The most important mine in America

2020.03.29

The covid-19 pandemic has put a laser-like focus on insecurity of lithium and rare earths supply for North America, especially because several battery companies and EV automakers are planning on setting up shop in the United States. When they do, they will need a ready supply of raw materials, the majority of which must currently be sourced in China.

Early in the outbreak, supply chains for thousands of goods made in China were impacted, as Beijing imposed tough travel restrictions, locked down entire cities and suspended factories to curb the spread of the virus.

The result was a major contraction in Chinese manufacturing. The Caixin China manufacturing purchasing managers index (PMI) fell to 40.3 in February, the lowest since the survey began in 2004.

PMIs not only in China have been seriously whacked due to the virus’ impact on supply chains. According to Zero Hedge the global manufacturing sector has suffered its steepest contraction since 2009. Out of 31 nations for which data was available, 15 saw their output contract. They include China, Japan, Germany, France, Italy, South Korea and Australia.

And while China appears to be getting back on its feet, the problem now is an anticipated huge drop in Chinese exports, as overseas orders are being scrapped by China’s trading partners whose economies are being ravaged by the coronavirus, and the draconian restrictions governments are placing on businesses (most non-essential enterprises are closed) and individuals, who are being ordered to stay at home and only go out when necessary.

“The unprecedented shutdown of normal economic activity across Europe, the U.S. and a growing number of emerging markets is certain to cause a dramatic contraction in Chinese exports, probably in the range of a 20-45% year-on-year drop in the second quarter,” Reuters quotes Thomas Gatley, senior analyst at research firm Gavekal Dragonomics.

Metals critical to the economic and military security of the United States could be affected including rare earths used in dozens of defense applications including missile guidance systems, permanent magnets, wind turbines, electric vehicle motors, as well as the materials required for the building of EV batteries – lithium, graphite, nickel, cobalt, manganese.

China has a lock on most of these materials and if exports are restricted, as they were in 2010, hiking the prices of most rare earth oxides, the effects on end users could be devastating.

Fastmarkets reported how the coronavirus closed Chinese factories and left them operating at reduced capacity or struggling to receive and send parts.

In the United States, the pandemic has hobbled US efforts to produce lithium, rare earths and other materials used in electric vehicles and high-tech equipment.

Some lithium exploration companies have put their projects on hold, due to engineering or regulatory setbacks. Not Cypress Development Corp (TSX.V:CYP, US:CYDVF), which is pressing ahead on its highly-anticipated prefeasibility study, for its Clayton Valley Lithium Project in Nevada, expected to be published soon.

Rare earths projects have also been paused, despite the Pentagon’s message last year that it would fund rare earth element mines through the Defense Production Act, which gives the military wide powers to secure needed raw materials.

The virus could delay any Pentagon decisions indefinitely.

“As untimely as COVID-19 is, it’s on point with what we’ve been saying: North American independence is needed now,” the New York Times quoted Pat Ryan, chairman of UCore Rare Metals Inc, which is developing an Alaska rare earths mine.

In a contributing column to Investorintel, rare earths expert Jack Lifton noted the dependence of US and European manufacturing on the Chinese rare earths supply chain. Its just-in-time nature means companies maintain limited or even zero inventories, making them vulnerable to a supply disruption – particularly for Rare earth enabled components for moving machinery, such as automobiles, trucks, trains, aircraft, industrial motors and generators, home appliances, and consumer goods, almost all today come from China or Japan (which of course get its rare earth magnets, alloys, phosphors, and catalysts from China). That flow is now slowing. This will have a domino effect on American and European industry. These items cannot be re-sourced due to China’s monopoly of rare earths production and its monopsony of rare earth enabled component manufacturing.

Indeed the outbreak has highlighted concerns about the dependence of the United States, Europe, Japan and Australia on Chinese rare earths refiners.

Jack Lifton writes: There is an urgency now for the creation of a total domestic rare earth end-use products supply chain in the USA, Europe, and non-Chinese Asia.

US mine–>battery–>EV supply chain

A Reuters analysis shows that automakers are planning on spending a combined $300 billion on electrification in the next decade.

