America’s critical metals mine

- Home

- Articles

- Uncategorized

- America’s critical metals mine

2019.06.15

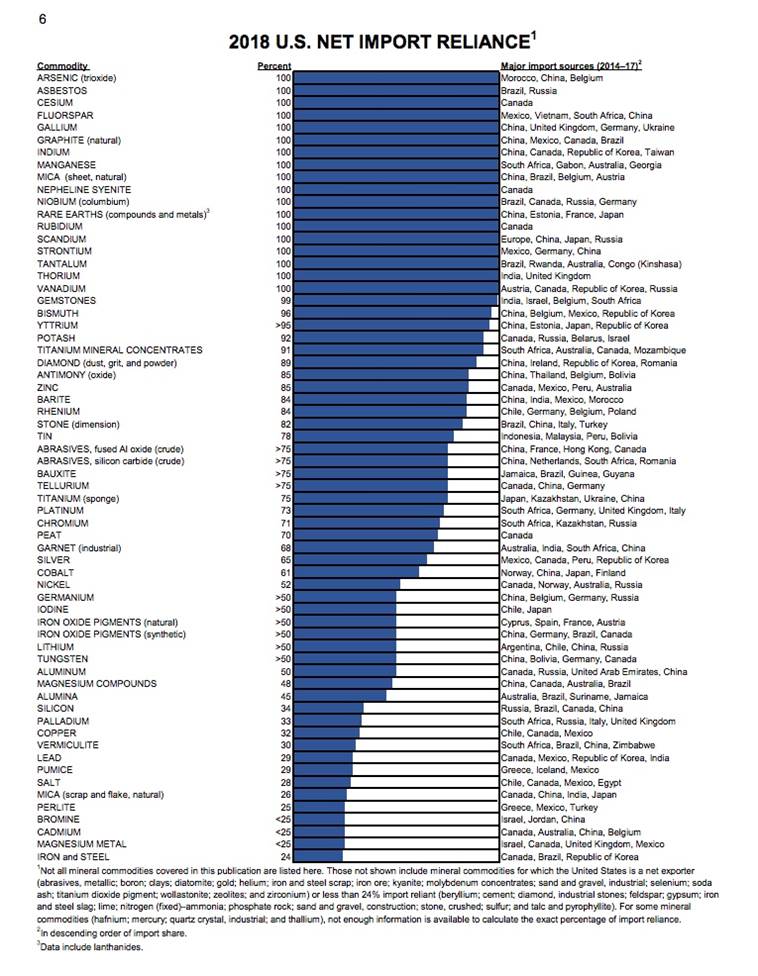

The United States is dependent on South Africa, the politically unstable Democratic Republic of Congo (DRC), and an increasingly aggressive China for over half of its supply of critical minerals – defined as minerals that are essential to a country’s economy and/or security, and whose supply is vulnerable to disruption. Nowadays, the term refers mostly to metals needed for high-tech sectors.

Depending on foreign countries for these critical metals, including battery metals used in electronic devices like cell phones and electric vehicles, deprives the country of what is known in the mining industry as “security of supply”.

Insecurity of supply

Without a reliable local supply chain, a country must depend on outsiders. This gives foreign suppliers incredible leverage over the United States. There is always the possibility of slowed flows or bans on critical minerals, due to politics or trade disputes – a perfect example being the ongoing trade war with China.

When the Trump administration upped the ante by threatening a 15% tariff increase on $200 billion worth of Chinese imports, Beijing reached for the rare earths card – pushing back at the US with the threat of export restrictions on rare earth metals.

China has a monopoly on the rare earths market. The country processes 95% of the 17 elements that are mined to manufacture military weaponry/equipment and the components of high-tech applications like flat-screen televisions and permanent magnets used in wind turbines and electric vehicles, to name a couple of uses.

If China were to suddenly slap an embargo on rare earths, or any of the 20 metals on which the US is 100% dependent on China, key sectors of the US economy would be in trouble.

Cobalt

Over half of the world’s cobalt – a key ingredient of electric vehicle batteries – is mined as a by-product of copper production in the Democratic Republic of Congo (DRC). In a $9 billion joint venture with the DRC government, China got the rights to the vast copper and cobalt resources of the North Kivu in exchange for providing $6 billion worth of infrastructure including roads, dams, hospitals, schools and railway links. China controls about 85% of global cobalt supply, including an offtake agreement with Glencore, the largest producer of the mineral, to sell cobalt hydroxide to Chinese chemicals firm GEM. China Molybdenum is the largest shareholder in the major DRC copper-cobalt mine Tenke Fungurume, which supplies cobalt to the Kokkola refinery in Finland. China imports 98% of its cobalt from the DRC and produces around half of the world’s refined cobalt.

In 2018 the United States produced just 500 tons of cobalt compared to 90,000t mined in the DRC. The US did not produce any vanadium either; the top three producers of the steel additive are, in order, China, Russia and South Africa.

In this article we take a deep dive into critical metals – specifically, lithium and rare earths – to determine what makes them critical to the United States, why that is important, and what the US can do to lessen its dependence on foreign critical mineral suppliers.

