Re-elected BC NDP pressing ahead with LNG disaster

2020.10.27

British Columbia’s NDP government was re-elected on Saturday with a comfortable majority, eliminating its dependency on the BC Green Party for maintaining power, and practically guaranteeing it will have four years, unencumbered, to carry out its agenda of resource development, including construction of the Site C dam and LNG Canada.

The two megaprojects are inter-related, because electricity from damming the Peace River will be put towards running the liquid natural gas plant, the first to be approved in British Columbia.

LNG Canada consists of an export plant that cools the natural gas to a liquefied form using a combination of hydro-electricity and natural gas, states LNG Canada. The pipeline, called Coastal GasLink, will be built and operated by TransCanada, now called TC Energy. It will extend from the Montney natural gas field in northeastern BC to the LNG terminal in Kitimat. Initially LNG Canada will export LNG from two processing units or “trains” with approximate capacity of 2.1 billion cubic feet of natural gas per day. The plan is to double capacity to four trains, at 5 billion cubic feet per day.

Premier John Horgan’s NDP government approved the $10.7 billion Site C dam in late 2017, knowing full well that it would be needed to power LNG Canada and future LNG plants, which are in the works.

The federal government will kick in $275 million. The $40-billion project’s ownership is split between Shell (40%), Petronas (25%), PetroChina (15%), Japan’s Mitsubishi Corp (15%) and Kogas from South Korea (5%). It is currently the largest infrastructure project in Canada. A conditional environmental assessment certificate was awarded in 2014 and regulatory approvals were granted in 2016.

Malaysian state-owned Petronas obtained substantial natural gas reserves in the Montney region of northeastern BC after acquiring Alberta’s Progress Energy. So did PetroChina and Mitsubishi through JV agreements with Encana Corp. These will all feed into the new LNG facility, expected to be operational in 2023.

“There is going to be $23-billion in revenue coming to the province that we can put toward the things that all of us want to see in our communities – child care, education, health care,” gushed Premier Horgan, after LNG Canada announced its final investment decision (FID). “I’m over the moon about it because a whole bunch of people over a long, long time worked to get this done.”

While many would agree with him, including former Premier Christy Clark, who congratulated the NDP while at the same time taking credit for her idea, we at AOTH have a different take on BC’s “excellent adventure” into LNG. Frankly, it’s not going to be excellent. We think it’s going to be an unmitigated disaster.

Pipeline construction

Construction on the Coastal GasLink pipeline quietly started up in July. There has been very little press on it, presumably due to the pandemic knocking it down on their priority list. A shout-out to local media for jumping on the story.

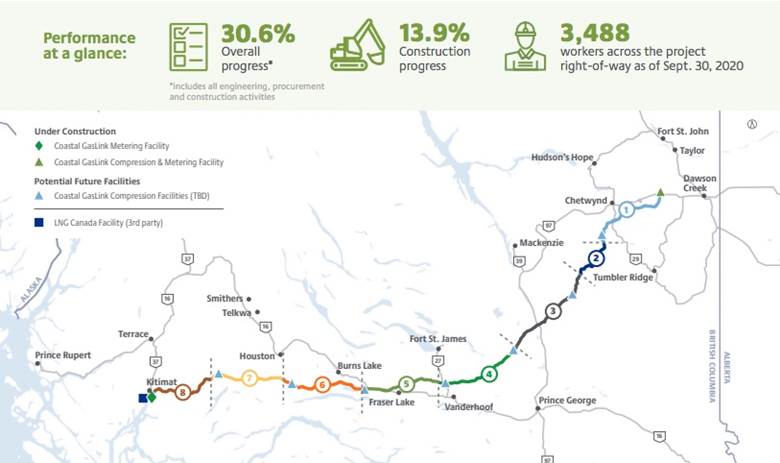

In July the Prince George Citizen reported the first pipe segments, of the $6.6 billion project, were in the ground – installed in the Peace region. Crews have started clearing the 670-km right of way from Dawson Creek to Kitimat.

