The next US Presidential election

2020.08.01

As gold prices hit all-time record highs this week, some market observers are wondering if the rally is sustainable. It is. Despite a slight pullback on Thursday, there is nothing to suggest that the bull-market case for gold has been in any way diminished.

While bullion prices tracked down upon release of the astonishingly bad second-quarter GDP reading of -32.9% – the worst quarterly reading since records began in 1947 – on Friday they were up again, on fresh safe haven demand and solidly bullish charts.

Another record for gold

That makes two records set for gold this week, one on Monday, when it rocketed past $1,920 an ounce, breaking the past high set in the fall of 2011, and the other on Friday, when gold futures in early US trading on Friday reached a never-before-seen $1,981.10 an ounce.

As of this writing, silver was also back in the black, up 2.68% to $24.14/oz. The white metal is heading for its largely monthly rise going back to 1982, up 34%, on both strong investment demand, and hopes for a revival in industrial activity, for which it has a myriad of uses including solar panels, electronics and 5G technology.

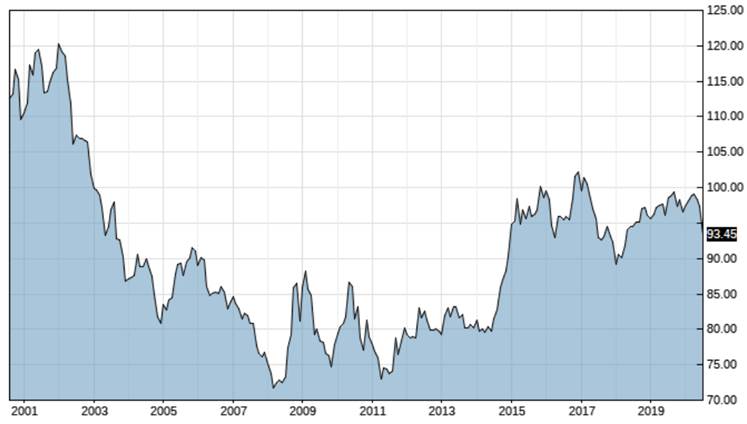

Among the factors pushing gold (and silver) higher, are the worsening covid-19 pandemic that continues to stifle the global economy; low interest rates which were affirmed by the US Federal Reserve on Wednesday, along with the continuation of monetary stimulus to prop up the beleaguered US economy; near 0% bond yields (the yield on the benchmark US Treasury 10-year note is currently trading around 0.53%, making the real yield – 0.53% minus 0.6% inflation – negative; and the struggling US dollar, which tumbled the most in a decade in July.

Gold prices and the US dollar generally move in opposite directions.

The Financial Times quoted a strategist at Pictet Asset Management saying that the narrowing gap between interest rates and potentially, economic growth rates, in the US and the rest of the world, has contributed to the dollar’s decline.

“There are other short-term factors weighing on the dollar. The US election is one. The worsening infection rates are another,” she said.

Gold has happily been the recipient of the buck’s woes, and low bond yields, rising 11% in July, its biggest monthly gain in 8 years. Year to date, the safe-haven metal is up a whopping 30%.

And there is no sign of it running out of steam, in fact it now seems inevitable gold will breach the $2,000 mark, or higher.

“Gold is more of a store of value right now than pretty much anything else,” Michael Hewson, chief market analyst at CMC Markets UK, told Reuters.

“Optimism about a V-shaped recovery is very much at risk and gold is seeing the benefit from that. It’s quite likely that we’ll see $2,000 an ounce in fairly short order.”

Earlier this month, Bank of America raised its 18-month target price to $3,000 an ounce, due to dovish central bank policies; Goldman Sachs forecasts a rally to $2,300 based on similar concerns about currency debasement; and David MacNicol, president and portfolio manager of MacNicol and Associates Asset Management Inc., sees the price of gold hitting $2,500 by the end of 2021.

What if Trump doesn’t leave?

