road that year, up 60% relative to 2021 and more than five times the stock in 2018. About 70% of the global stock of electric cars in 2022 were battery-electric vehicles, or BEVs.

The numbers from 2023 are in, and they show continued growth. According to estimates from Kelley Blue Book, a record 1.2 million US car buyers went electric last year, with the EV share of the total US vehicle market reaching 7.6%, up from 5.9% in 2022.

Atlas Public Policy says that electric-vehicle sales are expected to hit a record 9% of all passenger vehicles in the US in 2023 — up from 7.3% of new car sales in 2022. Fortune notes it will be the first time more than 1 million EVs are sold in a calendar year.

In Canada, despite a lack of EV supply, and long wait times, in the third quarter of 2023 one in eight vehicles registered were electric, or 13.3%. This is an increase of 2.7% from the second quarter of 2023, with a market share of 10.5%, according to the Pembina Institute.

2023 global purchases of battery electric vehicles and plug-in hybrids rose 20% compared to 2022. Pembina says that Research out of the Rocky Mountain Institute (RMI), a U.S.-based clean energy think tank, reveals a pattern of steadily rising demand alongside falling prices for batteries used in electric vehicles. Batteries are one of the biggest contributing factors to the high sticker prices for EVs.

Since 2014, however, battery demand has been growing at an annual average of 41 per cent, doubling every two years.

The two top-selling EVs in 2023 were Teslas — the Model Y and the Model 3, respectively — with Chinese carmakers taking the next five positions among the bestsellers. Volkswagen’s ID.4 electric SUV was the eighth highest-selling model, according to Visual Capitalist based on data from CleanTechnica.

The IEA says market penetration needs to reach around 60% by 2030 if the industry is to meet “net-zero” CO2 emissions by 2050. That would mean the number of electric vehicles on global roads jumps from 16.5 million in 2021 to 350 million in 2030, a 21-fold increase.

One of the biggest obstacles to higher sales of electric vehicles is limited public charging infrastructure, something governments around the world are spending billions to fix.

In the United States, there are currently 126,500 Level 2 charging stations, which take about five hours to fully charge an EV, and 20,431 Level 3 stations, which will charge an electric vehicle to 80% capacity in 15-20 minutes. There are also 16,822 Tesla Superchargers and Tesla destination chargers.

President Biden has set a goal of 500,000 public charging stations by 2030, a five-fold increase from the 100,000 in place already.

But this objective may already be out of date. S&P Global Mobility says that, assuming there are 7.8 million EVs on American roads in 2025, they will require 700,000 Level 2s and 70,000 Levels 3s.

By 2030, if the number of electric vehicles rises to 28.3 million, they will require 2.13 million Level 2 and 172,000 Level 3 public chargers, S&P Global Mobility forecasts. This does not include home charging stations drivers will install.

Graphite market

China is by far the biggest graphite producer at about 80% of global production. It also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain.

After China, the next leading graphite producers are Mozambique, Brazil, Madagascar, Canada and India. The US currently produces no graphite, and therefore must rely solely on imports to satisfy domestic demand.

Source: USGS

In October, Beijing said it will require export permits for some graphite products “to protect national security”. The real reason is retaliation against the United States for widened curbs on Chinese companies’ access to semiconductors, including stopping sales of more advanced artificial intelligence chips made by Nvidia; and the European Union for daring to impose tariffs on Chinese-made EVs the Europeans argue unfairly benefit from subsidies.

Under the new graphite restrictions, which took effect Dec. 1, exporters must apply for permits to ship two types of graphite: synthetic graphite, and natural flake graphite and its products.

While it’s unclear how much effect the ban will have in the short term, Bloomberg reported that, “With this new graphite export curb, South Korean firms which heavily rely on China for graphite imports would need to seek alternatives, such as mines from the United States or Australia, but it would likely increase the cost burden for many,” said Kang Dong-jin, an analyst at Hyundai Motor Securities.

Deficits are expected to kick in by 2025 as new graphite mines fail to keep up with surging demand from automakers.

Some of the world’s largest auto and battery makers aren’t waiting until that happens. They, and the US government, are racing to secure graphite supplies ahead of a coming supply shortage.

Tesla and Panasonic are among the companies that have signed graphite off-take agreements. Syrah Resources, for example, has an off-take with Tesla to ship graphite from its mine in Mozambique to a processing facility in Louisiana.

In 2022, the Wall Street Journal said the United States gave grants totaling about $500 million to three graphite producers — Syrah, Novonix and Anovion — to kickstart domestic supply using money from the $1 trillion infrastructure bill.

