Norra Metals pursuing high-grade VMS in Norway

2020.10.20

Norra Metals Corp. (TSX-V:NORA, FSE:1K0) is focused on developing copper, zinc, silver and gold properties in Norway and British Columbia. In Norway, the company has a past-producing mine it plans on returning to production, and a less-developed copper-zinc-silver property that saw a small amount of mining around the 1900s, but has witnessed little exploration since.

This, in my opinion, is a perfect combination for a base/ precious metals junior: a property that is already known to have mineralization that they plan to add to; and a project with lots of blue sky/ exploration/ discovery potential.

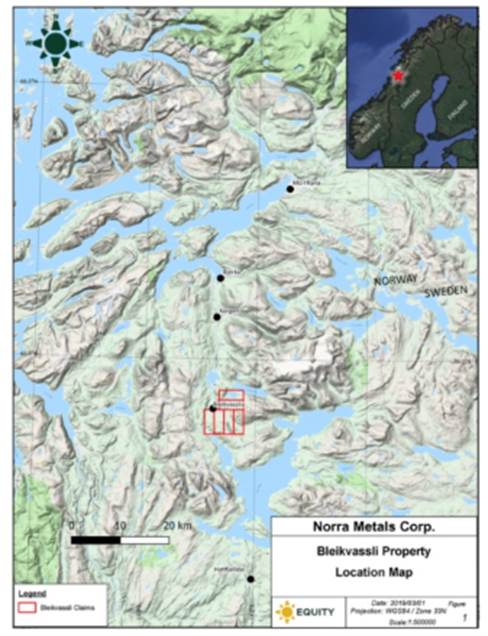

Norra Metals’ flagship Bleikvassli property is the last copper-zinc-silver-gold producing mine in Norway. Bleikvassli is a volcanic and sediment hosted massive sulfide (VMS) zinc-lead-copper-silver deposit with minor gold credits. The mine operated continuously since 1957, during which 5 million tonnes of copper-zinc silver ore was extracted. The mine closed in 1997 due to low metal prices.

The Meråker project hosts the historic Lillefjell and Mannifjell deposits which were mined intermittently, 1760-1918, by small-scale miners. Site visits by Norra Metals revealed massive, high-grade sphalerite-chalcopyrite dumps on zones outside of the main developed area. Sphalerite and chalcopyrite are pathfinder minerals for zinc and copper, respectively.

Norra’s Pyramid project in British Columbia is a greenfield copper-gold porphyry project within the Quesnel Terrane. Also known as the Quesnel Trough, the Quesnel Terrane is a Triassic‐Jurassic age arc of volcanic sedimentary rocks that hosts a number of large copper and gold porphyry deposits, several of which are currently in production. These include Mt. Milligan, Mt. Polley and Gibraltar.

Large portions of Pyramid remain untested including significant areas along trend with the highly prospective MT target. The property is road-accessible with the MT zone being ~3km from the highway – an important consideration in this remote, yet mineral-rich corner of northwestern BC.

Norway

Often overlooked by North American investors, the Norwegians have mining and mineral exploration running through their Nordic veins. A little-known fact: mining in Norway goes back 1,000 years, to the Akersberg silver mine in Oslo; large-scale mining for copper and sulfur became common in the early 1600s.

Most Norwegian mines and quarries are located along the coast. Norway produces titanium and a number of industrial minerals including iron ore and flake graphite.

Like Sweden, Norway boasts low energy costs, and a low corporate tax in the mid-20% range.

The Scandinavian nation has a predictable and efficient administration, no withholding tax on royalty payments, no government royalty, and an experienced workforce. There are several smelters, deep-water ports, and an excellent national rail system. Most roads are paved and accessible year-round.

The oil economy has been a boon to Norway. However, a shift in economic focus has seen the minerals industry come roaring back to the country, giving way to a renaissance of mineral exploration and mining.

Another major change occurred in 2010 with a new mining act. The Norwegian Minerals Act regulates the exploration, investigation, and extraction of mineral resources and the acquisition of mining rights. The new legislation added an important proviso that was absent in the previous mining act: owners of mining concessions must conduct work on them, to maintain the claims in good standing. The government gave owners seven years in which to show exploration activities had taken place. If, after that period, an owner could not produce such evidence, and expenditures, the property would revert back to the government.

The upshot was in 2018, a large number of mining properties in Norway that were previously owned by corporations or individuals, became available to potential acquirers.

Norra Metals Corp. (TSX-V:NORA, FSE:1K0)

One of the companies that happened to be in the right place at the right time was Norra Metals Corp. (TSX-V:NORA). The Vancouver-based company in 2018 acquired four projects from EMX Royalty Corp. (NYSE:EMX), a global prospect generator, then set about doing their due diligence to ascertain which properties they should keep.