We also present a way out of the thorny dilemma the US finds itself in, regarding years of neglect in developing “mine to battery” and “mine to magnet” supply chains. What if one mine could do it all, provide US battery- and auto-makers all the lithium they need for EV production, and a steady supply of rare earth elements for a nascent North American permanent magnets industry? This mine exists, today. The company behind the project is making good progress towards a prefeasibility study that aims to replicate the robust numbers achieved in last year’s preliminary economic assessment. That company is Cypress Development Corp. (TSX-V:CYP) and its future mine is the Clayton Valley Lithium Project in Nevada.

Electrification

The most prevalent trend related to mined commodities is the shift, driven by climate change, away from the use of fossil fuels, towards the electrification of the global transportation system. Electric vehicles offer three advantages over gas or diesel-powered cars and trucks.

First, while the up-front cost of buying an EV is more than a gas vehicle, owning an EV costs considerably less, over time, in terms of electricity use versus gasoline, plus the relative lack of maintenance in an EV engine.

Second, electric vehicles have far fewer moving parts than gasoline-powered cars – no mufflers, gas tanks, catalytic converters or ignition systems. There’s also never an oil change or tune-up to worry about. But the clean and green doesn’t end there. Electric drives are more efficient then the drives on regular cars. They are able to convert more of the available energy to propel the car, therefore using less energy to go the same distance.

And third, EVs of course produce no emissions.

Arguably, lithium is the most important metal for electrification. As the main ingredient in lithium-ion batteries that drive EVs, a steady supply of lithium for battery-makers and auto manufacturers is going to be crucial.

EV growth

Auto manufacturers are increasingly investing in EV models. Just about all car makers are incorporating EVs into their production mix, and they are calling for public charging infrastructure to accommodate them.

Volvo has banned the internal combustion engine, stating that this year, all new models will be electrics or hybrids. Nissan, JLR, Daimler, BMW, Geely and BYD have made public commitments to EVs.

In North America a very small percentage of the auto market is electric, but elsewhere governments have made deeper commitments.

With a focus on more CO2 and NOx legislation in cities, Stuttgart, Paris, Mexico City, Athens, Madrid, Paris are all banning diesel by 2030. Norway, the Netherlands, France, Germany, UK, China and India have indicated they will ban cars running on fossil fuels.

According to an article in Seeking Alpha, stringent CO2 emissions starting in 2020 “are paving the way for the meteoric rise of electric vehicles.” Germany is looking at doubling subsidies for EVs costing under 30,000 euros and raising subsidies for more expensive electrics. Mercedes Benz wants to make its entire fleet of vehicles carbon neutral by 2039.

Bloomberg says EV sales are expected to increase from 1.1% of the total auto market in 2017, by a factor of 10 by 2025, 27X by 2030 and 50X by 2040. JP Morgan is forecasting electric cars to be 35% of the global market by 2025 and 48% by 2030.

All these EVs will need lithium-ion batteries containing lithium, graphite, nickel and cobalt, plus other mined metals that go into EVs, like copper.

Need to develop North American lithium supply…

In 2008 the National Research Council saw lithium as potentially becoming a critical mineral due to the expected growth of hybrid vehicle batteries. Two years later the US Department of Energy’s Critical Materials Strategy included lithium as one of 16 key elements.

Lithium is also among 23 critical metals President Trump has deemed critical to national security; in 2017 Trump signed a bill that would encourage the exploration and development of new US sources of these metals.

MINING.com noted that according to the USGS, the United States last year imported around half of 48 minerals and 100% of 18 minerals – including 100% of rare earths, graphite and indium.

The publication also quotes Simon Moores, managing director of Benchmark Mineral Intelligence, stating that the US only produces 1% of global lithium supply and 7% of refined lithium chemicals, versus China’s 51%.

The US government recently introduced bipartisan legislation, led by Republican Senator Lisa Murkowski, to secure local mineral resources including battery metals lithium, graphite, cobalt and nickel.

The Newswheel reported that the pending bill, called the American Mineral Security Act, “would help boost domestic production of minerals used in making EV batteries” such as GM’s objective of “expanding its battery-production facilities so it can introduce 20 new EV models by 2023.”

Significantly for the current trade war, the legislation would also exempt automakers from paying tariffs for shipping extracted minerals like lithium carbonate and hydroxide overseas for processing, The Newswheel adds.

…and an EV battery industry

A Tesla executive said recently the company is worried about a shortage of lithium. And while the number of EVs on the roads are expected to multiply in coming years, they can only progress as fast as the lithium-ion batteries that go into them.

The pendulum is clearly China. Consider that in 2018, China sold 1.182 million NEVs (new energy vehicles including electrics and hybrids), 520,000 or 78% more than in 2017. And that was just 4.1% of China’s total vehicle market.

By 2025, the Chinese government wants EVs to represent 20% of all cars sold.

By comparison, the US sold 361,307 EVs in 2018, just under a third of China’s volume.

As Quartz notes, in order to maintain its dominance in the lithium market, Chinese manufacturers need a lot of cheap lithium. That explains why its largest lithium miner, Tianqi Lithium, owns 51% of Australia’s Greenbushes spodumene mine – the world’s dominant hard-rock lithium mine. And why China bid for, and got, a 23.7% stake in Chilean state lithium miner SQM, the second largest in the world, for $4.1 billion.

