2021.07.14

Exploits Discovery Corp (CSE:NFLD, FSE:634-FF) is making excellent headway on its 2021 exploration program, having completed first-phase drilling at Schooner, one of five drill targets that have been identified in the Exploits Subzone of Central Newfoundland. Three of the targets host visible gold at surface with high-grade assays up to 194 g/t Au.

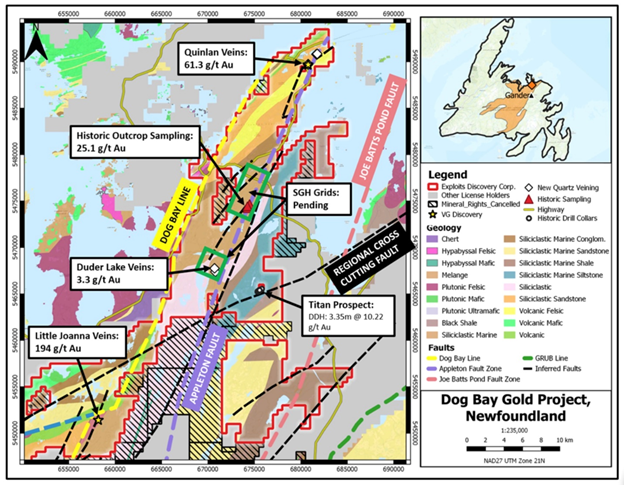

The company has mobilized the drill to its second target, the Quinlan Veins, where Exploits has an option agreement to earn a 100% interest by paying a combination of cash and shares to the claim owners. Quinlan is within Exploits’ Dog Bay project, one of nine properties in its Newfoundland portfolio, that have geological, geochemical and structural settings comparable to both New Found Gold’s (TSXV:NFG) Queensway project and Marathon Gold’s (TSX:MOZ) Valentine Lake deposit.

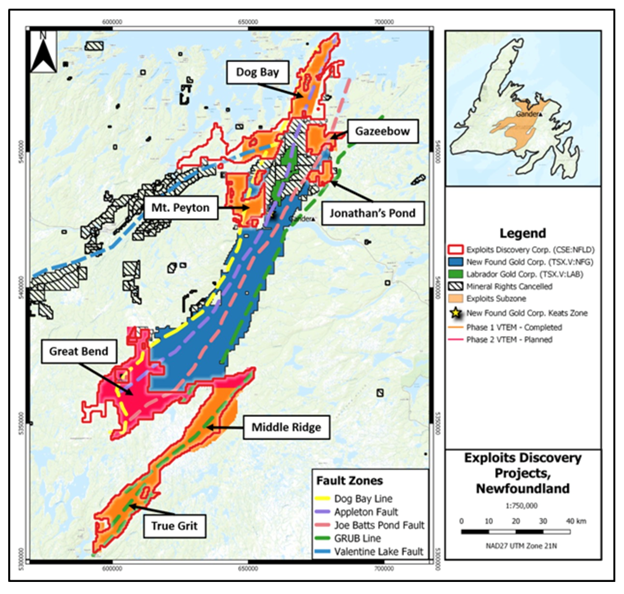

This ground includes over 40 km strike of the Appleton Fault, which hosts New Found Gold’s Keats Zone and Lotto Zone discoveries.

In fact, Exploits’ nine projects, when added together, form the largest land package ever consolidated in the Exploits Gold Belt Area Play, besting the likes of New Found Gold and Labrador Gold that are operating in the neighborhood.

In November 2019, thanks to exploration targeting supported by GoldSpot Discoveries’ (TSXV:SPOT) artificial intelligence technology, NFG announced one of the most significant drill results ever reported in the province at its Queensway project: a 19-meter intercept of 92.86 g/t Au. Since then, New Found Gold has gone public, made more discoveries, and now has around $1.7 billion in market capitalization.

The Exploits Gold Belt Area Play, which has been building on the momentum of NFG’s 2019 monster intercept, includes several junior exploration companies with much smaller market caps, for now. Among them is NFLD, sitting at just under $70 million. That is only 6% of New Found Gold’s capitalization today, with lots of room to grow on news and discovery.

Schooner

Schooner was the first high-priority target identified by Exploits, working in conjunction with GoldSpot Discoveries, whose machine learning algorithm has successfully processed billions of data points in some of Canada’s most prolific mining camps.

The Schooner Fault is parallel to the gold-bearing Appleton Fault which hosts NFG’s Keats Zone.

According to Exploits, the target is geologically similar to Keats, lying within the Davidsville Group of siliciclastic sediments with coincident historically sampled gold in tills over intersecting faults. The area was previously explored by Torq Resources, which released grab and till samples highlighting the grade and continuity of what would come to be known as the Schooner Fault.

