AOTH companies and metals roundup – Richard Mills

2025.01.08

Gold prices notched a series of highs in 2024 and the run could extend into 2025. “Investors are optimistic about gold and silver for 2025 because they are so pessimistic on geopolitics and government debt,” said Adrian Ash, director of research at BullionVault, via CNBC.

The news site said market participants will be keeping an eye on further China stimulus, in hopes that it may fuel a recovery in commodities demand in the world’s second-largest economy.

Bank of America predicts >$10,000 per tonne copper but a softening of iron ore prices. ING believes gold will set new records in 2025 as central banks continue to employ monetary easing, as well as a move to safe-haven assets due to an escalation in trade tensions. Central banks will remain strong buyers of gold this year, as they look to diversify their reserves.

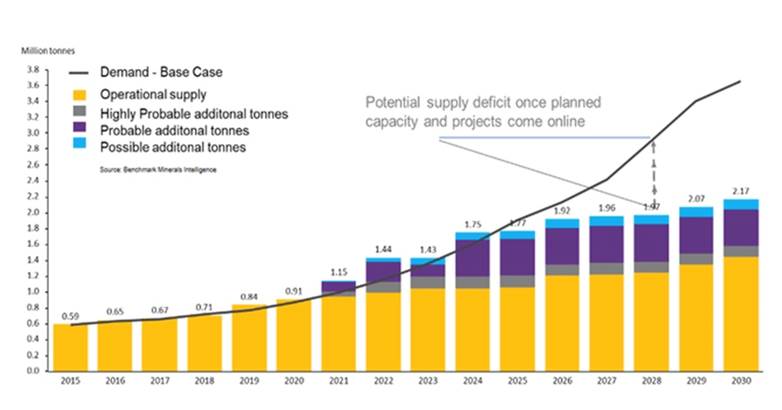

The graphite market experienced a slump in 2024 but the path to recovery is underpinned by supply-demand fundamentals. With few new graphite mines being built, demand for battery-grade graphite is expected to surpass supply this year.

At AOTH we remain bullish on these commodities and the companies that are exploring for them. A recap is presented below.

Storm Exploration (TSXV:STRM)

Storm Exploration (TSXV:STRM) has four properties in northwestern Ontario, a jurisdiction that has produced over 200 million ounces of gold. Three of Storm’s properties are in the Fort Hope area, home to a greenstone belt with the potential to host a major gold camp.

Miminiska has seen the most drilling, making it the obvious choice for an initial drill program, which is scheduled to begin in early 2025, subject to financing.

Historical drilling on the Miminiska target totals approximately 13,000 meters — enough to compile an 80,000-ounce resource. Notably, this resource is non 43-101-compliant, meaning it cannot be relied upon for investment purposes. Still, it provides a ballpark estimate of how much gold has already been discovered with very limited drilling.

CEO Bruce Counts said he thinks the gold endowment at Miminiska can be expanded vertically and laterally through drilling.

“We feel confident that we can expand the gold inventory very quickly and without a lot of expense,” he told me on Dec. 10, adding “The Miminiska target has the potential to host a multi-million-ounce deposit all on its own and it is only a small part of the 5,500-ha property.”

Storm Exploration to drill Miminiska BIF during H1 2025 — Richard Mills

EGR Exploration (TSXV:EGR)

EGR Exploration (TSXV:EGR) is receiving grant funding up to $200,000 to explore its Detour West property.

The funding is through the Ontario Junior Exploration Program (OJEP) from the provincial government. It covers 50% of exploration costs to a maximum of $200,000.

The grant will be used to fund a till and top-of-bedrock Reverse Circulation (RC) drill program to test the western extension of the Detour-Fenelon trend onto the Detour West property. EGR has drill hole fences permitted along two east-west structures interpreted from the high-resolution airborne magnetic survey completed in 2023.

Located in the northern part of the Abitibi Gold Belt, the Detour-Fenelon Gold Trend spans over 200 km of prospective strike length potential along the Sunday Lake and Lower Detour deformation zones. EGR’s property is located 20 km west of Agnico Eagle’s (TSX:AEM) Detour Lake open-pit mine (hence the name “Detour West”), and also directly adjoins Agnico’s holdings along the trend.

