A conversation with Dolly Varden’s head geologist Rob van Egmond

2024.04.19

Rick Mills: Good morning Rob. I’d like us to do a bird’s eye, a fly-over macro view of Dolly Varden Silver’s (TSXV:DV, OTC:DOLLF) Kitsault Valley project. Then we’ll get down into the dirt, the nitty gritty, results, comparables in the area and the Red Line and what it is.

Let’s start at the south end down by the Dolly and the Torbrit, move up north to the Homestake Main then please get into the Big Bulk, the hub and spoke mine model and building a 50-50 gold and silver resource.

I have the prefect guy to do a deep dive on the project.

Rob van Egmond: Yeah, technical stuff, but maybe not too technical.

RM: Well my readers are pretty sophisticated. They absolutely love it when I talk to a top-shelf geologist like yourself and he explains what’s going on, why he’s doing what he’s doing, what Dolly’s going to do on the Kitsault in 2024.

We’ve got so many silver occurrences on the southeast side of the valley under a sediment cap, as you go towards the west side of the valley we get into gold.

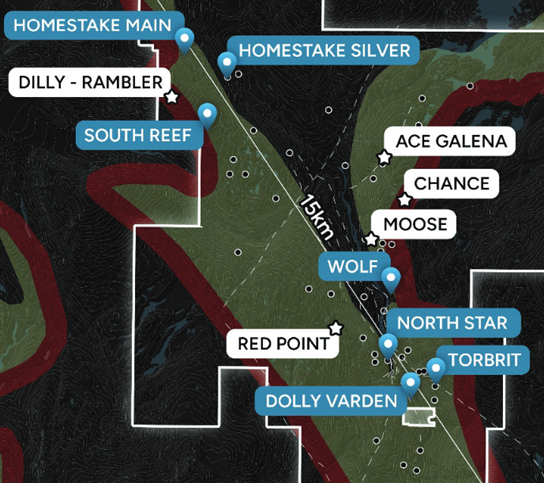

I look at the fact sheet map below it’s following the Minfile showings, and we see all the places where you’ve hit mineralization and it definitely seems to be a bit of a trend from the south to the northwest with maybe a bit of an offshoot to the north-northeast with the Ace and the Chance and the Moose.

RvE: Since the consolidation of the whole valley by adding the Homestake Ridge property, basically doubling the size of the project and with the recent consolidation and acquisition of the Big Bulk Copper-Gold porphyry system we have what we’re calling, and the BCGS is also calling, a sub-basin of the Eskay Rift period.

RM: The BCGS’s ‘Red Line’ is very noticeable on the map above.

RvE: All of the mineralization that you mentioned is within the Hazelton Formation. The Red Line is the contact between the Stuhini, the Triassic-aged rocks under the Hazelton, the Red Line is a time marker, when the Eskay Rift period started.

What the Red Line represents is a release in compression, the ongoing tectonic compression started to slow down and a time of expansion began. Basins started to form and were being filled with what is termed now the Hazelton Formation. All the mineralization within the Golden Triangle, or the vast majority of it, was put in during that Jurassic time period.

In our case there’s a lot of volcanic rock that was deposited at the time, so there’s a much more dynamic environment when the mineralization at Dolly Varden and Homestake was put in. Because of that the feeders and mineralizing events that occurred, during this Jurassic timeframe, occurred along structures where things were opening, so you have a lot more open space to be filled with mineralization.

The long and the short of it is that the Red Line marks the beginning of that phase and so that’s why people are always referring to their position of the Red Line and what they’re really saying is they’re within that Hazelton Formation package of rocks because all those deposits, Brucejack, Premier and Snip as well as Eskay, and on the intrusive porphyry side of that is KSM, all those are put in in different types of geological environments, and so now that we have all the whole property together we have a little bit of everything.

RM: So what’s driving the driving the mineralization in the Kitsault Valley?

RvE: Quite often you have a heat source like a big porphyry system, not necessarily mineralized, but it’s what’s driving the mineralized fluids and I’ve seen it working in Peru quite often, is that you have heat source and above it you’ll get your epithermal gold systems but distally radiating around that is quite often where you’ll get your high-grade silver veins and that’s what we have at Dolly Varden.