This summer’s drilling focuses on a Schooner Fault splay, where the fault splits in two, and two secondary fault intersections.

According to Exploits, Phase 1 drilling at Schooner completed 2,400 meters in seven holes, and successfully intersected the primary and secondary structures defined through geophysics.

Core logging and sampling is underway, with first assay results expected within six weeks.

Quinlan Veins

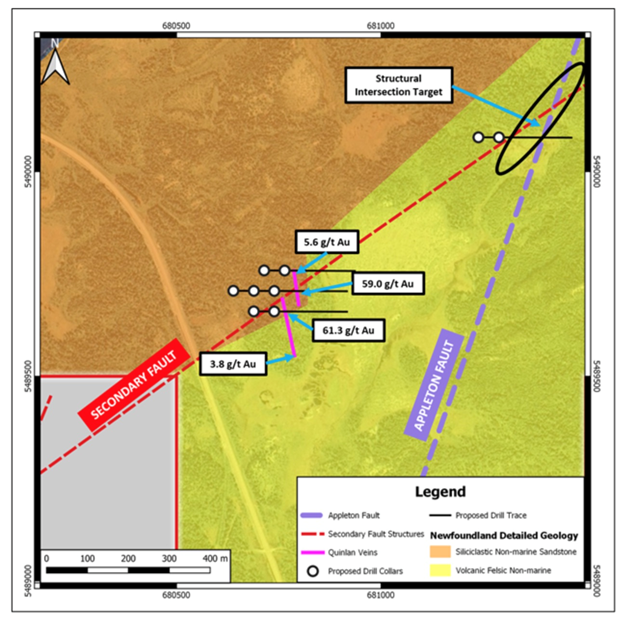

The Quinlan Veins prospect is located on a secondary structure splaying off the Appleton Fault. There are multiple 50-70 cm-wide quartz veins over a 25 meter-wide zone, currently exposed 5-20m in strike before diving under overburden. Visible gold was discovered as fine grains in crack seal fractures and as fine to coarse grains in the quartz veins. Trace sulfide mineralization is also present in the quartz veins as pyrite, chalcopyrite, galena, and sphalerite. The veins are milky white with sections of vuggy and crack seal textures, which are typical of epizonal, orogenic gold deposits. Structurally, the veins are situated within secondary fault structures associated with the Appleton Fault, that were highlighted by GoldSpot’s geophysical analysis.

First-phase drilling at Quinlan has already started, with a planned 2,400m in nine holes. The initial focus will be to test a secondary fault structure, associated with the Appleton Fault and the Dog Bay Line. According to Exploits, the sub-fault, which is deep-seated and visible gold-bearing, is closely associated with the secondary faults hosting New Found Gold’s Keats, Lotto and Knob zones gold discoveries.

Preparation work on the Quinlan Veins prospect has exposed the veins across 200m of strike length to the south, with mapping and sampling still ongoing.

“We are really pleased with the drill core we are seeing at Schooner and are looking forward to getting assay results, and returning for a Phase II program there later this summer,” said William Sheriff, Exploits’ Interim President & CEO, in the June 29 news release. He added:

“Quinlan Veins is one of our highest priority targets, with high grade visible gold outcropping at surface. We look forward to testing multiple intersecting structures at Quinlan, a number of which have visible gold in outcrop. This is only the second of five permitted targets we have slated for drilling along prominent structures in Newfoundland during the current campaign.”

The other three targets still to be drilled are:

- Little Joanna, which returned NFLD’s highest-grade visible gold in outcrop from quartz veins, averaging 30cm in width, uncovered up to 20m in strike, before disappearing under overburden. Sixteen samples from outcrop and subcrop at the Little Joanna Veins were taken with values ranging from 0.1 to 194 g/t Au. Five samples with visible gold returned assays of 194, 133, 123, 119 and 118 g/t Au.

- True Grit, adjacent to the GRUB line fault and has seen some historical drilling (including 0.60 g/t Au over 117m from surface) plus new VTEM geophysics and an SGH soil survey completed within the past five months. The soil and geophysical results indicate that the historical drilling was in the wrong orientation and missed the best targets.

- Jonathan’s Pond, about 30 km southwest from Little Joanna. Exploits consolidated its property here in late 2020 with land acquisition from New Found Gold, in exchange for 6.5 million shares, or 9.9% of the company at the time. This project has received the most historical work of any property in NFLD’s portfolio, with historical rock grab samples returning up to 29 g/t and 700 g/t Au. The property features a large, distinctive quartz vein exposed for over 200m, and is bound by the JBP and GRUB line faults. The company has also identified the JP Demagnetized Zone which stretches over 2 km, parallel to the structures known to host visible gold at the JP Veins.

