Max’s success at CESAR points to rich copper-silver district in Colombia

2021.03.25

Max Resource Corp (TSXV:MXR, OTC:MXROF, Frankfurt: M1D2) continues to make good progress at its CESAR copper-silver project in Colombia, this week announcing high-grade results from the CONEJO discovery at CESAR North.

The CONEJO zone spans 1.6 km by 0.6 km, is open in all directions and lies along the CESAR North Kupferschiefer-type sedimentary exhalative (sedex) copper-silver mineralization.

This new mineralization is thought to be related to the sediment copper-silver system but hosted in an igneous (volcanic) unit. It is associated with fracture-controlled primary chalcocite mineralization that becomes more continuous as fracture density increases.

Over 200 rock panel samples have been collected at CONEJO. The first assays from the new discovery were released on Wednesday, March 24.

Highlight assays greater than 9% copper and 50 grams per tonne (g/t) silver included 12.5% copper + 83.5 g/t silver over 5X5 meters; 10.4% copper + 95 g/t silver over 5 meters by 5 meters; 10.5% copper + 50.1 g/t silver over 3X2 meters; and 9.5% copper + 120 g/t silver over 1 meter by 1 meter.

Sixty-six samples returned values over 1% copper and 22 samples reported grades above 5% Cu.

“CONEJO is a new high-grade copper-silver discovery, extending the CESAR North outcropping discoveries to over 35 kilometres of combined strike length. The overall scale of the zone appears to be of district proportions,” Matich stated in the March 24 news release, adding that:

“CONEJO continues the pattern of new copper-silver outcrop discoveries as the Company’s in-country team extends exploration activities further into unexplored areas of Max’s CESAR Project.”

CESAR

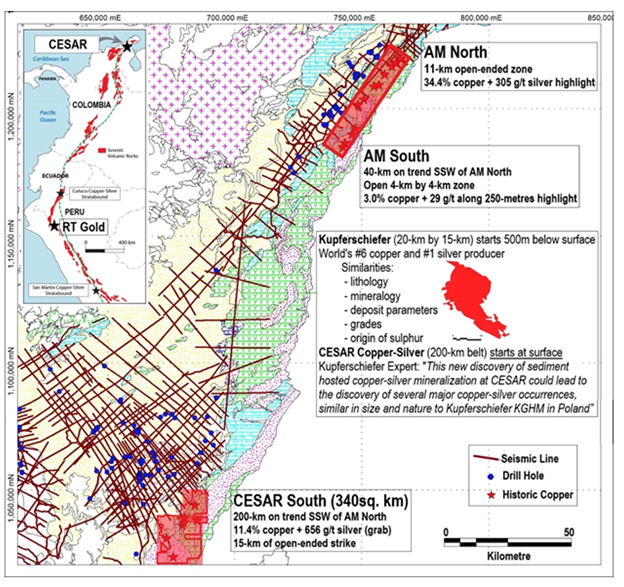

The CESAR property is in northeastern Colombia along the world-famous Andean Copper Belt, where silver is also abundant. It lies on a massive sedimentary system covering a cumulative 220-km strike of highly prospective Cu-Ag mineralization.

Max is the first company to explore all of the copper and silver-rich areas covered by the CESAR property. The junior already has multiple non-disclosure agreements in place to advance the project, including a collaboration agreement with an industry-leading copper producer.

Exploration thus far has identified multiple copper-silver target zones (CESAR North, CESAR South, and CESAR West) hosting significant discoveries with potential to expand further.

The North zone, which is open in all directions, has sedex stratabound mineralization spanning over 45 km2 with grades up to 34.4% Cu and 305 g/t Ag. At the South zone, discovered late last year 150 km south of CESAR North, grab samples returned values up to 11.4% Cu and 656 g/t Ag.

Due to newly discovered copper showings, the company recently expanded the CESAR West area by adding 500 km2 to the northern boundary, effectively expanding the CESAR project to a district-scale size of over 2,500 km2.

