Tinka makes tin discovery at Ayawilca project, Peru

2021.04.15

Tinka Resources’ (TSX.V:TK, OTCQB:TKRFF) Ayawilca polymetallic project in Peru just got a whole lot more interesting with the discovery of a new tin zone, that is expected to add significant value to what is already the largest zinc development project in Latin America and one of the biggest zinc resources held by a junior explorer.

This week the Vancouver-based company announced tin assays from the recently completed 7,600-meter, 21-hole drill program at Ayawilca.

While the focus of the program was on defining zinc-silver mineralization, as TK works on updating the 2018 resource estimate and putting out a new PEA, Tinka encountered remarkable tin intercepts in holes drilled adjacent to the highest-grade zinc resource on the property. It’s the first time that high-grade tin has been discovered at the South Ayawilca target.

According to the April 14 news release,

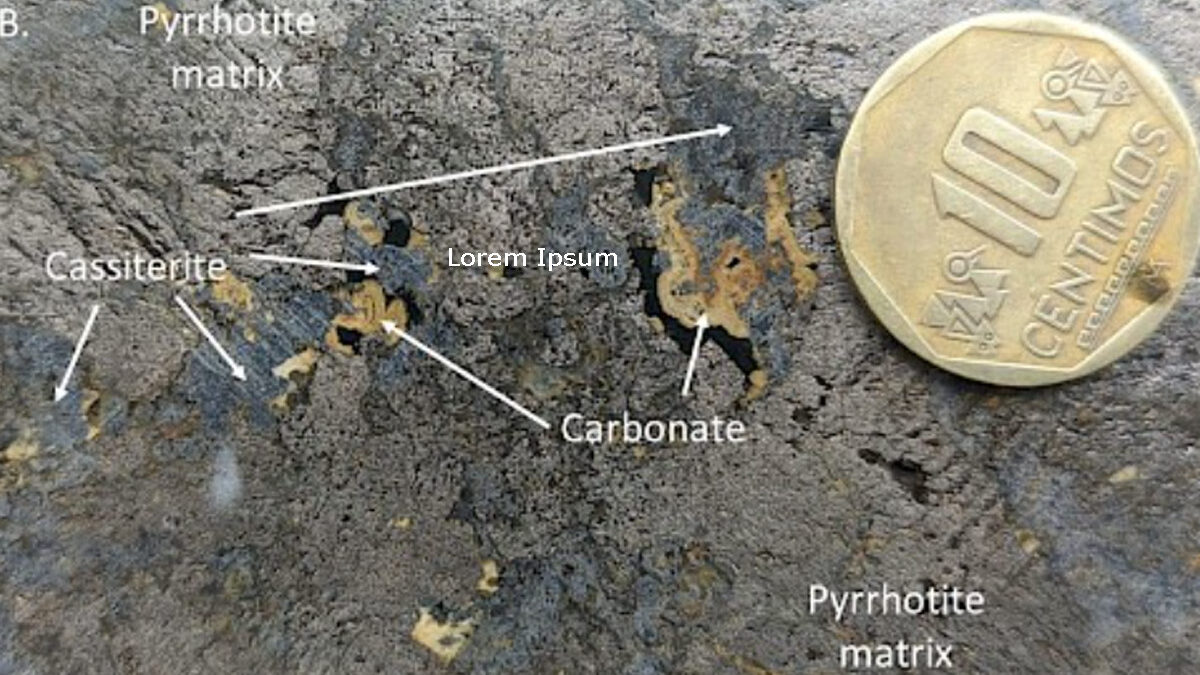

Tin mineralization was intersected in eight adjacent drill holes, including seven of the recent holes, in zones that typically contain very minor or no zinc mineralization. The tin mineralization is believed to be hosted by multiple, flat-dipping lenses with each lens up to 12 metres in thickness and with horizontal dimensions of approximately 200 metres, remaining open to the north. Tin mineralization in hole A21-187 (12 metres grading 3.1% tin) occurs 40 metres above zinc mineralization in the same hole (4.1 metres grading 17.7% zinc) (link to news release). Tin occurs as cassiterite (SnO2), the most common ore-forming mineral of tin.

Highlights included 12 meters of 3.05% tin from 262 meters down hole, including 2m @ 5.43% tin encountered at 266m; 4.0m @ 1.03% tin from 348m; and 11m @ 1.81% tin from 275m.

