Silver Dollar completes prospecting & soil sampling at Longlegged Lake; readies Ontario property for IP survey

2020.12.08

Silver Dollar Resources (CSE:SLV, OTC:SIDRF) continues to advance its Longlegged Lake project in northwestern Ontario, having recently completed prospecting and a soil sample survey using glacial till samples found within the Pakwash Lake Fault Zone (PLFZ).

The company reports 30 samples were taken to assess the potential for gold mineralization in basal till down ice direction of the PLFZ. The samples have been sent to a company in Nepean, Ontario for analysis, including the presence of gold grains, and their shape and size to help determine how close they are to the potential source.

In the spring of 2019, Silver Dollar completed a helicopter high-resolution magnetic (MAG) survey that identified northeast-southwest trending geological features interpreted to be the deep-seated Pakwash Lake Fault Zone.

The curved linear features identified by the 1,837 line-km survey (@ 25-meter spacings), could also relate to shearing and folding, where dilation zones may have enabled mineralization to occur.

The company thinks the mineralization at Longlegged Lake is hosted in splays off the main crustal fault, which extends over 12 km deep. The idea is to try and match the very positive geophysical survey with geochemical results at surface. Fieldwork currently underway includes soil sampling, geological mapping and prospecting to follow up on the key structures identified by the MAG survey.

The property is fully permitted and ready to drill once targets are identified.

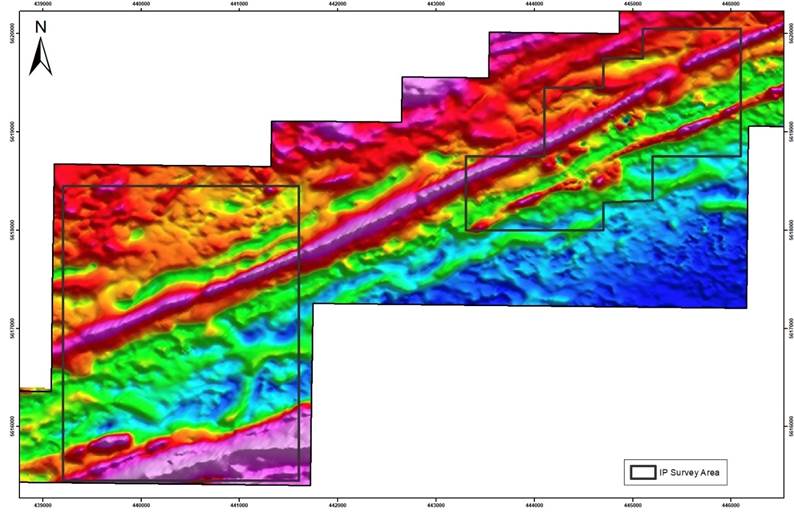

According to SLV, The next phase of exploration is comprised of two areas of Induced Polarization (IP) surveying which is ongoing with expectations of completion in the next two weeks. The two grids were selected using the interpretation of the airborne magnetics. The IP survey is intended to define sulfide mineralization within or adjacent to the PLFZ. In other locations within the Red Lake area, sulfide mineralization is associated with gold values.

“With drill permits in place and a healthy treasury, we will move quickly to follow up on any encouraging coincident targets,” said Silver Dollar’s President & CEO, Mike Romanik, in the Dec. 3 news release. (SLV completed a $10.5 million private placement in September, @ $1.40/sh. Among the buyers were renowned resource investor Eric Sprott, whose purchase of 4.621 million shares gives him a 19.9% interest in the company; and major silver miner First Majestic, which subscribed for 500,000 shares, giving them a 16.4% stake).