Two Fort St. John contractors, Surerus Pipeline and Macro Industries, have joint venture projects hired to build the 48-inch diameter pipe. The Surerus Murphy JV is constructing the first two sections between Groundbirch and McLeod Lake, while Macro Spiecapag will handle the 85 km of pipeline between Burns Lake and Houston, as well as the final 84 km from Morice Lake to Kitimat. In total the Surerus Pipeline/ Macro Industries construction contract is worth $900 million.

SA Energy Group, a 50:50 joint venture between Aecon and Robert B. Somerville, was awarded a $526m contract from TC Energy to build two sections, one 123-km long, the other 74 km. Pacific Atlantic Pipeline Construction (PAPC) was contracted for the sixth and seventh section, a length of approximately 166 km.

In an October construction update, Coastal GasLink Pipeline Limited reported 21% of the pipe has been installed in the project’s first spread which runs 92 km from Groundbrirch to Brule Mines. 59% of the second spread, which is 48 km to McLeod Lake, has been cleared but no pipe has yet been laid. Site preparations along with earthworks and piling for the Wilde Lake compressor station continues in Groundbirch, and civil works have begun for a third worker lodge at Mt. Merrick.

26% of the pipe has been installed between Bear Lake and Vanderhoof, 4.5% has gone in between Burns Lake and Houston, and 1% has been placed in the final spread between Morice Lake and Kitimat.

As of Sept. 30 there were 3,488 workers employed on the project.

“We’re reaching peak construction on the Coastal GasLink right-of-way while also continuing to progress construction on our compressor and meter station facilities,” the company states.

First Nations opposition

Opposition by the hereditary chiefs of the Wet’suewet’en Nation to building the pipeline through their traditional territory sparked demonstations and blockades in February that shut down large parts of the national economy.

The company responded that it had signed agreements with the elected councils of all 20 First Nations along the pipeline route including the Wet’suewet’en.

Tensions escalated when the BC Supreme Court granted Coastal GasLink an expanded injunction against the Wet’suwet’en Nation members blocking access to the project. The RCMP then began enforcing that injunction. Other blockades and protests sprung up across the country in solidarity with the Wet’suewet’en hereditary chiefs, disrupting railways, ports and highways.

Lawyers for the First Nation are currently seeking an order in BC Supreme Court that would quash an earlier decision to extend the project’s environmental assessment certificate, Alaska Highway News reported.

LNG and the environment

Extracting natural gas through hydraulic fracturing, transporting it to a terminal, and then super-cooling it for transport in tankers, is not clean energy; in fact it may even be dirtier than coal.

A recent US study found that newer gas plants in the United States were, over their lifetimes, projected to negate much of the emissions reductions from coal plant shutdowns.

To turn it into liquid form, the gas must be cooled to 163 degrees below zero. To do that requires a great deal of power, with massive compression units running 24/7. Where does that power come from? In most cases, the same fracked natural gas is used to run the compression units, which pretty much defeats the purpose of LNG as “clean”.

According to Wood Mackenzie, LNG will be the biggest source of carbon emission growth by 2025 – due to strong demand from Asian buyers.

The BC government estimates LNG Canada in its first phase will emit 4 megatonnes of greenhouse gases per year. Emissions from the first and second phase would represent nearly three-quarters of the province’s legislated target for greenhouse gas emissions in 2050, set at 13 megatonnes/yr.

Opponents say the project will blow the NDP’s goal of cutting GHGs by 40% by 2030 and 80% by 2050, out of the water.

It’s ironic that we in BC, who purport to be so “green” (Former Vancouver Mayor Gregor Robertson wanted to make Vancouver the “greenest city on the planet” with bike lanes) are presiding over an industry that is going to belch natural gas and methane, which is 86 times more damaging than CO2 over a 20-year period.

Then we’re going to turn around and sell that gas to China, so that it can get off of coal and build natural gas plants that will be just as dirty, if not dirtier?

