A decline of empires – Richard Mills

2025.07.11

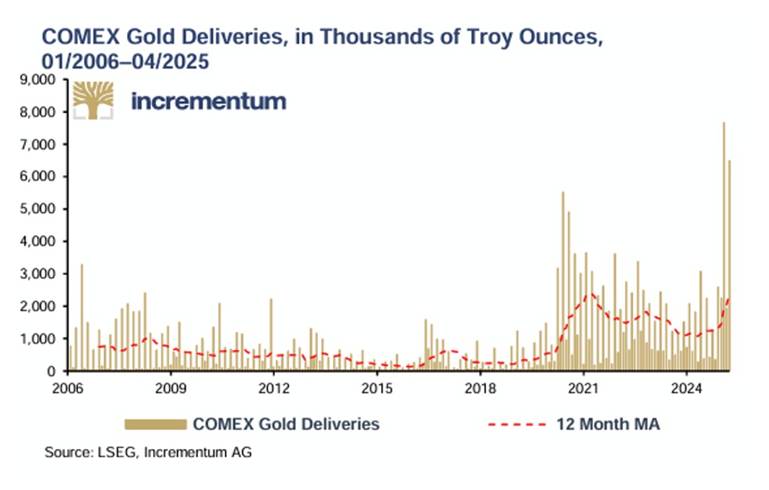

A group of European Central Bank economists recently warned that rising demand for physical gold (over 2,000 tons from London to NYC in 2025) could send the European Union into collapse.

As explained by gold market commentator Matthew Piepenburg, this is Because the Eurozone, already teetering on skyrocketing debts and rising bond yields (and hence interest rates), doesn’t have the money nor the gold to meet their 100:1 levered gold derivative contract hitherto floating on the London and NY Gold Exchanges with a gross exposure of over $1T…

But now they are seeing counterparties wanting the physical gold itself rather than just their extended paper contracts.

Unfortunately, the Eurozone doesn’t have the gold their contracts promised…

In other words, gold is no longer just a hedge or matter of speculation, it’s THE emerging global Tier-1 asset which even those folks at the BIS and IMF (notorious for “bending” truths) now openly recognize as THE reserve asset in a world openly losing confidence in the debased paper money and distrusted IOUs from a world falling off a $300T global debt cliff.

An inability for the Eurozone’s to meet its gold derivative obligations would be a major catastrophe with far-reaching consequences in an area already entering a “post-growth” era.

The Eurozone is currently facing a period of economic stagnation and potential decline, marked by sluggish growth, declining competitiveness, and policy paralysis.

After a very lackluster 0.7% increase in 2024 GDP the European Commission forecasts moderate growth of 0.8% for the EU economy in 2025.

Europe’s share of global GDP has fallen significantly, indicating a loss of economic momentum and competitiveness on the world stage.

The reasons are numerous:

- A lack of decisive action and structural reforms has hindered the Eurozone’s ability to address its economic challenges effectively.

- Volatile energy prices weigh on European businesses and consumers.

- Investment in innovation and new technologies is lagging other major economies.

- A “brain drain” of skilled workers to more dynamic markets is further weakening the Eurozone’s long-term prospects.

- A recent drop in Eurozone retail sales.

- EU industrial production has also declined; capital goods have experienced the greatest drop.

- Germany, once the powerhouse of the Eurozone, ended 2024 with a 0.2% contraction in GDP, marking two consecutive years of recession.

- France is facing a negative credit outlook due to its public finance challenges, further highlighting the economic instability within the Eurozone.

- The UK’s productivity growth has stagnated in recent years, lagging pre-2008 trends and other developed nations.

Bubbles and troubles

Ray Dalio in a CNBC video alluded to cycles that lead to bubbles and busts. The Economic LongWave Research Group takes this a step further. A comprehensive analysis of 56 major financial bubbles reveals a devastating pattern and suggests the worst is yet to come.