The Inflation Reduction Act provides US consumers tax credits of up to $7,500 per electric vehicle, provided the parts or materials are sourced from countries with which Washington has a free trade agreement. This increases the focus on graphite and other critical minerals.

(Why the Biden administration is giving away hundreds of millions of dollars to a company in Madagascar, is beyond me. This is not security of supply — Rick)

According to the USGS, the battery end-use market for graphite has already leaped by 250% since 2018. It’s thought that battery demand could gobble up well over 1.6 million tonnes of natural flake graphite per year.

For context, 2022 mine supply was about 1.3 million tonnes, which means we’re very close to entering, if not already, a period of deficits. Benchmark Mineral Intelligence projects natural graphite will have the largest supply shortfalls of all battery materials by 2030, with demand outstripping expected supplies by about 1.2 million tonnes.

According to a BMI analysis, graphite demand is likely to grow by a factor of eight by 2030 over 2020 levels (4.2 metric tons over a supply of 3.0), and 25 times by 2040. That translates into a predicted supply shortfall of 30% for graphite, compared to 11% for lithium (2.4 over 2.1), 26% for nickel (1.5 over 1.1), and 6% for cobalt (0.32 over 0.30).

By then, the world’s graphite supplies will not even be able to cover demand for EVs, let alone all end-use sectors, BMI projections showed.

And this is just counting EV battery use; the mining industry still needs to supply other end-users. The automotive and steel industries remain the largest consumers of graphite today, with demand across both rising at 5% per annum.

BMI has said as many as 97 average-sized graphite mines need to come online by 2035 to meet global demand. That’s about eight new mines a year, which at first may seem doable but considering the number of graphite projects worldwide and the time it takes to develop them into mines, we’re really up against it.

The International Energy Agency predicts that growth in graphite demand could see an 8- to 25-fold increase between 2020 and 2040, trailing only lithium in terms of demand growth upside.

Given that demand for graphite is accelerating at a rate never seen before, and the EV industry is gradually shifting towards natural graphite, the impending supply crunch could get serious.

How much graphite did you say?

BloombergNEF expects graphite demand by 2030 to quadruple.

The International Energy Agency (IEA) goes 10 years further out, predicting that growth in demand for selected minerals from clean energy technologies by scenario, 2020 relative to 2040, will see: increases of lithium 13x to 42x, graphite 8x to 25x, cobalt 6x to 21x, nickel 7x to 19x, manganese 3x to 8x, rare earths 3x to 7x, and copper 2x to 3x.

If we use the earlier-mentioned IEA forecast, that by the end of 2023, 14 million electric vehicles will have been sold worldwide, that equates to:

14,000,000 x 70 kg graphite per EV = 980,000,000 kg/1,000 = 980,000 tonnes of graphite. Mined graphite production in 2022 was 1,300,000 tonnes, so 980,000 tonnes = 75% of 2022 production.

Remember, the IEA says market penetration needs to reach around 60% by 2030 if the industry is to meet “net-zero” CO2 emissions by 2050. That would mean the number of electric vehicles on global roads jumps from 16.5 million in 2021 to 350 million in 2030, a 21-fold increase.

To calculate how much graphite this entails, we subtract 16.5 million from 350 million. Then divide this number by nine to give us how much graphite per year is required for meeting net-zero emissions:

350,000,000 – 16,500,000 = 333,500,000/9 = 37,055,555. 37 million tonnes of graphite is 28x the amount of mined graphite in 2022.

Except that it’s needed 10 year earlier than the IEA’s 2040 forecast. Note also that 37Mt needs to be added every year for nine years, meaning the mining industry would have to mine 28 times more graphite than currently, and then sustain this level of production to the end of the decade.

Let’s be conservative and say that EV penetration is only 30%, not 60%, by 2030, given the obstacles to EV ownership such as sticker shock and range anxiety. And that the net-zero target is woefully unrealistic and gets missed. That’s still a lot more graphite than currently available:

175,000,000 – 16,500,000 = 158,500,000/9 = 17,611,111 tonnes. 17.6Mt of graphite is 13.5x the amount of mined graphite in 2022.

Natural vs synthetic graphite

For ages, synthetic graphite held the lion’s share of the battery market (57% of the anode market in 2022, according to BMI), because it performs better in electrolyte compatibility and has fast-charge turnaround and battery longevity. But compared to the natural version, it costs nearly double and has a lower capacity.

Importantly, synthetic graphite is very energy-intensive, since it is made from petroleum coke. BMI estimates that anode production using synthetic graphite can be over four times more carbon-intensive than with natural graphite. Not to mention the pollutants, which make synthetic graphite counterproductive to climate goals.