Starting in the south the silver deposits that were the original Dolly Varden property are what we consider to be distal to a copper-gold porphyry feeder or heat source, so that would not be vertically above it but horizontally distal.

There is a bit of a combination in styles of mineralization at Dolly Varden. Torbrit, for example, which is our largest silver resource, and that’s pure silver so that makes it quite unique in the Golden Triangle. Torbrit has had past production and produced about 18 million ounces of silver, and We have approximately 35 million oz silver resource defined around that, size-wise, just to give a relative size of what we’re looking for, of Torbrit before production is about a 50-60 million oz silver deposit and so when these basins were forming the mineralizing fluids were coming up along the basin-bounding structures as well as cross-cutting structures that go off to the northeast, and they basically form different blocks within the basin.

We interpret that Torbrit started out as a volcanogenic-type system. It’s not a true VMS, we don’t have massive sulfide there, but the mechanism of emplacement where you have mineralizing fluids coming up along structures and then flowing out on a very shallow seafloor in our case and forming layers, that’s the volcanogenic part of it.

Eskay Creek occurs a little bit later but within that same Jurassic time frame, but it was ejected out into a deepwater basin where you have lot higher confining pressures which means the fluids aren’t reaching the substrate boiling, they’re precipitating out, that’s how you get your massive sulfide component. It’s sort of a spectrum, we call it all volcanogenic-related.

And then because we’re in a volcanic environment that was so much more dynamic, volcanic flows capped the mineralized layers forming, but the heat cells keep going and the mineralization style switched over to an epithermal system, so that’s the Wolf Vein which we’ve been making some big advances on, and new discoveries deeper down underneath the sedimentary layer that’s been masking it from past prospectors.

We’re still making new discoveries in 100-year-old mining camps because we’re employing new methods, deeper drilling, drilling’s a lot easier than it used to be so we can check out theories of offsets from faults and things that are covered up by sedimentary caps.

RM: The last time we talked to you was your theory about this, that you were going to step back and drill underneath these sedimentary caps. You guys went ahead and you did that, and you were quite successful, you proved your theory.

RvE: Yes, at the Wolf Vein we went under the sedimentary cap and last season we continued to do step outs.

Dolly Varden Silver Intersects 15.94 meters Averaging 1,499 g/t Silver Including 0.35 meters of 23,997 g/t Silver at the Wolf Deposit

Dolly Varden Silver Intersects 461 g/t AgEq* over 26.99m, incl. 2,260 g/t AgEq* over 0.5m in 81 meter Step-out at Wolf

The important thing is the width, because it’s within structures, I guess you would call it like a release-type environment, they’re not being compressed so you end up with a lot wider deposits and that’s what we’re looking for in places like Wolf.

Torbrit is already wide because it’s sort of flat-lying, and layers have built up so you have 25- to 40-meter-thicknesses averaging 300 grams per tonne silver.

Dolly Varden Silver Intersects near-surface Kitsol Vein Extension with 342 g/t Ag over 18m, including 2,270 g/t Ag over .5m and Adds Fifth Drill Rig

RM: Wider veins are much more amenable to bulk underground mining.

RvE: Yes, so we’re looking at these veins and finding the extensions underneath the sedimentary cap.

We’re getting 18 meters, 30 meters, 27-meter widths averaging 300 grams for tonne and quite often within that we’ll have a higher-grade breccia because these structures are fairly long-lived and there’s been multiple pulses and each pulse augments the grade.

But we won’t just be following these high-grade breccias, yes half a meter of a kilogram or a meter of 1,800 grams per tonne silver, up to 2,000 grams per tonne in some areas and at Wolf in 2022 had a 23,000-gram silver over 35 centimeters would hold the dilution but we’re looking at it in the whole width so we want to be able to take that 18 meters, that 30 meters, again using bulk underground mining methods because that brings your mining cost down and then you can add more of the lower-grade material and bring your number of recoverable ounces up.

RM: I see Wolf and then off to the northeast you’ve got discoveries at Moose, Chance and Ace Galena.

