Virus won’t keep copper down for long

2020.03.13

The current stock market rout is pulling the world economy down into what many fear could be the start of a global recession. Yet behind the apocalyptic headlines and angst-filled news reports, things are changing.

The number of coronavirus cases are dropping in China. One epidemiologist, renowned for helping beat SARS in 2003, says the pandemic could be over by June if countries take similarly aggressive containment measures that China has.

Factories closed since Chinese New Year are re-opening, and Beijing is eyeing a $570 billion infrastructure build-out, not unlike its stimulus package of 2008, to get the economy back on track.

A massive infrastructure spending push by China and, in the future, by other leading industrial nations such as the United States, which needs to spend around $2 trillion to close its “infrastructure gap”, could help to ameliorate the economic impacts of covid-19 which has so far been impervious to monetary easing, such as the US Federal Reserve’s emergency 50-basis-point interest rate cut earlier this month.

It would also be very good for base metals which, despite a major sell-off in stock markets this week, have actually done not too badly.

This article is all about the “copper” lining, showing up in an ever-darkening cloud of financial panic caused by an markets slayer – the coronavirus.

Base metals gain

On Wednesday, economic bellwether copper pushed higher, on hopes that stimulus measures by several countries – including the UK , Australia , Japan and the United States – can succeed in cushioning the economic blows from covid-19.

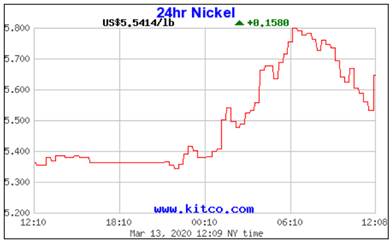

Three-month copper rose 0.6% on the LME, to $5,597.50 a tonne. The red-metal rally spilled over to other base metals. Zinc jumped 1.9%, to $2,013/t, nickel gained 1.5% to $12,860 a tonne, and lead increased 1.1% to $1,814.50/t.

While panic selling pushed the Dow, Nasdaq and the S&P 500 into bear-market territory (ie. a fall of over 20%) (Thursday was the worst day since 1987), year-to-date copper price declines are barely into double digits. Iron ore, another strong economic indicator metal, on Wednesday was up more than 2% for the week, recouping pandemic-related losses, according to Fastmarkets MB.

Worst is over in China

As for the spread of the virus, the epicenter, China’s Hubei province, logged only eight new infections on Wednesday – the first day since the outbreak started that numbers have dropped below 10.

“The peak of the epidemic has passed for China,” Reuters quoted a spokesman for the National Health Commission. The news service even had the Chinese government’s senior medical adviser, Zhong Nanshan, an 83-year-old epidemiologist renowned for helping combat the SARS outbreak in 2003, saying the crisis could be over by mid-year.

“If all countries could get mobilized, it could be over by June,” he said. “But if some countries do not treat the infectiousness and harmfulness seriously, and intervene strongly, it would last longer.”

Containment/ stimulus

The Trump administration has responded with an air travel ban between Europe (excluding the UK) and the United States, starting on Friday. Italy, of course, is in full lockdown. Its 60 million residents are subject to travel restrictions, the closure of schools, movie theaters, museums and gyms, along with limits on opening hours for restaurants, bars and shops – a previously unthinkable course of action in a country known for its tourism and cafe culture. The eighth largest economy in the world is hurtling towards a recession, as it struggles to contain the virus that has topped 9,000 infections and caused the deaths of 463. South Korea has also been hit badly, but has managed to prevent patients from dying through aggressive coronavirus testing, up to 10,000 tests per day. As of Thursday, less than 1% of South Korea’s 7,869 covid-19 patients had died.

Meanwhile stimulus measures are being rolled out, across the board.

The US Federal Reserve plans to intervene in short-term funding markets to the tune of $1.5 trillion, and purchase Treasury securities, opening the door to another round of quantitative easing. Earlier this week the UK Chancellor in his first budget announced a £12 billion emergency fiscal stimulus to counter the shock of the coronavirus outbreak. Japan plans to spend $4.1 billion in a second package of steps, and the European Central Bank approved fresh stimulus measures, including cheap loans. In the US, rumors are circulating of a return to financial crisis-era programs like TARP.

