African sources of graphite, uranium tainted by conflict – Richard Mills

2023.08.08

Country risk is one of the most important factors to consider in deciding whether to invest in a mining property.

This is where the political and economic stability of the host country is questionable and abrupt changes in the business environment could adversely affect profits or the value of the company’s assets.

On one side of country risk is resource nationalism, a topic we have covered extensively at Ahead of the Herd. This is the tendency of governments to assert control, for strategic and economic reasons, over natural resources located on their territory.

Governments may get in the way of miners’ progress by implementing anti-mining agendas and/or thinking up new ways to hit the extractive industry with higher taxes.

Some have gone beyond taxation in getting more out of the mining sector with a wave of requirements such as mandated beneficiation (where ore is processed locally rather than exported raw), export restrictions, and increased state ownership of mines.

The other side of country risk is more direct. It’s the threat companies and their employees face from civil unrest. Mining and oil and gas companies are often targeted because they offer immoveable hard assets that can be seized and used as bargaining chips. Employees of these firms are sometimes kidnapped and held for ransom, another revenue stream for insurgent groups seeking to destabilize the status quo.

Here we identify two countries, both in Africa, both rich in natural resources, that have become ensnared in civil conflicts that threaten to crimp mining and resource development.

They have also become the scenes of proxy wars funded and manned by foreign entities like ISIS and Russia’s mercenary Wagner Group.

Niger

Landlocked Niger, located in north-central Africa, is surrounded by Algeria and Libya in the north, Chad in the east, Nigeria in the south, and Burkina Faso and Mali in the west.

Niger is the seventh-biggest producer of uranium, and one of the main exporters of uranium to Europe. France, the country’s former colonial ruler, is a major importer of Nigerien uranium, which helps fuel the French nuclear industry. (The Washington Post, Aug. 1, 2023)

According to the World Nuclear Association, Niger’s two uranium mines provide about 5% of global mining output from Africa’s highest-grade uranium ores. In 2021, just under a quarter (24%) of EU uranium imports came from Niger, edging out Kazakhstan and Russia as the trading bloc’s leading source of U.

The Somak and Comair mines are majority-owned by French nuclear giant Orano (formerly Areva), while a third operation, Somina, is a joint venture between Chinese companies and the Niger government.

While France’s Orano has quietly been mining uranium in Niger for decades, it wasn’t until 2003 that the country was thrust into the international spotlight. A sketchy intelligence report about Iraq purchasing 500 tons of Nigerien yellowcake formed part of the US case for launching an invasion of Iraq.

Twenty years later, the country is again being buffeted by global forces, this time the result of a July 26 military coup that ousted its president and democratically elected government.

Colin Clark, who researches terrorism at the Soufan Group think tank, told Newsweek the coup is a “nightmare scenario” for the United States, and warned it could embolden Wagner Group mercenaries.

The group led by Yevgeny Prigozhin, which recently staged an unsuccessful rebellion against the Kremlin, praised the Niger coup and sees it as a step towards independence from the West.

Thousands of protesters reportedly took to the streets of Niger’s capital city, Niamey, with many carrying Russian flags and chanting support for President Vladimir Putin.

They blame France for not being able to manage jihadist groups affiliated with al-Qaeda and the Islamic State, and they see the void being filled by Russia’s Wagner Group, active in several African countries including the Central African Republic and Mali.

“A thousand Wagner fighters are able to restore order and destroy terrorists,” Prigozhin said on Telegram July 27, “preventing them from harming the civilian population.”

Time Magazine notes the group is training local militias and propping up fragile governments allied with Russia in exchange for lucrative mineral rights…

Companies linked to Prigozhin secured several independent gold and diamond mining contracts in the Central African Republic, for example.

However, Wagner mercenaries have frequently targeted civilians, including miners. In Mali alone there were 298 instances of political violence involving Wagner between December 2021 and this past June, according to Time. The group is estimated to have over 5,000 fighters in Africa.

Analysts say the Niger coup could jeopardize broader Western efforts to control Islamic extremism in Africa, and result in a power vacuum.

NPR notes that Niger is vital to U.S. counterterrorism efforts in Africa. It’s one of the few countries in the region that has agreed to house U.S. drone bases and hundreds of American Special Forces and logistics experts, who are involved in counterterrorism operations against Boko Haram and ISIS affiliates.

