Resurgent dollar paving route to higher gold

2020.05.24

In the 1960s, French politician Valéry d’Estaing complained that the United States enjoyed an “exorbitant privilege” due to the dollar’s status as the world’s reserve currency. He had a point.

Because the dollar is the world’s currency, the US can borrow cheaper than it could otherwise (lower interest rates), US banks and companies can conveniently do cross-border business using their own currency, and when there is geopolitical tension, central banks and investors buy US Treasuries, keeping the dollar high and the United States insulated from the conflict. A government that borrows in a foreign currency can go bankrupt; not so when it borrows from abroad in its own currency ie. through foreign purchases of US Treasury bills.

The dollar is the most important unit of account for international trade, the main medium of exchange for settling international transactions, and the store of value for central banks. The Federal Reserve is the lender of last resort, as in the 2008–09 financial crisis, and is the most common currency for overseas borrowing by governments and businesses.

Barry Eichengreen, author of ‘Exorbitant Privilege: The Rise and Fall of the Dollar and the Future of the International Monetary System’, names three unique attributes to the dollar that no other currency has. As quoted by DW, these are:

- Size: Due to the size of the US and its economy, there are more dollars available than other currencies.

- Stability: US Treasuries have historically been valued as a safe financial instrument that is backed by the US government, which pays its bills on time.

- Liquidity: Treasuries can easily be bought and sold without them losing much of their value, given the consistent strength of the dollar. The bond market for US Treasuries is considered the most liquid financial market in the world.

King dollar

Indeed there is nothing like owning dollars when the proverbial shit hits the fan, or a spanner is thrown into the machinery of the global economy – pick your metaphor they all fit the current coronavirus crisis.

Bonds, the Japanese yen, the Swiss franc, even gold, the world’s oldest safe haven, have been no match for the dollar, as the virus continues to cause widespread dislocation in the form of business closures, layoffs (500,000 Canadians filed EI claims last week, American numbers could top 2 million on Thursday), and requests for government bailouts.

After hitting a 7-year high on March 9 of $1,674.50 per ounce, gold prices retreated, as traders sold bullion to cover losses in other asset classes, amid a three-week market meltdown. According to Bank of America Securities, it took the S&P 500 only 22 trading days to fall 30% from its record high reached on Feb. 19, which is the fastest drop of this magnitude in history.

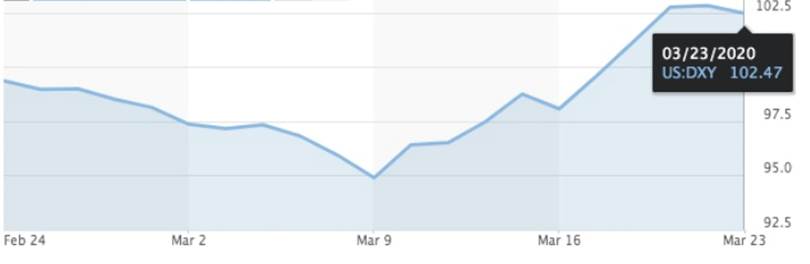

At first it looked as though gold was going to benefit the most from coronavirus fear, as the US dollar followed Treasuries downward, the steep fall in yields denting the dollar’s appeal. But the buck bottomed on March 9, its 2020 low, then shot higher, as investors fled emerging markets in record numbers and piled into safe-haven greenbacks.

Its attraction has seemingly been unaffected by the Federal Reserve’s two emergency interest rate cuts done in March to keep stalled economic growth moving, nor the mountain of liquidity the Fed is injecting into the economy.

Last week the central bank said it will increase its holdings of US Treasuries and mortgage-backed securities by up to $700 billion – adding to a promised $1.5 trillion intervention in short-term funding markets.

Financial Review lists five reasons for the spike in demand for greenbacks that have pushed the US Dollar Index from 95 on March 9 to just under 103:

- The dollar is the safest “bolt-hole”, the number one instrument of liquidity due to the depth of its bond market – a whopping $12 trillion in US-denominated borrowings outside the US.

- As companies find their supply chains disrupted, they want to own lots of cash, so they can borrow in US dollars.

