Dolly Varden Silver: Hot on the trail of past and future silver mines in BC’s Golden Triangle

2021.01.25

“Finding gold in the shadow of headframes” is an old mining adage, meaning the best place to find new mineralization is beside an existing mine. The saying is particularly apropos of Dolly Varden Silver Corp (TSXV:DV, OTC:DOLLF), a pure-play silver explorer working in British Columbia’s famed Golden Triangle.

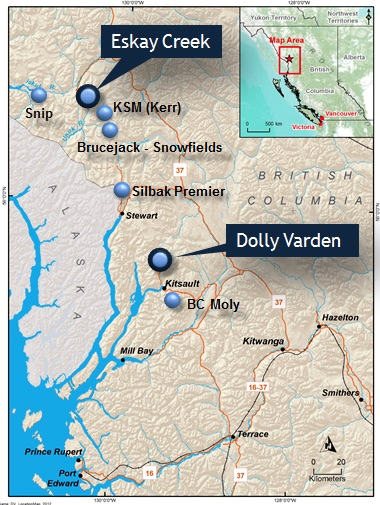

The Vancouver company’s signature Dolly Varden Project already hosts a high-grade silver resource, and is considered prospective for more discoveries, being on-trend with numerous other mines in the vicinity.

The property’s four historical deposits, mined in the 1920’s and 1950’s, are in stratigraphy (rock layers) analogous to Eskay Creek, a past producer, and Pretium Resources’ Brucejack, a high-grade underground gold-silver mine built on the edge of a glacier, about 25 kilometers north of Stewart, a deep-water port.

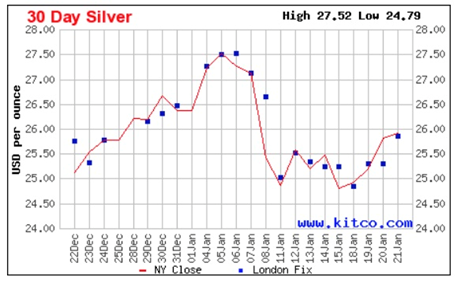

Newly capitalized, with a first-class management and technical team, including CEO Shawn Khunkhun, who joined DV about a year ago, Dolly Varden Silver is ready to embark on its next phase of exploration. The company last year completed over 10,000 meters of drilling, and is looking at the project through a new technical lense, energized by the possibility of finding new deposits along a 4.5-km mineralized trend, and a vastly improved silver market. Silver last year climbed from around $18 to a seven-year high of $29/oz, on the back of a record-breaking gold price run. While the price has since retreated, it is still north of $25, and that has changed the exploration economics not only for Dolly Varden, but its junior silver peers.