For these reasons, EV manufacturers are beginning to show a preference for natural graphite, especially as processors have improved the purity. It’s widely expected that the world’s natural graphite production is likely to outpace synthetic yields by 2030 (see below).

Flake graphite, as the name implies, has a distinctly flaky or platy morphology. Only flake graphite upgraded to 99.95% purity can be used in batteries. Herein lies a bigger problem: natural flake graphite is difficult to source. Only about 20 countries make up the world’s supply, many of which produce insignificant amounts (<10,000 tonnes a year).

Complicating matters is that not all mined material has the required purity for EV battery consumption.

Analysis by Benchmark Mineral Intelligence projects that natural graphite will have the largest supply shortfalls of all battery materials by 2030 — even more than that of lithium — with demand outstripping expected supplies by about 1.2 million tonnes.

And this is just counting EV battery use only; the mining industry still needs to supply other end-users. The automotive and steel industries remain the largest consumers of graphite today, with demand across both rising at 5% per annum.

BMI previously stated that flake graphite feedstock required to supply the world’s lithium-ion anode market is projected to reach 1.25 million tonnes per annum by 2025. For reference, the amount of mined graphite for all uses in 2022 was just 1.3 million tonnes.

The lithium price reporting agency has said as many as 97 average-sized graphite mines need to come online by 2035 to meet global demand.

US import dependence

Graphite is included on a list of 23 critical metals the US Geological Survey has deemed critical to economy and national security.

The United States currently imports 100% of its graphite. Another way of saying this is the US has zero production. With 70% of the world’s graphite supply coming from China, how will the United States compete in these new technologies that are shaping our world? Are we going to own what we need here or buy it from other countries? Current events are teaching us how dangerous it is to rely on foreign sources of supply, in a world where adversaries can use access to materials as an economic weapon.

American manufacturing including equipping the US military with the most advanced weapons systems in the world is untenable without domestic production of graphite and other critical minerals. 95% of the typical battery anode is composed of graphite, none of which the United States currently mines. The World Bank projects that the market for graphite will grow by nearly 500% by 2050; President Biden in his 100-day report said the number is 2,400% by 2040.

As much as the United States wants to keep pace with China in the global EV race, it can’t do so without a reliable graphite supply. As mentioned, the US does not mine any graphite, so it is solely reliant on imports.

According to the USGS, in 2022 the US imported 82,000 tonnes of natural graphite, of which 77% was flake and high-purity. The top importers were China (33%), Mexico (18%), Canada (17%) and Madagascar (10%).

But taking into account the fact that EV batteries require run-of-mine graphite to go through purification and coating, a process controlled by China, the US is actually not 33% dependent on China for its battery-grade graphite, but 100%. This is a precarious position to be in should the country want to stay in contention for EV dominance.

This is why graphite is firmly placed on the US government’s critical minerals list, and is identified as one of five key battery minerals that are at risk of supply disruptions. The other four — lithium, nickel, cobalt and manganese — typically form the cathode that decides the capacity and therefore tend to get more attention. But graphite, as the anode material, is probably the most crucial one since it’s far superior to current alternatives.

Support from government

Thankfully, the US. government has begun to appreciate the current crisis in graphite and other critical minerals it is import-dependent on.

In 2022 the Biden administration invoked its Cold War powers by including lithium, nickel, cobalt, graphite and manganese on the list of items covered by the 1950 Defense Production Act, previously used by President Harry Truman to make steel for the Korean War.

To bolster domestic production of these minerals, US miners can now gain access to $750 million under the act’s Title III fund, which can be used for current operations, productivity and safety upgrades, and feasibility studies.

The trillion-dollar infrastructure bill allocates $7 billion to advance domestic projects and renewable energy, supply chains and critical minerals with specific focus on EV batteries.

But where are we going to find the metals?

A green infrastructure and transportation spending push will mean a lot more metals will need to be mined, including lithium, nickel and graphite for EV batteries; copper for electric vehicle wiring, charging stations and renewable energy projects; and silver for solar panels.

In fact, battery/ energy metals demand is moving at such a break-neck speed, that supply will be extremely challenged to keep up. Without a major push by producers and junior miners to find and develop new mineral deposits, glaring supply deficits are going to beset the industry for some time, putting in jeopardy the global shift from fossil-fueled energy production and transportation to the new electrified economy.

Graphite One TSX.V: GPH

One of the battery metals the world needs more of is graphite, a key ingredient in EV batteries and energy storage systems for which there are no substitutes.

Analysts estimate that by 2030, it will take at least 5 million tonnes of graphite per year to fill battery demand. This is roughly four times the 1.3 million tonnes mined globally, according to the USGS’s Mineral Commodities Summaries 2023.