- Due to stricter banking standards, requiring banks to keep more capital when companies tap credit lines, banks aren’t providing enough US dollars to capital markets, to meet sky-high demand for them.

- There are less dollars available to capital markets because of the oil price war between Saudi Arabia and Russia.

- As covid-19 containment measures widen, the US economy is getting pummeled. Americans are spending less on imported goods, meaning there are less dollars for those who want them.

The demand is coming from a number of sources including banks, issuers of dollar-denominated debt, investors selling assets valued in dollars, companies needing cash for US operations, and foreign banks looking to supply customers demanding greenbacks.

The overall theme is a shortage of dollars, to which the Fed responded, on Sunday, by rolling out new dollar loans known as swap lines, with five central banks, and an expansion of the current swap arrangements with nine other national banks.

The strong dollar is not only wreaking havoc with US multinationals for which the stronger dollar is making their exports less competitive, but America’s trading partners whose currencies have been battered.

Between March 6 and 20, the British pound lost 10.9% of its value against the dollar, last Thursday marking its deepest 8-day rout since 1992. Next worse off was the euro, down 5.2% versus the buck, followed by the Japanese yen at -4.9% and the offshore Chinese yuan at -2.3%.

The Australian dollar suffered its biggest loss against the USD since 2002, Mexico’s peso and India’s rupee hit record lows, and the Korean won slid most in a decade last Thursday, Bloomberg said.

The news portal notes the dollar shortage stems from the “failure to fix a key [financial] crisis flaw.” Since the 2007-10 recession, foreign borrowers have racked up US dollar-denominated debt. Total dollar credit extended to borrowers, excluding banks, in September reached a record $12.1 trillion – more than double the level of a decade earlier.

Problem is their reliance on one currency makes it hard to finance their debts if the dollar spikes. Bloomberg reports:

“It’s precisely what the global economy does not need at this moment,” Alexander Wolf, head of Asia investment strategy at JPMorgan Private Bank and a former U.S. diplomat in China, said of a strong dollar. “It tightens financial conditions, makes servicing dollar debt more expensive, and can cause pass-through inflation just when that is not needed.”

The dollar’s current surge is renewing calls for a less dollar-centric global financial system, something we at AOTH have written about; or even a rare, multilateral intervention to stop the dollar’s rise.

The latter was successfully carried out in 1985, through the Plaza Accord, whereby the US and four other developed national coordinated actions to stem a destabilizing increase in the value of the USD.

Quantifornicating with the virus

Back to the coronavirus, the Fed says “aggressive action” is required to soften the blow from the pandemic. The central bank has earmarked $700 billion in asset purchases and an additional $300 billion in new lending programs. What’s more, in remarks reminiscent of Mario Draghi’s “whatever it takes” comment regarding recession-era European Central Bank stimulus, the Fed on Monday announced it would purchase an “unlimited” amount of Treasuries and securities to ward off a credit crunch.

There it is: quantifornication round 4. You read it here months ago, we just never could have predicted a pandemic would be the trigger.

US lawmakers are reportedly working on a jaw-dropping covid-19 response that could result in $2 trillion worth of liquidity to the markets.

How are they going to find that kind of money? They’re going to print it, of course! Here’s how Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, responded on ‘60 Minutes’, when asked whether the banks will “literally print money” to ensure they have cash for depositors:

“That’s literally what Congress has told us to do. That’s the authority they have given us, to print money and provide liquidity into the financial system. We create it electronically and we can also print it, with the Treasury Department, so you can get money out of your ATMs.”

When the program hosts asked him, “Can you characterize everything the Fed has done this past week as essentially flooding the system with money?” he responded simply: “Yes.”

The host says “And there’s no end to your ability to do that?”

“There’s no end to our ability to do that.” He later added: “We’re far from out of ammunition…your ATM is safe, your banks are safe. There’s an infinite amount of cash at the Federal Reserve.”

Really?! That just might be the best thing gold hears all week. The precious metal punched higher on Monday morning as investors digested the “unlimited” amounts of money comment, and the fact that Congress couldn’t agree on the $2 trillion fiscal stimulus package.