The Golden Triangle

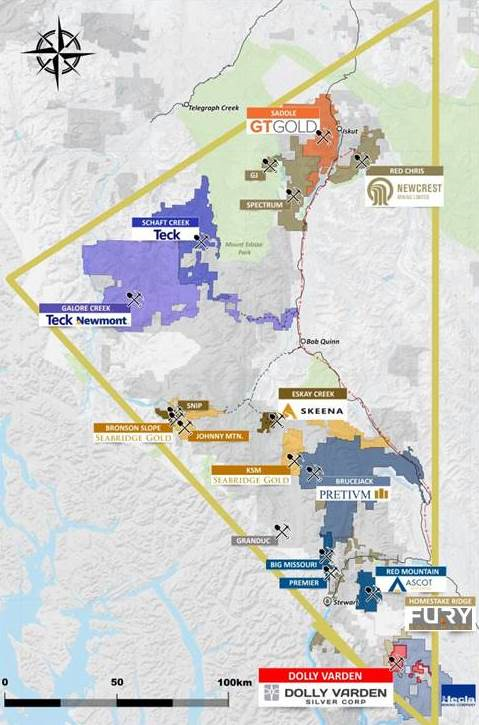

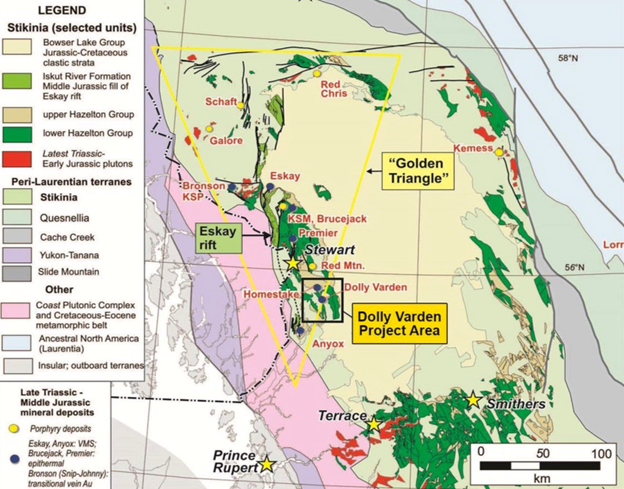

With a rich gold mining history that spans over 100 years, the Golden Triangle, just inland from the Alaska panhandle in northwestern British Columbia, has been the site of three gold rushes and some of Canada’s greatest mines, including Premier, Snip and Eskay Creek.

Other significant and well-known deposits include Brucejack, Galore Creek, Copper Canyon, Schaft Creek, KSM, Granduc and Red Chris.

The Premier Gold Mine, which started operations in 1918, returned 200% on the stock market between 1921 and 1923. The Snip Gold Mine produced a million ounces in the 1990s at an average grade of 27.5 grams per tonne (g/t). Eskay Creek was Canada’s highest-grade gold mine and the world’s fifth largest silver producer, with production well over 3 million ounces of gold and 160 million ounces of silver.

But after this amazing rush of discoveries, the Golden Triangle, at least news and investor interest-wise, went dormant; isolated from major infrastructure, the area was expensive to conduct sampling, surveys and drill programs, and due to its harsh winter climate, only accessible for half a year.

Lately, however, there has been a resurgence of interest in the Golden Triangle, with part of the excitement driven by new road and power infrastructure built by the BC government, receding glaciers revealing fresh mineralization, and the opening of Pretium’s Brucejack Mine in the summer of 2017. With 14.1 g/t gold in reserves, Brucejack, an underground gold and silver mine, was ranked the highest-grade new mine in the world in 2016.

Silver market

Dolly Varden is conducting exploration activities in the region at the perfect time for the silver market, which as mentioned, is supporting higher prices, and a renewed sense of purpose, as an essential metal for the modern economy.

Silver has some of the same properties as gold, making it suitable for artwork, jewelry, and as a medium of exchange in silver coins and bars.

But unlike gold, silver has many more industrial applications — almost as many as oil. The precious metal is strong, malleable and conducts heat and electricity better than any other material. Gold also has these properties but it is too expensive to use in circuit boards, solar panels, electric cars, etc.

While most of the mined gold is still around, either cast as jewelry, or smelted into bullion and stored for investment purposes, the same cannot be said for silver. It’s estimated around 60% of silver is utilized in industrial applications, leaving only 40% for investing. Thus, silver usually trades more like an industrial metal than an investment commodity.

This also explains silver’s volatility. Because the investment market for silver is so small, prices swing up and down wildly, at relatively low volumes.

Industrial uses for silver include solar panels, electronics and the automotive industry.

The solar power industry currently accounts for 13% of silver’s industrial demand.

More and more silver will be demanded for its use in solar photovoltaic cells, as countries move further towards adopting renewable energy sources. Around 20 grams of silver are required to build a solar panel. The Silver Institute predicts 100 gigawatts of new solar facilities will be constructed per year between 2018 and 2022, which would more than double the world’s 2017 capacity of 398GW.

According to a report by CRU Consulting, the amount of electricity generated by solar power is expected to increase by 1,053 terawatt hours (TWh) by 2025, which is nearly double what was produced in 2019.

All of that solar will be a major boon for silver.

CRU expects PV manufacturers to consume 888 million ounces of silver between now and 2030. That’s 51.5 million oz more than the combined output from all the world’s silver mines in 2019.

A study by the University of Kent found that rising demand for solar panels is driving up silver prices.

5G technology is set to become another big new driver of silver demand.

