Pampa Metals seeking major copper discoveries along the prime mineral belts of Chile

2021.09.17

When it comes to copper mining, there’s no better place than Chile.

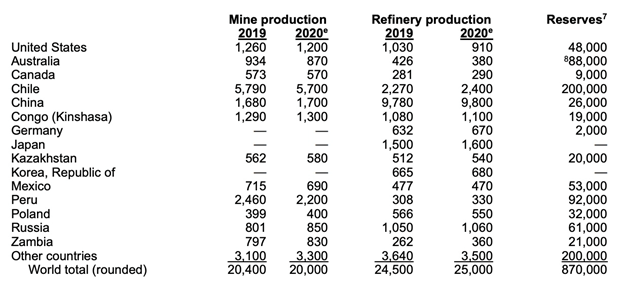

The South American nation is by far the world’s biggest copper producer, as well as an important miner of gold and other minerals.

Three of the top five copper mining districts are found in the northern Atacama Desert, home to world-class, copper-rich mineral belts that host the planet’s biggest mines. In fact, four of the leading copper mines (by production) are in Chile.

Despite a turbulent year caused by the covid-19 pandemic, Chile still managed to churn out 5.7 million tonnes of copper in 2020, accounting for over a quarter of global output. Its copper production more than doubles that of Peru, the next highest producer.

Production of refined gold, mostly as a byproduct of copper mining, also came to a healthy 1.4 million ounces.

Chile is an ideal elephant copper deposit hunting ground for the big-name major and mid-tier mining companies. Boasting the biggest copper reserves worldwide, at 200 million tonnes, means Chile’s dominance isn’t waning anytime soon,

Chile has a long mining history that pre-dates the Spanish Colonial era. The Incas exploited placer gold in northern Chile prior to the arrival of the Spanish. Besides gold, indigenous people mined native copper, producing copper jewelry and weapons. The use of copper in Chile has been traced to 500 BC.

Gold, silver and copper were exported directly to Spain in the 18th century. Following silver discoveries in 1811 and 1825, the North Chico mountains north of La Serena were exhaustively prospected. A silver find at an outcrop 50 km south of Copiano attracted thousands of prospectors and generated significant wealth.

By the start of the 19th century, minerals were being extracted from “Norte Chico”, or the former provinces of Atacama and Coquimbo. The mine known as “El Tofo”, exploited since 1870, was the most important iron mine of its time, operating the first electric railroad in South America to transport the ore to seaport. This led to construction of Chile’s first railway in 1851, which linked the city of Copiapo with the new port of Caldera.

Investments in Chilean mineral exploration peaked in the mid-1990s and declined until 2003. Major discoveries during this period included Escondida, Toki, Candelaria, El Penon, Gaby Sur, Pascua Lama and Spence.

Northern Chile has some of the largest copper and gold deposits in the world, formed from a combination of factors, but generally associated with intrusive-extrusive magmatism and tectonic activity on the western boundary of the South American plate.

Several metallogenic belts developed, reflecting changes in the tectonic setting and igneous activity. They include the Miocene High Cordillera Belt, the Mid-Terciary Domeyko Cordillera Belt, the Paleocene Central Belt, the Mesozoic Coastal Belt and the Overlap Paleocene and Domeyko Belt.

The long, continuous Andean Copper Belt extends from central Chile to Peru and southern Ecuador. Along this belt, Chuquicamata and El Teniente are the largest deposits; also very important are El Abra, Quebrada Blanca, Collahuasi and Cerro Colorado in the north, and Escondida, El Salvador, Potrerillos, Los Palambres, Rio Blanco, Los Bronces (Chile), and El Pachon (Argentina) in the south.

Around 80% of Chilean copper production comes from copper-gold porphyry deposits, with most situated in northern Chile. These porphyries, which are also rich in molybdenum with silver by-products, provide the ore for some of the world’s most prolific and highest-grade copper mines.

Among the largest are Chuquicamata, Escondida and El Salvador.

Naturally, given northern Chile’s copper riches, some of the mining industry’s largest red-metal producers have flocked to the region. Chilean state-owned Codelco operates El Teniente, the world’s largest underground copper mine, along with Chuquicamata, the second deepest copper mine on Earth and one of the largest open-pit mines.

