Sedimentary copper + silver explorers attracting major interest

2020.06.11

The world’s biggest sedimentary copper deposits are only found in three basins: the Paleoproterozoic Kodaro-Udokan Basin of Siberia, the Neoproterozoic Katangan Basin of south-central Africa, and the Permian Zechstein Basin of northern Europe.

However, this may be changing. Over the past year or so, an intriguing theory has come to light: that within the Andean Copper Belt, are a series of large-scale sedimentary copper deposits, formed in areas known to contain other minerals, including oil, gas, coal and salt.

Initial exploration of sedimentary basins in Colombia, Ecuador and Peru have revealed a startling realization – that surface outcroppings might be just the tip of giant icebergs of sediment-hosted copper-silver deposits lurking underneath. Samples derived from boots-on-the ground prospecting suggest these areas are analogous to “Kupferschiefer”-type copper-silver mineralization found in Germany and Poland.

Proving this theory could mean billions of pounds of copper and hundreds of millions of ounces of silver lay hidden beneath the diverse geography of northwestern South America.

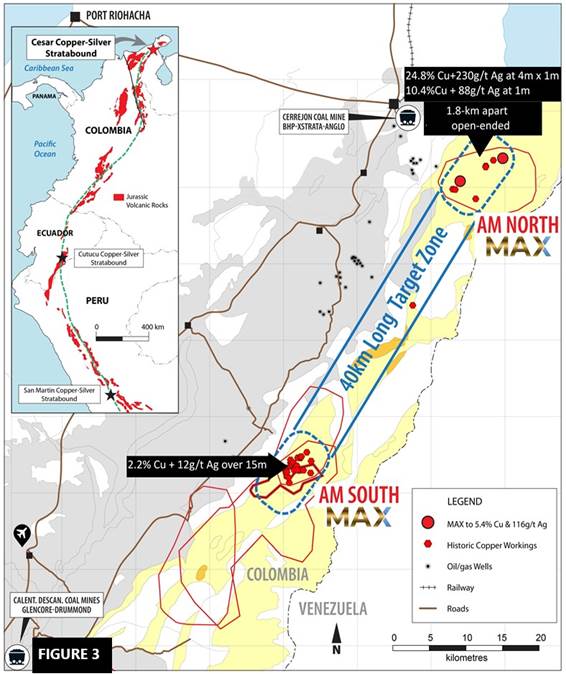

Max Resource Corp (TSX-V:MXR) in Colombia, Aurania Resources (TSX-V:ARU) in Ecuador, and Hannan Metals (TSX-V:HAN) in Peru, all claim to have encountered Kupferschiefer-type mineralization at their respective projects. Each is exploring a sedimentary copper basin within the highly mineralized Andean Copper Belt. The belt runs from northern Chile in the south, through Ecuador and Colombia, then arcs northwest into Panama. It hosts some huge copper porphyry (and gold, molybdenum) deposits including Escondida, Chuquicamata, Las Bambas and Collahuasi.

Anglo American, AngloGold Ashanti, Cordoba Minerals and privately held Minera Cobre, partially owned by First Quantum Minerals, are among the major mining companies exploring for copper and gold in the Andean Copper Belt.

BHP, Newcrest, Teck Resources, AngloGold Ashanti and Zijin Mining have all taken stakes in South American-focused copper explorers.

Max and Hannan have also attracted the interest of majors wanting to partner with them, as they move their copper-silver projects forward. We believe Aurania isn’t far behind, as it continues to develop its Lost Cities – Cutucu asset, found in the foothills of the Andes in southeastern Ecuador.

We discuss each of these companies in turn, starting with Max, the furthest advanced.

Max Resource Corp (TSX-V:MRX)

Since November, Max’s geological teams and prospectors have been identifying copper and silver targets in the 100 km x 20 km target area at its CESAR copper + silver project, using rock chip channel, panel and bulk sampling to identify structures, continuity of thickness, and strike length, to determine potential size prior to drilling.

Max’s head geologist, Piotr Lutynski, told AOTH that Colombia’s stratigraphy is similar to his homeland, Poland, and its Kupferschiefer sedimentary copper + silver deposits.

Crews have been looking for surface outcrops, that Max thinks could be the tip of the iceberg of a giant sediment-hosted copper system below surface.

Two greenfield discoveries earlier this year, AM North and AM South, appear to support this conclusion.

AM South features a number of stratabound copper + silver horizons, with mineralized structures totaling over 5 km of strike length. Sampling from 0.1 to 25-meter intervals returned highlight values of 5.4% copper and 63 g/t silver (US$324.26 gross metal value per tonne).

On trend 40 kilometers north, the AM North zone contains two mineralized areas from which rock chip samples were taken.