5G is the next generation of mobile broadband that will eventually either replace or augment existing 4G LTE connections. The main benefits of 5G are its drastically improved upload and download speeds. Latency, which is the time it takes devices to communicate with wireless networks, is also much quicker using 5G.

According to the Silver Institute, The electronic components that enable 5G technology will rely strongly on silver to make the global 5G platform perform seamlessly. In a future 5G connected world, silver will be a necessary component in almost all aspects of this technology, resulting in yet another end-use for silver in an already vast and versatile demand portfolio.

Among the 5G components requiring silver, are semiconductor chips, cabling, microelectromechanical systems, and Internet of things-enabled devices.

The Silver Institute expects silver demanded by 5G to more than double, from its current ~7.5 million ounces, to around 16Moz by 2025 and as much as 23Moz by 2030, which would represent a 206% increase from current levels.

On the supply side, among a wave of covid-19 temporary shutdowns last summer were some of the biggest producing silver mines in the world.

Mining companies in Peru were forced to keep operations suspended, and halt new ones, as the number of coronavirus cases soared. Companies affected included Trevali and its Santander silver mine, Hochschild Mining’s Inmaculada, and Fortuna Silver Mines’ Caylloma. Projects such as Anglo American’s $5 billion Quellaveco, Minsur’s $1.6 billion Mina Justa and Chinalco’s $1.5 billion Toromocho expansion were delayed by several months.

In Mexico, the world’s largest silver producer, a surge of covid-19 cases led to the suspension of non-essential services. Among the companies forced to temporarily halt their operations, were Newmont Mining, Argonaut Gold, Pan American Silver, Sierra Metals, Excellon Resources and Alamos Gold.

The Silver Institute predicted a 13% decline in silver production from Latin America in 2020 – equivalent to 67 million fewer ounces – with global supply set to fall 7.2%.

Given both supply and demand factors, Capital Economics estimates the silver market will remain in a small deficit, right through to 2022.

This year, analysts expect the white metal to break out of gold’s shadow as bullish sentiments from loose central bank monetary policies and industrial demand spill over.

Mike McGlone, senior commodity strategist at Bloomberg Intelligence, said in a recent report that silver may “follow its yellow peer” and set a record high of its own this year. Bank of America went even further, stating it expects silver prices to outshine gold in 2021. The gold-silver ratio has narrowed to 72, but that is still higher than historically, hinting that a further correction to the upside is possible.

Dolly Varden Silver Corp (TSXV:DV, OTC:DOLLF)

The story of Dolly Varden Silver’s involvement in the Golden Triangle, particularly the area south of Stewart, began in 1910, when the Dolly Varden Mine was discovered by prospectors of Scandinavian descent.

The Dolly Varden properties, consisting of two past-producing silver deposits, became part of British Columbia’s mining lore, featuring ore assays as high as 2,200 ounces (over 72 kg) silver per ton, with historical production of 20 million ounces Ag, between 1919 and 1959.

In fact the Dolly Varden/ North Star Mine was among the richest silver mines in the British Empire, producing 1.3Moz at an average grade of 1,109 g/t Ag between 1919 and 1921. An interesting historical tidbit: the mine was opened by mining engineer Herbert Hoover, who would go on to become US President.

The mine left a lasting legacy not only for its spectacular silver ore, but its infrastructure. In 1915, the Dolly Varden properties were sold to Chicago financiers, who built the Dolly Varden Mines Railway, the last narrow-gauge railway in BC. The railway ran for just 16 miles, facilitating the transportation of equipment and supplies to the mine site. The ore was railed to tidewater at Alice Arm for shipping to base metal smelters, mainly the nearby Granby Mines Anyox Copper smelter.

In 1919, the newly established Taylor Mining Company took over both the Dolly Varden Mine and the railroad. The Torbrit deposit was located and explored while the neighboring Dolly Varden Mine was in production.

Work at both mines was halted during the Great Depression, and in the mid-1940s, the railway at the Dolly Varden Mine was replaced by a road. In 1946 Torbrit Silver Mines bought the properties and built a 350-tonne-per day hydroelectric-powered mill and flotation concentrator plant.

