AOTH believes Kodiak Copper offers more investment upside – Richard Mills

2025-02-14

Kodiak Copper’s (TSXV:KDK, OTCQB:KDKCF, Frankfurt:5DD1) management team, and the Discovery Group, have a successful, envious track record of shareholder returns.

Kodiak was established by chairman Chris Taylor of Great Bear fame. The founder and CEO of Great Bear Resources presided over its acquisition by Kinross Gold in 2022 for $1.8 billion.

The Discovery Group company is led by Claudia Tornquist, previously a general manager at Rio Tinto working with Rio’s copper operations. She was also the former director of Kennady Diamonds, leading the $176M sale of the company to Mountain Province Diamonds.

Copper market fundamentals are currently strong, with analysts predicting increasing demand facing the headwinds of structural supply deficits.

The company plans to release a resource estimate on MPD. Resource estimates often serve as significant catalysts for junior resource company stock prices.

Kodiak announced on Jan. 16 that it has started work on a National Instrument 43-101-compliant resource estimate that will include seven mineralized zones: Gate/Prime, Man, Dillard, Ketchan, West, Adit, and South/Mid.

Kodiak Begins National Instrument 43-101 Compliant Resource Estimation at MPD Copper-Gold Project

Results will be delivered throughout the year, with initial results anticipated in the first half of 2025.

GT Gold comparison

Comparing Kodiak Copper to GT Gold (TSXV:GTT) is interesting from an investor’s perspective. Would an investor have made money if they had got in early enough, before the stock price rose following publication of the resource estimate? We wrote the article linked to below in late December 2025, following is a snippet.

Kodiak Copper presents compelling investment opportunity – Richard Mills

GT Gold began exploring its Tatogga project in northwestern BC in 2016. The Saddle South discovery was prospective for gold and silver. While drilling over the next two years outlined a strong mineralized system, it was the much bigger but lower-grade Saddle North porphyry copper-gold deposit that piqued a major’s interest.

A 2017 discovery hole at Saddle North cut 210 meters averaging 0.16% copper, 0.14 grams per tonne gold and 0.28 g/t silver. The grades got stronger the deeper the hole went.

A 2018 hole that undercut the 2017 discovery hit 822 meters averaging 0.26% Cu, 0.42 g/t gold and 0.62 g/t — confirming that the junior was onto a large porphyry reminiscent of the Red Chris mine about 20 km to the southeast.

Intrigued, Goldcorp grabbed an early 10% stake (like Teck has done with KDK), spending CAD$17.9 million in 2019. An additional $8.9M boosted Goldcorp’s stake to 14.9%. (Newmont acquired Goldcorp on April 18, 2019).

With Newmont’s backing, GTT continued to explore Saddle North, resulting in a maiden resource estimate in July 2020.

Less than five years after its founding, GT Gold and its Tatogga project was bought out by Newmont, which spent $393 million to acquire the 85.1% of GTT’s shares it didn’t already own.

GT Gold is an example of a company with huge potential to make big money for investors who got in early.

An investor who bought GT Gold for $0.51 in July 2017 and held on until the 2017 Saddle North discovery would have quintupled (5X) their investment. Those who saw the chance for a takeover by Newmont would have been rewarded handsomely when it happened on March 10, 2021 with Newmont offering $3.25 a share.

The investor who got in at $0.51 and sold at the buyout price of $3.25 would have realized a 537% gain.

GT Gold proves that a junior can make money by putting out a resource estimate, as can investors who play the game right.

We see no reason why investors won’t do very well for themselves owning KDK; in our opinion it’s an example, brought to you by AOTH, of what patient investors who know how to invest in this sector are paying attention to.

MPD project

Kodiak Copper’s MPD project has all the hallmarks of a major copper/gold porphyry system with the potential, in my opinion, to become a world-class mine.