According to respected geologist Quinton Hennigh, it’s intriguing when deformation belts like the Sunday Lake Deformation Zone become squeezed or pinched. Granites that were coming up out of the ground during deformation squeeze the greenstone rocks around them, often resulting in higher gold grades.

The RC drill program envisions 25 holes and the priority target is the “pinch” identified by Quinton Hennigh.

EGR will have to go to the market to raise funds for the program. CEO Daniel Rodriguez told me he’s looking at a private placement with half a warrant. The buy-in price has yet to be determined.

The company is currently talking to operators, figuring out the timing and seeing when it can start the program.

EGR planning winter drill program at Detour West — Richard Mills

Gold

Gold enjoyed its annual best performance in over a decade last year, rising 24%. Data from FactSet showed gold’s rally was driven by central bank buying and retail investor purchases of physical metal.

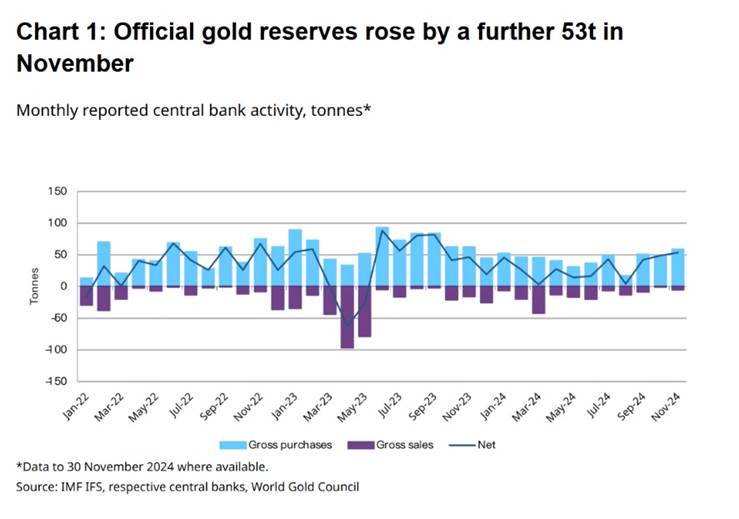

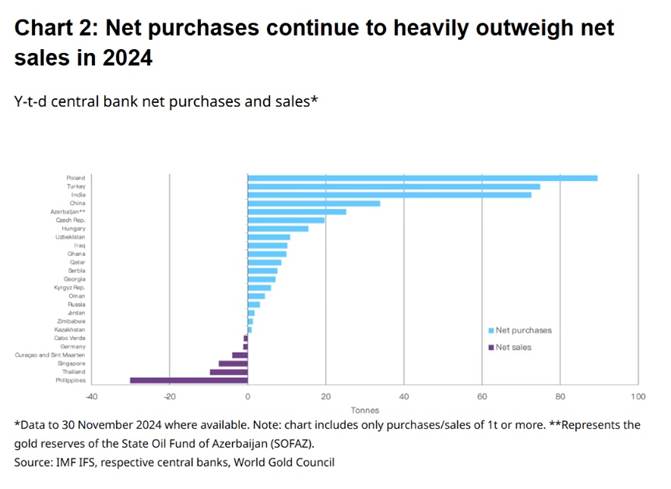

According to the World Gold Council, central banks continued to drive demand in November, with the lion’s share of purchases made by emerging markets.

“November represented another solid month of gold buying as central banks collectively added a net 53t to global official holdings based on available reported data,” WGC’s latest report on central bank gold statistics said. “This extends the broader trend observed throughout this year where central banks — mostly those from emerging markets — have remained keen buyers of gold, driven by the need for a stable and secure asset amid global economic uncertainties.”

The top buyer was the National Bank of Poland, which added 21 tonnes. Other purchasers included Uzbekistan, Kazakhstan and India. China, which halted gold-buying for six months, was back at the bullion trough, scooping up 5 tonnes and increasing YTD net purchases to 34t.