Other major copper miners, who have undertaken significant exploration and production, include BHP, Freeport McMoran, Rio Tinto and Antofagasta Minerals. The latter has four operating mines in Chile including its flagship Los Pelambres in the Coquimbo region.

Escondida, owned by BHP, Rio Tinto and a Japanese consortium headed by Mitsubishi, is the largest copper mine in the world (and the largest producer of copper cathodes and concentrates) while Collahuasi, another top Chilean copper mine, is jointly owned by Anglo American, Glencore and Mitsui.

Located at an altitude of 3,000 meters in the Atacama Desert of northern Chile, Escondida came on stream in the late 1990s and has a 58-year mine life, as of 2018.

Grades are an important part of the reason why Chile provides 25% of the world’s copper supply.

Chuquicamata hosts 690 million tonnes grading 2.58% Cu, sulfide ore grades at Escondida are between 0.2% and 1% Cu, and El Salvador has proven and probable reserves of 535Mt grading 0.68% Cu. This compares to an average grade of 0.4% Cu for copper mines in British Columbia, for example.

Pampa Metals Corp.

In recent years, there has also been an influx of junior miners looking for the next big copper discovery in Chile.

Of the companies that fit this profile, few are as promising as Pampa Metals Corp. (CSE: PM) (FSE: FIRA), which controls a 100% interest in eight exploration projects prospective for copper and gold in northern Chile.

These projects (Arrieros, Block 2, Redondo-Veronica, Block 3, Block 4, Cerro Buenos Aires, Cerro Blanco and Morros Blancos) are all located along the proven mineral belts of the Atacama region, including the Central Paleocene and Domeyko belts that have dominated the world’s copper production.

As shown on the map above, five of those projects are situated along the mid-Tertiary porphyry copper belt of northern Chile — the Domeyko Cordillera — that is host to three of the world’s top five copper mining districts at Collahuasi, Chuquicamata and Escondida (the world’s biggest).

The remaining three are located in the heart of the Paleocene mineral belt, which hosts a series of important porphyry copper deposits and mines such as Cerro Colorado (BHP), Spence (BHP), Sierra Gorda (KGHM & Sumitomo) and Relincho (part of Nueva Union – Teck-Goldcorp).

Note that many, but not all, porphyry deposits in Chile (and worldwide) occur in clusters, and brownfields exploration once a discovery is made can be very productive.

The northern Chilean Atacama Desert extends from the Peruvian border into Peru, down to somewhere north of Santiago; most of the principal mining districts in Chile are located in this sparsely populated, desert area. The main exceptions are the large copper mines (El Teniente, Los Bronces, Andina, Pelambres) to the east of Santiago.

The northern desert is characterized by elevated ranges of mountains, separated by relatively flat, piedmont-gravel-filled “pampas” that conceal the underlying geology. A rough estimate would suggest that at least 50% of northern Chile is covered by pampa deposits. One might consequently deduce that half of the likely mineral deposits are thus concealed by pampas.

These areas remain underexplored because they contain a layer of gravel, 30-50m thick, that was deposited after the formation of the porphyries.

Notwithstanding the important discoveries noted above, there are still very large areas of untested pampas in northern Chile that have potential to conceal important mineral deposits.

The main copper porphyry and related discoveries under cover in Chile are:

- Ministro Hales (formerly Mansa Mina) — Codelco —discovered 1990 to 1992 (brownfields exploration along West Fault from Chuquicamata. Original drill intercept in 1978 not followed up)

- Concealed by about 50m of post-mineral pampa deposits.

- Ujina / Collahuasi — Anglo American/ Glencore and others — discovered 1991 to 1993 (exploration program, including important geophysics, in the Rosario/ Collahuasi District, including Rosario and Ujina deposits — directed by Chevron/Shell/ Falconbridge joint venture)

- Fringing leached capping at Ujina exposed at surface, but copper mineralization obscured and concealed by thin gravels and about 70m of young, post-mineral volcanic deposits.

- Spence — BHP — discovered 1996 (greenfields grid-drilling program in large pampa areas — original discovery by Rio Algom)

- Concealed by 4m to 145m of post-mineral pampa deposits.