The AMN-1 zone returned values of 10.4% copper and 88 g/t silver (US$605.36 gross metal value per tonne) over a continuous chip channel 1-meter interval, along 1,800m of strike.

AMN-2 returned 24.8% copper + 230 g/t silver (US$1,455.13 gross metal value per tonne) over a continuous 4m x 1m rock chip panel discovery.

Both AMN-1 and AMN-2 lie within AM North’s mineralized Herradura Zone.

Max reported bulk sample assay and QEMSCAN values of 9.4% copper + 79 g/t silver (US$546.84 gross metal value per tonne) obtained in the vicinity of AMN-2, and 3.5 % copper + 29 g/t silver (US$203.37 gross metal value per tonne) from the vicinity of AMN-1. The AM North horizon is approximately 1.8-km long and is open along strike as well as down-dip and up-dip.

In a Feb. 27 news release, Max notes AM North and AM South discovery zones are both hosted in well-bedded sandstone-siltstone. They appear to be a significant size, gently dipping and they partly outcrop at surface.

The significant stratabound (confined to a single stratigraphic unit) copper-silver mineralization found at CESAR is similar to the mineralization found in Ecuador and Peru in Jurassic-age rocks. The project lies along a historic 120-km copper-silver belt within a major oil and gas and coal-mining sedimentary basin.

According to Wikipedia, the Cesar-Ranchería Basin is bounded by the Sierra Nevada de Santa Marta and the Serranía del Perijá mountain ranges. Two rivers flowing through the basin, the Cesar and Ranchería, bear its name.

The Cesar-Ranchería Basin hosts Cerrejón (owned by BHP Billiton Xstrata, Anglo American), the tenth biggest coal mine worldwide and the largest in Latin America, where low-ash, low-sulfur bituminous coal is mined from the Paleocene Cerrejón Formation. Offshore gas operators include Chevron and others, the Basin is relatively underexplored for hydrocarbons, compared to neighbouring hydrocarbon-rich provinces as the Maracaibo Basin and Middle Magdalena Valley.

The basin is also estimated to hold the second-largest reserves of coal bed methane in Colombia, or 25% of the country’s total resources.

Earlier this month, Vancouver-based Max announced it has entered into a collaboration agreement with “one of the world’s leading copper producers”, starting with a technical study of the property by Fathom Geophysics.

The aim of Fathom’s study is to map stratigraphic (rock layers) features that can help to pinpoint stratabound copper-silver mineral horizons at CESAR.

The collaboration with the major and the study being carried out by Fathom complements a research program initiated with the University of Science and Technology (“AGH”) of Krakow, Poland – one of the most important research centers in the world for the study of these sedimentary-hosted stratiform copper deposits, which are also large repositories of silver.

In an April 21, 2020 press release, Max said it sent surface rock samples extracted from CESAR’s stratabound copper + silver mineralization horizons to AGH. Researchers at the university, which has worked extensively with Polish state miner KGHM Polska Miedź S.A., will conduct mineralogical and geochemical studies on the samples; also, a Masters-level student is planning on writing a thesis paper on the results.

Initial results from petrographic analysis of two samples from AM South were released by Max on May 26.

They confirm the presence of native copper, chalcolite, and malachite hosted in siltstone and sandstone. Covellite, a rare copper sulfide mineral, was also detected, having not been found previously. That could be significant, because copper sulfides are more profitable to mine as a result of their higher copper content. The copper is also more easily separated from other minerals, compared to copper oxides.

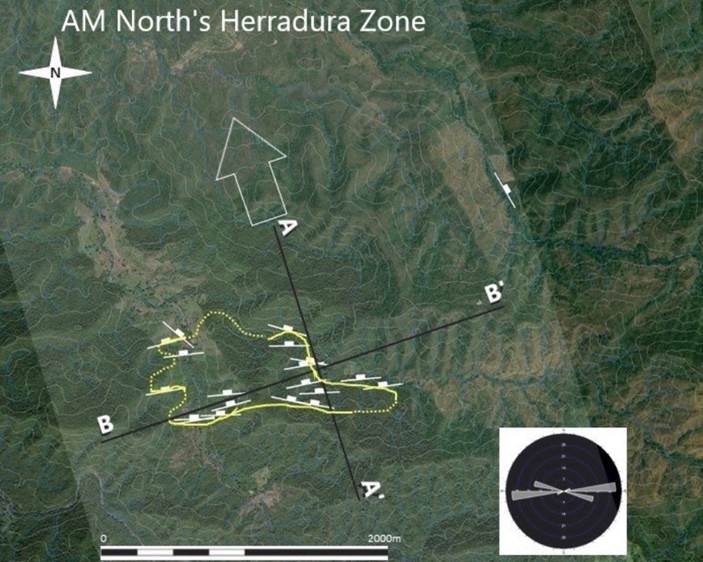

The latest news from Max involves a “structural interpretation” of the sediment-hosted mineralization at AM North’s newly discovered “Herradura Zone” at CESAR.