GM has rolled out its 2020 Cadillac SUV, built in Spring Hill, Tennessee, in a move designed to challenge Tesla.

In 2017, Mercedez-Benz announced plans to set up an electric car production facility and battery plant at its existing Tuscaloosa, Alabama plant. The $1-billion expansion will include a new battery factory near the production site, with the goal of providing batteries for a future electric SUV under the brand EQ. Six sites are planned to produce Mercedes’ EQ electric-vehicle family models, along with a network of eight battery plants.

Volkswagen has said it will invest $800 million to construct a new electric vehicle – likely an SUV – at its plant in Chattanooga plant, starting in 2022. For more read Volkswagen to drag Tesla, making EVs in Tennessee.

Korean company SK Innovation has said it will invest US$1.7 billion in the US’ first electric vehicle plant, to serve Volkswagen, in neighboring Georgia. The 9.8 gigawatt-hour-plant would be the first EV battery plant in the United States. SK recently announced a second 10-GWh plant requiring an investment of $1 billion.

Meanwhile more battery factories are being built globally; demand for lithium ion batteries is forecast to grow at a CAGR of over 13% by 2023.

All of this growth in battery plants and EVs will mean an unprecedented need for the metals that go into them. This includes lithium, cobalt, rare earths, graphite, nickel and copper. Lithium is expected to see a 29X increase in demand, driven not only by lithium required in EVs batteries, but in consumer electronics like smart phones and power tools.

Furthermore, as renewable energies come down in price and become a larger percentage of countries’ total energy mixes, the need to store energy for later feeding into the grid will become more and more important.

Researchers at Imperial College London developed a model to determine the lifetime costs of nine electricity storage technologies for 12 applications, between 2015 and 2050. The model predicted that the cost of lithium-ion batteries would fall far enough to beat pumped hydro energy storage – currently the cheapest way to keep energy on ice, as it were.

The finding is another arrow in the quill of lithium-ion battery makers and lithium miners, opening up a potentially lucrative market beyond electronics and EVs.

In fact lithium ion batteries are expected to be the fastest-growing energy storage technology, accounting for 85% of newly installed storage capacity, and over 28 gigawatts by 2028, according to an analysis by Navigant Research. (there was only 1.4GW in 2017)

The upshot? Total lithium demand of 300,000 tonnes LCE is expected to reach over 1 million tonnes by 2025 or higher, states S&P Global Platts Analytics. Current annual supply is around 360,000 tonnes.

How will the United States obtain enough lithium for the storm of demand that is brewing?

The US only produces 1% of global lithium supply and 7% of refined lithium chemicals, versus China’s 51%. The country is about 70% dependent on imported lithium.

To lessen US lithium dependency will require the building of a mine to battery to EV supply chain in North America.

The first step is to develop new North American lithium mines.

Currently the only US lithium producer is chemicals giant Albemarle. Lithium products from Albemarle’s Silver Peak lithium brine operation in Nevada are sent to its processing plant in North Carolina. This material is then loaded on ships and sent to Asian battery manufacturers, which sell the batteries to automakers.

According to Visual Capitalist Albemarle’s Silver Peak lithium mine only produces enough lithium to produce roughly 1,000 tonnes per year of lithium hydroxide, within a current lithium market of roughly 360,000 tonnes per annum of lithium carbonate equivalent (LCE), a term that encompasses both lithium hydroxide and carbonate used in EV batteries.

There’s no way Silver Peak can produce enough lithium to supply American needs, especially with all of the EV battery and auto production facilities planned.

Fortunately, there are other deposits in Nevada that lithium companies are racing to develop. One of them is held by Cypress Development Corp.

Cypress Development Corp (TSX.V:CYP, US:CYDVF)

Three and a half years ago Cypress began prospecting in the Clayton Valley, hoping to find a property that could support a lithium carbonate resource to compete with or possibly complement its neighbor, Albemarle’s Silver Peak Mine, whose lithium brine grades are declining. Cypress wasted no time in acquiring two land packages located in Esmeralda County: the 1,520-acre Glory property and the 2,700-acre Dean property.

