Renforth extends mineralized zone at Parbec, completes first hole at Surimeau

2021.07.08

Renforth Resources Inc. (CSE: RFR) (OTCQB: RFHRF) (FSE: 9RR) continues to deliver promising results from the 15,569m drill program carried out on its wholly owned Parbec open-pit gold deposit earlier this year.

Parbec – Additional Sampling

Last week, the company announced positive results of additional sampling of core from PAR-20-101, the second hole drilled in the program, creating one mineralized interval between 232.5m and 264m, a length of 31.5m which grades 0.69 g/t gold.

The additional sampling updates and joins the previously press released initial mineralized intercepts of 232.5 to 236.35m down the hole assaying 0.62 g/t gold, and 245.4 to 260.85m down the hole which assayed 1.48 g/t gold.

This extended interval commences at an approximate vertical depth of 164m, increasing the mineralization within the conceptual pit shell at Parbec, which accompanies the latest NI 43-101 resource estimate.

The May 2020 estimate will be updated upon receipt of all the results from the 2020/21 drilling, with 16 holes still to report upon.

Other Drill Results

Earlier in the month, Renforth also disclosed positive results for drill holes PAR-21-128, PAR-21-129 and restated the results for PAR-21-133. The restatement occurred due to an internal key punch error related to batch numbers.

PAR-21-128 was drilled as a downdip extension hole within the “Camp Zone” portion of the Parbec deposit, successfully extending mineralization seen in PAR-17-67, which assayed 26.5m at a grade of 0.64 g/t gold, downdip by approximately 80m vertically.

The downdip extension is expressed in two intervals, namely 12.6m of 4.39 g/t gold and 6m of 1.19 g/t gold, with incidental gold values between the two, which would allow interval continuity but result in a lower grade. The interval impacts the model positively as when modelling the mineralization can be extended between the two holes, Renforth says.

PAR-21-129 was a successful twin drill hole for PAR-88-42, drilled in 1988, which assayed 1.22 g/t gold over 12m as measured in the core box.

The corrected results for PAR-21-133 delivered a highlight interval of 12.5m grading 6.9 g/t gold, successfully twinning PAR-88-44, which assayed 6.32 g/t gold over 5.34m, in both instances as measured in core.

Most notably, within the highlight interval, PAR-21-133 gave the highest assay value yet drilled at Parbec, with 118.7 g/t gold over 0.35m.

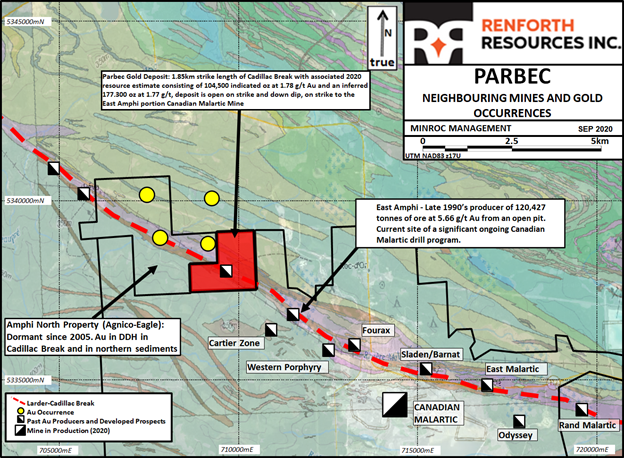

About Parbec Property

Parbec is an open-pit constrained gold deposit located in the town of Malartic, Quebec.

It sits on 1.8km of the Cadillac Break and is adjacent to the Canadian Malartic, Canada’s largest open-pit gold mine.

Parbec presently has an NI 43-101 resource estimate of 104,000 indicated ounces at a grade of 1.78 g/t Au and 177,000 inferred ounces at a grade of 1.78 g/t Au.

However, this estimate prepared in May 2020 is considered to be “out of date” by Renforth due to the results received so far from its recently completed 15,569m drill program.

This drill program was designed to twin, infill and undercut existing drill holes at Parbec to support a rebuild of the geological model and a resource estimate restatement, which is expected to be released in the coming weeks.

In addition to new data, Renforth intends to incorporate the results of 62 drill holes completed between 1986 and 1993 in the upcoming resource estimate, assuming that the lab results from holes twinned in the winter 2021 drilling support the inclusion.

These results were not used in the 2020 resource estimate.

Surimeau Project Update

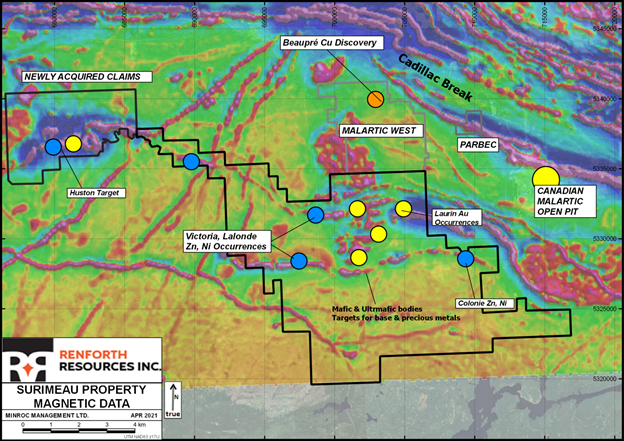

Elsewhere in Quebec, Renforth is also progressing with a drill program and field prospecting on the Surimeau district property, located south of the Cadillac Break.