The study was conducted by the National University of Colombia’s geological engineering department, with assistance from Max’s field team, as part of another Masters-level thesis, on stratabound copper-silver mineralization within the Cesar-Ranchería Basin of northeastern Colombia.

According to the news release,

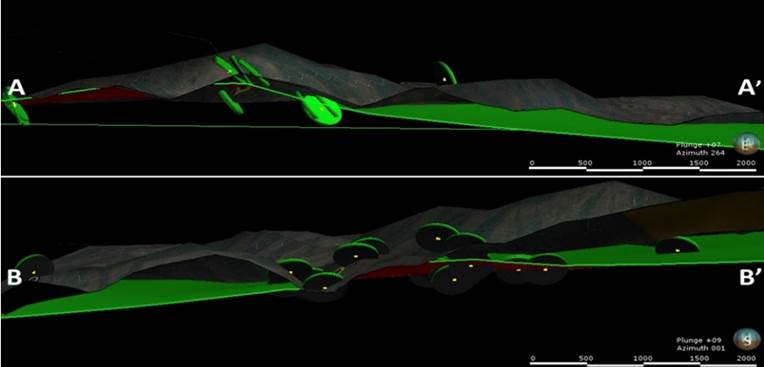

The initial structural interpretation of the Herradura Zone concludes Kupferschiefer type stratabound copper-silver mineralization at Herradura forms a continuous mineralized zone, striking approximately 265 degrees. The copper-silver mineralization dips gently to the NNW at 15 to 21 degrees, crops out up dip and is exposed down dip in erosional “windows” along several creeks.

The structural interpretation indicates the low angle copper-silver mineralized zone at Herradura is open along strike and down dip as displayed in Figure 2 and 3. Figure 4 documents the Herradura Zone in an exposed erosional window along a creek. The Company previously reported values of 24.8% copper + 230 g/t silver from a continuous 4-metre by 1-metre rock chip channel and 10.4% copper + 88 g/t silver from a continuous 1-metre rock chip channel in the Herradura Zone (March 4, 2020). In addition, two subsequent bulk samples extracted 1.8-km apart within the Zone, returned 10.4% copper +88g/t silver and 3.5 % copper +29 g/t silver (May 21, 2020).

The field team will focus on expanding AM North’s “Herradura Zone” through rock channel sampling of mineralized horizons exposed in creeks and on hillsides, continually moving out in all directions from the centre of the stratabound copper-silver zone.

Plan view of surface trace of the stratabound Cu-Ag horizon at the ‘Herradura Zone’

Cross Sections A to A’ and B to B’ showing continuation of low angle mineralization

Example of outcropping stratabound Cu-Ag mineralization at the “Herradura Zone”

Max Resource Corp.

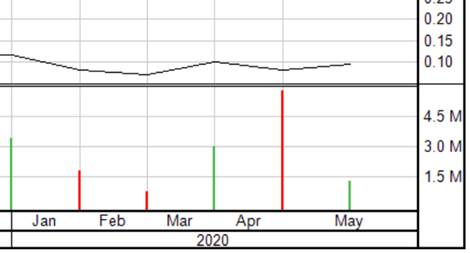

TSX-V:MXR

Cdn$0.95, 2020.06.10

Shares Outstanding 35,714,906m

Market cap Cdn$3.39m

MXR website

Hannan Metals (TSX-V:HAN)

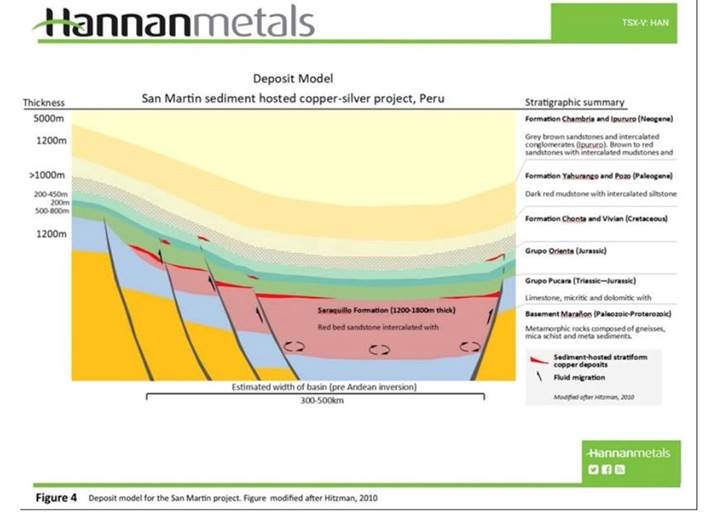

Hannan Metals (TSX-V:HAN) is developing a sediment-hosted copper-silver deposit in the Huallaga basin of north-central Peru. Described as one of the best surveyed thrust and fold belts in the world for oil and gas, the style of deformation in the Sub-Andean zone is mainly related to salt tectonics rather than a compressional thrust and fold belt. This insight has opened up a new window for sediment-hosted copper deposits in Peru.