However all of this wasn’t enough to prevent stock markets from taking another steep dive, Thursday, on continuing fears of a global slowdown due to coronavirus, which as of this writing, had infected more than 126,000 and killed 4,262. The flu-like virus has officially been called a pandemic by the World Health Organization.

China’s $570B infrastructure spend

Remember though, “the worst is over in China,” as one base metals trader, quoted in the Financial Post, said Tuesday. In the same article, an analyst at CRU Group noted the utilization rate at copper semi fabricators (makers of wire-rod or tubes) has picked up 60%, from 40-50% a week earlier. Chinese factories are slowly coming back online, raising hopes of an uptick in copper demand.

Indeed, China’s focus has clearly shifted, from containing the virus to rebuilding its economy. The stimulus plan involves two parts, according to PRC Macro, a China-focused consulting firm, which says, “in order to declare an economic victory, a 5% growth rate is the absolute minimum that will be acceptable”.

The first, already set in motion, is to cover cash flows at businesses impacted by weak demand. That also involves getting factories going again. For example in Wuhan, automakers have already been notified to restart operations.

In Tangshan, an industrial hub north of Beijing, famous for steelmaking, extreme measures to contain covid-19 are being eased, and if the area’s steel mills can raise production quickly, the short, sharp shock to the world’s second-largest economy since January might well be followed by a second-quarter rebound — the much vaunted “V-shaped recovery” according to the Financial Times.

The news site notes large deliveries to factories and construction sites have come back to around 60% of peak November levels. The renewed buzz of industrial activity should be reflected in China’s next round of PMIs, which fell to a record low in February.

The second part of the stimulus plan is to bolster growth, mainly through infrastructure spending. PRC Macro anticipates Beijing will inject up to $570 billion into the economy, mostly on infrastructure projects.

That jibes with a March 2 report in the South China Morning Post that reads Speculation is mounting that China will turn to its old playbook for bolstering economic growth that is set to suffer amid the coronavirus outbreak with massive state-led capital spending led by infrastructure investment.

The article notes at least seven of 31 Chinese provinces recently published lists of investment projects totaling US$3.6 trillion, including $500 billion for 2020.

It also quotes Ren Zheping, the chief economist for China Evergrande, the country’s main property developer, and a former researcher with the Development Research Centre of the State Council, saying:

“The most simple and effective way to offset the epidemic and economic downturn remains infrastructure construction. It can stabilize growth, employment, unleash growth potential and improve long-term competitiveness.”

In particular, Ren noted, China’s focus for infrastructure investment should be on 5G telecommunications, artificial intelligence, industrial internet, smart cities, education and health care.

Among the projects that could receive a huge boost in investment, courtesy of a government rescue package, are a $44.2 billion expansion to Shanghai’s urban rail transit system, an intercity railway along the Yangtze River ($34.3B), and eight new metro lines worth $21.7 billion, to be constructed in the virus epicenter city of Wuhan.

The Financial Times reports, In the face of languishing commercial activity, southern Guangdong province last week expanded its 2020 development plan to include Rmb100bn ($14bn) worth of new public health, rural development and shantytown reconstruction projects, while eastern Zhejiang province added 100 new railways, roads and disaster relief programmes. Seven other provinces have recently announced investments worth Rmb25tn…

Copper demand strength

I couldn’t help noticing that this monster of an infrastructure build-out, on par with China’s $572 billion stimulus package, done to manage the ‘08 financial crisis, prioritizes 5G; we know the global 5G buildout will require more copper.

Upgrading cellular networks from 4G to 5G is expected to result in a vast improvement in service, including nearly 100% network availability, 1,000 times the bandwidth and 10 gigabit-per-second (Gbps) speeds. Even though 5G is wireless, its deployment involves a lot more fiber and copper cable to connect equipment.

In Japan, demand for copper cables is seen growing 2.6% from 696,000 tonnes in 2018 to 714,000t in 2022, and copper for rolled copper alloy products growing 6% to 690,000t during the same period, according to the state-run Japan Oil, Gas and Metal National Corporation, or JOGMEC.

And we can’t forget about China’s China’s Belt and Road Initiative (BRI) – the vast network of railways, pipelines, highways and ports would extend west through the mountainous former Soviet republics and south to Pakistan, India and southeast Asia.

Research by the International Copper Association found BRI is likely to increase demand for copper in over 60 Eurasian countries to 6.5 million tonnes by 2027, a 22% increase from 2017 levels.

