A stagflationary debt crisis looms – Richard Mills

2022.11.03

The US Federal Reserve is grappling with how to reduce inflation, which at 8.2% (September CPI) is running about four times the Fed’s 2% target, without causing a recession or pushing unemployment higher by lifting interest rates too much.

The Fed has two options when it comes to interest rate increases designed to tackle the highest US inflation in 40 years. The first is it continues to hike rates, beyond what the economy can handle, causing a recession, usually defined as two consecutive quarters of negative economic growth.

In the second option, the Fed hits “pause” on interest rate hikes. Under this scenario, the central bank could even reverse course, like it did in 2018, and return to lowering interest rates and its monthly purchases of bonds and mortgage-backed securities, a policy known as “quantitative easing”, or QE. But it would take awhile to do so. The Fed for a long time has preached the gospel of rate hikes and it wouldn’t want to lose face by declaring them a failure; the more likely scenario therefore is, in the new year, a series of smaller increases followed by a pause.

The result, imo, of either option is stagflation, a particularly nasty combination of high, persistent inflation, stagnant growth and soaring unemployment, as the economy implodes under central banks’ (not only the Fed but the Bank of England, the European Central Bank, Bank of Japan, etc.) failed efforts to control inflation.

While the Fed has been focused on positive economic data, such as relatively low jobless claims, one doesn’t have to look very hard to find indications of a US economic slowdown.

Bloomberg reported that US manufacturing neared stagnation in October as orders contracted for the fourth time in five months. The Institute for Supply Management’s gauge of factory activity fell 0.7 of a point to 50.2, the lowest since May 2020, according to data released on Tuesday, Nov. 1. Any reading below 50% indicates a contraction in activity.

“The October index reading reflects companies’ preparing for potential future lower demand,” Timothy Fiore, chair of ISM’s Manufacturing Business Survey Committee, said in a statement.

Bloomberg said the report adds to evidence of growing global recession concerns as central banks, including the Federal Reserve, step up the fight to get inflation under control.

This week another key recession indicator emerged in the inverted yield curve. According to Reuters,

Yields on two-year Treasuries have been significantly above those of 10-year Treasuries since early July. Other parts of the curve that the Fed sees as more reliable warnings an economic contraction is expected have also inverted, or have flattened significantly, in recent weeks.

In a typical healthy market, the yield curve (typically the spread between the US 10-year Treasury note and the 2-year note) shows lower returns on short-term investments and higher yields on long-term investments. This makes sense, as investors earn more interest for tying up their money for longer. The yield curve is said to “invert” when short-term yields are higher than long-term yields.

The yield curve has inverted 28 times since 1900, and in 22 of those times, a recession followed. For the last six recessions, a recession began six to 36 months after the curve inverted.

Normally, the yield curve inversion would be a flashing red warning signal for the Fed to back off on its tightening policy, but the central bank appears unfazed by the risk of recession.

Moreover, the poor ISM readings wasn’t enough to convince the Fed to go back on their plans to hike interest rates another 75 basis points, Wednesday. Bloomberg reported that US job openings unexpectedly rebounded in September amid low unemployment, likely fueling further wage gains and adding pressure on the Federal Reserve to extend its aggressive campaign to curb inflation.

The S&P 500 closed lower on Tuesday, as investors’ hopes for a Fed pivot to a less hawkish policy fade, Bloomberg said via Yahoo News.

One commentary says the Fed has already “booby-trapped” markets, meaning that a trapdoor could fall out from under this market regardless of what the Fed says or does today. QTR’s Fringe Finance argues that markets have yet to digest the 325 basis points “baked into the economic cake”. Markets have yet to bottom, the commentor goes on to say, noting we are at the “return to normal” phase, with fear, capitulation and despair yet to happen, before a “return to the mean” occurs, as shown in the chart below.

Hurtling into stagflation

Historically high US inflation, combined with consecutive Fed interest rate hikes, have prompted a number of commentators to compare today’s situation with 1980, particularly whether both periods are stagflationary (high inflation + low growth/ high unemployment).

