Palladium One’s Phase 2 drilling campaign aiming for maiden resource estimate at Kaukua South

2020.11.12

In mature brownfield exploration, where a junior resource company is working on a property known to host mineralization with a history of past production, success usually depends on the junior’s ability to incrementally add tonnage to an existing resource. This is very different from a greenfield property, which is being drilled for the first time. Success at greenfields often comes suddenly with the discovery of brand new economic grade mineralization. These discovery holes can be highly rewarded by the market, but retail investors are fickle. Unless each hole continues to intersect at least as good or better mineralization, investors may quickly become impatient or disappointed, pull their investments and start chasing another project, leaving more loyal shareholders holding the bag.

Palladium One Mining (TSX-V: PDM, FSE: 7N11, OTC: NKORF) fits in the middle of these two extremes. The property is expanding the tonnage of known mineralization but is also having greenfield exploration success. The Vancouver-based junior has been quietly working its flagship Läntinen Koillismaa (LK) PGE-Cu-Ni project in Finland. On top of a current NI 43-101 pit contrained resource at Kaukua, PDM has been drilling since March despite the Phase 1 drill program being stalled in the early going by the coronavirus pandemic.

Drilling resumed in August, with a focus on expanding very promising discovery successes to the east of existing drill intercepts in the Kaukua South zone, and testing the potential for adding mineralization to the 2013 resource at the Haukiaho zone. The Murtolampi target was also drill-tested and represents a potential satellite open pit resource less than 2-km from Kaukua.

Läntinen Koillismaa (LK) project

The geology at LK dates back to the early Palaeoproterozoic era, ~2.4 billion years ago, during which rift-related igneous activity produced mafic-ultramafic rocks containing palladium-rich copper-nickel-platinum group elements (Cu-Ni-PGE) sulfide minerals, chromium, as well as iron-titanium-vanadium.

The LK project is a “basal Cu-Ni-PGE bearing sulfide accumulation within the larger Koillismaa Layered Mafic-Ultramafic Intrusion” that is part of an intrusive belt that runs east-west across Finland and into neighboring Russia.

The exploration permits — covering a total of 3,845 hectares — are divided into two groups: the Kaukua Group consisting of the Kaukua and Murtolampi targets; and the Haukiaho Group covering the Lipeävaara and Haukiaho targets, as well as Salmivaara, which represents the eastern and western extension of Haukiaho.

The project is comparable to the Platreef type deposits of the Bushveld Igneous Complex in South Africa, the largest layered igneous intrusion within the Earth’s crust. It is also where most of the world’s platinum is produced.

Surface sampling and previous drilling have shown evidence of palladium, platinum, gold, copper, cobalt and nickel.

Last year Palladium One published the first NI 43-101-compliant resource at the Kaukua target, putting the company on track to developing an open-pit PGE-nickel-copper mine in Finland.

Using a 0.3 g/t Pd cutoff grade, the optimized pit-constrained mineral resource at Kaukua includes:

- 635,600 Pd_Eq ounces of Indicated resources grading 1.80 g/t Pd_Eq (“palladium equivalent”) contained in 11 million tonnes

- 525,800 Pd_Eq ounces of Inferred resources grading 1.50 g/t Pd_Eq contained in 11 million tonnes

Palladium One wishes to add multiples of the existing 1.1Moz Kaukua resource, in the Kaukua South area, which adjoins Kaukua, as well as to update/ increase the resource estimate at Haukiaho.