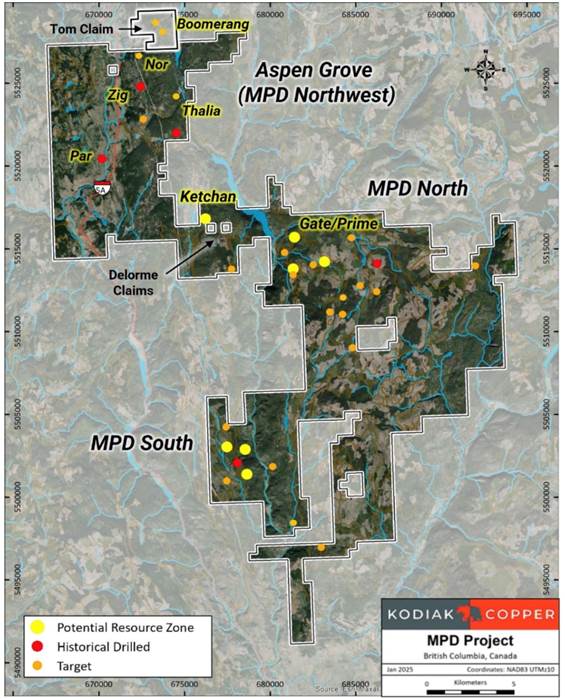

The project is a 344-square-kilometer land package near several operating mines in the southern Quesnel Terrane, British Columbia’s primary copper-gold producing belt. MPD is between the towns of Merritt and Princeton, with year-round accessibility and excellent infrastructure nearby.

A key focus of Kodiak’s 2024 drill program was to identify additional near-surface and high-grade mineralization. Drill results from the Adit Zone to date have clearly achieved this.

Kodiak Extends High-Grade Adit Zone, Intersects 0.45% CuEq Over 139m Near Surface – Richard Mills

Kodiak Regional Exploration Results Highlight Further Targets at MPD Copper-Gold Project

The holes significantly extend the copper envelope at Adit and when combined with historical drilling, Kodiak’s new results have outlined a sizeable near-surface, high-grade area of mineralization.

On Feb. 6 Kodiak reported results from soil geochemical, geophysical, prospecting and drilling from the 2024 exploration program. These results were from the northern and southern parts of the MPD property.

Last year’s exploration program confirmed that the Dillard East and Star target areas have significant copper-gold porphyry mineralization potential with new corroborating results from rock, soil and 3D Induced Polarization (3D-IP) surveys. These target areas have not yet been drill-tested by Kodiak.

3D-IP responses at Dillard East and Star are adjacent to, and on the flanks of significant kilometer-scale copper-in-soil anomalies, which also host prospecting results with porphyry-related copper and gold mineralization.

Prospecting in 2024 discovered copper-gold-silver mineralized outcrops in two new areas at MPD (Dry Creek, Northstar), further highlighting the discovery potential across the entire MPD property.

The best grab sample from last year’s prospecting program assayed 1.07 % Cu, 0.05 g/t Au and 7.0 g/t Ag.

Kodiak’s 2024 regional exploration program included the collection of 2,020 soil samples, 65 rock samples, a 3D-IP survey over 7 square kilometers, geological and geotechnical studies.

Kodiak completed 9,252 meters of drilling in 25 holes in seven target areas. Results from the final six holes of the 2024 drill program were reported in the Feb. 6 news release.

The company is incorporating all 2024 exploration results into VRIFY’s predictive AI modeling, thereby updating targets and identifying new ones for follow-up in 2025.

“Today’s results from our regional exploration work once again highlight the prospectivity of our MPD project by adding two new targets and upgrading existing targets across the property,” said Kodiak’s President and CEO Claudia Tornquist. “While the definition of a maiden resource estimate for MPD is an important focus for Kodiak in 2025, we also plan to drill further targets this year with the aim to make the next discovery. We are particularly excited about the exploration potential on the new Aspen Grove claims that we acquired in September and will be able to share an update regarding that portion of our property soon.”