“With only December data yet to be revealed, central banks will no doubt be substantial net purchasers for the 15th consecutive year. A performance fully deserving of a curtain call,” said World Gold Council analyst Krishan Gopaul.

After gold hit an all-time high of $2,788 per ounce on Oct. 30, the combination of a higher US dollar and the election of Donald Trump in the Nov. 5 US presidential election knocked the wind out of gold’s sails.

But as Kitco News points out, gold prices found fresh support as the President-elect’s threats of tariffs and trade wars combined with renewed inflation fears once again drove spot prices back above $2,700 per ounce, and even though the precious metal was unable to challenge its October highs, apart from a few dips, support at $2,600 per ounce held through the balance of 2024.

Most retail traders and some heavyweight US banks, including JPMorgan and Bank of America, expect gold to break above $3,000 an ounce this year.

Wall Street analysts however are a little more cautious. Kitco quotes Chantelle Schieven, head of research at Capitalight Research, saying that she is not concerned by gold’s recent volatility. While Schieven is as bullish on gold this year as in 2024, she expects the current consolidation phase to last a few months, meaning gold would trade between $2,500 and $2,700 in the first half of the year, then surpass $3,000 in the second half.

She expects slower economic growth in H2 due a global trade war and geopolitical uncertainty, along with inflation holding above 3%.

“A mild recession with higher inflation should be the perfect environment for gold,” she said.

Silver North Resources (TSXV:SNAG, OTCQB:TARSF)

Silver North Resources (TSXV:SNAG, OTCQB:TARSF) in November announced the Main Fault discovery at its Haldane silver project within the historic Keno Hill Silver District in the Canadian Yukon Territory.

Drilling confirmed that the Main Fault, marked by a series of silver-bearing surface showings, is a productive structure hosting multiple high-grade silver-bearing veins and breccias. 732 meters of drilling was completed in three holes testing the West Fault and Main Fault targets.

The 8,579-hectare Haldane property is located 25 km west of Keno City, YT, adjacent to Hecla Mining’s producing Keno Hill silver mine, and hosts numerous occurrences of silver-lead-zinc-bearing quartz siderite veins as seen elsewhere in the district.

Main Fault is the third discovery Silver North has made since acquiring the Haldane property.

The corporate presentation shows historical small-scale mining — underground workings developed at the Middlecoff and Johnson veins — produced 24.7 tons of 3,102 g/t silver and 59% lead, and 2.1 tons of 4,600 g/t silver.

The property showed the potential to double the combined strike length of known veins currently totaling 12 km, with new discoveries in 2019 and 2020 at West Fault and Bighorn.

The company found almost 2 ounces (1 troy oz = 31.2 grams) of silver in soils at Bighorn with high lead concentrations.

In talking to CEO Jason Weber on Nov. 12, two takeaways from Silver North’s progress to date jumped out at me.

First, discovery after discovery from first-time drilling makes Haldane a very prospective project. Rarely is a discovery made after completing just three drill holes; usually it takes tens, sometimes hundreds.

My second takeaway is the fact that the holes at Main Fault were drilled shallower than at West Fault, and SNAG is intersecting multiple veins with each hole.

Silver North offers investors exposure to one of the most prolific silver districts in Canada and the world — Keno Hill — which is seeing major investment from Hecla Mining, the largest silver producer in the United States, following Hecla’s 2022 takeover of Alexco Resources.

Silver North’s underexplored Haldane project demonstrates high-grade, high-width potential akin to the veins being mined at Keno Hill.

Max Resource Corp (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2)

Max’s Sierra Azul project sits along the Colombian portion of the Andean Belt — the world’s largest producing copper belt. It includes the copper-silver-rich Cesar Basin. This region provides access to major infrastructure resulting from oil & gas and mining operations, including Cerrejon, the largest coal mine in South America held by Glencore.

Despite the Spanish being there centuries ago, tunneling into the mountains looking for high-grade silver, and the equally-long-known-about massive outcrops exposing high-grade copper and silver mineralization throughout the entire basin, Vancouver-based Max Resource Corp (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2), led by CEO Brett Matich, was the first to recognize its potential.

