Does China’s new trade pact with Asia foreshadow the end of the US dollar?

Globalization may have been invented in the 20th century, but China made it happen over 400 years ago.

In 1581, the Chinese emperor ordered citizens to pay their taxes in silver, putting the 4,000-year-old civilization at the very heart of world trade. It is hard to overestimate the ramifications of this decision, but it requires some explanation.

Beginning with the travels of Marco Polo in the 13th century, the rest of the world had become dazzled by the scale and sophistication of China.

In the 16th century, the country was at the apex of its imperial power, with the Ming emperors ruling over a quarter of the world’s population.

The Middle Kingdom encompassed more territory than any European country at the time, and visitors marveled at its impressive buildings — the Forbidden City was the largest palace complex in the known world — as well as how much control the emperor exerted over his citizens. China was seen as more advanced and sophisticated than Western Europe, the emperor was richer than the wealthiest European kings, and the Chinese thought of themselves as the hub of civilization.

But the Ming emperors had a problem: their tax system was extremely inefficient. Citizens were required to produce goods or perform labor as a form of taxation (eg. rice, silk, cotton), making it easy to dodge taxes. There were other issues too with the tax system. Goods were difficult to ship, and it was hard to measure the quality of the products paid to Beijing.

While the government had been issuing paper money, on and off, since the 11th century, the people had little trust in its value (sound familiar?) The government could not resist the temptation to offer too much paper currency, hence it became worthless. That explains the tendency of the Chinese to only trust metal, as a medium of exchange, and to place a high value on gold jewelry, bars and coins. (China in 2009 surpassed India as the largest gold consumer)

In 1500s China, the copper coin was the most reliable currency, but the problem with copper was its weight. The coins with a hole in the middle would be strung together in measures of 10 and 100. The impracticality of carrying heavy bundles of coins had citizens turning to silver, a much lighter and more valuable metal than copper. This change in society did not go un-noticed by a forward-thinking administrator, Zhang Juzheng. Then secretary to the Emperor, Zhang realized that without huge financial resources, the country could not be run.

Thus, in response to widespread silver usage, in 1580 Zhang boldly altered the tax system. His Single Whip Reform collapsed all the different kinds of labor and goods tax payments, into one silver payment. The most powerful government in the world was no longer financed by exchanges of wheat, rice, etc., but by single payments of silver ingots.

However, with a population over 100 million, now taxed in silver, China required unprecedented amounts of the white metal. With little of its own, Beijing had to look to the outside world, making the country dependent on foreign trade.

China soon exhausted Japan’s silver reserves, and the Single Whip Reform might have been a colossal mistake, were it not for the discovery, 36 years earlier, of silver in Peru – then a remote territory of the Spanish Empire. During the 16th and 17th centuries, over half of the world’s silver was produced from upper Peru (now Bolivia) including the rich silver mines of Potosi, named “Cerro Rico” or “rich mountain”. To mine the silver, the Spanish enslaved the indigenous population, and when their numbers had depleted, brought over slaves from Africa.

They found a ready market for South American silver in the Philippines, a region Spain had recently colonized. Low-level trade was already going on between Chinese junks on which goods sailed goods over from nearby Canton to be exchanged with merchants in Manila. Soon, thousands of traders were plying the waters between China and the Philippines, sailing on junks laden with luxury items like silk and porcelain, to trade with the Spanish for silver, which they carried back by the tonne to the Chinese mainland.

The silver pouring into China helped fuel an economic miracle in the Middle Kingdom; in fact the country’s reputation as the world’s manufacturer dates from this time, when China was making goods on spec for foreign buyers – in Europe and Spanish America.

The reason for this historical diversion? To point out that the original global economy was driven by China’s practically insatiable demand for silver, which at the time was worth more than gold. Moreover, the yearning for an earlier epoch is not lost on the current Chinese President, Xi Jinping, who believes his destiny is to revive China’s past glories, including being at the center of global capitalism – not through the trade in silver, but the building of regional trading alliances.

