Love Hemp: Curaleaf’s $285 million deal signals Europe as the new battleground for cannabis giants

2021.03.15

The aftermath of the 2020 US election has affected another growth spurt in the cannabis industry.

Earlier in the year, New York Governor Andrew Cuomo promised a legalization program within his state, which, like California, is one of the nation’s top economies and a trendsetter. Virginia recently became the latest state to legalize recreational weed, fueling more hopes of federal reform.

Senate Majority Leader Charles Schumer and Sens. Cory Booker and Ron Wyden also said they would make cannabis reform a priority this year.

South of the US border, Mexico is expected to pass a new law to legalize cannabis very soon, which would open up another huge legal market in North America.

A recent study by Grand View Research predicted the global legal market for the plant to be worth as much as $73.6 billion by 2027. A multi-billion-dollar industry boom is not a matter of if, but when.

While the cannabis space has been greeted with bullish signals since the onset of the pandemic, that momentum has gotten stronger over the past few months. In February, marijuana stocks soared to record highs, hinting that something big is brewing in this sector.

Curaleaf Enters Europe

To cap off the marijuana equities rally, one of the industry’s biggest deals in recent history went down over the past few days.

Curaleaf Holdings Inc., a leading US provider of cannabis consumer products, has agreed to buy Emmac Life Sciences Ltd. in a deal worth approximately $285 million.

This acquisition marks Curaleaf’s entry into Europe’s rapidly growing cannabis market, turning the company into a dominant player internationally with presence in eight countries. Emmac is currently the largest vertically integrated independent cannabis company in Europe.

“By doing this transaction, Curaleaf is indisputably the largest operator on a revenue and a footprint basis around the globe,” executive chairman Boris Jordan said in an interview with Bloomberg. With a market capitalization of about $11 billion, Curaleaf is already the largest US-based multistate operator.

The tie-up will also allow Curaleaf to capitalize on a potential shift of Europe’s medical market toward a more consumer-oriented, recreational one, Curaleaf’s Jordan stated, given that Emmac has a deal to sell CBD products through Walgreens Boots in the EU.

Emmac CEO Antonio Costanzo said in a news release that the deal is “not only a significant milestone for Emmac, but for the European cannabis market as a whole.”

Growing Competition

Curaleaf’s major acquisition comes at a time when competition is beginning to heat up in both the US and international markets. All the major companies are racing to expand their businesses in anticipation of further legalization and increased acceptance for cannabis products globally.

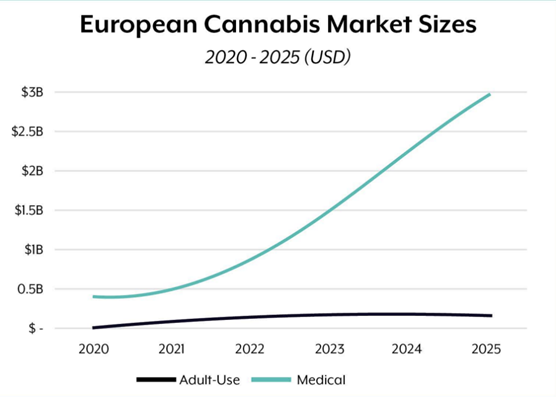

Europe is viewed by many as the new battleground for the global cannabis industry; it’s a fast-growing market that has benefited from the overwhelmingly high demand for cannabis during the Covid pandemic.

Its legal cannabis market alone was worth about $359 million last year, according to research by Brightfield Group, representing a rise of 25% from 2019. The study also projects it will reach $3.1 billion by 2025, with a compound annual growth rate (CAGR) of 52%.

While Europe only allows medical cannabis now, industry players are bracing themselves for an expanded market as more countries consider recreational use. The Netherlands and Switzerland, for example, are expected to implement recreational programs by the end of the year.

In late 2020, the market experienced its biggest breakthrough yet, with the European Union ruling that products containing CBD, an active ingredient in cannabis, are no longer listed as narcotics.

Taking all the upgraded regulations into account, MarketsandMarkets has set the entire European cannabis market at a value of about $37 billion by 2027, rising at a near 30% CAGR during the forecast period.

In the past, the top cannabis companies have mostly been focused on the North American market, but many — including Curaleaf — have realized that gaining a foothold in Europe is now a must to remain competitive.

Canada’s Tilray Inc. has been touting its plans for growth in Europe as part of its merger with Aphria Inc. Israeli cannabis producer Intercure Ltd. recently agreed to be acquired by a US firm and will list on the Nasdaq.

Investment Spree

As for Curaleaf, its investment spree in Europe looks to be far from done, and the US cannabis firm said it’s still looking for additional acquisition opportunities. “Getting into that market is a way to eventually expand into the Middle East and Africa,” chairman Boris Jordan added.