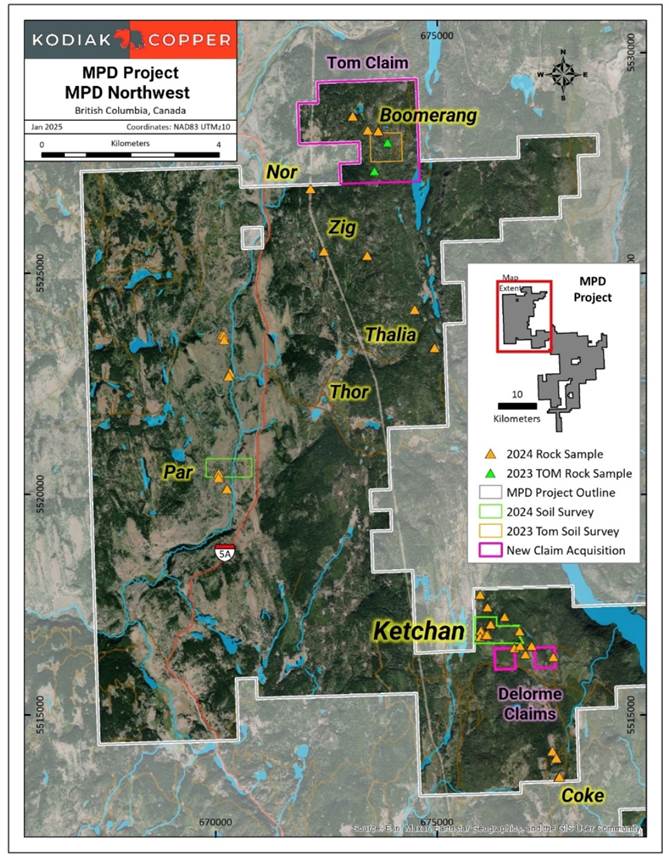

The Aspen Grove claims were the subject of the next news release on Feb. 12. Renamed the MPD Northwest claims, the claims host the high-grade, near-surface Ketchan Zone which will form a meaningful part of the upcoming MPD mineral resource estimate, and multiple other known mineral occurrences, providing considerable exploration upside. Historical data has also been analyzed, leading to the acquisition of new claims.

As highlighted by Kodiak Copper, MPD Northwest is a large, 118 square-kilometer claim package recently added to MPD. It hosts 18 known mineral occurrences, including six with significant porphyry-related copper-gold.

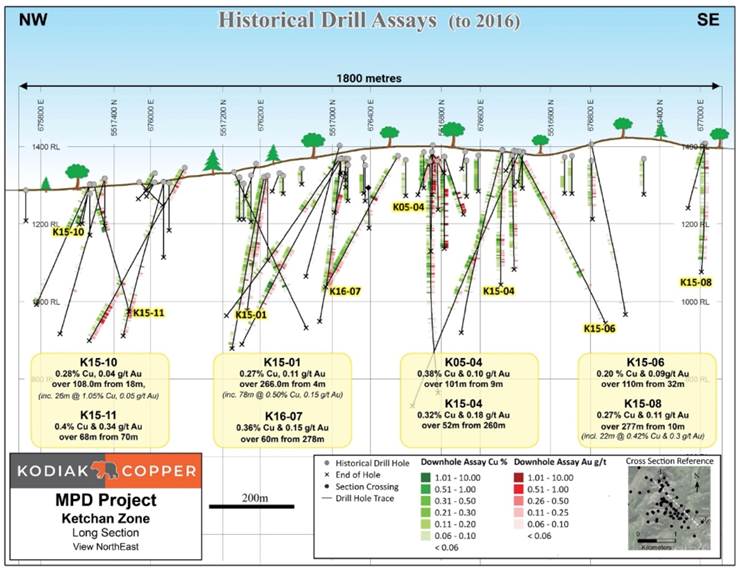

The large-scale Ketchan Zone adds significant drill-proven, near-surface, high-grade copper-gold inventory to MPD. It has been drilled over 1,800 by 500 meters — roughly three times the area of Kodiak’s Gate Zone discovery — and remains open in most directions.

Bedrock grab samples collected in 2024 confirm high-grade mineralization at Ketchan. The best two samples assayed 0.55 % Cu, 0.32 g/t Au and 0.5 g/t Ag, and 0.38 % Cu, 0.78 g/t Au and 1.7 g/t Ag, respectively.