The Chinese leadership is also, without a doubt, keenly aware that the United States is presently vulnerable. With a lame duck president in power until January, an election that to some foreign observers is still unresolved (President Xi and Russian President Putin were among world leaders that did not call to congratulate Joe Biden), and an economy still weighed down heavily by the pandemic, China is taking full advantage by strengthening its trading relationships as it continues on its path to complete economic independence, without need for the United States or its symbol of economic hegemony, the US dollar.

The world’s largest trading block

The signing of a trade deal between China and 14 countries across the Asia Pacific region hasn’t won much press this week, but it is nonetheless a development we, at AOTH, consider extremely important.

Summing it up, the blandly named Regional Comprehensive Economic Partnership (RCEP) aims to boost commerce among its member states by lowering tariffs, standardizing customs rules and procedures, and widening market access especially among countries that don’t have existing trade deals.

Launched in 2012 and signed on Sunday, the RCEP is impressive in its scale: the 15 countries make up close to a third of the world’s population — roughly 2.2 billion people. With a combined GDP of roughly $26 trillion, the Regional Comprehensive Economic Partnership accounts for nearly 28% of global trade, based on 2019 data. The trading alliance is the world’s largest — bigger than the European Union and the revised NAFTA, now known, equally boringly, as the United States-Mexico-Canada-Agreement (USMCA).

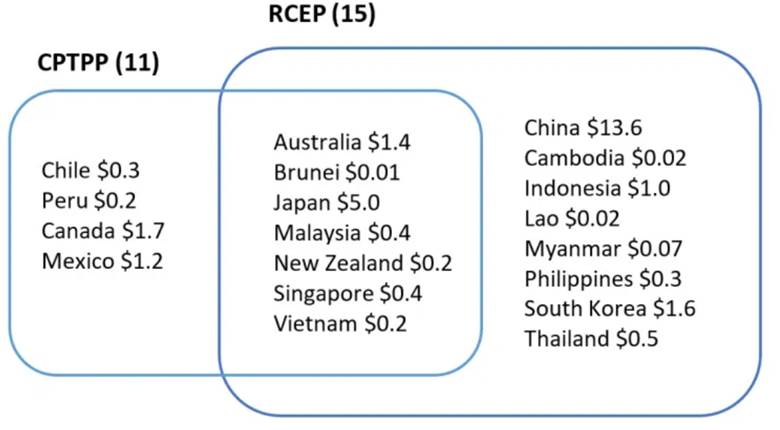

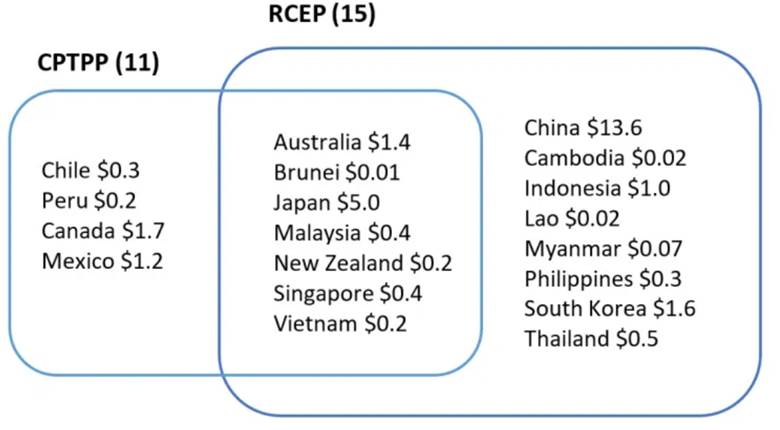

RCEP includes all 10 countries of ASEAN (Indonesia, Vietnam, Cambodia, Singapore, Malaysia, Brunei, Philippines, Laos, Myanmar, and Thailand) plus Australia, China, Japan, New Zealand and South Korea. India declined to join the pact due to concerns that the deal would hurt its domestic producers.

It is expected to eliminate tariffs and quotas on 65% of the goods that are traded in the Asia Pacific region, within 20 years. According to the Peterson Institute for International Economics, the deal could increase global national income by $186 billion annually by 2030 and add 0.2% to the economy of its member states.