What is more compelling about the CESAR project is that it bears a striking resemblance in terms of grade, scale, and mineralogy to the world-class Kupferschiefer deposits found in Poland, which are the largest source of copper in Europe.

Together, the Kupferschiefer deposits have produced the sixth-highest amount of copper in the world. Kuperschiefer is also the world’s #1 silver producer, with yields almost twice the production of the next largest silver mine.

The main difference between the Kupferschiefer and CESAR deposits is that the Kupferschiefer orebody starts at 500 meters below surface, while CESAR’s copper-silver mineralization starts at surface, giving the latter an advantage.

According to Kupferschiefer experts at the University of Science and Technology of Krakow, Poland: “This new discovery of sediment-hosted copper-silver mineralization at CESAR could lead to the discovery of several major copper-silver occurrences, similar in size and nature to Kupferschiefer.”

District-scale opportunity

It is extremely rare for a junior resource company the size of Max — valued at just $20 million as of Wednesday, March 24 — to come by this much ground in a greenfield (no mining has yet taken place) project.

Max Resource is developing a large sedimentary system, with high-grade discoveries over a 220-km belt. Grades of up to 34% copper and 656 grams per tonne silver have been assayed from surface outcrops. The company now has an additional 180 km to explore, at CESAR West. This year Max plans on sampling and mapping for Jurassic-age host rock and copper-silver mineralization along this new 180-km-long landholding.

The new CONEJO copper-silver discovery was delineated over a zone of 1.6-km by 0.6-km, open in all directions, and hosted in a stockwork cross-cutting igneous host rock, overlying or cross-cutting a mineralized stratabound horizon.

The Max field team is mapping the mineralization to determine the potential volume and average copper-silver grades of the CONEJO zone.

Max continues to expand the surface “Kupferschiefer-style” mineralization at CESAR, using continuous rock chip panel samples and composite grab samples to identify structures, continuity of thickness, strike length and potential size, prior to drilling.

In Poland’s Kupferschiefer deposits, continuous mineralization extends down dip and laterally for many kilometers. Could the mineralization at CESAR do the same? If so, Max could be looking at a district-scale, even a regionally extensive copper-silver mineralized system.

Since exploration began in 2019, Max has expanded CESAR to over 2,500 square kilometers.

Though early-stage, CESAR is one of the few copper projects that is demonstrating the massive scale needed to interest a major.

Moreover, and this is important, Max does not have to drill it, not at this stage. The whole idea is to identify the mineralized horizons and dips, then partner with a larger company, or companies, to further develop the deposit, sell the project, or get bought out.

So far, Max has managed to identify extensive copper-silver mineralization through rock chip sampling because rivers, streams and creeks cut across and expose the multiple horizons for a considerable depth.

Copper at depth

In fact, Max has gone a step further in verifying the exploration model at CESAR, based on analysis of recently obtained historical drill core.

In January, the company reported that stratabound copper-silver mineralization found at surface, extends for over 400m down dip.

The finding is critical for Max, which is quietly advancing one of the world’s most promising copper-silver projects in northeastern Colombia, along the Andean Copper Belt that is world-renowned for its porphyry deposits.

This sedimentary basin is a massive geological feature that extends for over 1,000 km from the northern tip of Colombia southwards through Ecuador and Peru. The basin was a seabed trapped behind the uplifting Cordillera mountain ranges, and the model suggests that rich copper and silver-bearing fluids flooded up into the basin and deposited as they encountered organic matter on the seafloor.

As such, CESAR represents a type of sediment-hosted copper mineralization that is typically flat-lying, near surface, and is known to be extensive in Africa, Poland, and Colombia. These types of deposits are generally higher grade than copper porphyry deposits.

The CESAR project area enjoys major infrastructure thanks to existing oil, gas and coal mining operations including Cerrejon, the largest coal mine in Latin America, jointly owned by global miners BHP, XStrata and Anglo American. However, this area has only seen limited copper exploration.

Recognizing the prospect of a major copper discovery in the Cesar region, Max Resource acquired full ownership of the CESAR property shortly after its discovery in the fall of 2019 and embarked on a first-pass exploration program focused on identifying surface outcrops.

