Graphite: the mineral flying under the radar during the global electrification push

2020.12.19

For all the talk about the era of “global electrification” and the race between world powers to secure minerals critical to this process, one raw material that has been flying under the radar is graphite.

Like lithium, graphite is indispensable to the global shift towards electric vehicles (EVs); it is the second-largest component in lithium-ion batteries by weight. It is not a substitute for lithium either, since graphite (in spherical form) is in the anode while lithium is used for cathodes.

Spherical graphite can only be produced from flake graphite, a form of natural graphite, upgraded to a high purity level, but its manufacturing process is expensive and wastes up to 70% of the flake graphite feed.

Out of the approximately1.2 million tonnes of natural graphite processed worldwide each year, only 40% of those are flake graphite. This figure is far from enough to sustain the growing demand for battery materials

Graphite Shortage

On average, a hybrid-gasoline electric vehicle (HEV) carries up to 10 kg of graphite, and a plug-in EV has around 70 kg. This means for every one million EVs, it would require over 70,000 tonnes of natural graphite.

By estimates, at least 125 million EVs are expected to be traveling global highways by 2030, nearly 20 times the global EV stock in 2019. That’s more than eight million tonnes of battery-ready graphite needed in the coming decade.

Furthermore, this does not factor in the relentless growth of consumer electronics, another industry that heavily relies on lithium-ion batteries, as well as future developments in portable tools and energy storage applications.

Overall, the global lithium-ion battery industry is expected to grow at a CAGR of 16.4% within the next five years, reaching a value of $94.4 billion by 2025. Sustained demand from developed nations in North America and Europe and expanding Asian markets such as China, India, and South Korea will all be the driving forces behind this growth.

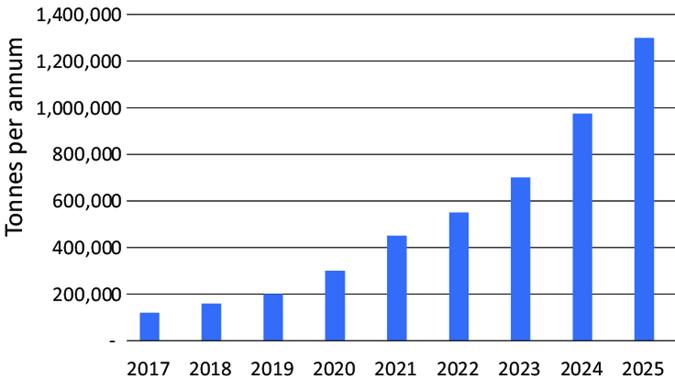

Benchmark flake graphite forecast

According to Benchmark Mineral Intelligence, the flake graphite feedstock required to supply the world’s lithium-ion anode market is projected to reach 1.25 million tonnes per annum by 2025. At this rate, demand would easily outstrip supply in a few years.

Supply Chain Vulnerability

The global supply chain for graphite is severely vulnerable to disruptions due to the near “monopolistic” nature of the market.

At present, China is by far the largest graphite supplier, producing around 60% of the world’s flake graphite, followed by Mozambique and Brazil. Other high-profile nations that also produce graphite include Canada, India and Russia.

Meanwhile in the US, arguably China’s biggest economic rival and a main driver of the future EV movement, there is currently no graphite being mined on American soil. The lack of a domestic source meant that US manufacturers had to import roughly 40,000 tonnes of graphite material during 2018, rising to 58,000 tonnes in 2019.

This kind of dependence on foreign suppliers is one of the primary reasons why the United States Geological Survey (USGS) included graphite on its list of 35 minerals considered “critical” to the nation. Many of these are overwhelmingly produced by one nation: China.

For years, the reliance on China for resources had been an “elephant in the room” for Western policymakers, but the executive order issued by President Donald Trump meant that the US had taken steps to rectify that. And now, the incoming Biden administration and like-minded leaders around the world will make their moves to address this supply chain vulnerability.

More Battery Metals

Another key factor for listing graphite as a critical mineral is the US domestic demand. The USGS sees a major spike in demand once Tesla’s Gigafactory in Nevada becomes fully operational.

Once complete, this 10-million-square-foot plant in Nevada is expected to be able to manufacture enough batteries for roughly half a million Tesla cars per year. This plant alone will need around 35,200 tonnes of spherical graphite per year, which is almost comparable to US annual imports.

An inevitable demand surge adds further “fuel” to the need to overcome the deficiencies in the battery metals supply chain.

