ZincX punches first of three holes into Cardiac Creek deposit

2021.07.05

ZincX Resources (TSXV:ZNX, FSE:M9R, US:ZNCXF) is off to a great start at its Akie property in British Columbia, where a 2021 drill program envisions three holes totaling 2,000 meters.

This week, the Vancouver-based junior announced completion of the first hole drilled into the Cardiac Creek deposit. The hole targeted the northwest area of high-grade core proximal to three historical drill holes, all of which yielded outstanding results, including 23.42 meters (true width) of 12.40% zinc (Zn) + lead (Pb) and 15.1 g/t silver (Ag); and 28.67m true width of 10.38% Zn + Pb and 14.2g/t Ag.

Drill hole A-21-155 intersected about a 28-meter-long section of core at the Cardiac Creek Zone, from a downhole depth of 558.56 to 586.80 meters.

According to ZincX, The Footwall Zone was intersected over approximately 8.75 metres from 593.45 to 602.24 and is characterized by a similar style of mineralisation to the Cardiac Creek Zone. A thin 1.5 metre massive sulphide lens enriched in pyrite, sphalerite and galena was encountered from 606.11 to 607.57 metres. The drill hole was terminated in Silurian siltstone at a depth 641.93 metres. A total of 147 samples including standard QA/QC samples will be collected from this drill hole and submitted for analysis.

The zone is characterized by thick beds of sulphides comprised of laminar pyrite and banded sphalerite. Locally the sphalerite bands display a well-developed “mottled” texture that is due to an enrichment in sphalerite with interstitial carbonate and quartz with galena. The sulphides are interbedded with the host black carbonaceous, siliceous shales of the Gunsteel Formation.

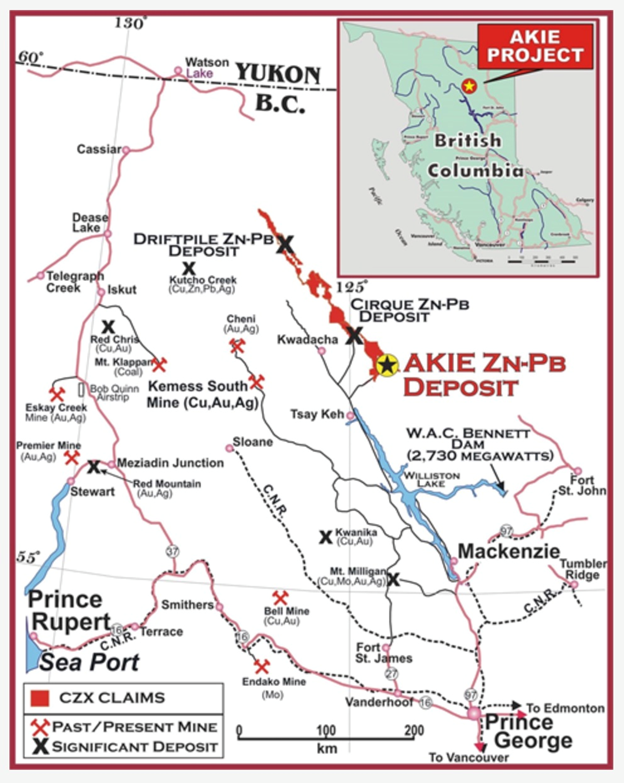

Akie property & Kechika Trough

ZincX’s Akie property is in northeastern BC, within a geological district known as the Kechika Trough.

The Kechika Trough is the southernmost area of the regionally extensive Paleozoic Selwyn Basin, known to be one of the most prolific sedimentary basins in the world for the occurrence of SEDEX zinc-lead-silver and stratiform barite deposits.

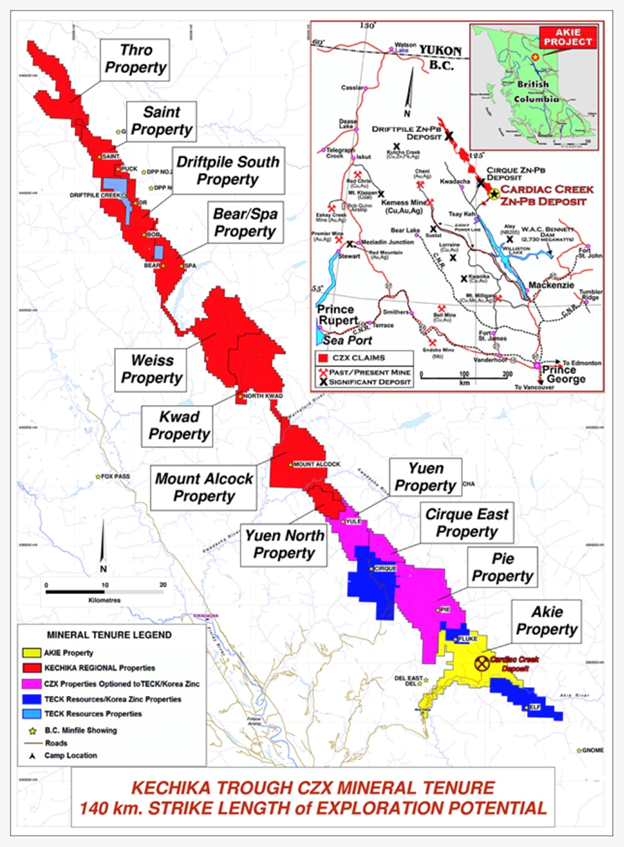

In addition to the Akie property, ZincX is looking to make more discoveries throughout the Kechika Trough region, having assembled as many as 11 other property blocks comprising 184 mineral claims covering approximately 682 square kilometers (together known as the “Kechika Regional Project”).