Duder Lake & Titan prospects

In addition to the five drill targets, Exploits has identified two more prospects within its Dog Bay gold property — Duder Lake and Titan.

From a late 2020 sampling program at Duder Lake, located along the 30 km of Appleton Fault strike length within the Dog Bay project, 36 samples from outcrop and subcrop, along with 21 one-meter channel samples, were taken.

Twelve grab samples returned assay values between 1.0 and 3.3 grams per tonne gold, while assays up to 8 g/t Au over one meter were reported from channel sampling.

About 5 km east of Duder Lake, the Titan prospect hosts historical diamond drill hole WP-01, which returned 22 g/t Au over 3.35 meters and trenching results of 15.25 g/t Au over 3m.

Five hundred meters south of this drill hole, Exploits’ partner GoldSpot Discoveries found a large-scale, northeast-southwest trending fault that stretches from the Appleton Fault to the Dog Bay Fault.

According to Exploits, This new data suggests a new model for gold mineralization in the historic Titan Prospect drilling and trenching area, with a second airborne VTEM geophysical survey, in addition to Exploits’ southern projects, being planned to cover the Dog Bay Gold Project. The data will be processed by GoldSpot’s proven A.I. and data analysis technology which was the basis for New Found Gold’s Keats Zone discovery along the Appleton Fault Zone.

“The results from the Duder Lake Prospect continue to demonstrate the scale of mineralization along the 30 kilometres of Appleton Fault situated on Exploits’ Dog Bay Gold Project,” William Sheriff, interim president & CEO, commented. “We see potential for both focused high grade mineralization, such as the Quinlan Veins, as well as lower grade peripheral systems along this structural corridor. Our technical team at Exploits also continues to identify value in historically explored targets within the company’s projects, such as at the Titan Prospect, 5 km to the east. Reinterpreting the results with new ideas and data analysis techniques allows us to revisit these areas and expand on the first pass drilling that was only scratching the surface. These are the initial type of results seen by New Found Gold; it shows gold in the system and may represent larger scale lower grade deposits that lie peripheral or above the higher grade structures.”

VTEM survey

More geophysical survey data from which to generate new drill targets is now available to Exploits Discovery Corp, thanks to the first-phase completion of a VTEM (Versatile Time Domain Electromagnetic) survey.

The company on July 6 announced the first phase of airborne VTEM geophysics has been flown across the Dog Bay, Jonathan’s Pond, Mt. Peyton, True Grit and Middle Ridge properties, comprising 12,420 line kilometers.

According to Exploits, Final results are currently being processed for further target refinement and highlight new target areas to explore on the ground.

Geologists & prospectors in the field will follow up on newly generated targets through VTEM with mapping, rock and soil sampling, and detailed ground magnetic geophysics, building these new targets up to drill ready status.

A second phase of airborne VTEM geophysics will cover the Great Bend project which includes approximately 30 kilometers of the Dog Bay Line, 18 km for each of the Appleton and Joe Batts Pond Fault Zones, with New Found Gold’s till anomalies southwest of Eastern Pond trending towards the project along the Appleton Fault Zone.

“VTEM survey data allows us and our technical team led by GoldSpot Discoveries to pinpoint targets in a way that is impossible with traditional prospecting techniques,” said William Sheriff, Exploits’ interim president & CEO. “The speed at which we can analyze vast areas is unprecedented and gives our geology team discrete areas to visit for exploration and sampling. This is our competitive advantage in advancing new targets and moving Exploits quickly towards discovery.”

Conclusion

It seems to me that Exploits Discovery Corp has presented itself, and shareholders, with a number of very promising drill targets that all have the potential for a discovery hole. In mineral exploration, drilling is where the rubber hits the road, so to speak. The company is doing exactly what it said it would do, ie., systematically drilling the targeted areas, based on sound geophysical analysis, and sending the core in for assaying. This is just the beginning of what I expect to be an exciting summer for NFLD and I expect regular news flow as drilling milestones are completed and the assays roll in.

Exploits has a full treasury from which to draw from, with key shareholder Eric Sprott recently upping his stake in the company by 5%. Having purchased 6.7 million shares of NFLD on June 30, the billionaire resource investor now owns 21.4 million shares and 14.6 million warrants, for a controlling stake of roughly 21.3%. When Eric Sprott has skin in a gold junior’s game, and keeps buying shares, you know it’s onto something.

Exploits Discovery Corp.

CSE:NFLD, FSE:634-FF

Cdn$1.27, 2021.07.13

Shares Outstanding 100.6m

Market cap Cdn$106.1m

NFLD website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Exploits Discovery Corp. (CSE:NFLD). NFLD is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.