Data review, select core re-logging, sampling and geological modeling has confirmed that Ketchan will be a material part of the upcoming MPD mineral resource estimate.

The Ketchan Zone is located only 4.5 kilometers from the high-grade Gate Zone. This proximity and potential synergies with Gate, plus multiple nearby targets, prioritizes this area.

Modeling with VRIFY’s Artificial Intelligence (AI) software has identified new prospective areas at MPD Northwest, including potential extensions to the Ketchan Zone.

Regional exploration has confirmed substantial mineralization through early-stage prospecting, mapping and soil geochemistry at select sites along the northerly trend of mineral showings central to MPD Northwest.

An additional three claims have been added to the MPD Northwest claim block. These secure strategic tenure in the Ketchan area interpreted to potentially host extensions to that zone (the Delorme claims) and high-grade showings in the north (the Tom claim).

“We are delighted with the results from our initial exploration work and the historic data review at the MPD Northwest claims, which very much validate our decision to acquire these claims last autumn,” said Tornquist. “The drilling done by previous operators at the Ketchan Zone has outlined a mineralized zone of significant scale and with good grades. Not only are we confident that the Ketchan Zone will become a material part of our resource estimate, we also believe there is ample room to expand it in multiple directions. We are equally excited about the targets and prospectivity of the wider MPD Northwest claim package, which hosts drill-proven copper and gold mineralization as well as untested targets with the potential for new discoveries. As we are plan our 2025 exploration program, MPD Northwest is certainly a priority.”

In an interview with Crux Investor, Chris Taylor highlighted the potential for a market re-rating based on the upcoming resource estimate, stating:

“That’ll give you an idea of what the project economics could be based on those comparables and then you build on it with the continuing exploration program as well. That’s what we could deliver to shareholders this year — a re-rating based on the amount of copper we see in the ground right now, and an appreciation for the fact that there are additional zones that we’re going to be drilling and there’s significant extensions on the zones that we will have resources on initially.”

Another important aspect of the MPD story is its potential upside. While the company has identified multiple zones, it remains committing to continued exploration to further grow the project, both through zone expansion and the testing of new targets. Says Taylor:

“We have all these additional targets on the project that we continue to test while we’re doing the resource work. It’s one of those things that makes our industry very interesting — I’ve lived through it many times — is we still have that discovery potential as well. We’ve done it in the past and it may happen again in the future.”

Map of project areas and exploration targets discussed in the Feb. 12 release – MPD project, southern BC. The Tom and Delorme claims have been added to the project.

Ketchan Zone northwest-southeast long section with historical drill results to 2016. Select historical intervals show significant shallow mineralization along 1.8 kilometers of strike length.

2024 exploration activity on the MPD Northwest claims. 2024 soil survey grids are outlined in green, 2023-2024 prospecting samples as triangles and newly acquired strategic claims are outlined in magenta.

Copper market

Kodiak Copper is on the cusp of a maiden resource at an interesting time in the copper market.

Copper caught a bid last week, rising from $4.12 a pound Tuesday to $4.58 Friday. The red metal is up nearly CAD$0.75 year to date, and was trading at USD$4.72 at time of writing.

Over the longer term, the red metal hit an all-time high of $5.20 per pound in May 2024 due to a supply squeeze. The transition to renewable energy, the rise of electric vehicles, and the growth of artificial intelligence (AI) have all increased demand for copper.

Chile is the world’s largest copper producer and the price forecast from its copper commission, Cochilco, puts copper at $4.25 a pound in 2025 and 2026. It expects copper to remain above $4/lb for the next decade.

As reported by Stockhead, Cochilco expects copper demand to rise 3.2% this year to 27.4 million tonnes, outpacing supply of 27.3Mt and generating a deficit of 118,000 tonnes.

Total mined copper in 2024 was 23 million tonnes, according to the US Geological Survey, with Chile supplying 5.3Mt.

Cochilco’s acting executive vice president Claudia Rodriguez said the country sees copper demand lifting due to the energy transition, electrical networks and restricted supply.

