Sentinel Resources targeting historic mining districts in southern BC

If real estate is all about location, location, location, success in mineral exploration starts with management. A saying I heard years ago pretty much sums up our theory, here at AOTH, in-regards to management. “I’d rather have excellent management and an average project than an excellent project with poor management because poor management will find some way to screw it up.”

A shareholder has to know everything flows from management – project acquisition, money raising, project development, share structure, communication:

- High-quality people are more apt to acquire the high-quality assets to develop.

- Management has to respect their shareholders and the capital they bring.

- A management group must be dedicated, and focused, on building a real company with a robust property portfolio to explore

in jurisdictions with a strong history of mining. - And, as always, ultimately, the drills have to be the truth serum.

At AOTH we believe the following company is an excellent example of our theory.

Sentinel Resources (CSE:SNL, US OTC PINK:SNLRF) has a ton of talent and experience at the management and board levels, and a tightly held share structure of just over 18 million shares issued and outstanding. Having recently IPO’d on the Canadian Stock Exchange (CSE) at a dime a share, SNL has already conducted field work at its Pass property near Nelson – one of three British Columbia projects the North Vancouver-based company has in its portfolio – and this week announced a work program at its flagship Waterloo property, situated near Vernon.

Sentinel Resources Corp. (CSE:SNL, US OTC PINK:SNLRF)

Ahead of the Herd last week interviewed President & CEO Rob Gamley, who talked about the company’s objectives, the team, and the Waterloo project, located 65 km east of Kelowna, BC, near the historic Lightning Peak high-grade silver and gold mining camp.

Gamley, a capital markets veteran who in conjunction with Sentinel’s team of advisors has successfully raised hundreds of millions of dollars for resource companies, says Sentinel is a strongly focused retail investment opportunity.

The company and its CEO are retail focused and seek to expand their shareholder base to a wide and engaged retail base so small investors can be part of the company’s future.

Well that got my attention. Gamley is a young, driven CEO who has assembled a team that knows how to raise money, manage public companies, and access the investing audience at the retail and institutional levels.

Team

Along with Gamley’s 10+ years in corporate finance and consulting – he has also served on the boards of several TSX Venture-listed companies – chief geo Greg Bronson brings over 29 years experience as a senior geologist. Bronson’s experience includes positions with Noranda Explorations and Zanzibar Gold, as well as numerous private mineral exploration companies.

Company advisor Karl Kottmeier has over 25 years experience in listing, financing and administering companies listed on the TSX, TSX Venture and Canadian Securities exchanges, where he has raised in excess of $200 million in equity capital for resource-based ventures.

Technical advisor Christopher Leslie, M.Sc., P.Geo, has been involved in mineral exploration and government geoscience for 15 years, with significant experience in Canadian and US corporate finance, mergers and acquisitions, and securities compliance matters.

Robert McMorran, CPA, CA, is the founder of Malaspina Consultants Inc., providing accounting and administrative services to public companies since 1991. McMorran has served as director or CFO of a number of junior resource companies.

Quesnel Trough

British Columbia is home to one of the largest, most productive mineral trends on Earth. The Quesnel Terrane (more commonly known as the Quesnel Trough) is a Triassic‐Jurassic age arc of volcanic sedimentary rocks that hosts a number of large copper and gold porphyry deposits, several of which are currently in production.

Geoscience BC, in conjunction with the BC Geological Survey, mounted a major program in 2007 to build up a modern geoscience database over the Quesnel Trough in order to facilitate the discovery of hidden resources. Now, this data set is likely the most comprehensive of its kind in North America and possibly the world.

It’s now understood that the southern region of the Quesnel Trough is deserving of careful and comprehensive exploration, by directly applying the knowledge and techniques developed in the important producing areas to the south.

All of the major pre-Tertiary geological elements have potential for large, economical mineral deposits; none should be ignored. A thorough knowledge of the thickness and distribution of the Tertiary rocks and the development of geophysical methods to “see through” them is of particular importance.

Since 1859, the region has been the site of significant placer gold production, including some very large-scale mining operations.

