Max’s exploration success at CESAR project comes right as copper enters “super bull” territory

2021.05.24

Energy and precious metals explorer Max Resource Corp. (TSX.V: MXR; OTC: MXROF; Frankfurt: M1D2) continues to make significant progress at its flagship CESAR project in northeastern Colombia, along what is considered to be the world’s largest copper-producing belt in the Andean.

Last week, the company reported more promising assay results from the copper-silver project, increasing the area of the newly discovered CONEJO zone at the CESAR North target by a substantial 500% — six times its previous size!

The high-grade CONEJO discovery was announced by Max in early March. The CONEJO zone spans 1.6 km by 0.6 km, is open in all directions, and lies along the CESAR North Kupferschiefer-type sedimentary exhalative (sedex) copper-silver mineralization in the region.

At the time, the discovery was considered to be a new type of copper mineralization related to the sediment copper-silver system, but hosted in an igneous (volcanic) unit, which enhanced the company’s steadfast belief of CESAR as a district-scale project with several pulses of mineralization.

Expanded CONEJO Zone

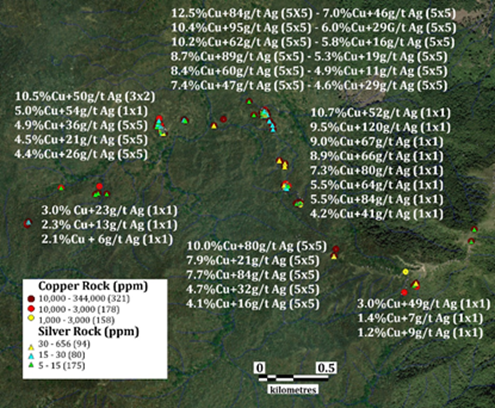

The latest set of assays expands the CONEJO zone to an area covering 3.2 km by 1.6 km. It remains open in all directions, lying along the mid-portion of the 80 km long CESAR North copper-silver belt.

Summary of the new assay results is as follows:

- Highlights of 3.0% copper and 22.6 g/t silver over intervals of 1.0 m by 1.0 m rock panels

- Ten rock panel samples returned values above 1.0% copper

- The CONEJO discovery returned values above 5.0% copper from 23 rock panels varying from 5.0 m by 5.0 m to 1.0 m by 1.0 m

- A total of 66 panel samples returned values over 1.0% copper

According to the Max exploration team, the CONEJO mineralization occurs both as a stockwork of cross-cutting fractures and as disseminated mineralization hosted in igneous rock. Observed minerals include; chalcocite, native copper, cuprite and copper oxides. Epidote is commonly associated with the copper mineralization (see figure below).

“Newly discovered in March of this year, and although early stage, CONEJO appears to have scalable potential. Systematic mapping is now underway to determine both the density and orientation of the mineralized structures,” Max CEO Brett Matich commented in the May 10 news release.

Meanwhile, the company is eagerly awaiting assay results from another new discovery, the URU zone located 30 km to the south, where the mineralization is “very similar” to that of CONEJO, Matich said.

In early April, Max reported the URU zone discovery lying along the southern portion of the CESAR North belt. The presence of copper mineralization extends over 3.7 km and is open in all directions. Over 125 samples were collected and sent for analysis, with results expected this month.

Fifth Discovery at CESAR North

Over the past 18 months, the Max team has significantly extended the CESAR North target area, consisting of multiple new discoveries spanning over 80 km of strike, demonstrating a district-scale sediment-hosted copper-silver system.

The most recent discovery, called the SP zone, was announced in late April. Following the aforementioned CONEJO and URU discoveries, and the AMS and AMN discovery zones of 2020, SP became the fifth copper zone discovered along the continuous copper belt at CESAR North.

The SP zone is located 8 km northeast of the CONEJO copper-silver discovery, along the mid-portion of the CESAR North belt. At first pass, it lines up well with the four previous copper discoveries.

