America’s much needed lithium mine

2020.06.09

Things are looking up in the lithium market and producers of the electric-vehicle battery ingredient may have covid-19 to thank for the positive developments.

Virus-related lockdowns have negatively impacted a lot of industries, but they have also accelerated the shift from fossil fuels to renewables, particularly in the fast-growing utility energy storage and electric vehicle sectors.

To be sure, EVs weren’t spared from significantly dampened auto sales during the darkest days of the pandemic in March and April. According to a recent report from Bloomberg New Energy Finance, global electric-car sales will decrease by 18% in 2020, to 1.7 million units. But sales of internal-combustion vehicles are predicted to fall even faster, by 23% globally.

Indeed the future looks undimmed for the electrification of the global transportation system, the inexorable shift, as gasoline and diesel vehicles are slowly eclipsed, both by hybrids and battery-electric models.

The report says electric cars this year will account for 3% of global new-car sales, rising to 7% in 2023, at 5.4 million units. According to Bloomberg, by 2040, EVs will represent over half of new-car sales (58%), and close to one-third (31%) of the global car fleet. 2037 is the year that EV sales are predicted to surpass gas/diesel-powered models.

The report also says that two-thirds of municipal buses, a quarter of light commercial vehicles, and 47% of two-wheelers (motorcycles, mopeds and scooters) will be electric by 2040.

Another study, by Cairn Energy Research Advisors, predicts a surge in electric vehicle sales in 2021 as countries around the world push new programs to encourage consumers to buy battery powered vehicles. Cairn estimates global sales of EVs in 2021 will jump 36% and top 3 million vehicles for the first time ever, CNBC reported on May 29.

Meanwhile, despite the virus continuing to crimp new-car demand, US auto-icons Ford and GM are joining a growing list of carmakers that are rolling out electric vans aimed at business owners, a potentially lucrative market segment that Tesla has yet to address.

With all that is going on, isn’t it a perfect time for a junior resource company to own a lithium deposit in the United States? Cypress Development Corp (TSX-V:CYP) has just published a very positive prefeasibility study for its Clayton Valley Lithium Project in Nevada.

In this article we get into the reasons for continued optimism for lithium, and take a detailed look at Cypress’ prefeas, which is now available on SEDAR.

10X increase in battery demand

Lithium is expected to see a 29X increase in demand, driven not only by lithium required in EVs batteries, but in consumer electronics like smart phones and power tools.

Furthermore, as renewable energies come down in price and become a larger percentage of countries’ total energy mixes, the need to store energy for later feeding into the grid will become more and more important.

Lithium ion batteries are expected to be the fastest-growing energy storage technology, accounting for 85% of newly installed storage capacity, and over 28 gigawatts by 2028, according to an analysis by Navigant Research. (there were only 1.4GW in 2017)

But we don’t have to wait eight years to see record-breaking activity in battery storage.

According to the International Energy Agency, renewable energy generation will increase in 2020 and push higher-cost fossil fuel resources out of the market. “In all regions that implemented lockdown measures, the electricity supply underwent a notable shift toward low-carbon energy sources,” states a new IEA report.

In a recent article, Greentech Media explains how renewables are replacing natural gas and coal-fired power plants, thus requiring energy storage systems powered by lithium-ion batteries. Examples include a coal plant in North Dakota being subbed in part by a one-acre battery array; Hawaii’s electric utility awarding 16 projects that add up to 3 gigawatt-hours of storage, to replace and oil-fired plant and a coal-fired plant; and Southern California Edison signing contracts for 770 megawatts of batteries that, many paired with solar projects, will replace gas plants.

“The utility energy storage market is blowing through milestones faster than we can report them,” says Dan Finn-Foley, Wood Mackenzie’s head of energy storage.

Meanwhile, a Reuters analysis shows that automakers are planning on spending a combined $300 billion on electrification in the next decade. Tesla last year opened its Shanghai, China gigafactory. More battery factories are being built globally; demand for lithium-ion batteries is forecast to grow at a CAGR of over 13% by 2023.

A more recent report by Roskill found lithium-ion battery demand is expected to increase more than 10-fold in a decade.

“The pipeline capacity of battery gigafactories is reported by Roskill to exceed 2,000GWh in 2029, at over 145 facilities globally,” the report reads. “Driven by demand from the automotive and energy storage markets, NCM/NCA type cathode materials are expected to remain dominant, though other cathode types will take market share in niche environments or applications.”

The United States is behind China in the race to build an electric vehicle ecosystem that can compete with traditional models, complete with residential and commercial charging stations, but several automakers and battery manufactures are either building facilities or planning them.