Former Fed Chair Paul Volcker is widely credited with curbing double-digit inflation in the late 1970s, but in doing so, he is also criticized for causing the 1980-82 recession. The way he did it was the same as the current US Federal Reserve is fighting inflation: raising the Federal Funds Rate. From an average 11.2% in 1979, Volcker and his board of governors through a series of rate hikes increased the FFR to 20% in June 1981. This led to a rise in the prime rate to 21.5%, which was the tipping point for the recession to follow.

Forty years later, the Federal Reserve faces a familiar foe, in rising and persistent inflation. And like Paul Volcker’s Fed, interest rate hikes are being touted as the solution to bringing it back in line.

The Great Stagflation 2.0 and gold

How successful will it be?

Economist Nouriel Roubini has for over a year now argued that the global increase in inflation would be persistent, not transitory, as the Fed initially claimed, and that central banks’ attempts to fight it would cause hard economic landings.

Notwithstanding their “hawkish talk” about controlling inflation, Roubini is so far the only economist to say publicly that central bankers, caught in a “debt trap”, may still “wimp out and settle for above-target [2%] inflation.”

In his latest commentary, Roubini writes:

It is much harder to achieve a soft landing under conditions of stagflationary negative supply shocks than it is when the economy is overheating because of excessive demand. Since World War II, there has never been a case where the Fed achieved a soft landing with inflation above 5% (it is currently above 8%) and unemployment below 5% (it is currently 3.7%). And if a hard landing is the baseline for the US, it is even more likely in Europe, owing to the Russian energy shock, China’s slowdown and the ECB falling even further behind the curve relative to the US Fed.

Are we already in a recession? Not yet, but the US did report negative growth in the first half of the year, and most forward-looking indicators of economic activity in advanced economies point to a sharp slowdown that will grow even worse with monetary-policy tightening. A hard landing by end 2022 should be regarded as the baseline scenario.

Roubini thinks that once the signs of a hard landing and a financial crash materialize, the Fed will “feel immense pressure to reverse their tightening,” and he points to the UK as an early sign of “wimping out.”

When now-disgraced Prime Minister Liz Truss promised reckless fiscal stimulus, the UK bond and currency markets had a hissy fit. For five days, not a single gilt, the UK equivalent of a Treasury note, was sold! The British pound plummeted and yields on government bond yields soared, prompting the Bank of England to launch an emergency QE program to buy up government bonds.

Global economy burdened by debt

Roubini has also made headlines for his views on global debt, which, when combined with the coming stagflation, set up a “stagflationary debt crisis”. What would this look like?

The first thing to understand, is this stagflationary period differs from that of the late 1970s/ early 1980s, due to the much higher debt levels.

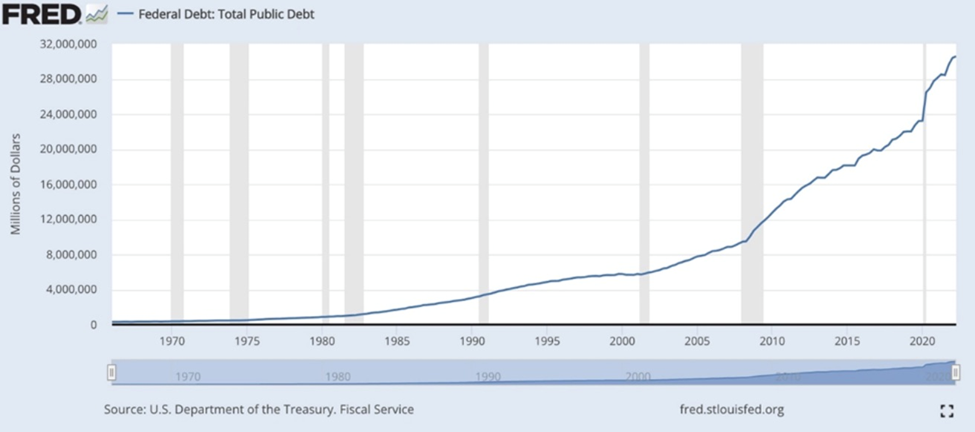

According to the FRED chart below, the US debt to GDP ratio in the ‘70s was around 35%. Today it is three and a half times higher, at 125%.