Natural gas is mostly methane (CH4), a potent greenhouse gas that is over 25 times more efficient than carbon dioxide at trapping heat in the atmosphere over a 100-year period. (the Intergovernmental Panel on Climate Change (IPCC) says methane is 86 times more damaging than CO2 over a 20-year period)

Fugitive methane emissions run from 1% to 9% of total natural gas life cycle emissions. For natural gas power plants to be cleaner than coal, methane emissions over the plant’s life cycle must be below 3.2%, according to one study.

Most methane leaks come from flaring excess NG instead of putting it into a pipeline. The journal ‘Nature’ published a study saying that the US oil and gas industry emits 13 million tonnes of methane a year, which is 60% higher than the EPA’s estimate.

How do we get the natural gas for LNG? We frack it. Most of the conventional natural gas formations in British Columbia have already been depleted. What’s left is “tight gas” trapped in shale rock formations, primarily the Montney in northeastern BC. According to the BC Oil and Gas Commission, only 22% of BC’s remaining natural gas reserves are conventional; the rest are unconventional, which involves fracking.

As use of fracking technology has increased worries are growing about its impact on our fresh water supply.

Fracking just one well can use 2 to 8 million gallons of water with the major components being water (90%), sand or proppants (8-9.5%), and chemicals (0.5-2%). One 4-million-gallon fracturing operation would use from 80 to 330 tons of chemicals and each well will be fracked numerous times. Many of these chemicals have been linked to cancer, developmental defects, hormone disruption, and other conditions. The water gets contaminated after the fracking process and is disposed of in tailings ponds or is injected into deep underground reservoirs.

Cracked wells and rock movement frequently leak fracking fluid and gases into nearby groundwater supplies. Fracturing fluid leak-off (loss of fracturing fluid from the fracture channel into the surrounding permeable rock) can exceed 70% of injected volume.

Methane concentrations are 17 times higher in drinking-water wells near fracturing sites than in normal wells. Hydraulic fracturing increases the permeability of shale beds, creating new flow paths and enhancing natural flow paths for gas leakage into aquifers.

Fracking has also caused benzene poisoning among pregnant native women in northeastern BC – natural gas country – and is known to cause earthquakes.

In other cases it has depleted water supplies, depriving other users of necessary irrigation or drinking water. The need for so much fresh water in the fracking process has resulted in the construction of at least 90 unlicensed dams in northeastern BC, some of which may be unsafe.

In fact there is evidence of a government cover-up of the risk fracking presents to dam safety. The Canadian Center for Policy Alternatives’ Ben Parfitt filed a Freedom of Information request with BC Hydro, asking the Crown corporation whether fracking could trigger earthquakes that cause Peace River dams to collapse.

According to The Narwhal, even before a fracking boom gets underway in the Peace region to support LNG Canada, there are over 11,000 inactive fracking wells in BC that need to be decommissioned and rehabilitated:

In an audit last year, B.C.’s former Auditor General Carol Bellringer found the oil and gas commission had not secured enough money from companies to cover an estimated $3 billion in cleanup costs.

Bankrupt fracking companies have also left the commission — and, ultimately, taxpayers — responsible for cleaning up a burgeoning number of orphan wells, including contaminated sites and wastewater pits.

The number of orphan wells is poised to double to between 646 and 746 this year, after a 769 per cent increase over the past four years. Last year, the commission reclaimed just four orphan well sites. It plans to reclaim 15 sites this year, leading many to wonder if the province will ever catch up.

It’s interesting to note that the nascent LNG industry in BC is being encouraged by the federal Liberals. In 2017 Trudeau’s Liberals passed Bill C-48, the Oil Tanker Moratorium Act, which stops crude oil tanker traffic on the northern coast of BC – thus formalizing a “voluntary” Tanker Exclusion Zone that has existed since 2015.

Excluded from the bill, though, are gasoline, naphtha, jet fuel, propane and liquefied natural gas (LNG) – allowing the unfettered expansion of LNG in BC.

According to The National Post, LNG will bring more marine traffic to BC’s waters than the current Trans Mountain Pipeline expansion will – about 350 LNG tankers per year compared to 300 oil tankers.