- Gaby Sur — Codelco — discovered 1996 (greenfields exploration program)

- Concealed by 10m to 70m of post-mineral pampa deposits.

- Toki Cluster (five discrete but closely spaced deposits) — Codelco — discovered 1999 to 2006 (brownfields/ greenfields exploration drill programs that outlined the five deposits)

- Concealed by 40m to 200m of post-mineral pampa deposits

- Pampa Escondida (sandwiched between Escondida and Zaldivar mines) — BHP/ Rio Tinto and others — discovered 2006 to 2007 (brownfields exploration drilling in the giant La Escondida district)

- Concealed by 10m to 130m of post-mineral pampa deposits and leached capping

- 25 years between original Escondida discovery and Pampa Escondida discovery, with the latter located <1 km from the Escondida open pit.

All of these deposits are large and some are world-class. Ministro Hales, Ujina, Spence and Gaby Sur are all important mines in Chile. The Toki cluster is not yet a mine, but will likely become a mine, or a series of mines, in the future history of mining in the Chuquicamata District, Likewise, Pampa Escondida is not yet a mine, but will provide multiple decades of future production to the La Escondida District at some point.

Outcrops in the pampa areas of the northern Chilean Atacama Desert are rare, however if found, they can display similar characteristics, in terms of geology and hydrological alteration, as copper porphyry deposits. Pampa Metals’ game plan is to first conduct surveys to find the outcrops, and then sample and drill them.

Brief descriptions of Pampa Metals’ properties are as follows:

Arrieros

The Arrieros property is located about 25 km south of the mining town of Calama, in the center of one of the most geologically productive segments of the principal northern Chile copper belt.

The project is along trend and approximately 43 km due south of the Chuquicamata mining complex (Codelco) and some 37 km northeast of the giant Esperanza copper mine and related deposits in the Centinela copper mining district (Antofagasta Minerals/Marubeni Corporation).

Covering an area of approximately 14,000 hectares, Arrieros is currently the largest project under Pampa Metals’ copper exploration portfolio.

Redondo-Veronica

The Redondo-Veronica project is centered about 150 km east of the coastal port city of Antofagasta, covering a total area of approximately 5,000 hectares.

Redondo-Veronica is situated along trend and approximately 40 km north-northeast of the giant Escondida copper mine and other related copper deposits in the district (BHP, Rio Tinto, Antofagasta Minerals and Barrick Gold).

Block 2

Block 2 is located approximately 120 km east of the coastal port city of Antofagasta. This 3,300-hectare property is along trend and approximately 45 km north northwest of the Escondida copper mine and other related copper deposits in the district.

Cerro Blanco

Cerro Blanco is located approximately 130 km southeast of the coastal port city of Antofagasta, with a total area of 6,500 hectares. The project is in a similar geological setting to, and approximately 200 km south-southwest of, the Spence (BHP) and Sierra Gorda (KGHM & Sumitomo) copper mines, and close to and along trend from both the El Peñon and Guanaco gold-silver mines.

Cerro Buenos Aires

Cerro Buenos Aires is located approximately 130 km southeast of the coastal port city of Antofagasta, covering 7,600 hectares of land. Like Cerro Blanco, it is in a similar geological setting to, and approximately 200 km south-southwest of, the Spence and Sierra Gorda copper mines, and close to and along trend from both the El Peñon and Guanaco gold-silver mines.

Block 3

Block 3 is centered approximately 170 km southeast of the coastal port city of Antofagasta. The property is situated along trend and approximately 50 km to 60 km south-southwest of the Escondida copper mine and other related copper deposits in the district. Total area of the property is 10,100 hectares.

Block 4

Block 4 is centered approximately 220 km south-southeast of the coastal port city of Antofagasta. The property is situated along trend and approximately 110 km south of the Escondida copper mine and other related copper deposits in the district. Total area of the property is 4,200 hectares.

Morros Blancos

Morros Blancos is located approximately 75 km east-southeast of the coastal city of Taltal, with a project area of 7,300 hectares. It is in a similar geological setting to, and approximately 320 km south-southwest of, the Spence and Sierra Gorda copper mines, and immediately east of the Amancaya gold-silver mine and close to the Guanaco gold-silver mine.