In 2017, Mercedez-Benz announced plans to set up an electric car production facility and battery plant at its existing Tuscaloosa, Alabama plant. The $1-billion expansion will include a new battery factory near the production site, with the goal of providing batteries for a future electric SUV under the brand EQ. Six sites are planned to produce Mercedes’ EQ electric-vehicle family models, along with a network of eight battery plants.

Volkswagen has said it will invest $800 million to construct a new electric vehicle – likely an SUV – at its plant in Chattanooga plant, starting in 2022. The German automaker has unveiled sweeping incentives for cheap electric cars and for hybrid vehicles, providing a boost to Volkswagen’s electric push, according to the Financial Post.

Korean company SK Innovation has said it will invest US$1.7 billion in the US’ first electric vehicle plant, to serve Volkswagen, in neighboring Georgia. The 9.8 gigawatt-hour-plant would be the first EV battery plant in the United States. SK Innovation recently announced a second 10-GWh plant requiring an investment of $1 billion.

GM has rolled out its 2020 Cadillac SUV, built in Spring Hill, Tennessee, in a move designed to challenge Tesla.

Introducing the electric van

General Motors is also reportedly developing an electric van aimed at companies with vast distribution networks, such as Amazon and UPS:

The GM electric van project is aimed at an important segment of the emerging EV market – commercial delivery vehicles. For established players, this is a hugely profitable business segment driven by cost of ownership, not fancy tech or star power. It is also a segment in which Tesla and its high-profile CEO, Elon Musk, lack an entry to compete for sales and CO2 credits, which allow automakers to offset the sale of non-electric vehicles including high-margin pickups and SUVs.

Sources say the GM van, code-named BV1, is due to start production in late 2021. Rival Ford has said it would introduce an electric version of its Transit van in 2022. Other companies expected to join the electric van market include Michigan-based startup Rivian, of which Ford is an investor, and British startup Arrival, backed by Hyundai Motor Corp and its sister company Kia. Rivian is scheduled to begin building the first of 100,000 mid-sized electric vans for Amazon next year. Other big industry players might follow, including Daimler, Volkswagen and Fiat Chrysler.

“The delivery vans is a volume not to be underestimated. I would not just call it a niche segment,” Reuters quotes Samit Ghosh, chief executive of the Americas for consulting and engineering firm umlaut.

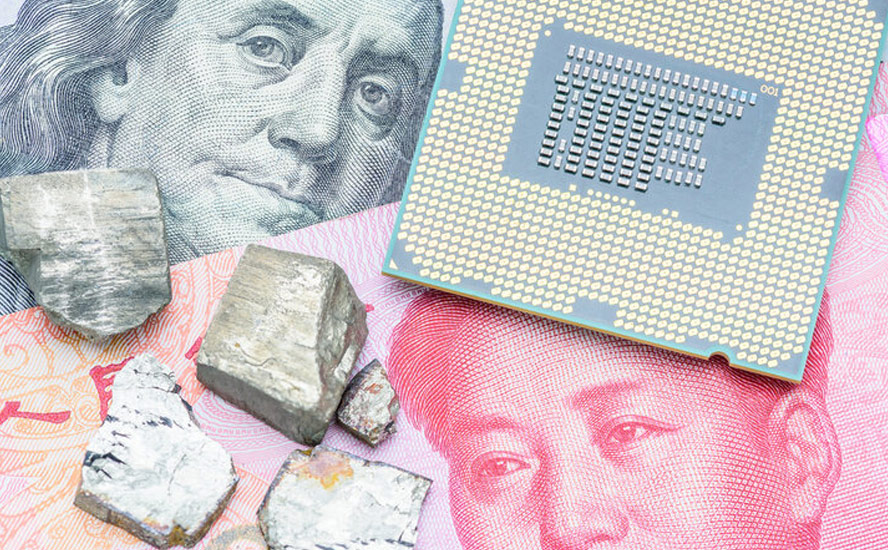

Trade war concerns

The covid-19 pandemic has put a laser-like focus on insecurity of lithium and rare earths supply for North America, especially because several battery companies and EV automakers are planning on setting up shop in the United States. When they do, they will need a ready supply of raw materials, the majority of which must currently be sourced in China.

China has a lock on rare earths and lithium, among other critical minerals, and if exports are restricted, as rare earths oxides were in 2010, hiking their prices, the effects on end users could be devastating.

And while China appears to be getting back on its feet, the problem now is an anticipated huge drop in Chinese exports, as overseas orders are being scrapped by China’s trading partners whose economies are still being ravaged by the coronavirus, notwithstanding attempts at limited re-openings.

In the United States, the pandemic has hobbled US efforts to produce lithium, rare earths and other materials used in electric vehicles and high-tech equipment.