RvE: We havethese structures that run up the center of the valley so they’re what we call basin-bounding structures. And then we have cross-cutting structures which host those epithermal veins.

Part of the Torbrit deposit is a vein called Kitsol, which again we had success on expanding out and then there’s the Wolf Vein, and then the Dolly Varden is also along one of those structures and we’ve noticed that there’s a periodicity of about a kilometer and a half, so in terms of those new discoveries the next one a kilometer and a half north of Wolf is another vein we call the Moose Vein.

It runs along those cross-cutting structures as well, and we had a little over 700 grams per tonne silver on one of those hits early last year, so that’s one of our exploration targets, and this year we’re going to be going in and following the projection of that underneath the sedimentary caps, so we’ll be applying the same geometry that we see at Wolf and at Kitsault and applying that to Moose to start chasing that down.

So to answer your question, it’s a showing along that volcanic edge that does punch or dip underneath the sedimentary cap, so that’s in the case of Ace Galena, it’s a little bit further into the volcanics and it’s showing a little more VMS-style where we have massive galena but you’re still getting kilogram grades of silver on some of the trenching, the old trenching from the ‘20s but that trend also goes down underneath the valley so when you mentioned earlier that all these Minfiles they curve up to the northeast, they’re following the Hazleton Formation and it curves around that way because of the topography at the end of the valley.

So it’s more of a topography thing that gives it that curve so in a general sense it’s a syncline in the valley with the younger sediments sitting down the middle and that’s where the volcanics are covered but the volcanics had the mineralization so the thing that happened at Wolf is just chasing the projection of that mineralization that we see, so we’re calling it the smoke on the edges poking out from underneath the sedimentary cap, so we’ll be following up the next vein up and then we have some planned holes for the next kilometer and a half interval which is place called Silver Horde, where we don’t see a vein but we see very strong alteration that’s associated with deposits like Torbrit and Wolf.

RM: I see the Wolf is underneath the sedimentary cap, so from the North Star to I suspect the South Reef, we’re not showing any findings in there is that like a gap in the mineralization or is it just not explored?

RvE: There’s a division on the property, we’ve been talking up till now about the silver deposits and they run up the eastern side of the valley on one limb of that syncline.

But the whole western side of it, you know looking at it holistically not between properties, that is a gold belt that runs from a showing that we call Red Point, which sits just beside North Star and it runs all the way up past Homestake Silver and Homestake Main, so that is higher-temperature alteration than the volcanogenic-type mineralization, that looks like it’s more stratigraphically above the heat source so that’s why we’re getting more gold-copper in that belt.

RM: Yes, the heat source, the porphyry system.

RvE: We did some drilling at Red Point last year trying to find areas where there’s a higher concentration of stock work and Red Point does show that. We have within the that alteration zone a 300m hole that runs 0.17 grams per tonne gold, not economic but shows there’s gold within that system in a strongly altered and stock works zone. At Red Point there’s a higher intensity of the stock work and then we’re starting to see areas where we get 5 to 7 gram material which is starting to approach the grades that we see at Homestake Main.

And so as we follow that north to Homestake Main and Silver, that trend is just west of Homestake Main and Silver, and Homestake Main and Silver sit along one of those basin-bounding structure so that would be a structure that runs parallel to the valley bottom, not cross-cutting it like Wolf and so those structures just to the west do go underneath that sedimentary cap as well but from a different direction, so Homestake Silver dives down underneath that sedimentary cap.

To get to your question, that 5.5-kilometer gap between Wolf and Homestake Main is covered by that sedimentary cap so we have smoke in terms of silver mineralization coming out of the eastern side of the valley and that’s where our silver deposits are, and then moving to that whole gold and silver trend to the western side.

Our last news release from the 2023 drilling was we hit a new style of mineralization at the north end of Homestake Silver. It looks a lot younger, and HR23-389 graded 1,335 grams per tonne gold with almost 800 g/t silver on the north end of Homestake Silver in a set of quartz carbonate veins, which is different from the pyrite-silica breccias that you see at Main.

