A junior copper stock on the cusp of world-class discoveries

By Trevor Abes – Stockhouse.com

Sitting at an irrational 93.45 per cent loss since 2019, shares of Max Resource are currently priced for exponential upside, as more drill targets based on high-resolution magnetic and radiometric survey data, as well as ongoing mapping, sampling and geochemistry, ride the tailwind of copper demand to wider market awareness.

When the junior miner begins drilling later this year – self-funded with almost C$8.7 million in cash as of Q3 2023 – it will do so on concessions that span less than 20 per cent of its 1,000 square km land package, leaving plenty of room for additional copper-silver prospects to be delineated, given prospecting and drilling results to date, propelling CESAR ever closer to identifying an economically extractable deposit.

While the CESAR project is strategically positioned to serve the global copper market, with the United States to the north, and Europe, Africa, and Asia to the east, Kassim-Lakha noted that Max would not have to do business anywhere other than Colombia to generate robust shareholder returns.

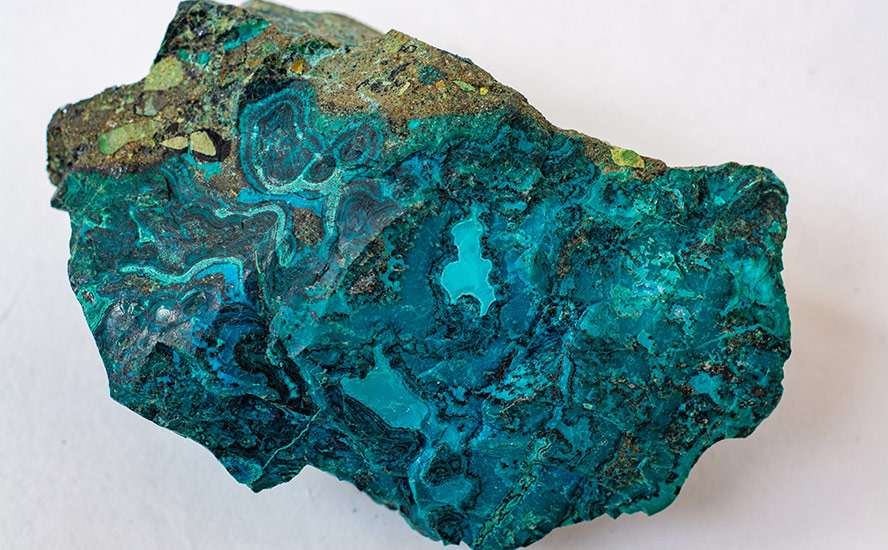

“We’re a different type of deposit,” he said in a recent interview with Stockhouse. “We’re a different kind of beast. The Cesar Basin has the potential to become a world-class copper-silver region in Colombia, with only 1 per cent of the country’s land package in the resource space producing something outside of oil and gas, and only 2 per cent having been explored. Colombia is moving towards an energy transition, and Max Resource is positioned to expedite it, with a resource at any one among AM, Conejo or URU capable of becoming a company maker.”

Matich echoed this sentiment, adding that “we’ve had representatives from numerous global miners and institutional investors on site, even before we had a drill hole,” highlighting the appeal Max Resource is building among major players, who will only knock on the junior miner’s door with increasing frequency at it expands mineralization on its 100-per-cent-owned land package.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.