It has long been suspected that engine noise from freighters, cruise ships and other large vessels disturbs cetaceans, the family of marine mammals that includes whales, porpoises and dolphins. In the spring of 2017, a group of scientists decided to study the phenomenon in the waters around the Ogasawara Islands of Japan.

The researchers found that male humpback whales swimming close to freighters stop “singing” to attract females. As important, they noticed that the noise from the ships impacted the ability of the whales to navigate and to identify food, a process known as echolocation. Cetaceans use sound to bounce off salmon and other prey in order to locate them.

A similar study in 2016 was done with killer whales (orcas), up the US West Coast as far as Puget Sound.

“The main concern of this is that even a slight increase in sound may make echolocation more difficult for whales,” said Scott Veirs, whose research was quoted in The Guardian. “That’s worrying because their prey, chinook salmon, is already quite scarce. Hearing a click off a salmon is probably one of the most challenging things a killer whale does. Hearing that subtle click is harder if there’s a lot of noise around you.”

Noise from the loudest ships was found to be 173 underwater decibels, which equates to around 111 dB in air – around the same level as a loud rock concert.

Note that as our oceans warm due to climate change they become more acidic due to increased CO2 absorption – this change in ocean acidity will allow sounds to travel up to 70% farther underwater. This will increase the amount of noise in the oceans, further affecting the behavior of marine mammals like killer whales.

Pipeline politics

There appears to be a policy shift, either directly or indirectly, at the provincial and federal government levels, that natural gas is the way forward, and the oil sands shouldn’t be encouraged to expand. Natural gas is seen as cleaner than oil, particularly when it is transported. A natural gas spill is invisible (though no less damaging to the environment); an oil spill evokes ghastly images of ruined beaches, dead seals and oily sea birds. This partly explains the enthusiasm with which the BC premier and the Canadian prime minister greeted the LNG Canada decision. It is more politically palatable.

But we need to recognize that the idea of natural gas being safer than oil is an illusion. The 2015-16 natural gas leak at Alison Canyon, California, is now on record as being the worst man-made greenhouse gas disaster in US history. The 112-day leak spewed about 5 billion cubic feet of methane into the atmosphere.

It’s not only the health of British Columbians that is at risk from LNG (polluted and depleted fresh water supplies, earthquakes and dams bursting from fracking, insane levels of greenhouse gas emissions including methane), it’s also their pocketbooks.

In September 2018, Shell and its partners announced their decision to go ahead with LNG Canada in Kitimat – after a $C5.3 billion tax break by BC’s NDP. The handout was necessary to make the project economical, and no doubt to entice the consortium to provide some 10,000 construction jobs and $24 billion in provincial revenue over the next 40 years.

Included in the fine print?

- LNG Canada is not required to pay PST during the construction period, effectively giving the consortium an interest-free loan for two decades and an annual savings of $19 million to $21 million.

- The NDP government also eliminated the LNG income tax, a tax they supported while in opposition. In its place, a natural gas tax credit gives LNG Canada an additional 3% corporate income tax cut.

- The consortium will get a rebate from the BC carbon tax amounting to about $62 million a year, after the tax, currently at $40 a tonne, rises to $50/tonne next year.

Also, LNG Canada will pay about half the regular cost of electricity from the Site C dam, amounting to a $32 million to $52 million annual subsidy that will have to be reimbursed by provincial ratepayers.

The Narwhal notes that ratepayers and the federal government will also foot the bill for new transmission lines for the project, through an $83.6 million “Investing in Canada Infrastructure Plan”. BC Hydro will provide $205.4 million, to be paid for by existing Hydro customers.

On top of this, there’s a $680 million provincial and federal fund, announced in 2019 to support further electrification of LNG in BC. The money was allocated despite the fact that the Canadian government’s support of LNG Canada, and the Coastal GasLink pipeline, is offside with the government’s climate targets.

Earlier this year the National Observer reported that Canada is undermining its own climate goals by allowing Export Development Canada (EDC), a Crown corporation, to loan potentially hundreds of millions of dollars to Coastal GasLink. The organization has reportedly provided about $45 billion to the oil and gas industry since 2016, and just $7 billion for clean technology.