In 2017, four US soldiers and five Nigerien troops were killed in an ISIS ambush, seen in a graphic video distributed by a pro-ISIS news agency. According to Al Jazeera,

Footage shows the US troops wearing only light body armour, desperately seeking cover behind an unarmored SUV while coming under heavy fire.

In a frantic bid to find some sort of concealment, the troops deployed red smoke grenades but the parched landscape of scrub and dirt provided no effective cover.

At one point in the video, a US soldier is shot and a comrade attempts to pull him to cover behind the SUV. As their position is overrun, they have no choice but to try to run away, but there is nowhere to hide.

As for how the Niger coup will affect the uranium market, the Washington Post reported that, amid escalating anti-French rhetoric, the junta allegedly said it was suspending exports of uranium to France.

An analyst quoted by Politico said the situation could complicate the adoption of yet-to-be levied sanctions on Russian uranium. According to an energy expert at the Jacques Delors Institute in Paris, tensions in Niger could discourage the EU from adopting sanctions against Russia in the nuclear sector — just as the continent is trying to phase out dependency on Russia.

Remember, Niger provides 15% of France’s uranium needs and accounts for a fifth of the EU’s uranium imports. If Europe wants to reduce Russia’s influence on its energy, it needs Niger’s uranium.

Mozambique

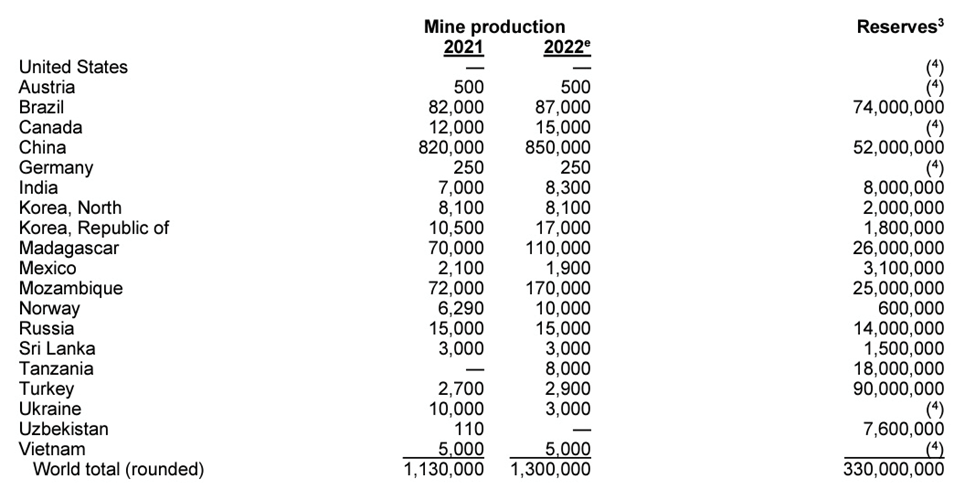

ISIS and the Wagner Group have also been active in Mozambique, located on Africa’s east coast. The country was the world’s second-largest producer of graphite in 2022, accounting for 14% of production — the other top producers being China, Brazil and Madagascar. Australia’s Syrah Resources opened its Balama mine there in 2018.

According to GlobalData, Mozambique’s graphite exports increased 106% last year, with the highest proportion shipped to China.

However, most of the country’s graphite is in Cabo Delgado, a northern province that has been wracked by political violence. According to S&P Global, militia attacks in the region forced mine shut-downs at Balama, with only 72,000 tonnes of production achieved in 2021, compared to 100,000t in 2018 and 153,000t in 2019.

A local media source confirms that Syrah Resources (ASX:SYR, TC:SYAFF), an Australian listed company, was one of the mining companies whose operations were affected by the armed conflict in Cabo Delgado. In June 2022, Club of Mozambique reported the supply chain was temporarily suspended due to attacks close to the road the graphite is shipped out on. In November, the mine had to evacuated due to violence in the area.

A more recent story by Club Mozambique said that, while the security situation has improved,

Cabo Delgado province has been facing an armed insurgency for five years, with some attacks claimed by the extremist group Islamic State.

The insurgency has led to a military response since July 2021, with support from Rwanda and the Southern African Development Community (SADC), liberating districts next to gas projects, but new waves of attacks have emerged in the south of the region and in the neighbouring province of Nampula.