The SP zone, currently represented by mineralized float, is being followed up with mapping and geochemical sampling to locate the source of mineralization. Results of soil and rock sample analysis are expected in June.

Earlier Discoveries

AMN Copper-Silver Zone

Reported in March 2020, the AMN discovery zone (previously named AM North) outcrops along 1.8 km, including a high-grade zone, with highlight values of 34.4% copper and 230 g/t silver.

The company has since expanded AMN into a 29 km² area of Kupferschiefer-type copper-silver mineralization.

AMS Copper-Silver Zone

In January 2020, Max made its very first stratabound copper-silver discovery at the CESAR project. The AMS zone, originally named AM South, is located 40 km south of AMN, with horizons exceeding 5.8 km of strike length.

The AMS zone has now been expanded to 16 km² of Kupferschiefer-type copper-silver mineralization, and is still open along strike and down dip, with highlights of 5.8% copper and 106 g/t silver from 0.1 to 25-metre intervals.

Encouraged by these discoveries made on the CESAR project, Max chief executive Brett Matich recently stated:

“Over an 18-month period, Max extended the CESAR North zone to over 80 km in length. Initial assay results for URU and SP are pending, but considering a CESAR target copper grade of 1%, with highlight values of 5.8 to 34.4% copper and 106 to 205 g/t silver from CONEJO, AMS and AMN, the overall district-size-scale potential for the CESAR basin has clearly been demonstrated.”

Matich also pointed to the high-price environment for commodities — especially copper — as well as the state of the global copper market being key factors driving the CESAR project’s development.

“Currently at $9,898 a tonne, the copper price is approaching the all time high of $10,170 a tonne, and combined with projected upcoming copper deficits, CESAR’s large-scale prospectively makes Max an extremely attractive opportunity for copper exposure,” he said.

Copper: “Superbull Market”

As Matich puts it, there could not be a better time for miners to make new copper discoveries.

Copper – an essential ingredient in our infrastructure, electronics, automotive and energy systems – has emerged as a leader in today’s commodity bull market, with demand growing relentlessly amid a global drive towards a “greener economy”.

Over the past 12 months, copper prices have nearly doubled as major economies – led by top consumer China – continue their spending spree on renewable energy and electric vehicle infrastructure. Copper equities, too, have been outperforming the broader market by a wide margin.

The market is showing no signs of slowing down either. In the past weeks, we’ve seen the red-hot metal continuously set new highs, after crossing the $10,000/t mark for the first time in a decade.

Still, some analysts believe that the copper bull market has only just begun.

Earlier this year, before the recent record highs, Trafigura Group said it expects the metal to reach as high as $15,000/t in the coming decade as demand from global decarbonization produces a deep market deficit.

Even in the early stages of the covid-19 pandemic, the world’s biggest copper trader was betting on copper to rebound in 2021 and breach $10,000 – which it has now done – and expects a longer-term range of $12,000-$15,000 over the next ten years.

Those at Goldman Sachs, Citigroup and Bank of America share a similar sentiment. Goldman analysts predicted copper prices to hit $10,500 within 12 months, while Citi sees it reaching $12,000 next year in its bull-case forecast.

In April, analysts at Bank of America said in a note that “copper could spike to $13,000 a tonne in coming months, partially over low inventories.”

Just recently, Wall Street natural resource investment house Goehring & Rozencwajg Associates went a step further by joining the “superbull” camp, stating that the fundamentals of today’s copper market are even more bullish than the super-cycle of the early 2000s.

In their latest market commentary, the Goehring & Rozencwajg managing partners wrote:

“We would not be surprised to see copper prices again advance a minimum of seven-fold before this bull market is over.”

Goehring & Rozencwajg is also projecting copper prices to reach north of $30,000/t, using early 2016 as a starting point, when copper prices were at their trough.

Mined Out Copper

As the forces behind copper’s growing demand are well documented by others, Goehring & Rozencwajg based most of their analysis on the supply side.