Relations between the US and China have deteriorated in recent weeks, as each blames the other on their handling of the coronavirus. President Trump has threatened new tariffs on China, and Beijing has suggested it could counter with punitive actions. A phase one trade deal in January had China promising to buy an additional $200 billion of US goods and services, but now, due to the impacts of the virus on China’s economy, it appears highly unlikely the Chinese government can live up to that commitment.

“The targets for purchases in the phase one deal were always unrealistic, and now they are impossible,” CNN Business quotes David Dollar, a Washington-based senior fellow at the Brookings Institution’s John L. Thornton China Center.

All of this points to the need for a reliable mine-to-battery-to-EV supply chain, in North America, that is immune to international supply chain disruptions and trade wars.

The first step is to develop new lithium mines.

Currently the only US lithium producer is chemicals giant Albemarle. Lithium products from Albemarle’s Silver Peak lithium brine operation in Nevada are sent to its processing plant in North Carolina. This material is then loaded on ships and sent to Asian battery manufacturers, which sell the batteries to automakers.

According to Visual Capitalist Albemarle’s Silver Peak lithium mine only produces enough lithium to produce roughly 1,000 tonnes per year of lithium hydroxide, within a current lithium market of roughly 360,000 tonnes per annum of lithium carbonate equivalent (LCE), a term that encompasses both lithium hydroxide and carbonate used in EV batteries.

There’s no way Silver Peak can produce enough lithium to supply American needs, especially with all of the EV battery and auto production facilities planned.

Fortunately, there are other deposits in Nevada that lithium companies are racing to develop. One of them is held by Cypress Development Corp.

Cypress Development Corp (TSX-V:CYP)

Cypress just put out a barnburner of a prefeasibility study (PFS) on its Clayton Valley Lithium Project. It’s the best study I’ve seen in over a decade of investing in and writing about the lithium space.

The PFS shows an outstanding present value of $1.052 billion at an 8% discount rate, yielding an internal rate of return (after tax) of 25.8%. Payback is 4.4 years.

The IRR is based on a lithium carbonate equivalent (LCE) price of $9.50 a kilogram. All of the recent lithium PFS’s, and the more advanced studies, have used at least $12.50/kg; Ioneer’s prefeasibility used $13.20/kg.

Currently lithium carbonate sells for $7.50/kg while lithium hydroxide prices in China, Japan and Korea are $9.75/kg. (Cypress plans on producing lithium hydroxide, a lithium end-product that is a key ingredient of an electric vehicle’s lithium-ion battery cathode)

The proposed mine would produce an average 27,400 tonnes of LCE a year and have a mine life of +40 years. The mine would be neither a hard-rock mine nor a lithium brine operation, but rather, would process the lithium from claystones in Nevada’s Clayton Valley by leaching the material with dilute sulfuric acid.

The PFS is all the more impressive considering that Cypress went from drilling to prefeasibility in only three years – a very short turnaround time for any junior in any commodity. Moreover, Cypress only spent a million dollars in exploration to achieve the numbers in the report, which are comparable to the preliminary economic assessment (PEA), released in the fall of 2018.

The Clayton Valley Lithium Project hosts Measured and Indicated mineral resources of 593 million tonnes (Mt) averaging 1,073 parts per million (ppm) Li (3.387Mt LCE). Production is based on a Probable mineral reserve of 222 million tonnes (Mt) averaging 1,141 ppm Li (1.353Mt LCE). The project ranks among the largest undeveloped lithium deposits in the world.

On Thursday June 4th AOTH called up Cypress’ CEO, Dr. Bill Willoughby, to get his thoughts on the PFS.

The fact that Cypress is planning on making lithium hydroxide, means a significantly higher profit margin than if they were producing lithium carbonate, or for that matter, low-quality technical grade lithium. (the current LME price of lithium carbonate is $7.50/kg, for lithium hydroxide it’s $9.75/kg).

At a cash operating cost of $3,329 per tonne LCE, the company stands to make a profit of $6,421/tonne, if lithium sells for $9,750/t. And that does not include extra revenue earned from the sale of (excess) sulfuric acid, needed to leach the lithium from the claystones, excess power generated from the acid plant and sold into the electricity grid, or revenues from rare earth oxides that were identified during previous metallurgical testing. As stated in the PFS, Rare earth elements (REEs) were found at elevated levels in the lithium recovery process along with Mg, Ca and other elements.

The proposed acid plant and co-generation facility would have a capacity of 2,500 tonnes per day, burning elemental sulfur to create sulfuric acid, and in the process, generating steam to heat leach tanks. Acid plant operations account for one-third of the future mine’s total operating costs.