IP survey

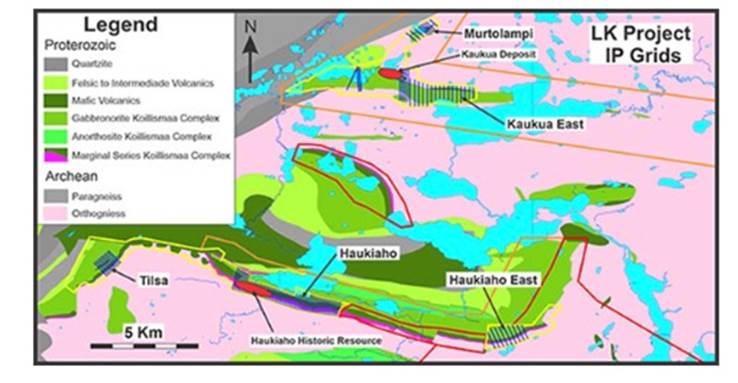

In January 2020, PDM commenced an induced polarization (IP) survey, designed to zero in on shallow zones of conductivity, containing higher sulfide concentrations. The company completed five grids that included the following target areas: Kaukua South, Murtolampi, Haukiaho, Haukiaho East and Tilsa.

In its Feb. 25 news release, Palladium One says initial IP results from the first grid, Kaukua East, discovered a large chargeability anomaly, which is indicative of underground mineralization.

“Significantly, the chargeability anomaly on the new Kaukua East survey appears to be more intense and wider than the one on the 2008 survey, making it a very high priority drill target,” President and CEO Derrick Weyrauch stated.

Murtolampi

On Aug. 25 Palladium One released the first drill results from the Murtolampi zone, just under 2 kilometers north of the Kaukua deposit. Starting at 5.8 meters down hole, hole LK20-012 intersected 87.2m at 1.43 grams per tonne Pd_Eq including 20.2m at 2.26 g/t Pd_Eq. Similar to Kaukua South, Murtolampi is associated with a strong induced polarization (IP) chargeability anomaly that has not been fully tested. IP has proven to be an invaluable tool for outlining palladium-rich sulfide mineralization on the LK project, as evidenced by the success of hole LK20-006 at Kaukua South, described below.

On Oct. 20, PDM reported wide zones of magmatic sulfide mineralization — two of three drill holes had mineralized core ranging in length from 40m to 70m — that extends over >600m of strike. “We are excited to report this second discovery. Initial results from Murtolampi indicate that it could form a significant satellite open pit resource, adding to the Kaukua deposit, which is located less than 2 kilometers to the south,” Weyrauch stated in the news release.

Kaukua South

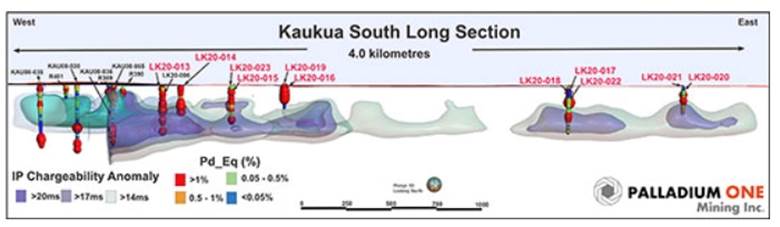

On Aug. 10 Palladium One revealed that data from last winter’s IP geophysical program suggested the Kaukua South anomaly now extends for over 5.5 kilometers, as shown in the figure below.

In the news release, Weyrauch commented, “Kaukua South has become a key focus for the Company. The existing Kaukua Deposit is robust and contained within 1 kilometer of strike length, while Kaukua South may now have a strike length of over 5.5 kilometers. This suggests the potential to add significant, near surface, tonnage to existing NI 43-101 open pit resources and could materially increase conceptual mine throughput and/or a conceptual life-of-mine plan. We are eagerly awaiting results from the now resumed drill program.”

They didn’t have to wait long. The next day the company press-released the results of the first hole to test the eastern section of the above-mentioned >5.5-km-long IP charageability anomaly.

Hole LK20-006 intersected 166.7m @ 1.16 g/t palladium equivalent, including 63.4m @ 1.88 g/t PdEq and thereby PDM made a new discovery.