HR23-389: 79.49 g/t Au and 60 g/t Ag (80.21 g/t AuEq*) over 12.45 meters including 1,335 g/t Au*** and 781 g/t Ag (1,344.42 g/t AuEq*) over 0.68 meters within a broad mineralized zone grading 15.26 g/t Au and 20.05 g/t Ag (15.50 g/t AuEq*) over 66.50 meters.

That style of mineralization is a lot younger and it’s cross-cutting everything and the gold shows up as VG [visible gold], so native gold and the silver is in the wall rock, which you see down at the silver end, so there’s a bit of a mixing going on there and the age of that is probably more like an Eocene, so that’s much younger, but it is a known mineralizing event within the Golden Triangle.

RM: I think Goliath Resources LTD (TSX.V:GOT) has just done some age dating and their mineralization is a lot younger than the Jurassic that Dolly has there.

The last two news releases that concern the operational side were step out drilling at Homestake and drilling expanding Homestake.

Dolly Varden Silver Intersects 93.95 m of 357 g/t AgEq including 9,422 g/t AgEq over 1.02m expanding Homestake Silver High-Grade Trend

Dolly Varden Silver’s Step-Out Drilling at Homestake Ridge Discovers New, High-Grade Gold Zone: 79.49 g/t Au over 12.45m, including 1,335 g/t Au over 0.68m

Can you do a quick summary of 2023?

RvE: Kitsault Valley is a huge project, getting back to the bird’s eye view, it’s going to be made up of a number of deposits, like I pointed towards Torbrit as 50-60 million oz size and we’re trying to find these different basins and looking for another Torbrit.

Wolf is starting to approach the size of Torbrit, we have a couple more steps before we get to Homestake Silver, it’s being made a little more difficult because it’s hard to look through that sedimentary layer.

We’ve been able to combine exploration drilling with near-resource drilling so we’ve focused in on the wider and higher-grade intervals. At Wolf, we’ve defined plunge of about -45 heading to the west, so we’ve been concentrating on that and we’ve been working on expanding out and finding out the size of that higher-grade wider plunge and that’s something we’ll continue this coming-up season.

In the case of Homestake Main when we first got it, the big thing was to prove the continuity, right? That was the biggest risk when we took it on because it was always these narrow high-grade breccias and these feeders coming up. We started doing oriented core, which had never been done at Homestake, a structurally controlled deposit. From that and the infill drilling we figured out the orientation and defined a low-angle plunge to that wider, higher-grade area.

We now know it’s a bend in the structure and it ends up creating more of these fluid pathways similar to Wolf. Obviously we like the high-grade feeders, 20-gram to 40-grams gold over 30 centimeters to 50 centimeters, even up to a meter but we would like to be able to take things that are 15 to 30 meters wide by combining a bunch of these narrow high-grade feeders, and include the wall rock, so we can go to that larger-stope underground mining.

We figured out the orientation at Homestake Main and than our focus in 2023 was to go to Homestake Silver and do the same thing we did at Homestake Main. We used the geometry that we learned at Main because they’re basically along the same sort of structure.

Now we’re getting 357g/t silver over 93 meters, that’s a significant width, I mean even at true width it’s probably 45 meters wide and again it includes these high grades of 2,800 grams per tonne silver-equivalent and this silver-equivalent is just precious metal so it’s only the gold and silver component.

We just started defining that same higher-grade, wider plunge, you have more of these feeders that kind of overlap and you can take the whole width so this season coming up 2024 we’ll be continuing to work down that projection of that plunge.

RM: Just to switch gears a little bit, awhile back in our talk you said that there’s often in these scenarios a porphyry driving the distal mineralization, the silver and then over the heat engine, the driver of the mineralization, you would have the gold deposit. You consolidated and managed to get the Big Bulk copper porphyry project.

RvE: The Big Bulk, prior to the consolidation, has had a lot of work done on it in the last three years especially by the BC Geological Survey as well as UBC students doing their masters they dated it and came up a model, it’s within the Texas Creek intrusive suite-aged rocks so it’s the same intrusive event as KSM.

The part of the model that the BCGS has come up with, they’re saying Big Bulk, relative to the mineralization in the Kitsault Valley, is similar to KSM and the mineralization at Eskay Creek. Meaning that those porphyry intrusives are what’s driving the mineralization. We have a lot of evidence that these events don’t just occur as a single intrusive, and there is a number of intrusive’s along these huge regional trends.