A first mover in this part of Peru, Hannan’s initial prospecting in 2018-19 identified high-grade mineralization in outcrops and alteration in an area covering 100 x 50 km. Similar-styled outcrop boulders have been discovered over 100 km of combined strike. The best rock-chip samples from two outcrops 20 km apart were 3 meters at 2.5% copper and 22 grams per tonne silver, and 2m at 5.9% Cu and 66 g/t Ag (US$352.65t gross metal value per tonne).

Drills have yet to be sunk into these areas.

Recognizing the exceptional potential for a new frontier basin-sized copper-silver deposit, in January 2019 Hannan submitted mineral claim applications covering 14,800 hectares to secure an unexplored district covering 15 km strike of copper-silver occurrences. In February 2020 Hannan upped its land tenure by 27%; holding 656 square kilometers covering multiple trends within 110 km of combined strike. On May 28th 2020 Hannan was granted more tenure.

According to the company, the San Martin project shares similarities with sedimentary copper-silver deposits including the Kupferschiefer deposit in Eastern Europe and deposits of the African Copper Belt situated in sub-Saharan Africa, two of the largest copper districts on Earth:

Copper and silver mineralization is hosted by the 150 million-year-old Saraquillo Formation, which was deposited in an intra-continental basin during the Jurassic-Early Cretaceous period. The Saraquillo Formation is 1.2-1.8 kilometres thick and extends for over 1000 kilometres of strike. The Saraquillo is associated with salt domes which suggest widespread evaporitic strata, with several small artisanal salt mines present in the area…

Mineralization is associated with the contact of fine-grained reduced carbonaceous sandstones with highly oxidized red beds of the Saraquillo Formation.

Mineralization consists of disseminated chalcocite, covellite, bornite and digenite with minor fine pyrite. Chalcocite is the dominant copper sulphide and it is always found together with carbonaceous material.

Initial grab sampling outlined four high-grade copper and silver areas over 15 km of strike, within at least two structural corridors, highlighting the potential for discovery of a strike extensive near-surface, sediment-hosted copper deposit. Nineteen mineralized boulders range from 0.1% to 8.3% copper and 0.2 g/t silver to 109 g/t silver. The average grade is 2.8% copper and 27.2 g/t silver (US$164.88 gross metal value per tonne).

“The eastern margin of the Peruvian Cordillera has seen very little previous exploration, and to collect undocumented high-grade copper-silver samples over a 15 kilometres strike is a rare and exciting experience,” says Michael Hudson, Hannan Metals’ chairman and CEO.

“The project has the hallmarks of forming a significant new sediment-hosted copper-silver district, with high grab grades of up to 8.3% copper and 109 g/t silver (US$505.37 gross metal value per tonne), from an intra-continental salt bearing sandstone sequence.”

Hannan has attracted the attention of billionaire resource investor Rick Rule, and 321gold.com publisher Bob Moriarty.

Rick Rule through Sprott Global Resource Investments Ltd. (Hannan news release 45-106F1 February 18, 2020) took down a significant chunk of a recent $0.15/sh with a full warrant exercisable at $0.30 financing that raised $2.2 million, and Bob Moriarty mentioned Hannan in a February 2020 article in Energy and Gold Ltd:

They just raised money at 15 cents a share and they expect to stake a lot of ground and they will be drilling sometime in the next six months. Could they go from 15 million to 75 million? Very easily.

Also of significance is Hannan’s appointment in January 2020 of Quinton Hennigh, a PhD in geology, to its geological advisory team. Hennigh is CEO of Novo Resources (TSX-V:NVO), which is developing a conglomerate gold play in Western Australia.

Hannan commenced a social program, baseline and geological field program in January 2020. Initial samples from this program are being analysed and will be released as they become available.

The company commenced a remote sensing study over the San Martin project. This will aid in geological understanding of the large area and help define areas for further groundwork. (MD&A April 28, 2020)

Recently Hannan published new results from a zinc-lead system that overlies stratabound copper-silver mineralization, from the Sanache zone at San Martin. According to the June 8 news release, lead and zinc mineralization has been identified, with the highest Pb and Zn values associated with NNE trending extensional shear structures, 500-1,000m long in parallel zones.