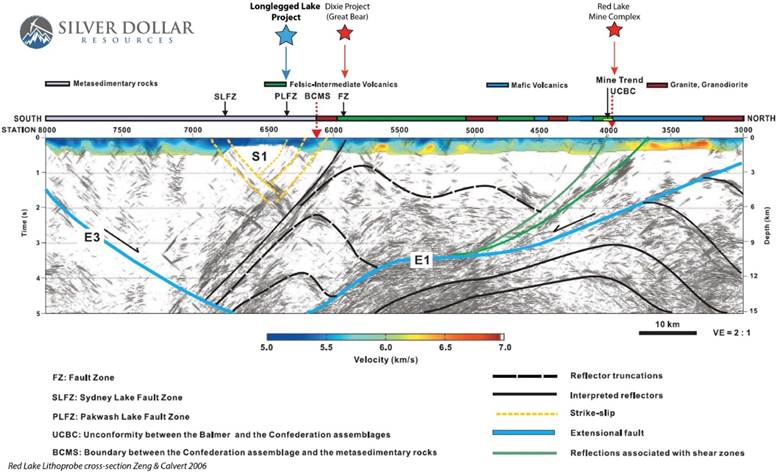

Deep Penetrating Regional Lithoprobe Seismic Survey

IP Survey areas

Longlegged Lake

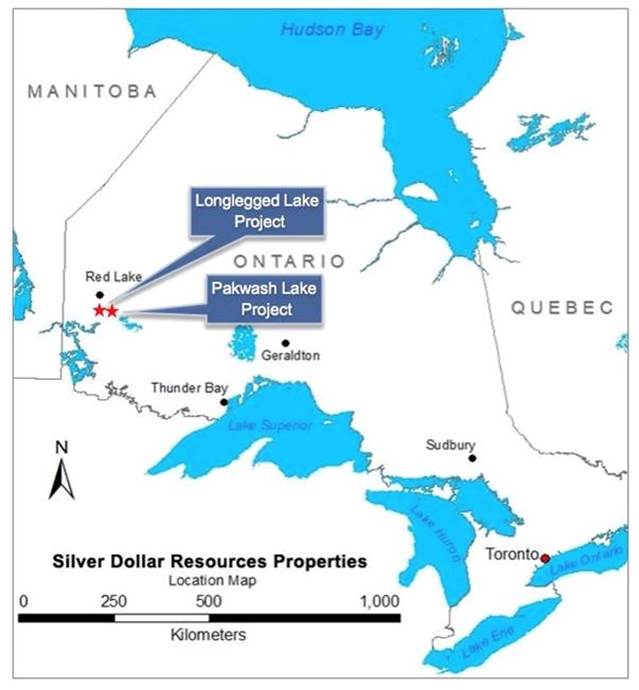

Silver Dollar has two properties, Longlegged Lake and Pakwash Lake, in the Red Lake Mining District, where around 30 million gold ounces have been pulled from 29 mines since the 1930s. Past producers include the Campbell, Cochenour, Red Lake, Madsen and Starratt Olsen mines.

Map of Silver Dollar’s Longlegged Lake and Pakwash Lake projects in the prolific Red Lake Mining District of northwestern Ontario.

Previous work by Laurentian Gold found anomalous gold in soil samples along the Pakwash Lake Fault Zone (PLFZ) — a major regional structure.

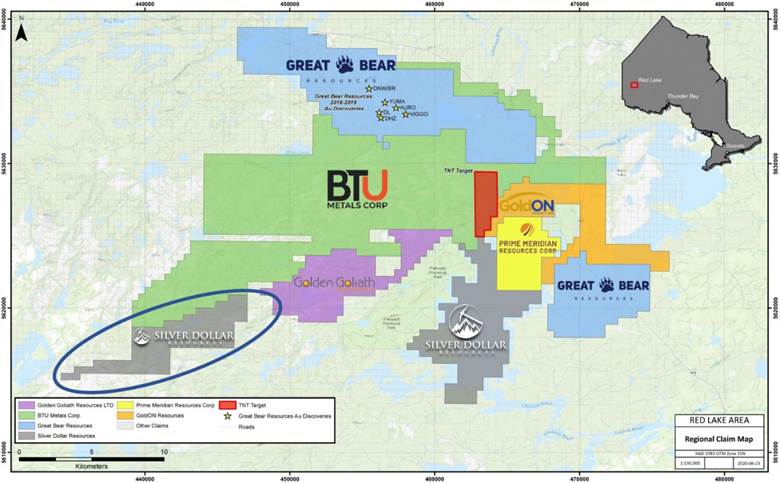

A sequence of metamorphosed felsic tuffs and sediments were found to occur adjacent to a regional basalt unit that can be traced through BTU Metals’ (TSXV:BTU) property north, along a regional fold structure, together with an adjacent conglomerate which is identical to the northerly outcrops. This basalt unit also occurs along the south side of the LP Fault shown on sections by Great Bear Resources (TSXV:GBR).

The Longlegged Lake property has been found to host a repetition of the same sequence of rocks that hosts the LP Fault zone on the Dixie Lake property. Both the Pakwash Fault and LP Fault are outlined as deep-seated structures, according to regional seismic profiling by the Canadian government, and are similar in nature to the faults associated with the major mines at Red Lake.

Regional claim holders include Great Bear, BTU Metals and Golden Goliath.

Exploration at Red Lake has been re-energized with the success of Great Bear Resources and the numerous high-grade gold discoveries on their Dixie property. From $0.50 a share in the spring of 2018, GBR leapt 375%, to a June 1, 2020 all-time high of $19.27/sh.

This past summer, GBR’s drills unearthed another big find at Dixie. In the new Arrow Zone, a drill hole hit three zones of gold mineralization including a 15-meter-wide interval containing high-grade visible gold in quartz veins.