Its Clayton Valley Lithium Project hosts an indicated resource of 3.835 million tonnes LCE (lithium carbonate equivalent) and an inferred resource of 5.126 million tonnes LCE. The project is ranked among the largest in the world.

Last year Cypress Development Corp completed the first two phases of a prefeasibility study (PFS) at its Clayton Valley Lithium Project in Nevada – confirming that lithium can be acid-leached and extracted at high recovery rates and successfully separating the lithium-rich claystone ores from the sulfuric acid leachate.

It’s a major technical problem to separate ultra-fine clay particles (<5 microns) from a leach solution. Cypress has done it, putting the company at the forefront of lithium clay projects globally.

The US now has a major source of lithium carbonate and lithium hydroxide and potentially a not-inconsiderable amount of rare earths including scandium – a highly prized metal used in aircraft components, for example.

The eagerly-awaited prefeasibility study is crucial to moving the project forward, not only for proving that the metallurgical process for separating lithium from clays is commercially viable, but demonstrating that Cypress’ costs are in line with the 2018 preliminary economic assessment (PEA).

The mine

Cypress’ vision is to build a mine with the ability to extract whatever oxides they choose, from the processing plant. The project design is based on mining 15,000 tonnes per day to produce 25,000 tonnes per year of LCE.

The end result is that through by-product credits Cypress could shave millions of dollars off of their processing costs – further enriching what we already think is looking to be a very profitable mine.

The mine would be neither a hard-rock nor a lithium brine operation, but rather, would process lithium from clays in Nevada’s Clayton Valley by leaching with sulfuric acid.

Picture the operation as a sulfuric acid plant with an open pit on one side, on the other side is a processing plant. Sulfuric acid produced from elemental sulfur in the acid plant is combined with water and claystone from the pit in heated agitated leach tanks. Solid particles are then separated and the leach solution goes into the lithium recovery plant where lithium carbonate or lithium hydroxide is the end result. Magnesium, potassium and rare earth oxides – scandium, dysprosium and neodymium – are potentially recovered out of the leach solution along the way.

The completion of the prefeasibility study’s first phase, in early 2019, confirmed that lithium can be acid-leached with lithium extraction and sulfuric acid consumption in line with the estimates in the PEA. The tests also showed impurities such as magnesium – which can significantly increase the complexity and costs of processing lithium – are controlled through conventional processing.

The second stage of the PFS, completed last August, successfully separated solids from liquids, and simplified the flowsheet that will be used to develop lithium products on a commercial scale. According to CEO Bill Willoughby, the changes in the process changed the chemistry of the leachate such that more testing was needed.

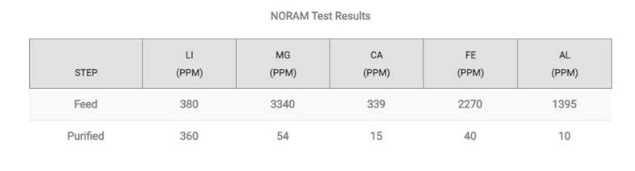

Cypress thus hired NORAM Engineering to conduct further work on lithium recovery.

The results of NORAM’s test program, presented below, are great. Starting with a feed of 380 parts per million (ppm), using Cypress’ flowsheet, NORAM was able to strip out the impurities to low levels of magnesium, calcium, iron and aluminium and end up with a solution of 360 ppm lithium. Says Willoughby, “we were quite pleased with these results, which represent the first of three stages in lithium recovery that NORAM tested. This stage confirmed we can easily and cheaply produce a clean lithium solution. The next two stages, which NORMAM has completed, will show how the lithium concentrates as water and sodium are removed.”

Cypress is waiting on the final report from NORAM, but Willoughby is confident in the process based on the results so far. “Based on the solution grades we see after purification, the steps to reaching battery-grade product are predictable and industrially proven. The work throughout the PFS addressed the risk areas identified in the PEA and successfully found solutions to problems we encountered along the way.”