The land package now spans more than 1,150 km of geology prospective for sedimentary and volcanic hosted copper/ silver deposits and includes 20 mining concessions covering over 188 square km.

The project was formerly known as CESAR.

Max has released assay results at Sierra Azul following a signed earn-in agreement with Freeport-McMoRan Exploration Corporation, a wholly owned-affiliate of Freeport-McMoRan Inc. (NYSE:FCX).

The results were from 10 continuous channel samples collected at the AM-13 target. AM is one of three districts within Sierra Azul, which means “Blue Mountain” in Spanish. The two others are URU and Conejo. The three contiguous districts stretch over 120 km in a north-northeast, south-southwest direction.

The best assay was 1.8% copper and 7.2 g/t silver over 48.0m (AM13_CS08, continuous saw-cut channel), including 3.4% copper and 14.0 g/t silver over 15.0m, and 3.5% copper and 15.7 g/t silver over 5.0m.

According to Max, AM-13 hosts Manto-style mineralization and alteration, similar to deposits in the Tocopilla-Taltal region of northern Chile, a mineralized corridor that extends well over 100 km and hosts several economic deposits including Mantos Blanco (500 million tonnes at 1.18% copper and 12 g/t silver).

A Manto is a geological term for a style of emplaced ore deposit.

While AM-13 is the top-priority drill target, the next step is to establish continuity of the mineralization between the Cedro Valley and Mapurito Valley outcrops with detailed mapping, soil sampling and ground geophysical surveys.

Max’s 2024 exploration budget was CAD$5.8 million. It had two objectives:

- Conduct systematic regional exploration over the entire Sierra Azul Project Area (>1,300 sq km)

- Define priority targets for drilling

2025 will bring a new budget, more exploration and planned drilling.

Max Resource discovers Manto-style mineralization at Sierra Azul — Richard Mills

Silver

Spot silver narrowly beat spot gold in 2024, with an annual gain of 27% to gold’s 24%. Silver has benefited mostly due to physical buying in India and China. Silver ETFs have also been a factor.

Silver, like gold, is a precious metal that offers investors protection during times of economic and political uncertainty.

However, much of silver’s value is derived from its industrial demand. It’s estimated around 60% of silver is utilized in industrial applications, like solar and electronics, leaving only 40% for investing.

The lustrous metal has a multitude of industrial applications. This includes solar power, the automotive industry, brazing and soldering, 5G, and printed and flexible electronics.

A report by Oxford Economics commissioned by the Silver Institute found that demand for industrial applications, jewelry production and silverware fabrication is forecast to increase by 42% between 2023 and 2033.

The transition to an electrified economy doesn’t happen without copper and silver, which is why in my opinion they are among the most highly investable commodities now, and for the foreseeable future. The danger, for end users, and opportunity, for resource investors, of coming shortages for both metals, only strengthens my thesis.

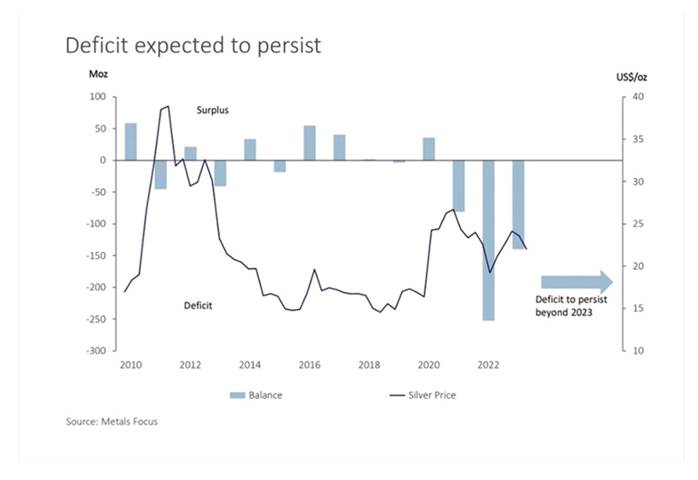

The Silver Institute reported a 184.3 million-ounce deficit in 2023 on the back of robust industrial demand.