Altogether, these eight projects cover 59,000 hectares in the heart of Chile’s copper belts, making PM one of the few juniors with significant landholdings in a region dominated by major miners that are operating some of the world’s largest mines.

2021 Exploration Plans

Since its inception in late 2020, Pampa Metals has been rapidly self-funding exploration on projects with the greatest potential for copper discoveries, with detailed geological mapping already completed at the Redondo-Veronica, Cerro Buenos Aires, Block 3 and Arrieros projects.

Redondo-Veronica and Cerro Buenos Aires are currently the focus of a planned 4,000-meter reverse circulation (RC) drill program, which began in June 2021.

The Redondo-Veronica portion of drilling was completed in late July, with a total of 1,956 meters drilled in seven holes testing several targets that are characterized by a combination of geological, hydrothermal alteration and geophysical features previously interpreted to be representative of porphyry copper systems. One of those targets, Cerro Redondo Norte, has been the subject of historic drilling with unknown results.

Drilling has since been mobilized to Cerro Buenos Aires to test additional geological, geophysical and geochemical anomalies. Initial focus was placed on the Cerro Chiquitin area to the north, which is representative of a porphyry-type level of exposure.

In an exploration update this week, Pampa Metals announced that drilling at Cerro Buenos Aires has also been completed, with nine RC holes totaling 2,738 meters. Results so far have shown “highly encouraging indications of a porphyry system,“ the company revealed. Analytical results are still pending.

“Drill hole evidence suggests that the drilling to the north of Cerro Chiquitin is at the periphery of the principal area of interest and reveals quartz veinlets in the pyritic, propylitic halo to the alteration system. Most of the area of interest to the south of Cerro Chiquitin is covered by 40m to 85m of post-mineral gravel cover where the underlying geology is not exposed,” Julian Bavin, CEO of Pampa Metals, commented, adding that further work is required to focus in on this target area.

Could the outcrop at Cerro Buenos Aires be the tip of the iceberg, so to speak, of a large porphyry underneath? Drilling some deeper holes should reveal more about the geology and mineralization.

Austral Gold Agreement

While at early stages of development, Pampa Metals’ projects have had no shortage of backing due to the favorable geography and proximity to world-class mines.

Just months into its exploration campaign, the company signed an agreement with Austral Gold Ltd. (TSXV: AGLD) (ASX:AGD), a major shareholder (19.6% stake), to jointly develop the Cerro Blanco and Morros Blancos properties in northern Chile.

Cerro Blanco and Morros Blancos are considered two of the three “lithocap” projects within Pampa Metals’ eight-project exploration portfolio. Lithocap targets geologically represent the upper portions of potential porphyry copper systems, and, according to the company, often have significant precious metals potential.

Historical results to date at both projects suggest good potential for near-surface gold-silver mineralization possibly associated with deeper copper mineralization.

As a result of the company’s primary focus on copper and desire to advance its portfolio as rapidly and efficiently as possible, it is open to third-party investment in some of its key projects, including this transaction with Austral.

In this way, Pampa Metals is taking a “portfolio-focused approach”. For the company, this means exploring a property to a certain point, then partnering with a larger miner that can come in with deeper pockets and develop the project to production. Pampa Metals would retain a percentage of the project “carried to production”, which is a smart strategy for a junior to take. The company avoids the costly endeavor (and the years), of proving up a resource which in the case of porphyry deposits can take hundreds of drill holes.

Austral currently operates two gold-silver mines (Guanaco/Amancaya) in Chile, has advanced projects in Argentina, as well as an interest in the producing Rawhide gold mine in Nevada.

PM’s projects are located within 50 to 60 km from Austral’s flagship gold-silver mine and processing facilities at Guanaco in northern Chile. Additionally, Morros Blancos is located adjacent to Austral’s Amancaya gold-silver mine, which provides additional feed to the Guanaco plant.