More interesting from our point of view, is that Hannan’s mapping from the first stage of this field season has revealed a transgressive structurally controlled copper-silver mineralization hosted by multiple lithologies in host rocks of Jurassic and Cretaceous age.”

Michael Hudson, CEO, states: “Geological mapping at San Martin has revealed extensive, transgressive stratabound and structurally controlled copper+silver and zinc+lead mineralization hosted by multiple lithologies in host rocks of Jurassic and Cretaceous age. Although our focus remains on the copper-silver end member of the mineralized system at San Martin, lead and zinc mineralization is well described in global sediment-hosted copper mineralized systems, often fringing copper mineralization. Our work continues to define a system of scale and tenor.”

Hannan Metals’ discoveries are attracting some major producer interest. According to the company,

At San Martin, we believe we have identified an opportunity which could result in a significant discovery. As a project generator we continue to review new opportunities, but at same time we need to consider all options to advance a district scale opportunity at San Martin. The results from our initial work to date has attracted the interest of a number of major mining companies. While we are in the early stages of our work programs, it would remiss to not consider partnership opportunities that we believe are in the best interest of the Company. To date the Company has had numerous discussions and exchanges of information and at this time is awaiting follow up documentation from select parties.

Hannan Metals

TSX-V:HAN Cdn$0.39 2020.06.10

Shares Outstanding 74,664,211m

Market cap Cdn$29,119,042m

HAN website

Aurania Resources (TSX-V:ARU)

Aurania Resources’ (TSX-V:ARU) flagship asset is the Lost Cities – Cutucu project, found in the Jurassic Metallogenic Belt of the Andes foothills in southeastern Ecuador. The company has carried out stream-sediment reconnaissance on parts of the sprawling 2,400-square-kilometer property, which includes 400 sq km across the border in Peru. Previously searching for gold, new observations from the field might have led Aurania to revise its exploration model.

Its Chairman and CEO, Dr. Keith Barron, explains: “In October of [2018] our geologists, tasked to carrying out rather routine stream sediment collection, started to bring an extraordinary array of copper-mineralized large boulders and slabs in from the jungle. Some of these samples were covered in vivid green chrysocolla and tenorite. At first, we treated these as a curiosity and believed they were related to the supergene weathering of nearby porphyries. However the copper minerals were hosted exclusively in well-bedded siltstone, mudstone, sandstone and shale, particularly in pieces showing abundant carbonaceous plant fragments and not in porphyry.”

Tracing these boulders back to the outcrops, over a strike length of 22 km, Aurania’s geologists observed the copper mineralized setting to be similar to the Kupferschiefer being mined by KGHM in Poland, and in Zambia and the DRC ie. that copper leached from the sedimentary basin remains in solution because of the oxidized state of the red sandstones (“red-beds”). Key to the mineralizing sequence is the presence of saline (salt):

Saline fluids from salt layers or domes within these sedimentary basins increase the solubility of copper, which forms stable, soluble copper-chloride complexes. Numerous salt domes are associated with the Jurassic red-beds in southeastern Ecuador. Salt is currently produced from two small artisanal operations on the Project.

When these basins are reactivated, the saline, copper-bearing fluids flow along the layering of the rock sequence to the faults, which constitute barriers to the fluids, and the fluids tend to rise along these permeability barriers. Where the fluids come into contact with reduced sedimentary layers, such as carbon-bearing black shale or limestone, the copper precipitates.

So far Aurania has identified copper-silver mineralization in boulders and in outcrops at surface. The sedimentary-hosted copper-silver mineralization is regional in nature, stratigraphically confined to key horizons of carbon-bearing sediments that have been verified in outcrop to extend for a minimum of 22 km (open along strike) across the project area.

These areas have yet to be drilled.

Aurania also notes that data from the geophysical survey it flew over the project identified a number of magnetic centers that are interpreted as porphyries or porphyry clusters. If this interpretation is correct, the porphyries represent an additional significant source of copper potentially injected into the red-bed sequence.

In March, 2019, Aurania’s management team learned that a competitor, Hannan Metals operating about 300 kilometers south in Peru, had discovered copper-silver sediment-hosted mineralization of a similar style and grade to what ARU had found in the Cutuco Cordillera in Ecuador. (In fact, Hannan’s San Martin project lies within the same geological formation as that mapped in Ecuador, albeit with a different name in Peru.)

Recognizing the possibility of extending its Lost Cities -Cutucu project southward into northern Peru, the company in January 2020 registered a subsidiary in Peru (Vicus) and applied for 419 mineral concessions covering 413,200 hectares in the northern part of the country.