We have indications that there could be a similar type of intrusive off to the west of Homestake Main by just looking at alteration temperatures and indicator elements.

That idea of another Big Bulk-aged intrusive off to the west is extremely interesting but the most important point to us is that the Big Bulk Dolly Varden has is mineralized. It has copper and gold mineralization, Libero did some drilling two years ago on the southern end, the part that we just acquired and they assayed 100 meters of 0.3 percent copper-equivalent, borderline economics right now but with these porphyries you have to have the whole thing to put the model together to find out where your alteration shells are, your mineralization shells are.

We’ll be doing that compilation and getting some drill targets ready for either late this season or early next year.

RM: We have an entire mini sub-basin from the so important Eskay Rift period.

RvE: Yes, now that we have these properties consolidated, we have a mini sub-basin of all the different styles of mineralization that you see up in the main part of the Golden Triangle.

Goliath is on the next fold over so they’re only 10 kilometers west of us so it’s all part of a mineralized system in its own right, it’s just now getting a lot more eyes on it. And Dolly’s CEO, Shawn Khun Khun done a great job of getting the story out there, it’s been here the whole time it’s just putting it together.

Being able to raise money gives us the opportunity as geologists to test out more theories because we have more meters that we can now drill, which means successfully expanding out deposits, making new discoveries, and it’s given us the density of data to be able to come up with these theories of where the highest-grade, wider intervals are.

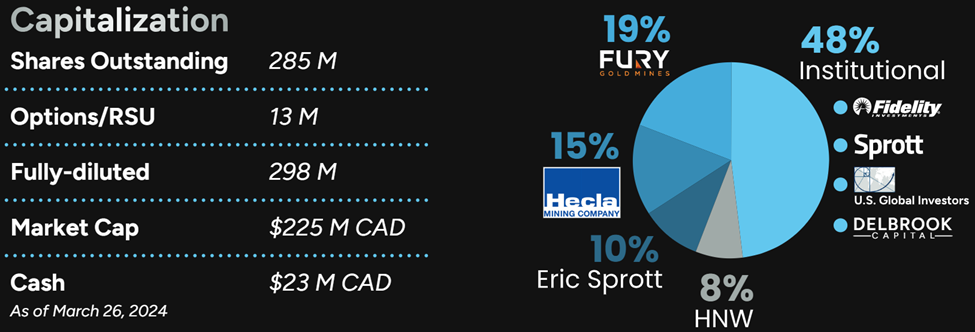

RM: What I like about this is it’s not just Dolly Varden. We looked at the bird’s eye picture in Dolly Varden, and this project, but really if you fly a little higher and look, Dolly Varden is part of what is a district play in the area. I mean people talk about Hecla (HL:Z) looking at Dolly Varden, taking pieces of private placements and maintaining their interest, and that’s awesome but there’s a bigger picture at play here.

When you start to think about Goliath Resources, and others, being in the picture I naturally start thinking about a major miner coming in, and not slighting Hecla in the least, but I start to think about the more this develops, the more work that’s done in the area, I think about a major niner coming in to consolidate the entire district.

RvE: Yeahexactly, and I mean that is why Hecla is here and don’t forget that not only did they up their stake in us they’re now at 15%, but they do own a very large land package, almost three times the size of Dolly Varden, all the way down to the south. It is because they are looking at the big picture, they see this also as a whole mineralized trend. They’re getting more and more interested, we meet with their VP Exploration and go over what we have planned.

We listen to their messaging, they don’t tell us what to do but we do listen to what they like to see and we’re getting closer to what needs to be seen but like you say that consolidation, we started it on a smaller scale by consolidating Dolly Varden with Homestake Ridge and now consolidating Big Bulk and so we’ve made it easier for a major be it Hecla or someone else to start coming in and you know doing the next step in consolidation.

The consolidation was a no-brainer, it needed to be done because we’re not talking huge deposits like KSM these are Torbrit size,about 50-60 million oz siver deposits, if we could find a couple more of those and then Homestake Main and Homestake Silver so it’s a number of deposits, high-grade underground that will benefit from being consolidated and under one ownership and then you can start employing that hub and spoke model idea where you’re feeding a number of these deposits into a central mill and processing area.