The conflict has already displaced one million people, according to the United Nations High Commissioner for Refugees (UNHCR), and cost around 4,000 lives, according to the ACLED conflict registration project.

A 2022 report by the Hanns Seidel Foundation documents the rise of insurgent group al-Shabaab, which has claimed allegiance to Islamic State since 2019. The group has terrorized the population since 2017, in a region known for drug trafficking, human smuggling, illicitly exported timber, illegal wildlife products, and smuggled gems and gold.

“Al-Shabaab have committed grave human rights abuses against the civilian population, including beheadings, kidnappings of young women and forcing recruits to join their ranks, and have caused more than 800,000 people to flee the area,” states the report, explaining that:

“Three interlinked themes emerge as key to understanding what sparked and continues to drive the insurgency, namely socio-economic exclusion driven by political elites linked to the national government, the emergence of religious extremism, and tensions between Cabo Delgado’s main ethnic groups.”

Despite the instability, Mozambique was one of five African countries invited by the United States last year to the new Minerals Security Partnership. The MSP was formed to try and reduce China’s influence on US imports of critical minerals, including graphite, a component used in electric vehicle battery anodes.

In fact the US Department of Energy went further than that, providing Syrah Resources with a USD$107 million loan to build a graphite processing facility in Vidalia, Louisiana, and then later, a $220 million grant enabling it to expand the facility four-fold.

Meanwhile, Russian influence in the country is growing, both from the Russian government and the Wagner Group, which see big opportunities for resource development in exchange for providing counter-insurgency assistance.

A 2019 article notes that dozens of private military contractors are aiding the Mozambique army in Cabo Delgado province. While the Wagner Group’s presence was denied by Russian officials, the deployment of Russian contractors quickly followed a visit to Moscow by Mozambique’s president.

During the visit, Presidents Putin and Nyusi signed agreements on mineral resources, energy, defense and security.

Shortly after the trip, 160 guns-for-hire arrived in Mozambique, according to an eyewitness. They arrived on September 13 in a giant Russian Antonov An-124 plane, according to flight data.

Twelve days later, a second Antonov An-124 touched down at Nacala Airport carrying military equipment, including an Mi-17 attack helicopter.

The story adds that Moscow has signed more than 20 defense agreements with African governments. In return, the Kremlin gains strategic influence and preferential access to the continent’s natural resource wealth. Along with graphite, Mozambique contains what CNN describes a “huge unexploited resources,” including LNG, gold, diamonds and rubies.

In 2019, Russian state-owned Rosneft signed an agreement with Mozambique’s national energy company to develop gas fields, while Alrosa, a Russian diamond miner, is carrying out geological surveys.

Conclusion

Niger and Mozambique are two examples of countries where natural resources — in these cases uranium and graphite — are used as trump cards in local conflicts backed by powerful outside countries.

In Niger, the military junta has threatened to suspend uranium exports to France. The uncertainty is weakening the resolve of European countries to impose sanctions on Russian uranium, also a large supplier of the nuclear fuel to the EU.

Russia’s Wagner Group has suggested it is better equipped to handle Niger’s Islamic insurgents than the government and the country’s former colonial overseers, France. This could further undermine Western efforts to control Islamic extremism in Africa, efforts that were significantly eroded when the United States left Afghanistan in 2021.

In Mozambique, political violence in Cabo Delgado province has already forced shut-downs at Balama, one of the country’s most important graphite mines. The Mozambique army is clearly being supported by Wagner Group fighters, with military equipment including guns and helicopters provided by the Russian government.

Yet the US government wants to include Mozambique in its Mineral Security Partnership, and risk over $325 million to build a graphite processing facility in Louisiana using feedstock from Syrah Resources’ Balama mine.

Like Niger, Mozambique is a viper’s nest of Islamic extremism. It’s also fertile ground for Russia, which wants to expand its influence in Africa, and the Wagner Group, which sees access to natural resources in exchange for military assistance as a powerful quid pro quo.

Russian state-owned companies have already shown their interest in Mozambique’s natural gas and diamonds, could graphite be next?

Is dealing with Niger and Mozambique, and their complicated cast of characters, really any better than depending on China for critical minerals or Russia for energy?

Arguably, it’s another good case for developing mines right here in North America.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.