Finally, the province has given away almost $400 million per year in royalty credits to the consortium, leaving royalty revenues at $153 million (in the early 2000s, natural gas royalties of $ billion to $2 billion were collected); provided $1.2 billion in “deep well credits” to fracking companies; and granted a $1 billion tariff exemption for the importation of steel modules to the LNG Canada and Woodfibre LNG projects.

If the BC NDP party can’t protect the environment and present a viable strategy for dealing with climate change, surely the Green Party can. (the BC Liberals have consistently supported LNG since Christy Clark campaigned on it, and in their 2020 election platform said they would expedite LNG export projects and accelerate the review and approval process)

As the party holding the balance of power in the last government (its 3 seats plus the NDP’s 40 beat the Liberals’ 42) the Greens could have brought down the government with a no-confidence motion. But former party leader Andrew Weaver caved when he had the chance to do so.

In 2018, when the NDP announced their new “framework” supporting LNG, ie., the tax giveaways outlined above, Weaver refused to force an election, even though the NDP’s policies in support of LNG broke an earlier agreement between the NDP and the Greens, and that [Weaver] does not see a way in which the government can meet legislated climate reduction targets while the proposed LNG Canada facility is operating, according to Global News.

So, the Greens opposed LNG, but they weren’t principled enough about it to risk losing their three measly seats, by wrecking the fragile NDP-Green coalition.

Now, following the Oct. 24 election results, the Green Party has managed to retain its three seats, but lost all of its previous leverage; having won 55 seats of 87, the NDP no longer need them to stay in power.

Having throttled the Liberals and emasculated the Greens, the NDP is now free to pursue its LNG ambitions without opposition.

In the leaders’ debate just before the election, Horgan defended his decision to support LNG Canada, and recently said he has no intention of changing his position on the Coastal GasLink pipeline:

“I firmly believe, after many decades involved in public policymaking and observing events, that we are absolutely on the right course,” the Premier said, “and I’m going to carry on.” Right.

LNG glut

A new liquefied natural gas industry in British Columbia that would be so successful, it would pay off the provincial debt, turned out to be just fairy dust sprinkled by ex-BC Premier Christy Clark. “We’re doing this for our kids,” enthused a folksy-sounding Clark geared up in coveralls and a hardhat, on the campaign trail that won her the premiership in 2013. The prospective LNG projects, which at one time totaled 20, would use natural gas piped from BC’s northeast gas fields to terminals on the BC coast, then shipped on tankers for energy-hungry markets in Asia.

LNG tankers too dangerous for East Coast, but OK for BC?

One by one, however, the projects collapsed amid low natural gas prices (BC was late to the game and faced a wave of new export capacity, including LNG produced from Australia and the US). The biggest was Petronas, which in 2017 pulled the plug on its $36 billion Pacific NorthWest LNG project in Prince Rupert, citing poor economics.

Defenders said the industry is cyclical and prices would come back, making BC-based facilities attractive to oil and gas companies due to the shorter shipping route to Asia versus terminals in the States.

While Henry Hub natural gas prices enjoyed a run up to $4.50 per MMcf in 2018, NG has been hurt lately by the pandemic, which sent demand plummeting alongside an already oversupplied natural gas market. Prices dropped to a four-year low.

The result is that plans to build pipelines, terminals and other infrastructure in Canada and around the world have been put on hold, or scrapped entirely.

According to a 2020 report from Global Energy Monitor, an NGO, 13 LNG projects out of a potential 18, have been suspended or canceled in recent years. That includes a $10 billion LNG export facility in Nova Scotia.

And while the Kitimat LNG project on the BC coast is still viable, its Australian partner, Woodside Petroleum, in February warned it will take a $720 million after-tax writedown on its natural gas fields in northern BC. The setback came only a few weeks after the project’s operator, Chevron Corp, announced it will try to sell its 50% stake in Kitimat LNG.

Politics is another factor going against Canadian LNG, more specifically, organized opposition to pipelines.