In 1956, the Torbrit Mine was the third largest silver producer in Canada, outputting 18Moz at 466.3 g/t Ag, plus base metal credits, between 1949 and 1959, when the mine closed. A large part of the Torbrit deposit was left intact due to silver prices falling below $0.85/ton.

Team

Shawn Khunkhun was named President & CEO of Dolly Varden Silver in February 2020, at the same time that Rob McLeod was appointed a director and technical advisor. A capital markets veteran with experience growing early-stage companies through capital raises, acquisitions, joint ventures and spinouts, Khunkhun saw Dolly Varden as undervalued, and made it his mission to bring the company’s stock price closer in line with its peers. (DV’s share price hit $1.10/sh last August, and is currently valued at $93.5 million)

“When I came in it had a $20 million market cap, it was in good financial shape, no debt, $3 million in the treasury, and had a superstar board — people with experience with Hecla, Coeur Mining and Anglo[Gold],” Shawn told Kai Hoffmann of Soar Financial in an interview last summer. “I wanted to re-energy the company with some capital markets experience that I bring. I owe a lot of Dolly’s recent success regarding market cap growth, to Rob McLeod and the technical team he’s brought.”

A geoscientist with over 25 years experience in mining and mineral exploration, McLeod has worked for a number of major and junior mining companies, his latest stint as President and CEO of IDM Mining. McLeod was part of the 2010 White Gold area play as a founder and VP exploration of Underworld Resources. Discovery of the 1.4Moz White Gold deposit in the Yukon eventually led to a $139 million buyout by mid-tier gold miner Kinross.

Other key people on Dolly Varden’s management team include Robert van Egmond, P.Geo., chief geologist, and directors Don Birak and James Sabala. van Egmond’s career as a professional geologist includes positions with Cominco, BHP and Kennecott, along with junior explorers Orex Minerals, Platinum Group Metals, Candente, Northern Dynasty and Keewatin. Birak, another veteran geologist, has over 37 years experience, highlighted by a nine-year career with Coeur Mining, where he served as Senior Vice President of Exploration from 2004 to 2013. Before that, he was VP Exploration with AngloGold North America, Independence Mining Company, and Hudson Bay Mining and Smelting. His accolades include co-recipient of the ‘Bill Dennis Prospector of the Year’ award given by the Prospectors and Developers Association of Canada (PDAC).

Before retiring, James Sabala was the Senior Vice President and Chief Financial Officer at Hecla Mining. The largest US silver producer has mines in Alaska, Idaho and Mexico, and also generates gold from mines in Quebec and Nevada. The company in 2020 expected to generate 10.9 to 11.9Moz of silver and 195,000 to 208,000 oz gold. Before working at Hecla, Sabala was Executive Vice President – Chief Financial Officer of Coeur d’Alene Mines from 2003-08, and held the same position (Executive VP/CFO) with Stillwater Mining Company from 1998 to 2002.

Rounding out Dolly Varden’s technical team, are Ryan Weymark, Jodie Gibson and Kurt Allen.

Weymark, a professional engineer (P. Eng.) with experience in mining, heavy civil and infrastructure projects, is currently Principal of Weymark Consulting, providing project management and advisory services to the resource sector, including Teck Alaska, NexGen Energy, Coeur Mining and Imperial Metals.

Gibson is an exploration geologist with over 14 years of mineral exploration experience throughout the North American cordillera from Alaska to Mexico, including precious and base metal systems. He was the project manager of Underworld’s exploration team that discovered and defined the Golden Saddle and Arc deposits — assets that were subsequently sold to Kinross in 2010 for $139 million. Gibson also served as VP Exploration for White Gold, where he supervised over $30 million in exploration activities, including expansion of the Golden Saddle and Arc deposits and five new discoveries across the White Gold district, including the high-grade Vertigo discovery on the JP Ross property.