That involved sending a team to Norway and Sweden to review the projects, including VP Exploration George Cavey, credited with discovering Orko Silver’s 264-million-ounce La Preciosa silver deposit in Durango, Mexico. Orko Silver was sold to Coeur Mining in 2013 for $380 million.

Norra’s President and CEO Mike Devji was Vice President of Orko Silver prior to the buyout. He raised over $50 million to develop the deposit. An experienced financier of public companies, Devji led a group of investors who financed a 40% interest in the South Kemess gold-copper deposit in British Columbia, that was subsequently sold for over $400 million.

In January of this year Norra announced they had reduced their Scandinavia portfolio from four properties to two; one Norwegian and one Swedish license were returned to EMX Royalty.

According to the news release, The remaining Norwegian properties contain historic mining areas and/or historic, drill-defined zones of polymetallic base metal mineralization (zinc-lead-copper) with variable levels of precious metal enrichments (silver ± gold).

The company recently closed a $1.37 million financing, with the proceeds going towards initial exploration at their flagship Bleikvassli project, located in central Norway.

Norra Metals currently has 53.75 million shares outstanding, with around 25% owned by management and associates, and 9.9% by EMX Royalty. The junior has a market capitalization of $15 million, as of Tuesday, Oct. 20, and last closed at $0.18.5/sh, up 2.7%.

Bleikvassli

In an interview with AOTH, CEO Devji related what happened when George Cavey and his team met the mine manager at Bleikvassli. The manager told Cavey all they needed to know about the property was sitting in two rooms – including hundreds of boxes of drill core and drill logs.

“We knew it was a past producer but we had no idea how much info was there,” says Devji. “That data was input into a 3D lithographic model, from which a video was created, and posted on our front page, showing where they mined, what was left behind, 27 km of underground workings – drifts, adits, shafts – this is unbelievable info we acquired.”

Indeed the most prominent feature of the 6,000-hectare property is the Bleikvassli mine, a past-producing SEDEX-style sediment-hosted massive sulfide Pb-Zn deposit with minor Cu, Au and Ag credits. As mentioned the mine operated for 40 years (1957-97) and extracted 5.0 million tonnes grading 4.0% Zn, 2% Pb, 0.15% Cu, and 25 g/t Ag. Historic resources remaining at time of closure, according to the Norwegian Geological Survey (NGU), were 720,000 tonnes grading 5.17% Zn, 2.72% Pb, 0.27% Cu, 45g/t Ag, and 0.2 g/t Au.

Mineral rights for the mine and surrounding areas became available and were staked by EMX in early 2018. Underground development spans 40 levels, and about 25 km, extending over a kilometer of strike length, accessed via a portal and ramp system. Over 1,400 drill holes were punched into the mine and environs, with assay data available for about 350 of the holes.

Three types of mineralization are present at Bleikvassli:

- Massive pyritic Zn-Pb-Cu mineralization

- Massive pyrrhotite, Cu-rich Zn-Pb

- Vein/disseminated wallrock mineralization- reported to contain Au/Ag mineralization

Two main mineralized lenses, with strike lengths of 400m and 1,500m, are 2 to 20m thick.

The property’s geology and mineralization is reportedly similar to Lundin Mining’s (TSX:LUN) Zinkgruvan deposit in Sweden. Zinkgruvan has proven and probable (2017) reserves of 11.9 Mt @ 7.2% Zn, 2.9% Pb and 63 g/t Ag, and 5.3mt @ 1.8% Cu, 0.2% Zn and 26 g/t Ag.

Despite past production of gold, the precious metal content at Bleikvassli has never been systematically assessed. There are several areas with numerous Cu, Pb, Zn and Ag-bearing drill intercepts, although true widths were not reported.

So what is the plan going forward with Bleikvassli? Devji told me the first priority is to hire an independent geologist to help Norra bring the historical resource into NI 43-101-compliance. To do that, the geologist will likely require Norra to pick about 20 random holes in the existing resource area and drill new holes close to them. The other expected requirement is to randomly choose 20-30 holes that have drill core, and re-assay them.

A significant amount of work has already been done to prepare the project for a Phase 1 exploration program. Norra’s technical team has conducted a comprehensive review of available historic data for the Bleikvassli mine and incorporated it into a Leapfrog 3-D geological model that compiles both historic assay data from over 650 drill holes, as well as outlines underground workings and the previously mined areas of the deposit. These efforts have allowed the company to gain a better understanding of structural controls on mineralization in and around the Bleikvassli mine area.

Additionally, the company has identified three high-priority drill target areas at the north and south end areas of the historic mine area, as well as at depth underneath the main area of historic mining. Norra is currently finalizing plans to conduct a five- to 10-diamond-drill-hole campaign totalling 1,500-meters, to test these targets.

The end game, naturally, is to build tonnage. The northern part of the deposit is considered under-explored, with only limited drilling completed. Norra also believes the deposit may be truncated in the south by a fault – an offset fault could be another exploration target.