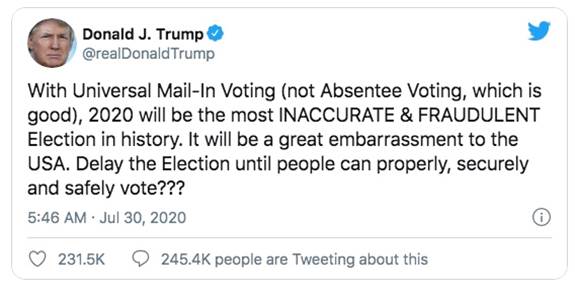

This week precious metals got an additional boost from Donald Trump, who raised alarm bells in Washington and on Wall Street Thursday, when he floated the idea of moving the Nov. 3 presidential election – something he is constitutionally prohibited from doing.

Whether or not Trump was aware of this, the reaction condemning his tweet was swift, and came from both sides of the aisle.

Nancy Pelosi, Speaker of the Democrat-controlled House of Representatives, tweeted a quote from the US Constitution that cites the congressional authority to move the election date, which by federal law happens after the first Monday in November, in the election year.

Article II, Section 1 of the Constitution states: ‘The Congress may determine the Time of choosing the Electors, and the Day on which they shall give their Votes; which Day shall be the same throughout the United States.’

Moving the date would require an act of Congress, which in the current polarized political environment, would never happen.

The other thing Trump doesn’t realize, or chooses to ignore, preferring to sow confusion by tweeting his thoughts on the election, while down in the polls, is that if no election is held, he must vacate the White House at noon Eastern time on January 20, 2021, when his term officially expires.

If that were to happen, the next in line for the presidency would be Speaker of the House, currently Nancy Pelosi. This raises the farcical possibility of Pelosi scrambling a team of Democratic insiders to form a Cabinet, as they try, presumably with help from police or the National Guard, to forcibly evict Trump and his inner circle from the White House including his daughter Ivanka, and his shady son-in-law, Jared Kushner.

Watching Pelosi escort Trump out of the White House would be the perfect cap on the unreality of his presidency. She gave out pens on the impeachment process beginning…

The idea of delaying the election, something by the way that I predicted Trump would try months ago, long before the coronavirus, was also roundly criticized by congressional Republicans.

Senate leader Mitch McConnell said it hasn’t happened before and won’t happen now.

“Never in the history of this country, through wars, depressions and the Civil War, have we ever not had a federally scheduled election on time. We will find a way to do that again this November third,” he told a Kentucky radio station.

Sen. Lindsay Graham, a Trump backer, agreed a delay “was not a particularly good idea.”

And Majority Whip Sen. John Thune, part of the Republican leadership, told CNN there will be an election in November despite the President’s tweet.

So, according to the GOP’s top brass a delay will not happen, the vote will go ahead as planned. I can’t help but have this nagging doubt… in politics nothing is ever official until its officially denied.

Trump has been making other noises about the election which play into Democrat fears that the mercurial billionaire will reject the result if he loses, or try to claim the election was rigged.

As the election nears, Trump says he’s against mail-in ballots – deemed the safest way to vote amid the coronavirus – claiming that voting by mail would lead to “the most INACCURATE & FRAUDULENT Election in history.”

CBC notes that voting by mail is already available in many states, and has been the standard way of voting in Oregon for more than 20 years, without the massive fraud Trump alleges.

Columnist Keith Boag opines that If his tweet isn’t really serious about an election delay, then the important part is his claim that the election will be the most inaccurate and fraudulent in U.S. history. That’s a tell — it suggests he thinks he’s going to lose.

He did the same thing before the 2016 election when polls were suggesting Hillary Clinton would be the next president.

In a Guardian op-ed, legal scholar Lawrence Douglas raises the possibility, in a close election, of the swing states submitting conflicting electoral certificates – one awarding its electoral college votes to Trump, the other to Biden.

This could happen if in each of these three states, Trump has a slim lead, but election-day returns do not include many mail-in ballots. These states do not allow the counting of mail-ins until election day, meaning it will take days or weeks for the swing states to finish their count. Trump declares himself elected, but after all the votes are counted, it’s Biden that is ahead.

Douglas describes what could happen, drawing a parallel to the election of 1876.

Seems far-fetched? And yet the nation faced a nearly identical crisis in the notorious Hayes-Tilden election of 1876, when three separate states submitted conflicting electoral certificates. With neither Hayes nor Tilden enjoying an electoral college majority, a divided Congress – a Democratic House and a Republican Senate – fought bitterly over which certificates to recognize. Congress tried to resolve things by handing the problem to a one-off special electoral commission, but partisan rancor plagued the work of that body, too. Inauguration day neared and the nation had no president-elect – or rather, it had two rivals both claiming victory. President Ulysses S Grant weighed declaring martial law.