Weyrauch was pleased with the assays, stating, “To date, Hole LK20-006 bears the most significant results of the Phase 1 drill program. It is hard to understate the importance of this hole, as it has not only confirmed the eastern extension of the Kaukua South Zone, but intersected a core zone twice as thick as the next best intersection in Kaukua South. Significantly, the mineralization begins only 43m down hole, making it highly amenable to open pit mining. This confirms our belief that Kaukua South has the potential to quickly add tonnes to the 2019 NI 43-101 open pit constrained Kaukua resource estimate.”

In late September, Palladium One said drilling at Kaukua South had extended magmatic sulfide mineralization by more than 3 km east of hole LK20-006. Because historical drilling returned 33m @ 1.9 g/t Pd_Eq 600m west of the hole, that means a new strike length of about 4 km – a more than six-fold increase from the previous 600m-long strike.

Eleven holes were drilled in August/September, on the Kaukua South extension of the Kaukua deposit. Each contained magmatic sulfide mineralization. The results demonstrate Kaukua South has the same host rocks as Kaukua, and confirm that the Kaukua South IP anomaly, shown by earlier geophysics, is the result of magmatic sulfides.

According to the company, preliminary indications are that Kaukua South could be several times the size of the 2013 resource at Kaukua that delineated 1.1 million Pd_Eq ounces of Indicated and Inferred resources.

“The Kaukua South strike extension is exceptionally significant because it has shallow disseminated sulfide mineralization the same as Kaukua and points to the footprint of a large-scale mineral system,” said Dr. Peter C. Lightfoot, one of Palladium One Mining’s directors and a globally recognized expert in magmatic precious metal and nickel-copper-cobalt sulphide ore deposits. Dr. Lightfoot also stated, “LK is shaping up to potentially be the largest palladium dominant open pit project in a best in class mining jurisdiction, globally.”

This figure shows the greater Kaukua Area, the NI 43-101 compliant Kaukua Open Pit resource, Murtolampi and Kaukua South zones. The drill-defined 4-km strike length of the Kaukua South zone is shown with select drill holes from the winter (labeled in black) and summer (labeled in red) campaigns of the Phase I drill program.

Two more important news releases about Kaukua South came out in October. The first, dated Oct. 6, described a wide zone of shallow, high-grade palladium mineralization. Stepping out 100m east from hole LK20-006 (described above) hole LK20-014 returned high-grade drill core of 72m @ 1.96 g/t Pd_Eq, within a 145.5m interval grading 1.28 g/t Pd_Eq. The mineralization started just 13.5m down hole, suggesting that Continuity between holes LK20-006 and LK20-014 demonstrates potential to rapidly add tonnes and thereby scale to existing NI 43-101 resources, the company stated.

But it appears Palladium One was saving the best for last. On Oct. 22, PDM reported that hole LK20-016 had the best combination of grade and width, from the entire LK project to date.

Drilled 1,350 meters east of the most westerly hole at Kaukua South (which returned 33m @ 1.90 g/t Pd_Eq), LK20-016 began showing mineralization just 23.5m down hole. From there it returned 62.7m @ 3.52 g/t Pd_Eq including 18.5m @ 4.58 g/t Pd_Eq.

According to Palladium One, Continuity between holes LK20-006 and LK20-016 demonstrates potential to rapidly add ounces, providing the opportunity to significantly increase the existing NI 43-101 Kaukua open pit resource.

Another hole, LK20-19, started in mineralization and intersected 35m @ 2.76 g/t Pd_Eq, plus a higher-grade 3.29 g/t Pd_Eq over 10.5m, very near surface.

Phase 2 drilling

This week Palladium One kicked off its second phase of drilling at LK with a 17,500m program targeting Kaukua South.

According to PDM, Phase 2 is designed to support a future Inferred resource estimate at the Kaukua South zone, which now encompasses a >4 km long strike.

The drills will initially be positioned along the 750-meter-long high-grade section between holes LK20-006 and LK20-016. Drilling will also include step-out exploration to the east of hole LK20-016.

