Magna restarts San Francisco mine, Mexico, targeting 90,000 oz per year

2021.07.01

Magna Gold (TSXV:MGR, OTCQB:MGLQF) said it wanted to be Mexico’s next precious metals producer. This week the company put its money where its mouth is by announcing commercial production at its flagship San Francisco mine.

Before getting into the nitty gritty production details, a bit of background on the restart project.

San Francisco mine

Located 150 km north of Hermosillo, the capital of Sonora state, the 47,395-hectare property consists of two previously mined open pits (San Francisco and Chicharra) and associated heap leaching facilities.

The mine was previously operated by Geomaque from 1995 through 2000.

In 2005, Timmins Gold (now Alio Gold) acquired the mine and processing equipment, and began commercial operations in 2010. Since then, the mine has processed more than 1.2Moz (over 100,000 oz per year on average), making it one of the most successful gold mining operations in recent history.

Looking to re-establish San Francisco as a profitable mine, in March 2020 Magna agreed to acquire the project for nearly 20% of its share capital.

“We have a simple business model; it starts with growing organically. We only acquire properties in near-term production that were either mismanaged or forgotten in previous years,” Magna’s President and CEO, Arturo Bonillas, said in a 2020 interview, adding that the San Francisco mine was “such a perfect match” for this operating model.

Last September, the company released an updated pre-feasibility study (PFS) on the property, showing total proven and probable reserves of 47.6 million tonnes, graded at 0.495 g/t Au, leaving 758,000 ounces of contained gold.

“The numbers were great. The study shows that we have 1.5Moz of resources in the ground. We have close to 800,000 oz of gold that we’re going to extract from the mine over the next seven years, at a rate of 70,000 oz per year,” Bonillas commented on the PFS results.

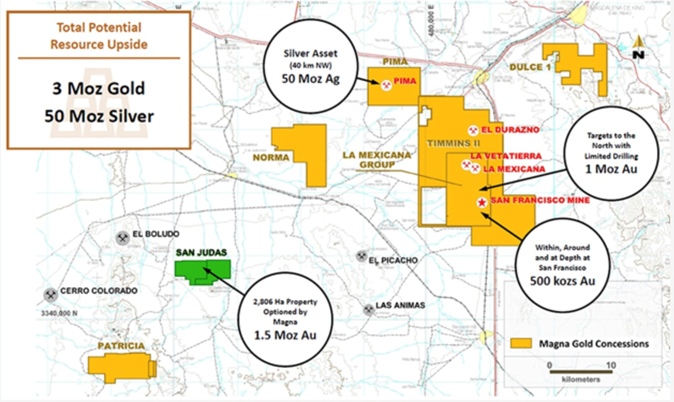

There is also ample room for resource expansion, with an estimated upside of 3Moz gold and 50Moz silver.

Magna restarted production in June 2020 from the open pit and in September 2020 from an underground portion.

Commercial production

According to Magna’s June 29 news release, full-scale commercial production was achieved on June 1, as scheduled, putting the company on track to reaching 2021 output guidance of between 55,000 and 65,000 ounces.

Magna anticipates a run rate of around 6,000 ounces per month in the third quarter, ramping up to ~7,500 oz/mo by the end of this year.

The company highlights the fact that it managed to lower the strip ratio from about 8:1 to 3:1, which is moving in the right direction towards the life of mine average of 2.5:1, with further reductions to the strip ratio anticipated, thus lowering costs.

New leach pads have been constructed and fresh ore is being stacked at a rate of 900 tonnes per hour. The expected recovery rate is ~70%, with further improvements anticipated over the remaining seven years of mine life.

“We are all extremely proud of the Magna team for achieving this tremendous milestone on schedule,” Bonillas stated in the news release. “Achieving full-scale commercial production in such a short period of time is a testament to the hard work and quality of our Mexico-based operations team and as a company, we have demonstrated our ability to execute on all our target deliverables. Production numbers are trending upwards month-to-month, and we anticipate exiting the year producing ~7,500 Au oz/month. We are continuing our systematic exploration efforts as we look to grow the Company into a mid-tier producer.”

A little back of the envelope map by yours truly shows the San Francisco mine at full capacity producing 90,000 ounces per year. Setting a minimum gold price of $1,700/oz, and a maximum of $1,800/oz, has the mine bringing in between $153 million and $162 million a year.

The prefeasibility study estimates total cash costs of $1,160 per ounce ($104,400,000 @ 90,000 oz/yr) yielding a profit of between $48,600,000 @ $1,700 gold, and $57,600,000 @ $1,800 gold.

2021 exploration

As mentioned there is ample room for resource expansion at the San Francisco mine, with an estimated upside of 3Moz gold and 50Moz silver.

Having recently secured a C$10 million private placement, Magna Gold plans to explore a number of its Mexican properties this year. The highlights are as follows:

- At its Margarita silver project, Magna plans to complete 10,000m of drilling for expansion exploration at depth at the Margarita vein system, and infill resource definition along strike. This is aimed to convert and expand the current inferred geological resource into M+I+I categories. In addition, the company plans 1,500m of drilling on the Mina del Oro target to define an initial gold and silver resource.

- At its San Judas gold project, Magna plans to conduct 5,000m of reverse circulation (RC) drilling and 1,000m of core drilling on four different targets. The San Judas property is located within the prolific Mojave-Sonora Megashear and 40 km west of the San Francisco mine.

- At its Veta Tierra gold project, the company is planning 2,000m of RC drilling to follow up on discovery hole VT14-002 (1.286 g/t Au over 33.85m including 22.40m of 3.26 g/t Au) from a drill program carried out in 2014. The objective is to potentially define a satellite open-pit target for heap leaching. Veta Tierra is located 4 km north of the San Francisco mine.

- Magna plans 3,000m of RC drilling to test the downdip extension of the discovery holes on four different areas and test new gold anomalies north of the La Pima silver project. The target at La Pima is limestone ridges approximately 2.5 km long with varying surface thicknesses from 40m to 10m. The Pima mine, West and North targets are the focus of drilling to test the continuity of this mineralization at depth.

- At Los Muertos, Magna plans to carry out extensive fieldwork to further define drill targets. The property is in the La Colorada district in Sonora, defined by hundreds of low-sulfidation epithermal-vein type historical silver-gold deposits and showings which remain largely unexplored.

Conclusion

Magna Gold has something you rarely see in a company its size: a producing mine. While most of Magna’s peers need to tap private investors and must frequently go to the public equity markets to raise funds for exploration programs, Magna has a cash-generating asset that just entered commercial production.

By my calculations the mine will book a tidy profit of between $48 million and $58 million, using PFS cash costs of $1,160/oz and setting a wide gold price range of between $1,700 and $1,800 per ounce.

A steady cash flow gives Magna Gold options. It can redistribute profits to shareholders in the form of a dividend, tighten up the outstanding shares float through share buybacks, keep exploring the surrounding properties to increase the San Francisco mine’s reserves and extend its life, or make acquisitions.

I’m pleased to see Magna Gold succeed in re-starting the San Francisco mine and I’m looking forward to the exploration upside on a number of projects where the company plans to drill and generate new targets this summer and fall.

Magna Gold Corp.

TSXV:MGR, OTCQB:MGLQF

Cdn$0.91, 2021.07.01

Shares Outstanding 89.4m

Market cap Cdn$81.4m

MGR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Magna Gold Corp. (TSX.V:MGR). MGR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.