Given the outstanding regional scale prospectively of the CESAR project, Max has applied the same exploration model used on Poland’s Kupferschiefer, and is in the process of a multi-faceted exploration program that includes advanced analysis and modeling of historical drill cores.

New commodities supercycle

The last commodities super-cycle, starting in 2003, was driven by China, which demanded almost every commodity under the sun to meet double-digit annual increases to its GDP. This time is different. I believe we are going to see demand across the board for nearly every type of commodity, based on infrastructure renewal, electrification, reduction of carbon, and food demand.

Goldman Sachs agrees that the next structural bull market for commodities will be driven by spending on green energy.

BNN Bloomberg states The world’s metals producers stand to benefit from increasing electrification, and not just in the transport sector. BloombergNEF estimates that global copper demand in both the clean power and the clean transport sectors will double in the next decades, to almost 5 million tons per year. Copper demand this year is expected to be about 24 million tons, so that jump would be a material increase.

A green infrastructure spending push, currently underway by China, the US and Europe, will mean a lot more energy metals will need to be mined, including copper for electric vehicle wiring, motors, charging stations and renewable energy projects; and silver for solar panels and 5G.

China’s copper needs

As China plows ahead with its plan to reach for carbon neutrality by 2060 – the Asian superpower is already the world’s largest manufacturer of wind turbines, solar modules, and EV batteries – Wood Mackenzie believes that Beijing will be challenged to secure supplies of certain raw materials critical to the shift toward clean energy/ transportation, namely copper, aluminum, nickel, cobalt, and lithium.

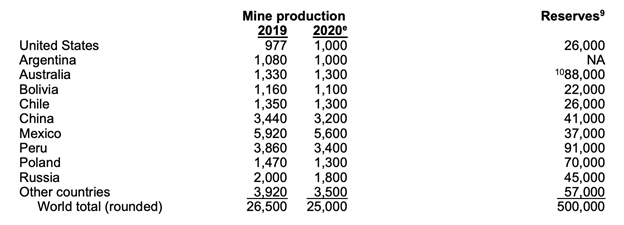

Most notably, China’s dependence on foreign miners for its copper supply is a major concern, says Woodmac. The global commodities consultancy believes China will need another 7.5 million tonnes of copper every year, based on current usage levels. (global mined production is only 20Mt).

However, as we have reported, without new capital investments, global copper mined production will drop from the current 20 million tonnes to below 12Mt by 2034, leading to a supply shortfall of more than 15Mt. Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

Even with a 30% penetration of EVs, a relatively conservative estimate, we need to find another 20 million tonnes of copper per year over 20 years. And we will still need enough copper for all its other uses, in construction wiring & plumbing, infrastructure build outs, electrical grids, energy storage, 5G, etc.

UBS recently upgraded its forecast for EV market penetration and raw materials demand. The firm now believes EVs will be adopted at a rate of 20% (of the regular vehicle market) by 2025, and 50% by 2030, meaning an increase of electric vehicles from 3 million last year to 46 million by 2030.

Lithium-ion battery demand jumps 17-fold to 4,650 gigawatt hours (GWh) by the end of the decade. By 2030, copper consumption in EVs will represent 4.4Mt of copper demand or around 13% of the total — about 3% growth per year — well above the long-term trend of 2.4% CAGR (1976-2019).

Do not forget, Wood Mackenzie is saying China will require an additional 7.5 million tonnes per year.

The upshot? There will not be enough copper for future electrification and energy needs, without a massive acceleration of copper production worldwide, as well as discovery of new copper deposits, the likes of which Max Resource Corp is developing in northern Colombia.

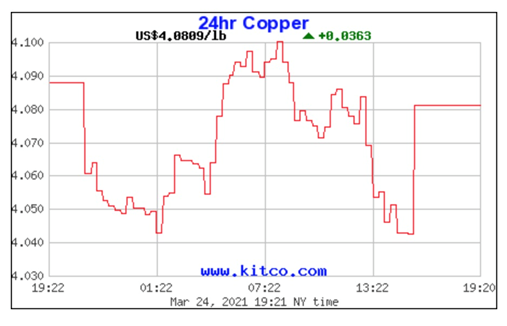

The world’s largest copper trader, Trafigura, expects the metal to hit $15,000 a tonne in the coming decade as demand from global decarbonization produces a deep market deficit, Bloomberg reported this week.