The Silver Institute expected demand to grow by 2% in 2024, led by an anticipated 20% gain in the solar PV market.

Total silver supply should decrease by 1%, meaning 2024 should see another deficit, amounting to 215.3Moz, the second-largest in more than 20 years.

In fact it’s the fourth year in a row that the silver market would be in a structural supply deficit.

In November, a report commissioned by the Silver Institute found that “silver offers a unique blend of stability and growth potential as a tangible asset with significant safe-haven appeal and growing use in industrial applications. Silver has a low correlation with equities and bonds, unlike traditional assets, making it an excellent diversification and risk-reduction tool.”

In fact a multitude of factors are aligning for what the institute calls a “silver supercycle”, including silver’s dual use as a monetary and an industrial metal, the de-dollarization trend, and interest rate cuts by the US Federal Reserve.

As Kitco reported, Looking at the potential long-term silver supercycle, the report noted that “Compared to short-term fluctuations, which are influenced more by microeconomic factors, supercycles differ in that they tend to span a much longer period of time. Price upswings during these periods may last 10 or even 20 years, generating 20 to over 40-year complete cycles.”

As for what’s in store for silver in 2025, UBS financial markets strategist Julian Wee says that silver could enjoy a spillover effect from gold, which he expects will reach $2,900 around September 2025.

He suggested stronger industrial demand could propel silver higher, especially if China lowers interest rates, sparking a recovery in global manufacturing. The People’s Bank of China lowered its benchmark lending rates by 25 basis points in October.

Wee said on the supply side, mining output should remain constrained in 2025. “We thus expect prices to reach USD 36-38/oz in 2025, and advise investors to stay long the metal or use it for yield pickup opportunities,” he said via Kitco.

Kodiak Copper (TSXV:KDK, OTCQB:KDKCF, Frankfurt:5DD1)

Kodiak Copper (TSXV:KDK, OTCQB:KDKCF, Frankfurt:5DD1) was established by chairman Chris Taylor of Great Bear fame. The founder and CEO of Great Bear Resources presided over its acquisition by Kinross Gold in 2022 for $1.8 billion.

Kodiak, a Discovery Group company, is led by Claudia Tornquist, previously a general manager at Rio Tinto, working with Rio’s copper operations. She was also the former director of Kennady Diamonds, leading the $176M sale of the company to Mountain Province Diamonds.

MPD is a 338-square-kilometer land package near several operating mines in the southern Quesnel Terrane, British Columbia’s primary copper-gold producing belt. The project is between the towns of Merritt and Princeton, with year-round accessibility and excellent infrastructure nearby.

A key focus of Kodiak’s 2024 drill program was to identify additional near-surface and high-grade mineralization. Drill results from the Adit Zone to date have clearly achieved this.

The holes significantly extend the copper envelope at Adit and when combined with historical drilling, Kodiak’s new results have outlined a sizeable near-surface, high-grade area of mineralization.

Results from 10 holes drilled at the Adit, South, Mid and 1516 zones were presented in November.

Claudia Tornquist, Kodiak’s President and CEO, said “The results from the two latest drill holes at the Adit Zone are important as they show that this near-surface high-grade zone is significantly larger than previously known. Drilling to date has extended Adit to a length of 500 metres and it is still open in multiple directions. Our last hole this year at the Adit Zone, hole 15, turned out to be a real cliff hanger and we will definitely drill this area further.”

The drilling portion of 2024 exploration at MPD is now complete, with 9,252 meters drilled in 25 holes which evaluated seven targets and/or zones. Results from the remainder of drilling will be reported in Q1 2025. Regional exploration on the project is still ongoing and includes a 2,000-sample soil geochemistry program, 25 line-kilometers of 3D IP surveying, and a review of core from the newly acquired Aspen Grove claims.

If management thinks it’s light on tonnage, KDK will do more drilling to build more critical mass. It won’t stop until it builds enough tonnage to potentially interest a major.