This is what Republican Senator Lisa Murkowski, who serves as chair of the Senate Committee on Energy and Natural Resources, had to say:

“It is a greater vulnerability, I believe, than we once had when it came to our need for oil and resources to power ourselves.”

Murkowski has been pushing legislation to boost domestic mining of minerals such as lithium, cobalt and graphite, those essential to the national movement towards batteries and energy storage.

In short, America needs domestic sources of these minerals, and fast.

Graphite Creek Deposit

Fortunately, US manufacturers may not need to look farther than the northwest corner of the continent.

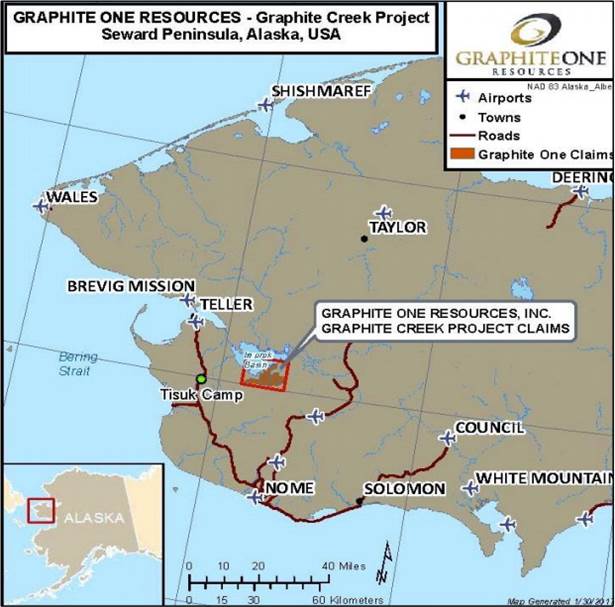

Large graphite deposits can be found in many parts of Alaska including the Seward Peninsula, where Vancouver-based junior Graphite One Inc. (TSXV: GPH) (OTCQB: GPHOF) is currently developing the largest known resource in the US, and what could potentially be the leading domestic source of graphite material used in lithium-ion batteries for generations.

Graphite Creek location map

The Graphite Creek deposit is located along the north flank of the Kigluaik Mountains in western Alaska, about 55 km north of the city of Nome.

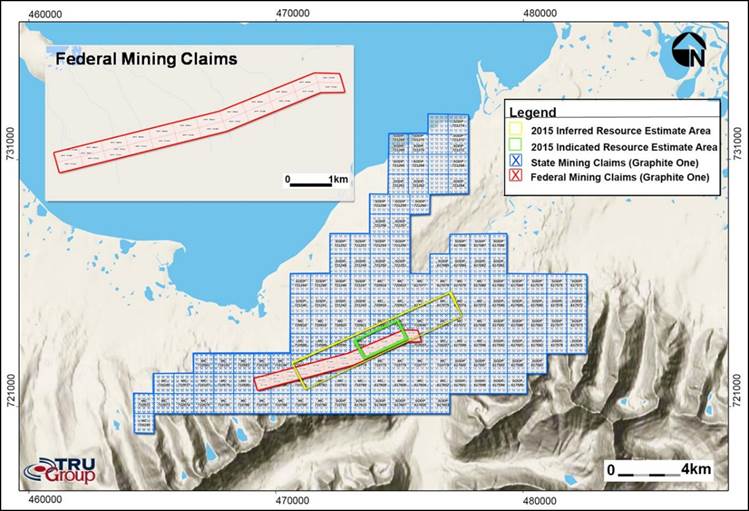

The entire property consists of as many as 176 Alaska state mining claims (figure below, shown in blue) covering 9,583 hectares of land. Twenty-four of these were formerly federal claims (shown in red) that the company later converted into state mining claims, thus relieving the project of certain federal regulatory requirements during the permitting process.

Graphite Creek mining claims

Graphite showings on the property were first discovered after the 1898 Cape Nome gold rush, and have been reported under several names including the Uncle Sam, Tweet and Kigluaik graphite deposits. These deposits were intermittently mined from 1907 to 1920, with some 580 tonnes of hand-sorted graphite mined from talus and adits (small <10 m excavations into exposed outcrop) that penetrated high-grade graphitic zones.

Prior to Graphite One’s interest, the deposits were last explored during the mid-1990s when mapping, sampling and mineralogical work were conducted. The graphite showings were never drill tested prior to the company’s exploration program in 2012.

Graphite Creek PEA

To establish the potential viability of Graphite Creek’s resources, the company hired TRU Group Inc., a technology metals consultant with expertise in the graphite supply chain, to complete a preliminary economic assessment (PEA) for the project in 2017.