In particular, the report mentions stagnating supply as a key factor pushing “copper prices far higher than anyone expected.”

According to Goehring & Rozencwajg, the number of new world-class discoveries coming online this decade “will decline substantially and depletion problems at existing mines will accelerate.”

Also, geological constraints surrounding copper porphyry deposits, a subject few analysts and investors understand, will contribute to the problems, the report said.

The authors also believe depletion isn’t a new phenomenon, but rather a trend that began some 15 years ago and quietly took its toll on the industry over the years.

While Academics, engineers and investors could debate all day about what constitutes a depletion problem, the report brings up the irrefutable fact that both ore reserves and quality of ore mined around the globe are “in pronounced declines.”

Investigating a comment made by Freeport-McMoRan CEO Richard Adkerson that “investors did not appreciate the depletion problem quickly taking hold”, the authors modelled 115 copper mines representing 80% of global supply outside of China and found that their head grades had started to decline. That was in 2005.

By 2015, the industry’s head grade was already 30% lower than in 2001, and the capital cost per tonne of annual production had surged four-fold during that time — both classic signs of depletion.

Although the industry had been adding copper reserves easily, and global output hardly missed a beat for a number of years (i.e. major mines coming online), the underlying problem has only been masked by miners through a simple maneuver of re-classifying waste rock into mineable ore.

In general, copper companies add reserves in one of two ways: 1) by making new discoveries; or 2) lowering the “cut-off” grade of their existing reserve base, which is nothing more than the minimum grade needed to make a unit of rock economic to extract at a certain price in a projected mine plan.

Since nearly 80% of the industry’s gross new reserves booked between 2001-2014 did not come from new discoveries or new copper zones near existing deposits, as the report finds, it was natural to conclude to link most of the new reserve additions to lower cut-off grades.

Evidently, the average cut-off grade in 2014 was sitting at 0.25%, down from 0.4% in the early 2000s, as calculated by the authors.

This was a worrying sign, as brownfield expansions have been the biggest contributor to global copper reserves. The major copper mines, despite being able to maintain their production levels, are now facing declining reserve and head grades (the prime example being Chile’s Escondida mine).

“The reason the distinction of how reserves are being added is ultimately so important is that there is a natural limit on how far you can lower your cut-off grade. In other words, below a certain cut-off grade, the cost and complexity to produce copper begin to grow exponentially,” the authors stated.

According to the Goehring & Rozencwajg model, the industry is “approaching the lower limits of cut-off grades,” and brownfield expansions are just no longer a viable solution.

“If this is correct, then we are rapidly approaching the point where reserves cannot be grown at all,” the report concluded.

This report also shines a light on the importance of making new discoveries in establishing a sustainable copper supply chain. Over the past ten years, greenfield additions to copper reserves have slowed dramatically, with tonnage from new discoveries falling by 80% since 2010.

Conclusion

A dearth of new discoveries during the yesteryears may be finally catching up to the global copper industry.

There’s a general expectation that copper prices will reside in “bull territory” next ten years. This is not only a manifestation of the metal’s growing demand, but also the severe supply problems that the mining industry has mostly overlooked.

Not to mention, the prospect of stricter regulations and higher taxes in top producer Chile has the entire industry on alert, which could serve as another obstacle in expanding the world’s dwindling copper supply.

With that in mind, new copper discoveries including those at CESAR could prove to be invaluable.

It’s also unusual to see a company make this many discoveries in such a short span of time, let alone a style of mineralization related to Poland’s Kupferschiefer deposits — the 6th largest copper producer in the world.

Max Resource Corp.

TSX.V:MXR, OTC:MXROF, Frankfurt:M1D1

Cdn$0.23, 2021.05.24

Shares Outstanding 90.6m

Market cap Cdn$20.8m

MXR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resources (TSX.V:MXR). MXR is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.