Max Resource reports another significant copper discovery at CESAR North target zone

2021.04.15

Exploration by Max Resource Corp. (TSXV:MXR) (OTC:MXROF) (Frankfurt: M1D2) at its wholly owned CESAR project in Colombia continues to demonstrate the property’s potential to host what would be a district-scale sediment-hosted copper-silver system.

Another Copper Discovery

Following up on its high-grade CONEJO copper discovery at the CESAR North target last month, the company has now reported a second newly discovered copper zone, named “URU”, located 30 km south of the CONEJO zone.

This URU copper zone lies along the southern portion of the 60 km long CESAR North target area. It appears to be of significant size, as the collected samples so far have indicated the presence of copper mineralization extending over 3.7 km that is open in all directions. Over 125 rock samples have been collected and sent for assays, with results expected early next month.

The surface mineralization at the URU zone occurs as stockwork of cross-cutting fractures or as disseminated mineralization hosted in igneous rock. Observed minerals include: chalcocite, native copper, cuprite and copper oxides. Epidote is also common and appears to be associated with copper mineralization.

Similarly, copper mineralization at the CONEJO discovery is also hosted in igneous rock, and is associated with fracture-controlled primary chalcocite mineralization that becomes more continuous as fracture density increases. Twenty-two rock panel samples from the CONEJO zone returned values above 5% copper.

The Max field team is currently mapping the rock-bearing mineralization to determine the potential volume and average copper-silver grades of the CONEJO zone while it awaits assay results from the newly discovered URU zone.

“The discovery of new copper mineralization at the URU zone is a significant addition to the stratabound copper-silver mineralization at CESAR North, as the company’s in-country team extends activities further into unexplored areas of Max’s CESAR project,” Max CEO Brett Matich commented in the April 8 news release.

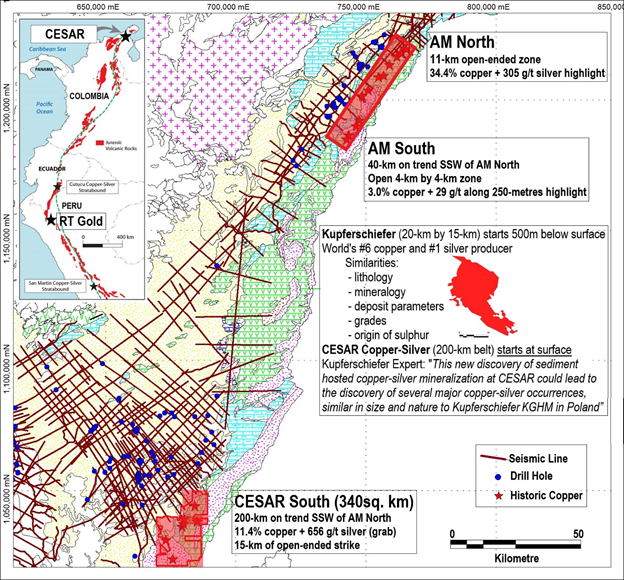

Over the last 18 months, Max’s exploration team has identified copper-silver mineralization over 38 km of combined strike length at CESAR North, with highlight values of 0.1 to 34.4% copper and 5 to 305 g/t silver over continuous intervals ranging 0.1 to 25 metres, demonstrating a district-scale sediment-hosted copper-silver system.

District-Scale Cu-Ag System

The CESAR property lies on a massive sedimentary system covering a significant portion of the 200 km long Cesar Basin, a massive geological feature that extends for over 1,000 km from the northern tip of Colombia southwards through Ecuador and Peru.

The basin was a seabed trapped behind the uplifting Cordillera mountain ranges, and the model suggests that rich copper and silver-bearing fluids flooded up into the basin and deposited as they encountered organic matter on the seafloor.

As such, CESAR represents a type of sediment-hosted copper mineralization that is typically flat-lying, near surface, and known to be extensive in Africa, Poland and Colombia. These types of deposits generally have higher grades than copper porphyry deposits.