Kurt Allen, a geologist with expertise in volcanic and sediment-hosed epithermal gold-silver deposits is a Hecla Appointee to Dolly Vardens Technical Committee. Allen is currently Director – New Projects with Hecla, and has worked for the silver major in a number of positions since 1991, including Senior Mine Geologist, Chief Geologist, Manager of Exploration at Hecla’s Rosebud operation from 1995 to 2000, and District Geologist, Chief Geologist, Exploration Manager, and General Manager at Hecla’s San Sebastian deposit in Durango, Mexico from 2000 to 2010.

Ownership

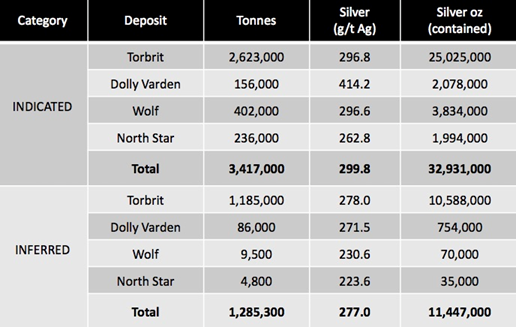

In the interview with Soar Financial, CEO Khunkhun says when he joined the company, he wanted to bring on a couple of large shareholders that could “get us the runway over a couple of exploration seasons to play out a thesis.” The goal is to try and extend the Torbrit deposit through some step-out holes, and to get into the high-grade, 500g to 1kg material at Torbrit. There are early indications of other Torbrit “look-alikes” along a 4.5-km trend. Through drilling, Dolly Varden wants to prove up another Torbrit and drastically increase the size of the resource which in all categories is about 44Moz at an average grade of 300 g/t.

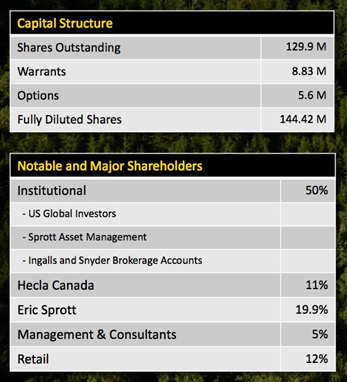

Last year, 2020, the company raised $27 million through two tranches ($2.5M from Hecla).

In May, Eric Sprott soaked up CAD$2.3 million of a $0.33 financing, the billionaire resource investor upping his stake in Dolly Varden to 19.9%. Institutional investors have come into DV in a big way — they own 50% of the 129.9 million shares outstanding (144.4 million fully diluted) and include Frank Holmes’ US Global Investors and Sprott Asset Management. Hecla Canada is another major shareholder, with 11% ownership. Dolly Varden has a complicated relationship with the major silver miner, which in 2016 tried to buy the junior out. The hostile attempt failed, and Dolly Varden was able to raise funds to repay its debts and start a field program.

Last fall, Hecla participated in Dolly Varden’s $7-million flow-through private placement, thereby maintaining a 10.7% interest. After the raise, Hecla holds 13.9 million shares and 940,948 warrants which, if exercised, will up its ownership to 11.3%.

It’s unusual for a junior Dolly Varden’s size to be so tightly held by institutional and notable shareholders. In fact, when all is said and done, retail only owns 12%.

“This capital we’ve brought in will allow us to potentially expand the current resource,” Khunkhun told Soar Financial’s Kai Hoffmann, last summer.