The property blocks (from south to north on the tenure map below), include: Pie, Cirque East, Yuen, Yuen North, Mt. Alcock, Kwad, Weiss, Bear/Spa, Driftpile South, Saint and Thro. The company owns 100% of eight blocks and maintains a significant interest in the Pie, Cirque East and Yuen properties with partners Teck Resources and Korea Zinc, both of which are prominent figures in the zinc industry.

Drilling on the Akie property since 2005 has directed ZincX to a significant body of baritic-zinc-lead SEDEX mineralization known as the Cardiac Creek deposit.

According to ZincX, Cardiac Creek is capable of matching, if not surpassing, the production of some of the largest zinc deposits found in the United States. Results from the 2018 preliminary economic assessment (PEA) support the company’s view.

The deposit contains an estimated 22.7Mt of indicated resources averaging 8.32% Zn (4.16 billion lb), 1.61% Pb (804 million lb) and 14.1 g/t Ag (10.3 million oz.) The PEA for Cardiac Creek contemplates a 4,000 tonnes per day underground mine capable of producing 178 million lb of zinc and 20 million lb of lead annually over an 18-year mine life.

The current 2021 drill program at Akie consists of three holes totalling approximately 2,000 meters, targeting specific areas of the high-grade Cardiac Creek deposit.

Additional drill targets and/ or exploration activity will be contemplated as budget and time constraints allow.

The primary objective of drilling is to acquire mineralized Zn-Pb-Ag drill core samples for advanced metallurgical testing.

This material will be used by ZincX to further investigate previous metallurgical testing, with a focus on enhancing the recoveries and boosting the concentrate grades for both zinc and lead. The work will be done at a metallurgical testing facility owned by Tongling Non-Ferrous Metals of China (Tongling), a key shareholder.

One of China’s largest smelting companies, Tongling is known for its deep pockets and an eye for high-upside projects. In 2009, Tongling, together with China’s second-biggest railway builder, bought out TSX-listed miner Corriente Resources for $680 million, and later led the consortium that put the $1.4 billion Mirador copper project in Ecuador into production.

As previously agreed, Tongling will fully fund the drilling and subsequent metallurgical test program. ZincX will manage the drill program on behalf of Tongling, which is expected to conduct the metallurgical test program at the conclusion of the 2021 exploration season. This testing is intended to enhance metallurgical work conducted and reported in the 2018 PEA.

When announcing the Tongling-designed drill program last year, ZincX Resources CEO Peeyush Varshney stated:

“Tongling is thoroughly familiar with the progress to date on the Akie property, including the 2017 metallurgical test program and the robust and positive results from the 2018 PEA. Tongling last toured the Akie property in 2018, and to this day recognizes the inherent value of the company’s significant prospective land package and the potential long-term district development opportunity.”

Conclusion

Given the current rate of consumption, it is projected that global zinc reserves — estimated by the US Geological Survey at 250 million tonnes — will only last another 17 years. The global zinc market has reached a critical stage where more mines are needed. But even if all the development projects come online at full capacity, industry experts think that won’t be enough to outpace demand.

As such, explorers like ZincX are facing a tremendous growth opportunity. Its Akie project is one of the premier global zinc projects in a top-tier jurisdiction (Canada was at one point the world’s largest zinc producer). Through the Cardiac Creek discovery, the company has demonstrated a high-grade, large-tonnage deposit that has expansion potential and even district-level prospectivity — via the Kechika Trough.

To us at AOTH, ZincX is trading at a deep discount to most its peers. Akie is a high-quality project with the size, grade, jurisdiction and exploration upside that I look for. And it’s one deposit not several smaller deposits.

The fact that Tongling, one of China’s largest smelting companies, has been heavily invested in the project for more than a decade, including bankrolling the current 2,000-meter drill program and metallurgical testing regime, says a lot. I’m eager to see how far the assays, once available, go in boosting the zinc concentrate grades and elevating the Akie project’s potential production value.

ZincX Resources Corp.

TSXV:ZNX, FSE:M9R US:ZNCXF

Cdn$0.17, 2021.06.30

Shares Outstanding 177.8m

Market cap Cdn$31.1m

ZNX website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of ZincX Resources Corp. (TSXV:ZNX, FSE:M9R US:ZNCXF). ZNX is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.