The PEA study envisions a 40-year operation with a mineral processing plant capable of producing 60,000 tonnes of graphite concentrate (at 95% Cg) per year, once full production begins in year 6.

At full production, a product manufacturing plant is expected to convert the annual 60,000 tonnes of concentrate into 41,850 tonnes of CSG and 13,500 tonnes of purified graphite powders.

However, those figures were based on exploration done prior to Graphite One’s 2018 drill program, which returned impressive results such as 5.8 m of 8.06% graphite from 27.8 m and 16.3 m of 11.93% graphite from 44 m.

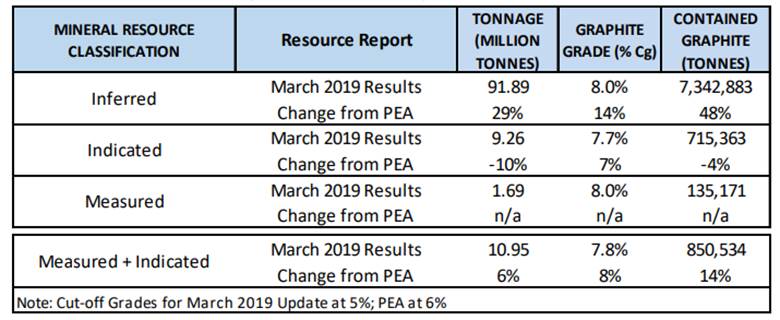

The 2018 infill drilling allowed the company to expand the existing graphite resources at Graphite Creek to:

1.69 million tonnes (“Mt”) Measured, grading 8.0% graphitic carbon (“Cg”)

9.26 Mt Indicated, grading 7.7% Cg

and, 91.89 Mt Inferred, with 8.0% Cg

All using a 5% Cg cut‐off grade.

“This increase in resources demonstrates the potential for a robust, high-grade US graphite project,” Graphite One chief executive Anthony Huston said. The upgraded resource will be used to advance the Graphite Creek project towards pre-feasibility (PFS) stage.

STAX Advantage

Apart from its size, Graphite One’s deposit also boasts characteristics that could make it an ideal candidate for supplying high-grade coated spherical graphite (CSG) to the lithium-ion battery industry.

According to TRU Group, the Graphite Creek samples have shown morphological characteristics that are both globally unique and commercially important.

Using the STAX acronym, TRU highlighted the following advantages:

- Naturally occurring Spheroidal shapes, close to the size ranges required for lithium-ion batteries;

- High proportions of Thin, large flake graphite with high aspect ratios;

- Significant proportions of “pressed flake” or 3D Aggregated graphite particles, some in the shape of flakes, alongside integral classic flake both with high aspect ratios;

- Naturally Expanded or exfoliated flake graphite

In summary, the “STAX” properties could lend to a diverse set of applications with minimal processing, thus making Graphite One’s material a good fit for many high-tech and green energy sectors.

For example, tests carried out by TRU found that more than 74% of the flake graphite could be turned into spherical graphite without milling. This could be significant, considering only about 40% of the large flake graphite found in other known deposits, such as those in China, can be converted to spherical graphite.

To highlight these advantages, Graphite One has applied to trademark the “STAX” graphite within the US and Canada to differentiate its product from the rest of the pack.

Conclusion

The World Bank is projecting that demand for graphite will soar by 383% between now and 2050, which means projects like Graphite Creek will play a vital role in the global economy as we transition towards clean energy.

Graphite Creek’s potential hasn’t gone unnoticed by automakers either. Last fall, Graphite One revealed that material from the project site was being tested by a major multinational EV manufacturer in the US.

Prior to that, Alaska Governor Michael Dunleavy submitted a letter to President Trump requesting that the Graphite Creek project and associated processing facility be designated a high-priority infrastructure project (HPIP).

Remember, we’re in the middle of a global electrification push, and there is a dire need for minerals critical to this process. This is especially true for graphite, where the US has zero domestic sources to draw from.

Not to mention, prices of industrial metals have already seen a huge increase this year, which analysts are comparing to the commodity supercycle of 2003.

We – at Ahead of the Herd – also believe we’re on the cusp of another commodity bull market. But this time, it’s on a global scale, not just driven by emerging markets. That would make the previous “supercycle” pale in comparison.

Graphite One Inc.

TSX.V:GPH, OTCQB:GPHOF

Cdn$0.495, 2020.12.18

Shares Outstanding 43,109,143m

Market cap Cdn$21,555,000m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not own shares of Graphite One Inc.

(TSX.V:GPH, OTCQB:GPHOF). GPH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.