Stockhead notes Chile’s mines have been a disappointment in recent years, and last month downgraded its 2034 supply forecast from 6.43Mt to 5.4Mt, a cut of around 900,000 tonnes, just under the 1Mt annual production of the world’s largest copper mine, Escondida.

Rodriguez expects a stronger global economy will push copper prices higher this year, with the wildcards being China’s economic recovery and President Trump’s tariff war.

A separate article by Stockhead predicts that if 25% tariffs on Canada and Mexico go ahead at the beginning of March, the effect on copper is expected to be neutral. According to Benchmark Mineral Intelligence, while Canada supplies 15% of US refined copper exports and 82% of US wire rod imports, “The lost copper import volume from Canada could be mitigated by a curtailment of refined copper and copper wire rod exports from the US to Mexico, supplemented by imports from tariff-exempt countries like Chile,” Benchmark’s analysts wrote.

Others are more bullish on the tariffs. According to Baystreet.ca, “Dr. Copper” which has a PhD in economics for its ability to predict economic trends, is playing an even more pivotal role amid heightened geopolitical tensions. President Trump’s impending tariff policies are sparking waves of uncertainty across global trade flows, with copper futures in New York surging on fears of heightened import taxes.

Baystreet.ca names three key drivers of copper demand in 2025: energy transition and electrification, especially renewable energy technologies, electric vehicles and grid infrastructure; urbanization and infrastructure, particularly investments in 5G networks, clean energy and modernized grids; and China’s strategic role. Baystreet notes China is expected to increase its copper smelting and blending capacities in 2025, further amplifying demand.

Meanwhile supply is expected to lag demand, with analysts projecting a modest 2.8% increase in global output.

Looking further out, another source says copper mine supply growth is expected to peak in 2030 at 27.3 million tons before declining by 2035. Smelter demand for copper concentrate is forecast to outpace mine supply, driving the concentrate market into a 3.8-million-ton deficit by 2035.

Conclusion

With bullish fundamentals, now is as good a time as ever to be a company exploring for copper, especially in a safe, stable jurisdiction with low-cost power like British Columbia.

David Eby’s NDP party, not known for its pro-mining stance, is fast-tracking 18 resource projects to reduce reliance on the United States, with the list including an expansion of the Highland Valley copper mine located in close proximity to Kodiak Copper’s MPD project.

Investing in junior mining companies isn’t for the faint of heart, nor the “get rich quick” crowd. It takes time, skill and perseverance to identify a company, do your due diligence, and then have the faith and PATIENCE to stay with it through the often-bumpy ride from discovery to buy-out.

If management thinks it’s light on tonnage, KDK will do more drilling to build more critical mass. It won’t stop until it builds enough tonnage to potentially interest a major.

Indeed, Kodiak Copper is working diligently towards a resource estimate while still exploring to find fresh ground to either incorporate into the RE, or save it for a later expansion plan.

That is, if a larger company doesn’t buy them out , which your author believes is a real possibility, amid a rising copper price and a resource estimate that impresses the acquirer with the size and scalability most are looking for in an early-stage exploration project.

Kodiak Copper

TSXV:KDK, OTCQB:KDKCF, Frankfurt:5DD1

Cdn$0.47 2025.02.12

Shared Outstanding 75.9m

Market cap Cdn$35.6m

KDK website

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard does not own shares of Kodiak Copper (TSXV:KDK). KDK is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of KDK

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

3 Comments

Leave a Reply Cancel reply

You must be logged in to post a comment.

#Copper #KodiakCopper $KDK

Kodiak Copper is working diligently towards a resource estimate while still exploring to find fresh ground to either incorporate into the RE, or save it for a later expansion plan.

That is, if a larger company doesn’t buy them out , which your author believes is a real possibility, amid a rising copper price and a resource estimate that impresses the acquirer with the size and scalability most are looking for in an early-stage exploration project.

Copper price to remain elevated due to increasing demand for electricity and supply challenges

https://aheadoftheherd.com/copper-price-to-remain-elevated-due-to-increasing-demand-for-electricity-and-supply-challenges-richard-mills/