Renforth continues to report high grades from Parbec drilling ahead of upcoming resource update

2021.05.22

With a new resource estimate on its Parbec project in Quebec imminent, Renforth Resources Inc. (CSE: RFR) (OTCQB: RFHRF) (FSE: 9RR) has kept on delivering exciting results from the second phase of drilling completed during winter 2021.

Winter 2021 Results

PAR-21-127

This week, the company gave investors more good news by announcing the results of PAR-21-127, the first hole drilled in 2021.

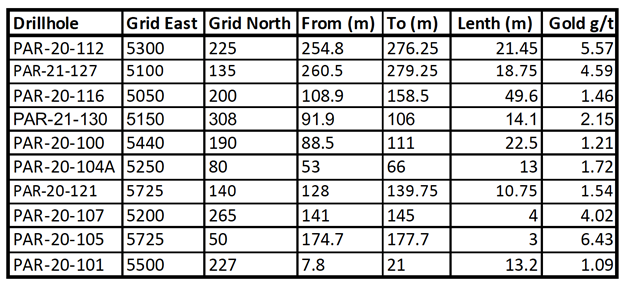

As with drill holes from the fall 2020 program, PAR-21-127 was able to intersect new gold mineralization, in particular 18.75m of 4.59 g/t Au, at a vertical depth of approximately 200m. This makes PAR-21-127 the second-best intercept received to date from drilling at Parbec (see table below).

What makes PAR-21-127 intriguing is that it was designed as an infill hole in the Camp Zone of the previous resource model, so this mineralized zone came as a pleasant surprise to the Renforth team.

Specifically, this intersection occurs at a place within the resource model where, prior to completing the 15,569m drill program at Parbec, there was only one drill hole in the area, which was collared further to the north. That drill hole (PAR-86-01) also failed to intersect most of the Cadillac Break, and the values obtained were not used in the May 2020 resource estimate.

Just how large is this new mineralized zone remains to be seen. As shown in the section below, there were three holes drilled in the recent program in this area. Results are still outstanding for the first 148m of PAR-21-127 and for all of PAR-21-142.

The gold mineralization in PAR-21-127 was intersected in the lower drill hole PAR-20-106, but it was of a lower grade. Renforth believes that this could mean the structural zone continues, though at varying grades.

The mineralization seen at a shallower depth in PAR-20-106 may also occur in PAR-21-127; however, this would need to be confirmed once the first 148m of PAR-21-127 is received.

PAR-21-130

Days earlier, Renforth also reported the results of PAR-21-130, a successful “twin” of historic (1993) drill hole PAR-93-55, the assays of which were not used in the previous resource estimate due to limited sampling.

In PAR-21-130, the interval of 4.1m of 2.15 g/t Au was able to support the historic result of 9.3 g/t Au over 4.3m and extend the mineralization further. A shallow 123m drill hole, PAR-21-130 lies entirely within the NI 43-101 resource estimate open pit.

In the vertical section presented above, PAR-21-130 is seen terminating in the pit wall, slightly longer than PAR-93-55. Drill hole PAR-87-16, which intersected 5.27 g/t gold over 4.88m, is essentially in the same place, with that hole ending at the outer edge of the pit wall. The main mineralized interval in all three holes is occurring at a vertical depth of 75m.

PAR-21-130 was also an overcut of PAR-20-109, which intersected 12.85m of 0.69 g/t gold, demonstrating vertical continuity of mineralization.

Two drill holes (PAR-93-56 and PAR-93-61), collared to the north of PAR-93-55/PAR-21-130 and drilled shallower, also demonstrate the vertical continuation of the mineralized horizon.

Results for PAR-20-128, a deeper undercut of all the drilling on this section, are pending.

Fall 2020 Results

In late April, Renforth reported assays for the remaining five holes of the 2020 drill program on the Parbec property. In total, 9,644m were drilled in the Phase 1 drilling.

Highlights of this batch of results are as follows:

- PAR-20-116 obtained assay value of 1.71 g/t Au over 1.25m, adding to intervals previously released for PAR-20-116, which included 49.6m of 1.46 g/t Au

- PAR-20-117 intersected 0.65m of 1.23 g/t Au, successfully undercutting surface gold results before the hole was lost at 30.5m length when it hit the ramp underground

- PAR-20-119 intersected 1.27 g/t Au over 2.8m in a gap within the geological model

- PAR-20-120 intersected 3.89 g/t Au over 1.75m in an overcut of PAR-10-05, which had, prior to this program, been the best gold interval at Parbec

- PAR-20-124 intersected 1.54 g/t Au over 3.45m, an undercut of PAR-18-78, which extends the mineralized zone 160m down dip

According to Renforth, each of the results above is accretive to the overall gold endowment of the Parbec deposit, and together, they are expected to positively impact a resource estimate calculation.

About the Parbec Project

Parbec is an open-pit constrained gold deposit located in the town of Malartic, Quebec. It sits on 1.8 km of the Cadillac Break, contiguous to the Canadian Malartic, Canada’s largest gold mine.

The Parbec deposit presently has an NI 43-101 resource estimate of 104,000 indicated ounces at a grade of 1.78 g/t Au and 177,000 inferred ounces at a grade of 1.78 g/t Au.

However, this estimate prepared in May 2020 is considered to be “out of date” by Renforth due to the results received so far from its recently completed 15,569m drill program.

This drill program was designed to twin, infill and undercut existing drill holes at Parbec to support a rebuild of the geological model and a resource estimate restatement, which is expected to be released in the coming weeks.

In addition to new data, Renforth intends to incorporate the results of 62 drill holes completed between 1986 and 1993 in the upcoming resource estimate, assuming that the lab results from holes twinned in the winter 2021 drilling support the inclusion.

These results were not used in the 2020 resource estimate.

Gold Gets Inflation Boost

The 2021 resource estimate for Parbec is likely to arrive just as inflation concerns are creeping back into the market, sending precious metals prices potentially higher.

In recent weeks, gold has quietly climbed back to levels last seen in early January, shaking off a torrid start to the year which saw bullion fall to a 9-month low in March.

Now, gold may be back on the menu for investors. The high volatility of the stock markets combined with falling bond yields has forced more funds to flow into bullion, as it is a safer alternative and is impervious to inflation.

As Bob Haberkorn, RJO Futures senior market strategist, recently told Bloomberg: “It’s flight to safety, that’s helping gold.”

Not to mention the weakening US dollar, which is making gold cheaper and increasingly attractive for other currency holders.

Good evidence of that is the rebound in gold-backed ETF holdings. Although this asset class continued to record outflows in April, that has slowed down “significantly,” according to the World Gold Council, and European funds returned to adding assets after months of sell-off.

TD Securities analysts led by Bart Melek said in a note to Bloomberg: “Following months of outflows, returning speculative interest could ultimately spark a breakout in gold.”

Conclusion

A high price environment is music to the ears of those invested in the gold mining space, and for junior miners with promising deposits, the value of their projects could only head one way.

For Renforth Resources and its Parbec project, the new resource estimate may unlock even more value from the open-pit constrained deposit that is situated within the neighborhood of several proven gold producers.

After seeing the assay results thus far, one might expect that a significant resource increase is a real possibility.

CSE:RFR, OTC:RFHRF, WKN:A2H9TN

Cdn$0.10 2021.05.22

Shares Outstanding 251m

Market cap Cdn$25.1m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Renforth Resources (CSE:RFR). RFR is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.