A report by Roskill forecasts total copper consumption will exceed 43 million tonnes by 2035, driven by population and GDP growth, urbanization and electricity demand. Electric vehicles and associated charging infrastructure may contribute between 3.1 and 4 million tonnes of net growth by 2035, according to Roskill.

How on earth is copper going to satisfy all of these demands on it, looking ahead 5, 10, 20 years? Will the mining industry be able to find new mineral deposits to replace the ones existing mines are depleting? Let alone find enough new copper tonnage required by vehicle electrification, energy storage, infrastructure upgrades, and an expanding developing world population that wants all of the copper products we in the developed West take for granted and plan to keep buying at first-world volumes?

To answer that we need to understand world copper supply, then match it with global demand and the two headwinds we see temporarily holding back pent-up demand: the coronavirus and the (unresolved) US-China trade war.

Headwinds

On Jan. 15 the United States and China signed the first phase of a comprehensive trade deal, which went part-way towards ending the uncertainty the trade war, and its billions worth of tit-for-tat tariffs, was having on the global economy. Prices of base metals like zinc, copper and lead have been swiped to some extent by the trade war, their declines made worse by slowed growth in China, the world’s largest commodities consumer.

All three rose for the first two weeks of January in anticipation of a trade deal, fell abruptly following the start of the coronavirus, but as stated above, are recovering.

Quarantines, done to contain the outbreak, have had an impact on global supply chains including mined commodities. Some mining companies have had trouble delivering supplies due to transportation blockages and delays.

But, we believe that once the trade war is resolved and the coronavirus pandemic is contained – China’s success offers hope – copper’s bullish fundamentals will be the cream that rises to the top of the base metals complex.

Supply weakness

We already know that copper demand is outstripping supply.

Over the next two years, copper supply is expected to be weak in relation to all the strong demand factors we outlined above. In short, the world needs more copper.

The base metal is heading for a supply shortage by the early 2020s; in fact the copper market is already showing signs of tightening – something we at AOTH have covered extensively.

Some of the largest copper mines are seeing their reserves dwindle and are having to dramatically slow production due to major, capital-intensive projects to move operations from open pit to underground. On top of that, copper smelting declined in China and Europe during February, owing to some smelters in China shutting down completely due to the coronavirus, Reuters said.

Grasberg in Indonesia, the world’s second largest copper mine, is emblematic of the problems copper miners are facing. The mine began as a large open-pit mine but after decades of extracting the easy-to-reach ore, all the high-grade is gone and future production is expected to come from a deep cave deposit known as the Deep Mill Level Zone.

Existing copper mines just aren’t able to crank out as much production that they must, to ensure all the demand bases are covered.

Consider the situation in Chile, the world’s largest copper-producing country.

Codelco’s Chuquicamata mine is expected to see a 40% fall in production over the next two years. A $5 billion expansion, moving from open pit to underground, will take five years to reach full output of 300,000 tonnes per annum. Production will fall from an expected 459,000 tonnes in 2019 to 182,000t in 2021.

Exports from BHP’s Escondida, the world’s biggest copper mine, were expected to drop by 85% last year due to operations moving from open-pit to underground. That’s a dramatic fall from 1.8 million tonnes in 2018 to just 200,000 in 2019. The Chilean mega-mine is expected to take until 2022 to re-gain full production.

These cuts are significant to the global copper market because Chile supplies 30% of the world’s red metal. Adding insult to injury, for producers, copper grades have declined about 25% in Chile over the last decade, bringing less ore to market.

As we wrote in The coming copper crunch, by 2035, without major new mines up and running to replace the ore that is being depleted from existing copper mines, we are looking at a 15-million-tonne supply deficit.

We can see this happening already. According to the International Copper Study Group (ICSG), reporting last October, world copper output gained 2.5% in 2018 but in 2019 production was expected to fall half a percentage point.

How about building new copper mines?

The current copper pipeline is the lowest it’s been in a century. New supply is concentrated in just five mines – Chile’s Escondida, Spence and Quebrada Blanca, Cobre Panama, and Kamoto in the DRC.

That means exploration for new copper deposits that are large and high-grade enough to be economically brought into production is of primary importance to the mining industry. Especially considering that the demand side of the equation, despite the current lull in China, is only going to get stronger.