According to Global Energy Monitor, via Global News, Warren Buffett’s decision earlier this year to withdraw his investment firm Berkshire Hathway’s planned $4 billion contribution to an LNG export terminal in Saguenay, Quebec, is a sign of things to come.

“While many projects face opposition from local communities, the case of the Energie Saguenay LNG Terminal in Quebec shows the potential for a local protest to galvanize a national movement,” said the Global Energy Monitor report.

Despite a recent rise in the price of North American natural gas, owing to a curtailment of shale oil & gas production, and an uptick in demand from colder weather, the commodity’s long-term fundamentals are not encouraging.

In June World Oil warned that natural gas prices could “go negative” on oversupply, like crude oil prices had a month earlier:

While crude has staged a rapid recovery after a deal by the biggest producers to curb a surplus, the $600 billion global gas market remains extraordinarily oversupplied. Traders and analysts say the worst may be yet to come as demand falls and storage nears capacity, creating the ideal conditions for negative prices in some parts of the world…

The fuel, used to generate power and heat and as a feedstock for chemicals and fertilizers, was already slated to have a terrible year after a mild winter exacerbated a glut. But things turned from bad to worse as the pandemic hammered demand, forcing major buyers to reject deliveries. Meanwhile, top sellers haven’t yet throttled back enough output as stockpiles near capacity.

Like oil’s brief plunge in April below minus-$40 a barrel, the key factor is the lack of storage to absorb excess supply. Traders and analysts point to Europe as the first market likely to hit that crisis point, which could have ripple effects for buyers and sellers from the U.S. to Asia.

Another problem that could impact the market is North American oil and gas companies floundering in debt. A recent Rystad Energy report quoted by Oilprice.com says the debt from oil and gas bankruptcies in 2020 has already reached an all-time high and is set to go further this year, as Chapter 11 filings continue.

At a current Henry Hub price of $3.00 per MMcf, the report forecasts North American E&P bankruptcies to rise to 55 by the end of the year. At a more pessimisic $2.50 per MMcf, bankrupties could reach 61 cases this year and 68 in 2021.

Conclusion

With the acceleration of an LNG industry in BC, the politicians, who are the gate-keepers of our air and water – have given the keys to large, foreign multi-nationals who don’t care about BC. They only want to buy our gas and ship it overseas, supposedly to get Asia off of coal and onto cleaner natural gas. But as we have shown, NG is anything but clean. When burned, it emits noxious pollutants. These emissions are part of the problem of climate change, not the solution. Methane release makes the problem many times worse. The more methane in the atmosphere, the warmer the planet will get. It’s just science.

The only way to get the liquid natural gas is to frack it, which comes with a whole host of problems, presenting huge risks to human and animal health, and the environment. Is it worth it? Is 24 billion dollars over the 40-year life of one project worth the risk of what we’re going to do to northeastern BC?

Not from the economic side…The financial cost to BC residents is massively lopsided. Politicians are giving the LNG multinationals, none of which are Canadian companies, a $5.3 billion tax break and $86.68 billion in free water over the 40-year period they supposedly give us $24 billion. The Feds are giving them another $275m. Hmmmmm.

Hundreds of millions of dollars in give-aways to LNG Canada might be worth it in the long run if the huge investment we are making in liquefied natural gas is going to be profitable for decades to come, to reap our return on investment. Maybe. But this is a market in decline. Even before the pandemic throttled demand for LNG, there was a natural gas glut. Can LNG Canada, currently the only project likely to see a production date, even survive at current prices without these outrageous government subsidies?

And what price will BC residents pay for failing to reach our carbon reduction goals? We at Ahead of the Herd believe that the costs to human health of fracking natural gas, pipelining and burning it to get LNG, in terms of increased hospitalizations, and drains on the Medical Services Plan, plus the many negative effects on the environment – greenhouse gases contributing to global warming, earthquakes, the extinction of BC’s killer whales – to name a few, will cost a great deal more than $24 billion, over the next 40 years.

What is the net benefit to BC of just one LNG project, let alone two or three more and a massive pipeline system that is being built to move all that gas around? I strongly suggest there is none.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.