The first thing to understand is something called the 85.63% Rule. This, believe it or not, is the average loss that investors experience when bubbles burst. While the 85.63% Rule is one of the most consistent patterns in financial history, going back some 400 years, what’s new is that bubbles are forming more frequently. What historically happened every seven to 10 years has now happened 7 times in the last 13 years, creating what the group’s author calls “The Great Bubble Parade”.

Examples include the 3D Printing Bubble (2012-2014); Cannabis Stocks Bubble (2018-2021); Clean Energy/Solar Bubble (2020-2021): SPAC Bubble (2020-2021); Meme Stocks Bubble (2021); AI Bubble (2023-2025); and the worst bubble of all, real estate, averaging 93.67% losses compared to the average bubble loss of 85.63%.

Today bitcoin, AI and tech stocks might each be in a bubble.

The godfather of financial economics, Nobel laureate Eugene Fama says for something to be a bubble one must be able to spot it in advance.

Mass psychology and irrational exuberance are at the heart of financial bubbles.

According to Economic LongWave, the Great Bubble Parade aligns perfectly with Nikolai Kondratieff’s long-wave theory, which predicted economic cycles lasting 40-60 years:

According to this framework, we remain in the centralized fourth wave that began around 1950, and we’re approaching the “winter” phase — a period of economic contraction, debt deflation, and structural reform typically lasting 10-15 years.

The evidence is compelling:

- Bubble Acceleration: The frequency of bubbles has increased exponentially since 2008, suggesting we’re in the final speculative phase before the deflationary crash.

- Debt Saturation: Global debt levels now exceed those of 2008 across all major economies, limiting central banks’ ability to respond to the next crisis.

- Demographic Decline: Aging populations in all major economies are reducing natural demand for housing and consumption, creating deflationary pressure.

- Central Bank Exhaustion: After years of quantitative easing and near-zero interest rates, monetary policymakers have limited ammunition for the next crisis.

Several factors suggest we’re approaching the climax of this bubble cycle:

- AI Valuations: Extreme price-to-sales ratios with unclear paths to profitability, reminiscent of 1999-2000 dot-com levels.

- Global Housing Metrics: Record price-to-income ratios across all major economies, with some markets (Vancouver, Hong Kong, Sydney) showing ratios never seen in history.

- Central Bank Policy: Interest rates already cut aggressively with limited room for further stimulus, while quantitative tightening removes liquidity from markets.

- Demographic Trends: Birth rates below replacement level in all developed economies, reducing long-term demand for housing and consumption.

- Geopolitical Instability: Rising tensions between major powers creating uncertainty that historically triggers flight from speculative assets.

Imperial overreach

The US has overextended itself through military interventions and foreign policy engagements.

All empires come to an end, whether it’s Rome, Austria-Hungary, Russia, Britain, Holland, Spain, Portugal, or the current empire holder, the United States. All these empires ended due to a combination of factors including internal strife, nationalist movements, economic pressures, and major global conflicts. These factors, combined with the rise of new powers and ideologies, led to the dissolution and the redrawing of the political map of Europe and the world.

So, the end of empire not only signifies the conclusion of imperial power but also encompasses the broader historical phenomenon of empires declining and collapsing due to various factors.

In John Whitehead’s latest commentary, he is of the opinion that America’s military misadventures have less to do with national defense than empire maintenance.

“It’s about preserving a military-industrial complex that profits from endless war, global policing, and foreign occupations—while the nation’s infrastructure rots and its people are neglected,” he writes.

Here is where Whitehead jibes with America’s debt problem. “War spending is bankrupting America,” he says, noting that, although the US only constitutes 5% of the world populations, it represents almost 50% of the planet’s total military expenditures, spending more on its military than the next 19 countries combined.

Since 2001, the U.S. government has spent more than $10 trillion waging its endless wars, much of it borrowed, much of it wasted, all of it paid for in blood and taxpayer dollars.

Add Yemen and the Middle East escalations of 2025, and the final bill for future wars and military exercises waged around the globe will total in the tens of trillions.