Several current and former producing mines can be found in the area, including Iamgold’s Weswood mine and Agnico’s LaRonde (see map below).

This brownfield project was recently expanded with the acquisition of 81 claims covering 4,520 hectares, bringing its total area to 26,000 hectares.

The most notable addition was the Huston target located west of Renforth’s Surimeau target area. Huston was documented in the early 1980s as a privately held property which was subsequently acquired and drilled by Hecla Mining.

The Surimeau property already hosts numerous areas of interest, both sulphide nickel-rich VMS targets such as the Victoria West prospect, which is the company’s current exploration focus, as well as gold prospects.

Both the gold and battery metal targets are supported by historic findings and Renforth’s follow-up exploration.

Earlier this year, Renforth completed 15 drill holes in a 3,456m maiden drill program on the Surimeau property, drilling off 2.2km of strike within the ~5km long Victoria West target area.

The Victoria Target was last explored in the 1990s by LAC Minerals looking for gold. In addition to the presence of gold, which did not meet the criteria then used (in a much different gold price environment) for further development, LAC and previous operators determined that there were nickel, zinc and copper present, plus a few more minerals.

Renforth’s initial fieldwork validated the presence of the mineralization, and the company is now focused on determining the scope of the battery metals on this largely underexplored property.

June 2021 Drill Program

The ongoing drill program is planned for approximately 1,000m, likely to be four holes, drilled from the previously used drill pads located within the magnetic anomaly at Victoria West (the southern collar in each pair of holes), with the hole drilled to the north in order to attempt to obtain depth extension of the mineralization seen in the spring 2021 drilling.

In last week’s press release, it was announced that the first drill hole of the June 2021 program at Surimeau has been completed at a length of 237.7m.

This hole was drilled to the north from the drill pad used for SUR-21-12, which, like all the holes drilled in the April/May 2021 drill program at Surimeau, encountered visual mineralization. SUR-21-19 undercuts SUR-21-15.

The goal, which was met, for SUR-21-19 was to obtain a deeper intersection of the mineralization and structure observed in SUR-21-15. The drill hole intersected mineralization from 175.5-178.65m down the hole with 5-10% fine to medium grained disseminated pyrite and pyrrhotite.

The best (visual) bit is from 176-176.7m where there are fine clotty chalcopyrite stringers (5%), semi-massive pyrite and pyrrhotite (15-20%) and trace sphalerite.

The core will be sampled and sent for assay, to be reported on when results are received.

More drill holes are planned for June/July 2021 (indicated in green in map below), using pads cut for the prior 2021 drilling where each hole drilled over a 2.2km strike within the Victoria West target intersected visible nickel, copper and zinc sulphides.

The Victoria West target area is located within the western 5km of a 20km magnetic anomaly that hosts proven mineralization at either end, with the Colonie target area at its eastern end.

Victoria West is one of six polymetallic target areas on the Surimeau property historically documented as hosting mineralization, with several targets confirmed as mineralized and explored by Renforth.

Results are still outstanding from the April/May drill program at Victoria West, which was first drilled with 2.5 short holes in October 2020.

Unique Nickel Opportunity

What makes Surimeau intriguing is that unlike many copper-zinc VMS systems around the world, this property also happens to host an ultramafic sulfide nickel system at surface nearby.

While the scale of this nickel sulfide system remains to be seen, Renforth considers it to be representative of another “Outokumpu-like” occurrence, referring to a district in eastern Finland that is known for several unconventional sulfide deposits with economic grades of copper, zinc, nickel, cobalt, silver and gold.

Between 1913 and 1988, about 50 million tonnes of ore averaging 2.8% Cu, 1% Zn and 0.2% Co, along with traces of Ni and Au, were mined from three deposits in that district.

Historic surface sampling in the Victoria target area on the Surimeau property had values as high as 0.503% Ni.

Such findings were later supported by Renforth’s exploration team from grab sampling in summer 2020, which returned values up to 0.495% Ni.

Conclusion

2021 is gearing up to be a busy year of exploration and pending milestones for Renforth. Drilling results received to date have more than confirmed the upside of its two projects neighboring Canada’s largest gold mine.

And don’t forget that a maiden drill program was due to begin on a third project — Malartic West — which hosts a surface copper-silver discovery adjacent to the Canadian Malartic mine.

With about $1.7 million cash on hand and another $1.5 million in contingent payments coming in should Radisson Mining achieve certain milestones, Renforth has plenty of capital to make progress in its exploration activities for a significant period of time.

The company already has 281,000 ounces of wholly owned gold in “storage” (underground at Parbec), accompanied by a rare battery metals discovery yet to be comprehensively explored.

Further development (such as the new resource estimate for Parbec) this year may well elevate the value of these assets, drawing increased attention from the major industry players.

Renforth Resources

CSE:RFR, OTC:RFHRF, WKN:A2H9TN

Cdn$0.09 2021.06.01

Shares Outstanding 251m

Market cap Cdn$22.9m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Renforth Resources (CSE:RFR). RFR is a paid advertiser on Richard’s site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.