As China’s mark on the lithium market becomes more pronounced, growth in the sale of lithium end products is taking off.

According to Adamas Intelligence, in February 2019, 75% more lithium carbonate was deployed for batteries in electric and hybrid passenger vehicles compared to February, 2018.

We know that the lithium market, long term, is likely to be in deficit as troubles ramping up production meet a mounting wall of demand.

For more on this read our Call for lithium tsunami cancelled

We also know that China produces roughly two-thirds of the world’s lithium-ion batteries and controls most of its processing facilities. This gives China tremendous clout should it decide to deprive the United States of lithium batteries or raw materials, just as the US is planning a mine-to-EV battery supply chain.

Currently the only US lithium producer is chemicals giant Albemarle. Lithium products from Albemarle’s Silver Peak lithium brine operation in Nevada are sent to its processing plant in North Carolina. This material is then loaded on ships and sent to Asian battery manufacturers, which sell the batteries to automakers.

We don’t know how much lithium hydroxide Albemarle exports to China from Kings Mountain (the company does not disclose the amount to the USGS in tabulating global production statistics), but we do not think it is significant in global terms. According to Visual Capitalist, Silver Peak only produces 1,000 tonnes per year of lithium hydroxide, within a current lithium market of roughly 280,000 tonnes per annum of lithium carbonate equivalent (LCE), a term that encompasses both lithium hydroxide and carbonate used in EV batteries.

Rather, the larger weapon in China’s arsenal is the ability to use its size in the EV batteries market to bully US lithium consumers. Remember China produces two-thirds of the world’s lithium-ion batteries and has a lock on most lithium-ion processing facilities.

Chinese lithium suppliers and battery makers could restrict lithium sales or stop supplying batteries to US battery or automobile companies. A number of automakers and a Korean company, SK Innovation, are planning on building EV and EV battery plants in the United States, but if these companies are targeted by China in the trade war, via a threat to their lithium supplies, these new factories are unlikely to proceed.

Or get left behind

Due to the immature state of the EV battery industry in America (out of the top 10 US battery-makers only four produce batteries for electric vehicles, and of the top 12 global battery manufacturers, none are American), the big carmakers are turning to China to lock in battery supply.

Toyota for example is reportedly aiming for half of its vehicle sales to be electrics by 2025 and is turning to two top Chinese battery companies for help. The Japanese automobile firm said this week it is planning on partnering with China’s CATL and BYD Co for battery procurement, according to Reuters.

CATL already makes batteries for Honda, Nissan and Volvo.

The fact that Toyota, a pioneer in EV/hybrid technology with the launch of the Prius over 20 years ago, is looking beyond itself to source EV batteries makes a statement as to how fast the EV market is growing. They can’t keep up.

Not only that, it shows just how far out of the game the United States is, in offering supplies of electric-vehicle batteries and battery raw materials to huge automakers like Toyota, which has a very established presence in North America – the company has produced nearly 32 million vehicles in the US since 1986, from five manufacturing plants in five states, one in Canada and one in Mexico.

With virtually no domestic EV battery capacity, Big Auto has nowhere else to go but China which has a huge head start in the EV battery space.

Reuters notes that Toyota has been trying for decades to develop its own lithium-ion technology and has partnered with Panasonic to make rectangular-shaped prismatic batteries.

But Toyota’s top brass aren’t confident they can do it alone. Executive Vice President Shigeki Tarashi reportedly told a briefing that higher-than-expected demand for electric vehicles, combined with more strict vehicle emissions regulations, are pushing the Japanese automaker out of its EV comfort zone:

“We consider ourselves as a maker of electric vehicle batteries, going back to when we developed the battery for the Prius,” he said, referring to the pioneering gasoline hybrid. “But there may be a gap between the amount of batteries we can produce, and the amount of batteries we may need.”

US EV growth to zoom 540%

Electric vehicle makers in the United States are facing the same plight.

Right now, Tesla is the leading EV seller in the US; the California-based firm partners with Panasonic, a Japanese company, to produce lithium-ion EV batteries at its Gigafactory in Nevada. It’s building another factory in China.

But if current growth rates continue, Tesla may soon to be hit with an onslaught of competitively priced models that will challenge its number one market position.

Reporting on predictions for the US EV market, research firm IHS Markit said 43 companies are expected to be offering EVs in the US in seven years, compared to just 14 last year – accounting for 7.6% of new vehicle sales versus just 1.1% in 2018. SUVs are expected to be a core target market, reaching nearly 60% of total American EV sales by 2026, according to IHS Markit.

The London-based firm notes that global EV sales surpassed 1 million units in 2017 for the first time, and last year doubled to 2.1 million units sold.

US EV sales grew 79% last year, with the majority of the growth, 138,000 of 158,000 EV sales, coming from the Tesla 3 according to EV-Volumes.

The inflection point in the United States is expected to come in 2026, when the cost of electric vehicles will reach parity with gas or diesel-powered cars, states a Deloitte report on the battery-electric vehicle industry.