Devji thinks putting the mine into production would require 10 to 15 million tonnes. (recall that 5Mt @ Bleikvassli has been mined and 720,000 tonnes are left). “At that point you have a mid tier mining company that would look at this to acquire, like an Agnico Eagle or a Lundin,” he said.

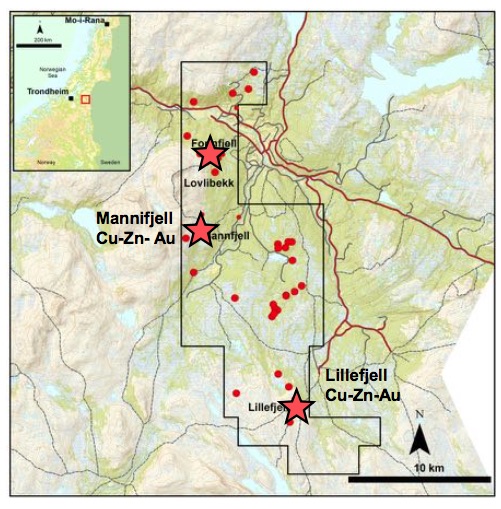

Meråker

Norra’s Meråker project is less advanced than Bleikvassli, but according to Norra Metals, it contains extensive areas of gold-rich volcanogenic massive sulfide (VMS)-style mineralization, among a commanding 18,600 hectares The property is located 100 kilometers north of the prolific Roros mining district, where more than 30 million tonnes of copper-rich VMS material have been mined:

There is a long history of mining on the Meråker property, with production of copper ore from VMS deposits dating back to the 1700’s and continuing until the early 1900’s. The Norwegian Geological Survey (NGU)’s databases of surface rock samples and mineral occurrences both record an abundance of mineralized locations scattered throughout the property, with economically significant values of copper, zinc, gold and silver at multiple locales. Private companies have conducted exploration scale surface work and very limited diamond drilling on the many VMS showings throughout the property, with the most significant work programs being: geophysics, surface geochemistry and drilling in the late 1960’s; soil sampling and airborne geophysics by the NGU in 1991 – 1992; and mapping, soil/silt geochemistry and ground-based geophysics from 1998 – 2001. Prior to acquisition of the exploration licences by EMX, mineral tenure had been allowed to lapse by the prior rights holders.

Geologically, Meråker is analogous to “Kuroko-style” VMS systems, which features copper, zinc and gold. The mineralization developed in felsic volcanic successions, with subsequent folding and deformation focusing the sulfide minerals into fold hinges, meaning a possible increase of grade and tonnage. Greenschist metamorphism has coarsened up sulfide mineral assemblages, improving the metallurgy. It’s interesting to note that gold enrichment at Meråker wasn’t appreciated until the mid-1990s.

There was historical mining of copper-rich ore at the Lillefjell zone, which produced 110,000 tonnes at 5% copper and 4.5% zinc between 1760 and 1895; and 100,000 tonnes @ 1.8% Cu and 5.3% Zn, at the Mannfjell zone between 1901 and 1918.

Norra is therefore targeting VMS-style mineralogy and metal assemblages at Meråker. The company notes only shallow historic mining and drilling has been done – mineralization remains untested at depth. Bedrock sampling by NGU confirms the presence of unmined surface areas. Mapped exposures of mineralization extend for multiple kilometers along strike, with little historic emphasis on exploitation of Zn and Au-rich zones of mineralization.

Rock and chip sampling by Norra consultants during site visits in 2018 identified very anomalous levels of zinc, copper and gold.

“Meråker has a tremendous amount of upside based on new exploration,” says Devji. “It could be a sleeping giant.”

The company is planning a multiphase exploration program that will include additional field visits for reconnaissance sampling and geological mapping, that will be followed up by a diamond drill program to test high-priority targets.

Conclusion

Norra Metals is cashed up and ready to go exploring, having recently closed a $1.3m financing.

An important point worth emphasizing, is that NORA doesn’t have to hunt for mineralization; it already has it, at the past-producing Bleikvassli mine, and some good evidence of previous mineralization at Meråker, and lots of upside especially with respect to the gold-rich zones. Surface rock grab samples show up to 3,745 parts per billion Au.

We love the Bleikvassli project, especially its high-grade zinc. The company has only just started exploring this property with 1,400 historic drill holes and many unmined areas with numerous Cu, Pb, Zn and Ag-bearing drill intercepts. Importantly, the company also appears to have an extensive drill core and data set, which will help tremendously to pinpoint targets for drilling, and to assist with deposit modeling going forward.

We expect plenty of news flow as Norra Metals looks for more high-grade VMS among the historic mine workings at its flagship Bleikvassli, and identifies additional prospects.

Norra Metals

TSX-V:NORA, FSE:1K0

Cdn$0.18 2020.10.19

Shares Outstanding 53,750,173m

Market cap Cdn$9.67m

NORA website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not own shares of Norra Metals (TSX.V:NORA). NORA is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.