Today’s exploration and mining companies have been met with tremendous success in revisiting these old mines, using modern data and exploration techniques. Systematic geophysics and diamond drilling allow for examination and testing of rock well beneath historic workings for the first time, opening up the potential for major new discoveries.

New Gold Inc. (TSX:NGD), with a market capitalization of $1.6 billion, is an example of this strategy culminating in a major success.

New Gold’s New Afton gold-silver-copper mine is an underground block cave mine located within the footprint of the historic Afton mine, 10 km west of Kamloops. The original Afton project was an open-pit mine operated by Teck Corporation between 1977 and 1997. In targeting a specific mineral deposit, New Gold constructed underground tunnels, along with a new concentrator and tailings facility. They achieved commercial production in July 2012 at which time the mine had an expected 12-year life. Between 2013 and 2019 the mine produced between 69,000 and 105,000 oz of gold, annually.

Waterloo

Intending to apply similar strategies as New Gold, Sentinel Resources announced an option to acquire 100% of the historic Waterloo high-grade silver-gold property. The property is host to numerous high-grade silver and gold showings exposed over an area of 4.0 by 0.7 kilometers. Central to the property is the historic Waterloo Mine that has seen sporadic production of high-grade silver since 1903.

Encompassing 3,130 hectares, the Waterloo project has never been systematically drill-tested, although several high-grade drill targets have been identified by previous operators – defining a 4.5-kilometer E-W strike.

The project is underlain by Mesozoic Quesnel Terrane rocks that also host nearby copper-gold porphyry deposits (New Afton, Ajax, Copper Mountain), copper-silver skarn (Phoenix), mesothermal gold (Greenwood camp), polymetallic lead-zinc-silver (Slocan camp) and epithermal gold (Knob Hill, Washington).The historic Waterloo mine has seen sporadic production of high-grade silver with gold since 1903, resulting in numerous shipments of ore to the Trail, BC smelter in 1954, 1967 and 1983. The mine is centered on a structurally controlled easterly striking zone (Waterloo structure) of high-grade silver, lead and zinc mineralization associated with quartz and carbonate vein material. This zone is apparently mineralized along its mined length (550 meters in the #4 adit) including numerous higher-grade sections.

Previous operators speculate that this structure extends below thick cover, with a total strike length of up to 2 km. Gold-dominant showings (for example the gold showing located 550m north of the mine) are hosted in north-trending sulfide and quartz veins, with associated iron carbonate wallrock alteration.

According to Sentinel, the Carbonate Replacement Deposit (CRD) model fits with known mineral occurrences (porphyry to skarn to base metal sulfide replacement to epithermal) and needs testing.

The road-accessible property has undergone small-scale production from high-grade gold and silver prospects since the early 1900’s. A shallow drill program was conducted by a previous operator, producing 12 short holes.

“The Waterloo project, which includes the historic Waterloo Mine, has clearly shown the potential to host high-grade silver and gold mineralization. Historic work on the project such as geological mapping and prospecting have produced compelling results of high-grade silver and gold – metals which have been mined in the region for over 100 years,” states CEO Gamley.

Waterloo highlights:

- Road-accessible, 3,130-hectare project close to developed infrastructure.

- High-grade silver and gold veins exposed over approximately 4 by 0.7 km.