Kodiak Copper’s MPD project has all the hallmarks of a major copper/gold porphyry system with the potential, in my opinion, to become a world -class mine.

Kodiak Copper presents compelling investment opportunity — Richard Mills

Copper

“As we look towards 2050, we foresee global copper demand increasing by 70% to reach 50 million tonnes annually. This will be driven by copper’s role in both current and emerging technologies, as well as the world’s decarbonization goals,” says BHP’s chief commercial officer Rag Udd.

The largest mining company in the world expects that by 2050 the energy transition sector will represent 23% of copper demand compared to the current 7%. The digital sector including data centers, 5G and AI is projected to rise from 1% today to 6%.

Transportation’s share of copper demand is expected to climb from about 11% in 2021 to 20% by 2040, thanks to the EV rollout.

On the supply side, BHP points to the average copper mine grade decreasing by around 40% since 1991. The next decade should see between one-third and one-half of the global copper supply facing grade decline and aging challenges.

The company estimates that an investment of $250 billion will be required to address the widening gap between supply and demand.

Two other sources confirm that huge new investments in the copper sector are required.

According to BloombergNEF’s annual Transition Metals Outlook, the industry will need $2.1 trillion by 2050 to meet the raw materials demand of a net-zero-transmissions world. As stated by Mining.com,

Despite a decade of growth in metals supply, BNEF reports that current raw material availability remains insufficient to meet the rising demand.

The report highlights that critical energy transition metals, including aluminum, copper, and lithium, could face supply deficits this decade —some as early as 2025.

China is the world’s biggest copper consumer, so what happens there is watched closely be copper bulls and bears alike.

China in September announced its biggest economic stimulus since the pandemic, which caused big jumps in Chinese and American stock markets, along with commodities.

The aim is to achieve a 5% annual growth target.

Yahoo Finance reported the stimulus — designed to pull the economy out of a slump caused be a property crisis and deflationary measures — includes over $325 billion in monetary measures.

The People’s Bank of China reduced the reserve requirement ratio — the amount required by banks to set aside for loans — by half a percentage point, freeing up about $142 billion in short-term liquidity.

The plan also lowers short- to medium-term interest rates and makes mortgage relief a top priority, says Yahoo Finance.

These moves are expected to benefit about 50 million households, saving them $21.3B annually in interest expenses.

The central bank also introduced a plan to prop up China’s ailing stock market. A $71 billion stock market stabilization program will allow securities firms funds, and insurers to access funding for stock purchases through a swap facility, Yahoo Finance explained.

If China adds fiscal measures (i.e. government spending) to its monetary tools, particularly for infrastructure, commodities would likely see another big push, impacting everything from US manufacturing to energy sectors.

Bank of America projects copper will reach $10,750 per tonne in 2025, in light of potential further interest rate cuts by the Federal Reserve. Also, copper is in a robust position due to strong demand, limited supply, and increased investment in energy transition projects, according to BoA analysts.

Max Iron Brazil (private)

Max Resource Corp (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2) in October closed the transaction to purchase the Florália DSO Iron Ore Project, located 70 km east of Belo Horizonte, Brazil. The transaction closed pursuant to a mineral rights purchase agreement entered into with the company’s Brazilian subsidiary, Max Resource Brazil Ltd. (Max Brazil and, together with the company, the “Max Entities”) Jaguar Mining Inc. (TSX:JAG), and Jaguar’s Brazilian subsidiary, Mineração Serras Do Oeste Limitada (together with Jaguar, the “Jaguar Entities”).

The Florália DSO Iron Ore open pit reveals sizable, sub-horizonal plunging bands of hematite iron ore which appear to extend in all directions. Upon successful exploration and development, with iron ore buyers situated within 20 km, Florália would have a significant transportation cost advantage, as bulk tonnage haulage to a shipping port would not be required,” said Max’s CEO, Brett Matich, in the Oct. 11 news release.