US excluded

Most observers view the pact as an extension of China’s power, and a way to counter US influence in the region, which has diminished as a result of Trump’s “America First” policies including aggressive trade protections.

China wasn’t part of the Trans-Pacific Partnership (TPP), a trade agreement between Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, Vietnam, and the United States, signed in 2016. The US was, but then it wasn’t.

When President Trump pulled the US from the TPP in 2017, before a series of punitive tariffs were slapped on China and several US trading partners, Beijing saw an opportunity.

According to Al Jazeera, The [RCEP] accord is a coup for China, by far the biggest market in the region with more than 1.3 billion people, allowing Beijing to cast itself as a “champion of globalisation and multilateral cooperation” and giving it greater influence over rules governing regional trade, Gareth Leather, senior Asian economist for Capital Economics, said in a report.

China already had a number of bilateral trade agreements, but this is the first time it has joined a regional trading pact.

The Washington Post adds that China has been looking to further integrate itself with its neighbors as the Trump administration urged them to shun Chinese infrastructure loans and 5G technology… RCEP’s imminent implementation illustrates America’s diminished clout and could make it harder for U.S. businesses to compete in the vast region.

But the RCEP isn’t only significant for the fact that China is involved; many Asian exporters have been hurt by the US-China trade war, which has reduced demand for their goods and slowed growth. For them, the pact is a way of pushing back against US protectionism, which has become especially jarring under Trump.

Economists at HSBC reportedly said the agreement “signals that Asia keeps pushing ahead with trade liberalization even as other regions [ie., the United States] have become more skeptical.”

“It may reinforce a trend that’s been already underway for decades: that the global center of economic gravity keeps pushing relentlessly to the East,” they wrote in a research note.

In this respect, the timing introducing the world’s largest trading block is, shall we say, interesting. It comes as the United States engages the coronavirus in a “second-wave front”, in an epic battle to contain the global pandemic.

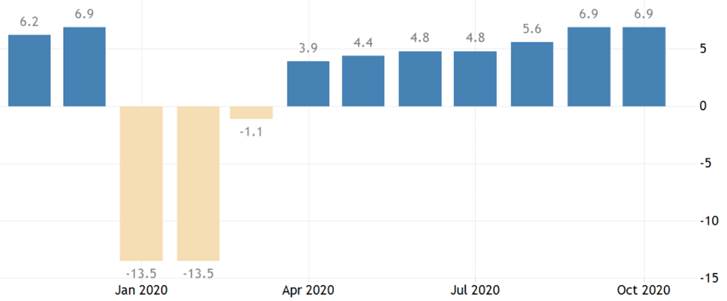

This is in sharp contrast to Asia’s biggest economies, which have managed to escape prolonged fallout from covid-19. Earlier this month, Japan reported its economy expanded 5% in the third quarter, allowing the world’s third largest economy to emerge from recession and expand at an annual rate of 21.4% – its fastest pace on record.

The same day, China released data showing that industrial production rose nearly 7% in October, while retail sales grew at a >4% clip, the most so far this year.

In a joint statement, the leaders of ASEAN said the deal “will play an important role in building the region’s resilience through inclusive and sustainable post-pandemic economic recovery process.”

One of the key questions is how the RCEP will affect the US-China trade relationship, especially with a Democrat set to move into the White House. CNN quotes Myron Brilliant, US Chamber of Commerce executive vice president and head of international affairs, saying that while America shouldn’t try to join the RCEP,

“The United States should however adopt a more forward-looking, strategic effort to maintain a solid US economic presence in the region. Otherwise, we risk being on the outside looking in as one of the world’s primary engines of growth hums along without us,” Brilliant added.

Indeed that is entirely possible; when the RCEP is combined with the renamed CPTPP, or Comprehensive and Progressive Agreement for Trans-Pacific Partnership, that leaves the world’s biggest economy out of two trade groups that span the fastest-growing region on Earth.

Most observers predict that incoming President Biden will take a softer tone on China than Trump. However, a Biden presidency may not roll back many of the US trade sanctions imposed on China by the Trump administration, given the lingering frustration with Beijing’s trade and human rights record, and accusations of spying and technology theft.