“We’ll be very acquisitive, similar to what we did in the U.S.,” he said of his EU strategy. “Countries like Poland, Ukraine, South Africa — there are even rumors of Egypt — are also moving toward legalization and Europe is a great hub to attack those markets from.”

As Europe progresses legislatively, the Emmac announcement could be “the springboard to Curaleaf becoming a dominant global cannabis player,” Bill Kirk of MKM Partners said in a research note.

BTIG analyst Camilo Lyon believes its acquisition of the privately held European medical marijuana producer brings “significant expansion potential” for Curaleaf.

In 2020, Curaleaf completed a total of eight acquisitions and had a record managed revenue of $653 million, representing a 161% year-over-year growth, despite the underlying macro factors hindering the global economy.

The fourth quarter alone saw the company rack up $233.3 million in managed revenue, up 186% from 2019, providing it with the cash to complete a deal for Emmac.

With these figures, it’s no wonder that analysts are upbeat about the prospects of more deals from Curaleaf, as well as the cannabis industry in general.

One thing of note is that Emmac’s revenues as of year-end 2019 were only about $6.9 million, meaning that the big cannabis players are not messing about and are willing to pay a premium — and in Curaleaf’s case — nearly half of its annual revenue, on pure potential.

Love Hemp: A Leading UK Brand

At Ahead of the Herd, we are always on the lookout for value plays within the nascent global cannabis space.

This brings us to cannabis investment firm World High Life, which recently changed its name to reflect its prized holding company: Love Hemp Group PLC (AQSE: LIFE) (OTCQB: WRHLF).

Established in 2015 by two London entrepreneurs, the Love Hemp brand has become a household name amongst UK cannabis consumers. Its founders were inspired by the lack of a premium CBD brand in the country, and always believed in the company’s potential to blossom once CBD hits the mainstream.

Love Hemp is now the largest supplier of CBD and hemp products within the UK, with more than 40 product lines comprising oils, sprays and vapes, and a variety of edible and water-based CBD products. These products are sold across its Love Hemp and CBDOilsUK platforms, as well as through wholesale activities via the LH Botanicals subsidiary.

The brand has already established relationships with over 2,000 stores in the nation, including leading brands such as Sainsbury’s, Boots, Ocado and Holland & Barrett.

Since its inception, sales have grown rapidly on a year-to-year basis, reaching a reported figure of £2.6 million in the 2019 fiscal year. But a substantial increase in product demand during the pandemic meant Love Hemp may well see some monster earnings for the current year.

In the past quarter, Love Hemp absolutely obliterated its previous sales record with £1.56 million in revenues, a 97% increase on the previous quarter. For the half-year, sales amounted to approximately £2.36 million, nearly surpassing last year’s entire total.

Love Hemp also saw its online conversion rate increase by 11% during the quarter, leading to over 69,000 units sold and more than 10,500 customer accounts created.

These numbers show more than just a successful growth story; they also suggest to us that Love Hemp has been spot on with its marketing strategy.

The Love Hemp brand is quickly gaining traction internationally, having signed mixed martial arts (MMA) legend Georges St-Pierre, widely considered one of the greatest fighters in the sport’s history, as brand ambassador. GSP — as many avid MMA fans would prefer to call him — has attributed his recovery from a severe inflammatory bowel disease that forced him to retire to the use of CBD.

In its Q2 results release, the company stated:

“We continue to keep positioning for future growth and look forward to expanding what is already an exciting and promising business both across the UK and further afield.”

Conclusion

“When there’s change, there’s opportunity.” This quote from former General Electric chief executive Jack Welch cannot better describe what is happening within the global cannabis space.

Many are predicting a sweeping regulatory transformation across North America and Europe, which could open-up new frontiers for industry players to joust for market share and experience further growth.

Curaleaf’s major acquisition this week is not only a sign that cannabis companies are swimming in cash, but the industry is thriving on a global scale. This may even serve as both a benchmark and a catalyst for further deals in the cannabis space.

We believe Love Hemp Group PLC (AQSE: LIFE) (OTCQB: WRHLF) is one of those companies to bookmark for the future, given it is the largest CBD supplier in the UK, where many of the top cannabis companies are looking to penetrate. Its sales numbers — which are growing in near multiples by the quarter — as well as increased brand recognition also speak for themselves.

As seen with Emmac’s $285 million price tag, the entrance fee into the fast-growing European market can be exorbitant. But if consumer demand keeps its current pace and more favorable policies are implemented, that valuation could prove to be a bargain.

After all, Europe is a lucrative cannabis market for the top cannabis companies.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard Mills owns shares of Love Hemp (OTCQB:WRHLF, AQSE:LIFE). Love Hemp is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.