In the event of an election too close to call, or one where Trump claims voter fraud, what if he refuses to leave office?

Politico quotes constitutional law expert Jonathan Turley, saying that while a lingering incumbent would “simply become irrelevant,” every candidate has a right to contest the result in federal court.

“It’s not up to the candidate to decide if an election is valid. It’s not based on their satisfaction or consent. They have every right to seek judicial review.”

Remember the hanging chads? In 2000, the Supreme Court agreed to stop the vote counting in Florida and to award the presidency to George W. Bush, over Democrat Al Gore.

The popular US politics site notes the Democratic National Committee and Trump’s campaign were in court all the way up to Election Day 2016, fighting over charges of voter intimidation and ballot access.

In 2018 Trump praised the Chinese Communist Party for abolishing presidential term limits, effectively making President Xi Jinping President for life. A month later he pondered why he couldn’t be in office for 16 years, like President Roosevelt, who died during his fourth term.

Finally, last weekend he tweeted, “do you think the people would demand that I stay longer?”

David Frum, the Canadian conservative who writes for The Atlantic, runs through a number of Election 2020 scenarios, as postulated by the nonpartisan Transition Integrity Project. The “war games” involved 67 former government officials, staffers, consultants and journalists. His conclusion?

The good news is that Trump cannot postpone the election or the next presidential inauguration; he has no means to do either of those things. Those dates are set by law or in the text of the Constitution

The bad news is that there is a lot of mischief that can be done within the legal boundaries by a determined president, especially with the compliance of the attorney general and enough political allies in the state capitals.

Examples include the Trump campaign team diverting funds to Trump himself; preemptivily pardoning Trump and his associates/ family members from criminal charges; and deliberately causing economic damage so as to prevent economic recovery and boosting Republican chances in 2022 mid-term elections.

Frum doesn’t reject the possibility of a smooth transition of power, such as occurred when Obama took over from George W. Bush, but he is doubtful that will happen:

Nothing like that can be expected this winter. Instead, we are likely to see a recurrence of 1932–33, when the defeated Herbert Hoover tried to sabotage the incoming Roosevelt administration in hopes of preparing his own comeback in 1936. Trump will soon be fantasizing about running again in 2024. If his health does not permit it, his children may envision a dynasty of their own. These are not realistic plans. The Trump brand will be toxic in U.S. politics after the catastrophes of 2020. But the Trump inner circle will not believe that and its members may hope that if they can cause Biden to stumble out of the gate, they will benefit.

Gold and elections

The Trump presidency appears to lurch from one crisis to the next, and from this brief analysis, it seems likely that chaos is likely to reign until the bitter end.

Gold is a store of value and a hedge against inflation. It is also the logical response to fear.

Heightened global tensions such as terrorist attacks, border skirmishes, coups, protests and pandemics, scare investors into shifting their funds to precious metals.

A constitutional crisis would certainly qualify as a safe-haven event, likely to cause another cascade of investment into gold bullion, gold ETFs and gold stocks.

Does history tell us anything about how gold is likely to perform? We know that gold prices typically do well in the month of September before Election Day, drop in the days leading up to the polls, and continue to decline, on average, until the following January.

When Trump was elected in 2016, the day after the election gold climbed nearly 5%, followed by dips in November and December. When George W. Bush was re-elected in 2004, gold prices rose about 7% in the month following his win. After Obama was elected in 2008, the price of gold had jumped nearly 18%, by the end of the year.

Elections, then, are generally bullish for gold prices.

Most observers see a Trump win as good for stock markets, obviously, while a Biden victory will drag down stocks on the threat of increased taxes. The latter would also be a catalyst for gold. Peter Schiff, CEO of Euro Pacific Capital, told Kitco he thinks if Trump loses and Biden wins, gold could surpass $2,000/oz – a likely scenario given we’re almost there already.

In the run-up to the election, we expect gold to do better than its safe-haven competitor, US Treasuries, which will stay mired in low interest rates for the conceivable future.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.