This news does not take all the risk out of CYP going into production, but, says Willoughby, with the PFS in hand, the Company will be ready to take the next steps which will include a pilot plant and permitting. “With more than $1 million in the treasury, Cypress has the resources to complete the PFS while taking steps to weather the present Covid-19 crisis.” The PFS is the foundation for further work, which Willoughby acknowledges opens it up to partnership agreements, financing deals, or even a buyout. “Obviously, we will need financial support to move forward past the PFS. We are optimistic that the PFS shows Cypress’ vision for the future.”

Rare earths potential

According to the 2018 PEA, Cypress has the potential to recover rare earths at its Clayton Valley Lithium Project. REEs were detected in the claystones ranging from 100 to 200 parts per million (ppm). The rare earths include scandium, dysprosium and neodymium, in order of economic value.

Cypress ran diagnostic leach tests and determined there is the potential to recover these elements, along with potassium, magnesium and other salts. From the PEA:

Using just the 1-hour leach test extractions and an annual feed rate of 5.475 million tonnes, the project, for example, could generate 10 to 15 tonnes of scandium, 25 to 40 tonnes of neodymium, and 5 to 10 tonnes of dysprosium in solution as potentially recoverable oxides. Additional test work is warranted.

Scandium

No scandium is currently mined in the United States. The US gets most of its scandium and scandium components from China.

Scandium is usually a by-product of mining for battery metals – particularly cobalt and nickel needed for lithium-ion batteries. Scandium is said to be so obscure, that rocks on the moon have higher concentrations than earth rocks.

When added to aluminum the silver-white metal delivers a potent combination – lighter, stronger and more malleable, making the alloy ideal for aircraft, cars or ships that can save on fuel costs. It is also used in solid oxide fuel cells (SOFCs) and sports equipment like baseball bats and tennis rackets. Smith & Wesson has even used scandium-aluminum alloys in revolvers. The Russian MIG 29 is the aircraft with the highest content of aluminum-scandium alloys, according to Aluminum Insider.

According to the USGS, supply and consumption of scandium is estimated at just 10 to 15 tonnes per year. It’s a small market, but scandium is expensive.

A gram of scandium oxide at 99.9% purity sells for US$3.90 a gram while a gram of the same-purity scandium acetate is $45 a gram. The really big numbers come from 99.9% scandium chloride, which sells for $129 a gram, and 99.9% scandium fluoride, which goes for a whopping $209 a gram. Now we can’t assume that Cypress has the flowsheet to produce and sell scandium acetate, chloride or fluoride, but mining 15 tonnes of scandium oxide, over the life of the mine, fetching $4 a gram could be looked at a couple of ways: as enough revenue to pay for the acid plant, projected to cost just over $100 million; or, the potential for the recovery of saleable rare earths with the lithium could also represent a major reduction in processing costs. And that isn’t counting the revenue from the magnesium and potassium salts, which could shave off more costs per tonne.

Neodymium

The rare earths needed for electric vehicles are neodymium and praseodymium – used for making the magnets in electric motors and generators. The market for the neodymium-iron-boron magnet, installed in Tesla’s Model 3 Long Range electric car, is estimated at $11.3 billion. Demand for neodymium has been growing steadily.

Dysprosium

Dysprosium’s main use is in neodymium-based magnets, due to the element’s resistance to de-magnetization at high temperatures. This makes dysprosium ideal for magnets placed in motors and generators. Because it is good for absorbing neutrons, dysprosium is also used in nuclear reactor rods. Most dysprosium is mined from clay ores found in southern China. According to the US Department of Energy, dysprosium is the most critical rare earth element for clean energy technologies.

Certain rare earth elements and the permanent magnets made from them are central to the electrification of our transportation system, wind and solar energy, and the whole spectrum of defense technologies that are vital to every military. Without them economies suffer and countries would be unable to produce much of the military hardware and equipment required for national defense. In most cases there are no substitutes.

“USGS experts prepared an analysis of which critical minerals would be components of a Navy SEAL’s combat equipment. It concluded that the outfit would include five critical mineral elements in night-vision goggles, 13 for communications gear and a Global Positioning System and three for an M4 rifle.