“The shallow mineralization and continuity of drill results demonstrates potential to rapidly add open pit ounces and significantly increase the existing NI 43-101 open pit constrained resource estimate,” said Derrick Weyrauch, CEO, in the news release.

Kaukua South long section looking north, showing IP chargeability isoshells and Pd_Eq grade for resumed Phase I drill holes labeled in red.

Haukiaho

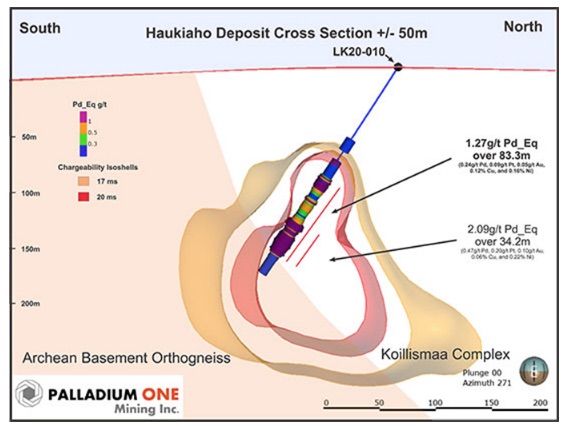

Haukiaho hosts the highest nickel grades on the LK project with potential for a large bulk-tonnage deposit. The most significant drill result from Haukiaho came from hole LK20-010 (pictured below), which intersected a wide interval — 34.2m at 2.09 g/t Pd_Eq (0.77g/t PGE, 0.22% nickel, 0.20% copper) — within a larger zone grading 83.3m at 1.27 g/t Pd_Eq. The other two holes, LK20-008 and LK20-009, returned 16.2m @ 1.99 g/t Pd_Eq and 6.6m @ 2.34 Pd_Eq respectively.

All three holes were designed to expand higher-grade zones at Haukiaho, and in the case of LK20-010, to test the large chargeability anomaly described above, in the IP survey section, at Haukiaho East.

The mineralized interval for LK20-008 is likely wider than reported, according to Palladium One — initial sampling ended in mineralized quartz-albite footwall. Additional sampling is currently underway. Hole LK20-009 intersected a thick diabase dyke shortly after the hole entered the mineralized zone, resulting in only partially testing the zone.

With these results in hand, especially for LK20-010, Weyrauch believes that drilling to target higher-chargeability areas could discover wide zones of higher-grade mineralization.

Moreover, since the company has found a wide interval in an area that had not been tested, there is potential to increase the 2013 Haukiaho resource area (represented by the red circles in the figure below).

The consistency of the company’s IP surveys is telling. So far this year, in the three IP survey grids totaling 7.5 km of strike length conducted along the Haukiaho Trend, each was able to identify chargeability anomalies.

IP continues to prove very reliable in identifying PGE-Cu-Ni mineralization at the LK project.

The Haukiaho Trend encompasses over 17 km of favorable basal contact, of which the 2013 Haukiaho resource only occupies some 1.5 km of strike length.

KS project

In April, PDM acquired the 20,000-hectare Kostonjarvi (KS) property, which is adjacent to the company’s flagship Läntinen Koillismaa (LK) project in north-central Finland.

The addition of KS brings the company’s total land package in Finland to 32,226 hectares. Permission has been granted for exploration to be conducted on all permits and exploration reservations.

According to the April 2 news release, while the two properties are contiguous, KS differs from LK in that KS is an underground target, with high-grade massive sulfide potentially similar to the giant Voisey’s Bay nickel deposit in Labrador, Canada and the Norilsk-Talnakh in Russia; whereas LK is an open-pit-style deposit, featuring disseminated sulfide mineralization along the prospective basal unit of the Koillismaa complex, with similarities to Platreef in South Africa. Platreef and Norilsk are the largest known nickel-copper-palladium deposits in the world.

Obtaining KS is of interest to PDM shareholders, because it covers a large gravity and magnetic anomaly that is thought to represent a “feeder dyke” to the Koillismaa Complex, which hosts the palladium-dominant LK project.