According to a recent analysis by CNN Business, Economists and trade experts believe that the United States and China will move further apart on trade and technology as Washington continues to scrutinize virtually every aspect of its relationship with the world’s second-largesteconomy.

“We have a fundamental, systematic rivalry between these two systems,” said Alex Capri, research fellow at the Hinrich Foundation and senior fellow and lecturer at the National University of Singapore. “In many ways, that rivalry is going to intensify.”

Spheres of influence

Of course, China’s attempts to broaden its “sphere of influence” in Asia go far beyond trade alliances, arguably the most benign of its soft-power overtures.

China has also projected economic heft through a series of mineral and oil acquisitions in Africa, Canada, the US, Australia and Latin America. The reason, of course, is to feed China’s insatiable appetite for commodities. As an example, the Chinese are both the largest producers and consumers of aluminum and iron ore.

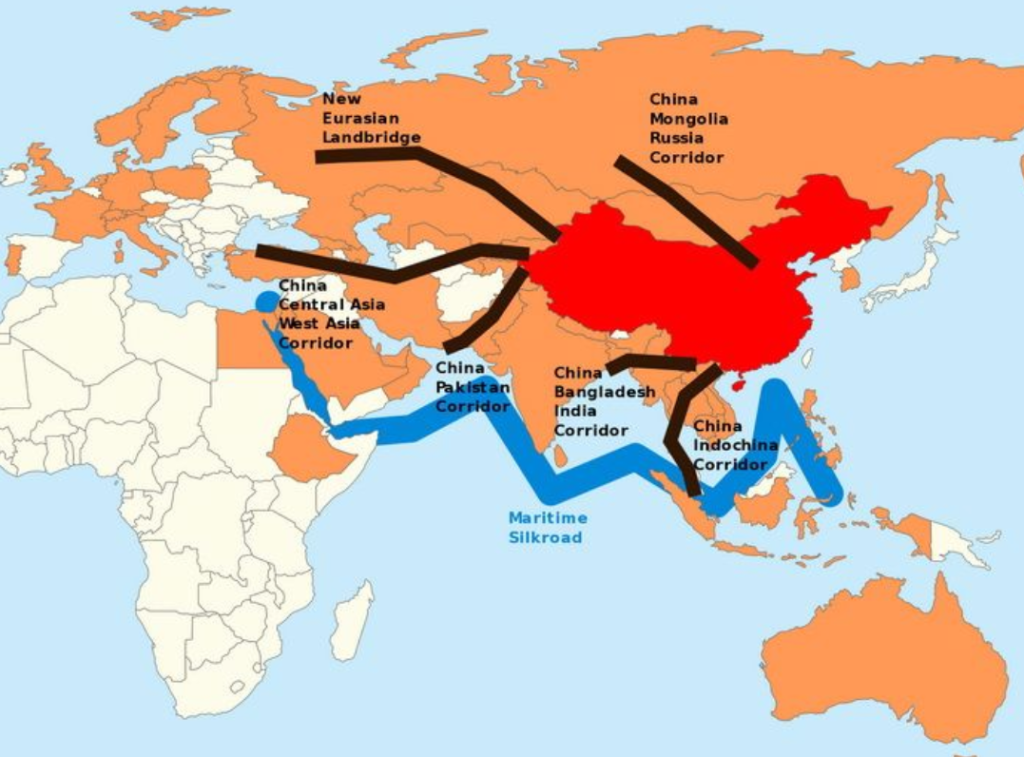

The enormous political, economic and cultural shift in China, from a developing agrarian society to a modern, urban one, has led to some remarkable developments, all of which are good for commodities. China’s Belt and Road Initiative (BRI) is a $900 billion program to open channels between China, its Central Asian neighbors and beyond, mostly through infrastructure investments.

BRI is seen by proponents as an economic driver of proportions never seen before in human history. It would not only allow Asia to relieve its “infrastructure bottleneck” ie. an $800 billion annual shortfall on infrastructure spending, but bring less-developed neighboring nations into the modern world by providing a growing market of 1.39 billion Chinese consumers.