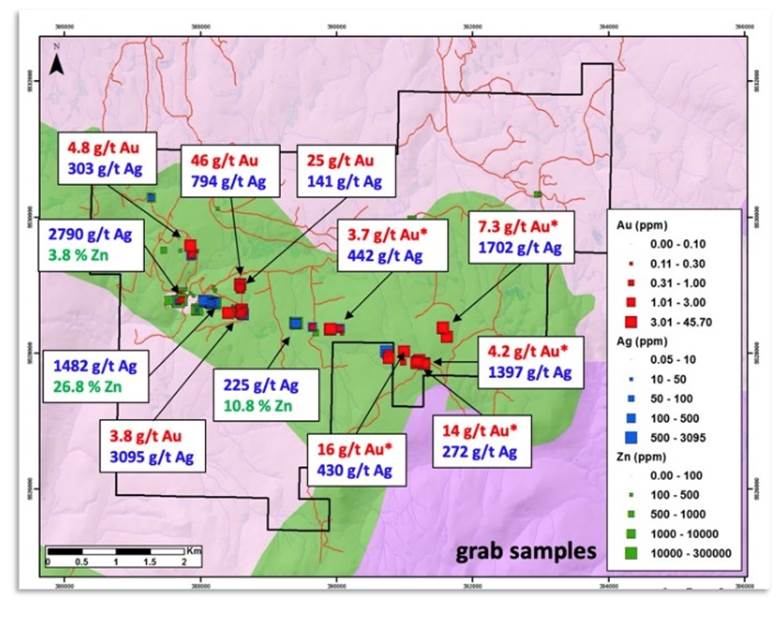

- Grab samples from historic workings returned assays of 2,790 g/t silver (Waterloo) and 45.70 g/t gold (Au Showing).

- The property has not been systematically drill-tested. Numerous untested targets are defined.

Exploration program

Sentinel will be the first company to investigate the true potential of Waterloo through a systematic exploration and diamond drill program. The plan is to conduct further geophysics and sampling with the intent to drill deeper into the most prospective silver and gold-bearing structures.

Given the success rate of surrounding mines, the potential for high-grade, low-cost gold and silver resource development is intriguing.

Sentinel will be directing its efforts to the well-mineralized, 4.5-kilometer trend centered across the property. High-grade grab samples along this trend, including 2,790 g/t silver and 46 g/t gold, will help provide guidance on where the company will focus exploration, in order to advance their understanding of the underlying structures.

The map below depicts crosscutting subsurface structures which could significantly expand the footprint for potential high-grade gold-zinc discoveries. These zones of structural intersections remain largely untested and represent priority targets for follow-up.

A financing of up to $500,000 will be put towards a work program at the Waterloo silver-gold property, which kicked off this week.

“The Company is pleased to have been able to immediately deploy an exploration team to the newly acquired Waterloo project and start this first work program,” Gamley states in the Sept. 15 news release. “As previously stated by Sentinel, selected previously reported historical high grab samples have returned very robust silver-gold sampling results from three separate areas on the project, including:

Waterloo Silver area:

2,790 g/t silver and 25.4 g/t gold; 3,095 g/t silver and 45.0 g/t gold

Forge East:

1,507 g/t silver and 2.80 g/t gold; 3,085 g/t silver and 3.80 g/t gold

AU Showing:

794 g/t silver and 45.70 g/t gold

Gamley adds: “We are now seeking to confirm and hopefully expand upon that success. The data we collect from this program will give us a better understanding of the geological footprint and will allow us to design and plan the next phase of exploration with the aim of identifying multiple targets to be drill tested. We look forward to receiving the initial results from the program.”

From the field, chief geologist Greg Bronson commented, “At this point I am pleased to report the presence of favorable mineralization in those areas I visited and am looking forward to continuing confirmation sampling on the property and assessing the prospectivity of as many underexplored or as yet unexplored areas of the Waterloo project as possible.”

Conclusion

Sentinel Resources (CSE:SNL, US OTC PINK:SNLRF) checks all the boxes we like to see in a discovery-phase junior: cashed up from a recent financing, led by experienced management, working in a jurisdiction in an area known for historic mining, with high-grade veins and loads of exploration and discovery upside.

Sentinel has just 18 million shares outstanding, with potentially $1.26 million available from the exercise of warrants.

We’re excited to be working with Sentinel Resources and will be reporting news from its Waterloo silver-gold project as soon as results are available.

Sentinel Resources Corp.

CSE:SNL, US OTC PINK:SNLRF

Cdn$0.40 2020.09.15

Shares Outstanding 18,555,000m

Market cap Cdn$7.4m

SNL website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not own shares of Sentinel Resources (CSE:SNL, US OTC PINK:SNLRF). SNL is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.