“While Ayawilca is best known for its large and high-grade Zinc Zone resource, the property also hosts a Tin Zone resource which is mostly located at deeper levels along a northeastern trend away from the highest- grade zinc deposit at South Ayawilca,” says Tinka Resources’ CEO, Dr. Graham Carman.

“The new discovery of tin at South Ayawilca is potentially very important as a complement to the zinc deposit, as it is the first time we have encountered such high grades of tin immediately adjacent to one of the best zones of zinc at the property, an area which would likely be prioritized in the early years of a future mining operation.”

Dr. Carman adds that the style of tin mineralization appears to be different from the material previously seen in the deeper part of the tin zone at Central Ayawilca. The new style contains clots of coarse-grained cassiterite, which has a high density compared to other minerals including sulfides, making it easier to separate. The company plans to immediately undertake mineralogical test work including gravitational separation.

Now that all the drill results are in, Tinka’s next move is to advance Ayawilca towards a resource update and an updated preliminary economic assessment (PEA) by early in the third quarter.

“Green tin”

In my mind it makes perfect sense to prioritize the tin, in terms of metallurgy, re-evaluating the deposit in a revised PEA, and working the tin into a future mine plan, considering that tin is so highly valued.

Currently trading at around $27,000 per tonne, the metal mainly used in soldering has the highest value of the major base metals, is triple the price of copper and 9X the price of zinc.

Since the beginning of the year spot tin has risen a whopping 29.8% — on March 11 hitting a 10-year high of $30,995/t, within range of the record $32,250/t set on May 2, 2011.

Tin’s usage across a wide modern manufacturing spectrum has not gone unnoticed by the US Geological Survey, which in 2018 included tin on its list of 35 critical minerals.

In addition to primary uses in solder, tin plating, tin chemicals, brass and bronze alloys, tin is also becoming important for “green” applications. Over the next decade tin is likely to be found in autonomous and electric vehicles, renewable energy, energy storage, and advanced computing.

According to the International Tin Association (ITA) tin has been in a supply deficit for three years, with global mine output under further pressure amid the pandemic. Even China, the world’s largest producer, is running short of the metal, dramatically increasing its refined tin imports last year.

High rock value

Tin’s outstanding market fundamentals need to be factored into Tinka Resources’ new and existing tin zones at Ayawilca. The tin zone outlined in the 2018 resource estimate contains an estimated 200 million pounds in the inferred category.

It would obviously be better to have it measured and indicated, but for now we will use the less economically certain inferred for the basis of the rock value, calculated as follows:

200 million pounds divided by 2204.62 (the number of pounds in a metric tonne, with an “ne”) equals 90,718 tonnes. Using $27,000/t as a tin price works out to $2.449 billion of insitu tin. ($27,000 X 90,718).

We know in-fill drilling needs to be done to convert inferred to measured and indicated and then to reserves before the amount of tin that can be mined economically is known, but even if it’s 75 million tonnes, that is still almost a billion dollars ($918,525,641) worth of contained metal.

Remember, this is without the recently discovered high-grade tin pods.

Ayawilca is known as a high-grade zinc and silver deposit so we should calculate the worth of that rock too.

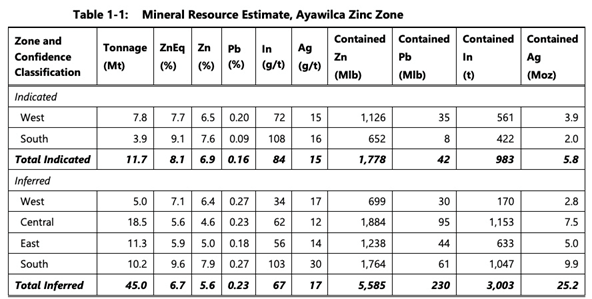

The zinc zone contains an estimated 1.8 billion pounds of zinc and 5.8 million ounces silver in indicated resources, and 5.6 billion pounds zinc and 25.2Moz silver inferred.

Taking only the indicated resources, the grades shown in the mineral resource table (below) of the 2019 PEA are 6.9% zinc, 0.16% lead and 15 grams per tonne silver. Plugging these figures into Kitco’s “rocks in the box calculator” leaves a gross metal value of $208.58 per tonne, which is equivalent to a gold deposit grading 3.7 g/t. Any gold junior would be extremely fortunate to be developing a deposit with that high a grade.