The occurrence of gold-bearing quartz veins with red-brown hydrothermal biotite alteration is a key characteristic of the High Grade Zone discovery at the Red Lake gold mine, first discovered by Goldcorp (now merged with Newmont) and presently operated by Evolution Mining.

Great Bear is currently in the throes of a CAD$21 million exploration program at Dixie, with 198 holes completed this year.

The company recently reported all 16 new drill holes sunk into previously undrilled gaps in the 4,200m by 500m LP Fault drill grid, intersected gold mineralization. The highlight was hole BR-212, which assayed 4.69 g/t gold over 101.50m, including 41.25 g/t Au over 5.25m. According to Great Bear, the highest-grade central mineralized interval assayed 181 g/t Au over 0.50m, which is the longest multi-gram gold interval drilled at the project to date and occurs at shallow depths of approximately 80 to 170m.

Silver Dollar has followed Great Bear’s stock price trajectory, climbing from $0.28/sh in June to a record-high $1.92/sh in August, mostly on the strength of its La Joya project in Mexico, discussed below.

La Joya

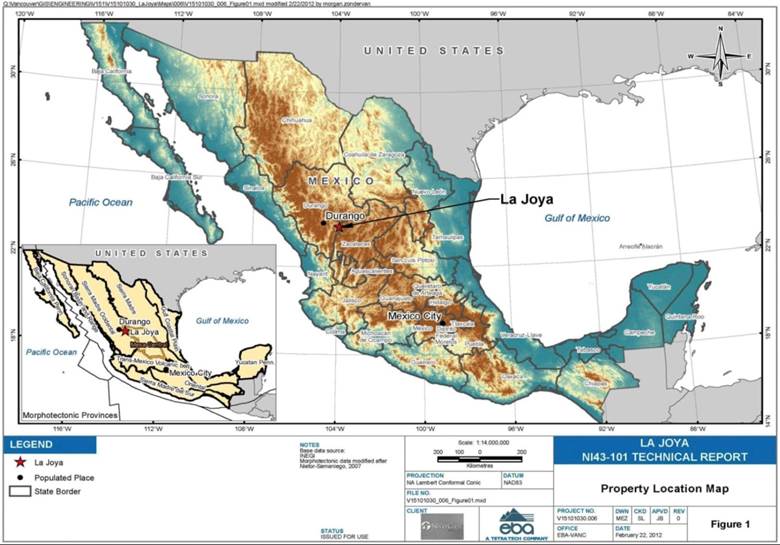

Earlier this year, SLV signed a Letter of Intent (LOI), to acquire up to a 100% interest in First Majestic Silver’s La Joya silver project, located in the State of Durango, Mexico.

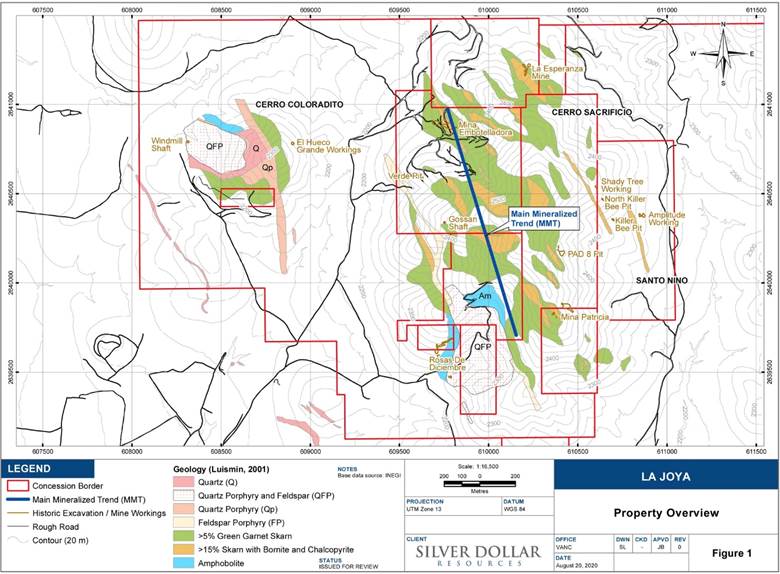

Map of the La Joya property in Mexico optioned from First Majestic Silver.

For the past few months, Silver Dollar has been going through historical exploration data at La Joya, including records of a Phase 3 drill program conducted by SilverCrest in 2014.

Included among the unreported results of a 17-hole in-fill drill program (2,698 meters), was “the presence of discrete high-grade stockwork and structurally controlled veining”. Hole LJ DD14-116 intercepted 2.0 meters grading 723.5 grams per tonne (g/t) silver (Ag), 8.97% copper (Cu) and 0.09 g/t gold (Au), or 1,778.1 g/t silver equivalent (AgEq).