This severely limits how much and how quickly the Fed can raise interest rates, due to the amount of interest that the federal government will be forced to pay on its debt.

During 2021, before interest rates began rising, the federal government paid $392 billion in interest on $21.7 trillion of average debt outstanding, @ an average interest rate of 1.8%. If the Fed raises the Federal Funds Rate to 4.6%, interest costs would hit $1.028 trillion — more than 2021’s entire military budget of $801 billion!

The national debt has grown substantially under the watch of Presidents Obama, Trump and Biden. Foreign wars in Afghanistan and Iraq have been money pits, and domestic crises required huge government stimulus packages and bailouts, such as the 2007-09 financial crisis and the covid-19 pandemic in 2020-22.

Each interest rate rise means the federal government must spend more on interest. That increase is reflected in the annual budget deficit, which keeps getting added to the national debt, now sitting at a shocking $31.2 trillion.

Now let’s bring in what Roubini says about the stagflationary debt crisis. First, he argues that debt ratios in advanced economies and most emerging markets were much lower in the 1970s, compared to today.

Conversely, during the financial crisis, high private and public debt ratios caused a severe debt crisis, exemplified by the housing bubble bursting. The ensuing recession led to low inflation/ deflation (falling prices), and there was a shock to aggregate demand. Today, the risks are on the supply side, such as the energy crisis in Europe caused by Russia halting exports of natural gas; and high food prices due to blocked shipments of grain and other agricultural commodities from Ukraine, along with various droughts. According to Roubini,

We are thus left with the worst of both the stagflationary 1970s and the 2007-10 period. Debt ratios are much higher than in the 1970s, and a mix of loose economic policies and negative supply shocks threatens to fuel inflation rather than deflation, setting the stage for the mother of stagflationary debt crises over the next few years.

A key point is that raising interest rates won’t work, because the current inflation is supply-oriented not demand-driven. Roubini predicts future supply shocks could come in the form of renewed protectionism; demographic aging in advanced and emerging economies; immigration restrictions in advanced economies; the reshoring of manufacturing to high-cost regions; or the balkanization of global supply chains.

As inflation continues to soar, central banks will face a dilemma: if they keep raising rates, they risk triggering a massive debt crisis and a severe recession. But if they loosen monetary policy (lower interest rates + quantitative easing), they risk double-digit inflation.

Roubini fears that, due to the high debt ratios, any anti-inflationary policy will lead to a depression, not a recession. He warns that, The stagflation of the 1970s will soon meet the debt crises of the post-2008 period. The question is not if but when.

Roubini, the economist who predicted the 2008 market meltdown, calls forecasts for a brief and mild US recession “delusional”, and in July he told Bloomberg he expects the United States to be hit by a “severe recession and a severe debt and financial crisis”.

In an interview with German newspaper Der Spiegel, via Zero Hedge, Roubini goes a step further, saying that in addition to economic, monetary, and financial risks currently in play, the world faces higher geopolitical risks. These include the ongoing conflict between Russia and Ukraine, and the “collision course” that Iran and Israel are on.

“It [World War III] is already happening. The U.S. has just passed new regulations banning the export of semiconductors to Chinese companies for AI or quantum computing or military use. Europeans would like to continue doing business with the U.S. and China, but it won’t be possible because of national security issues.”

“…just this morning, I read that the Biden administration expects China to attack Taiwan sooner rather than later. Honestly, World War III has already effectively begun, certainly in Ukraine and cyberspace.“

Emerging market debt crisis

Admittedly, Roubini’s pessimism is expected from an economist nicknamed “Dr. Doom”, but his views aren’t that different from mainstream thinking.

In July, the World Economic Forum published an article stating that the global economy is facing slowing growth and rising inflation, raising concerns of a return to the stagflation of the 1970s.