Gold futures finished trading at $1,590/oz on the Comex in New York, up nearly 1.5%, while spot gold ended the day up $52.40, at $1,551.20/oz. In fact, the entire precious metal complex traded 3.5% higher, with silver doing the best percentage wise, with a net gain of 7.4%, as the white metal reclaimed the $13 level, finishing at $13.27/oz.

The massive stimulus package being contemplated, is evoking comparisons of the previous three rounds of quantitative easing, done to pull the US economy out of its recessionary doldrums. QE is widely credited for fueling the gold bull run that peaked in the second half of 2011 at an all-time high of around $1,900/oz.

However as we have argued, economic stimulus can’t save the United States economy from deflation and recession, not this time.

Lower interest rates and massive asset purchases by central banks are the monetary tools of choice when it comes to restoring shocked financial systems. The idea being that making the cost of borrowing cheap for individuals and businesses will entice them to spend, spend, spend. And it’s no wonder this is the panacea for floundering markets. In the US, consumer spending makes up two-thirds of Gross Domestic Product; in Canada it’s also the largest portion of the economy. If it doesn’t work and prices start falling, we have deflation.

Back in 2008, several rounds of quantitative easing, or QE aka Quantifornication – essentially printing money to buy government bonds and mortgage-backed securities – worked to allay the worst effects of the financial crisis, for a couple of reasons. First was the fact that interest rates were much higher at the time, meaning the Fed’s staged reductions had a lot of room to make an impact. Not so in 2020, when three interest rate cuts in 2019 left the federal funds rate in a range of between 1.50% and 1.75% at the point of the coronavirus becoming an epidemic in January-February (two reductions this month put the federal funds rate at 0%).

The second reason is self-evident; in 2008-09, there was no coronavirus to restrict spending. This, in our view, is the biggest risk to the US economy. How can the usual stimulus response of low interest rates, asset buying and money-printing work, in an economy where citizens are jobless (it has been reported up to 30% unemployment is coming), too scared and too broke to go out and spend?

A decline in consumer spending is the canary in the coal mine for deflation. We saw it happening as early as September, 2019, when US retail sales fell for first time in seven months, as households slashed spending on building materials, online purchases, and especially cars, CNBC reported.

Three months later, sales at clothing stores declined the most since January 2009. The Reuters report also noted that January 2020 marked the second straight month of decreased industrial production – which jibes with our finding of a slowdown in manufacturing. The IHS Markit PMI in January fell to a three-month low, we wrote. Firms noted a slower improvement in operating conditions and slack domestic and foreign demand from clients.

Another indicator of deflation is an increase in savings. When times are good, businesses are booming, cranking out products whose prices, over time, gradually rise. With an economy close to full employment, consumers don’t mind paying a little more for goods and services, since their jobs and incomes feel safe. This is a normal and healthy fiat inflationary environment.

Unfortunately, that is not what we are currently seeing. Instead of going out and spending their hard-earned shekels, many Americans are plowing it into savings accounts, or investing it, or stuffing it under the mattress.

According to the Wall Street Journal, the savings rate averaged 8.2% in the first seven months of 2019 – higher than any full year since 2012.

The coronavirus has, understandably, deepened consumers’ fear of racking up any significant new purchases, like a new car, house, appliances or vacation. People are holing up, waiting to see what happens.

The Hill reported the Morning Consult consumer sentiment index is down 3.2% since the start of the year, with much of the decrease corresponding with the spread of the coronavirus in late February.

Since our above-mentioned article was published, the economic situation has gotten worse, as has the spread of the pandemic in the United States.

There are now over 43,000 infections, including 10,000 new cases, and 552 deaths. That puts the United States third highest for coronavirus spread, behind only China and Italy.

Canadian infections are also growing – as of this writing, over 2,000 people have the virus and 24 have died from it.

As the crisis deepens, with the number of cases and deaths around the world increasing, leaders and health officials are discouraging travel, telling people to restrict gatherings, stay at home and practice social distancing.

Many businesses have been forced to close by ordinance, or due to a severe drop in clientele.