Exploration & geology

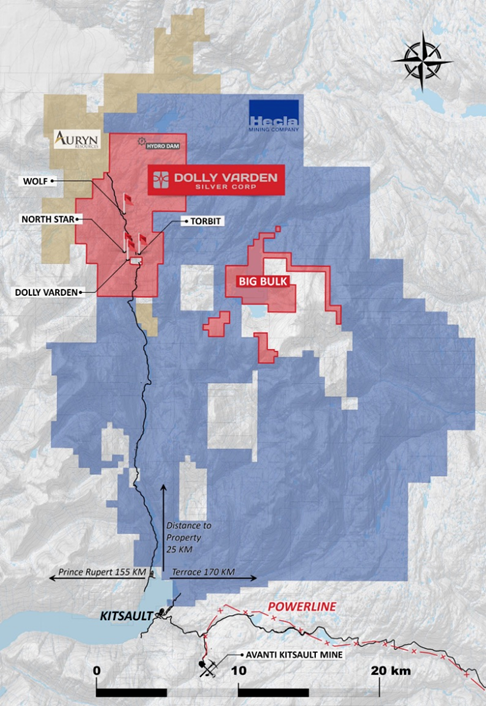

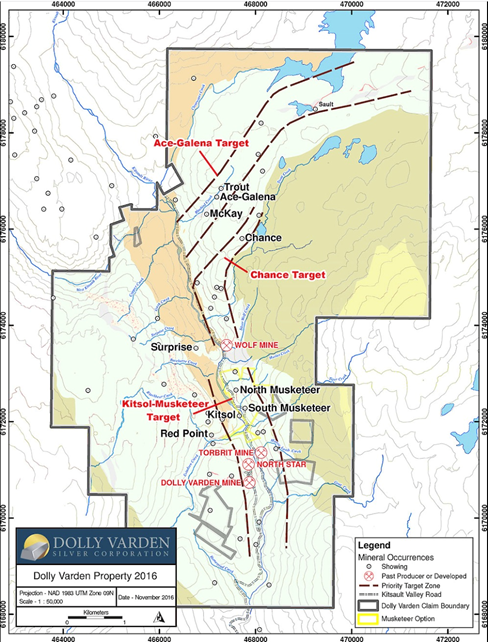

The Dolly Varden Project comprises 8,800 hectares (88 square km) in the Stewart Complex of northwestern BC, which hosts both base and precious metals deposits. The property has four historically active mines — Dolly Varden, Torbrit, North Star and Wolf. According to the company, only 3% of the property has been explored in detail, leaving tons of upside for shareholders.

It lies to the west of Hecla Mining’s (NYSE:HL) Kinskuch Project, and borders Fury Gold Mines LTD (T:FURY) Homestake Ridge, where a PEA envisions a 13-year mine with peak annual production of just over 88,000 gold-equivalent ounces. More than 275 holes totaling over 90,000 meters have been completed on the property. Hecla’s Kinskuch is an early-stage project with the potential for discovery of epithermal silver-gold, gold-rich porphyry and VMS deposits. On the map below, note that Dolly Varden’s project is located in the bottom corner of the Golden Triangle, which hosts deposits and mines such as Teck’s Schaft Creek, Teck/Newmont’s Galore Creek, the Red Chris Mine formerly owned by Imperial Metals, now operated by Australia’s Newcrest, and Seabridge Gold’s monster KSM deposit.

The project is logistically supported by roads, water and power. The ports of Stewart and Alice Arm are less than 50 km away, Terrace, a potential source of labor, is a driveable 170 km inland from Kitsault, and there is a power line 30 km to the south. As mentioned at the top, there is a historical hydro project, that was used to power the mill/ concentrator plant at the Dolly Varden Mine, which could be re-purposed for modern mineral processing. Seven kilometers of historical underground workings were rehabilitated in 2017.

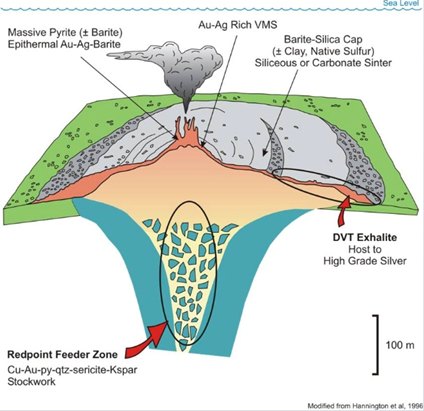

The geology at Dolly Varden consists of volcano-sedimentary rocks belonging mostly to the lower and middle Jurassic Hazelton Group. These include intermediate volcanic and volcaniclastic rocks of the Betty Creek Formation and bimodal volcanic and sedimentary rocks of the Salmon River Formation.

Geological work commissioned between 1979 to 1990 established the common characteristics of the major silver deposits and occurrences in the upper Kitsault valley. The rock formations and the style of mineralization and alteration on the Dolly Varden properties share strong similarities to the Eskay Creek deposit, an exceptionally prolific gold- and silver-rich lode 100 km to the north.