As the first company ever to explore all of the copper and silver-rich areas covered by the CESAR property, Max has so far identified multiple copper-silver target zones, all with significant potential to expand further, demonstrating the presence of a widespread highly prospective copper-silver mineralization.

The Max team interprets the sediment-hosted stratabound copper-silver mineralization in the Cesar Basin to be analogous to the Kupferschiefer Basin in Poland in terms of grade, scale, and mineralogy.

The Kupferschiefer deposits, Europe’s largest copper source, produced 3 million tonnes of copper in 2018 and 40 million ounces of silver in 2019 from an orebody 0.5 to 5.5 metres thick, grading 1.49% copper and 48.6 g/t silver. This makes Kupferschiefer the sixth biggest copper producer in the world, and the #1 silver producer with yields almost twice that of the second-largest silver mine.

In comparison, the CESAR target has grades of 1.0% copper and 20 g/t silver over a similar horizon, but the orebody starts at surface rather than 500 meters below surface like the Kupferschiefer orebody, which is even better.

According to Kupferschiefer experts at the University of Science and Technology of Krakow, Poland: “This new discovery of sediment-hosted copper-silver mineralization at CESAR could lead to the discovery of several major copper-silver occurrences, similar in size and nature to Kupferschiefer.”

This sort of district-scale potential is what compelled Max to commence a multiple faceted exploration program for 2021 that includes advanced analysis and modeling of historical drill cores.

Though still in its early stage, CESAR appears to be one of few copper projects in the world that has the massive scale to draw significant industry interest, especially at a time when demand for the metal is growing at an unprecedented rate.

A New Copper Age?

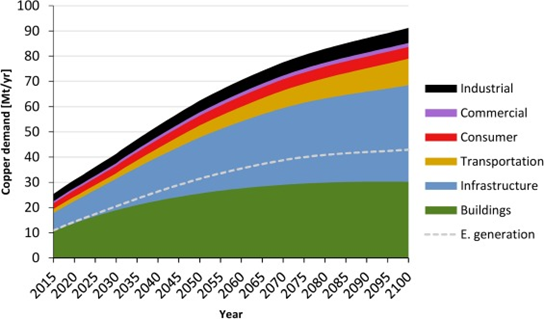

Given that the world is transitioning towards a “green economy”, more and more raw materials will be needed to build the necessary infrastructure (energy storage, electric vehicles, etc.). Copper, due to its excellent conductivity, will be the centrepiece of the industrial revolution of our time.

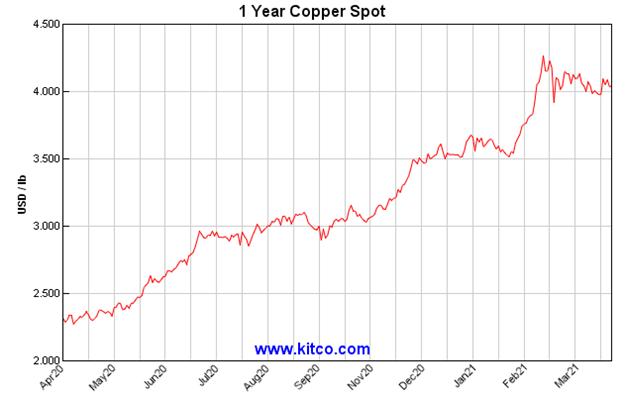

Also known today as Dr. Copper, the base metal provides a general “diagnosis” of the state of the global economy, and its recent price performance is indicative of how industrial activities have ramped up in the wake of massive spending by governments worldwide.

But long before that, way before machines and electricity were invented, copper has always played a crucial role throughout human civilizations, dating back thousands of years.

Beginning around 5000 BC, the Chalcolithic – or so-called the Copper Age – is considered one of the great eras of cultural development. It was during this time where copper was introduced into the metalworking industry, paving the way towards the use of bronze later on.