That year IHT Markit thinks electric vehicle sales in the US will smash 1.28 million units, a whopping 540% increase from the 200,000 sold in 2017, or a CAGR of 30.4%.

The big question is, where are all the North American auto plants, once they get re-tooled for EVs, going to get their batteries from? Unless there is a big push to develop a North American mine to battery to EV supply chain, it will very likely be China. The Trump administration has shown no interest in this industry. It rejected tax incentives for EV buyers and gutted the EPA, which was directed to loosen fuel-economy and emissions requirements for new cars. Oil interests have coalesced to try and end the federal tax credit for EV purchases.

Consider this: China is by far the largest market for EVs. In 2018 the Asian superstar grew its EV market by 83%, selling 1.1 million EVs. This is greater than the 1 million in global EVs sales in 2017. In other words, Chinese citizens are buying more EVs than the whole world combined.

And it’s not just the EVs that China controls. China has three-quarters of the world’s lithium-ion battery manufacturing capacity, and 50% of the world’s public vehicle-charging infrastructure.

It’s a gargantuan market that can’t and won’t be ignored.

Chevrolet is planning to launch 10 EV models in China by 2020. Tesla is building a plant in Shanghai that will make half a million Tesla’s a year over the next two years. Add in that Toyota, Nissan, Volvo and now Toyota have battery deals with CATL, a large Chinese battery company, and we can see who is putting a lock on the manufacture of EV vehicles and batteries. Just like rare earths, China is playing the US for a fool.

Rare earths: some perspective

In last week’s article, How China wins trade war, we argued that the threat to impose export restrictions on the United States is a red herring.

Because the global rare earths market is so small, placing an embargo on them would hurt certain end-users like defense contractors and makers of permanent magnets, but the overall impact would be small compared to other metals that might be hit with restrictions or export bans.

This is proven by analyzing the rare earth elements (REE) market. Out of a 200,000 tonnes per year market, China produces 80%, and the US consumes about 9%, leaving 18,000 tonnes vulnerable to a supply squeeze from China.

Now consider that of that 18,000 tonnes, 60%, represents lanthanum and cerium production. The rest of the REE market in the US is therefore only 7,200 tonnes (the US Military takes about 500t).

Could countries other than China supply the US with the 7,200 tonnes it currently needs to make high-value products? Probably. But what increasing current REE supply and building true mine to magnet and mine to battery industries? No. And processing them is a different story.

China currently controls almost all REE processing and magnet manufacturing. But they import a considerable amount of REEs. This cannot be reinforced enough. China doesn’t have a lock on rare earths supply; it has a lock on rare earths processing.

For more on the complexities of REE processing, read our Mine to Magnet.

North America is well-endowed with large, high-quality rare earth deposits, enough to supply us with decades of production. What we lack is processing and large-scale battery and magnet manufacturing. We have enough tonnage in North America to supply what is an admittedly small market. Moreover, REE processing has already started happening outside China:

- Mountain Pass in California will start processing REEs by the end of 2020.

- Lynas signed a joint-venture agreement with Blue Line Corp. to build a processing plant in Texas.

- Solvay SA, a French chemicals company, recently set up a demonstration project to produce nearly 200 tons a year of rare earths from recycling light bulbs.

We believe that, if those processing plants (or even one) gets up and running, companies will rush in to fill the demand for the rare earth concentrates to further process into oxides – the obvious sector being permanent magnet manufacturers requiring high-purity dysprosium, neodymium and praseodymium.

The problem is, the decision-makers regarding the country’s military uses of rare earths aren’t looking inward; they’re looking outward, all the way to Africa.

A recent story about the Pentagon eyeing Africa for a rare earths supply caught my attention. Apparently, the Department of Defense is talking to a company in Malawi and one in Burundi about its plan to diversify sources of REEs outside of China. I don’t have a problem with the quality of these deposits – just their location.

The seed of this idiotic plan is right here in the article: “The Pentagon has long supported efforts to require military contractors to buy domestically sourced minerals, though there are no current U.S. rare-earth processing facilities.”

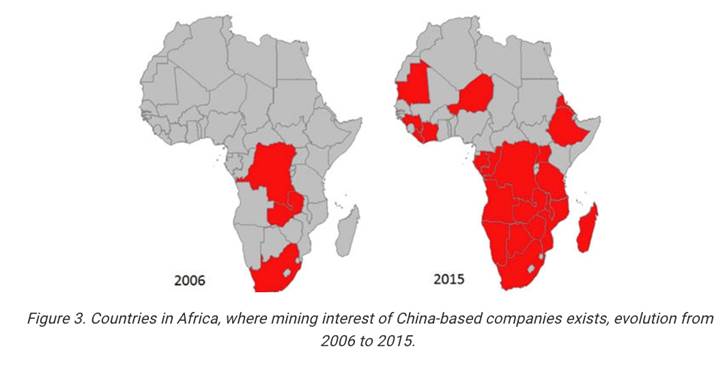

So instead, the Pentagon is going to Africa, where China has been working for decades to lock up supplies of critical and other industrial minerals. China is heavily invested in the DRC, as it works towards its goal of mass EV adoption, and ensures its factories have access to clean-technology raw materials like cobalt, lithium and graphite. In a $9 billion joint venture with the DRC government, China got the rights to the vast copper and cobalt resources of the North Kivu in exchange for providing $6 billion worth of infrastructure including roads, dams, hospitals, schools and railway links. China imports 98% of its cobalt from the DRC and produces around half of the world’s refined cobalt.