While the WEF says global inflation is forecasted to peak this year and decline to about 3% by mid-2023 (color me extremely skeptical — Rick), it acknowledges there is a risk that inflation expectations will eventually de-anchor, as they did in the 1970s, as a result of persistently above-target inflation and repeated inflationary shocks.

If that were to happen, it raises the risk of a debt crisis in emerging markets and developing economies (EMDEs), such as occurred during the 1980s. Then, as now, high debt, elevated inflation and weak fiscal positions made EMDEs vulnerable to tightening financial conditions. Monetary policy tightening in advanced economies sharply increased the cost of borrowing, especially in Latin America and the Caribbean. Over the 1980s, more than three dozen debt crises erupted, mostly in LAC and sub-Saharan Africa.

The WEF article states:

Should steep policy rate hikes now again be required to bring inflation in advanced economies under control, EMDEs would once again face severe challenges. Total EMDE debt is at a record high of 207% of GDP. EMDE government debt, at 64% of GDP, is at its highest level in three decades, and about one-half of it is denominated in foreign currency, and more than two-fifths are held by non-residents in the median EMDE (Kose et al. 2022). A sharp increase in borrowing cost – or the sharp currency depreciation that often accompanies policy tightening in advanced economies – could once again trigger sovereign debt distress as these economies have even larger vulnerabilities now than before the pandemic. About 60% of the poorest countries are already in, or at high risk of, debt distress.

Forbes cites a report from the United Nations’ trade and development arm, UNCTAD, stating that at least 107 nations were facing at least one of the three shocks threatening the world today — rising food prices, rising energy prices, and tighter financial conditions — while 69 countries were being thrashed by all three (25 in Africa, another 25 in Asia and the Pacific, 19 in Latin America). According to figures cited by the Financial Times’ Gillian Tett, total global debt has tripled since 2000 and doubled since 2006, reaching 352 percent of global GDP in the first quarter of 2022.

Also, as we previously wrote, the strong US dollar is causing problems among developing countries who borrow in currencies other than their own, usually dollars or euros.

The Fed, the debt, China and gold

Developing-world economies that borrowed heavily in dollars when interest rates were low, are now facing a huge surge in refinancing costs.

The 15% climb in the greenback this year (DXY) has raised the cost of their dollar-denominated imports and triggered inflation, as the value of their currencies relative to the dollar plunged, prompting their own central bank tightening cycles. The latter is hindering economic growth. The IMF has downgraded its 2023 growth outlook for the world economy to 2.7%, down from the 2.9% they had estimated in July.

Sovereign dollar bonds from a third of countries within the Bloomberg EM Sovereign Debt Dollar Index, are trading with a spread of 1,000 basis points of more over US Treasuries — a generally considered metric of distress.

A wave of defaults across developing nations would have major implications for the global economy, just as Asian debt contagion in 1997 spread to Russia and Latin America.

The 4th horseman of an economic apocalypse

Getting back to the topic at hand, an article written 11 years ago is eerily correct in its warnings about inflation, described by author John H. Coltrane as “a form of sovereign debt”. Coltrane is no slouch. His accolades include the AQR Capital Management Distinguished Service Professor of Finance at the University of Chicago Booth School of Business, a research associate of the National Bureau of Economic Research, and an adjunct scholar at the Cato Institute.

Coltrane also describes serious inflation as often the fourth horseman of an economic apocalypse, accompanying stagnation, unemployment, and financial chaos. Think of Zimbabwe in 2008, Argentina in 1990, or Germany after the world wars.

Here is where Coltrane hits scarily close to the mark. He says most analysts “today” (i.e. 2011), ignore the direct link between debt, looming deficits and inflation (sound familiar?)

The Fed’s inflation “hawks” worry that the central bank will keep interest rates too low for too long and that, once inflation breaks out, it will be hard to tame. Fed “doves,” meanwhile, think that the central bank can and will raise rates quickly enough should inflation occur, so that no one need worry about inflation now.