Note that Eskay Creek isn’t a pure gold-silver deposit, but is rather described as a volcanogenic massive sulfides (VMS) deposit with substantial base metal credits. High-sulfidation VMS deposits form near underwater vents, or “black smokers”, where base and precious metals-rich hydrothermal fluids exhale onto the seafloor in shallow water, and eventually form mineral deposits.

Although the lead and zinc grades at Torbrit and Ace-Galena have been lower than at Eskay Creek, the fact that the two base metals exist, validates Dolly Varden’s geological model of the deposit being analogous to Eskay Creek.

Even more exciting are the epithermal veins running over the property, indicating that the Dolly Varden Project isn’t a true VMS deposit like Eskay Creek, but rather, shows characteristics of Pretium Resources’ Brucejack Mine. Epithermal veins generally contain high-grade precious metals mineralization. The fact that the Dolly Varden project’s historical drill results include 0.5m of over 3,000 g/t silver, and 2m @ 2,500 g/t Ag, confirms it is a blend of Eskay-Creek style and Brucejack-style mineralization worthy of follow-up.

Regarding the four targets, the most prominent mineralized zone known as the Dolly Varden-Torbrit Horizon (“DVTH”) extends from the Dolly Varden Mine, on the west, passes though the North Star underground workings and continues into the Torbrit Mine, on the east. The DVTH exhalative body forms an almost continuous sheet, ranging in true thickness from 3 to 38m, which extends from the Dolly Varden West zone to Moose-Lamb.

Separate from the DVTH body, the Red Point Zone (on the western fringe of the upper Kitsault Valley) and the Wolf (on the eastern side of the valley) each have geological similarities to the targeted hydrothermal vein and underwater hot springs (“black smokers”) geology.

In 2011 Dolly Varden drilled 4,607 meters in 21 core holes at the Wolf deposit, achieving assay highlights of 595 g/t silver over 15.2 meters in an epithermal vein and 384 g/t silver over 5.45 meters in a VMS layer.

2012 drilling targeted the Dolly Varden mine, with assay highlights of 5.3m grading 536 g/t Ag. Work in 2013 focused on the Torbrit Mine, with underground rehabilitation, surveying and sampling, in addition to 3,064 meters of drilling in 14 holes. Nearly all holes at Torbrit intersected significant VMS mineralization ranging in thickness from 9.3 meters to 89.1m. One assay highlight was 17.1m grading 509 g/t Ag.

Under 10,000m of drilling led to a maiden resource estimate in 2015, of 42.5Moz silver, using a cut-off grade of nearly 5 oz Ag per ton, three-quarters of which was in the Indicated resource category.

The 2016 exploration program focused on the Ace-Galena trend, which hosts the Torbrit Mine, where drill results confirmed a high-grade silver system with intersections of 1.25m @ 454 g/t Ag, and 3.15m @ 591 g/t Ag.

An updated NI 43-101 resource estimate completed by Dolly Varden in 2019 revealed 32.9Moz silver in Indicated resources and 11.477 Moz Inferred, adjacent to the historic deposits. Drilling and underground work that went into the resource estimation confirmed that the mineralization occurs as two styles: bedding-parallel VMS, similar to that mined at Eskay Creek, as well as cross-cutting epithermal mineralization similar to that being developed at Pretium’s Valley of the Kings deposit (Brucejack Mine).

According to DV, both the Eskay Creek and Valley of the Kings deposits are located on the same structural trend to the north of Dolly Varden’s ground. Dolly Varden represents the silver end of these styles of mineralization and includes the base metals lead and zinc.