This is why the DoE, in its assessment, ranked graphite near the top of its list of minerals critical to America’s energy future. The US federal government’s critical minerals list also has graphite as one of five key battery minerals that are at risk of supply disruptions.

The only way to alleviate that risk is for the United States to find its own source of graphite production, and at AOTH we believe a project like Graphite One’s Graphite Creek depositticks all the boxes.

The results of its 2022 drill campaign demonstrate the potential, in my opinion, for significant resource expansion. Step-out hole 22GC079 was the furthest step-out from the campaign, collared over 2 km west of the next closest hole and 4 km west of the PFS pit boundary. It intercepted a combined 58.2m of mineralization averaging 4.18% graphite. These are excellent grades; flake graphite ore suitable for electric-vehicle batteries typically grades 2-3% Cg.

The 2023 drill program was designed to double the measured and indicated resources and increase the inferred resource by infill drilling along trend to hole 22GC079.

In October, Graphite One announced the completion of the 2023 drill program along with a selection of assay results. The program quadrupled the scope of 2022’s, with 57 holes completed for a total of 8,736 meters — the largest drill program in GPH’s history. Of the 57 holes, 5 holes were geotechnical and the remaining 52 resource holes all intersected visual graphite mineralization and continued to demonstrate exceptional consistency of a shallow, high-grade graphite deposit that remains open both to the east and west of the existing mineral resource estimate.

Graphite One could represent a significant portion of the amount of graphite demanded by the United States, currently.

Consider: In 2022 the US imported 82,000 tonnes of natural graphite, of which 77% was flake and high-purity, suitable for electric vehicles.

Based on the PFS, the Graphite Creek mine is anticipated to produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life.

If all goes according to plan, the feasibility study — ahead of schedule by one year — would move Graphite One’s Graphite Creek deposit that much closer to becoming America’s only source of mined graphite, helping to shed its import reliance. (In fact, the FS contemplates a tripling of production, from 50,000 tonnes of graphite concentrate per year as estimated in the PFS to more than 150,000 tonnes)

More broadly speaking, Graphite One’s activities should be considered a bolt-on to what is already happening in northwestern Alaska with respect to the building of the first deepwater port in the US Arctic region.

The U.S. Army Corps of Engineers and Alaska’s Department of Transportation have chosen two sites for a deepwater port facility: Nome and Port Clarence. Nome has received $600 million in government grants and appears to be well on its way to doubling the size of its existing port to accommodate the world’s largest commercial and military vessels. Work is expected to start this year.

Port Clarence is only about 25 miles from Graphite One’s Graphite Creek deposit, meaning G1 could become an anchor customer for a port on BSNC land at Point Spenser. At AOTH, we are agnostic as to which deepwater port site gets built — both Port Clarence and Nome are within a short distance of Graphite Creek and could easily be connected by road.

While the development of Graphite Creek is in feasibility study stage, the project has been given a leg up by the federal government, which in 2021 gave the project High-Priority Infrastructure Project (HPIP) status. This ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process. In other words, having HPIP means that Graphite Creek will likely be fast-tracked to production.

Although there has been criticism of Alaska’s permitting system, at AOTH we don’t believe Graphite Creek would be subject to lengthy delays. The project isn’t near a salmon fishery and it has the backing of local communities such as Nome, which has a long history of resource extraction.

The company has political help from the highest political offices in Alaska — the governor and senators. They clearly see an investment to increase domestic capabilities for graphite as money well spent.

The Bering Straits Native Corporation has pledged its support for the project including an up-front US$2 million investment with an option to increase its investment up to US$10.4 million.

The United States must build port infrastructure and start developing this region if it wants to maintain Arctic sovereignty, and we see Graphite One’s Graphite Creek project as fitting in perfectly with these plans.

We see Graphite One taking a leading role in loosening China’s tight grip on the US graphite market by mining feedstock from its Graphite Creek mine in Alaska and shipping it, either through Nome or Port Clarence.

Alaska Senator Lisa Murkowski

(use slider to 1:48)

https://www.energy.senate.gov/hearings/2024/1/full-committee-hearing-to-examine-federal-electric-vehicle-incentives-including-the-federal-government-s-role-in-fostering-reliable-and-resilient-electric-vehicle-supply-chains

Pentagon support accelerates Graphite One

Graphite One Inc.

(TSXV:GPH), OTCQX:GPHOF

2024.01.03 share price: Cdn$0.90

Shares Outstanding: 129.0m

Market cap: Cdn$108.00M

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc. TSXV:GPH. GPH is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of GPH

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.