The Chinese government has for years been actively encouraging state-owned and private companies to pursue mining deals throughout the world. The “Two Resources, Two Markets” strategy has been ongoing since 2006. MINING.com notes that between 2006 and 2015, the number of mining or processing assets owned by China-headquartered firms went from less than five in 2006 to over 120 in 2015. The map below shows the extent of Chinese mining influence in Africa.

Among the major projects, which are usually negotiated government to government, making the Pentagon’s idea of talking to individual rare-earths companies naively mis-placed, are the acquisition of the Husab uranium deposit in Namibia by China General Nuclear Power Corp (CGNPC); and the massive Kamoa copper deposit in the DRC, the largest undeveloped in the world, towards which China’s largest gold mining company, Zijin Mining, spent half a billion dollars for a controlling share in the project.

The United States needs security of supply with respect to its lack of rare earths. The Pentagon’s idea of going to Africa, already well-trampled by the Chinese, will instead make REE supplies even more insecure.

That’s on the downstream end. On the upstream, consider that the global rare earths market is small because it is dominated by one miner/processor: China. If the US develops processing facilities, expect the number of mines to sprout faster than dandelions in a hay field. What’s holding the US mine-to-magnet industry back is a lack of processing capacity. Build that, and they will come.

According to the USGS, the United States has 1.4 million tonnes of rare earth reserves. A small player compared to China’s 44Mt, Vietnam and Brazil’s 22Mt and Russia’s 12Mt, but easily enough to supply the current US annual consumption of 18,000 tonnes. Bloomberg reports that America mines 3,000 to 4,000 tonnes of rare-earth concentrates each month. Nearly all of it is shipped to China for processing. For now.

So, rare earths are a relatively small, niche market compared to some of the other metals China supplies like lithium and cobalt (sourced from the DRC). If China really wanted to hit back at the US, it would bring out the big guns, and target the large-market metals that go into lithium-ion batteries, primarily lithium and cobalt.

Lithium and cobalt are great examples of how China has the United States over a barrel when it comes to security of critical mineral supplies. Since the electric vehicle began to penetrate the internal combustion engine (ICE) car market, lithium and cobalt have become the commodities to secure.

Lithium is the metal, in our opinion, that China would target, if it really wanted to hurt the US clean-tech economy. We aren’t the only ones saying this.

Our friends at Benchmark Mineral Intelligence – considered an authority on critical minerals – told Bloomberg that growth in rare-earths consumption is flat, but demand for lithium-ion batteries, containing other critical raw materials that China either controls through off-take agreements (lithium and cobalt) or is the biggest exporter of (processed graphite), is expected to grow 10-fold over the next decade.

“If you’re looking at severe economic impacts of embargoes, there are much bigger fish to fry,” says Simon Moores, managing director at Benchmark.

Cypress Development Corp (TSX.V:CYP, US:CYDVF)

Three and a half years ago Cypress began prospecting in the Clayton Valley, hoping to find a property that could support a lithium carbonate resource to compete with or possibly complement its neighbor, Albemarle’s Silver Peak Mine, whose lithium brine grades are declining. Silver Peak is the only operating lithium mine in the US. Cypress’ former head geologist noticed that some of claims on the south flank of an outcrop known as Angel Island had not been staked, and those that had been, had elapsed. Cypress wasted no time in acquiring two adjoining land packages located in Esmeralda County: the 1,520-acre Glory property and the 2,700-acre Dean property.

A 23-hole drill program concluded in the spring of 2018; the highlight was an intersection of 97 meters averaging 1,144 ppm Li in the final hole.

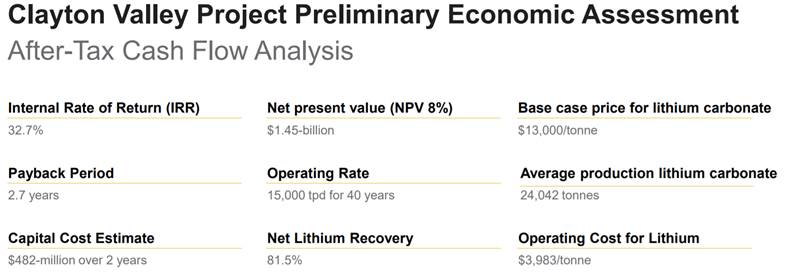

A maiden resource estimate (RE) appeared on SEDAR last June. The report showed 1.3 billion tonnes containing 6.2 million tonnes of LCE, including 3.287 million tonnes LCE in the indicated category and 2.916MT LCE inferred. The RE was later upgraded in the PEA to a 1.8 billion-tonne- resource, hosting a combined (indicated and inferred) 8.9 million tonnes of LCE. This breaks down to 3.835 million tonnes of LCE in the indicated category, and 5.126 million tonnes of LCE in the inferred category (or for easy math, about two-thirds are inferred and one-third is indicated).