According to CEO Mike Romanik, the 750m-wide gap between the Main Mineralized Trend and the Santo Nino deposit will be a priority at La Joya because “It demonstrates the tremendous potential for resource expansion.”

Silver Dollar summarizes SilverCrest’s 2014 results in an Aug. 25, 2020 news release.

It’s interesting to note that the 17-hole program was done with the goal of completing an updated resource estimate during the first half of 2015. However the new resource estimate was never finished, due to First Majestic’s takeover of SilverCrest in October, 2015.

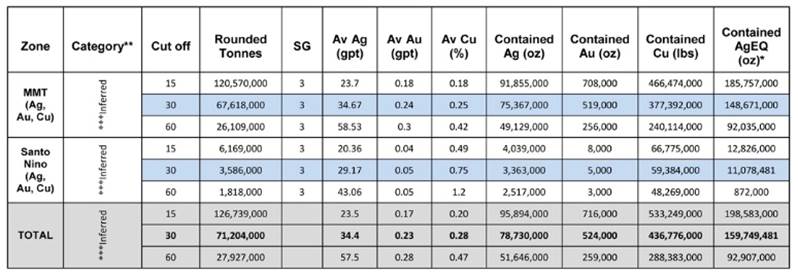

So Silver Dollar is basing its exploration going forward on the 2013 resource estimate, which outlined 159.7 million inferred silver-equivalent ounces at a 30 grams per tonne cut-off. Doubling the cut-off grade to 60 g/t yields a more conservative 92.9 million AgEQ ozs.

Table is from the National Instrument (NI) 43-101 Technical report titled

“Preliminary Economic Assessment for The La Joya Property, Durango, Mexico”, dated 5 December 2013.

The estimate took into consideration 89 historical holes totaling just over 30,000m. Mining would be by open-pit methods.

The property is about 75 km southeast of the state capital city of Durango in a prolific mineralized region with past-producing and operating mines including Grupo Mexico’s San Martin mine, Industrias Penoles’ Sabinas, Pan American Silver’s La Colorada, and First Majestic Silver’s La Parrilla and Del Toro Silver mines. Access and infrastructure are considered excellent with highway, rail and power lines nearby.

Property overview of La Joya, including the Main Mineralized Trend (blue line).

La Joya’s unrealized potential is evident from news about the property in 2012, when SilverCrest saw the project as an integral part of growing its resource base.

The project hosts the La Joya mineralized trend as well as the Santo Nino and Coloradito deposits. The Ag-Cu-Au property consists of 15 mineral concessions totaling 4,646 hectares.

Initial exploratory drilling identified a 2.5-kilometer mineralized trend with economic intercepts up to 230m wide.

Between 2010 and 2012, SilverCrest completed 149 drill holes and 348 surface samples. Widespread drilling throughout a first-phase 1 km x 500m area, delineated 151.3Moz silver, 333,400 oz gold and 270.2 million pounds of copper in the inferred category, equal to more than 100Moz silver-equivalent, at a cut-off grade of 15 g/t AgEq.

New tonnage added in late January, 2012 marked a 424% increase, to 125 million contained ounces, in SilverCrest’s total silver-equivalent inferred resource.

A phase 2 drill program further tested the phase 1 area. In September of 2012, SilverCrest published the results of 15 more drill holes plus surface sampling. According to then-President J. Scott Drever,

“The drill results continue to support our large tonnage silver deposit model and the extensive surface sampling in conjunction with certain drill holes support the concept of a potentially higher grade, open pit concept.”

SilverCrest also re-analyzed drill core from a historic 56 drill holes completed between 1979 and 2003 by previous operators. Their analysis identified the Coloradito molybdenum, tungsten, silver and gold target.

Coloradito has weighted average grades similar to near-surface bulk tonnage deposits such as Thompson Creek and Endako — two of the largest moly mines in the United States — the Sisson tungsten-moly mine in New Brunswick, Canada, and El Creston in Mexico.

Highlight drill intercepts from Coloradito included 55 meters grading 16.8 g/t silver, 0.06 g/t gold and 0.072% molybdenum; 208m averaging 12.4 g/t silver, 0.10 g/t gold and 0.226% moly; and 78m carrying 12.5 g/t silver, 0.15 g/t gold and 0.098% moly. Five collared holes were also drilled at the nearby nearby Santo Nino and Esperanza targets.

Silver Dollar Resources Inc.

CSE:SLV, OTC:SIDRF

Cdn$1.46, 2020.12.07

Shares Outstanding 35,253,567m

Market cap Cdn$51.47m

SLV website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not own shares of Silver Dollar Resources (CSE:SLV). SLV is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.