Dr. Willoughby noted that by 2030, the demand for lithium products are estimated to grow to 1.6 million tonnes a year, of which 1.4Mt is for lithium hydroxide. “If that’s the case, that’s exactly the space we want to be in, to make ourselves attractive to a miner, or a battery or EV manufacturer,” he said.

If there is one takeaway for investors interested in reading the 161-page technical report, it is the concept of scalability. Major mining companies are not interested in small deposits because they are not scalable ie., the junior mining company may be able to produce the metal they’re after, whether it be gold, silver, copper, rare earths, lithium, etc., but if the operation can’t be scaled up to the level needed by the major, it will not pass muster.

Cypress’ Clayton Valley Lithium Project has the size in its PFS already to interest a large company or fund, and has the resources to be scaled up to produce more.

In the PFS, mining is planned to occur in eight pit phases which will result in 40 years of production – at the envisioned production rate of 15,000 tonnes per day.

Now, it is possible that whoever decides to buy the project (or Cypress) will find the specifications of the mine as outlined in the PFS, sufficient for its purposes. However it is just as likely, if not more likely, that a major company would want to double or even triple the 15,000 tpd capacity and 27,400 tonnes of annual LCE production set out by Cypress in its base case scenario.

Cyprus will be designing a pilot plant capable of continuous production of at least one tonne per day of claystone, for a month. If that test phase is successful, ie., if the flow sheet works and the lithium hydroxide finished product is acceptable, then a potential acquirer could envision whatever production rate is required.

In the three years I’ve been covering Cypress, the business plan has always involved attracting a major financial or mining partner that can help drive the project forward.

Cypress states in a June 3, 2020 news release,

With the next step a pilot plant program, as recommended in the PFS, Cypress intends to invite proposals that can add value to the project and the Company through financial, technical, operating or marketing capabilities.

In preparation for the pilot plant program, the following work is underway, core logging and analyses on several drill holes, supplemental metallurgical tests, and environmental studies. In the past week, another large sample was leached and filtered at Continental Metallurgical Services (CMS) in Butte, Montana and the filtrate shipped to NORAM in Vancouver, BC for further work to test the NORAM-CMS flowsheet under varying conditions. Testing thus far has yielded concentrated lithium solution suitable for producing high purity lithium hydroxide. The recommendations in the PFS are to study the process with a pilot plant and simulate all key functions of a full-scale operation. Planning for the collection of material for the pilot plant program is underway.

The time frame and cost for the pilot plant program are estimated in the PFS at six months and US$6.75 million.

As for how Cypress is planning to fund the pilot plant study, here is where it gets interesting. Dr. Willoughby told us, “We want to find a partner to help us reach the next level. It could be fund or financial backer, another miner, or government entity, we’re going to explore all those options.”

Does he have somebody in mind?

Albemarle is the world’s largest lithium producer, it’s mine is just next door. Tesla is the largest EV manufacturer; its Gigafactory is just 200 km away from CYP’s Clayton Valley Lithium Project. Then there are other suitors that might be interested in securing a 40-year lithium mine in the United States. SK Innovation, Mercedes Benz, Volkswagen, Ford or GM are all possibilities.

I asked Dr. Willoughby what he thinks sets Cypress apart from its peer group and where the Clayton Valley Lithium Project sits in relation to the global lithium market.

Again it comes down to scalability. According to Willoughby, 50,000 to 100,000 tonnes of lithium per annum is probably what a company in the future would like to see in terms of making an impact on the world’s supply.

“What would 50,000 tonnes a year of production mean down the road when the world needs 1.5 million tonnes? Well that’s a significant percentage. It would be enough to have people say you’re contributing to the world supply and price of lithium if you’re a low-cost producer.”

In other words, be a price maker, not a price taker.

Of course, Cypress has a ways to go, but it’s interesting to hear the ambition in Willoughby; here is a man, and a company, that is looking at the big picture.

The next step is proof of concept. The purpose of the pilot plant is proving, in a real-world application, everything that Cypress has done so far in a laboratory. It’s showing to everyone that its technology works, on a commercial scale. After that, it’s on to a feasibility study – another major milestone in Cypress’ path to production.

Willoughby concludes,

“When we get to the point of a pilot plant and you see the reality of taking the clay out of the ground and making a lithium product, that’s when you’re going to see a lot greater appreciation of Cypress and what we’re doing.”

Cypress Development Corp

TSX-V:CYP Cdn$0.215 2020.06.05

Shares Outstanding 90,077,001m

Market cap Cdn$19,366,555m

CYP website

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Cypress Development (TSX.V:CYP), CYP is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.