Co-opted by greedy defense contractors, corrupt politicians and incompetent government officials, America’s expanding military empire is bleeding the country dry at a rate of more than $32 million per hour…

As investigative journalist Uri Friedman puts it, for more than 15 years now, the United States has been fighting terrorism with a credit card, “essentially bankrolling the wars with debt, in the form of purchases of U.S. Treasury bonds by U.S.-based entities like pension funds and state and local governments, and by countries like China and Japan.”…

We are funding our own collapse. The roads rot while military convoys roll. The power grid fails while the drone’s fly. Our national strength is being siphoned off to feed a war machine that produces nothing but death, debt, and dysfunction.

In 2024, global military expenditure reached a record high of $2.7 trillion, a 9.4% increase from the previous year, according to the Stockholm International Peace Research Institute (SIPRI). This surge was the steepest year-on-year rise since at least the end of the Cold War, driven by escalating conflicts and geopolitical tensions. The increase was observed across all world regions, with notable spikes in Europe and the Middle East. The top five military spenders – the United States, China, Russia, Germany, and India – accounted for 60% of the global total.

The United States was the largest military spender in 2024, allocating $997 billion towards it military. Note this figure does not include the Department of Energy’s role in maintaining and modernizing nuclear weapons, the special forces budget is tracked separately and is not fully transparent and the substantial budget for the VA is not included. Yet the US 50-year average of monies spent on defense is a staggering 4.2% of GDP.

The global military burden, which is the share of global GDP devoted to military expenditure, increased to 2.5% in 2024, while the average military expenditure as a share of government expenditure rose to 7.1%.

From sipri: Global military spending has increased every year for the last decade going up by 37 per cent between 2015 and 2024. For the second year in a row, military expenditure increased in all five of the world’s geographical regions, reflecting heightened geopolitical tensions across the globe. The decade-long growth in global spending can be partly attributed to spending increases in Europe, largely driven by the ongoing Russia–Ukraine war, and in the Middle East, driven by the war in Gaza and wider regional conflicts. Many countries have also committed to raising military spending, which will lead to further global increases in the coming years.

Conclusion

The decline in the relative power of the United States and the Eurozone in geopolitical and economic contexts is happening. Both entities are experiencing a decrease in their global influence and dominance compared to other emerging powers, such as China.

Some would argue that the declines are due to factors like infrastructure problems, geopolitical overreach and the increasing economic power of other nations.

Others blame, or add, internal divisions within the entities, including political polarization and social unrest.

AOTH will add to the above; military spending, the faltering dollar, de-dollarization, unsustainable US deficits and national debt, the potential for a global recession caused by Trump’s trade war, increased social inequality, potential economic crises stemming from government actions, and erosion of democratic institutions and trust.

Over on Project Syndicate Stephen Roach talks about his ‘Stall Speed’ rule.

“This simple rule has worked remarkably well in predicting global recessions over the past 45 years. Unlike a recession in an individual economy, which generally reflects a contraction of real output, one at the global level typically involves about half the world’s economies contracting while the remainder continue to expand. As a result, a worldwide recession is usually associated with global GDP growth slowing to the still positive 2-2.5% range – a shortfall of 0.8 to 1.3 percentage points from the post-1980 trend of 3.3%. The exceptions were in 2009 and 2020, when the global financial crisis and the pandemic, respectively, caused outright contractions in global output.

The stall speed holds the key to cyclical risk assessment. It can be thought of as a zone of vulnerability, measured by significant downside deviations from trend growth. Looking back over the past 45 years, I would place the global economy’s stall speed in the 2.5-3% range: when in this zone, the world lacks the resilience needed to withstand a shock. That is what happened in each of the past four global recessions.

Fast-forward to today. According to the International Monetary Fund’s latest World Economic Outlook, global GDP growth is expected to slow to 2.8% in 2025 – right in the middle of the stall-speed zone.”

A decline of empires has begun. Meanwhile gold is rising against all global fiat currencies as their purchasing power is diluted by policies that inflate away their debt with debased fiat currencies.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.