“Believing that salt is geochemically a significant piece of the puzzle and potentially the reason for the extent and distribution of the copper and silver, it was considered too compelling to ignore the Peruvian opportunity, and we filed for open ground covering the prospective sedimentary horizons in proximity to salt deposits previously discovered during oil exploration. We believe that the areas may also have some copper porphyry potential if they prove to be an analogous geological setting to our ground across the border in Ecuador,” Barron said.

According to Aurania, the concession applications are divided into 20 blocks, located where the sedimentary layers that are prospective for copper-silver are at or near surface. The concession areas in Peru have been extensively covered with seismic, magnetic and gravimetric geophysical surveys undertaken by oil and mineral exploration companies, as well as by the Peruvian government.

Among the commentaries on Aurania Resources is one by Bob Moriarty, publisher of the website 321gold. Moriarty says “They may have discovered the first Kupferschiefer copper/silver deposit found or at least recognized in the Western Hemisphere. These sediment-hosted systems tend to be very big in lateral extent and rich.”

In the column, run by Streetwise Reports, Moriarty comments on a high-grade sample from the Ecuador project that assayed at 6.37% copper and 48.04 g/t silver, noting the material has a gross metal value of US$367.40 per tonne (Rick – current pricing).

In its quarterly update, Aurania says exploration teams are back in action, after having to withdraw from the area in mid-March due to covid-19.

The highlight from a LiDAR geophysical survey flown over seven targets in the first quarter was the presence of an ancient road that travels along a ridgeline in the central part of the project. Aurania states, The structure is completely jungle-covered, and there is a footpath along the structure that is used by the Shuar people. We believe that the engineered road is part of an infrastructure network that linked the Spanish Colonial gold mining centres of Logrono and Sevilla. LiDAR interpretation is on-going.

Meanwhile, the results are in from the first phase of reconnaissance drilling on the Yawi epithermal gold-silver target. According to the company, out of 3,010m drilled in seven holes, All of the boreholes confirmed the presence of a maar-diatreme system and alteration and pathfinder element distribution provided a clear vector direction towards the core of the mineralized system. Detailed field work in the direction of the vector identified a diatreme breccia that contains fragments of mineralized porphyry and fragments of silica typical of an epithermal gold-silver system. Now that the geological framework of the target area has been established, the next step is to undertake a geophysical program aimed at identifying sulphides related to epithermal and porphyry systems.

Geophysics are also planned for the Crunchy Hill target, where a 10th hole drilled before the coronavirus lockdown intersected the maar-diatreme target and alteration and pathfinder element distribution between holes CH-009 and 010 showed a vector towards the north.

Aurania recently completed a $6.470 million financing, having issued 2,087,139 shares, while paying the Ecuador government just over $2 million in renewal fees for the 42 mineral concessions that comprise the project.

Aurania Resources

TSX-V:ARU Cdn$2.82 2020.06.10

Shares Outstanding 40,486,673m

Market cap Cdn$114,172,417m

ARU website

Market update

The news from Max Resource, Hannan Metals and Aurania Resources comes at a very interesting time in the markets for copper and silver.

Gold and silver have been the main beneficiaries of the coronavirus pandemic, while copper is a bellwether for the global economy. If industrial production picks up with the successful reopening of economies, copper will be in high demand, surely resulting in price gains.

Over 50% of silver demand comes from industrial uses like solar panels, electronics, and the automotive industry. The solar power industry currently accounts for 13% of silver’s industrial demand. Around 20 grams of silver are required to build a solar panel.

The Silver Institute predicts 100 gigawatts of new solar facilities will be constructed per year between 2018 and 2022.

Indeed solar power is becoming more and more popular with utilities as the price per kilowatt hour drops in relation to traditional fossil fuels – ie, coal and natural gas. According to a report from CRU Consulting, by 2025 the amount of electricity generated by solar is expected to reach 1,053 terawatt hours, nearly double the amount produced in 2019. Among the solar power converts, Amazon is planning five new major solar installations, including the retail giant’s first in China.

How will all this solar impact silver? A 2019 study by the University of Kent found that rising demand for solar panels is driving up silver prices. Between now and 2030, PV manufacturers are projected to consumer 888 million ounces of silver, CRU states, which is 51.5Moz more than the combined output from all the world’s silver mines in 2019.

5G adoption is also expected to consume a lot of silver. In a recent column, Frank Holmes, CEO of US Global Investors explains:

The global rollout of 5G technology, still in the very early stages, will increase production for goods such as semiconductor chips, cabling, microelectromechanical systems (MEMS), Internet of things (IoT)-enabled devices—all of which require silver. In 2019, the amount of silver used in the applications stood at 7.5 million ounces, or 0.75 percent of annual output. By 2025, that amount could more than double to 16 million ounces and, by 2030, triple to 23 million ounces, according to estimates by Precious Metals Commodity Management.