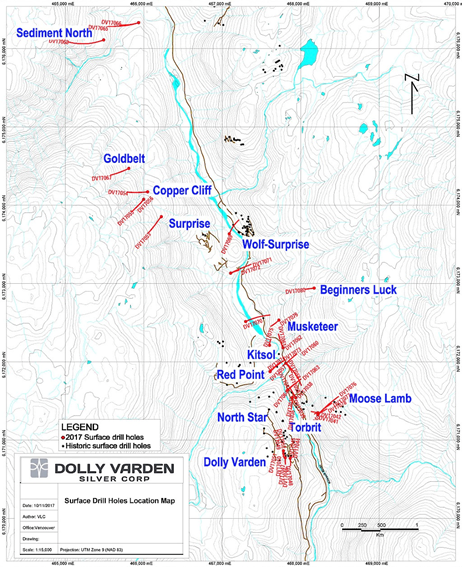

Over the past three years, structural re-interpretation and aggressive drill testing have yielded new discoveries of high-grade silver mineralization proximal to areas with 100 years of exploration history. Since 2017, Dolly Varden has drilled over 55,000 meters in 174 holes.

Assay highlights, with locations identified on the map below, include 433 g/t Ag over 21.3m at the Torbrit North Offset; 120 g/t Ag over 22.6m and 482 g/t over 5.0m at the Torbrit East Offset; 394 g/t Ag over 7.07m at the Moose Lamb Vein; 110 g/t Ag over 2.94m at Beginner’s Luck; and 385 g/t Ag over 24.9m (including 1,605 g/t over 4.87m) at the Chance Offset.

At Torbrit North and Torbrit East, offset basins reveal mineralized sequences similar to the main Torbrit Mine, ie., exhalative stratabound mineralization with later epithermal vein brecciation overprint. 4.5 km north of the Torbrit Mine, the Chance Zone comes to surface. Historical resources at the Chance and Moose-Climax deposits have yet to be upgraded to NI 43-101 standards. Another interesting prospect is the Ace-Galena target, where 3.25m grading 406 g/t has been identified at the Ace-Galena VMS horizon, and 3.15m grading 515 g/t Ag was reported from the Ace-Galena epithermal vein.

Additionally, Dollar Varden’s Big Bulk copper-silver prospect lies 10 km to the southeast of its flagship project, along the south shore of Kinskuch Lake. Seven mineral claims are surrounded by Hecla’s above-mentioned Kinskuch Project. According to DV, the property’s alkali porphyritic rocks of the Hazelton Group, with altered quartz monzonite intrusives, mean Big Bulk is analogous to the Sulphurets, KSM (Seabridge) and Red Mountain (IDM Mining) deposits. Intermittent exploration has taken place over the past several decades, with one hole reporting 0.31% copper over 54m, and 4 g/t gold over 10m. An airborne geophysical study was flown in 2017.

Last October, Dolly Varden published the results of 2020 exploration, which included step-out drilling for the current resource at the Torbrit Mine, and infill drilling to expand the high-grade zones within the deposit. The step-out highlights were 351 g/t over 12.75m, including a higher-grade 1,083 g/t Ag intercept over 2.7m; and 135 g/t Ag over 37.5m, including 906 g/t over 1m. The best infill drill hole featured 302 g/t Ag over 31.95m, including 642 g/t Ag over 4m.

Conclusion

It’s rare these days to find a pure silver explorer, and Dolly Varden Silver appears to have everything it needs to make a success of its project of the same name. That includes a first-rate exploration team with loads of experience and successes behind their collective belt; a project in a jurisdiction that is both safe and geologically endowed with high-grade silver mineralization including four past-producing mines; and a tightly-held share structure with an impressive 75% institutional and notable shareholder ownership, including Eric Sprott and NYSE-listed Hecla Mining, the largest silver producer in the United States.

Dolly Varden’s management is looking at the project through a new technical lense, energized by the possibility of finding new deposits along a 4.5-km mineralized trend, and a vastly improved silver market. Silver prices north of $25 change the exploration economics for Dolly Varden and its junior silver peers, opening the door to financings and exploration programs that expand or fill in existing resources.

Beyond the drill bit, Dolly Varden is also looking at opportunities for consolidation. “My goal is to build up some ounces through exploration and through M&A, as long as it’s accretive and it moves the needle,” says CEO Shawn Khunkhun.

Dolly Varden Silver Corp.

TSXV:DV, OTC:DOLLF

Cdn$0.72, 2021.01.22

Shares Outstanding 126,022861m

Market cap Cdn$90.7m

DV website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not own shares of Dolly Varden Silver Corp (TSX.V:DV). DV is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.