In terms of geology, Cypress believes the lithium-rich mudstones likely were allowed to accumulate in a protected, lagoon-type environment, compared to the rest of the valley where boulders and debris were washed away throughout millions of years of rainy seasons.

The PEA describes the mineralization in terms of three layers, with significant lithium concentrations found at surface and up to 124 meters deep – in mudstones and claystones:

The mineralized zone consists of three primary units: an “upper” olive-colored mudstone, “middle” blue mudstone/claystone, and “lower” olive-colored mudstone. The middle (reduced) portion of the mineralized zone represents much of the overall mineralized sedimentary package… Elevated lithium concentrations occur in all the uplifted lacustrine strata encountered, but lithium concentrations are notably higher and more persistent in the three primary units. These units are 20 to 80 meters thick, with the middle units, referred to as Upper Olive, Main Blue, and Lower Olive, respectively, having average grades of 850 to 1,100 ppm. Portions of these units could be selectively mined at grades exceeding 1,100 ppm lithium.

The company has established a resource and has an economic metallurgical process for what Cypress believes is a large, bulk-tonnage deposit of leachable, non-hectorite claystone (clays containing hectorite are more difficult and costly to process).

CYP has shown that lithium can be extracted from the claystones using a flow sheet whereby recoveries of +80% can be achieved in short leach times (4 to 8 hours) using conventional dilute sulfuric acid and leaching. The amount of sulfuric acid and reagents needed are relatively low, and being able to leach the lithium with acid avoids more costly processing historically associated with other claystone deposits, specifically those needing high temperature roasting.

Slurried feed from a shallow open pit will be transported to the mill where lithium extraction is achieved through leaching at elevated temperatures with dilute sulfuric acid, followed by evaporative concentration, purification and crystallization of lithium carbonate. Processing costs are estimated at $3,983 per tonne of LCE.

The capex of the proposed lithium mine is $481 million, with the proposed mine producing an average 24,042 tonnes of lithium carbonate a year and having a minelife of 40 years.

The project has a net present value of $1.45 billion at an 8% discount rate, yielding an internal rate of return (after tax) of 32.7%. It’s important to note that the mine’s break-even IRR is at $4,800 a tonne – significantly below current lithium prices, which range from $10,000 a tonne in China for low-quality, non-battery-grade technical lithium, up to $16,500/t for lithium brines produced by world number one and two lithium producers Albemarle and SQM.

Regarding the metallurgy at the Clayton Valley Lithium Project, Cypress describes a series of purification processes that separate the lithium carbonate from the source clay using an acid leach solution. Significantly, the PEA notes that membranes could be used to improve the recovery rates of lithium from the acid leach solution. The membranes pump solutions at high pressure and allow the selective passage of elements across the membrane surface.

Currently Cypress is in the second phase of a prefeasibility study expected to come out in the second quarter.

The completion of the PFS first phase confirmed that lithium can be acid-leached to between 75% and 83% extraction with sulfuric acid consumption of between 85 and 132 kilograms per tonne – lower than the 125 kg/t estimated in the PEA. The tests also showed impurities such as magnesium – which can significantly increase the complexity and costs of processing lithium- are easily controlled through conventional processing.

The next step is to determine whether lithium carbonate and lithium hydroxide can be made out of the concentrated solution. If it is successful in doing that, the company would demonstrate its flow sheet at a pilot plant in order to show that lithium products can be produced at a commercial volume, and economically, based on current lithium prices.

Rare earths potential

According to the PEA Cypress has a unique and potentially extremely lucrative opportunity to mine rare earths at its Clayton Valley Lithium Project. REEs were detected in leach solutions from hole DCH-2 in all samples, ranging from 100 to 200 parts per million (ppm). The rare earths include scandium, dysprosium and neodymium, in order of economic value.

Cypress ran diagnostic leach tests and determined there is the potential to recover these elements, along with potassium, magnesium and other salts. From the PEA:

Using just the 1-hour leach test extractions and an annual feed rate of 5.475 million tonnes, the project, for example, could generate 10 to 15 tonnes of scandium, 25 to 40 tonnes of neodymium, and 5 to 10 tonnes of dysprosium in solution as potentially recoverable oxides. Additional test work is warranted.

Taking each of these REEs in turn, scandium is an extremely valuable rare earth element that is alloyed with aluminum to make light and strong airplanes for example. Russia was the first to recognize scandium as a useful metal in the 1950s, and found applications for it in Soviet aircraft and weaponry. Since then, Russia, Ukraine, Kazakhstan and Uzbekistan produced the vast majority of the world’s scandium concentrates and other scandium compounds. Over this period the US and Australia produced small amounts of scandium as a by-product of fluorite, uranium and tungsten ore processing, according to an interview in Streetwise Reports.

Scandium is expensive, but the market is small. According to the USGS, supply and consumption of scandium is estimated at just 10 to 15 tonnes per year. The same USGS webpage details scandium prices, which are eye-poppingly high. A gram (yes a gram, not an ounce or pound a single gram) of scandium oxide at 99.9% purity sells for US$8 a gram, while a gram of the same-purity scandium acetate is $44 a gram. The really big numbers come from 99.9% scandium chloride, which sells for $124 a gram, and 99.9% scandium fluoride, which goes for a whopping $277 a gram.