Under the LOI signed in April, which was followed up with a definitive agreement in late July, Austral was granted an option to acquire up to an 80% interest in the two projects. In exchange, the Australian miner will make cash payments, exploration expenditures (at least $1 million in year 1 and $2 million in year 2) and cancel approximately 6% of Pampa Metals’ outstanding share capital) held by subsidiary Revelo Resources Corp.

Moreover, depending on results of a Bankable Feasibility Study (BFS) to be completed by Austral, Pampa Metals can become the project operator and earn back to an 80% interest should copper prove to be the dominant mineralization rather than gold — a win-win for both parties.

Shortly after closing the JV agreement, Austral last month initiated exploration activities at the Morros Blancos project, which is prospective for high-sulfidation epithermal gold-silver, located in the heart of the Paleocene mineral belt.

As mentioned, the Paleocene belt is host to many important gold-silver and copper deposits and mines, and this project is situated along a prolific segment of the prospective belt.

Conclusion

Under the current market environment, copper projects with great discovery potential simply cannot go unnoticed.

At present, the global copper industry is challenged by a lack of new projects and booming demand, and as a result, we’re seeing a supply deficit that is rapidly growing on a yearly basis.

Some forecast that the copper supply gap forecast could reach as high as 15 million tonnes by 2035.

Copper is one of the most important industrial metals with applications across many industries including manufacturing and construction, so its demand isn’t likely to wane barring any unexpected developments.

Plus, the metal is also set to play an integral role in the global drive towards electrification, given its increased adoption in electric vehicles and other energy-related infrastructure.

Copper prices in 2020 improved by more than 25%, then peaked at an all-time high this past May, showing continued strong support for the industrial metal that has been crucial to economic development since ancient times.

Pampa Metals is working in one of the most highly mineralized regions on Earth. Three of the top five copper mining districts are found in the northern Atacama Desert, home to world-class, copper-rich mineral belts that host the planet’s biggest mines. Four of the leading copper mines are in Chile, which alone produces a quarter of the world’s annual output.

The company has eight properties in its portfolio, most of which are within the “pampas” (plains).

These areas remain underexplored because they contain a layer of gravel, 30-50m thick, that was deposited after the formation of the porphyries.

There are still very large areas of untested pampas in northern Chile that have potential to conceal important mineral deposits. Above we detailed the main porphyry copper and related discoveries under cover in Chile.

All of these deposits are large and some are world-class.

Pampa Metals has a strong management team behind it with a solid record of capital-raising. The board and management carry more than 100 years of combined experience in the exploration and mining business, and with a track record of discovery and project development including multiple decades working in South America in general and specifically in Chile.

Some of the team have worked for large mining companies that are active in the region including BHP, Rio Tinto and Anglo American. This is a huge plus for a junior, because these individuals already have “the rolodex” for contacting the right people when it comes to cutting partnership deals or financings.

- Julian Bavin, M.Sc. – CEO, President, Director. 35 years experience. Ex-exploration director at Rio Tinto, living in Chile.

- Adrian Manger, CPA – Chairman, Director. 30 years experience. 20 years in executive and leadership roles with BHP, including the $US1 billion development of the Spence Cu mine in Chile.

- Timothy Beale, M.Sc. – 35 years experience. Director. Geologist, BP Minerals, RTZ, Rio Tinto, Hochschild and Anglo American, 20 years living and working in Chile, Argentina and Peru.

- Yannis Tsitos, M.Sc. – 30 years experience. Director. Physicist, geophysicist, explorer, deal maker. Former Business Development Manager with BHP (19 years).

The old mining/ real estate adage of “location, location, location” is evident here. Pampa Metals’ properties are all situated in a region with many mineralized belts and copper mining districts, which significantly elevates its chances of success. Further tipping the scales in its favor, is the “pampas factor” — the next monster porphyry could well be hiding under a layer of gravel cover.

With a high-quality portfolio of projects scattered across northern Chile, Pampa Metals might be on its way to becoming the next exploration success story in the world’s most fertile copper-producing country.

Pampa Metals Corp.

CSE: PM, FSE: FIRA

Cdn$0.40, 2021.09.16

Shares Outstanding 46.4m

Market cap Cdn$18.5m

PM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Pampa Metals Corp. (CSE: PM). PM is a paid advertiser on his site aheadoftheherd.com.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.