While silver is expected to be in surplus this year, the Silver Institute says the glut will be limited (to 14.7 million ounces, 53% smaller than in 2019), by government-imposed covid shutdowns in top producers Mexico and Peru.

The Silver Institute therefore expects silver prices, currently trading around $17 an ounce, to hit $19/oz before year-end, possibly even outperforming gold on the back of its historically low relative value. If that happens, it would be a repeat of silver’s pattern last year. (+15.5%)

Year to date, silver has held up surprisingly well, considering its many industrial applications that have been negatively affected by the pandemic. In May silver soared more than 19% – its best month since 2011 – due to a combination of safe-haven demand and expectations of a quick economic recovery.

Since taking a dive in mid-March to $11.94/oz, spot silver has risen $5.60, for an increase of 47%!

Less than a third of the world’s silver output comes from primary silver mines; the rest is mined as a by-product of lead/zinc, copper or gold. Silver’s fortunes, therefore, are often tied to these minerals.

Let’s look at one of them, copper, in detail.

At the beginning of the year, RBC Capital Markets was predicting that M&A in the copper market could surge in 2020, especially if Chinese companies remained hungry for the red metal.

Unfortunately, any copper M&A flames were snuffed out by the covid-19 pandemic, and copper prices since March have taken a hit. However over the past month they have ticked up, as the prospects for the global economy improve, on continued relaxation of covid-19 restrictions.

So much so that Bank of America analysts recently increased their price forecast by 5.4% to $2.54 a pound. The BoA analysts, via CNBC, suggested that while Western economies may not completely mirror the rebound seen in China, the easing of lockdown measures would likely facilitate a rise in raw material purchases around the world.

Copper prices hit a 12-week high last Thursday, @ $2.50 a pound, close to 27% better than copper’s mid-March low. The big gain was due to news that Beijing has begun a widely anticipated $700 billion stimulus program focused on “new infrastructure” and “new urbanization”.

According to BMO, new urbanization refers to refurbishing old urban housing stock, railways, airports, and upgrades to power grids and local utilities while new infrastructure includes 5G networks, ultra-high voltage power grids, EV charging stations and data centers.

Among the projects that could receive a huge boost in investment, courtesy of a government rescue package, are a $44.2 billion expansion to Shanghai’s urban rail transit system, an intercity railway along the Yangtze River ($34.3B), and eight new metro lines worth $21.7 billion, to be constructed in the virus epicenter city of Wuhan.

Research by the International Copper Association found that China’s Belt and Road Initiative (BRI) is likely to increase demand for copper in over 60 Eurasian countries to 6.5 million tonnes by 2027, a 22% increase from 2017 levels.

The country already consumes over half the world’s copper; its refineries are reportedly using copper concentrates at higher volumes than the record-setting 2019 total of 22 million tonnes.

Meanwhile President Trump has renewed his pledge for infrastructure renewal, urging Congress to pass a $2 trillion plan for improving the country’s roads, bridges, water systems and broadband Internet:

In its 2016 report card, the American Society of Civil Engineers projected the country needed to spend about $450 billion per year to maintain an “adequate” level of infrastructure through 2020. This compares with actual expenditure projections of about $250 billion per year.

Upgrading cellular networks from 4G to 5G is expected to result in a vast improvement in Internet service, including nearly 100% network availability, 1,000 times the bandwidth and 10 gigabit-per-second (Gbps) speeds. Even though 5G is wireless, its deployment involves a lot more fiber and copper cable to connect equipment.

A report by Roskill forecasts total copper consumption will exceed 43 million tonnes by 2035, driven by population and GDP growth, urbanization and electricity demand. Electric vehicles and associated charging infrastructure may contribute between 3.1 and 4 million tonnes of net growth by 2035, according to Roskill.

BMO cites the latest survey of copper wire and cable fabricators, showing operating rates in May hitting 101.7%, the highest level in the history of the survey – thanks mainly to purchases by China’s State Grid.

We believe a significant part of a global infrastructure build-out should be “green”. There is an undeniable need to move away from energy sources powered by fossil fuels, and replace them with renewable hydro, wind and solar. A key part of the program should be a continued ramping up of vehicle electrification, since the transportation sector is such a large contributor to greenhouse gas emissions.

Electric vehicles contain about four times as much copper as regular vehicles.

Copper is a crucial component for auto-makers because it is a fraction of the cost compared to silver and gold, which also conduct electricity. There is about 80% more copper in a Chevy Bolt compared to a Volkswagen Golf; an electric motor contains over a mile of copper wiring.