As a former Navy SEAL, I didn’t realize that when I was entering combat, much of it was made in China…” Interior Secretary Ryan Zinke

For example, smart weapons rely on sophisticated motors and actuators to steer them towards their targets. Missiles and bombs therefore incorporate REEs such as terbium, dysprosium, samarium, praseodymium and neodymium.

Among the military applications of rare earth elements are:

- Radar and sonar used to prevent collisions, for surveillance and navigational aids. The Patriot Missile Air Defense System employs radio frequency circulators to magnetically control the flow of electronic signals in the radar and missiles. Rare earths required: gadolinium, samarium, yttrium.

- Communications and displays required by soldiers, sailors and airmen to see analog and digital data. Examples are lasers that help line-of-sight communication links in satellite and ground-based systems; old and new computer monitors; and avionics terminals. Rare earths required: dysprosium, erbium, europium, neodymium, praseodymium, terbium and yttrium.

- Lasers employed on vehicle-mounted systems like tanks and armored vehicles. They can identify enemy targets up to 22 miles. According to DefenseMediaNetwork, “The laser-equipped computer main gun sight on the Abrams M1A/2 tank combines a Raytheon rangefinder and integrated designator targeting system used to obtain a high-probability first hit.” Rare earths required: europium, neodymium, terbium and yttrium.

- Precision-guided munitions (PGMs) take in a number of missile classes including cruise, anti-ship (ASM) and surface-to-air (SAM), as well as bunker busters. The heat-seeking AIM-9 Sidewinder missile has four fins on its fuselage that use rare-earth magnets to control its flight trajectory. Rare earths required: dysprosium, neodymium, praseodymium, samarium and terbium.

- Guidance and control systems that steer missiles and bombs towards their targets. Rare earths required: terbium, dysprosium, samarium, praseodymium and neodymium.

- Electronic warfare refers to a range of equipment that includes high-capacity power sources, storage batteries and electronic jamming devices. Rare earths required: yttrium-iron-garnet.

- Electric motors that require permanent magnets, of which the US Military is an important buyer. New equipment requiring powerful permanent magnets in the next generation of electric motors will include the US Navy’s Zumwalt DDG 1000 guided military destroyer, hub-mounted electric traction drives and integrated starter generators. Rare earths required: terbium, dysprosium, samarium, praseodymium and neodymium.

- Jet engines. The rare earth element erbium is added to vanadium to make it more malleable for use in vanadium-infused steel that goes into jet engines. While not specifically a rare earth element, the rare element rhenium is alloyed with molybdenum and tungsten. The F-22 Raptor and the F-35 Lightning II stealth fighter reportedly use 6% rhenium in their engines. The electrical systems in aircraft employ samarium-cobalt permanent magnets to generate power.

Lithium supply issues

It’s true the lithium market is currently oversupplied, at about 300,000 tonnes of demand versus 363,000 tonnes of supply. This accounts for the price slippage in the lithium market recently. Some lithium miners are pulling in their sails, holding off on expanding operations until better prices return. Albemarle and SQM, the two biggest lithium producers, are both delaying plant expansions.

The two main reasons for lower prices are oversupply from Australian hard-rock lithium producers, most of whom sell their spodumene concentrate to China; and reduced Chinese demand for lithium, after Beijing cut EV subsidies that made electric vehicles more affordable.

Low spodumene prices though are really hurting Australian lithium miners; how long before their production cuts start reversing the downturn in spodumene prices? With prices for hard-rock lithium mines low until the supply overhang can get sopped up, it falls to lower-cost lithium brine and claystone operations to meet the industry’s long-term supply challenges.

But there are problems in South America’s salt flats (salars), too. Obstacles to increasing lithium supply in the “lithium triangle” of Chile, Argentina and Bolivia are mounting. They include social unrest happening in Chile and Argentina, problems with water in the Salar de Atacama, low lithium grades in Argentina, and difficulties processing lithium in Bolivia because the salars are higher in altitude, not as dry, and contain more impurities, magnesium and potassium, than in neighboring Chile, making the extraction process much more complicated, and costly.