Among the industries hardest hit by covid-19 restrictions are hospitality – including hotels, restaurants, cafes and bars – travel (airlines and cruises), the auto sector and the oil patch.

Last week, among efforts to contain the pandemic, Canada shut its borders to foreigners including its southern border with the United States – an unprecedented move that restricts all non-essential crossings. Trade flows and seasonal workers are exempted.

Most Canadian provinces and major cities have declared states of emergency, including a health order that bans large public gatherings, closes gyms and casinos, and allows the prosecution of people who fail to comply.

In the United States which has over 20 times as many coronavirus cases, there are even tighter restrictions around movement.

As more states lock down, including Maryland, Massachusetts, Michigan, West Virginia and Wisconsin on Monday, one in three Americans are under orders to stay home.

Most business venues such as indoor malls are closed, as are dine-in restaurants, bars, nightclubs, gyms and fitness studios. Convention centers and public events are also out of bounds. Only businesses providing essential services have remained open. These include grocery stores, food banks, convenience stores, banks, doctor’s offices and pharmacies.

Many companies are suddenly finding they can no longer count on routine business to keep cash flows intact.

Last week, Goldman Sachs came out with a shocking unemployment prediction, that a record 2.25 million Americans could enter claims for unemployment benefits.

The influential bank bases its numbers on Labor Department data showing unemployment filings shot up 70,000, to 281,000. That would mean an 8-fold increase in jobless claims, blowing past the record of nearly 700,000 [weekly claims] set in 1982, Markets Insider reported.

“Even the most conservative assumptions suggest that initial jobless claims are likely to total over 1 million,” according to Goldman economists, who noted a surge in claims across 30 states.

With a horror show like that, it’s no wonder many are predicting a recession very soon.

The US economy is expected to grow slightly by 0.6% in the first quarter before falling a steep 12.9% in the second, states a Deutsche Bank forecast.

Kashkari, the Minneapolis Federal Reserve Bank President, said “If we’re not [in a recession] right now, we will be soon. My base case scenario is we’ll at least have a mild recession like after 9/11. The worst case would be we’d have a deep recession like the 2008 financial crisis, we just don’t know right now.”

You heard it here first: deflation then recession. If prices stop dropping across the board, likely by summer, you’ll know we were right.

At AOTH, we are forecasters, making intelligent, educated guesses on what the future brings. We’ve analyzed the covid-19 fallout from a lot of angles thus far, but what resource investors want to know is, what do we expect for commodities, for investable metals like gold, silver, copper?

The way we see it, the coronavirus is disruptive, to put it mildly, but it will end. The number of cases will definitely rise, and the economic fallout will get worse, but eventually, things will return to normal. And when they do, you want to be ahead of the herd.

Right now, we have a demand shock, where nobody is buying anything, or very little of it, except for basic necessities. Within a short period of time we will also face a supply shock, because businesses are shutting down, or working at much reduced levels. We see this both in the number of businesses that are hanging up “Closed temporarily” signs on their doors, and the increasing regularity of reports from mining companies that they are temporarily halting operations.

Just in Monday’s mining news, we see South African President Cyril Ramaphosa ordering mines to close for 21 days as part of a nationwide lockdown; B2Gold stopping mining at its Masbate operation in the Philippines; Newmont putting four mines on temporary care and maintenance, and lowering its 2020 production guidance; Ecuador scaling back workers and operations to a minimum at its largest gold and copper mines; and Peru evacuating three-quarters of its personnel from mine sites.

Also of note, three of the largest gold refineries in the world on Monday suspended production in Switzerland, for at least a week, after authorities ordered the closure of all non-essential industry. The refineries are located in the Swiss canton of Ticino, which borders Italy, where the virus has killed over 5,000 patients.

All of these closures will almost certainly add to the supply woes of metals that are already facing supply restrictions, such as copper.

We already know that copper demand is outstripping supply, with demand for everything from copper wire and pipes, to smart grids, electric vehicles, smart grids and 5G networks, all requiring more of the red metal. Supply cannot keep up without developing new mines.

The base metal is heading for a supply shortage by the early 2020s; in fact the copper market is already showing signs of tightening – something we at AOTH have covered extensively.