Problem is miners are having to go further afield and dig deeper to find copper at the grades needed to economically produce copper products for end users. This usually means riskier jurisdictions that are often ruled by shaky governments with an itchy trigger finger on the resource nationalism button. Combine that with production problems and you have the makings of a supply shortage.

Chilean state-owned Codelco, the world’s largest copper miner, in January saw output fall 6.8% compared to the same month in 2019. That was nothing, though, compared to full-year country totals – in 2019, Chile produced just 1.7 million tonnes of copper, the lowest level since 2008, when it generated 1.5Mt.

As Chile’s reliability is called into question amid weaker output, social divisions and water restrictions, mining companies are looking to Africa as an alternative. The continent’s two top producers, Zambia and the DRC, hold a combined 38 million tonnes of copper reserves, more than the 58Mt in the United States.

However, Africa is home to rampant resource nationalism.

In 2018 the Democratic Republic of Congo (DRC) raised taxes and royalties on copper and cobalt – of which the DRC is the top producer – amid fierce opposition from miners.

The World Bank ranked the DRC 183 out of 190 countries in its 2016 Ease of Doing Business Index, cited limited infrastructure, a poorly trained workforce and a deficient legal system.

Over in Zambia, Africa’s second largest copper producer, an economic crisis is forcing the country to consider seizing copper mines.

Zambia also must deal with an unstable electricity grid. An industry group flagged the expiry of a supply deal on March 31 as the biggest risk the country’s copper miners face this year. Mines consume around half of Zambia’s electricity and contribute about 70% of the country’s export earnings, states BNN Bloomberg.

Artisanal mining is another big problem in many part of Africa, where hard-scrabble miners dig for minerals in often squalid and dangerous working conditions. At Glencore’s Kamoto mine – among the five mines new copper supply will come from – the DRC’s armed forces were called in last year after a landslide killed 43 people. Glencore estimates around 2,000 unauthorized people enter the open-pit mine on a daily basis.

Conclusion

The copper market, along with other metal commodities and stock markets around the world, is facing major turbulence right now due to a pandemic that nobody could have seen coming even three months ago.

Yet here we are, with China, South Korea and Italy facing unprecedented restrictions on travel and day to day activities, health officials scrambling to contain covid-19’s spread, and central bankers scratching their heads as to how to arrest tumbling markets and negative economic fallout.

There is no denying that copper is facing strong headwinds, in the coronavirus and a trade war front that is still very much in play, and unresolved, despite a phase one agreement signed in January by presidents Trump and Xi.

However we also have much reason for optimism. If China can get the virus under control (admittedly it’s easier with a planned economy and centralized control), presumably Italy and South Korea can too. Less affected countries like Canada and the US need to pay attention to what China has done to successfully contain the virus. If they don’t, expect this thing to keep going, for who knows how long. Remember, China’s infectious disease specialist thinks it could be history by June, if proper containment procedures and testing protocols are followed.

China’s planned half-billion-dollar infrastructure spend is very good news for base metals, including copper. So are moves toward normalization of industrial activity. A key question is whether China can keep its economy rolling, if its trading partners are seeing supply chain disruptions and demand destruction due to the coronavirus. It all comes down to containment.

All pandemics are serious business, covid-19 is no different. But it isn’t as though we haven’t seen them before. Yes it will take time for a vaccine, it may still spread further, and we might not be done with the economic fallout. But rest assured, eventually it will die off, as all pandemics do, and things will return to normal.

For copper, all it means is a delay in the inevitable copper surge that is coming. Its fundamentals remain intact, with demand for everything from copper wire and pipes, to smart grids, electric vehicles, smart grids and 5G networks, all requiring more of the red metal. Supply cannot, keep up without developing new mines. Remember, the current copper pipeline is the lowest it’s been in a century. New supply is concentrated in just five mines, in countries looking less mining-friendly – Chile and the DRC – and where copper prices must remain above $5,000 a tonne to be profitable.

For the short term, the outlook for copper is good. In a new report, Fitch analysts revised their 2020 copper price upward by $200 per tonne, from $5,700 to $5,900, writing that they expect increased stimulus from the Chinese government to raise copper prices in the second half of the year.

When trade impediments are solved and the viral outbreak is contained, hopefully eradicated, expect copper prices to go through the roof.

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.