Opponents argue that is naive and the real intent of BRI is to carve new Chinese spheres of influence in Asia that will replace the United States, in-debt poor nations to China for decades, and restore China to its former imperial glory.

The latter interpretation of BRI, particularly linkages between China’s industrial and military build-up, explains why Belt and Road is really a dangerous trojan horse hiding behind China’s territorial ambitions, that should be resisted, especially by vulnerable countries that are risking long-term debt servitude.

Beyond its borders, China long ago put a lock on much of Africa’s vast resources. More recently the most desired metals are those that feed into a tectonic global shift from fossil fuels to the electrification of vehicles. This has meant a hunt for lithium, cobalt, graphite, copper and rare earths – metals that are used in electric vehicles, of which China has become the world leader.

The most interesting part of this trend is not that China is acquiring mines and mining company stakes abroad – that has been going on for over a decade – but that the overt attempts to lock up the world’s mining and energy resources, some of which are critical to the future world economy, are happening under the nose of the United States in Latin America, in countries previously subject to the Monroe Doctrine (the US sphere of influence) and in one case, right in their own front yard.

Shifting alliances

Recognizing the Kremlin’s need to expand its influence in the face of US dominance, China has grown closer with Russia. Trade volumes are reportedly surging. In 2018 bilateral trade rose by >25%, moving past $100 billion for the first time. It should come as no surprise that Russia is a card-carrying member of Belt and Road.

Russia has been the top oil supplier to China since 2016. In 2019 the two Communist nations signed natural gas contracts equivalent to a third of Chinese NG imports. Novatek, a Russian gas producer, sold a 20% stake in Arctic LNG 2, a $25.5 billion project aiming to ship LNG in 2023, to two Chinese firms.

Belt and Road will likely increase and strengthen these connections.

For lighter reading, click here to learn about the bro-mance between two leaders for life – China’s President Xi and Vladimir Putin of Russia.

China has also reacted to US protectionism by reaching out to Europe. In 2018, China and Europe agreed to oppose protectionism and defend the multilateral trading system. China is Germany’s most important trading partner, in 2019 exporting US$108.32 billion.

The European Union is looking at ways to circumvent US sanctions on Iran, by working around the dollar payments systems – in effect setting up its own SWIFT SWIFT. (The Society for Worldwide Interbank Financial Telecommunications is the communications system used for transferring money between countries. SWIFT claims political neutrality, but has bowed to US influence in the past, blocking transactions to Cuba and Iran.)

“We must increase Europe’s autonomy and sovereignty in trade, economic and financial policies. It will not be easy, but we have already begun to do it,” DW quoted Germany’s Foreign Minister Heiko Maas, in 2018.

Besides Russia and Iran, Turkey is also cozying up to China. This past June, Turkey’s central bank for the first time allowed the payment of Chinese imports to be settled in yuan. The capability to do so was signed in 2019, under a swap agreement with the People’s Bank of China, amid global financial uncertainties and liquidity pressure on the the US dollar, according to Global Times.

Dollar’s demise?

We have written previously about the threat to US dollar supremacy. Because the dollar is the world’s reserve currency, the US can borrow more cheaply than it could otherwise (lower interest rates), US banks and companies can conveniently do cross-border business using their own currency, and when there is geopolitical tension, central banks and investors buy US Treasuries, keeping the dollar high and the United States insulated from the conflict. A government that borrows in a foreign currency can go bankrupt; not so when it borrows from abroad in its own currency ie. through foreign purchases of US Treasury bills.