RM: Let’s talk about that more. Hub and spoke mining offers many different options, there’s and old permitted millsite, deep tide water access, we’re not land locked at all.

RvE: We have a number of options that we’re looking at in conjunction with the exploration work we’re doing.

We have ongoing studies about hub and spoke-type models and one of the studies that’s been announced was by Blackwolf Copper and Gold (TSX.V:BWCG).

BLACKWOLF SIGNS MOU WITH TWO ADDITIONAL COMPANIES TO STUDY VIABILITY OF HUB AND SPOKE MILL COMPLEX AT A PERMITTED SITE AT KITSAULT, BC

We have a letter of intent with New Moly because they are rehabilitating the old Kitsault molybdenum mine and they have a permitted mine site on tidewater. There’s no mill or anything there, everything’s been removed, but the value is that it is a permitted site it’s been cleared it is sitting there and they’re going to rebuild the mill and so to add on a gold circuit or a silver circuit and have us feed into that would be very cost-effective right?

It’s not only cost-effective in terms of your capital cost but the timeline for permitting is non-existent, it’s already permitted and less of an environmental footprint too with a central processing area.

The Nisga’a are very involved, they are the first nation’s people whose traditional territories we’re on, they’re very keen on seeing that central processing thing at Kitsault as well. We work pretty closely with the Nisga’a and they are involved and have equity in it, so they have ownership of this whole thing they would be partners basically so that helps move things forward.

There’s other hub and spoke ideas that we’re looking at, one would be trucking it down the existing road to tidewater and just barging in around to Stewart and using the Premier mill or even going out east there’s a route of forestry roads that we’ve been looking at that joins up with Hwy. 37 which would be only about a 20-kilometer road build and then trucking it around to Premier, so that’s the advantage of having smaller higher-grade deposits is that it’s not like a big open-pit copper-gold porphyry system.

RM: This all ties in with what we’re talking about with not just Dolly Varden but with more of a regional expansion. One central processing plant on tidewater with a permitted mine site already there and let’s not forget that Teck’s Red Dog mine barges everything. They mine when they can in the summer and they barge everything out to ships and take it down to Vancouver. It’s a very viable idea and it’s already in practice, so there’s obviously a need for it.

RvE: Yeah exactly and it’s nothing new, Dolly Varden was doing it 100 years ago, they were transporting their ore down to tide water and then barging it over to Anyox, Anyox was the hub in the ‘20s, you know they had a full mill and smelter there that’s long gone now but it’s basically revitalizing that plan and barging is the cheapest mode of transportation I mean they barge dimension stone down from Alaska to California, that’s how inexpensive it is.

RM: Yeah AOTH’s been pounding the table for a refinery up in the Golden Triangle for over 20 years I’ve been in the area numerous times and I still don’t understand why we don’t have one of Teck’s hydro-met smelters up there. I just don’t get it but you know we’re a tiny little voice in the wilderness when you start talking about stuff like that.

RvE: Yeah, but you know it’s becoming more of a possibility because we’ve got some weight behind us now in terms of being in in with Fiore Group. I mean we’re still separate from it but just the interaction with capital and talking about these big ideas there’s lots of things going on here we’re part of it.

And Goliath is part of that whole hub and spoke idea, they are on that letter including Blackwolf and their Niblack project. Anything on tidewater that’s high grade and can be thrown onto a barge is viable to bring in. Kitsault might just become that next hub.

RM: Dolly Varden was silver, when I started talking about the company a few years ago it was silver and we were going to increase the silver, we did. Then we take over Homestake we’ve basically become “Dolly Varden Silver and Gold,” our resource is 50-50 gold-silver, that’s important.

RvE: While we do have gold, lead and zinc, we still call ourselves a silver company. Right now our resources are value-wise approximately 50% silver and 50% gold, but the thing that’s helped us, especially in the last couple of weeks is that silver component is quite unique. Finding a clean, pure silver play outside of Latin America in a safe jurisdiction is rare so we get, imo, a lot more leverage on that as silver prices go up.