Local context

According to the International Tin Association (ITA), South American production of tin concentrates peaked in 1989 at over 75,000 tonnes of contained tin. Since 2000, output from the continent has been falling as grades at historical mines decline. Tin exploration has been fairly limited, with only established producers increasing known resources and reserves. Recently, however, new junior mining companies have begun work across the continent.

Peru’s tin industry has long been dominated by Minsur’s San Rafael mine which started in 1975. Located in the Puno region, San Rafael is the third largest tin producer, currently producing 12% of the world’s tin.

The company will reportedly re-process the mine’s extensive tailings via a project known as B2, which contains 81,500t of tin as a resource, 96% of which is classified as reserves.

Note that B2’s 1% Sn (cassiterite) grade is only slightly higher than the 0.63% Sn at Ayawilca’s tin zone, but a lot lower than the grades Tinka has just drilled at South Ayawilca, which run as high as 5.5% Sn.

The majority of CRIRSCO-compliant tin resources and reserves come from Europe, Australia and South America.

ESG credentials

Tinka Resources is advancing Ayawilca during a period of more enlightened mine production and mineral exploration. Juniors these days are paying closer attention to environmental, social and governance (ESG) issues, and Tinka is no exception.

The company says it is committed to controlling the environmental impacts of its exploration activities, has implemented sustainable business practices and promotes community environmental monitoring.

Recognizing the importance of stakeholder engagement, Tinka is working with the three local communities near the property: San Pedro de Pillao, San Juan de Yanacocha and Huarautambo. Two community relations officers hired by Tinka work in rotation within each community, helping to fulfill the company’s mandate of ensuring that local populations are informed of exploration activities, and that there is a platform where questions or concerns can be addressed.

Tinka funds community initiatives such as health care programs and construction projects and employs local labor to fulfill numerous roles including building roads, constructing drill pads, camp maintenance and cleaning.

According to a recent study published by Ernst & Young (EY), losing social support, or social license to operate (SOL) is now seen as the main risk mining firms are facing.

Another survey by BDO said stakeholders are demanding stronger engagement, transparency, and accountability, to the point where a social license will soon be akin to a mining permit. More positively, attaining a social license will shine a light on the importance of companies like Tinka Resources, whose plans to explore for and eventually mine zinc, silver, and tin, will play an important role in the future green economy.

Conclusion

Tinka’s Ayawilca has always been thought of as a monster zinc-silver deposit, and while that is still true, the discovery of high-grade tin on the property could put it in a brand-new league.

Until fairly recently tin was an under-rated base metal, but its use as solder in practically unlimited electronics applications make it an essential “future-facing metal” needed in clean technologies like renewable energy and electric vehicles, not only electric cars but trucks, delivery vans, buses, trains, and e-bikes, all powered by batteries and electronic circuits collectively containing millions of solder points.

The market has recognized the importance of tin and the fact that demand is outpacing supply; prices have been on an absolute tear, with tin’s year-to-date 30% gain besting the likes of copper and zinc by a long shot.

Tinka’s plan this year is to undergo a resource expansion and infill drill program on the Ayawilca property.

All 21 holes of the 7,600m program are now complete, meaning the company is ready to compile the drill data and complete geological interpretations in preparation for an updated mineral resource and PEA scheduled for the third quarter.

Two holes at South Ayawilca intersected high grade zinc-silver mineralization associated with massive sulfide mineralization over substantial widths and are expected to expand the indicated mineral resource.

I’m excited to see that tin for the first time is front and center, shoring up Ayawilca as a true “energy metals” deposit containing zinc, silver and now tin, without which the shift to a green economy can’t happen.

The deposit already has 1.8 billion pounds of contained zinc and nearly 6 million ounces of silver (not counting the inferred). The tin zone contains 201 million pounds in the inferred category, along with 67 million pounds of copper and 8Moz of silver. How much will this week’s tin discovery add to the resource and the project’s already impressive economics? I can’t wait to find out.

Tinka Resources Ltd.

TSX.V:TK, OTCPK:TKRFF

Cdn$0.235, 2021.04.14

Shares Outstanding 340,740,717

Market cap Cdn$80m

TK website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Tinka Resources (TSX.V:TK). TK is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.