Now we can’t, and won’t, assume that Cypress has the flowsheet to produce and sell scandium acetate, chloride or fluoride, but mining 15 tonnes of scandium oxide, over the life of the mine, fetching $8 a gram could be looked at a couple of ways – as enough revenue to pay for the acid plant, projected to cost just over $100 million. Or, the potential for the recovery of saleable rare earths, with the lithium, could also represent a major reduction in processing costs.

And that isn’t counting the revenue from the magnesium and potassium salts, which could shave off more costs per tonne.

Dysprosium has a number of uses including the manufacture of lasers, commercial lighting, and in the control rods of nuclear reactors. Dysprosium’s high susceptibility to magnetism makes it ideal for use in hard disks. However, dysprosium’s growth market is in permanent magnets used in an array of clean-tech applications including electric car motors and the generators of wind turbines. Substituting a portion of neodymium for dysprosium, in neodymium-iron-boron magnets, makes this type of permanent magnet ideal for applications requiring a high level of magnetism, such as the drive motors for EVs.

According to Adamas Intelligence, because China, the number one producer of dysprosium, is cracking down on illegal (and polluting) rare-earth mining, global production may increase and prompt the need for sources of new supply. Global dysprosium oxide production has already been cut by a third since 2013. By 2025 Adamas says China’s demand for dysprosium oxide, use in EV traction motors, will alone amount to 70% of China’s production, meaning more supplies will be needed.

Seems like an ideal time for Cypress to step into the breach.

The market for the neodymium-iron-boron magnet, installed for example in Tesla’s Model 3 Long Range electric car, is estimated at $11.3 billion. Demand for neodymium has been growing steadily. Most neodymium comes from China.

A recent media report however calls into question whether the US will be able to find enough neodymium (Nd) to keep up with the expected demand for offshore wind power. The US Department of Energy reportedly plans to install 86 gigawatts (Gw) of offshore wind by 2050. To find enough Nd to support that kind of build-out would require 15.5 gigagrams (Gg) of Nd between now and 2050. That’s the equivalent amount of neodymium needed to go into the permanent magnets of 20 million hybrid and electric cars!

Cypress’ mine could help to fill this order and prevent the DoE from having to buy neodymium from China.

How would the Clayton Valley Lithium Project process rare earths? The flow sheet envisions the lithium extracted from the claystones will be crushed and leached with sulfuric acid. On one side of the production circuit, is lithium ore coming into the plant. On the other side is a production line that has the ability to extract rare earths – and not a mixed rare earth concentrate that is of no use to an end user w/o further processing to an oxide, but the oxides of dysprosium, neodymium and scandium. Potash and magnesium oxide are the other by-products expected to be incorporated into the flowsheet and extracted in saleable forms.

The beauty of this system is two-fold. First, Cypress doesn’t have to go out and mine these valuable rare earth elements, they occur naturally in the claystones and literally “drop out” during the metallurgical process. In other words, there is no extra cost to gain materials that can be sold for pure profit, to magnet companies (for the Nd and Dy) and to scandium end-users like aircraft manufacturers.

Second, the flow sheet for extracting the rare earths is scalable, meaning that Cypress can move production up or down depending on the demand from end users. The scale could also be adjusted accordingly, to bring down operating expenditures or help to offset capital expenditures during expansions.

Perhaps most importantly, the ability to produce rare earth oxides means Cypress is a supplier to a North American permanent magnet industry, cutting out the China middleman and helping to wean the United States off rare earths dependence to a situation of supply security, in much the same way the US has moved in recent years from being a net importer of crude oil to a net exporter.

Something else we find interesting regarding production cost reductions is potential revenue from Cypress’ proposed sulfuric acid plant. A sulfuric acid plant converts molten sulfur into sulfuric acid, reducing transportation costs and providing a low-cost source of power. Excess acid production/sales is not expected but if a co-generation facility were built in, it could provide enough carbon-free electricity to power the entire project with perhaps excess power being sold to the grid.

Conclusion

The United States needs critical metals to advance clean-technology sectors necessary for the new economy, and to maintain its military superiority. Currently it doesn’t have them, domestically. This article has outlined the problem and the solution.

The problem is insecurity of supply. The US is 100% reliant on China for 20 critical metals.

Many minerals are critical in the supply chain of a modern economy and a country’s defense. But how critical they are has to take into account:

- Who controls how much of supply/production and where is this supply coming from?

- Size of market.

- Who controls processing?

- Who manufactures end products?

North America is well endowed with huge quality rare earth deposits, enough to supply us with decades and decades of production. What we lack is processing and larger scale manufacturing. But we have a ready supply for what tonnage wise is an admittedly smallish market and REE processing has already started happening outside China:

- Mountain Pass in California will start processing REE’s by the end of 2020.

- Lynas signed a joint venture agreement with Blue Line Corp. to build a processing plant in Texas.

- Solvay SA, a French chemicals company, recently set up a demonstration project to produce nearly 200 tons a year of rare earths just from recycling light bulbs.

Manufacturing of all needed value-added rare earth products will surely follow REE security of supply.