“You can’t move to a green economic environment and not have the copper price moving significantly higher,” the firm’s head of copper trading Kostas Bintas told the news outlet. “How can you have one without the other?”

Congruent with arguments made above, regarding a new commodities super-cycle, Bintas notes that covid-19 has made the rest of the world a factor in consumption growth whereas in the past, copper was all about China.

“I’m not sure about the commodities super-cycle, but I’m 100% sure about the copper super-cycle,” he said.

Polling done by Transfigura during the pandemic points to a rare surge in demand across Europe and the US, even before green-infrastructure stimulus packages take effect.

According to the firm, the strain on supply as the “green revolution” takes hold will be too great to avert a price spike. It notes that covid-19 has heavily impacted the supply of both scrap and mined copper. Global drawdowns have stockpiles approaching critical levels, as the chart below shows.

The combination of strong demand and tight supply has spot copper so far this year gaining nearly 16%.

China’s silver challenge

China is also going to be challenged to find enough silver to meet huge demand from its solar power industry, which leads the world in production of solar panels.

The country is currently the third largest miner of silver, behind Mexico and Peru.

Silver prices this year should gain momentum on the back of ongoing fiscal stimulus in China, and greater industrial activity which drives around half of annual silver consumption.

The latter will be helped by governments investing in green energy, including solar panels which contain silver paste. The solar power industry currently accounts for 13% of silver’s industrial demand.

More and more silver will be demanded for its use in solar photovoltaic cells, as countries move further towards adopting renewable energy sources. Around 20 grams of silver are required to build a solar panel. The Silver Institute predicts 100 gigawatts of new solar facilities will be constructed per year between 2018 and 2022, which would more than double the world’s 2017 capacity of 398GW.

All that solar will be a major boon for silver.

CRU expects PV manufacturers to consume 888 million ounces of silver between now and 2030. That is 51.5 million oz more than the combined output from all the world’s silver mines in 2019 and works out to an average 81Moz per year.

Global mined silver production in 2020 was 25,000 tonnes, or 881.8 million ounces.

As expected the growth in solar will be led by China, states a 2020 report by The Silver Institute, followed by Europe, North America, developed Asian countries and India.

The report maintains that a combination of global efforts to reduce fossil fuel reliance, legislation to lower carbon emissions, and favorable government tax policies, should result in a continued expansion of solar panel installations over the next decade.

5G

5G technology is set to become another big new driver of silver demand.

Among the 5G components requiring silver, are semiconductor chips, cabling, microelectromechanical systems (MEMS), and Internet of things (IoT)-enabled devices.

The Silver Institute expects silver demanded by 5G to more than double, from its current ~7.5 million ounces, to around 16Moz by 2025 and as much as 23Moz by 2030, which would represent a 206% increase from current levels.

China is aggressively expanding its 5G network. BMO Capital Markets cited reports indicating that up to 18 provinces in China were aiming to build over 413,000 base stations in 2020, which BMO said, “would be a positive for silver demand.”

Its three main telecom carriers have all reportedly pledged to accelerate their investments in to 5G, in response to the Chinese government’s call for new infrastructure projects to revive economic activity, according to BMO.

As the country has done with other critical metals, including rare earths, lithium, graphite, and cobalt, we would expect China to try and lock up silver supply through offtake agreements and purchases of foreign silver mines/ silver deposits with enormous scale.

Is Max’s CESAR copper + silver project in Colombia on their radar? If it isn’t, perhaps it should be.

Max Resource Corp.

TSX.V:MXR, OTC:MXROF, Frankfurt:M1D1

Cdn$0.245, 2021.03.24

Shares Outstanding 86.3m

Market cap Cdn$20m

MXR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Max Resources (TSX.V:MXR). MXR is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.