(High-grade hematite (60% Fe) such as Florália is often referred to as Direct Shipping Ore (DSO) because it is mined and beneficiated using a relatively simple crushing and screening process before being exported for use in steel mills. The appeal of DSO lies not only in its high iron content but also in small environmental footprint, lower greenhouse gas emissions from dry processing, no requirement for water or environmentally sensitive tailings dams.)

Florália is within Brazil’s Iron Quadrangle, which hosts some of the largest iron mines in the world.

As mentioned by Matich, it is also within 20 km of major iron ore mines and steel mills, seen on the map below. Local mining infrastructure includes railways, haul roads, mining services and personnel.

Max announced on Nov. 15 the addition of a wholly-owned Australian entity, Max Iron Brazil Ltd., which will hold the Florália Brazilian assets. The company plans to list on the ASX and to do a pre-listing financing to fund the proposed transaction and to advance drilling. 30 million shares are being offered for AUD$0.10 per share.

“If you’re a junior iron ore player this project has everything you could hope for,” Matich told Paydirt. “High-grade hematite DSO, strong local demand, minimal infrastructure requirements, and a management team with a proven track record. It’s as simple as that.”

Max has completed characteristic ore tests and commenced environment studies and other components of the Feasibility Study the company plans to complete before the end of 2025. There is no native title on the property, water permits are not necessary so no tailings dam is necessary, and workers/ contractors will not need accommodation on site.

The channel sampling across road cuts is now complete with assays pending. The next step is auger and diamond drilling.

Max Resource/Max Iron Brazil Florália DSO Iron Ore Project – Richard Mills

Iron ore

The iron ore market is forecast to increase by USD$57.5 billion between 2023 and 2028 for a compound annual growth rate of 3.2%.

The World Steel Association forecasts global finished steel consumption to increase by 1.9% in 2024.

Rising demand for high-strength iron and steel, coupled with industrialization across developing nations and a booming construction sector, are driving this explosive growth.

While there has been a slowdown in China affecting iron ore demand, the Asia Pacific region is estimated to contribute 89% to the growth of the global iron ore market from 2023-28.

High-strength steel and green steel are promising new markets for iron ore mining companies.

Deutsche Bank has brushed off signs of oversupply in iron ore markets, suggesting China’s stimulus package could rocket prices of the steelmaking ingredient to $USD130/t this year.

On Dec. 30 iron ore futures rebounded, helped by improving steel margins, falling portside stocks and China’s stimulus hopes, Reuters said. The most traded May iron ore contract on China’s Dalian Commodity Exchange ended daytime trade 0.98% higher at $106.25 per tonne.

Also, the news site reported on Jan. 2,

China’s iron ore imports are likely to hit a new high in 2025 as traders stockpile cheap ore for the world’s top consumer despite a protracted property crisis continuing to weigh on Chinese steel demand, traders and analysts said.

The country’s imports of the key steelmaking ingredient will likely rise by between 10 million and 40 million metric tons to up to 1.27 billion tons this year, up from what forecasters expect to be record volumes in 2024, seven analysts and two traders said in a Reuters survey.

Graphite One (TSXV:GPH, OTCQX:GPHOF)

Graphite One (TSXV:GPH, OTCQX:GPHOF) has received strong support from the US government for developing its “made in America” graphite supply chain anchored by Graphite Creek in Alaska, the largest graphite deposit in the country and one of the biggest in the world. Two Department of Defense grants have been awarded, one for $37.5 million, the other for $4.7 million.

G1’s feasibility study is now 75% funded by the DoD. It is due out in early 2025.

In addition, G1 qualifies for federal loan guarantees worth $72 billion.

Graphite Creek in early 2021 was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

Graphite One plans to develop a “circular economy” for graphite. Its supply chain strategy involves mining, manufacturing and recycling, all done domestically — a US first.

The new 25% tariff on Chinese graphite imports will help G1 to develop a home-grown graphite supply chain.

Graphite One’s importance to the US government is exemplified through CEO Anthony Huston’s appearance at a recent White House event.

Graphite has been elevated to the status of rare earths.

China, meanwhile, has imposed restrictions on Chinese graphite exports. Exporters must apply for permits to ship synthetic and natural flake graphite.