Wood Mackenzie states that US utilities have invested nearly $2.3 billion in EV charging infrastructure. The consultancy predicts that by 2030 there will be more than 20 million (residential) charging points consuming over 250% more copper than in 2019.

With each residential charger using about 2 kg of copper, that’s 42 million tonnes, or double the current amount of copper mined in one year.

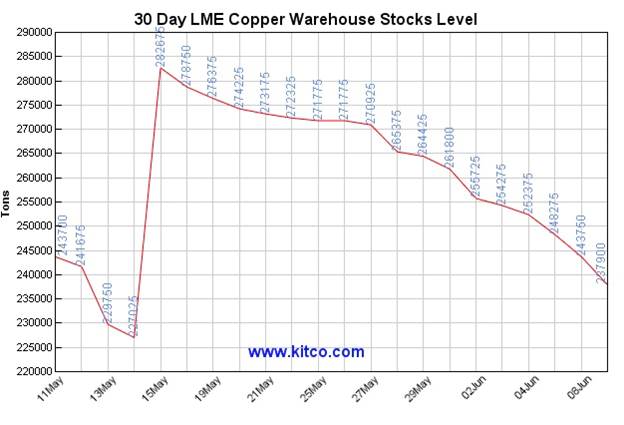

We already know that copper demand is outstripping supply. Copper stocks at LME warehouses recently fell below 250,000 tonnes for the first time in seven years.

Over the next two years, copper supply is expected to be weak. The base metal is heading for a supply shortage by the early 2020s; something we at AOTH have covered extensively.

Conclusion

The three companies discussed here, Max Resource Corp, Aurania Resources and Hannan Metals, are each believed to have “Kupferschiefer”-type mineralization, analogous to the large group of sediment-hosted copper-silver deposits underlying Poland and Germany.

It must be emphasized that this type of mineralization is extremely rare; only in Poland and Germany is it known to exist. And it’s BIG. Poland’s three copper-silver sediment-hosted mines, operated by state miner KGHM, amount to the largest silver producer in the world, at 40.2Moz in 2019 – almost twice the production of the second-largest silver mine.

if a look-alike at one, two or all three exploration projects we have discussed in this piece can be delineated, it would be a major find – on the scale of the world’s largest undeveloped copper deposits, such as the huge Kamoa-Kakula Copper Project being built under joint venture in the DRC.

Aurania has staked a large land position. Comprising 2,400 square kilometers, its Lost Cities-Cutucu project now straddles Ecuador and Peru. If the company can show there are structures below surface that point to a mineralized system, it could be onto something. The company is cashed up and ready to undertake ageophysical program aimed at identifying sulfides related to epithermal and porphyry systems.

Hannan Metals’ San Martin project in Peru also covers a large area – 600 square kilometers. The recent identification of a zinc-lead system, overlying stratabound copper-silver mineralization at the Sanache zone, is an encouraging sign, though more evidence is needed to support its Kupferschiefer thesis.

Max Resource is following the Kupferschiefer model of mineralization at its CESAR project in northeastern Colombia. “It’s the same stratigraphy with the sandstone below the limestone on top and the Kupferschiefer equivalent in the middle,” says Max’s head geologist, Piotr Lutynski, who is very familiar with the Kupferschiefer in his native Poland.

From the latest news release,

The initial structural interpretation of the Herradura Zone concludes Kupferschiefer type stratabound copper-silver mineralization at Herradura forms a continuous mineralized zone, striking approximately 265 degrees. The copper-silver mineralization dips gently to the NNW at 15 to 21 degrees, crops out up dip and is exposed down dip in erosional “windows” along several creeks.

Max is ahead of the game compared to its peers. While Aurania and Hannan continue to search for Kupferschiefer-type deposits, and have published positive news in that direction, Max has already found evidence of high-grade, sediment-hosted copper + silver at its AM North discovery, and to a similar extent, at AM South. While discoveries are still being made, Max is further along the path to drilling and resource delineation.

There is also a 40-km, potentially mineralized area between AM North and South that has yet to be explored.

Max and Hannan have both attracted major mining interest in their properties, including Max’s agreement with a still-anonymous major copper company that initially involves a geophysical survey to confirm surface sampling done to date.

There is no doubt there will be plenty of prospective news from all three (Aurania, Hannan and Max), with potentially major discoveries. I believe all three companies have an excellent chance to give its shareholders a big win.

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Max Resources (TSX.V:MXR), MXR is an advertiser on his site aheadoftheherd.com

Richard does not own shares of ARU/ HAN. Neither are advertisers on is site.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.