The current copper pipeline is the lowest it’s been in a century. New supply is concentrated in just five mines, in countries looking less mining-friendly – Chile and the DRC – and where copper prices must remain above $5,000 a tonne to be profitable.

When trade impediments are solved and the viral outbreak is contained, hopefully eradicated, expect copper prices to go through the roof.

Inflationary recovery

As for gold, we first need to look at the monetary picture.

Once the coronavirus is beaten, and we are confident it will be, hopefully within the next few months, there will be a very strong wave of pent-up demand for goods, many of whose supply chains have been impacted, therefore there is a very limited supply. When the covid-19 restrictions are lifted, and people are allowed to move around freely, and spend freely, expect prices to rise rapidly. The Fed will of course be watching inflation to see if it goes above its 2% target, and it likely will. We predict a significant rise in inflation, maybe to 4, 5 or 6%. The Fed will be forced to increase interest rates to bring inflation down, but it will have to act very carefully, in order not to squelch the recovery in consumer spending. Leave rates too low, and prices will rise too much, raise them too high, and consumer spending/ borrowing and business spending/ borrowing, might continue to lag. We expect real interest rates to negative for quite a while.

We know from economic history that gold does well in a hyperinflationary environment, but not so well in a deflationary scenario. In the 1970s, when there was double-digit inflation in the US, gold entered a bull market. When inflation decreased during the ‘80s and ‘90s, gold prices slumped.

How about bonds? At yields around 2%, investors piled into US Treasuries as a safe haven amid coronavirus fears and other geopolitical tensions. They were attractive in comparison to the trillions of negative-yielding sovereign debt sloshing around. But with all US Treasuries except for the 30-year note offering less than 1% interest (real yields are negative), they are now a poor investment. If foreign investors slow or stop buying US Treasuries, as Russia has done and China did last May, the United States is in real trouble.

Without purchasers of US debt (Treasuries) the US has no way of financing its annual deficits and $23 trillion pile of debt, without printing money. Printing money on a large-scale causes hyperinflation.

A worsening US economy will turn investors away from bonds and Treasuries. The dollar will fall and commodities will rise, including gold and silver, pushed higher by investment demand for ETFs and physical metal.

Matthew McLennan, head of an investment fund that manages about $110 billion in assets, was quoted by Bloomberg saying that we are already seeing gold’s purchasing power rise, due to declines in equity markets and other commodities.

“When the Fed progressively removes liquidity fears, provides forward guidance on rates, and when it possibly even controls the yield curve, and the economic softening is observable across the whole economy, the potential hedge value of gold can reassert itself powerfully,” he said.

On the supply side, gold’s fundamentals are bullish. Gold output peaked in 2018 at 3,503 tonnes, in 2019 it fell to 3,463t – the first annual decline in 10 years. We believe it will continue to drop further, owing to continued depletion of the major producers’ reserves, the lack of new discoveries to replace them, and production problems due to lower grades and temporary, possibly prolonged, stoppages owing to the coronavirus.

The current gold-silver ratio, a record 113:1, is double the historical ratio of 54:1, meaning silver is more then on sale, it’s being given away. As we wrote in Hi-yo Silver Away! silver is expected to do well in 2020 through a combination of higher industrial and investment demand, and tightened supply owing to mine production issues and output cuts. While demand for silver, like for most industrial metals, will fall during this current period of virus-related uncertainty, after the pandemic is beaten, we expect it to come roaring back.

At this point we see every reason to believe that the trade deal is on hold – with supply chains so messed up it may not be long before all non-essential trade grinds to a complete halt, with every country implementing severe border restrictions.

Think about it; global growth plummets, the US dollar tanks, bond yields at or near zero (when yields go below 2% it’s time to buy gold because the real yield, interest rates minus inflation, is 0%), meaning this an extremely bullish time for gold. There is a very good possibility that gold is going to get very dear in the next few months, if you can even get it.

The gold-silver ratio keeps going up and it’s only a matter of time before silver corrects, because imho, gold is going higher as the pandemic rolls on.

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.