Before that, stone tools had reached their highest advanced stage, so such a big change and a new material were equal to an absolute wonder to people. Copper – although unrefined and malleable – was tough, strong and much more versatile than stone. Great for use in weapons and tools, copper gave those who were able to master its creation process an edge.

So, with the rise of the Copper Age, new cultures were formed, and the era also appeared to coincide with the emergence of the first state societies, which changed the course of history. Economy was also emphasized during that time, with evidence of long trade routes.

Copper soon became a sign of prestige and dominance. Groups that could not smelt or mine copper themselves relied on trading with those who could, and regional centers and large settlements were often centered on large copper ore mines.

The Copper Age was especially instrumental in the history of Europe and the development of the cultures emerging during this era. Maritime trading expanded, and Mediterranean influence can be observed in many areas of Europe. Also, the number of villages grew rapidly, as did the emphasis on centralized rule and labor classifications.

Copper’s influence also spread to other parts of the world — from the Americas to East Asia. Archaeological evidence suggests that it was instrumental in the development of the Ancient Chinese civilization, which has a long history of using metal objects.

When it’s all said and done, the appearance of copper made a major shift in the lifestyle of the world’s first civilizations, and it is probably the first metal used by ancient cultures.

Beginning of Supercycle

Fast forward to today, copper has found its way in a variety of key applications, and it remains an integral part of the next major social and economic change of modern times. As the old nomadic hunter-gatherers were able to find out, copper is the way of the future.

Global leaders have set strict decarbonization targets that require green-focused infrastructure built with copper. This, combined with a massive rise in government expenditures and years of underinvestment, has investment banks led by Goldman Sachs predicting that another commodity supercycle is on the horizon.

Goldman analysts this week doubled down on copper, estimating that these green projects would cost around $16 trillion to build, which is even more than the $10 trillion spent by China during the last supercycle.

BloombergNEF estimates that global copper demand in both the clean power and the clean transport sectors will double in the next decades to almost 5Mt per year. Copper demand this year is expected to reach 24Mt, representing a material increase.

On the supply side, as previously reported, global copper mined production will drop from the current 20Mt to below 12Mt by 2034, resulting in a supply shortfall of 15Mt. By then, over 200 copper mines are expected to run out of ore, with not enough new mines in the pipeline to take their place.

Taking into account an expected rise in EV adoption, at least another 20Mt of copper will be needed each year over the next 20 years.

At the end of the day, more copper will be required to keep the world running at its current pace, and new copper discoveries such as the ones developed by Max Resource could prove to be a crucial part of the supply chain.

Conclusion

At the moment, Max is holding onto what may be a district-scale or even regionally extensive project comparable to the largest copper source in Europe.

This region already enjoys major infrastructure as a result of nearby oil & gas and mining operations including Cerrejon, the largest coal mine in Latin America, so developing the project could be quick and easy.

More importantly, Max does not have to drill it at this stage, as the whole idea is to identify the mineralized horizons and dips at the CESAR property from analysis of historic drill cores, which was the same exploration model used on Poland’s Kupferschiefer deposits.

Thus far, the company has made significant enough progress to attract the attention of others within the mining industry. The junior already has multiple non-disclosure agreements in place to advance the project, including a collaboration agreement with an industry-leading copper producer.

Add in the fact that copper has been and remains the most influential metal of our time, there is only one direction that its demand is headed.

As Max CEO Brett Matich states: “CESAR provides Max shareholders significant exposure to copper, a strategic energy metal and a key metal for the world’s transition to electric vehicles and clean energy.”

Max Resource Corp.

TSX.V:MXR, OTC:MXROF, Frankfurt:M1D1

Cdn$0.25, 2021.04.15

Shares Outstanding 87.6m

Market cap Cdn$21.9m

MXR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resources (TSX.V:MXR). MXR is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.