Conclusion

The supply issues inherent in the lithium market, combined with the ever-expanding demand picture, which encompasses lithium not only for EVs, but for lithium ion batteries used in consumer electronics/ power tools, and lithium needed for renewable energy storage, put lithium mines at the very top of the priority list for countries that want to ensure an adequate supply of what has been called “white petroleum”.

The United States produces a very small amount of lithium from its one lithium mine, Albemarle’s Silver Peak Mine in Nevada, compared to its current and future needs. This makes the country dependent on China for processing lithium, of which it holds a 51% global market share, and other countries for the raw material, such as Chile, Argentina and Australia.

The answer to the problem of lithium supply insecurity is to build new lithium mines in North America (note that Nemaska Lithium and its new mine in Quebec recently filed for bankruptcy) – something that has recently been recognized by the Trump administration.

Lithium is also among 23 critical metals President Trump has deemed critical to national security; in 2017 Trump signed a bill that would encourage the exploration and development of new US sources of these metals.

It’s a similar story with rare earths.

While nearly all rare earth mining and processing currently takes place in China, the United States is making moves to end the monopoly.

The 2019 National Defense Authorization Act prohibits the Department of Defense from acquiring rare earth magnets – along with certain tungsten, tantalum and molybdenum products – from China, Russia, Iran and North Korea.

This is great news for exploration companies that can step in to replace foreign rare earths with domestic supply.

Moreover, the rare earths market, which was flat for awhile, is poised to take off again. On the demand side, there’s all the military applications, plus the exponentially growing need for permanent magnets in electric vehicles, wind turbines, hard disks, even electric toothbrushes and lawnmowers.

Cypress has a unique opportunity to develop a lithium mine at the perfect time and place. Although many sectors of the economy have been halted, due to the coronavirus, we are certain this hiatus is temporary. When the outbreak is contained to a point when economic activity can get back to normal, we predict a surge in demand that may even overwhelm suppliers of in-demand metals like copper, nickel, iron ore and yes, lithium and rare earths.

Lithium producers will be racing to resume pre-coronavirus levels; to meet the onslaught of new demand, Cypress offers an attractive solution.

Consider: Cypress has the potential to produce lithium carbonate and hydroxide on site. And not only lithium products but rare earth oxides, including the magnet rare earths dysprosium, neodymium and high-value scandium.

It should also be noted that Cypress’ flow sheet suggests a relatively straight-forward means of producing rare earths – they simply need to dig up the ore, create an acid leach solution, run it through a processing plant, and recover the rare earths from the by-product stream.

We talk a lot about addressing critical minerals shortages in North America. Most projects have one or two minerals that fit this description. Cypress’ Clayton Valley Lithium Project has not one, not two, but five strategic products – lithium hydroxide, lithium carbonate, scandium, dysprosium, and neodymium. And that doesn’t include minerals such as potassium and magnesium, which can also be sold as by-products to minimize operational expenditures.

When you think about the huge amount of ore available to be mined – it’s among the largest LCE resources in the world – and the valuable products that will be coming out of the relatively easy processing flow sheet at the end, we believe Cypress may have the most important mine in America in decades.

Don’t forget, it’s in Nevada, one of the most mining-friendly jurisdictions in the world, with an experienced workforce and necessary mining infrastructure already in place, no tariffs, no potential supply chain issues to impact production such as a “black swan” pandemic.

Cypress is sitting on a massive potential lithium mine and the company is smartly taking all the right steps to de-risk it. The impressive resource estimate and PEA, both released last year, should have significantly boosted the stock price. Yet, in our opinion, it is still outrageously undervalued at $0.175 a share.

It also needs to be stressed, Cypress is the only advanced lithium project in North America without a strategic partner or offtake agreement. Obtaining either following a successful PFS, would be a significant catalyst for a market re-evaluation.

Cypress Development Corp.

TSX.V:CYP, OTCQB:CYDVF

Cdn$0.175, 2020.03.27

Shares Outstanding:90,077,001m

Market cap:Cdn$15,763,475m

CYP website

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Cypress Development Corp. (TSX.V:CYP)

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.