Feeder dyke is a geological term that describes a conduit for magma to flow, carrying minerals that become deposits.

Palladium One describes the exploration targets at KS as “traps” in the buried feeder dyke, that potentially host massive sulfide mineralization. As for how KS connects to LK, the news release explains:

The Feeder Dyke begins at the ultramafic Narankavaaara intrusion and then dives to a depth of 3-5km before coming near surface again where it’s interpreted to connect to the Koillismaa Complex.

While magnetic, gravity and seismic surveys have been conducted to try and model the feeder dyke, little on-the-ground exploration has been done. However the scientific branch of the Finnish government has in recent weeks begun drilling a 3,000 meter hole into the deepest part of the dyke and 5-kilometers from the KS project. The results of this first drill hole into the dyke could be a very positive game changer for the KS given it’s shallower depth.

Conclusion

Palladium One has, in the space of just four months (August to November) significantly expanded the mineralized potential at its LK project in a number of areas. Guided by the results of an IP survey done earlier this year, PDM sunk drills into Kaukua South, Haukiaho and Murtolampi, nailing win after win at each of these targets.

At the eastern part of Kaukua South, the IP survey discovered a large chargeability anomaly, that was later was initially confirmed by discovery hole LK20-006. This hole not only proved that Kaukua South extends to the east, it intersected a thick core zone of 166.7m @ 1.16 g/t palladium equivalent, including 63.4m @ 1.88 g/t Pd_Eq. Also noteworthy was the fact the mineralization began at 43m down hole, making it highly amenable to open-pit mining. As CEO Derrick Weyrauch put it, “This confirms our belief that Kaukua South has the potential to quickly add tonnes to the 2019 NI 43-101 open pit constrained Kaukua resource estimate.”

More drilling found that the magmatic sulfide mineralization extends more than 3 km east of hole LK20-006. This meant a 6-fold increase of the strike length, to 4 km from an earlier 600 meters. According to the company, preliminary indications are that Kaukua South could be several times the size of the current 1.1 million PdEq ounces of Indicated and Inferred resources at Kaukua.

Moreover, a high-grade zone, which approaches underground mining grades was discovered at surface in the past few weeks at Kaukua South and has given Palladium One a roadmap for planning future drilling at this target. Starting at the 750-meter-long high-grade section between holes LK20-006 and LK20-016, drilling during the Phase 2, 17,500-meter program is designed to support a future Inferred resource estimate at Kaukua South, which now encompasses a >4 km long strike.

At Haukiaho, the drills tested the chargeability anomaly identified in the earlier IP survey. All three holes hit PGE-nickel-copper mineralization. According to the company, there is potential to increase the 2013 Haukiaho resource area, and CEO Weyrauch believes that drilling to target higher-chargeability areas could discover wide zones of higher-grade mineralization.

At Murtolampi, initial results indicate that this zone could form a significant satellite open-pit resource, adding to the Kaukua deposit, which is located less than 2 kilometers to the south.

Finally, the KS property, which has yet to be explored, offers more upside to Palladium One’s Finnish project portfolio. KS is an underground target, with high-grade massive sulfide potentially similar to the giant Voisey’s Bay nickel deposit in Labrador, Canada and the Norilsk-Talnakh in Russia. If PDM is able to show scale at KS in the same way that it is gradually uncovering the potential at LK, we see even more upside to Palladium One, adding to the string of successes the company has put together in 2020 during challenging times.

The news has been flowing all year from Palladium One and I expect it will continue well into 2021, as Phase 2 drilling at Kaukua South ramps up.

Palladium One

TSX.V:PDM, OTC:NKORF, Frankfurt:7N11

Cdn$0.185, 2020.11.10

Shares Outstanding 142,642,816m

Market cap Cdn$26.38m

PDM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of PDM and PDM is a paid advertiser on Richards site Ahead of the Herd

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.