All sides of the conventional inflation debate believe that the Fed can stop any inflation that breaks out. The only question in their minds is whether it actually will — or whether the fear of higher interest rates, unemployment, and political backlash will lead the Fed to let inflation get out of control. They assume that the government will always have the fiscal resources to back up any monetary policy — to, for example, issue bonds backed by tax revenues that can soak up any excess money in the economy. This assumption is explicit in today’s academic theories. [Bloomberg reported on Oct. 10 that the biggest players in the $23.2 trillion US Treasury market are in retreat]

While the assumption of fiscal solvency may have made sense in America during most of the post-war era, the size of the government’s debt and unsustainable future deficits now puts us in an unfamiliar danger zone — one beyond the realm of conventional American macroeconomic ideas. And serious inflation often comes when events overwhelm ideas [covid, the Ukraine war — Rick] — when factors that economists and policymakers do not understand or have forgotten about suddenly emerge. That is the risk we face today.

Stagflation and gold

Gold historically performs best when government deficits are large and/ or growing. While the market currently doesn’t understand the looming US deficit problem, we believe when it becomes more apparent that the government has a debt servicing issue and that interest rates are making it worse, then demand for US Treasuries will fall even further. Could we be heading for a “no bid” situation like in the UK when buyers for UK gilts completely disappeared?

Eventually, if the debt grows more rapidly than the GDP, which it has done for several years now, the interest payments could become so high that the US defaults on its debt. While that would be catastrophic to the global economy, it would obviously be good for gold.

How has gold done during stagflation? As it turns out, quite well. The chart below by Sunshine Profits shows the gold price climbing during the stagflationary 1970s, surging from $100 per ounce in 1976 to around $650 in 1980, when CPI inflation topped out at 14%.