The most important lynchpin metals that China could really hurt the US with, are lithium and cobalt, and select rare earths – particularly dysprosium, neodymium and praseodymium which go into permanent magnets needed for electric vehicles and wind power equipment.

Having a domestic supply of rare earths is great, but without lithium, the US economy is not going to be a leader in clean technologies like electric vehicles and permanent magnets. Think about it. Everything relies on Li batteries. You can’t make an EV run without a Li battery, the most high-tech military equipment using the rarest and most expensive rare earths is not moving without a lithium-ion power source. Cell phones and GPS are useless without lithium batteries.

Lithium is the new oil. Those who control it, will run the world. At the moment, that is not the United States.

At Ahead of the Herd, we have identified a company and a mine that could go some distance towards establishing a made-in-America solution to the current insecurity of critical metals supply.

Cypress Development Corp (TSX.V:CYP) has a huge resource of lithium in Nevada’s Clayton Valley next to Albemarle’s Silver Peak lithium mine, the only current US producer. Nevada for those who don’t know is the most mining-friendly state in the US. There are no issues expected with permitting, no tariffs to worry about, and infrastructure and labor are close by.

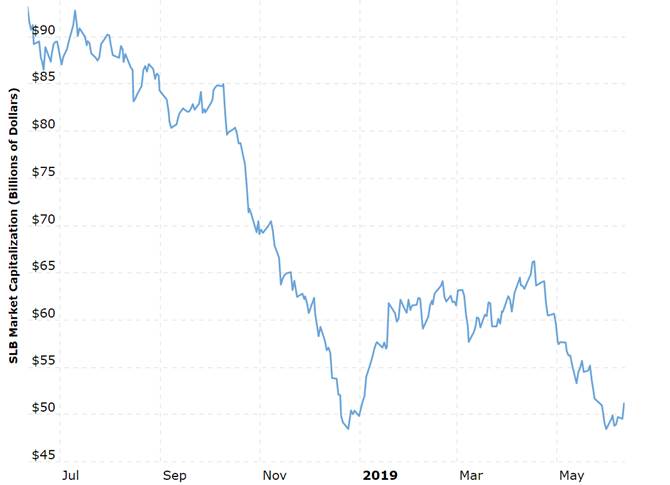

Albemarle is the worlds largest lithium producer. But its market cap of USD$7.7B is dwarfed by Clayton Valley’s new ‘elephant in the room’ – Schlumberger Ltd (NYSE:SLB). SLB has a market cap of US$50.5B, employs 100,000 people, works in 85 different countries and is the world’s largest oilfields service company. They recently paid $2m for Pure Energy’s (C:PE) lithium brine project in the valley.

The chart below shows SLB’s market cap.

Oilfield services does not seem to be paying off quite so handsomely as in the past. If Schlumberger is intent on getting into the US lithium business I very much doubt that that story stops with Pure Energy. Time, as always, will tell.

Tesla’s massive lithium battery plant, Gigafactory 1, in Sparks Nevada, was built to supply Model 3 electric motors and battery packs along with Tesla’s energy storage products. Panasonic makes Tesla’s EV batteries, the individual cells, they are assembled into battery packs for the cars at the Sparks plant.

Elon Musk, Tesla’s CEO, recently talked about plans to ramp up car production and to start mass producing electric pick ups and electric Class 8 semi trucks by the end of 2020. Musk added these plans were dependant on Tesla being able to manufacture a lot more lithium-ion battery cells.

Once Tesla increases production to a “very high level it will look further down the supply chain and get into the mining business” said Musk.

Reuters reported Tesla’s head of minerals procurement said that the company expects global shortages of lithium, copper and nickel in the near future.

Cypress is currently working out the details of a flowsheet that will produce lithium carbonate and lithium hydroxide – two materials that are used in the anode of a lithium-ion battery. The upcoming prefeasibility study is expected to prove the economics of the project, as set out in the PEA.

The truth is, Cypress doesn’t need rare earths to be profitable. The PEA clearly shows a lithium-only project is economic, with a fantastic IRR of 32.7%. The economics of the PEA are calibrated at $13,000 a tonne but the mine makes money all the way down to $4,800/t, an unlikely low price due to the continuing demand for lithium needed for EV batteries. The upcoming PFS, because of work already made public, is expected to, at the very least confirm those numbers.

But if you have an opportunity to make an even better margin, why wouldn’t you do it? The project’s flow sheet offers the chance to further offset costs and enhance profitability by processing rare earths that drop out in oxide form – thereby skipping the normally tricky, dirty step of converting a concentrate to an oxide. This alone puts the Clayton Valley Lithium Project in a class by itself.

The way we see it, Cypress has an ideal mine for the perfect time. Keep following Ahead of the Herd as we chart CYP’s progress on America’s first critical metals mine.

Cypress Development Corp

TSX-V:CYP, US:CYDVF

Cdn$0.195 June 6th

Shares Outstanding 73.3m

Market cap Cdn$14.2m

Cypress website

*****

Richard (Rick) Mills

Ahead of the Herd Twitter

Ahead of the Herd FaceBook

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as

to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares of Cypress Development (TSX.V:CYP).

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.