Increased usage of natural graphite is expected from non-Chinese sources, who are seeking to establish ex-China supply chains.

Graphite One is at the forefront of this trend. The company has significant financial backing from the Department of Defense, the Export-Import Bank of the United States. and political support from the highest levels of government, including the White House, Alaska senators, Alaska’s governor, and the Bering Straits Native Corporation.

The project isn’t near a salmon fishery and it has the backing of local communities. Nome has a long history of resource extraction.

Graphite One could take a leading role in loosening China’s tight grip on the US graphite market by mining feedstock from its Graphite Creek project in Alaska and shipping it to its planned graphite anode manufacturing plant in Voltage Valley, Ohio. Initially, G1 will produce synthetic graphite and other graphite products.

Graphite One could supply a significant portion of the amount of graphite demanded by the United States, reducing or even eliminating dependence on China.

China’s metal dominance — Richard Mills

Graphite

The electrification of the global transportation system doesn’t happen without graphite. That’s because the lithium-ion batteries in electric vehicles are composed of an anode (negative) on one side and a cathode (positive) on the other. Graphite is used in the anode.

The cathode is where metals like lithium, nickel, manganese and cobalt are used, and depending on the battery chemistry, there are different options available to battery makers. Not so for graphite, a material for which there are no substitutes.

Due to its natural strength and stiffness, graphite is an excellent conductor of heat and electricity. It is also stable over a wide range of temperatures.

Graphite is thus found in a wide range of consumer devices, including smartphones, laptops, tablets and other wireless devices, earbuds and headsets. Besides being integral to electric car batteries, graphite is found in e-bikes and scooters.

Graphite has the largest component in batteries by weight, constituting 45% or more of the cell. Nearly four times more graphite feedstock is consumed in each battery cell than lithium and nine times more than cobalt.

Needless to say, graphite is indispensable to the EV supply chain.

BloombergNEF expects graphite demand to quadruple by 2030 on the back of an EV battery boom transforming the transportation sector.

The IEA goes 10 years further out, predicting that growth in graphite demand could see an 8- to 25-fold increase between 2020 and 2040, trailing only lithium in terms of demand growth upside.

Given that demand for graphite is accelerating at a rate never seen before, and the EV industry is now gradually shifting towards natural graphite, the impending supply crunch could get serious.

Analysis by Benchmark Mineral Intelligence projects that natural graphite will have the largest supply shortfalls of all battery materials by 2030 — even more than that of lithium — with demand outstripping expected supplies by about 1.2 million tonnes.

And this is just counting EV battery use only; the mining industry still needs to supply other end-users. The automotive and steel industries remain the largest consumers of graphite today, with demand across both rising at 5% per annum.

BMI previously stated that flake graphite feedstock required to supply the world’s lithium-ion anode market is projected to reach 1.25 million tonnes per annum by 2025. For reference, the amount of mined graphite for all uses in 2022 was just 1.3 million tonnes.

The lithium price reporting agency has said as many as 97 average-sized graphite mines need to come online by 2035 to meet global demand.

While graphite prices have been down lately due to oversupply in China, the expectation of a market recovery in 2025 is likely to re-ignite interest in graphite projects, writes GraphiteHub founder Harry Minnis.

BMI warns that shortages could persist for up to 20 years unless production diversifies especially outside of China. Fastmarkets also forecasts a deficit in the natural graphite market until 2025, driven by soaring EV demand and delayed capacity expansions. Rising power costs and environmental controls are expected to contribute to increasing prices, making the market more dynamic in the coming years, says Minnis.

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard does not own shares of Storm Exploration (TSXV:STRM), EGR Exploration (TSXV:EGR), Silver North Resources (TSXV:SNAG), Kodiak Copper (TSXV:KDK).

Richard owns shares of Max Resource Corp (TSXV:MAX), Max Iron Brazil (private), Graphite One (TSXV:GPH).

STRM, EGR, STRM, MAX, GPH and KDK are paid advertiser’s on his site aheadoftheherd.com

This article is issued on behalf of STRM, EGR, STRM, MAX, GPH and KDK

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.