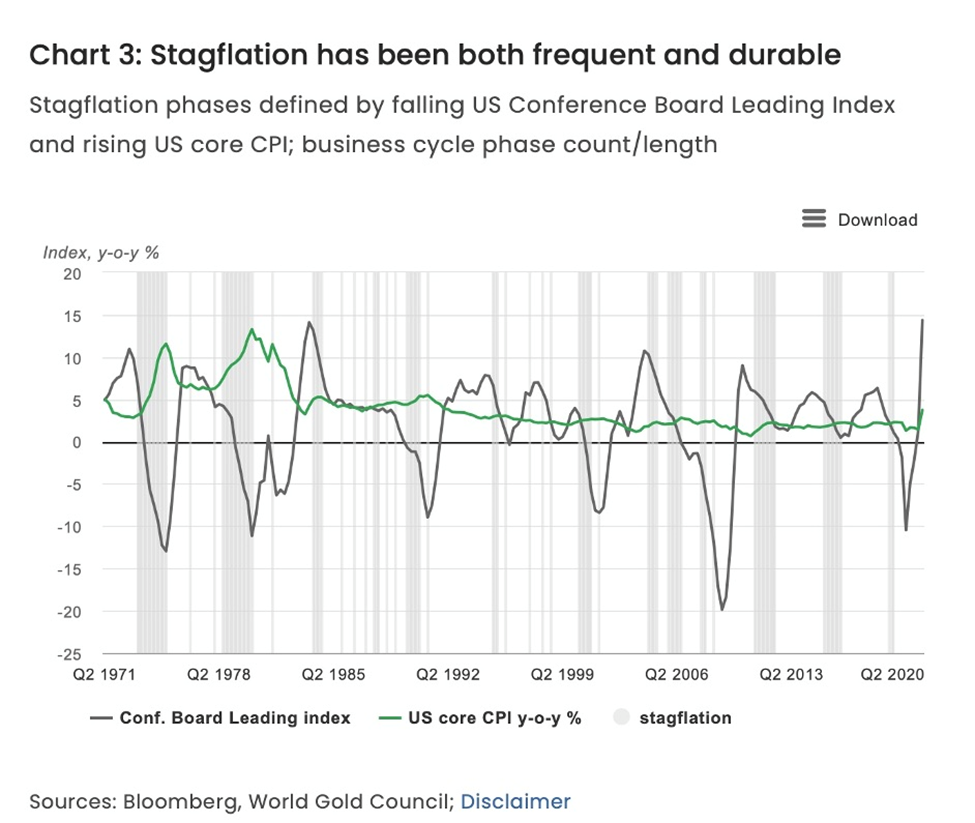

In fact, gold outperforms other asset classes during times of economic stagnation and higher prices. The table below shows that, of the four business cycle phases since 1973, stagflation is the most supportive of gold, and the worst for stocks, whose investors get squeezed by rising costs and falling revenues. Gold returned 32.2% during stagflation compared to 9.6% for US Treasury bonds and -11.6% for equities.

According to the World Gold Council, a look at US economic history back to 1971 reveals that stagflation has been the most frequent scenario (occurring in 68 of the 201 quarters) as well as the most enduring, having twice lasted eight consecutive quarters .

Simply put, gold does well in stagflationary environments because it benefits from the elevated risk environment, high inflation and falling real interest rates (interest rate minus inflation). Although nominal interest rates have been climbing since March, real rates remain negative because inflation is so high. (Right now 3.08% – 8.2% = -5.12%).

Conclusion: Two outcomes, both good for gold

Staggeringly high debt is what differentiates the current economic environment from previous periods, especially the inflationary late 1970s to which 2022 is being compared.

The US debt to GDP ratio in the ‘70s was around 35%. Today it is three and a half times higher, at 125%.

This severely limits how much and how quickly the Fed can raise interest rates, due to the amount of interest that the federal government will be forced to pay on its debt.

Few analysts seem to recognize the direct link between debt, looming deficits and inflation. Inflation is the fourth horseman of an economic apocalypse, accompanying stagnation, unemployment and financial chaos. The size of the US government’s debt — currently $31.2T — and unsustainable future deficits, puts us in an unfamiliar danger zone.

I agree with Nouriel Roubini’s take on the situation, that a stagflationary debt crisis looms. He warns that the stagflation of the 1970s will soon meet the debt crises of the post-2008 period. The question is not if but when…

A mix of loose economic policies and negative supply shocks threatens to fuel inflation rather than deflation, setting the stage for the mother of stagflationary debt crises over the next few years.

Raising interest rates won’t work, because the current inflation is supply-oriented not demand-driven.

The crisis threatens to envelope both the developed economies and the emerging markets. Developing-world economies that borrowed heavily in dollars when interest rates were low, are now facing a huge surge in refinancing costs. About 60% of the poorest countries are already in, or at high risk of, debt distress.

Gold historically performs best when government deficits are large and/ or growing. It appears all but certain the world economy will enter a recession within the next six to 12 months. The warnings are written in the inverted yield curve (an extremely reliable recession indicator), stagnant US manufacturing data, and a return to high debt levels among US and Canadian consumers, post-pandemic. The latter is a concern because it ups the risk of bankruptcies, delinquencies and forced stock selling, amid higher interest rates.

A new study quoted by Global News found Canadians are leaning more heavily on credit cards, amid higher inflation and despite rising interest on credit cards. Equifax Canada’s survey found the average credit card held by Canadians at the end of September was at a record-high $2,121.

As inflation continues to soar, central banks will face a dilemma: if they keep raising rates, they risk triggering a massive debt crisis and a severe recession. But if they loosen monetary policy (lower interest rates + quantitative easing), they risk double-digit inflation.

The World Gold Council proved, through the charts and table above, that gold does well during stagflationary episodes. Gold is also a traditional inflation hedge, and while high inflation hasn’t yet resulted in a flight to gold, I believe it will happen when there is a shift from monetary tightening to easing as a result of poor US economic performance and/or the widely anticipated recession. The latter will almost certainly crush the dollar, bringing about higher commodity prices.

So whether or not the Fed pivots, I’m not bothered.

Either way, it’s good for precious metals — gold and silver.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.