But we have that gold component which is that stable component when metals prices go up so we’re getting a sort of a double whammy. We have much more leverage using just the precious metal equivalent (Silver + Gold = PM Eq, no base metals – Rick). This is based on our last resource estimate, which was done in 2019, where we have approximately a million ounces in in all categories of gold and about 63 million ounces of silver, all categories.

RM: Are we looking at another resource update coming soon?

RvE: The way we do things has been beneficial, but on the other hand it ends up taking more time. Every season we’re combining exploration and testing new targets, as well as expansion, and a little bit of infill. Since the last resource we’ve drilled 100,000 meters, but that’s split between the four main deposits, plus the exploration drilling, so not all that goes into the resource update, we will be doing at least another summer of drilling, 2024, before we look at doing a public release of a resource update.

RM: Is your drilling thisyear aimed at consolidating, placing some of the holes a little closer together?

RvE: At least a third of our drilling is dedicated to exactly that because at Wolf we have drilled some large step outs, 100 to 200 meters, last year we did do some in-between drilling but that’s just basically along the centerline.

What we have to do now is step outs from those centerline holes and yes you’re right we will be decreasing our distance trying to get as much mineralization into the next geological model as possible which we’ll use to constrain the block model.

RM: Tell us about using directional drilling.

RvE: This year we are going to be using directional drilling. We can drill through the sediment with one 300 meter “mother hole” and from it we can peel off several holes. It costs a little bit more but you’re saving re-drilling that 300m for every hole, if you can do five splays off the mother hole that’s a huge savings.

But the big thing is that we can be more specific with our targeting. If we have two holes that are 50 meters apart we can split them, get exactly 25 meters in the middle because in this environment if you hit a different rock type or something like that and you’re just drilling straight it can deviate a little bit.

The 10% of holes that decide to deviate, decide to go somewhere else, means you can end up 10 meters from one hole and 40m from the other, that’s a waste of time, money and resources. We will use directional drilling and do that infill in the most efficient way possible.

RM: Directional drilling is used a lot in O&G

RVE: The oil industry pioneered it, they would have a single vertical hole but then they might want to go horizontal. I’ve used it in the past in South Africa drilling Bushveld, where it had a 250-meter sediment cover, similar-type thing to what we see at Kitsault.

The Waterberg project with Platinum Group Metals was very similar, everyone assumed that the Bushveld platinum mineralization just kind of curved off to the west but it went underneath the sedimentary cover and did exactly the opposite, went east, so the point is we drilled these mother holes and then did five splays, so you just get more sample intensity and then you don’t have to redrill 300m caps so that’s why we’re using it here is to save the drilling through that sedimentary layer and then pinpoint our pierce point on the vein.

RM: I think we’ve covered everything what do you think? Do you want to add anything, do you think we missed anything?

RVE: Our plans for 2024 are to continue following up on discoveries that we had last year, and continue to define those higher-grade plunges as well as hitting some of these exploration targets. So 2024 into ‘25 will be a good mix of results coming out, hopefully some new discoveries and expansion of these wider higher-grade zones.

We’re getting an earlier start as we’ve had a very low snow year so the barge will be going up at the beginning of May as opposed to near the end of the month. We should be drilling a few weeks earlier than other years because of that less snow.

RM: Thank you for doing this Rob, an hour or so out of your time that we very much appreciate here at Ahead of the Herd, it’s always great talking to you. You know we never said it before but congratulations on the success of drilling under the sedimentary cap, it’s opened up an awful lot of territory and given us a hell of a payback in just a relatively few drill holes.

RVE: Thank you. I’ve got a good team, working with the young geologist with fresh eyes was the one who saw the trend at Wolf and said “let’s go under the sediments and drill.” You’ve got to listen to everybody who’s in on the project, it’s a team effort.

Dolly Varden Silver

TSXV:DV, OTC:DOLLF

Cdn$0.92, 2024.03.05

Shares Outstanding 284.6m

Market cap Cdn$261.8m

DV website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Dolly Varden Silver (TSX.V:DV). DV is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of Dolly Varden

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.