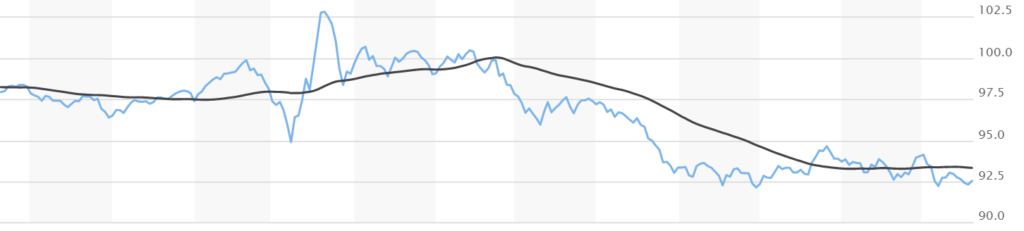

The dollar is still the reserve currency, but how important is it right now? The dovish response of the US Federal Reserve to the pandemic, in keeping interest rates near zero and blowing its balance sheet beyond $7 trillion, through the purchase of Treasuries and mortgage-backed securities, not to mention the trillions in covid-19 rescue funds spent by the federal government, has a growing chorus of analysts suggesting that the greenback’s status as world currency is in jeopardy.

When the pandemic went global in March, the dollar strengthened on the back of safe-haven flows into US Treasuries. By May, all those gains had been erased, as the US Federal Reserve poured trillions worth of liquidity into financial markets.

The dollar’s two-year low against the euro in July prompted many headline-writers to herald the end of the buck as the world’s reserve currency. What we can say is that the dollar is likely to be pressured, so long as the United States battles the coronavirus, with further depreciation likely even if the economy starts to recover.

According to a September article in International Banker,

[T]he US could lose all of those perks as a weak coronavirus response, long-term persistence in implementing quantitative easing (QE) and ultra-low interest rates, and concerted drive to encourage higher inflation all conspire to threaten the dollar’s hegemonic influence around the world. Goldman Sachs, for instance, issued a stark warning that the dollar is in serious danger of losing its reserve-currency status. The US bank’s concerns are primarily related to the massive monetary injections into the economy by the Federal Reserve, the balance sheet of which has now topped a staggering $7 trillion thanks to the reintroduction of its quantitative-easing policy as well as the fiscal stimulus provided by Congress.

Conclusion

The Trump administration thought they could back China into a corner by hitting it with hundreds of billions worth of tariffs, but what it has found instead, is that China has options. It can pivot to Europe (China is Germany’s biggest trading partner), or it can continue to do what it’s doing, carving a huge sphere of influence in the East through its ties with Russia and 60-odd countries through One Belt, One Road, and now, through a new 15-nation regional trade agreement, the largest in the world, called the Regional Comprehensive Economic Partnership (RCEP).

If China is at war with the US economically, and maybe even militarily if things get out of hand in the South China Sea (or even North Korea), why would it keep buying its Treasury bills? If China slows or stops buying US T-bills, how will Washington be able to finance its $27 trillion debt?

Could this happen? Maybe not right away, but the end of US dollar hegemony is like a snowball at the top of a hill and starting to roll down, becoming larger and faster along the way. We already see moves underway to diversify away from the dollar. It’s happening in Europe, which is trying to create its own SWIFT system on inter-bank transfers, and it’s happening with all the cooperation between China and Russia, Iran and Turkey, who are signing agreements denominated in their own currencies – thus bypassing the US dollar.

China would be more than happy to see the dollar lose its reserve currency status and have everybody trade in their own currency and let the IMF set the rates. The yuan joined the Special Drawing Rights (SDR) club in 2015 so the structure is already set up for this to happen. (To understand how SDR works, watch this video).

And China is working to gradually make the yuan more international by opening up its financial markets. In a recent report, Morgan Stanley wrote that increased foreign investment into China could boost usage of the yuan, to becoming the third largest reserve currency in the world – behind only the USD and the euro. Although the yuan only accounts for about 2% of global foreign exchange reserve assets, Morgan Stanley analysts predict it could rise to between 5% and 10% by 2030, surpassing both the Japanese yen and the British pound, CNBC reported.

The bottom line is this: No currency lasts forever. The British pound sterling was top of the currency heap for most of the 19th century and the start of the 20th, but it eventually gave way to the dollar. The greenback has enjoyed exorbitant privilege for over 100 years, if you go by the establishment of the Federal Reserve in 1913. It may be time to move over and let natural economic forces take over.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security.

AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.